Dividend stocks can be an addition to your portfolio if you’re looking to invest in companies that allow you to combine passive income with steady growth.

In this guide, we show you how to buy dividend stocks in a matter of minutes with a commission-free trading site that requires a minimum deposit of just $10.

How to Buy Dividend Stocks

A guide on how to buy dividend stocks with eToro can be found below.

The eToro website not only offers thousands of commission-free stocks – but it takes just five minutes to set up an account.

- ✅Step 1 – Open a Trading Account: Users can head over to the website of their preferred broker and begin the registration process. Enter your personal details and create a username and password.

- 🛂Step 2 – Upload ID: Get your newly created account verified instantly by uploading a copy of your ID. Choose from a passport, state ID, or driver’s license.

- 💳Step 3 – Deposit Funds: Users can deposit funds by choosing a payment method which may include e-wallets, credit/debit cards, and ACH.

- 🔎Step 4 – Buy Dividend Stocks: Users can search for their preferred dividend stocks on the search bar of their platform and begin the open order process. Enter the amount you wish to invest and confirm the transaction.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

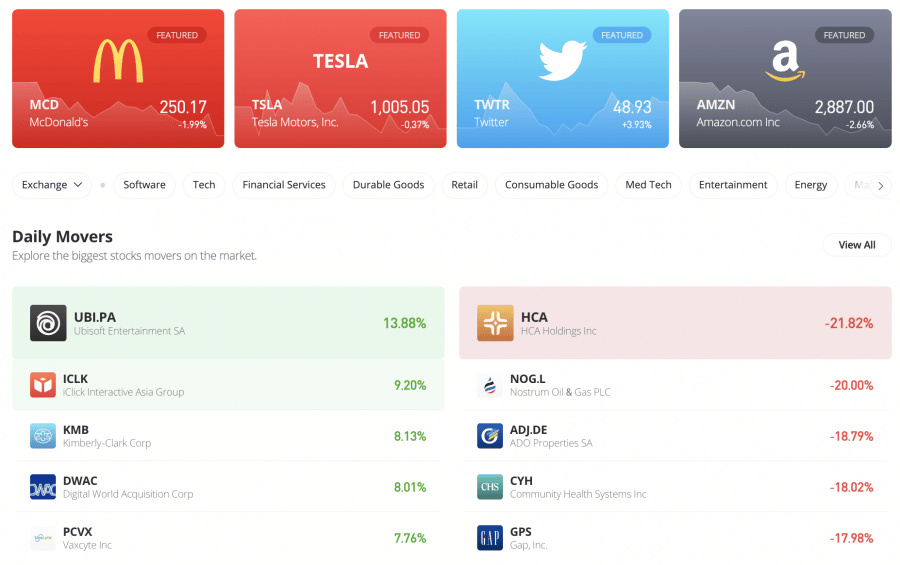

Popular Brokers that Support Dividend Stocks

When deciding on where to buy stocks online for the purpose of acquiring dividend-paying shares, you’ll need to ensure that the broker stipulates suitable minimum account balance requirements and that it offers low trading fees.

The sections below review two popular stock brokers that allow users to invest in dividend stocks.

1. eToro

US clients are treated to fee-free deposits across PayPal, debit/credit cards, bank wires, and a number of other supported e-wallets. This means that you can buy stocks with PayPal on eToro with competitive fees. Plus, you only need to deposit $10 or more to get started as a US client. This means investors can buy fractional shares of Samsung stock with an eToro trading account. When your eToro account has been funded you can then proceed to buy dividend stocks at 0% commission and tight spreads.

In terms of supported markets, you will find all dividend aristocrats and kings listed on the NASDAQ and NYSE. Additionally, eToro supports nearly 20 international markets based in Europe, Asia, North America, and more. When you buy international dividend stocks on the eToro website – you will still avoid the need to pay any trading commissions. eToro also lets users invest in popular NFT stocks and cannabis stocks.

eToro lets users invest in a basket of undervalued dividend stocks via a single trade. In fact, this can be achieved in two different ways. First, users can invest $10 or more into a dividend stock ETF. At eToro, this is inclusive of the popular iShares Core Dividend Growth ETF and even the SPDR S&P US Dividend Aristocrats ETF.

All dividend ETFs at eToro can be traded without paying any commission and the minimum stake is also $10. The second option that you have is to invest in dividend stocks passively or with a smart portfolio. One option is the DividendGrowth portfolio – which focuses on stocks that have increased their annual dividend payment for at least 20 years.

Crucially, smart portfolios are managed on your behalf – which means that your basket of dividend stocks will be regularly rebalanced and reweighted based on broader economic indicators. We should also mention the copy trading tool at eToro – which offers access to thousands of verified investors.

Put simply, this enables you to select a stock trader that aligns with your financial goals and then automatically copies all ongoing and future investments. Outside of its stock and ETF trading department, eToro also allows you to buy cryptocurrency. This covers dozens of leading digital assets – which is inclusive of metaverse crypto tokens and DeFi coins.

| Minimum Deposit | $10 |

| Fractional Shares? | Yes – $10 minimum |

| Pricing System | 0% commission on all dividend stocks and ETFs |

| Cost of Buying Dividend Stocks | Spread only |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull

And, you can create a diversified portfolio of dividend stocks – as Webull supports fractional shares. The minimum stake per stock trade that you can execute is just $5. This means that a small deposit of $50 would allow you to diversify across 10 different dividend stocks.

Just like eToro, Webull also gives you access to a wide number of dividend stock ETFs. The key issue is that you cannot directly access international exchanges. As such, the only option you have to buy foreign-based dividend stocks is via an ADR – which is arguably worth avoiding.

Nonetheless, Webull also offers support for stock options and a selection of crypto assets. The latter can be traded from just $1. When it comes to fees, ACH deposits and withdrawals attract no transaction charges. You can also trade any asset supported on the Webull platform – including that of dividend stocks, without paying any commission.

Read More: If you can’t make your mind up about which brokerage site is right for your needs, check out our eToro vs Webull comparison.

| Minimum Deposit | $0 |

| Fractional Shares? | Yes – $5 minimum |

| Pricing System | 0% commission on all dividend stocks, ETFs, and options |

| Cost of Buying Dividend Stocks | Spread only |

Your capital is at risk.

How Much Does it Cost to Buy Dividend Stocks?

When deciding on where to buy dividend stocks, it is important that you check the broker’s fee table before proceeding, as well as understanding the basics. As such, our article on what is dividend investing covers everything you need to know about this passive investing strategy.

Here are the following charges that users may have to pay when purchasing dividend stocks.

Funding Charges

Some brokers will charge deposit fees on certain payment methods. Oftentimes, this is the case when you wish to fund your account with a domestic bank wire.

At Webull, for instance, this will cost you $8 on each transaction. If you are looking to deposit funds in US dollars and you wish to avoid paying any fees, eToro allows you to do this via a debit/credit card, e-wallet, ACH, and a domestic bank wire.

Commissions

Very few brokers in the US charge commissions these days when you buy dividend stocks that are listed on the NYSE or NASDAQ. Certain conditions might apply, such as Schwab requiring the dividend stock to be listed on the S&P 500.

Spreads

The spread is typically a hidden fee that you need to research yourself, not least because it refers to the difference between the buy and sell price of your chosen dividend stock.

The spread will vary from one broker to another, so be sure to understand how much you are paying before placing an order.

Conclusion

Dividend stocks are a potential way to diversify portfolios by offering passive income opportunities to investors. Users can review the popular dividend stock brokerages and pick the right platform to begin trading with.