Buying shares in Australia from the comfort of home involves choosing a suitable stock broker, opening an account and making a deposit, and choosing which shares to invest in.

In this guide, not only do we explain how to buy shares in Australia in 2023, but we explore some popular companies that some investors are adding to their watchlists.

Where to Buy Shares in Australia – Regulated Stock Brokers Reviewed

The first step to consider when learning how to buy shares in Australia is to choose a suitable and regulated trading platform.

There are many providers in this space, so it’s common practice to do some research regarding supported shares, fees, and commissions, minimum investment requirements, accepted payment methods, and of course – regulations.

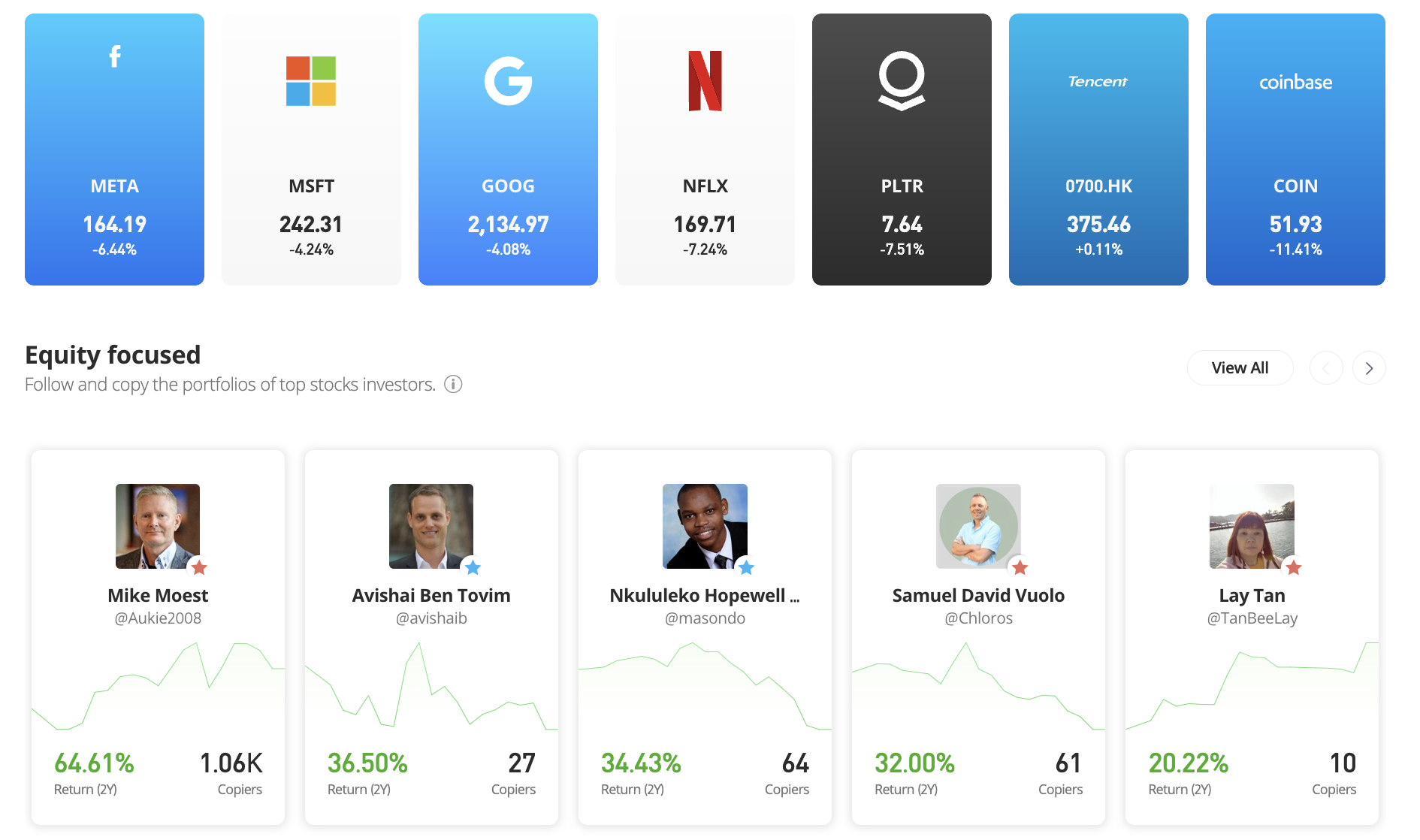

1. eToro

One popular share trading platform in Australia for both beginners and experienced traders alike is eToro. This online broker is authorized and regulated by ASIC, as well as by licensing bodies in the US, UK, and Cyprus. eToro is also used by 25 million clients globally, which makes it one of the popular providers in this space.

Joining eToro takes less than five minutes from start to finish – as the identity verification process is automated. Moreover, eToro requires Australian residents to deposit a minimum of just $50 to activate the account.

Some of the most convenient payment methods accepted by eToro are inclusive of Visa, MasterCard, Maestro, PayPal, Skrill, POLi, and bank wires. The fee to deposit funds across all payment methods is just 0.5% and this is to convert AUD to USD. Once the account is funded, it is then possible to buy shares in Australia at the click of a button.

eToro does not charge any trading commissions when buying and selling shares on its platform. The spread is often very competitive too, which is the gap between the bid and ask price of the respective shares. eToro also supports fractional shares.

Put simply, this means that investors can buy any share of their choosing – irrespective of the stock price, from just $10. For instance, if the stock is priced at $100 and the investor allocates a $10 purchase, they will own 10% of the respective company. Another innovative feature offered by eToro is its Copy Trading tool.

This allows eToro users to allocate funds to an experienced investor, and then elect to copy their future trades automatically. For instance, let’s say that the user allocates $200 into the Copy Trading tool, and their chosen trader risks 20% of their capital into Apple shares. In this case, the user will have $40 worth of Apple shares automatically transferred to their portfolio.

There are also Smart Portfolios on the eToro platform, which are for investing passively. eToro has created dozens of strategies – such as BigTech and renewable energy. Through a single investment, Smart Portfolios offer access to a basket of stocks – which is subsequently managed and rebalanced by the eToro team.

Ever wondered what some of the popular forex brokers in Australia are? We also like that eToro offers commission-free ETFs, as well as leveraged CFD markets on forex, commodities, and indices. eToro also allows Australians to buy Bitcoin and other digital currencies. When investing in tokens via the eToro crypto exchange, more than 70 coins are supported and the minimum trade requirement is just $10.

We found that eToro is also a popular place to invest in shares in Australia on a smartphone. The eToro mobile app is available to download for free on both iOS and Android devices. Finally, eToro also offers a demo trading account. This allows users to buy and sell shares without risking any money. Instead, paper funds are utilized.

| Supported Shares | 2,500+ shares across 17 international markets |

| Share Trading Commission | 0% |

| Minimum Share Purchase | $10 (about 14 AUD) |

| Minimum Deposit | $50 (about 70 AUD) |

79% of retail investor accounts lose money when trading CFDs with this provider

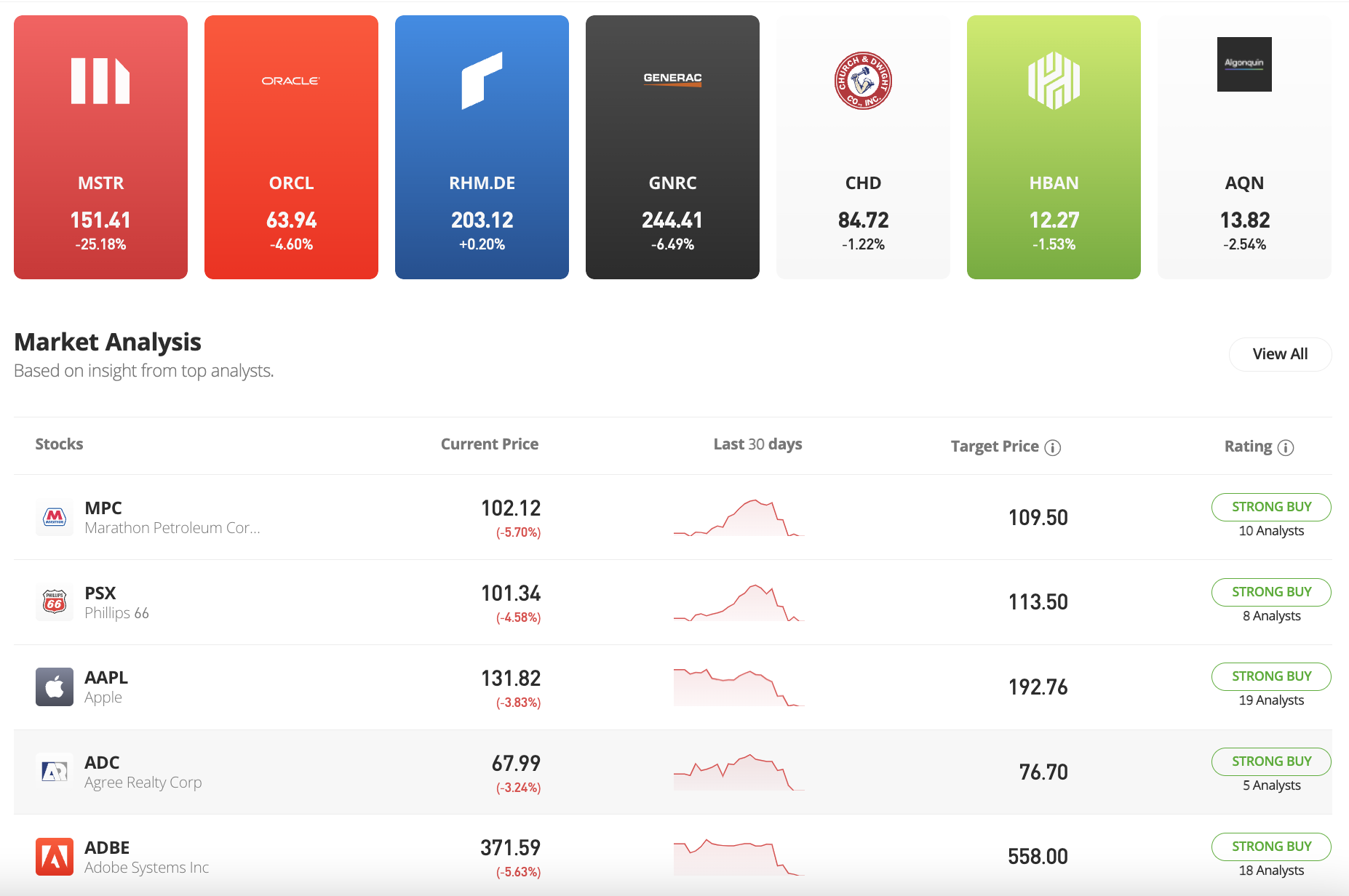

2. Plus500

Investors wanting to use this platform can access 2,800 financial instruments, including popular shares such as Tesla, Rio Tinto, and Meta.

Traders can start on the demo account to get a feel for the platform, then go live, with just AU$200 needed to start trading with this CFD provider.

To fund the account, traders can use several payment options such as bank wire, cards, Paypal, and Apple Pay.

Plus500 does not charge deposit fees, while withdrawals are also free on non-international transactions.

Trading shares on Plus500 means that traders will pay for spreads but not commission, with other fees traders should know about being overnight funding, currency conversion, and guaranteed stop order.

If traders are inactive for three consecutive months, Plus500 charges $10 monthly.

To optimize their analysis, traders can use Plus500 to incorporate advanced indicators and fundamental data provided via news and market insights, and position sizes can be increased thanks to Plus500’s leverage of 1:5.

Traders can also use the risk management feature to protect their positions.

Besides the free educational content, Plus500 offers enrollment into its trading academy, while traders seeking more knowledge about the platform can contact the 24/7 support centre.

| Supported Shares | 2,000+ shares across 19 international markets |

| Share Trading Commission | 0% |

| Minimum Share Purchase | $1 |

| Minimum Deposit | AU$200 |

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing money. Plus500UK Ltd authorized & regulated by the FCA Plus500CY Ltd authorized & regulated by CySEC.

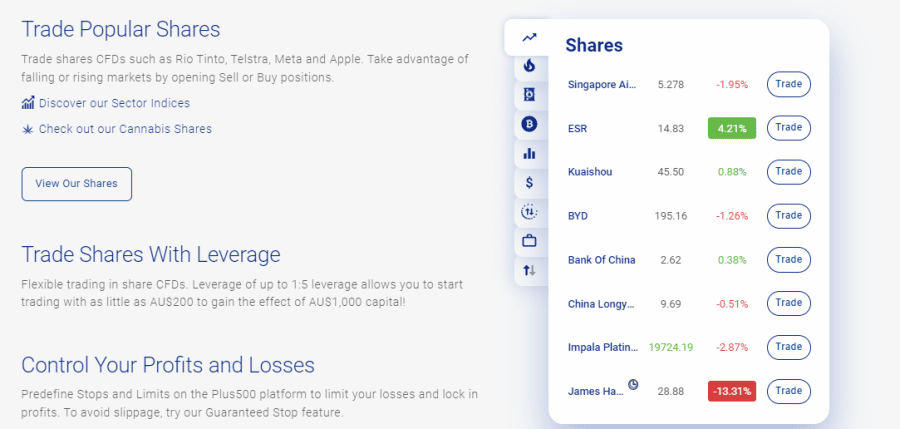

3. CommSec

Those looking for popular shares to watch right now on ASX might come across CommSec. This domestic trading platform offers access to the Australian markets at a commission of 10 AUD when the order size is below 1,000 AUD. While CommSec is popular for building a diversified portfolio of Australian shares, fees are high.

After all, those buying just 500 AUD worth of shares would subsequently pay an equivalent commission of 2%, considering the 10 AUD dealing fee. On the other hand, those investing more than 25,000 AUD on a single share purchase will pay a commission of 0.12%.

This is a lot more competitive and thus – CommSec is ideally suited for large-scale investors. Furthermore, CommSec is even more expensive when users buy shares over the phone, with the platform charging a flat commission of $59.95.

CommSec also offers access to the international stock markets and fees will depend on the specific exchange as well as the order size. For instance, those looking to buy US stocks in Australia at less than 5,000 AUD would pay a commission of 19.95 AUD. Shares in New Zealand, Singapore, and the UK are a lot more pricey, with a commission of 39.95 AUD or 0.4% – whichever is greater.

| Supported Shares | All ASX shares plus multiple international markets |

| Share Trading Commission | 10 AUD for trades below 1,000 AUD |

| Minimum Share Purchase | 500 AUD for new share purchases |

| Minimum Deposit | None – but must cover share purchase of 500 AUD |

4. Westpac

Westpac is another popular choice for traders looking to buy and sell ASX shares via a domestic platform. This option gives Australian investors access to over 2,200 ASX shares, alongside the ability to trade the US markets. There is also support for options, warrants, and ETFs.

We also like that Westpac allows its customers to invest in upcoming initial public offerings (IPOs). However, the main drawback with Westpac is that just like CommSec, it charges high fees to invest.

For example, brokerage fees of 19.95 AUD or 0.11% – whichever is greater, will apply to ASX share orders. Crucially, this is only the case if the order is funded via a Westpac Cash Investment Account. If using an alternative Australian bank account, the commission is increased to the greater of 29.95 AUD or 0.29%.

Furthermore, investing in ETFs from a non-Westpac account will cost the greater of 43.95 AUD or 0.44%.

| Supported Shares | All ASX shares plus US markets |

| Share Trading Commission | Greater of 29.95 AUD or 0.29% for non-Westpac accounts |

| Minimum Share Purchase | 500 AUD for new share purchases |

| Minimum Deposit | None – but must cover share purchase of 500 AUD |

5. CMC Markets

CMC Markets is a hybrid platform, insofar that it offers both traditional share investments as well as leveraged CFDs. If opting for the latter, this allows Australians to trade shares with leverage of up to 1:5 at 0% commission. Moreover, CFD trading at CMC Markets supports both long and short positions.

Those preferring to buy shares in Australia in the conventional sense will have access to over 35,000 markets. This includes ASX shares as well as plenty of international exchanges. On the one hand, it is notable that CMC Markets allows Australians to buy ASX shares without paying any brokerage fees.

However, upon assessing the small print, this is limited to one buy order per day. As such, CMC Markets is perhaps more suited to long-term investors that do not plan to trade actively.

There is also the pro platform, which has been designed for seasoned traders. This comes packed with advanced tools and charting features, alongside technical indicators and custom orders. Customer service is also well-rated at CMC Markets, with telephone support available throughout the week. There is also a mobile app for those wishing to trade via their smartphone.

| Supported Shares | 35,000 shares – both domestic and international |

| Share Trading Commission | 0% on ASX shares – but only one free trade per day |

| Minimum Share Purchase | 500 AUD on ASX shares, 1,000 AUD on international shares |

| Minimum Deposit | None – but must cover minimum share purchase |

Popular Australia Stock Brokers Compared

The comparison table below summarizes our reviews of regulated stock brokers in Australia:

| Stock Brokers | Supported Shares | Commission | Min Share Purchase | Min Deposit |

| eToro | 2,500+ shares across 17 international markets | 0$ commission on all shares | $10 (about 14 AUD) | $50 (about 70 AUD) |

| Plus500 | 2,000+ shares across 19 international markets | 0$ commission on all shares | $1 (about 1.4 AUD) | $200 |

| CommSec | All ASX shares plus multiple international markets | 10 AUD for trades below 1,000 AUD | 500 AUD for new share purchases | None – but must cover share purchase of 500 AUD |

| Westpac | All ASX shares plus US markets | Greater of 29.95 AUD or 0.29% for non-Westpac accounts | 500 AUD for new share purchases | None – but must cover share purchase of 500 AUD |

| CMC Markets | 35,000 shares – both domestic and international | 0% on ASX shares – but only one free trade per day | 500 AUD on ASX shares, 1,000 AUD on international shares | None – but must cover minimum share purchase |

The Basics of Buying Shares

When buying shares, the investor will own a small percentage of the company. Therefore, if the share value of the company increases, this will allow the investor to increase their wealth.

- For instance, let’s say that the investor buys 10 shares in Rio Tinto, at $100 each.

- This takes the total investment to $1,000.

- If the shares increase to $150 and the investor cashes out, this will result in a total withdrawal of $1,500.

- And thus, the profit on this share investment is $500.

Additionally, buying shares gives the stockholder a right to dividends. Not all companies pay dividends, but if they do, the amount received will be determined by the number of shares being held – more on this later.

Nonetheless, in order to buy shares in Australia, an account must be opened with an online broker. The broker will sit between the investor and the respective stock exchange, and take a commission for executing the trade.

It is, however, important to remember that when learning how to invest in shares in Australia, a risk is being taken. This means that if the shares go down in value and the investor decides to sell, a loss will be reported.

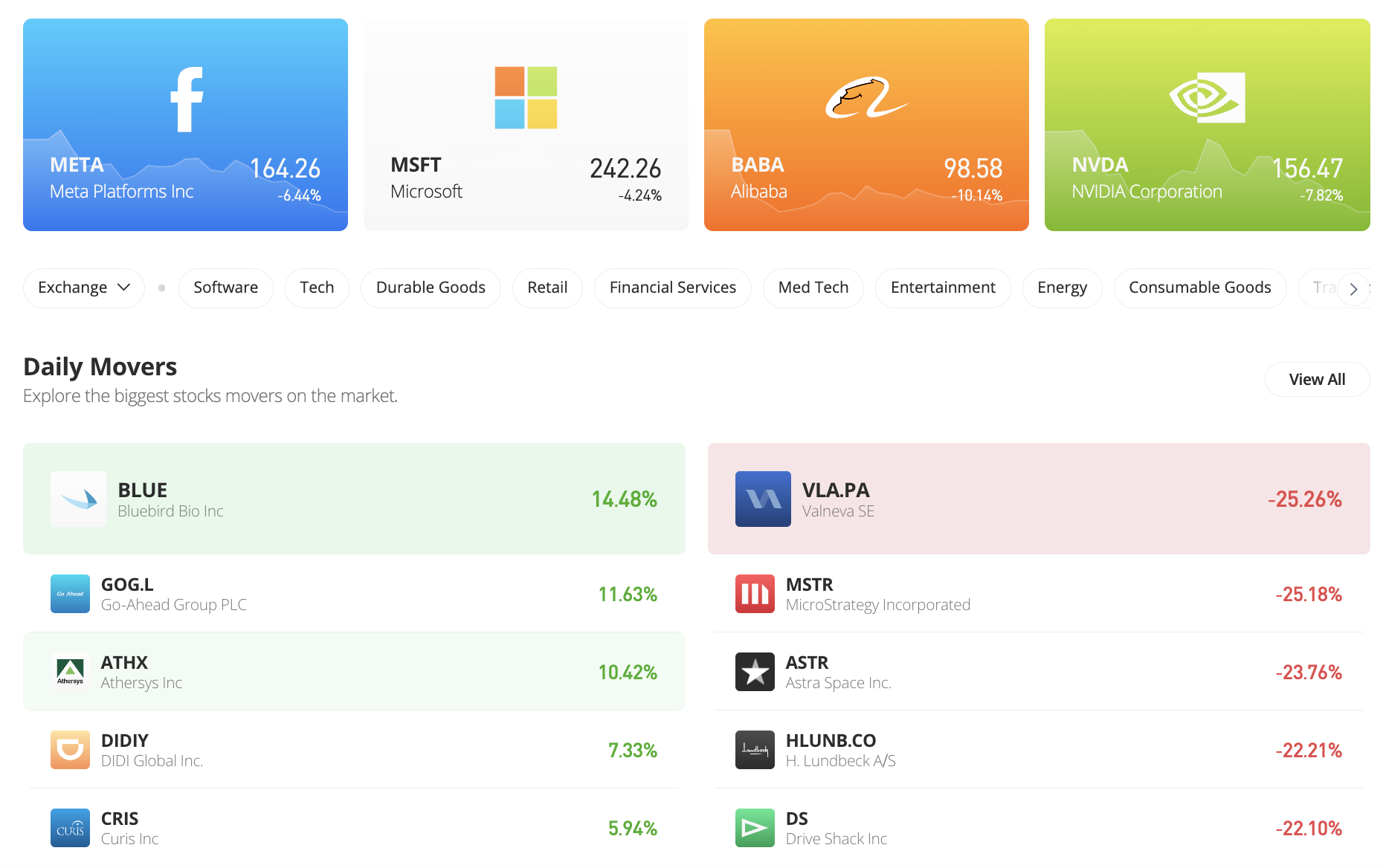

How do I Find Popular Shares to add to my Watchlist?

In Australia alone, there are thousands of shares listed on the ASX. As such, trying to decide what shares to watch now in Australia can be challenging.

Those looking to create a diversified portfolio that includes international shares will have access to tens of thousands of additional markets. For instance, many Australians will look to invest in shares listed in the US, UK, or even Hong Kong.

Either way, investors will need to do some research to determine which shares to add to their portfolio.

Sector

A popular starting point when finding shares to watch in 2023 is the respective sector that the company operates in.

For example, those looking to buy tech stocks might turn to companies like Apple, Amazon, IBM, or Meta Platforms.

Alternatively, those looking to gain exposure to travel shares might look at airline companies like EasyJet or Delta Airlines. Other options here might include Marriott International or even Booking Holdings. On the other hand, investors looking to gain exposure to the renewable energy sector may be inclined to consider buying carbon credits in Australia.

Either way, think about what sectors are likely to perform well in the coming months or years and then look for market leaders in this space.

Dividends

Those looking to combine capital gains and regular income might decide to add some dividend stocks to their portfolio.

As of writing, Rio Tinto has a dividend running yield of nearly 10%. BHP Group is also a dividend share to watch, with a running yield of over 11% as of writing.

Undervalued

Perhaps the most common way to find shares to watch is to look for undervalued stocks. These are companies that are trading below their true value.

While this is somewhat subjective, there are many solid and established shares that have struggled in 2022 due to external factors, such as rising inflation levels or global supply issues.

For instance, in the first half of 2022, the likes of Apple and Meta Platforms are down 27% and 50% respectively.

Index Funds

Instead of trying to find individual shares to buy in Australia, it might be better to invest in an index fund. This consists of a basket of different shares from a particular exchange or market.

For instance, those looking for popular ASX stocks to watch now might consider an index fund like the S&P/ASX 200. Through a single investment, this index fund offers access to the largest 200 shares that are listed on the ASX.

However, the S&P/ASX 200 has generated returns of just 15% over the prior five years. Perhaps a better alternative is the S&P 500 – which consists of 500 large US companies. Over the same period, the S&P 500 has increased in value by 54%.

10 Popular Shares to Watch in Australia in 2023

Those looking for some inspiration on what stocks to watch might consider researching the 10 companies discussed below.

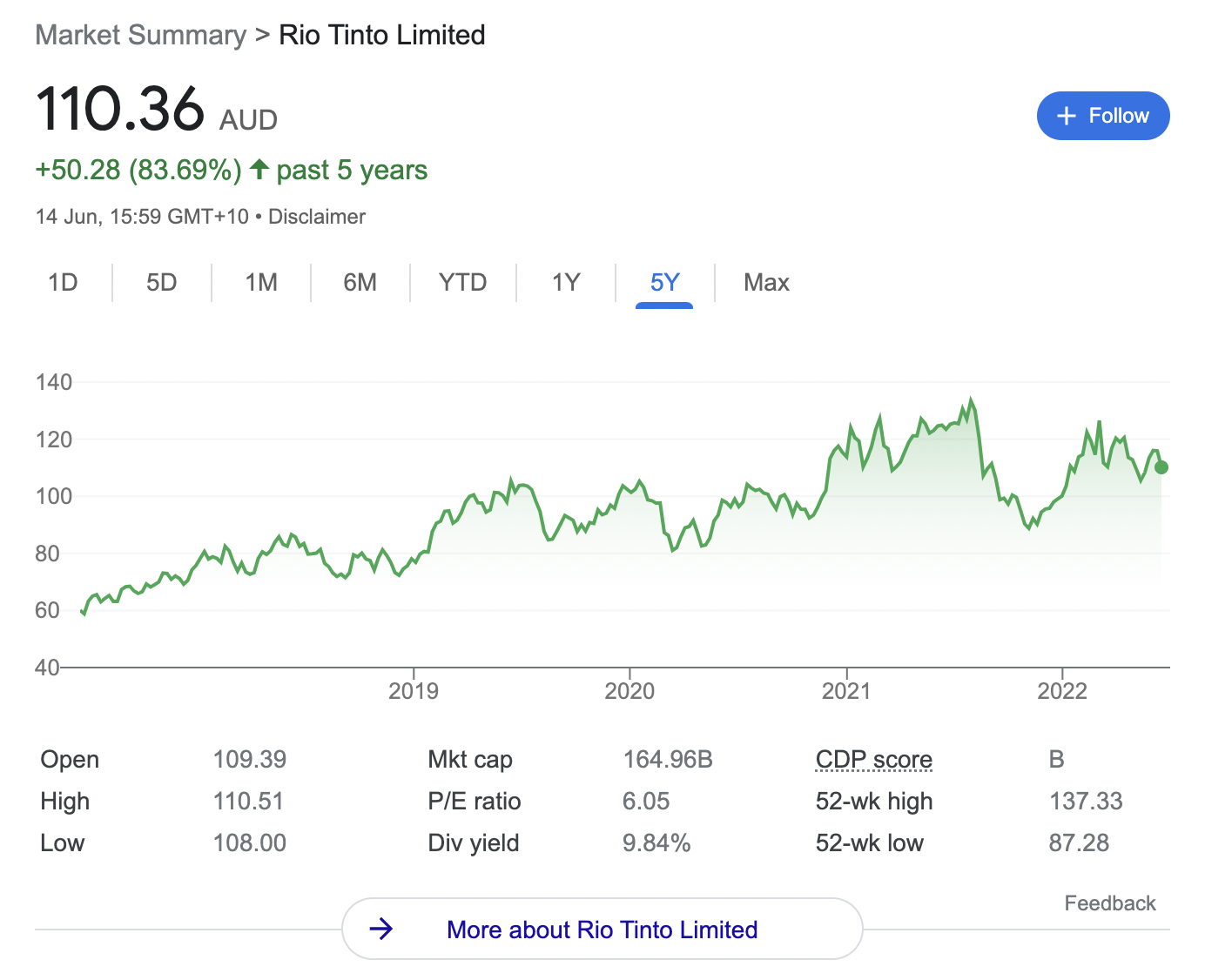

1. Rio Tinto

Rio Tinto is an Australian mining company that offers exposure to a diversified variety of commodities and raw materials. This includes everything from diamonds and iron ore to copper and uranium. As per its most recent earnings report, Rio Tinto generated revenues of $15.2 billion for the quarter ending December 2021, which translates into a year-on-year increase of 20%.

Moreover, net income increased by 36% to $4.3 billion. With that said, over the prior year, Rio Tinto shares are down just under 13%. This is broadly in line with the ASX.

However, over the five-year period, Rio Tinto shares have increased by 85%. Compared to the 15% gains generated by the ASX over the same period, this shows that Rio Tinto has outperformed the wider market by a considerable amount.

If that wasn’t enough, as of writing, Rio Tinto shares are offering a running yield of over nearly 10%. Moreover, based on share prices at the time of writing, Rio Tinto carries a P/E ratio of just over 6 times. This perhaps illustrates that the shares are undervalued – especially when you consider its most recent earnings report.

79% of retail investor accounts lose money when trading CFDs with this provider

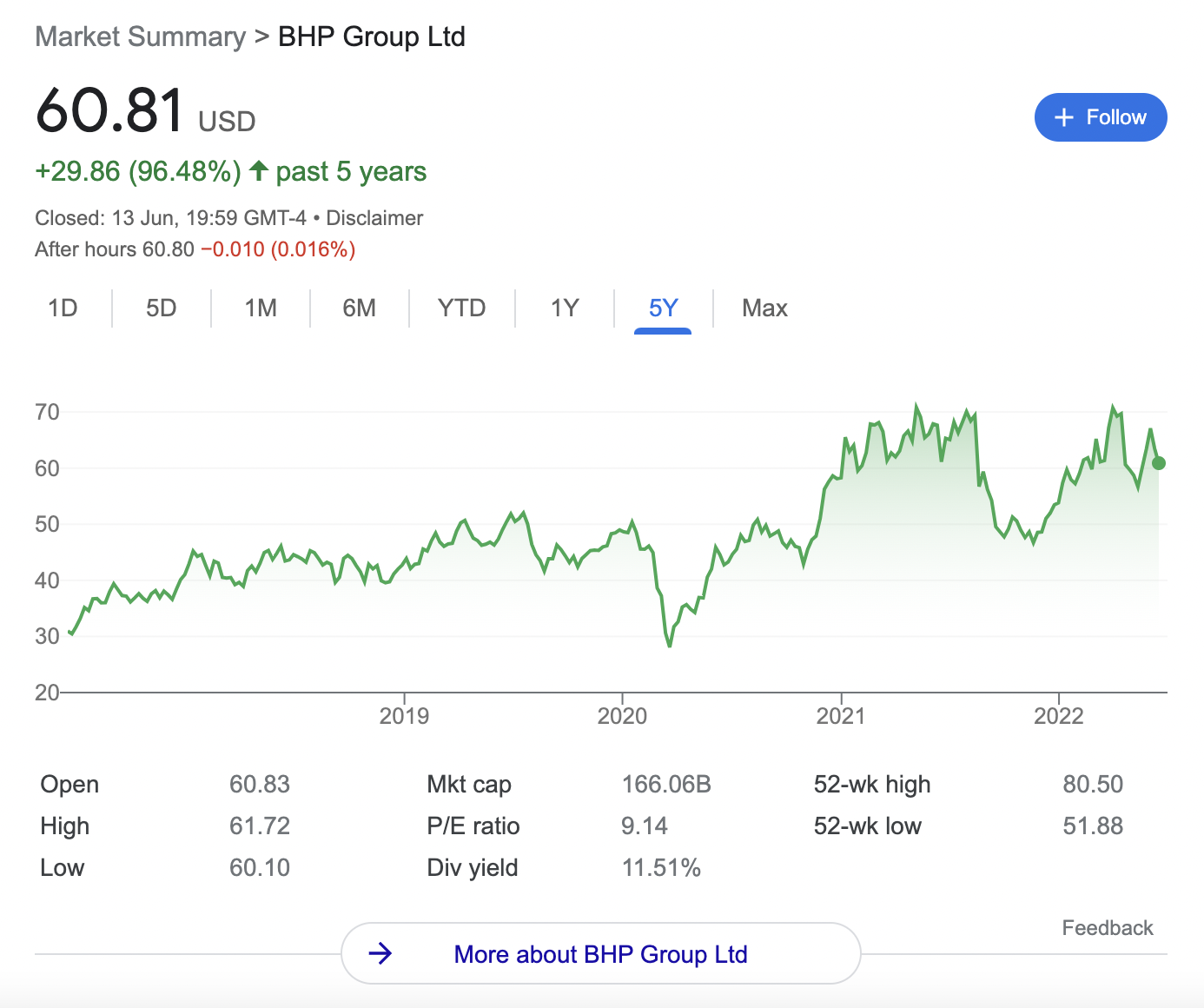

2. BHP Group

Those in the market for regular income from their share investments might want to consider adding BHP Group to their portfolio. The reason for this is that BHP Group is a popular dividend payer in the stock markets. As of writing, the company is offering a huge running dividend yield of over 11%.

Over the prior five years, for instance, BHP shares have increased by over 96%. Once again, this supersedes the ASX index by a significant amount. Moreover, considering that over the prior 12 months the shares are down nearly 10%.

79% of retail investor accounts lose money when trading CFDs with this provider

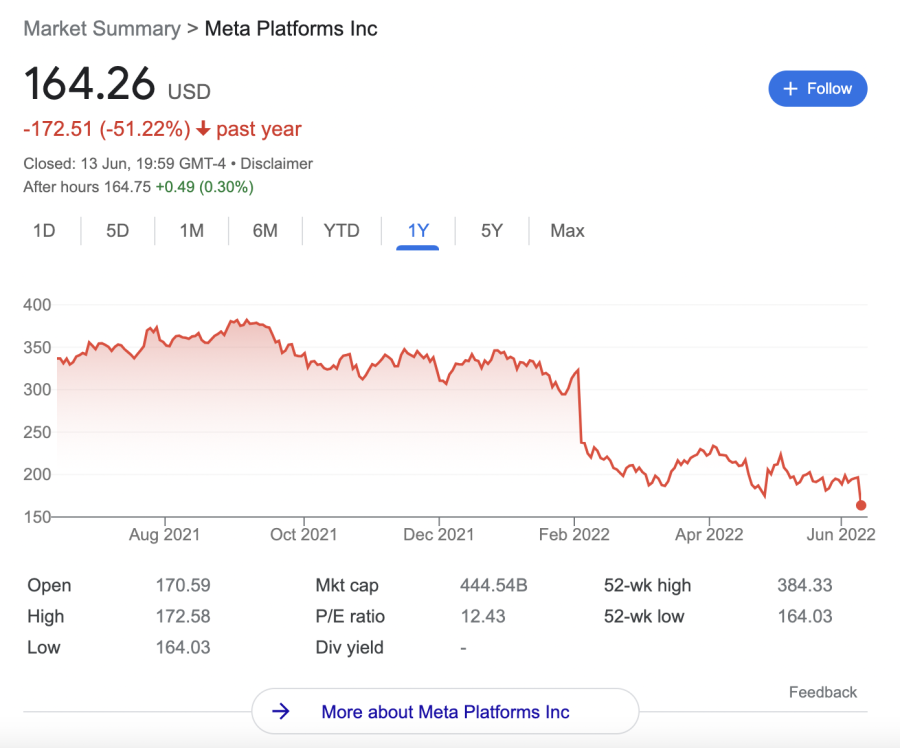

3. Meta Platforms

It could be argued that Meta Platforms – formally known as Facebook, is one of the most undervalued shares in the market today. This social media giant, which trades on the NASDAQ and oversees a variety of platforms like Facebook, Instagram, and WhatsApp, has seen its share price decline by over 50% in the first six months of 2022 alone.

However, it is important to remember that Meta Platforms has a monthly active user base of over 3.8 billion people. Furthermore, the firm has a rock-solid balance sheet and the broader business model moving forward will have a strong focus on the metaverse. As a result, those wishing to buy Meta Platform shares can now do so at a major discount.

79% of retail investor accounts lose money when trading CFDs with this provider

4. Tesla

Tesla is not only the largest EV (electric vehicle) maker in this sector but the biggest car manufacturer globally. This is notable considering that Tesla was only founded in 2003 and went public in 2010. Since listing on the NASDAQ 12 years ago, Tesla has gone on to become one of the biggest success stories on Wall Street.

For instance, Tesla has increased its share price by more than 16,000% since 2010 and 770% over the prior five years alone. While the firm does carry a high P/E of over 87 times, investors can buy Tesla shares at a major discount, not least because the broader tech market has struggled in recent months. In fact, Tesla shares are now 46% cheaper than they were six months ago.

79% of retail investor accounts lose money when trading CFDs with this provider

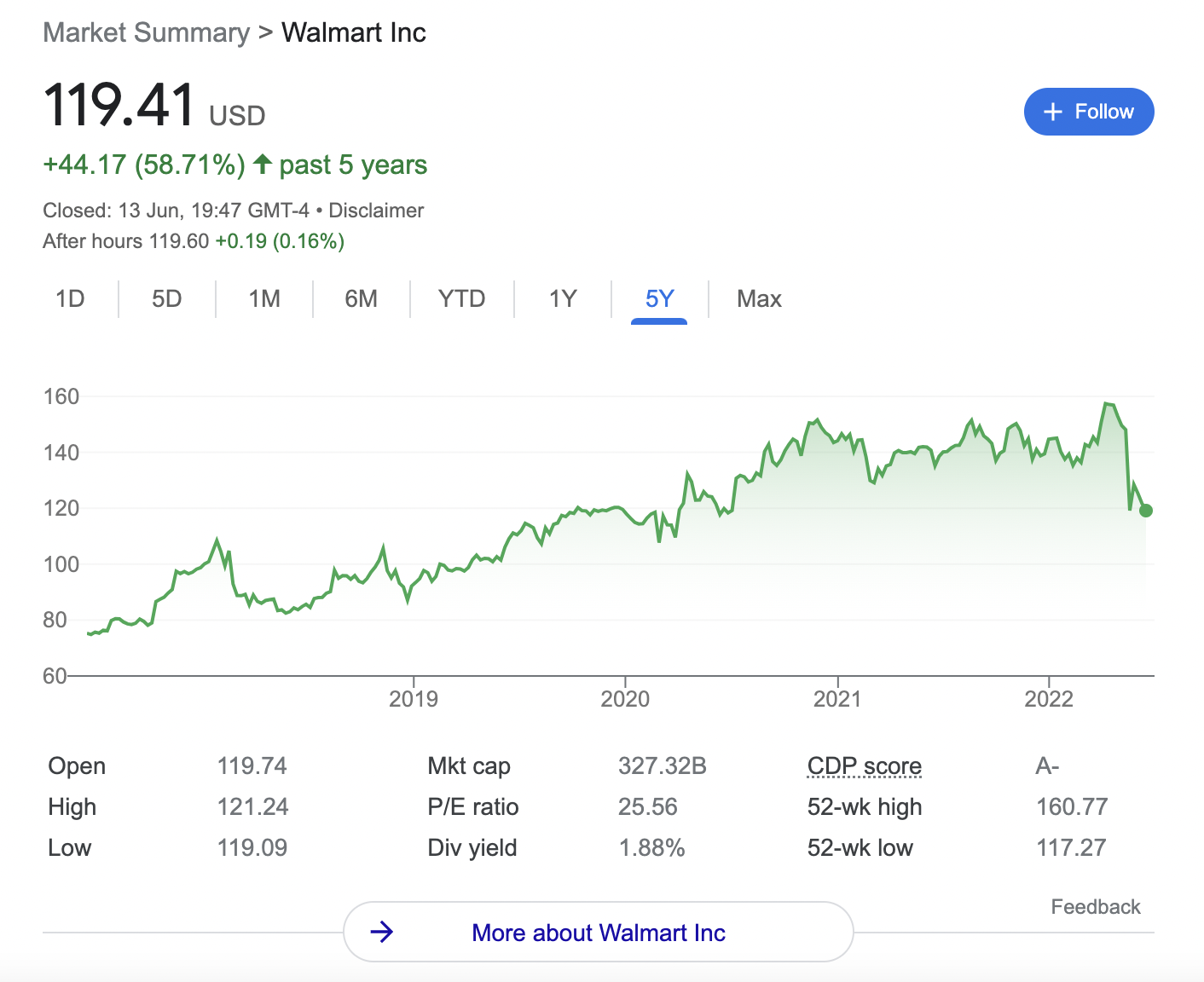

5. Walmart

Those looking for shares to invest in for long-term portfolio stability might research a blue-chip stock like Walmart. This powerhouse has been a public company for many decades – which means that it has gone through multiple recessions, bear cycles, and global crises.

After all, the US-based grocery giant sells products that will always be in demand regardless of broader economic sentiment. Over the prior five years, Walmart has generated share price growth of nearly 60%. The firm is also a consistent dividend payer, albeit, Walmart is offering a modest running yield of just under 1.9% as of writing.

79% of retail investor accounts lose money when trading CFDs with this provider

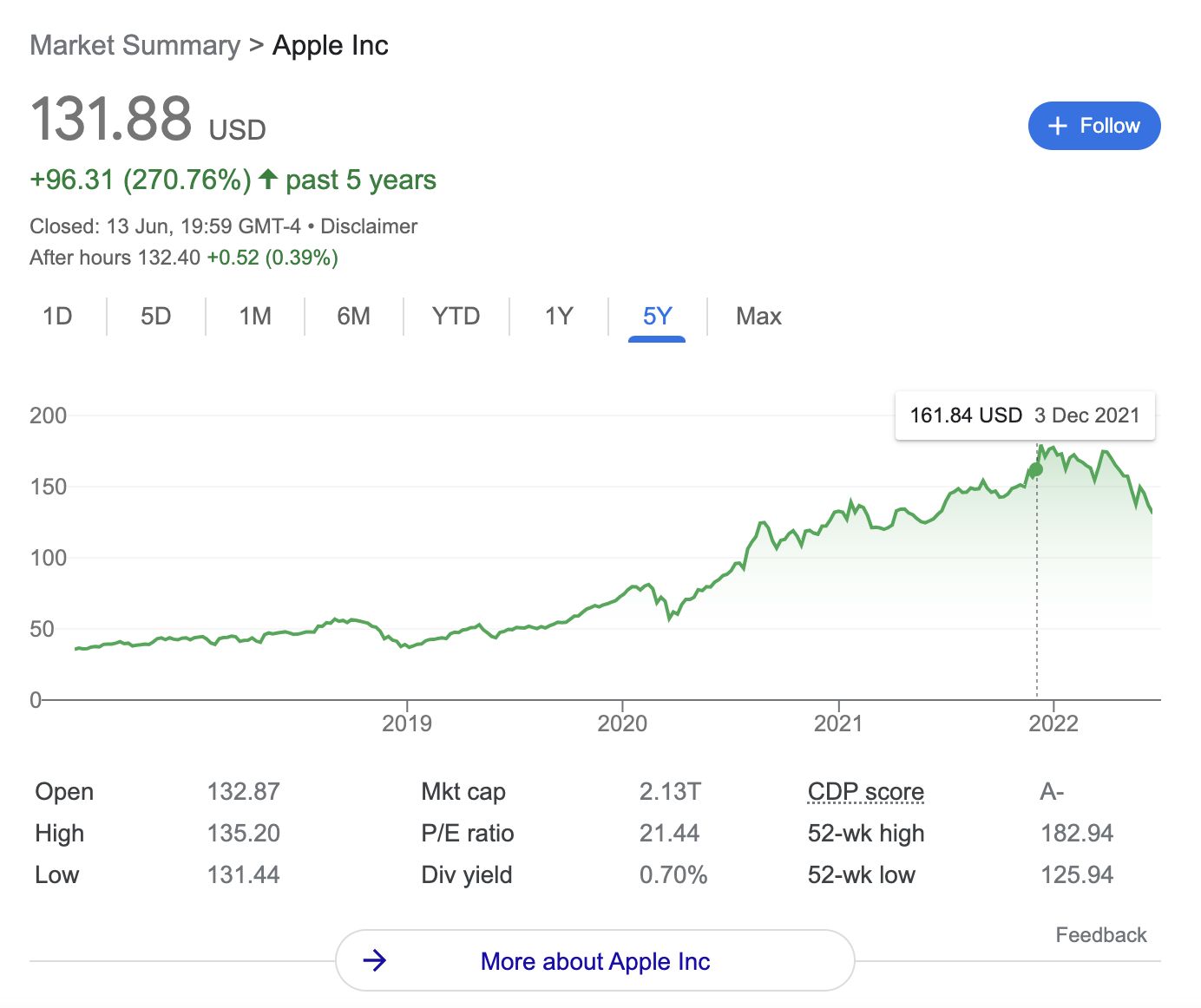

6. Apple

Apple is a global tech leader with a variety of products and services under its parent umbrella. In addition to its core smartphone, tablet, and laptop divisions, Apple is also seeing major growth with its streaming service. With that said, Apple shares – like most tech stocks, are down considerably in 2022.

Over the first six months of the year, the shares are trading at a discount of 27%.

Although the shares are down in 2022, Apple is up over 270% over the prior five years. Apple is also one of the few large-cap tech shares to pay a dividend. As of writing, however, this stands at a running yield of just 0.7%.

79% of retail investor accounts lose money when trading CFDs with this provider

7. NVIDIA

Another popular share to consider researching today is NVIDIA. This company is a market leader in the global GPU production space. As per its most recent earnings report, NVIDIA generated revenues of $8.2 billion, which is 46% up year-on-year.

Perhaps most importantly, over the prior five years, NVIDIA shares are up over 312%. This means that the firm continues to outperform the broader markets. A modest dividend is also on the table for investors. As of writing, its running dividend yield amounts to 0.1%.

79% of retail investor accounts lose money when trading CFDs with this provider

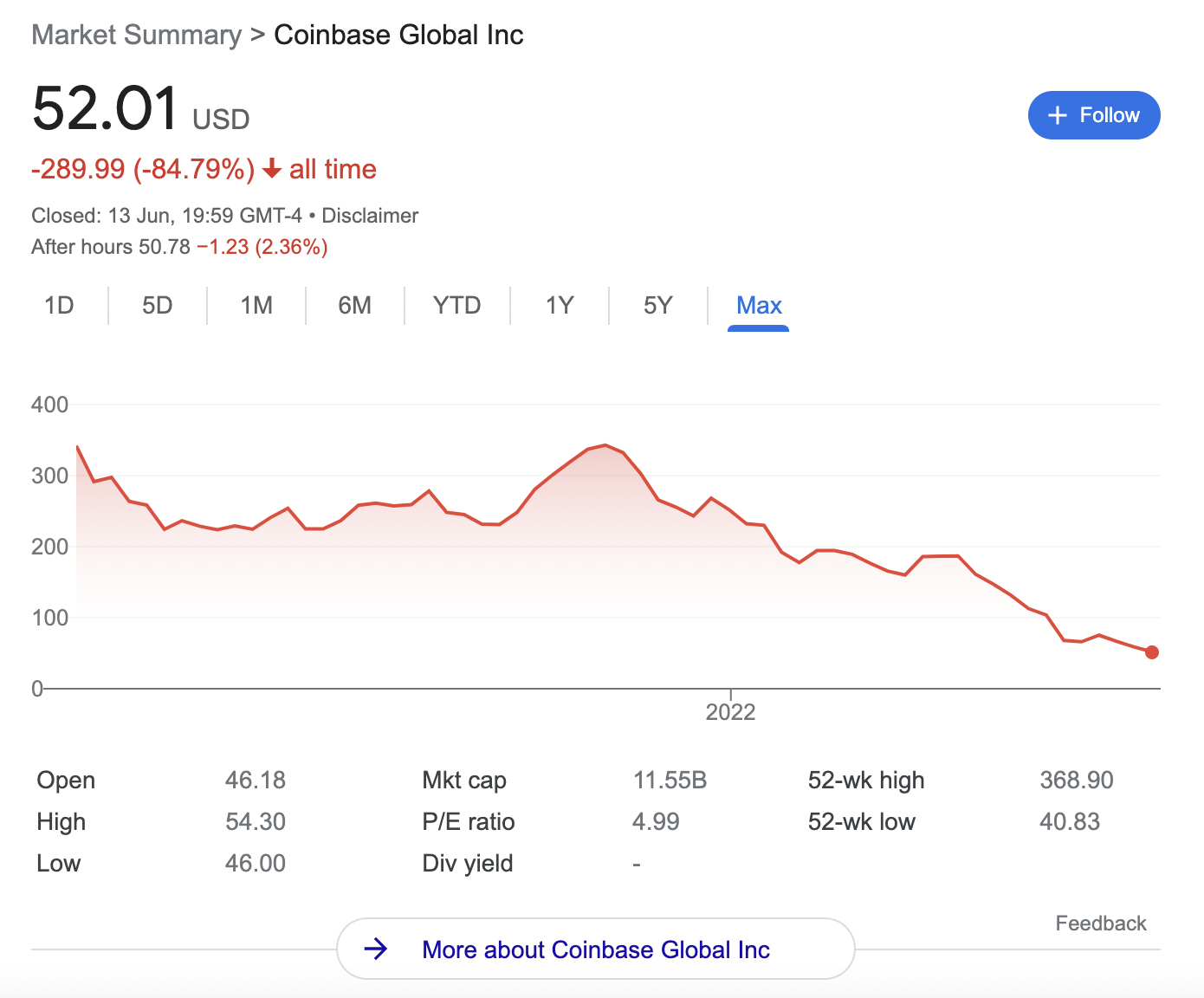

8. Coinbase

Those looking to gain exposure to cryptocurrency in Australia, but prefer to invest in stocks, might research Coinbase. This crypto exchange is home to over 98 million clients and it went public on the NASDAQ as recently as April 2022. However, while Coinbase’s IPO was anticipated, its shares have since plummeted.

Some investors put this down to the broader cryptocurrency markets taking a hit in recent months, while others point to the fact that Wall Street is still somewhat skeptical of digital assets. Nonetheless, Coinbase shares are down nearly 85% when compared to its IPO.

79% of retail investor accounts lose money when trading CFDs with this provider

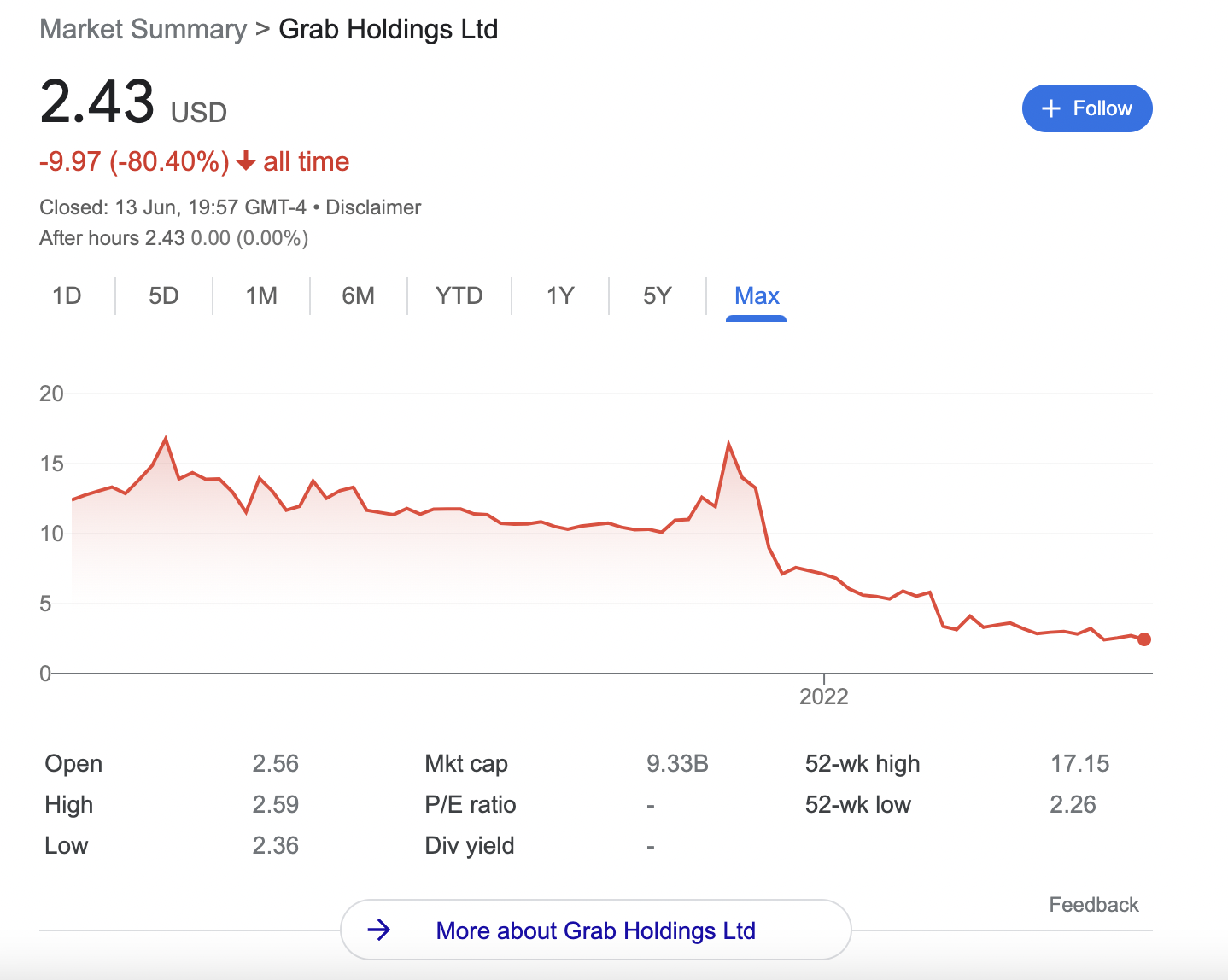

9. Grab

Grab is another growth share that was recently launched and in a similar nature to Coinbase, has seen its valuation hammered in recent months. The firm is behind the Grab app, which offers taxi rides and food deliveries – among many other services, to customers in South East Asia.

Considering the size of markets such as Indonesia and the Philippines, Grab has access to a significant customer base. However, since the company went public in December 2020, it has seen its share price decline by 80%.

79% of retail investor accounts lose money when trading CFDs with this provider

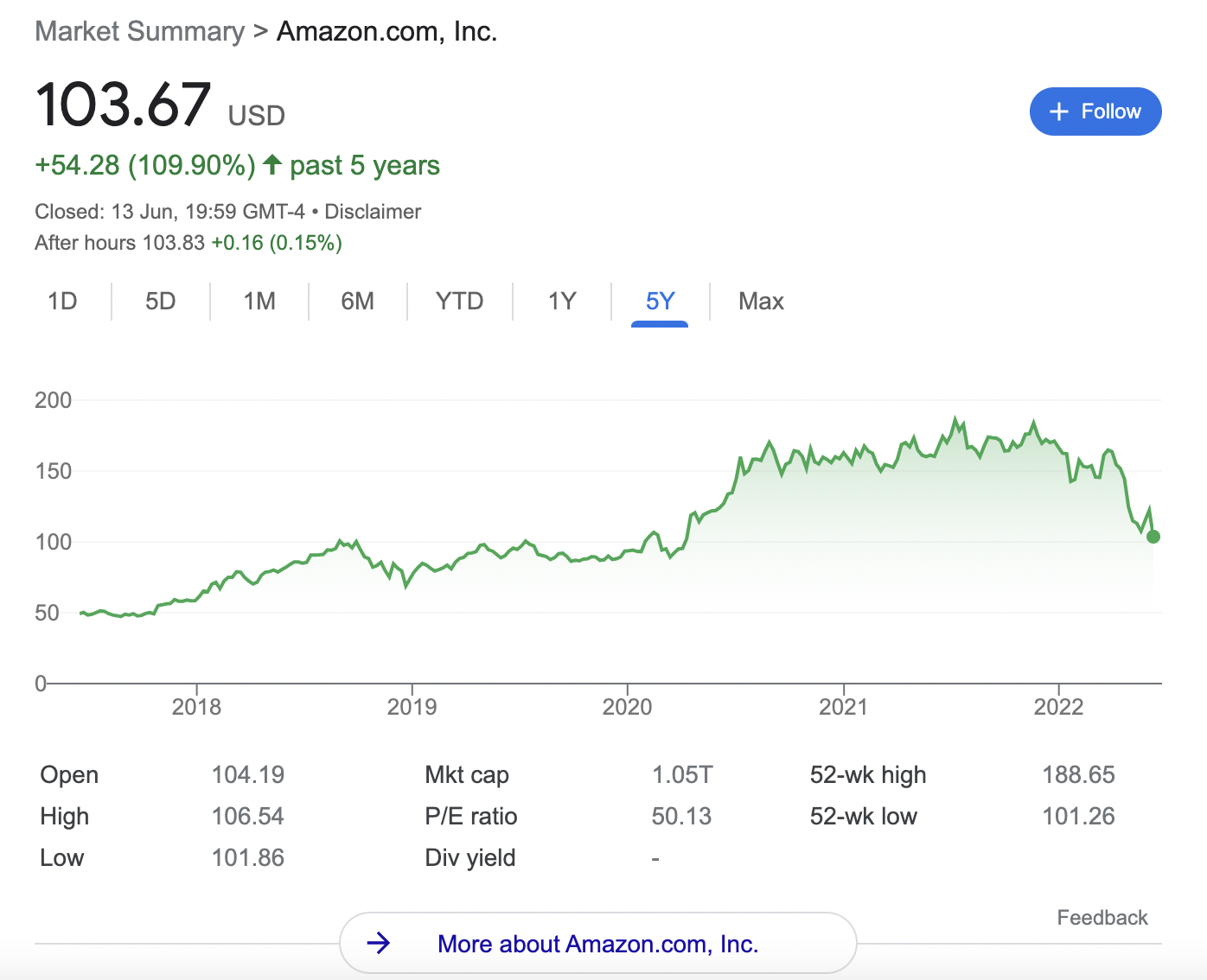

10. Amazon

This global powerhouse is a multi-trillion dollar company that is active in a wide variety of sectors. In addition to its core online marketplace, Amazon offers everything from cloud computing and streaming services to kindle tablets and groceries.

Even though Amazon has been a public company since 1997, the firm still generates above-average market returns. For example, over the prior five years, Amazon shares are up almost 110%. Furthermore, Amazon recently executed a share split, which means that it is now a lot more affordable to invest in.

Previously, a single Amazon share would have over $3,000. But, since the split, the shares are hovering around the $100 level.

79% of retail investor accounts lose money when trading CFDs with this provider

Fundamentals of Investing in Stocks

Capital Gains on Shares

Any profits made from the investment – which will happen when the shares are sold at a higher price than the individual originally paid, are known as capital gains.

Here’s an example of how capital gains work when buying shares in Australia:

- Let’s say that the investor buys 15 BHP Group shares

- At the time of the investment, the shares are trading at $60 each

- A few years later, the BHP Group shares are trading at $90 each

- The investor sells the shares at $30 more than they originally paid

- At 15 shares, this amounts to capital gains of $450

Capital gains on shares in Australia are liable for tax. We discuss this in more detail later in this guide.

Dividends on Shares

As we mentioned earlier, many companies will pay dividends. If they do, the company will normally distribute the dividends to shareholders every three months.

The amount of money that each investor receives is based on the number of shares owned at the time of the distribution.

For example:

- Let’s say that 15 BHP Group shares are owned

- The company announces that it will pay a quarterly dividend of $1.75 per share

- As 15 shares are owned, the investor will receive a total dividend payment of $26.25

The dividends will be paid into the brokerage account where the shares are held. Just like capital gains, share dividends also attract tax.

Compound Interest on Shares

Compound interest follows the concept that by reinvesting dividends back into the share markets, wealth can grow at a much faster rate.

In other words, instead of withdrawing a dividend payment, the funds can be used to buy additional shares. Not only will these newly purchased shares attract additional dividends, but also capital gains too – should the stock price increase.

For example:

- $10,000 is invested into a dividend share

- The share yields 5% in dividends over the year

- This amounts to dividends of $500

- The investor allocates the $500 to buy more shares

- In the second year, this means that the dividend yield will be based on a total portfolio worth $10,500

- As such, another dividend yield of 5% would this time generate $525

If the investor had instead withdrawn their $500 dividends, compound interest would not have been possible. As such, at a yield of 5% in the second year, the dividend payment would have been the same at $500.

How to Buy Penny Stocks in Australia

Penny stocks allow investors in Australia to gain exposure to newly launched companies, or firms with a very small market capitalization. Either way, penny stocks come with a very high risk/reward ratio.

On the one hand, those that are able to invest in the next big thing before the company becomes mainstream will have the opportunity to make significant gains.

However, penny stocks are volatile and speculative. As such, most penny stock investments will end up losing money. Furthermore, penny stocks often trade on over-the-counter markets, which makes it difficult for the average investor to access.

With this in mind, those learning how to buy shares in Australia for the first time should perhaps focus on established companies with robust balance sheets. In doing so, this will reduce the risk associated with the investment.

Are Shares Taxed in Australia?

Yes, shares are taxed in Australia. However, what investors pay on capital gains will depend on how long the shares are held for. Crucially, if the share investment was held for at least 12 months, Australians will get a 50% deduction on the capital gains owed.

- For example, let’s say that the investor buys $4,000 worth of Apple shares and sells them 15 months later for $6,000.

- While the capital gains on this trade amount to $2,000, only $1,000 will contribute to the investor’s annual report.

Moreover, dividends received on a share investment are also taxed. This will form part of the investor’s annual income.

- For instance, if the individual makes a salary of $50,000 and receives $5,000 in dividends, the total amount that needs to be declared for the purpose of income tax is $55,000.

Any capital gains for the year would also need to be added to this figure.

Tax on share investments can be complex, so it’s better to speak with a qualified advisor.

Conclusion

This guide has explained how to buy shares in Australia. We’ve reviewed some popular brokers for the job and explained what investors need to consider before building a share portfolio for the first time.