Investors based in South Africa can now buy shares in a matter of minutes via a regulated online broker. The most popular brokers in this industry offer thousands of shares across both the domestic and international markets, at low fees.

In this beginner’s guide, we explain how to buy shares in South Africa in less than 10 minutes via a commission-free broker.

How to Buy Shares in South Africa

Those looking for an overview of the required process when learning how to buy shares in South Africa can follow the step-by-step guide outlined below.

- ✅ Step 1: Open a Trading Account – The first step is to open an account with a regulated online broker. This will require the investor to provide some personal information, such as a name, home address, and cell phone number. The investor will also need to upload some ID.

- 💳 Step 2: Deposit Funds – Next, make a deposit into the newly created brokerage account. Stock brokers in South Africa will support a variety of deposit methods, including but not limited to credit cards, PayPal, and local bank transfers.

- 🔎 Step 3: Search for Shares –Now that the brokerage account is funded, the user can search for the shares that they wish to buy. Most trading platforms offer a simple search function.

- 🛒 Step 4: Buy Shares in South Africa – Once a company has been identified, the investor will need to create a buy order. This entails entering the total investment stake and confirming in the share trading position.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

We explain the above step-by-step walkthrough in much greater detail alongside example screenshots later on in this guide.

Where to Buy Shares in South Africa

When learning how to buy shares in South Africa, it is important to understand that no two stock brokers are the same.

Some stock brokers are known for offering low fees and a user-friendly interface, while others specialize in advanced technical and research materials.

Below, we review the popular trading platforms in South Africa for the purpose of buying and selling shares.

1. eToro

When buying shares on the eToro platform, no commissions are charged. We found that the spread charged by eToro, which is the difference between the buy and sell price of the respective stock, is largely competitive. When buying shares on this platform, the minimum required investment is just $10.

This is the case regardless of how much the stock is trading for at any given time. This is because eToro supports fractional investing, which means that South Africans can buy a small portion of one stock. eToro also makes it easy to fund a newly created investment account.

The minimum deposit for South African traders is just $50 and supported payment methods are inclusive of e-wallets, debit credit cards, and bank transfers. We also like eToro for its commitment to regulation and client safety. For example, the eToro website is licensed by the SEC, ASIC, FCA, and CySEC.

This is perhaps why more than 25 million clients now use the eToro platform to buy and sell stocks. On top of stocks, eToro also allows its users to invest in ETFs, buy Bitcoin and cryptocurrency assets. When utilizing the eToro crypto exchange, investors will pay a 1% fee of the total investment stake. South Africans can also use eToro to trade forex, hard metals, energies, indices, and commodities.

Finally, and perhaps most importantly, eToro offers copy trading tools. This will appeal to beginners that wish to invest in stocks in South Africa but have little to no experience in doing so. All that is required is to choose a suitable investor to copy alongside an investment amount – and all future positions will be mirrored in the user’s portfolio.

Read More: Check out our full eToro South Africa review.

Note: Newbies will need to tread with caution when learning how to buy stocks on margin.

| Number of Stocks | 2,500+ |

| Deposit Fee | 0.5% |

| Fee to Buy Amazon Shares | Commission-Free |

| Minimum Deposit | $50 |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. Capital.com is a CFD trading platform. This means that users will not be able to buy shares in South Africa in the traditional sense. Instead, when trading CFDs at Capital.com, the user will simply be speculating on whether they believe the share price will increase or decrease in the short term. This is made possible as the CFD instrument will track the underlying stock price on a second-by-second basis. Share CFDs at Capital.com can be traded on a commission-free basis alongside competitive spreads. The platform support fractional share trading and when depositing funds via a credit card or e-wallet, the minimum amounts to just $20. $250 is required when transferring funds via a bank transfer. In terms of supported markets, Capital.com offers share CFDs from more than a dozen international exchanges. This includes markets in Australia, the UK, Singapore, Germany, the US, Spain, and more. Capital.com also offers CFD instruments from other asset classes, such as commodities, ETFs, forex, and cryptocurrency. Capital.com offers leverage on all of its supported markets and limits will vary depending on the asset class. Nonetheless, stock CFDs can be traded with leverage of 1:5. Another important aspect of the Capital.com platform is that users have the option to enter a long or short position when creating an order. This means that users can attempt to profit from both bullish and bearish stock market prices. Finally, Capital.com offers a mobile app that is compatible with iOS and Android smartphones, and this enables traders to enter buy and sell positions while on the move.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. When using Libertex.org, which is a requirement for non-EE traders, stocks are offered in two different forms. First, there is the Libertex CFD division, which allows South Africans to trade the future value of stocks without taking ownership. This enables a trader to apply leverage to positions as well as engage in short selling. Second, Libertex also allows South Africans to buy real shares at a minimum trade size of just $50. There are no commissions to pay when buying real shares and Libertex users will be entitled to dividend payments as and when these are distributed by the respective stocks. We like that Libertex offers plenty of resources to learn about the stock trading market, which includes investment ideas, video courses, and an economic calendar. In addition to stocks, Libertex also offers CFDs that track forex, commodities, ETFs, and cryptocurrencies. Finally, Libertex accepts a wide variety of payment methods, which include Visa, MasterCard, and e-wallets.

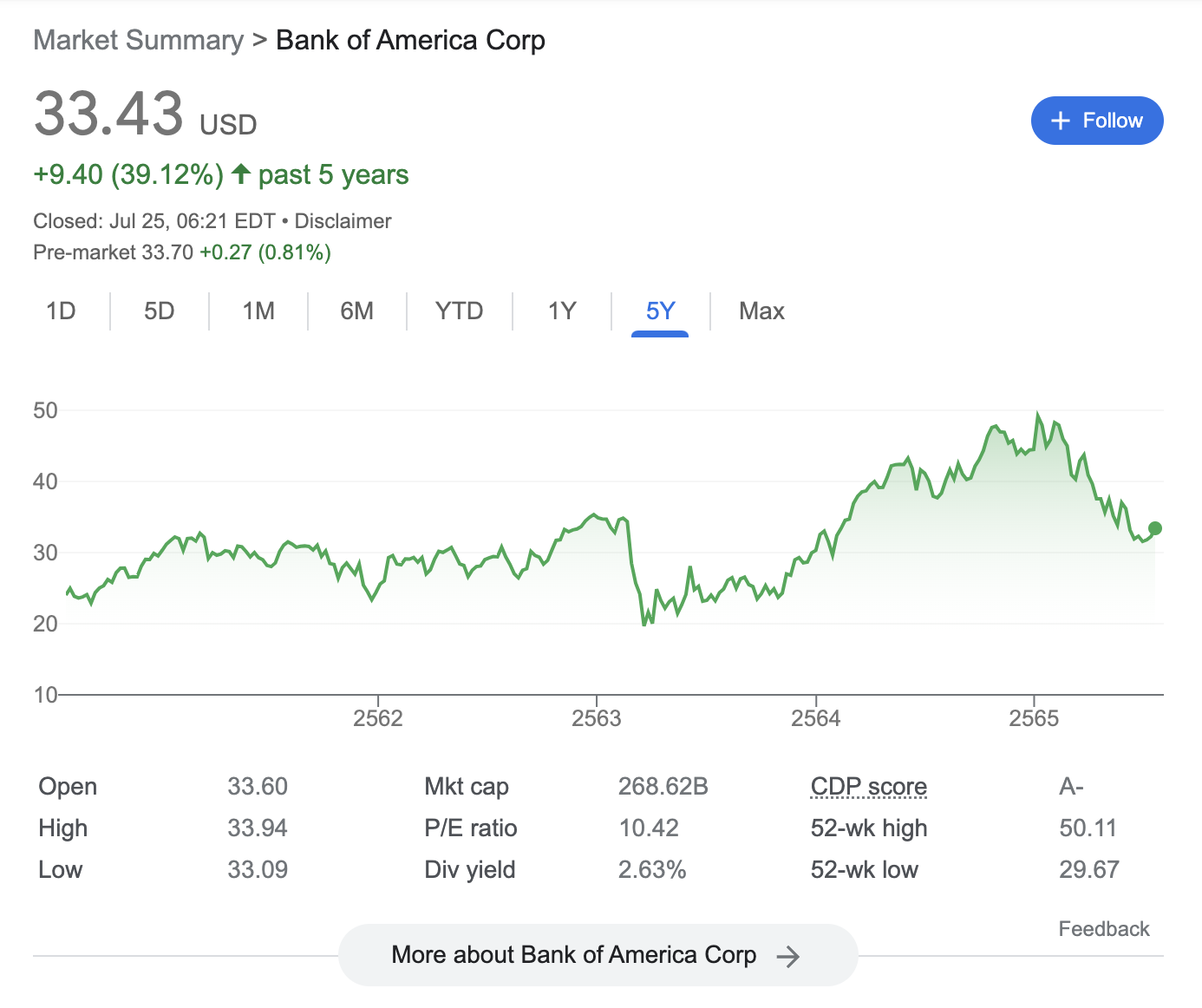

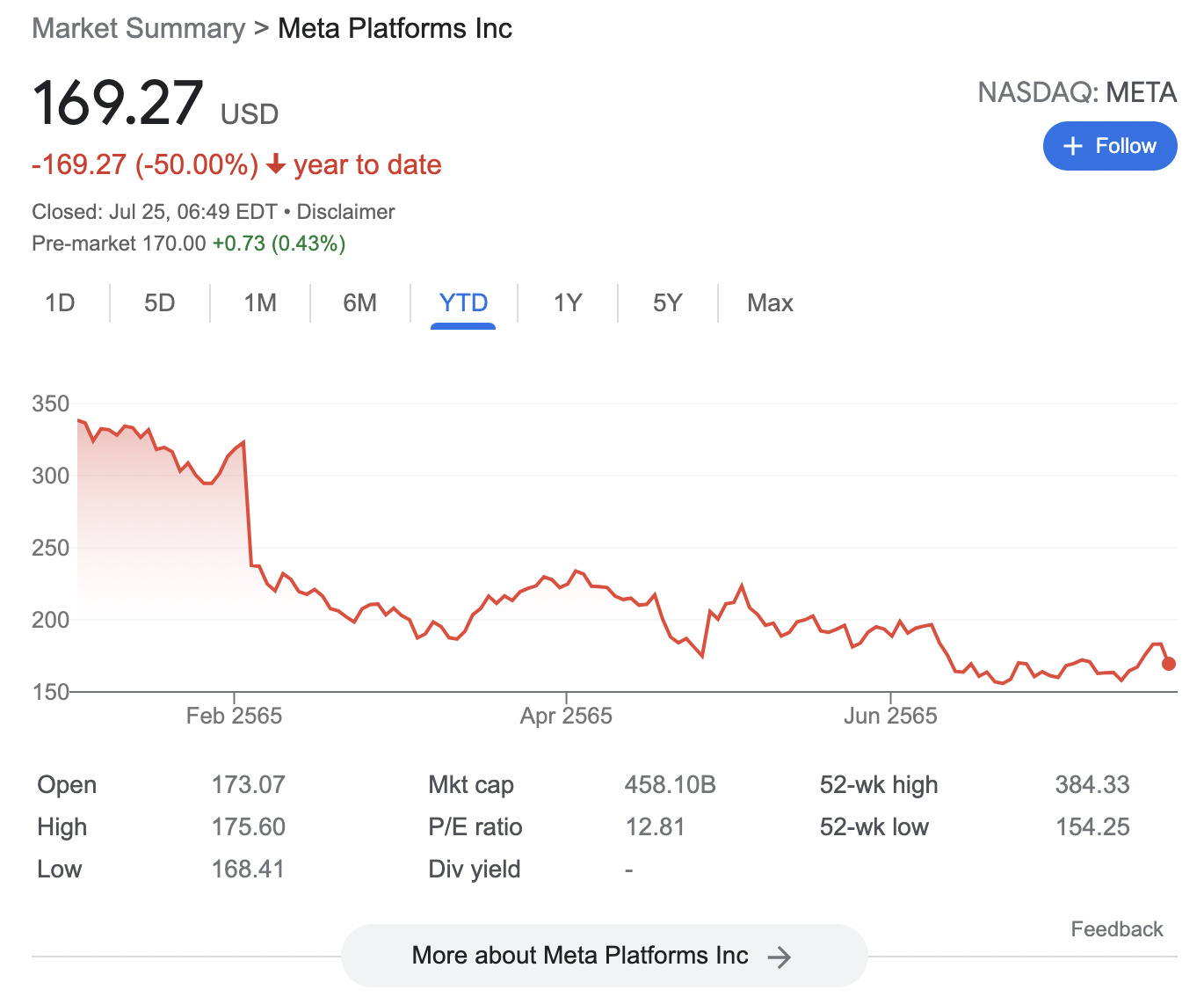

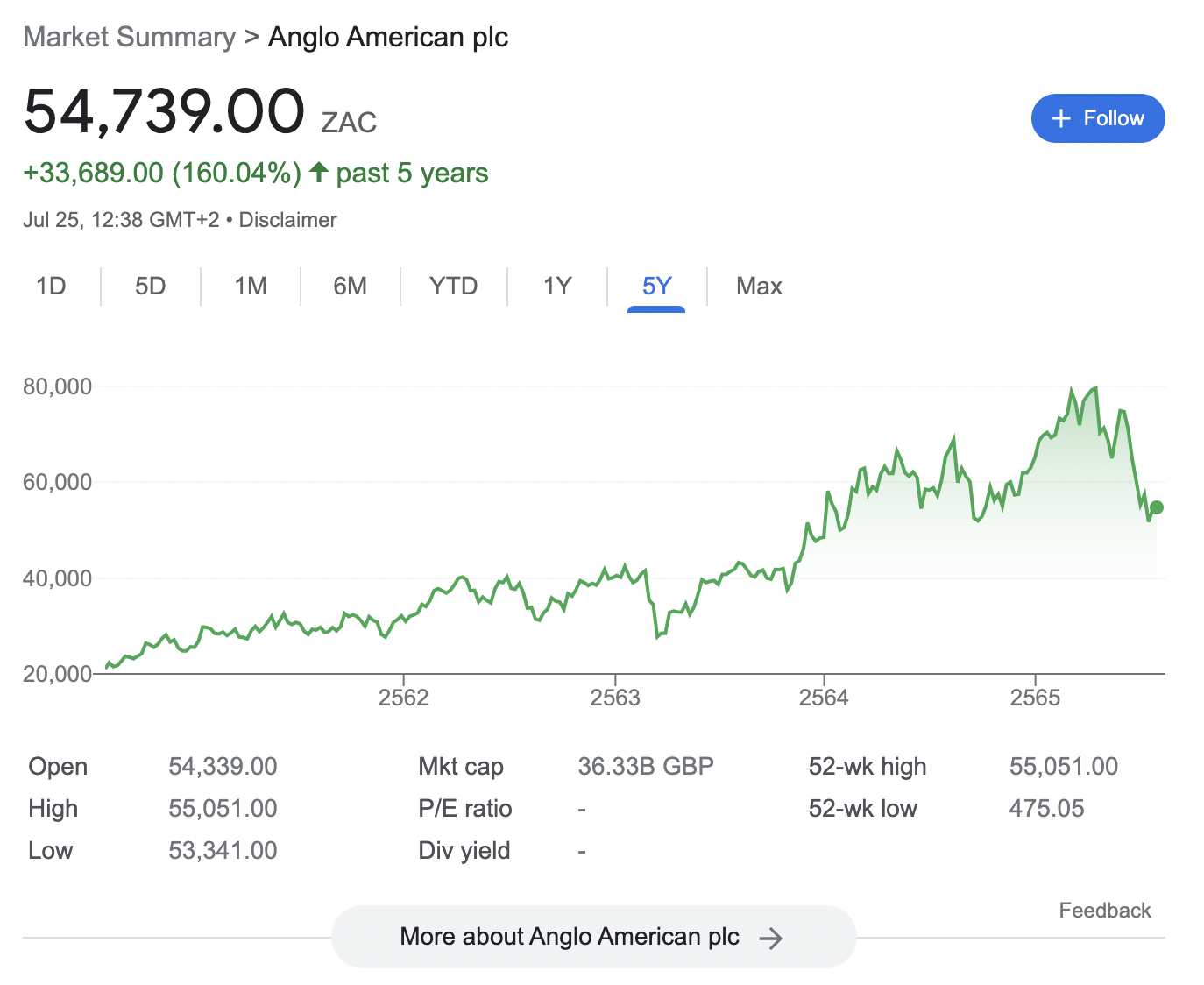

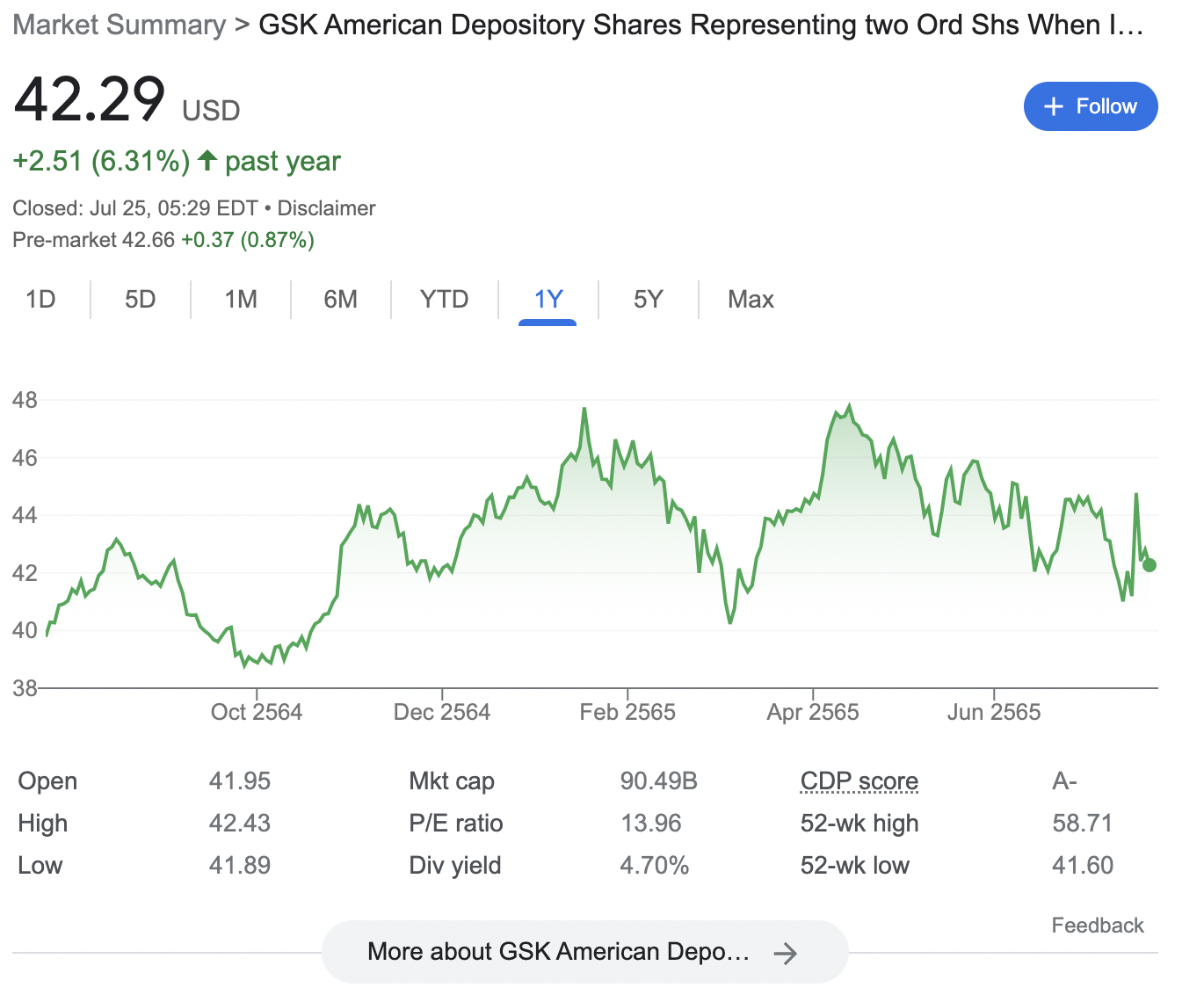

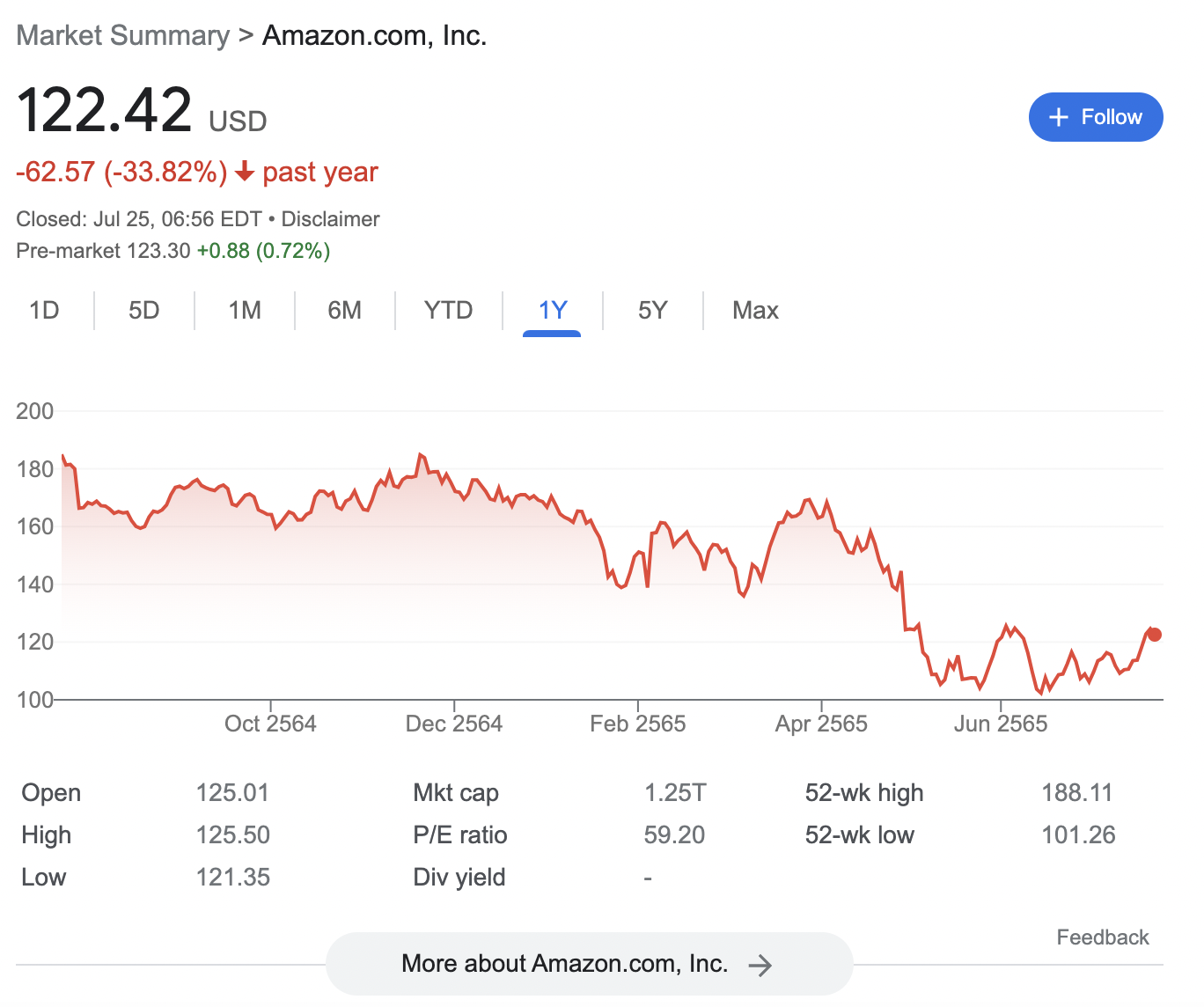

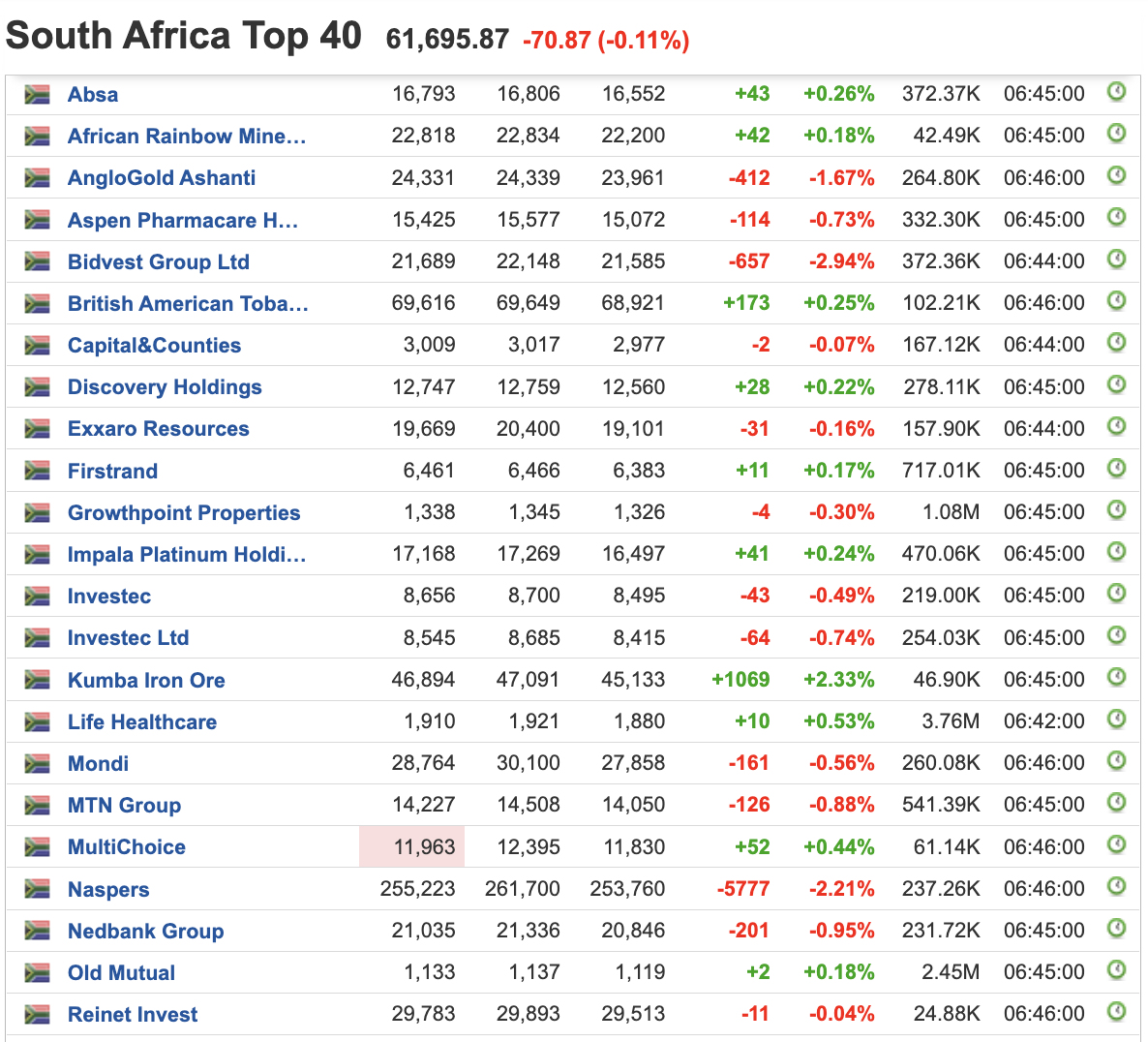

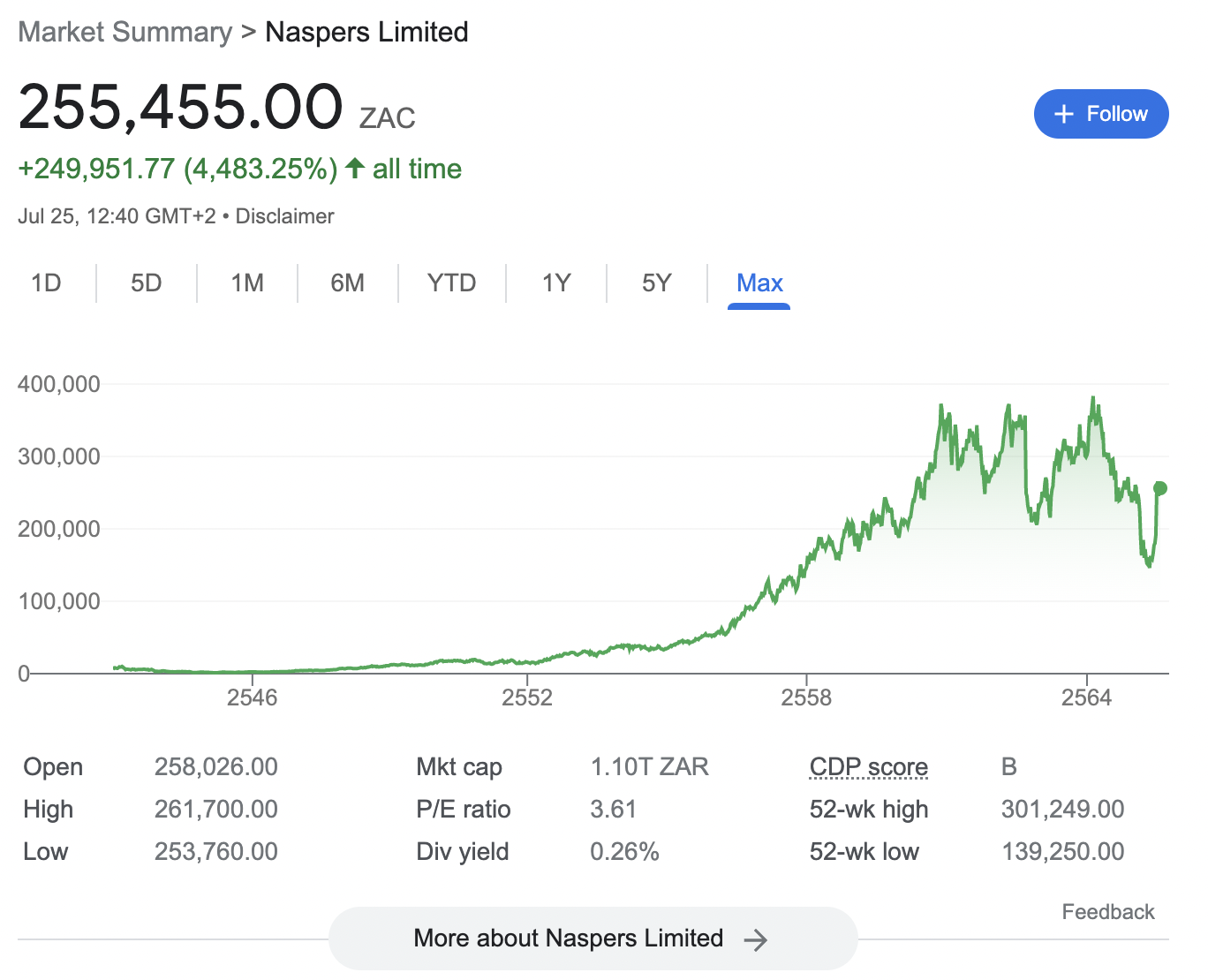

Your capital is at risk. 70.8% of retail investor accounts lose money when trading CFDs with this provider. Absa is a South African-based bank and financial institution that also offers share trading services to retail client investors. This particular option might be worth considering for those that wish to invest in the domestic stock exchange. With that said, Absa also offers a free demo account. This comes with 100,000 rands in virtual currency to practice for one month. Once the investor feels comfortable trading with real capital, they can then make a deposit via a local payment method. While most Absa users will look to buy and sell shares on a DIY basis, newbies and time-starved investors might consider utilizing the professionally-managed portfolio service. In doing so, this will see a financial expert at Absa making investments on behalf of the account holder. Absa claims to offer competitive shares trading fees alongside comprehensive security features and controls. Absa also offers a knowledge marketplace, which gives newbie investors the chance to learn about the broader financial markets. EasyEquities is another South African-based share trading platform that offers accounts to retail clients. The platform is very simple in nature, which is evident when visiting the EasyEquities website for the first time. The platform claims to avoid using intimidating and complex jargon. When it comes to share trading fees, EasyEquities charges 64 cents for every 100 rands invested. We also like that EasyEquities does not have a minimum stock trading requirement in place, as it supports fractional investments. Setting up an account at EasyEquities is also very straightforward and plenty of local payment methods are accepted. Complete beginners might consider opening a free demo account with EasyEquities. Not only will this allow newbies to get to grips with the EasyEquities platform, but to practice potential trading strategies. When it comes to supported markets, EasyEquities offers all JSE-listed companies alongside ETFs and access to IPOs. Furthermore, the platform offers retirement accounts alongside share baskets and bundles. A comparison of the above stocks brokers can be found in the table below: Buying shares was historically a financial service offered to wealthy and affluent clients. However, fast forward to 2023 and it has never been easier to buy shares in South Africa. However, before proceeding, it is wise to have a firm grasp of the basics. However, the overarching way that investors can make money when buying shares in South Africa is when the value of the stock increases in the open market. Share prices are determined by market forces alongside demand and supply. Typically, however, when investing money in a company that performs well in terms of revenues and operating profits, the respective share price will perform well. However, it is also possible that the share price of a company will decline. If this happens, the investor will lose money should they cash the shares out. This is why, as we explain in much more detail later, beginners and seasoned investors alike should consider building a diversified portfolio of shares to help mitigate the risk of financial loss. In terms of how to buy shares, this is simply a case of choosing an online stock broker in South Africa, opening an account, making a deposit, and finally, placing a trading order. It goes without saying that investors in South Africa are spoilt for choice when it comes to trading opportunities. By this, we mean that popular brokers in this industry not only offer access to the domestic stock exchange but thousands of international marketplaces. In turn, this means that South Africans have thousands of shares to choose from when building a portfolio. Those who are completely new to choosing shares to buy for a portfolio might find the process somewhat intimidating. Therefore, in the sections below, we explain the basics behind selecting suitable shares to invest in. The first step to take when learning how to buy stocks in South Africa is to focus on a select number of core sectors. Preferably, these should be sectors that the investor understands, which will ensure the individual can conduct sufficient levels of research and analysis. It is also important to diversify across numerous sectors, which, as discussed earlier, will help mitigate the risk of loss. For example, it might be worth exploring shares from sectors such as energy, gold, banking, tech, retail, consumer goods, and pharmaceuticals. Then, within each individual sector, the investor might consider gaining exposure to multiple market leaders. Seasoned traders will make full use of key accounting ratios when searching for the hottest stocks to watch now. In a nutshell, accounting ratios look at fundamental data from the company’s balance sheet and income statement. This enables the investor to get an idea of how the company is performing in relation to the respective sector and the broader economy. One of the accounting ratios to get to grips with is the price to earnings (P/E). This ratio has the potential to illustrate whether a company is either over or undervalued. It does this by extracting the company’s recent earnings against the current share price. If the company has a P/E ratio that is below the industry or sector average, this could highlight that the shares are undervalued. When a company trades on a public stock exchange, it must release an earnings report every three months. This provides a full and frank overview of how the company has performed in the prior quarter and seasoned investors will religiously listen in on earnings announcements to assess whether the stock is on course to hit its forecasts and targets, or if it is falling behind its market competitors. In the vast majority of cases, earnings reports are initially read out orally by the company’s CEO. It is therefore wise to listen to an earnings report to ensure that the investor stays ahead of the market at all times. A simple way to avoid the hassle of choosing individual stocks to add to a portfolio is to instead invest in an index fund. Index funds track a specific stock market by creating a diversified portfolio of relevant shares. Many brokers serving South African clients offer access to index funds at fractional amounts and low feeds. 2022 has been disastrous for the global stock markets. This means that the vast majority of shares have seen their valuation decline in line with the wider economy. On the flip side, this does mean that investors can buy shares in South Africa at an attractive entry price, especially when it comes to high-grade stocks. Below, we explore 10 popular shares to buy in South Africa as per our own subjective viewpoints. Tesla, which was founded in 2003 and went public in 2010. The company specializes in electric vehicles (EVs) and it is now the largest carmaker by market capitalization. This means that even though Tesla is still relatively young in the grand scheme of things, it is worth more than legacy carmakers such as Ford, Mercedes, BMW, and Toyota. With that being said, Tesla is more than just an EV maker. On the contrary, it is behind a number of innovative technologies that could one day solve many globalized issues. For example, Tesla is building a global network of solar-based panels that can be installed directly onto real estate rooftops. This will not only make solar energy more accessible and affordable to the average South African, but arguably, Tesla panels are a lot more attractive to look at than conventional renewable energy infrastructure. Tesla is also working on gigawatt battery pack technology as well as space-related exploration. Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. The next company to consider when searching for the most popular shares to watch in South Africa in 2022 is Apple. This company is a market leader in electronics with core products including the iPhone, iPad, and Mac desktop devices. Apple is also increasing its exposure to digital services, which now includes a fully-fledged streaming platform that aims to rival both Amazon and Netflix. Just like Tesla, Apple shares have taken a hit in 2022. Year-to-date losses as of writing amount to just over 50%. Over the past five years, however, Apple shares are up over 300%. Apple pays a very small dividend of 0.6% as of writing, and the firm possesses a market capitalization of well over $2 trillion. Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. British American Tobacco is a global tobacco company with multiple stock exchange listings, which includes the JSE. In fact, British American Tobacco is one of the largest companies listed on the domestic marketplace. Unlike the vast majority of publicly listed companies, British American Tobacco is enjoying a fruitful 2022. Year-to-date, as of writing, the shares are up over 17%. Over a one-year period, British American Tobacco stock is up 25%. British American Tobacco is also considered a staple stock. This means that irrespective of wider economic conditions, its products remain in demand. Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. The Bank of America is a US-based financial institution with a large market capitalization on the New York Stock Exchange. This stock has a consistent dividend policy in place which will appeal to income seekers. As of writing, the stock is offering a running dividend yield of just over 2.6%. Over the past five years, Bank of America shares have increased in value by nearly 40%. Year-to-date, however, the shares are down over 27%. Bank of America does have a solid balance sheet and is recognized as a leading financial brand on the global stage, so its current share price action potentially offers the opportunity to invest at discounted prices. Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. Nvidia is a large semiconductor and graphics processing unit (GPU) company listed on the NASDAQ exchange. This company could be one to watch considering the recent Senate draft bill – which could provide billions of dollars worth of investment to the US semiconductor sector. Over the prior five years, Nvidia shares have increased by more than 320%. Over the same period, the S&P 500 has grown by just 60%. Over one year, however, Nvidia shares are down a little over 10%. Nvidia is also a dividend-paying company, albeit, as of writing, it is offering a running yield of less than 0.1%. As per its most recent quarterly earnings, Nvidia revenues were up 46% year over year. However, net income was down 15%. Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. Meta Platformsis the parent company of Facebook, Instagram, WhatsApp, and many other subsidiaries. As a result, it is one of the largest publicly listed companies in the US. Formerly trading as Facebook, Meta Platforms rebranded in 2021 to illustrate its intention to focus on the growth of the metaverse in the coming years. The metaverse is expected to be a multi-trillion dollar industry within the next 10 years, and Meta Platforms is primed to dominate the space considering its vast resources. For example, it is estimated that more than 3.5 billion people are defined as monthly active users across at least one of Meta Platforms’ social media subsidiaries. Furthermore, Meta Platforms has a robust balance sheet and sufficient resources to invest in its research and development ambitions. In terms of performance, Meta Platforms has seen the value of its share price decline by more than 50% over the prior 12 months. Like many tech companies on Wall Street, Meta Platforms does not pay any dividends. Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. In a similar nature to British American Tobacco, Anglo American is a global company with multiple stock exchange listings, including the JSE. According to recent figures, Anglo American supplies approximately 40% of the world’s platinum consumption. This global powerhouse is also involved in the production of other commodities and raw materials, such as nickel, diamonds, iron ore, and copper. Over the prior five years of trading, Anglo American shares have increased by 160%. Over a trailing 12-month period, however, the shares are down 13%. With that being said, Anglo American is offering one of the highest running dividend yields in the market, which, as of writing, amounts to more than 8%. Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. Naspers is a South African conglomerate with interests in a wide variety of products and services. Headquartered in Cape Town, this includes everything from venture capital and online retail to traditional publishing. Although Naspers is one of the largest companies on the JSE, its share price performance has been somewhat underwhelming in recent years. For example, over the prior five years, Naspers’s shares have declined by just over 5%. Moreover, Naspers is offering a pittance in terms of its running dividend yield, which as of writing, amounts to just 0.25%. Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. Glaxo Smith Kline, now trading as GSK, is a UK-based pharmaceutical and biotechnology firm with globalized operations in virtually all corners of the world. GlaxoSmithKline has begun 2022 well, which was further supported by its most recent quarterly earnings report. For example, revenue was up 31% year over year, and operating expenses declined by 17%. Net income increased by 67%, and earnings per share rose by 28%. GSK has a robust balance sheet with plenty of free cash flow reserves. GSK also offers a consistent dividend policy, with the running yield standing at nearly 6% as of writing. Over the prior 12 months, GSK shares are up over 6%. Over a five-year period, however, the shares are up just 1%. Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. Amazon is the largest e-commerce and online retail company globally. It dominates the online marketplace sector by a considerable margin, which became fully evident in the midst of the COVID pandemic. With that said, Amazon continues to diversify into other niche markets, and research and development budgets smash through previous figures. One of the main reasons why Amazon is so cash-heavy is that it has never paid a single cent in dividends since it became a public company in the 1990s. However, over the prior 12 months, Amazon shares are actually down 33%. Over the past five years, Amazon shares have generated growth of 140%. In terms of its financials, its most recent earnings report noted a 7% year over year increase in revenue. Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider. It is important to understand the basics of making money from a stock investment. In the sections below, we offer a simplified overview of how to generate growth when buying and selling shares in South Africa. When it comes to capital gains, the investment thesis is simple. In a nutshell, investors will look to buy shares and then cash out at a higher price at some point in the future. When an investor is able to achieve this goal, they will make a profit. Just remember that share price movements will go both up and down across bullish and bearish cycles. This means that the most successful investors are able to ride out volatile market conditions by keeping hold of the shares over a much longer period of time. On the flip side, investors should not be afraid to sell their shares if the outlook of the respective company does not look positive. Many of the stocks we have discussed on this page are dividend-paying companies. This means that every three months, shareholders will receive a dividend payment. The gains made from dividend payments are in addition to any profits generated from a share price increase. During a bear market, which means that the vast majority of stocks decline in value, dividend shares can come in handy. After all, even if the share price is declining, if the company continues to pay dividends, the investor will still generate income. In order to achieve compound interest, the investor must engage in a specific trading strategy. This can be achieved by reinvesting dividend payments back into the stock markets as soon as they are received. This will, over the course of time, increase the size of the investor’s portfolio. Furthermore, any capital gains or dividends generated by the stock will also be applicable to the newly purchased shares. Therefore, this enables the investor to grow their portfolio at a much faster rate, had the individual withdrawn the dividend payments on receipt. This once again highlights that when learning how to buy shares in South Africa, investors should always take a long-term approach. When searching for the best stocks to watch for 2023, some investors might be tempted to invest in small-cap companies. These are often companies with a stock price of less than $1, so are typically viewed as cheap shares to buy in South Africa. By investing in penny stocks, traders should expect highly volatile and speculative conditions. While the odd penny stock might one day become a huge global leader in its respective industry, the vast majority fail to achieve this goal. As such, those learning how to invest in shares in South Africa for the first time should consider avoiding penny stocks. Instead, it makes far more sense to concentrate on established companies with a large market capitalization that are dominant in their respective sectors. Nonetheless, those wishing to buy penny stocks in South Africa will likely need to find a specialist broker. This is because penny stocks will often trade outside of public exchanges and instead on OTC markets. This results in highly unfavorable trading conditions, such as wide spreads and low levels of liquidity. Understanding tax on share investments can be a complex undertaking. As a result, it’s best to speak with a qualified advisor when attempting to assess potential tax liabilities. Nevertheless, the vast majority of South African retail clients will be required to pay tax on specific types of investment gains. First, tax will be due on capital gains made from a share investment. Second, investors in South Africa will also need to pay tax on dividend payments. Unlike capital gains, this is typically payable on receipt. There are also rules surrounding dividends received from foreign companies listed on the JSE, but once again, advice should only be sought from a qualified tax advisor. This beginners guide has covered each and every consideration to make when learning how to buy shares in South Africa for the first time. In the sections below, we will now explain how to complete a share investment purchase through an online broker. First, the investor will need to open an account with a stock broker. In the earlier sections of this guide, we reviewed some of the most popular share trading platforms in South Africa in terms of fees, security, supported markets, and more. Once a broker has been chosen, the investor can proceed with the registration process. In many cases, this should take no more than a few minutes from start to finish. Simply visit the provider’s website and enter some personal information when prompted. Online brokers are required to collect a copy of the user’s government-issued ID before they can offer access to investment services. Once again, when choosing the right broker, this process can often be completed in a couple of minutes. At the other end of the scale, conventional brokers that are required to perform manual verification processes can take several days to validate the user’s identity. Once the brokerage account has been verified, the user can then make a deposit. Payment methods will vary from one broker to another but can include debit and credit cards, wallets, and local bank transfers. Be sure to take note of the minimum deposit requirement and whether or not any transaction fees will be charged on the payment. At this stage of the walkthrough, the investor should have a funded brokerage account. If this is the case, now it is time to search for the respective shares to buy. All of the stock brokers that we reviewed on this page offer a simple search function. This means that the user can type the name of the company into the search bar to go straight to the relevant trading page. The final step requires the investor to create a trading order. Depending on the chosen broker, this might require the investor to specify the exact number of shares. In other cases, however, the investor can enter the exact monetary amount into the order box. Either way, once the investment stake has been specified, the investor will need to confirm the position. If the markets are open at the time of the investment, the broker will execute the order in real-time and add the shares to the user’s portfolio. Investors might wish to consider the five tips outlined below when learning how to buy shares in South Africa. First and foremost, inexperienced investors often make the mistake of constantly checking the value of the shares they have purchased. This should be avoided, not least because share prices will change throughout the course of the day. Furthermore, beginners should remember that the stock markets are viewed as a long-term investment. The most seasoned of investors will typically check their portfolio once per month. Another mistake that beginners often make when learning how to buy shares in South Africa for the first time is that they inject their entire investment capital into the stock markets in one lump sum. However, this will result in the investor becoming overly reliant on just a single cost price. The wiser move is to dollar-cost average. This means spreading out investments on a weekly or monthly basis, at a smaller amount of capital. This will, over the course of time, average out the investor’s cost price. We briefly mentioned earlier that when investing dividends back into the financial markets, this will result in compound growth. For example, by using dividend payments to buy new shares, will increase the exposure that the investor has to the respective company. If that company continues to pay dividends, the newly purchased shares will also be entitled to a payment. This effect multiplies over the course of time. Those without the time or financial experience to pick individual shares might consider a copy trading tool. This is an investment feature offered by a number of online brokers and it allows users to copy the trades of an experienced investor. Once the investor has been chosen, the user will need to decide how much capital to risk on the respective individual. This means that all future investments will be mirrored in the user’s account without needing to personally place any orders. In addition to dollar-cost averaging and taking a long-term approach to the stock markets, it is also important to understand the benefits of diversification. As we briefly noted earlier, diversification means buying shares from multiple sectors and industries. The overarching objective here is to avoid putting too much money into a specific market. Investing in the financial markets in South Africa has never been less complicated. Now it’s just a case of choosing a suitable stock broker and making a deposit, before selecting individual shares to buy. Investors should remember that the stock markets offer no guarantees of investment returns, so both diversification and dollar-cost averaging should be considered. Furthermore, seasoned investors will look to achieve compound growth by reinvesting dividends back into the markets on receipt.2. Capital.com

Number of Stocks

5,400+

Deposit Fee

FREE

Fee to Trade Amazon Shares

Commission-Free

Minimum Deposit

$20

3. Libertex

Number of Stocks

Not stated

Deposit Fee

FREE

Fee to Buy Amazon Shares

Commission-Free

Minimum Deposit

$10

4. Absa

Number of Stocks

25 global exchanges

Deposit Fee

Not stated

Fee to Buy Amazon Shares

0.25% (minimum $20)

Minimum Deposit

$1,000 per international market

5. EasyEquities

Number of Stocks

JSE and US exchanges

Deposit Fee

Not stated

Fee to Buy Amazon Shares

Buy shares for R100, pay 64 cents

Minimum Deposit

No minimum

Popular South Africa Stock Brokers Compared

Broker

No. Shares

Deposit Fee

Cost to Buy Amazon Shares

Min Deposit

eToro

2,500+

0.50%

Commission-free

$50

Capital.com

5,000+

No fee

Commission-free

$20

Libertex

Not stated

No fee

Commission-free

$10

Absa

25 global exchanges

Not stated

0.25% (minimum $20)

$1,000

EasyEquities

JSE and US exchanges

Not stated

64 cents for every 100 rands purchased

No minimum

The Basics of Buying Shares in South Africa

How do I Find Shares to buy

Choose Suitable Sectors

Learn Accounting Ratios

Stay Up-to-Date With Earnings Reports

Invest in an Index Fund

10 Popular Shares to Consider Now in South Africa

Tesla

Apple

British American Tobacco

Bank of America

Nvidia

Meta Platforms

Anglo American

Naspers

GSK

Amazon

How do some investors Make Money From Stocks?

Capital Gains

Dividends

Compound Interest

How to Buy Penny Stocks in South Africa

Are Shares Taxed in South Africa?

How to Buy Shares for Beginners in South Africa

Step 1: Open a Stock Broker Account

Step 2: Upload Verification Document

Step 3: Deposit Investment Funds

Step 4: Search for Shares to Buy

Step 5: Buy Shares

Buying Shares in South Africa

Ignore Short-Term Price Fluctuations

Dollar-Cost Average

Reinvested Dividends on Receipt

Copy Trading

Diversify

Conclusion

FAQs

How can I buy shares in South Africa as a beginner?

What is the most popular way to buy shares in South Africa?

Where can I buy stocks and shares in South Africa?

What is a good share to watch on the JSE?