An investment of $10k into the financial markets offers plenty of opportunities across several asset classes.

The purpose of this beginner’s guide is to assess the best way to invest $10k across 10 core markets – including but not limited to index funds, stocks, crypto, and gold.

We also offer some insight into how investors can determine the best assets for their $10k portfolio based on their respective financial goals and risk tolerance.

11 Best Ways to Invest $10k in 2023

Investors might consider the 10 asset classes and markets below when assessing the best way to invest $10k.

- FightOut – Best Way to Invest $10K by Yielding Exceptional Returns in a Revolutionary Move-To-Earn Project

- Dash 2 Trade – Overall Best Way to Invest $10K by Diversifying into Cryptos

- Index Funds – Invest in Hundreds of Stocks via a Single Trade

- Commodities – Hedge an Investment Portfolio With Gold, Oil, and Other Commodities

- Crypto Staking – Generate a Fixed Rate of Interest By Depositing Crypto Into a Staking Pool

- NFTs – Find Undervalued NFTs to Flip

- Stocks – Buy and Hold Individual Stocks

- ETFs – Invest in a Group of Assets via a Managed Fund

- Crypto Interest Accounts – Passively Earn Interest on Long-Term Cryptocurrency Investments

- 401k Plans – Invest in Tax-Efficient Way Through a Traditional or Roth 401k

- Copy Trading – Day Trade Stocks and Other Assets Passively

Investing in promising new cryptocurrency projects, such as new gaming token Tamadoge, is our top investment pick. Click the link below to learn more about Tamadoge.

As we explain in more detail shortly, the best way to invest $10k is to create a diversified portfolio with assets of various risk profiles and upside potential.

A Closer Look at the Best Ways to Invest $10,000

Investors should consider their personal goals and tolerance for risk when assessing how to invest $10k.

In addition to diversification, dollar-cost averaging is also worth considering – which will result in smaller but more frequent investments, rather than injecting the entire $10k in one lump sum.

Below, we offer a comprehensive analysis of 10 asset classes and markets that potentially represent the best ways to invest $10k.

1. FightOut – Best Way to Invest $10K by Yielding Exceptional Returns in a Revolutionary Move-To-Earn Project

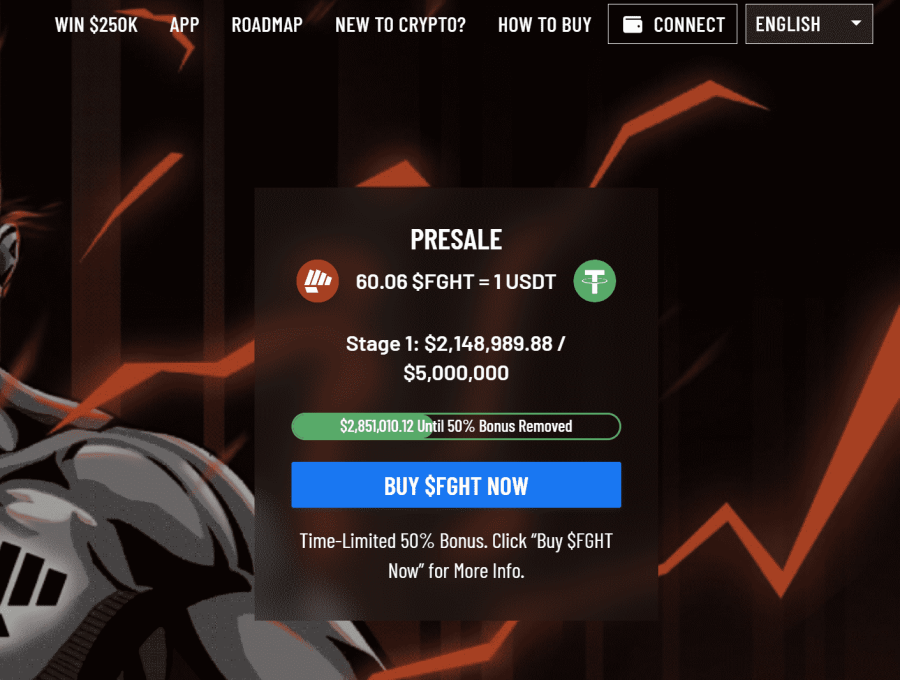

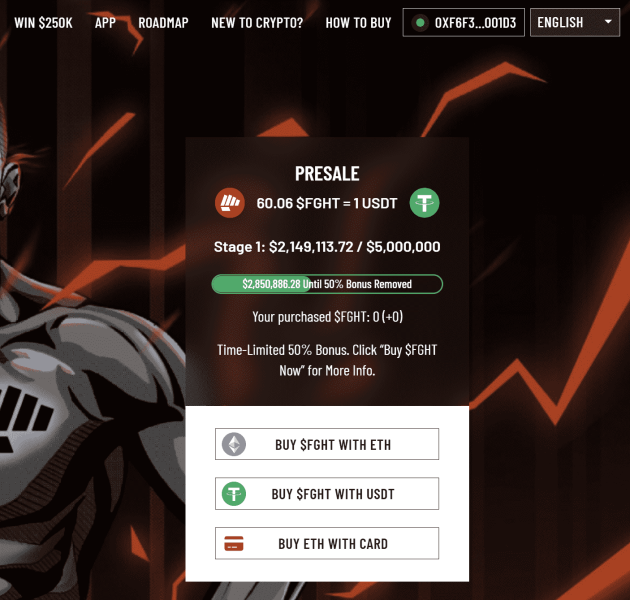

The project has induced a solid investor response while raising over $2.1 million USDT in its first presale stage in just a few days. At the time of writing, FightOut’s native token $FGHT can be bought at a discounted price of $0.0167.

The project’s unique fitness app empowers users to earn exciting rewards while completing their daily workouts, fitness challenges, and other fitness-related tasks.

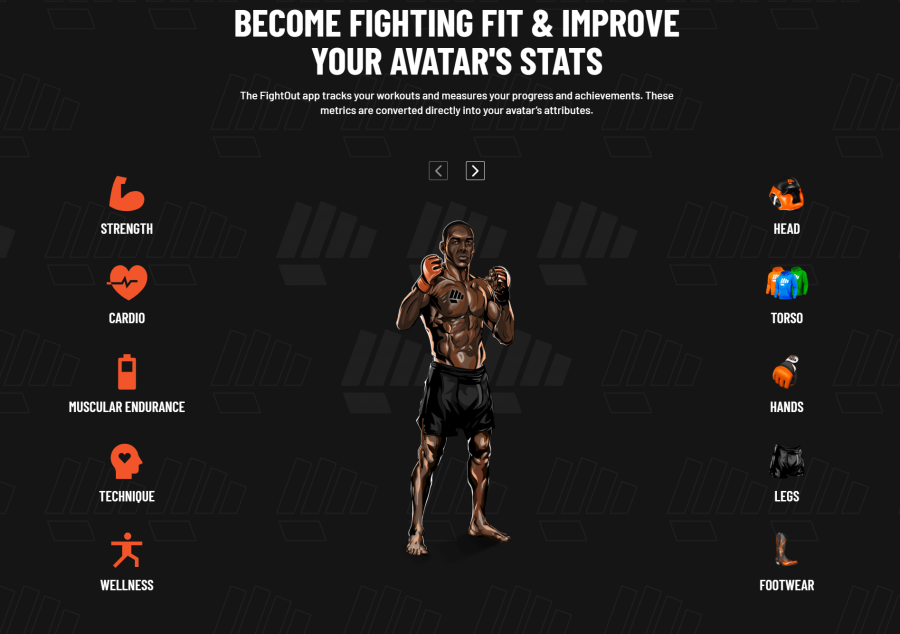

In addition to this, FightOut has created a metaverse for gamifying users’ fitness lifestyles. At the time of creating a new account, users can create their own soulbound NFT avatars in the project’s metaverse. Interestingly, these NFT avatars will enhance in relation to the user’s real-life fitness metrics. FightOut also enables users to compete with other community members in its metaverse.

The project also created its in-app currency known as REPS to reward users for completing their workouts. Users can use REPS to buy cosmetic NFTs for their avatars, membership discounts, and similar products. Investors can also check the project’s whitepaper to gain an in-depth understanding of the project’s features.

$FGHT Tokenomics

The project’s native token $FGHT is an ERC-20-based token built on Ethereum’s network. Out of its total supply, 9 billion of them will be sold through the project’s presale stages.

Buyers can use $FGHT to take part in several tournaments and leagues. Also, investors can use these tokens to buy more REPS. Buyers using $FGHT to buy the in-app currency would receive an additional 25% REPS.

Presale Performance & Purchase Bonuses

FightOut has seen a phenomenal response in its first presale launch as it raised over $2.1 million USDT in just a few days. Investors also have a chance to get up to 50% additional tokens as rewards during the ongoing presale stages.

Users buying $FGHT during the presale stages are also entitled to get bonuses that start at 10% with an investment of just $500 and 6 months of vesting. Furthermore, investors can get membership rewards when they stake more $FGHT tokens or stake them for a longer time.

To always stay updated, buyers can consider joining FightOut’s telegram.

| Presale Started | 14 December 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

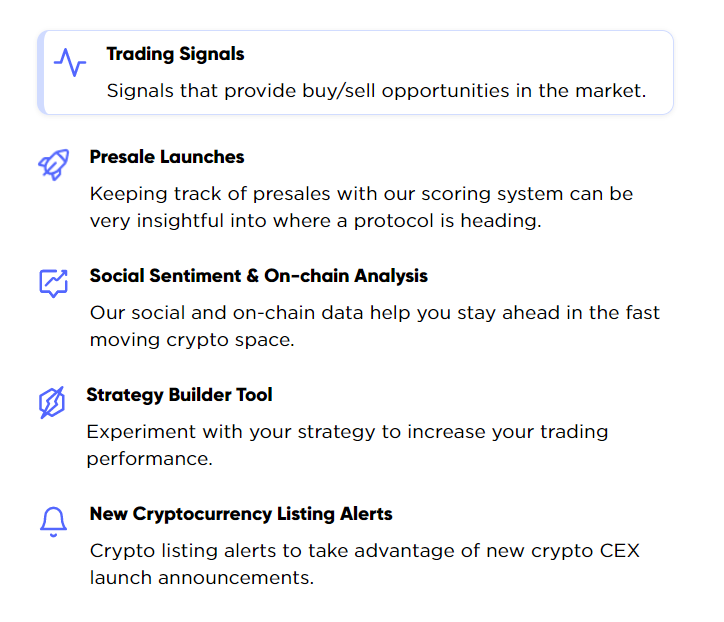

2. Dash 2 Trade – Overall Best Way to Invest $10K by Diversifying into Cryptos

Currently, on stage 2 of the presale, D2T is available to buy for only $0.05 per token. However, the price will increase by the last round to $0.0662. The token can be leveraged to get access to a wide range of exclusive features on the Dash 2 Trade dashboard.

The Dash 2 Trade whitepaper states that the dashboard will officially be launched in Q1 2023 – giving access to presale listings, real-time crypto listing alerts, auto trading features and even risk profilers to measure one’s risk-taking ability.

One of the best utility tokens to buy, D2T can be leveraged to take part in Dash 2 Trade’s weekly trading competitions. With D2T, investors can purchase a premium tier (1,000 D2t) or a starter tier (400 D2T) on a monthly basis. D2T holders get access to community-wide competitions, where one can earn free token rewards. To incentivize widespread adoption, the team is hosting a $150,000 D2T giveaway which can be won by investing in the presale.

To take part in the presale, you must make a minimum purchase of 1,000 D2T – equating to $50 during the second presale round. However, the same number of tokens will cost $62 by the last presale stage. To stay on top of the presale updates, join the Dash 2 Trade Telegram channel.

| Presale Started | October 19 |

| Purchase Methods | ETH, USDT, Transak |

| Chain | Ethereum |

| Min Investment | 1,000 D2T |

| Max Investment | N/A |

3. Index Funds – Invest in Hundreds of Stocks via a Single Trade

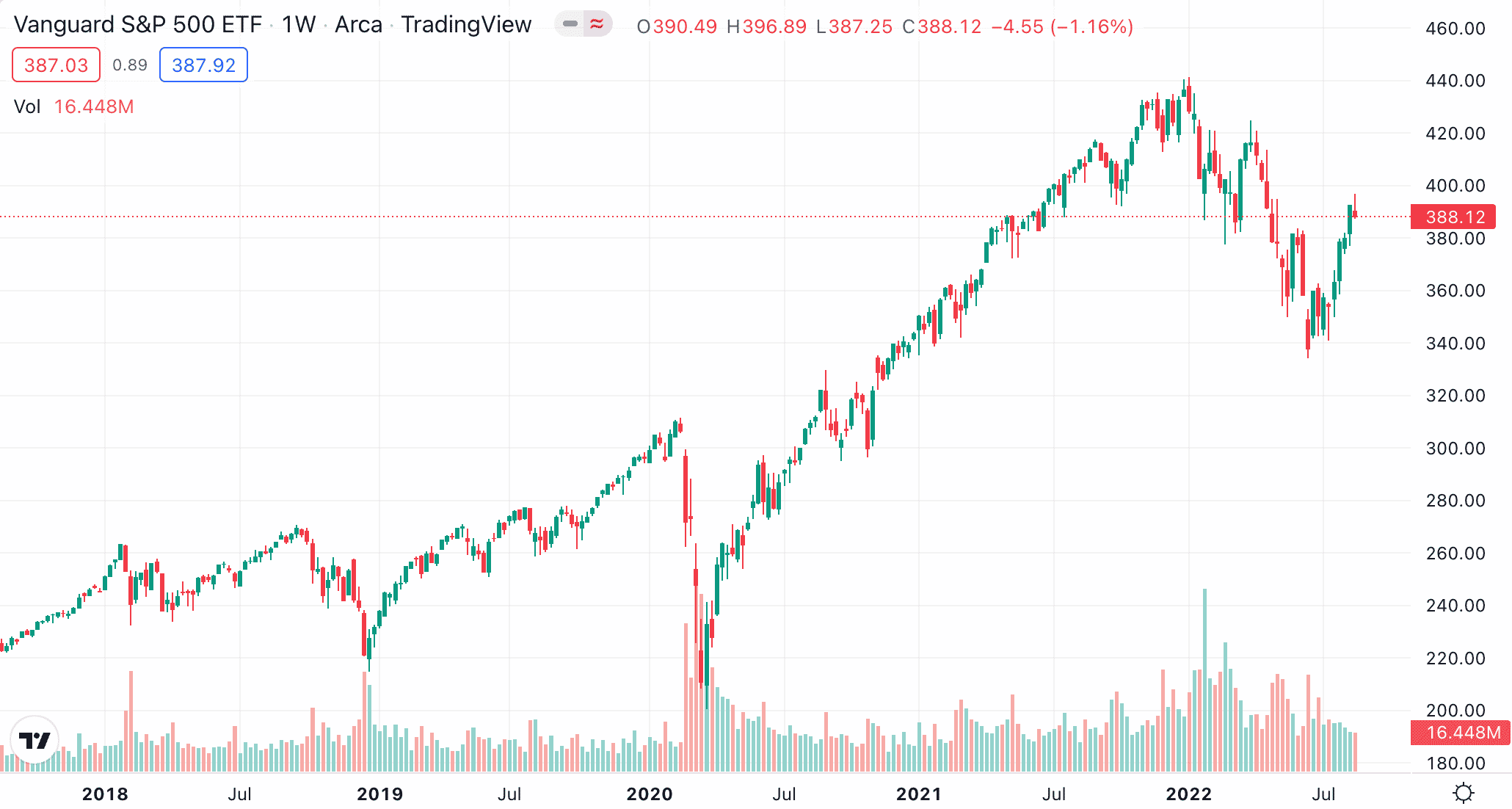

In addition to cryptocurrencies and presales, those in the market for the best way to invest $10,000 might also consider an index fund. In a nutshell, index funds will track a predefined segment of the broader stock market. The idea is to give investors exposure to a diversified range of stocks through a single trade.

For example, the most traded index fund globally is the Standard and Poor’s 500 (S&P 500). This index fund tracks 500 large stocks from the two primary US exchanges – the NYSE and NASDAQ. Although there is a variety of. criteria that companies need to meet to be listed as an S&P 500 constituent, the overarching requirement is based on market capitalization.

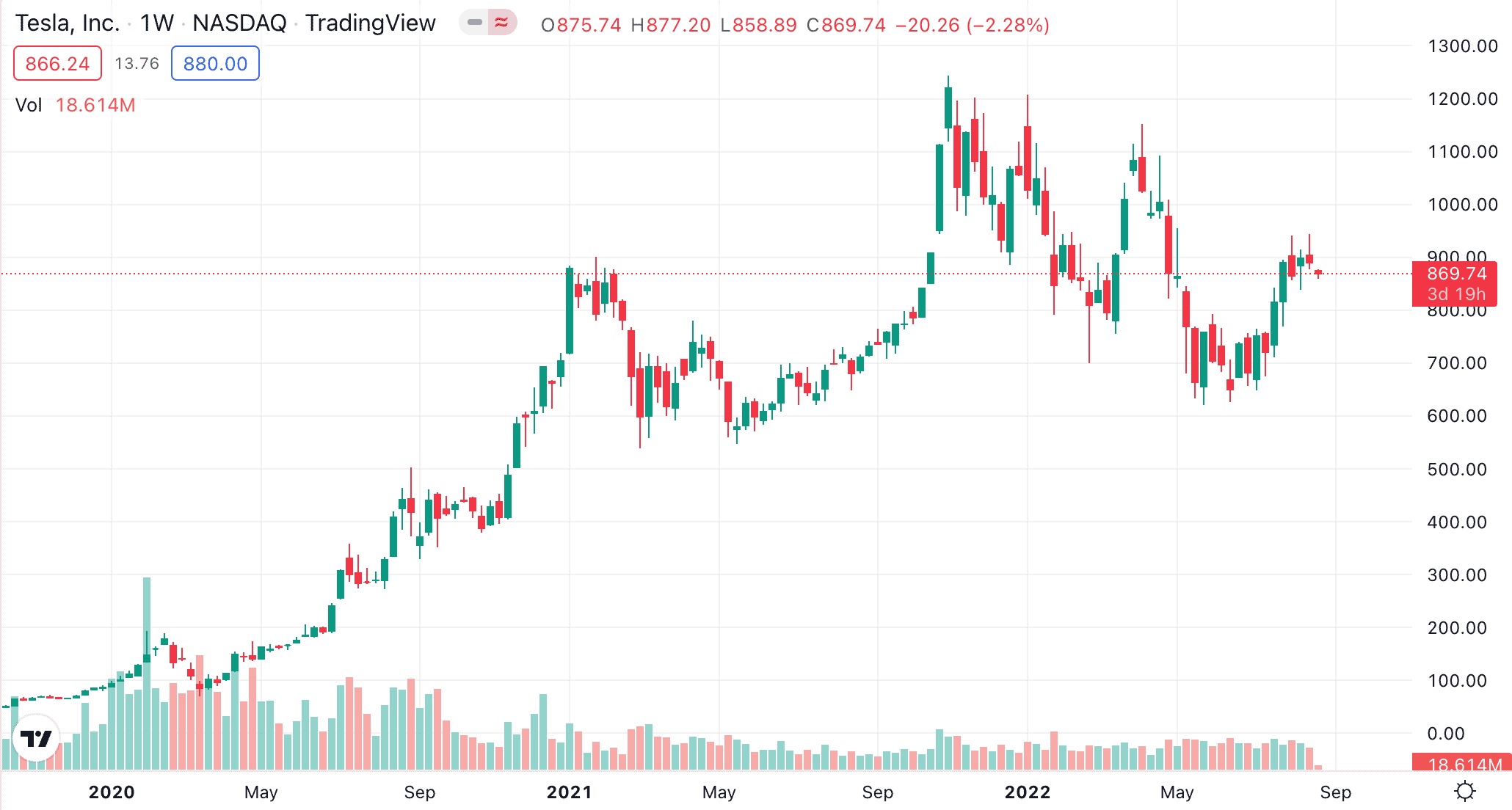

This is highlighted in the table below, which represents the 10 largest constituents of the S&P 500 index as of writing:

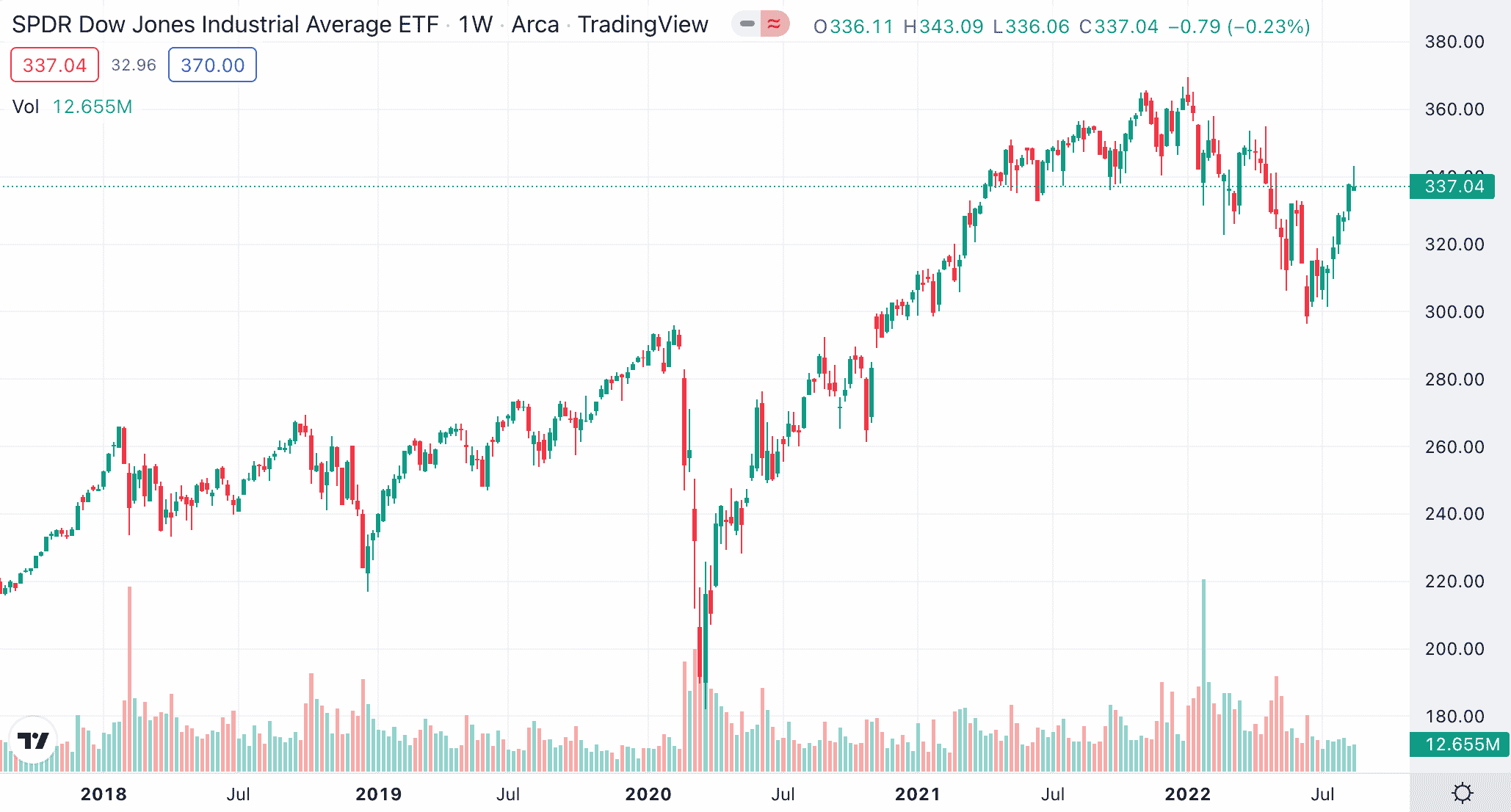

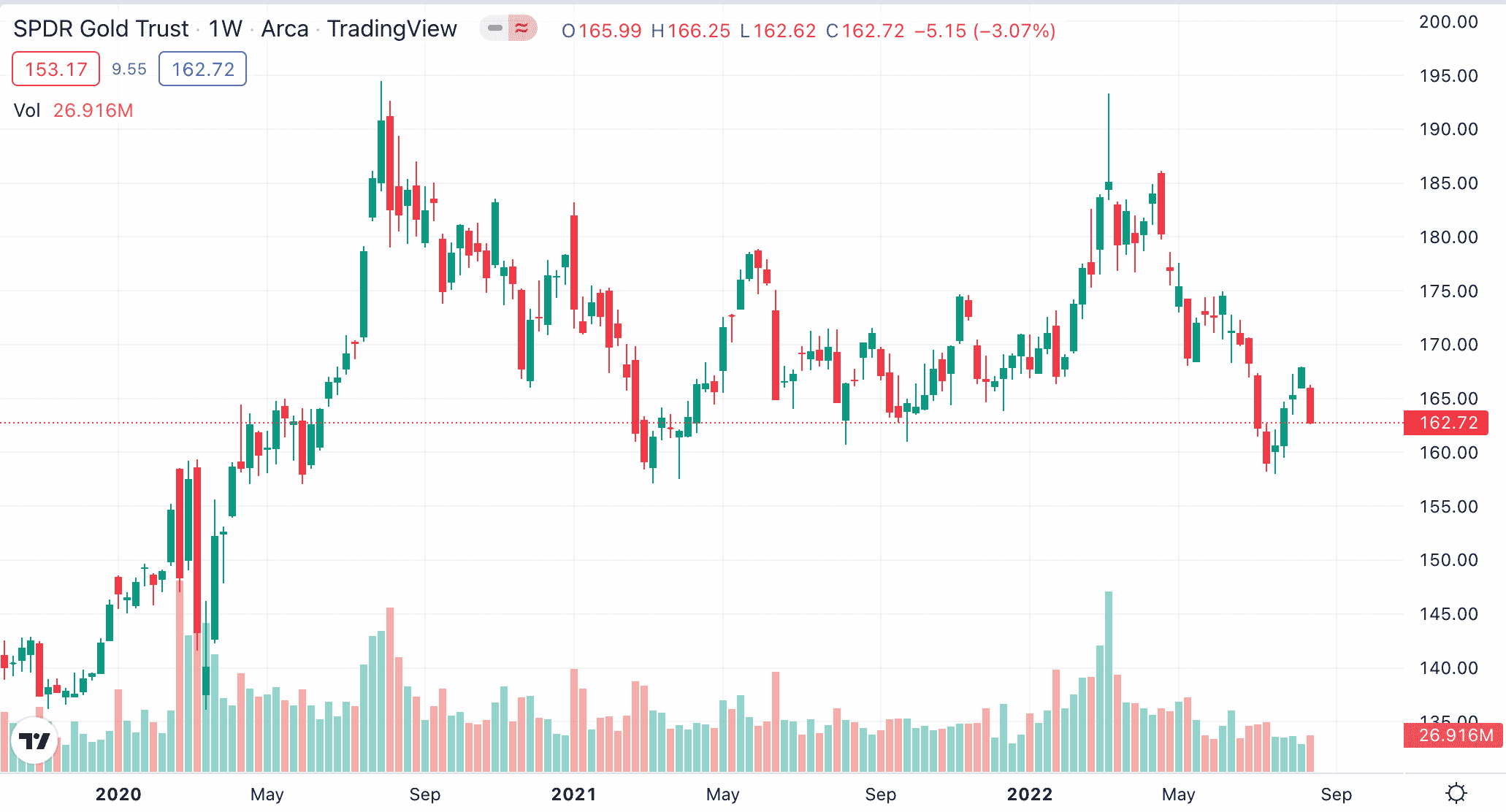

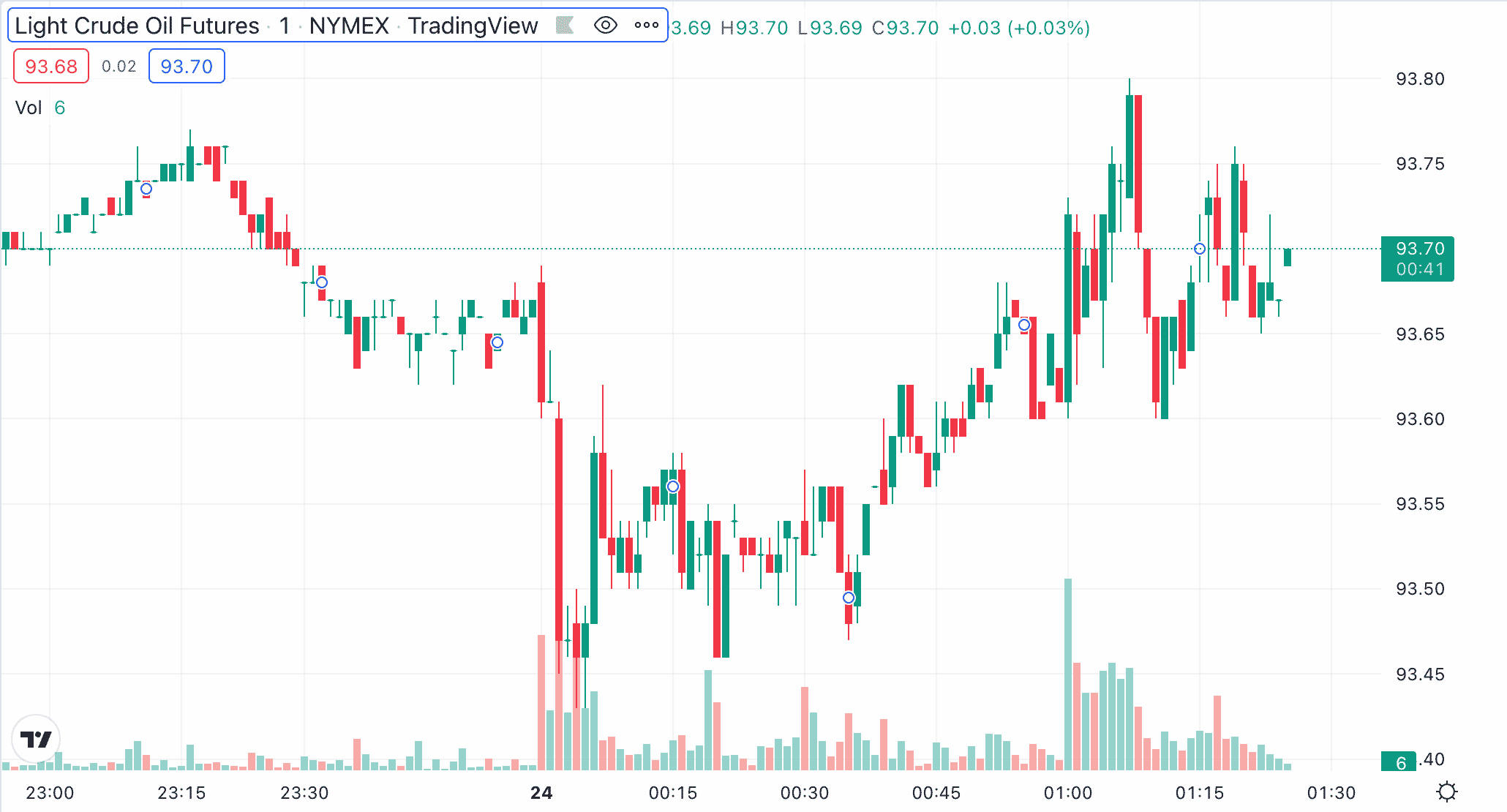

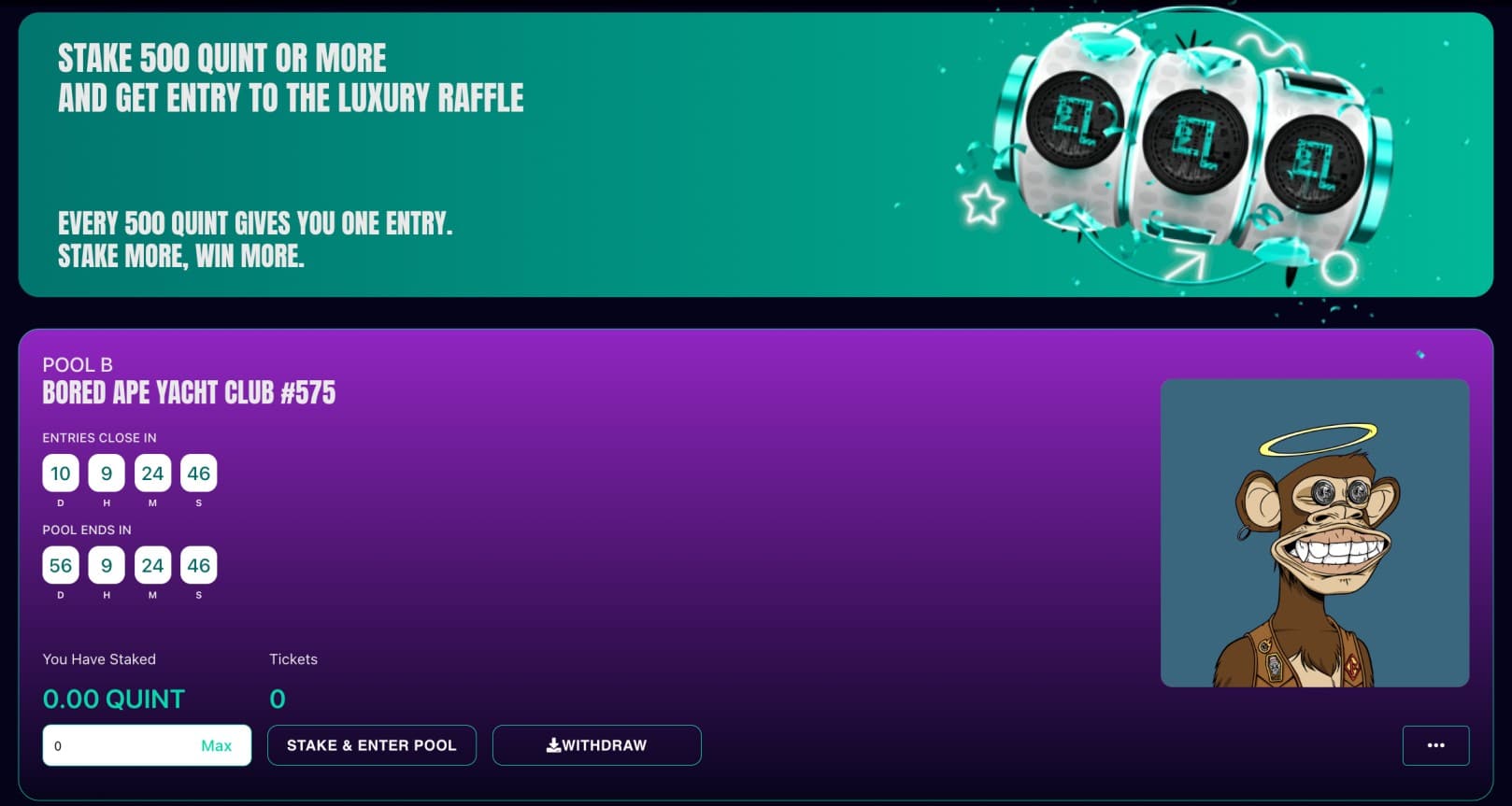

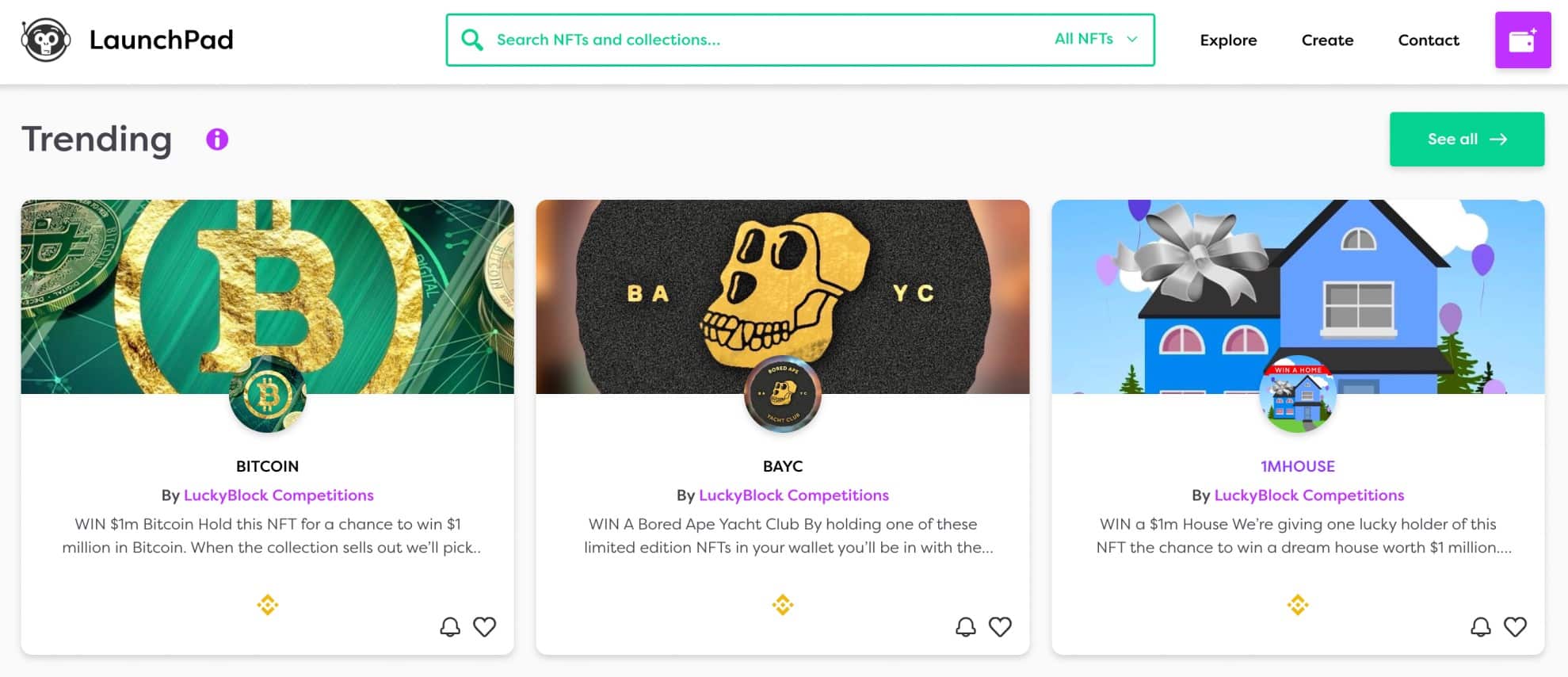

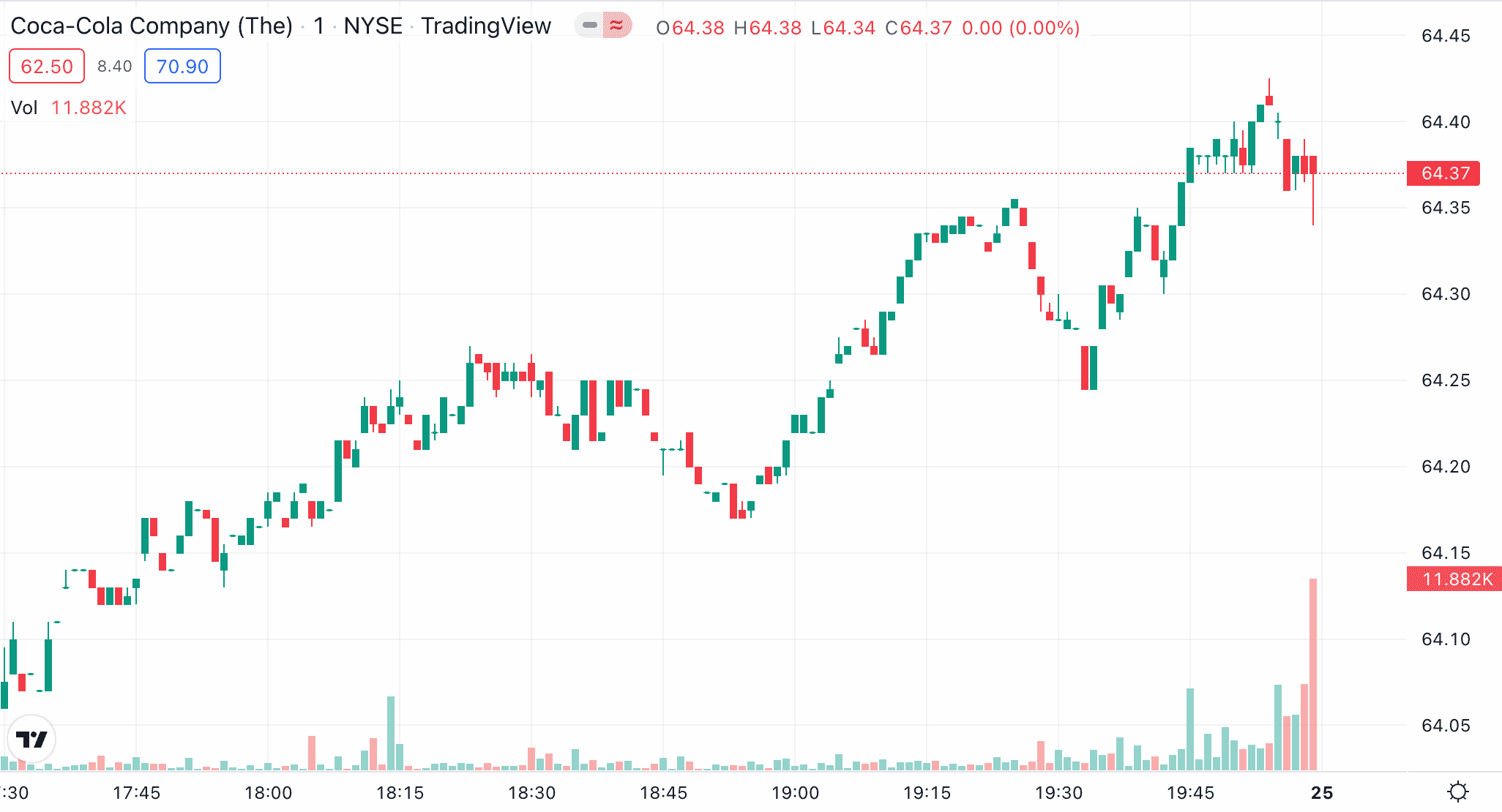

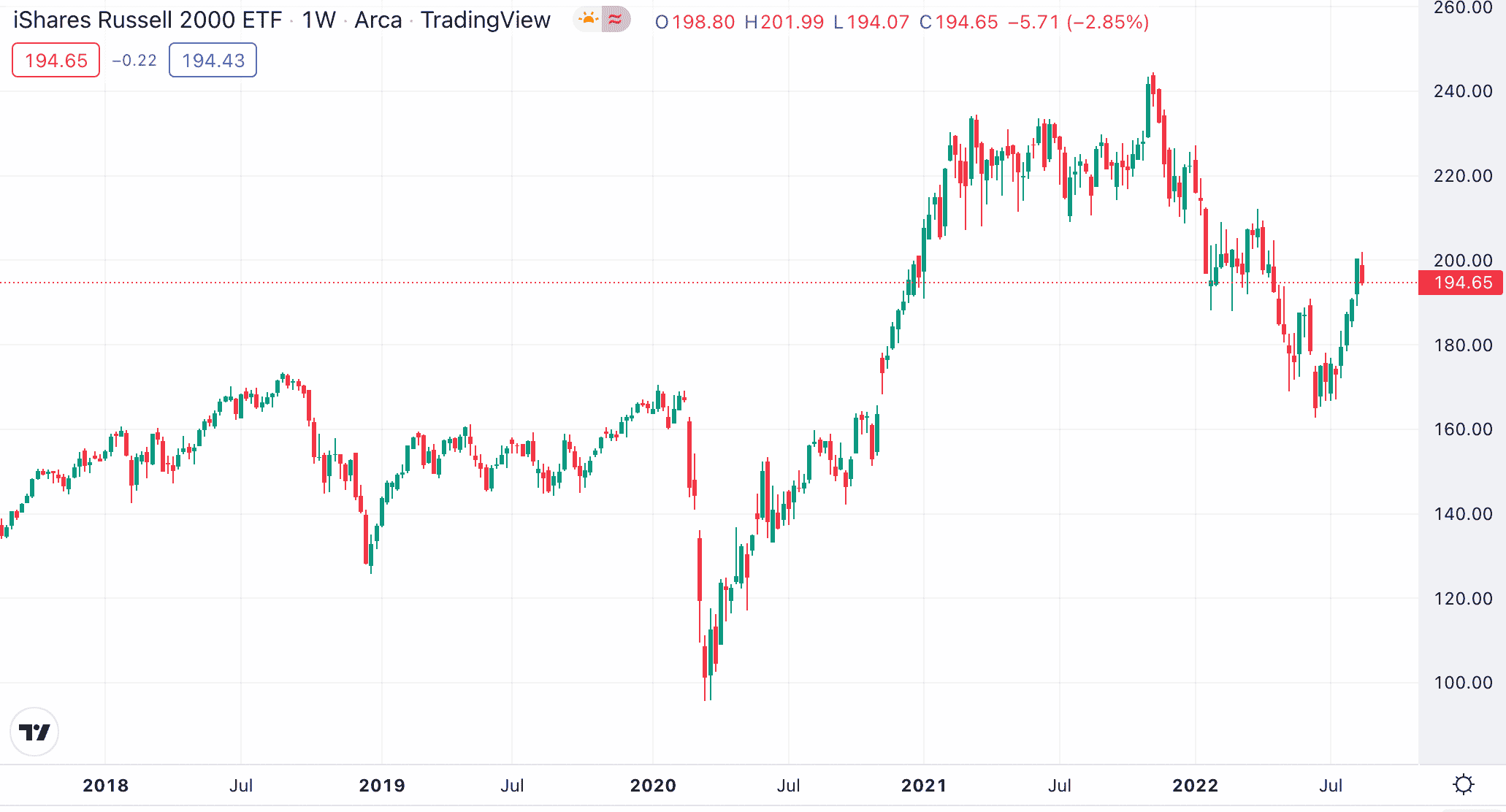

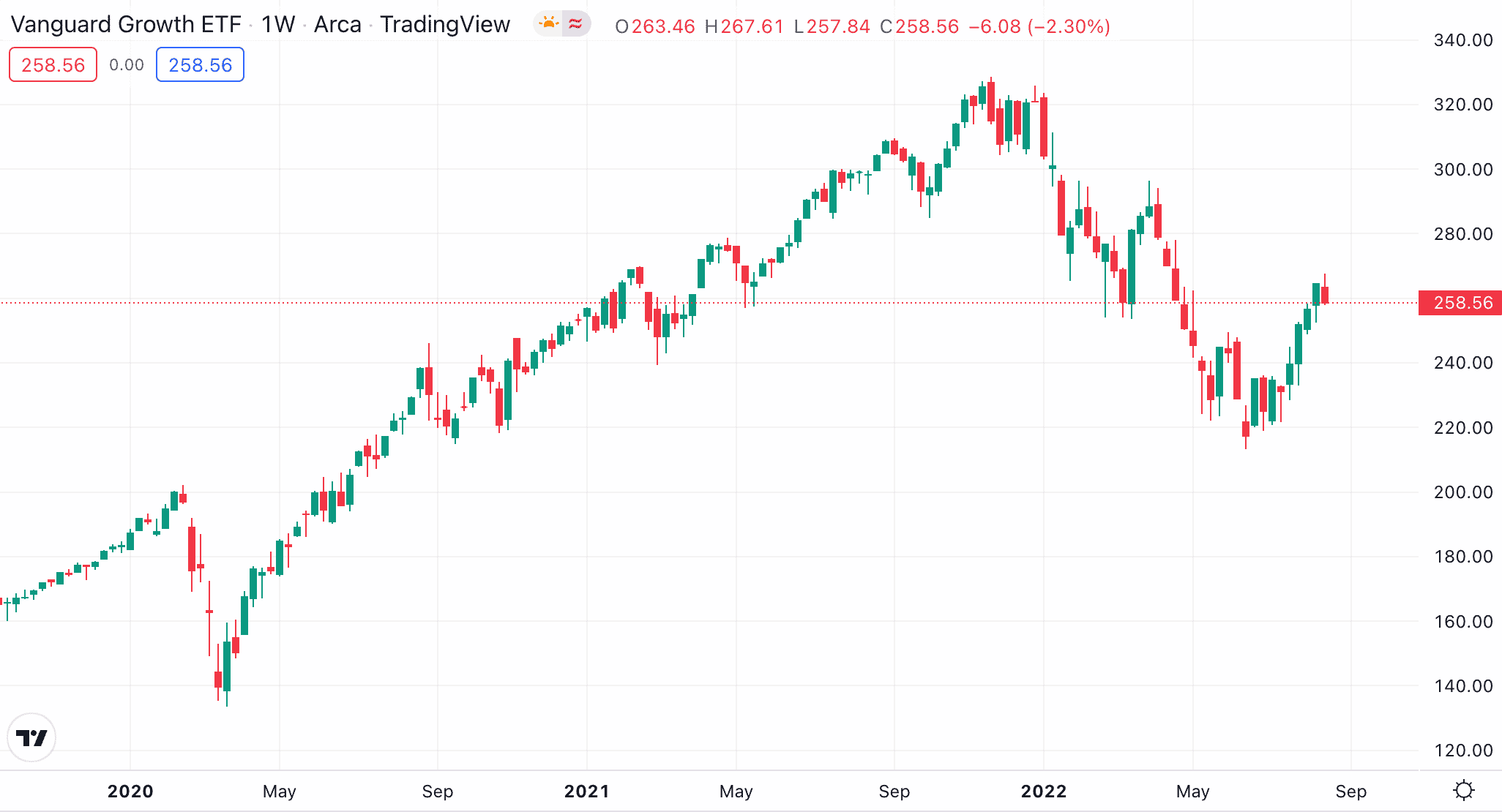

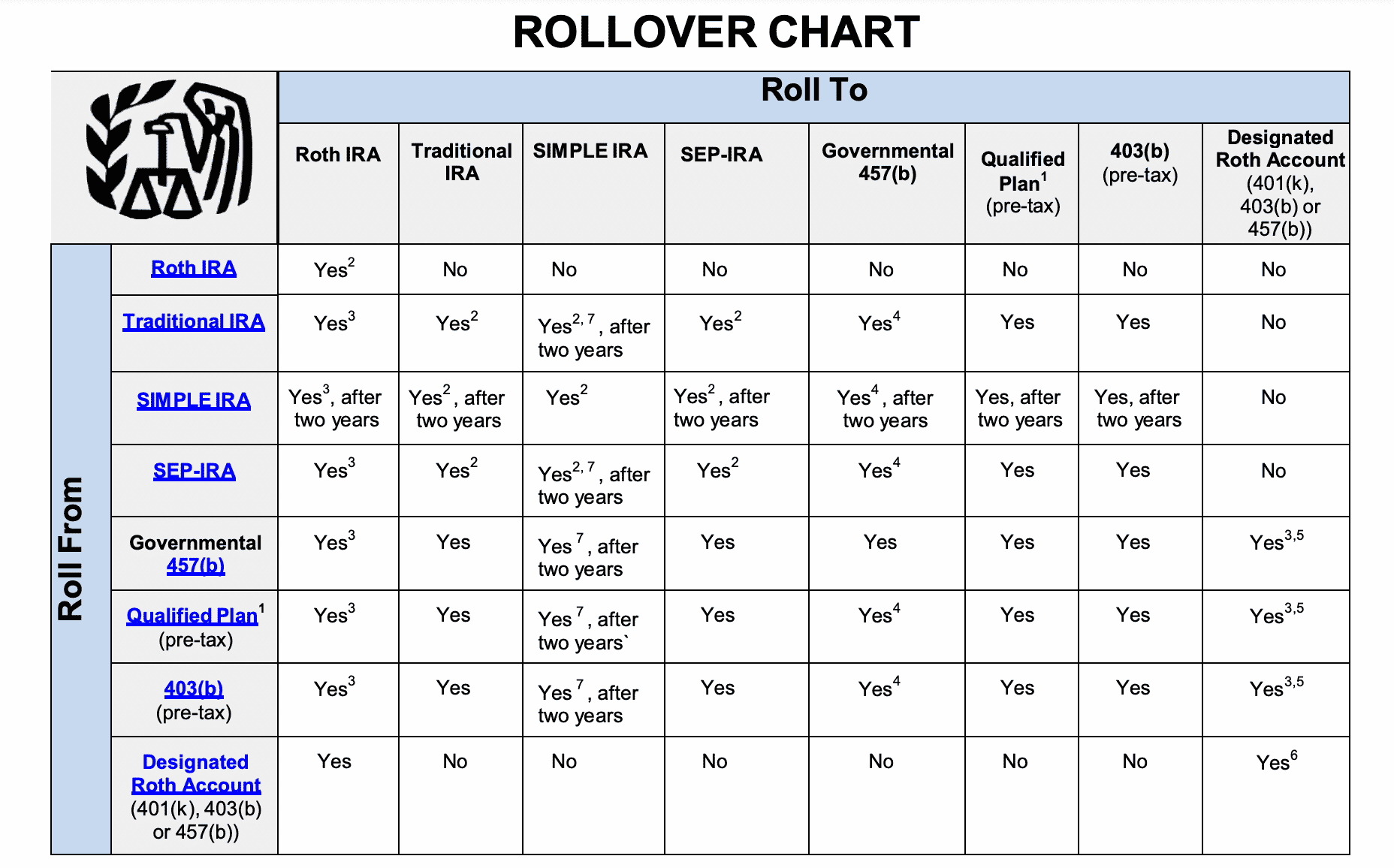

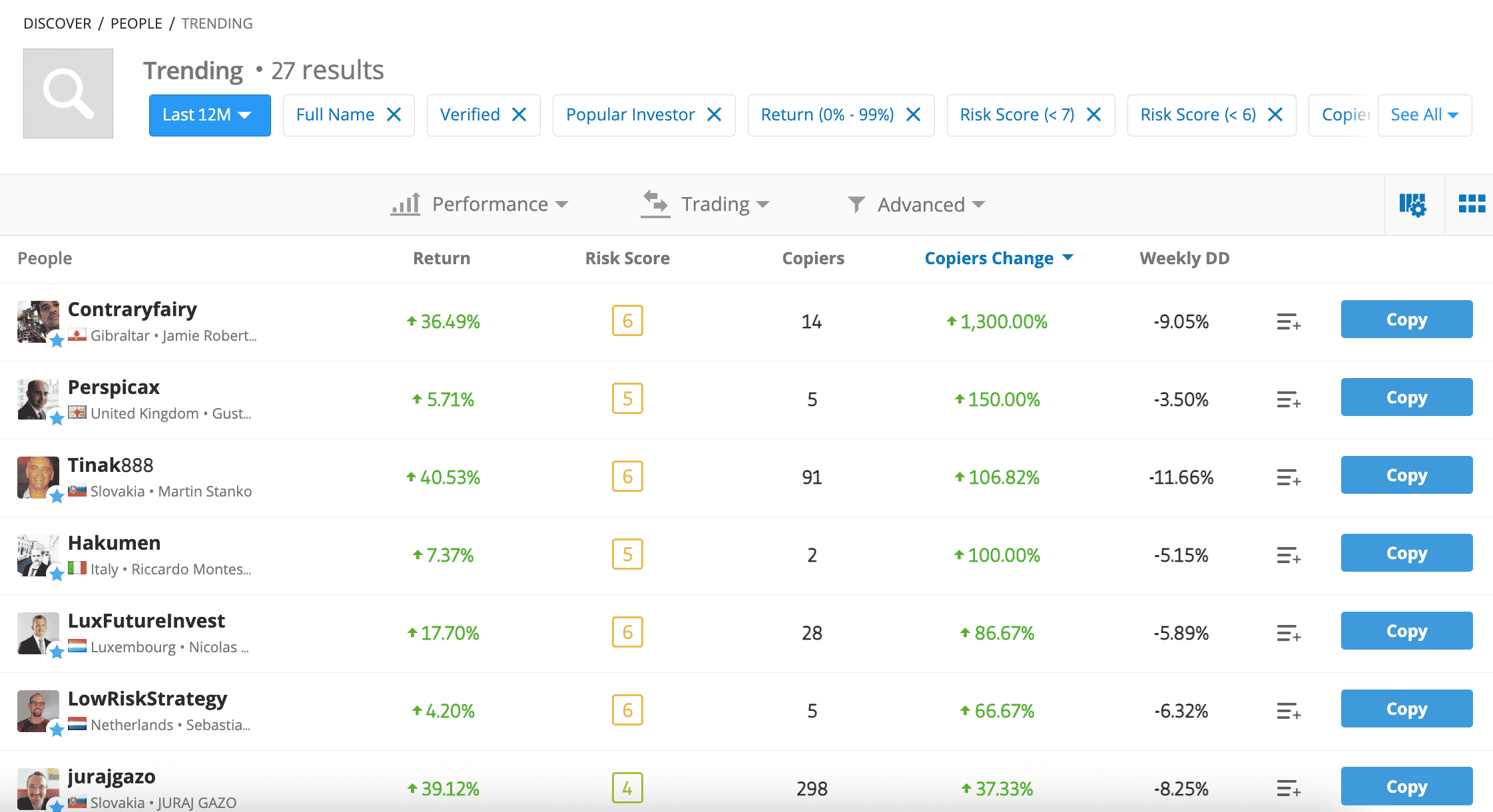

As per the above, more than 7% of the 500 companies in the S&P 500 are represented by just one stock – Apple. Microsoft, Amazon, and Tesla also have a large index weighting, with approximately 6%, 3%, and 2% respectively. At the other end of the spectrum, the likes of Electronic Arts, Digital Realty Trust, and Newmont Corporation contribute just 0.1% each to the S&P 500. The reason for this is that the S&P 500 aims to replicate the performance and health of the wider US economy. When it comes to returns, the S&P 500, since it was launched nearly a century ago, has generated average annualized gains of approximately 10%. This figure is based on the investor reinvesting their quarterly dividends back into the S&pP 500 on receipt. Although the S&P 500 is by far the most popular index fund with retail and institutional clients, there are many others active in this market. For example, there are index funds that track the NASDAQ 100 and Dow Jones, as well as foreign markets such as the FTSE 100 and China 50. With that being said, another super-popular index fund to consider when assessing how to invest $10k is the Total Stock Market Index. As the name suggests, this index fund offers access to the entire US stock market. This means that through just one investment, the investor will indirectly own stock in more than 4,000 companies. This comprises a weighted selection of small, medium, and large-cap stocks and over the prior 10 years of trading, the index fund has generated average annualized returns of over 13%. In terms of the investment process, some index fund providers – which are represented by ETFs, support direct purchases on their websites. However, when going direct with an index fund provider, this often requires a much larger capital outlay. For example, when investing in the previously discussed Total Stock Market Index via the Vanguard website, this would require a minimum investment of $3,000. When completing the same investment at a stock broker like eToro, the minimum stands at just $10. Furthermore, eToro does not charge any trading commissions when buying, selling, or storing index funds in an account portfolio. However, the underlying index fund expense ratio will still apply. The next option to think about when considering how to invest $10k is trading commodities. Many of the world’s most in-demand commodities have performed extremely well since the pandemic. For example, although crude oil hit lows of $19 per barrel in mid-2020, the commodity has since gone on to hit highs of over $120 per barrel. This represents a hugely volatile upward swing of over 500%. Some of the main factors driving up the price of oil include global supply chain issues, increased demand for global travel, and ongoing tensions in Ukraine. Those wishing to gain exposure to a commodity like oil have several options. Perhaps the most suitable way is to add some of the best oil stocks to an investment portfolio – such as BP, Shell, and ConocoPhillips. The performance of oil stocks will often mirror global prices, as this has a direct impact on each company’s operating margin. Another way to trade the price of oil is via financial derivatives that track the asset’s real-time price on a second-by-second basis. This can be achieved via CFDs (non-US clients), futures, or options. In addition to oil, gold is another commodity that might be of interest to those in the market for the best way to invest $10k. Gold is a cyclical asset and its value is heavily driven by geopolitical and macroeconomic events. For example, gold is considered a safe haven asset, so investors will often load up on the precious metal when the economy is weak. Gold will also perform well when inflation levels are on the rise, not least because it is viewed as a store of value. See our guide to investing during inflation. There is no requirement to purchase or store physical gold bullion when considering an investment. Instead, the easiest way to gain exposure to this precious metal is via an ETF – which we cover in more detail further down. Nonetheless, a gold ETF will enable an investment in gold without needing to worry about storage, security, or liquidity. On the flip side, it should be noted that perhaps with the exception of gold, commodities investments are generally a short-to-medium term hedge, rather than a long-term investment. The reason for this is that the price of a commodity is dictated by demand and supply – which will rise and fall depending on external factors. If you’re asking yourself what’s the best way to invest $100k then this guide covers everything you need to know. Another option to consider when building a shortlist of $10k investments is crypto staking. This option is potentially suitable even for those that do not currently own any cryptocurrency at this moment in this. The reason for this is that it is just a case of buying some tokens, transferring them to a staking platform, and earning an attractive rate of interest. The amount of interest that can be generated from a staking pool will depend on a number of factors. First, some cryptocurrencies yield a higher rate of interest than others. For example, smaller-cap tokens will often come with a higher APY than say Bitcoin or Ethereum. This is because the risk of staking smaller-capped tokens is higher. Second, the interest rate offered by staking pools will depend on the chosen term. For example, those staking cryptocurrencies on the DeFi Swap exchange can earn up to 75% on a 365-day lock-up period. This means that the investor will not be able to withdraw their tokens until the term has concluded. However, staking platforms like DeFi Swap also offer shorter terms, including 30, 90, and 180 days. Some staking platforms even offer flexible terms, meaning that the investor can withdraw their tokens at any given time. Flexible accounts typically come with the lower APY possible, but many investors prefer this arrangement nonetheless. Here’s an example of how staking works to help clear the mist: The example above highlights a staking arrangement on a stablecoin, meaning, that in theory, its value will always remain pegged to the US dollar. However, it is also possible to stake standard cryptocurrencies – which fluctuate in value throughout the day. As such, if the respective token increases in value during the staking period, this will amplify the rewards earned. Another option to consider in the staking world is Quint. This up-and-coming project offers ‘super staking’ pools. This means that in addition to earning a yield on the staked tokens, the investor will also receive entry into a competition. For example, Quint recently offered a competition draw for two luxury watches for those staking tokens in the respective pool. Learn More: Wondering how to invest 10,000 dollars in super staking? If so, read our review of Quint. NFTs, or non-fungible tokens, are a type of crypto asset that operates on the blockchain. However, what makes NFTs so popular is that each token is unique from the next. This opens up a whole world of possibilities, not least because real-world ownership of both tangible and non-tangible assets can be represented by an NFT. This could include anything from real estate and insurance to patents and in-game items. With that said, one of the most popular segments of the NFT space remains digital art. For example, one of the most expensive NFTs of all time – The Merge, sold for more than $90 million in late 2021. Additionally, the First 5000 Days NFT collection – a piece of digital art created by Michael Winkelmann, sold for more than $69 million. However, perhaps the most renowned NFT collection to date is the Bored Ape Yacht Club. This collection of 10,000 ape-inspired digital drawings originally sold for just under $200 apiece when the NFT series was launched in 2021. The Bored Ape Yacht Club collection quickly gained traction among celebrities and thus – many have since sold for over $1 million. This illustrates that there is a potential flipping market in the making for those that wish to buy and sell NFTs for profit. In order to find a suitable collection to flip, investors might consider browsing Launchpad.xyz. This is a marketplace for up-and-coming NFT collections – some of which are trading at under $50. Having explored the Launchpad.xyz marketplace, we came across an NFT competition project called Lucky Block. This NFT collection is running a wide range of lucrative competitions that covers everything from a $1 million property to VIP FIFA World Cup tickets. The main concept is that in order to enter a Lucky Block competition, a specific NFT must be purchased. Not only does the NFT offer access to the draw, but ongoing crypto rewards are paid in LBLOCK tokens. This means that even if the NFT owner does not win the competition, they will still be entitled to rewards for as long as they remain a holder. The next asset class to consider when assessing how to invest $10k is the stock market. There are stock exchanges in just about every country globally, which offer access to tens of thousands of companies from a wide variety of sectors and markets. With that said, investors will typically stick with the two primary US exchanges – the NYSE and NASDAQ. These two exchanges are home to more than 4,000 stocks and trillions of dollars in market capitalization. When building a portfolio, investors might consider diversifying into a range of different stock types. For example, dividend stocks refer to companies that share some of their retained profits with investors. Popular dividend stocks in this space include Coca-Cola, Dover, 3M, and Procter & Gamble. The reason for this is that the aforementioned stocks have paid dividends for more than six decades. Furthermore, throughout this period, these stocks have increased the size of their annual dividend payment for 60+ consecutive years. However, ‘dividend kings’ – which represents companies that have increased their annual distributions for at least 50 years, typically offer conservative returns in terms of stock price growth. As a result, in order to counter this, many investors will also consider adding some growth stocks to their portfolios. On the other hand, some traders prefer to invest in startups. As the name implies, these are companies that are still firmly in their growth stage – meaning that they are likely behind a new business concept or an unproven product or service. Either way, growth stocks come with additional risk and less certainty, but in addition to offering greater upside potential. In addition to growth and dividend stocks, investors might also consider exploring blue-chip companies. This will offer the $10k investment portfolio with further solidity. Blue-chip stocks are not only established companies that carry a large market capitalization, but they dominate their respective industries. Examples include the likes of Walmart, Microsoft, Johnson & Johnson, Mcdonald’s, and UnitedHealth. Crucially, the idea here is to create a well-balanced portfolio that covers a large number of stocks from a variety of industries, sectors, and risk profiles. This will ensure that the investor avoids becoming overexposed to a stock that subsequently fails. Additionally, investors might also consider allocating some funds to international stocks. Once again, this offers even greater diversification and thus – will avoid too much exposure to the US economy. Some of the most traded foreign stock exchanges can be found in the UK, Europe, and Japan. In order to create a diversified portfolio of stocks in a risk-averse manner, investors will need to have an account with a regulated online broker. The chosen broker should offer competitive fees and support for fractional stock purchases. The latter enables investors to invest in stocks without needing to purchase entire shares. For example, when assessing the best place to invest $10k, eToro enables registered users to buy stocks at a minimum trade of just $10. This means that if the stock is trading at $100 and the investor allocates $10 to the position, this would result in 10% ownership of a share. eToro also offers commission-free trading in addition to its fractional stock tool. ETFs are also a popular option to consider when assessing the best way to invest $10k. ETFs are managed funds backed by large investment houses – such as Vanguard and iShares. The vast bulk of ETFs will look to track a specific asset or group of assets. For instance, we previously discussed index funds like the S&P 500 and the Total Stock Market Index. In order to invest in an index fund, the investor must go through an ETF provider. The ETF will look to track the underlying market by purchasing the respective assets, at the correct weight. This means that a Total Stock Market Index ETF would subsequently buy and hold more than 4,000 individual stocks. Moreover, the provider will likely rebalance the ETF every quarter to ensure it is still aligned with the underlying market that it is tracking. From the investor’s perspective, they will gain exposure to the market at proportion levels. Let’s take the Vanguard Dividend Appreciation ETF as a prime example. By injecting capital into this ETF, the investor will indirectly own 289 dividend stocks. This includes everything from Pepsi, Visa, and Microsoft to JPMorgan Chase, MasterCard, and Home Depot. Pepsi, for instance, has a portfolio weight of 1.98% in this ETF, while Visa has 2.76%. This means that a $10,000 investment in the ETF would own $198 and $276 worth of Pepsi and Visa stock respectively. There are more than a thousand ETFs trading in the US alone, each of which will track a specific market. While many specialize in stocks, others will give investors exposure to bonds. For example, Vanguard Total International Bond ETF offers exposure to more than 6,000 bonds from a variety of global markets. This includes the US, Europe, the Middle East, and emerging markets such as Malaysia, Indonesia, and Thailand. This ETF will suit investors that prefer lower levels of risk alongside monthly dividend payments. In addition to stocks and bonds, there are also ETFs that are favored by investors that wish to gain exposure to commodities. A common example is ETFs that are physically backed by precious metals like gold and silver. This means an investment into precious metals can be made from the comfort of home – with no requirement to worry about storage or security. Another benefit of ETFs is that they often come with very low fees – even though the fund will manage the portfolio on behalf of its investors. In many cases – especially with index fund ETFs, this will cost less than 0.10% per year. Investors can access ETFs from an online broker like eToro without paying any trading commission. For example, with an eToro live trading account users can invest in carbon credits such as the Carbon Emissions futures. Crypto-centric interest accounts are also worth considering when exploring the best way to invest $10k. This will require the investor to choose a suitable provider, before opening an account and depositing some crypto tokens. In doing so, the investor will be paid a rate of interest on their tokens – which is usually fixed. For example, let’s suppose that the investor injects $10k worth of capital into a Crypto.com interest account. Opting for Bitcoin, the investor will have access to an APY of up to 5%. Other digital currencies supported by Crypto.com pay a higher yield. Moreover, the yield is also determined by the lock-up term that the investor chooses. Either way, this option will potentially suit long-term cryptocurrency investors that wish to generate additional gains on their holdings. The idea is that even during a bear market, the investor will continue to earn interest. This interest can be used to purchase more cryptocurrency tokens, through a dividend reinvestment plan (DRIP). This will result in the investor gradually increasing their exposure to the cryptocurrency markets. Furthermore, when depositing tokens into a crypto interest account, the investor retains full ownership of the funds. This means that shoulds the tokens increase in value in the open marketplace, the investor will still benefit from the capital gains. 401k plans are exclusive to US clients, albeit, similar alternatives exist in many other regions (e.g. ISAs in the UK). For those unaware, 401k plans offer a way for US workers to invest some of their salaries into the stock market in a tax-efficient way. This is because the tax on the investment will either be deferred until retirement, or paid at the source. For example, if opting for a Roth 401k – which is often the best option for younger workers, the tax will be paid at the time of receiving the salary. However, the subsequent funds that are paid into the Roth 401k plan will not attract any tax thereon. This means that when the worker reaches the age of retirement, they can make tax-free withdrawals on their investments. The other option is a traditional 401k. This option will allow the worker to invest money into a 401k plan without paying any tax on the income. Instead, the tax is only paid once withdrawals are made from the 401k plan at the age of retirement. Both Roth and traditional 401k plans are offered by employers. Moreover, many employers that offer 401k plans also provide matching contributions as an incentive to save for retirement. Commonly, US employers will match 3% of any contributions made by the employee, on a dollar-for-dollar basis. This means that by maximizing the 2022 401k limit of $20,500 ($27,000 for over 50s), the employer would match $615. This $615 should be viewed as free capital that will continue to grow in value over the course of time. As such, if an employer offers a matching contribution scheme, this should be maximized. When it comes to choosing an investment, options are specified by the employer and will often be limited in number. However, virtually all 401k plans enable the employee to invest money into popular index fund ETFs such as the S&P 500 or Total Stock Market Index. Those working for an employer that does not support 401k plans might instead consider a Roth or traditional IRA. This offers tax-efficient access to the financial markets via a broker, albeit, annual limits are capped to $6,000. Those in the market for a passive investment stream will typically turn to ETFs or mutual funds. After all, once the investment is made, the fund provider will be managed and maintain the investor’s portfolio. However, these options are more suited to traditional long-term investments that largely focus on stocks and bonds. Copy Trading, on the other hand, is a revolutionary tool that enables investors to actively day trade the financial markets but in a passive nature. The idea is that the investor will choose a trader to copy and then any future buy or sell orders will be copied over to their portfolio. At eToro, for example, account holders can copy a trader from just $200 and no additional fees apply. For example: There are thousands of verified traders signed up for the Copy Trading program on eToro, so the first port of call is to determine which asset class the investor wishes to gain exposure to. At eToro, this covers everything from stocks, ETFs, and indices to cryptocurrency and forex. The investor should also consider the risk score attached to the trader. Moreover, the eToro user should explore the historical performance of the trader before electing to copy them. To offer some insight into what is available, one of the most popular Copy Traders at eToro is Juraj Gazo. This trader specializes in stocks and forex and generated gains of 38% in 2021 for his followers. The trader made gains of 5% and 40% in 2020 and 2019, respectively. Now that we have covered the benefits and drawbacks of each $10k investment, we now offer some insight into how to build a diversified portfolio that mirrors the risk profile and financial goals of the investor. This will that when searching for the best way to invest $10k, the investor is making an informed decision based on their own personal objectives. It goes without saying that the overarching objective of assessing the best way to invest $10k is to maximize growth potential. In other words, investors will aim to make as much money as possible from their investments. In this regard, the risk-reward concept is an important metric to understand. Put simply, the higher the returns expected, the more risk that needs to be taken. Risk should, however, be taken seriously when investing in more unpredictable assets. Investors in the market for the highest ROIs possible might also consider crypto presales like Tamadoge. Do remember, however, that while up-and-coming crypto tokens offer an attractive upside potential, this comes with enhanced risk and volatility. When assessing the best ways to invest $10k, the investor should consider how much time they can realistically dedicate to the markets. On the one hand, those with ample time and experience to dedicate to their portfolio might consider an active investment strategy. This means that the investor will actively research the markets and place regular orders to buy and sell assets. Those without the necessary time or knowledge of investing on a do-it-yourself basis will likely prefer a passive investment strategy. This means opting for a passive asset class like ETFs, index funds, or even Copy Trading. It is also important for the investor to assess their financial goals when building a portfolio. For example, some investors might be looking to inject $10,000 into a long-term retirement account, with the view of topping this up on a monthly basis. In this regard, the investor might consider a long-term index fund such as the S&P 500. Other investors will be more interested in the best ways to invest $10k short-term – especially those that are looking to adopt an active trading strategy. Suitable markets in this respective might include crypto presales, growth stocks, or short-term corporate bonds. Some asset classes will enable the investor to generate a regular income in a passive nature. A prime example of this is dividend stocks. By holding stock in a company that pays dividends, the investor will receive a payment every three months. On the other hand, some investors will prefer to focus on capital gains. Both cryptocurrencies and growth stocks are an option here, as neither will yield income. Instead, the primary goal is growth. Some asset classes offer a perfect balance between income and growth. For example, while stock ETFs will typically increase when the broader markets are bullish, they also offer quarterly dividends. Still wondering where to invest $10k? The overall best option when it comes to investing $10k will ultimately depend on the investor’s financial goals and risk tolerance. Diversification is key too – meaning that the investor’s portfolio should cover a range of assets, markets, and upside potential. On the lower-risk side, investors might consider major index funds and a selection of dividend kings. For above-average gains, investors might also consider allocating some funds to growth stocks and cryptocurrencies. FightOut (FGHT), for example, is a new cryptocurrency token giving access to exclusive features for users to earn exciting Move-to-Earn rewards. To get in early, buy FGHT during the ongoing presale for only $0.0167 per token.

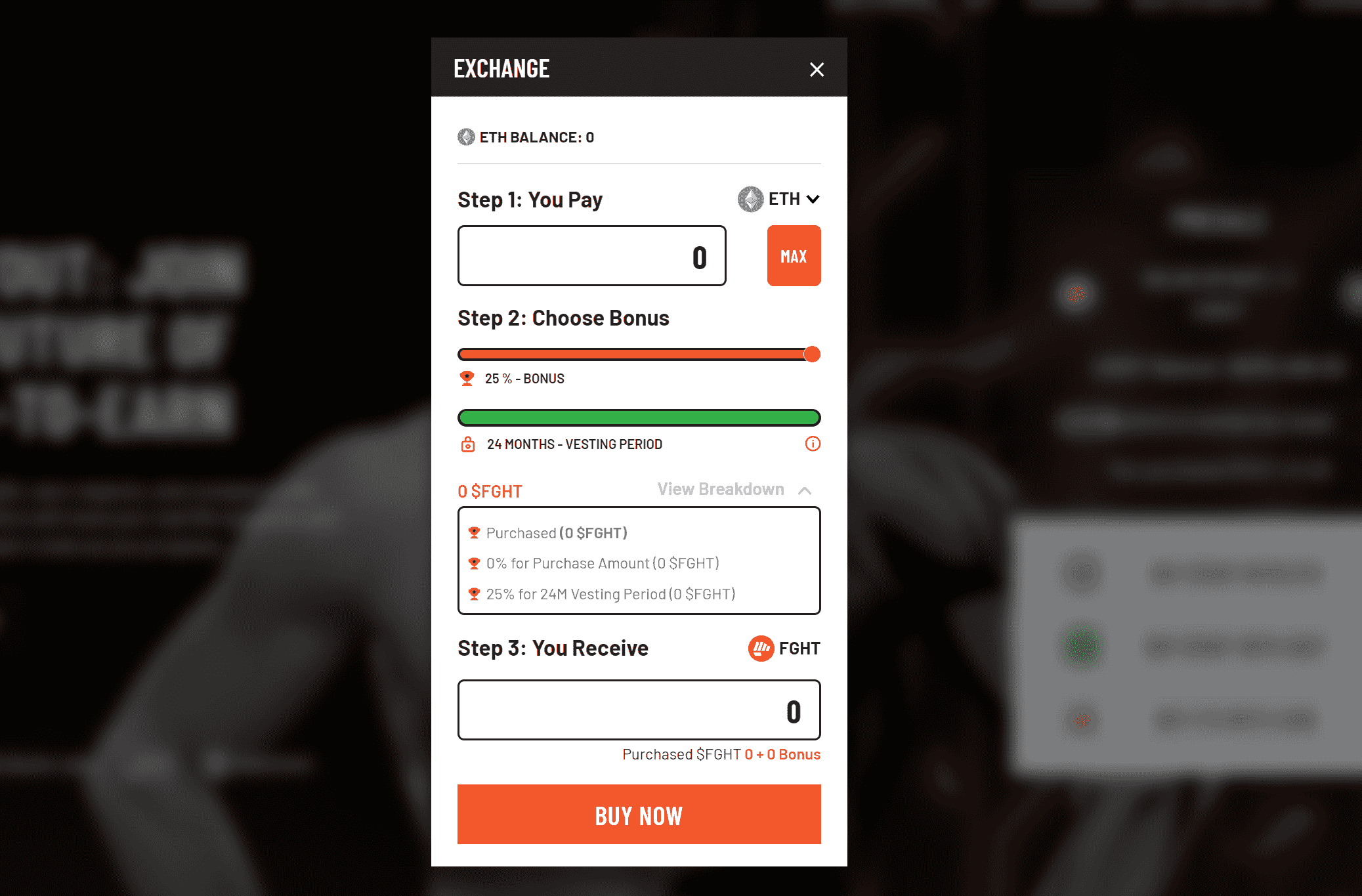

Still wondering what to invest in right now? For an overview of how to invest in crypto presales – such as the one currently underway with the FightOut project, we will now explain the required steps. Note: It goes without saying that investors should avoid injecting their entire $10k capital balance into cryptocurrencies. Investors should install a crypto wallet like MetaMask on their browsers. (Mobile users are recommended to download the TrustWallet) Investors can now go to FightOut’s official presale page. Then buyers should locate and click on the “BUY $FGHT NOW” button. After this, they must select the wallet they have installed (eg Metamask or TrustWallet) and subsequently login to their wallets. Investors must check if they have any ETH or USDT in their wallets after logging in to their wallets. Buyers also have the option to buy ETH with a credit card via Transak. After topping up an adequate balance of ETH/USDT in their wallets, investors can click either on the “Buy $FGHT with ETH” or “Buy FGHT with USDT” button. In this step, buyers must now enter the amount of ETH/USDT they would want to spend in return for $FGHT tokens. Finally, investors can confirm the transaction after ensuring the quantum of $FGHT tokens that will be received. It becomes important to note that investors can claim these tokens based on the vesting period they choose in the previous step.

Crypto assets are a highly volatile unregulated investment product. This guide has discussed the best ways to invest $10k into the financial markets. We have covered multiple asset classes and markets, such as cryptocurrencies, index funds, gold, growth stocks, and Copy Trading. Overall, our recommendation would tilt toward FightOut (FGHT) due to its multiple use cases on its unique fitness app. The crypto is currently available to buy for presale at a discounted price of $0.0167. FightOut - Next 100x Move to Earn Crypto FAQs

Company

Symbol

Weight (%)

Price

Apple Inc.

AAPL

7.39

$167.84

Microsoft Corporation

MSFT

5.94

$276.08

Amazon.com Inc.

AMZN

3.36

$133.85

Tesla Inc

TSLA

2.14

$892.99

Alphabet Inc. Class A

GOOGL

1.97

$113.75

Alphabet Inc. Class C

GOOG

1.82

$114.65

Berkshire Hathaway Inc. Class B

BRK.B

1.51

$293.52

UnitedHealth Group Incorporated

UNH

1.45

$536.46

Johnson & Johnson

JNJ

1.26

$165.58

NVIDIA Corporation

NVDA

1.24

$164.38

4. Commodities – Hedge an Investment Portfolio With Gold, Oil, and Other Commodities

5. Crypto Staking – Generate a Fixed Rate of Interest By Depositing Crypto Into a Staking Pool

6. NFTs – Find Undervalued NFTs to Flip

7. Stocks – Buy and Hold Individual Stocks

How to invest $10,000 in stocks

How to invest in pre-IPOs8. ETFs – Invest in a Group of Assets via a Managed Fund

9. Crypto Interest Accounts – Passively Earn Interest on Long-Term Cryptocurrency Investments

10. 401k Plans – Invest in Tax-Efficient Way Through a Traditional or Roth 401k

11. Copy Trading – Day Trade Stocks and Other Assets Passively

How to Choose the Best $10k Investments For You

Returns and Risk Tolerance

Passive or Active Investing

Financial Goals

Income, Capital Gains, or Both

Where to Invest $10,000 Right Now – the Best Option?

How to Invest $10,000 – FightOut Tutorial

Step 1: Download a Crypto Wallet

Step 2: Connect the Wallet

Step 3: Buy ETH/USDT

Step 4: Buying $FGHT

Step 5: Claiming $FGHT

Conclusion

What investments can I make with $10k?

What is the best way to invest 10,000 dollars?

What can I invest in with $10k?

References