Investing is one of the best ways to build wealth over time and save up for big financial goals like retirement. Have $2,000 to invest and need to know what to do with it? In this guide, we’ll explain how to invest $2,000 and explore the 10 best 2,000 dollar investments for 2023.

11 Best Ways to Invest $2,000 in 2023

Want to know how to invest $2,000? Here are the 10 best ways to invest $2,000 in 2023:

- FightOut – Overall Best Way to Invest $2000 to get Additional Token Rewards of up to 50%

- Dash 2 Trade – Overall Best way to Invest $2,000 via Crypto Tokens

- Stocks – Invest in the World’s Biggest Companies

- ETFs – Invest in a Market Sector or Country

- 401(k) Plans – Put Money Away for Retirement

- Crypto Interest Accounts – Earn Ultra-high Interest on Crypto

- Index Funds – Match the Performance of the Stock Market

- Crypto Staking – Earn Crypto Rewards while Supporting Blockchains

- Copy Trading – Trade Stocks, Crypto & More on Autopilot

- NFTs – Invest in the Next Big Digital Artwork

- Commodities – Trade Oil, Gas, Coffee & More

A Closer Look at the Top Ways How to Invest 2,000 Dollars

We’ll explain more about how to invest $2,000 and explore the best sectors for investing 2,000 dollars today.

1. FightOut – Overall Best Way to Invest $2000 to get Additional Token Rewards of up to 50%

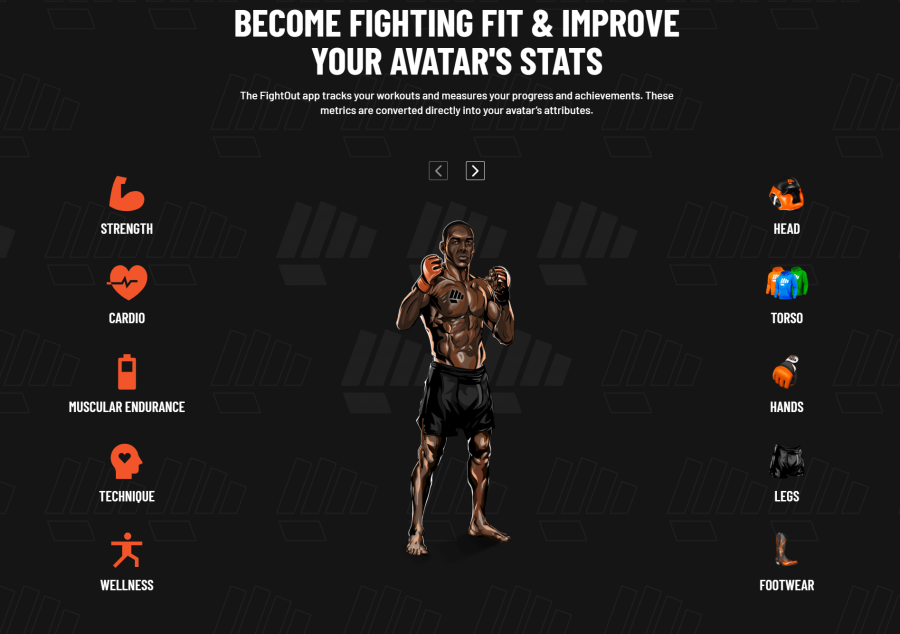

While inducing positive lifestyle changes, the project also allows users to create their avatars in its Metaverse.

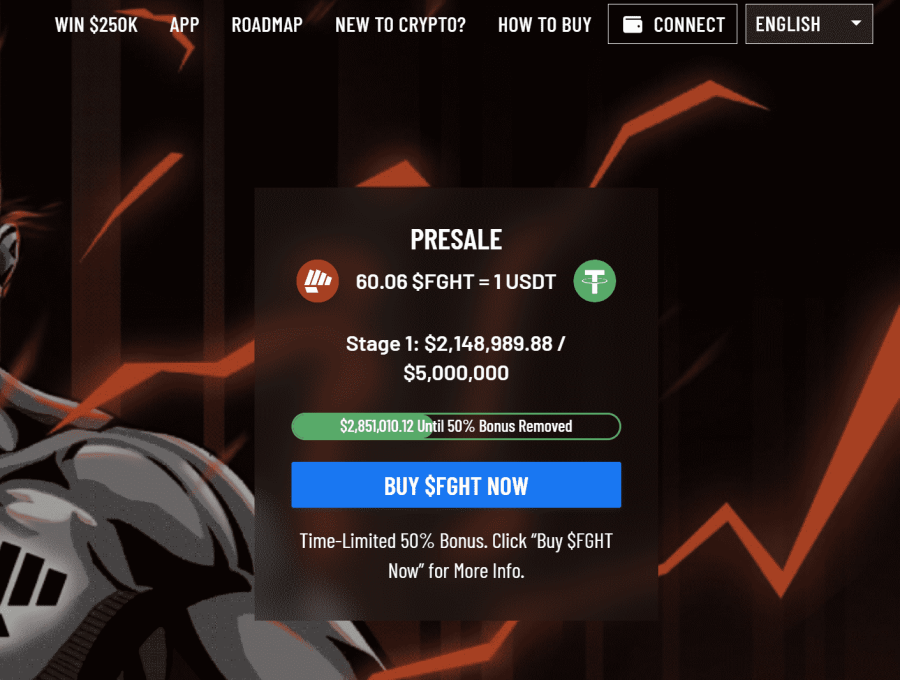

The recent launch of its first presale stage saw a phenomenal response from users and investors while the project has already raised over $2.1 million USDT in a short amount of time. At the time of writing, FightOut’s native token $FGHT can be bought at a relatively low price of $0.0167.

The project has created a one-of-a-kind fitness app that allows users to earn rewards by simply doing their daily workouts, completing fitness challenges, and similar tasks.

FightOut has also set up a metaverse to gamify the fitness lifestyle and incentivize users. As a consequence, users can create their own NFT avatars in FightOut’s metaverse. These avatars are known as soulbound avatars.

The soulbound NFT avatars will progress in harmony with the users’ real-life fitness performance. Also, FightOut allows users to compete with other community members in its metaverse.

The project has created an in-app currency called REPS. Users will receive REPS as a reward for completing their workouts and fitness-related tasks. This currency enables users to buy products from FightOut’s marketplace. Also, this in-app currency enables users to buy cosmetic NFTs for their avatars, membership discounts, and similar products

Investors can go through the project’s whitepaper to understand the project’s features in-depth.

$FGHT Tokenomics

$FGHT is an ERC-20-based limited supply token that is native to FightOut. Out of its total supply, 9 billion tokens are will be sold through FightOut’s presale stages.

Buyers can use this token to take part in several tournaments and leagues. Furthermore, $FGHT can be used to buy more REPS. Buyers would receive an additional 25% REPS if they use $FGHT to buy the in-app currency.

Presale Performance & Purchase Bonuses

At the time of writing, FightOut had impressive results in its presale launch as it raised over $2.1 million USDT in just a few days. Investors buying the tokens during the ongoing presale stages have an opportunity to receive up to 50% additional $FGHT tokens as rewards.

Moreover, buyers will also receive purchase bonuses. Investors buying FGHT during the presale stages will receive bonuses that start at 10% with an investment of $500 and 6 months of vesting. Buyers will also receive membership rewards when they stake more $FGHT tokens or stake them for a longer time.

Investors can join FightOut’s telegram to always stay up-to-date.

| Presale Started | 14 December 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

2. Dash 2 Trade – Overall Best way to Invest $2,000 via Crypto Tokens

The D2T token gives investors access to exclusive trading tools, charts and signals on the Dash 2 Trade platform. Traders looking to benefit by utilizing exceptional trading strategies can buy one of Dash 2 Trade’s 3 packages – the free tier, the starter tier, or the premium tier. The last two tiers must be purchased with D2T tokens – at a monthly price of 400 and 1,000 tokens, respectively.

The Dash 2 Trade whitepaper states that the tokens give access to exclusive items on the platform, such as presale project listings. Dash 2 Trade individually ranks and scores upcoming presales, offering analysis on some of the best new tokens to buy. Investors can also practice future trading strategies on a virtual screen known as the backtesting platform. Furthermore, users will be able to access auto-trading features, risk profilers and technical indicators and charts.

To incentivize new customers, Dash 2 Trade is hosting a $150,000 D2T giveaway for one lucky investor who joins the presale. If you are looking for how to earn free crypto, Dash 2 Trade will also feature weekly trading competitions where the top performers can earn D2T rewards. Currently, Dash 2 Trade is holding a 9-stage presale to release 700 million D2T tokens. Within 5 days, the platform has raised $5 million, as it looks to raise a total of $40 million.

Currently trading at $0.05 per token, D2T will increase by 32% by the 9th and final presale round. Investors can read the table below to understand the token allocation and follow the Dash 2 Trade Telegram Channel to stay updated with the project.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

| $0.0556 | $4,865,000 | 87,500,000 |

| $0.0580 | $5,075,000 | 87,500,000 |

| $0.0606 | $5,302,500 | 87,500,000 |

| $0.0635 | $5,556,250 | 87,500,000 |

| $0.0662 | $5,792,500 | 87,500,000 |

3. Stocks – Invest in the World’s Biggest Companies

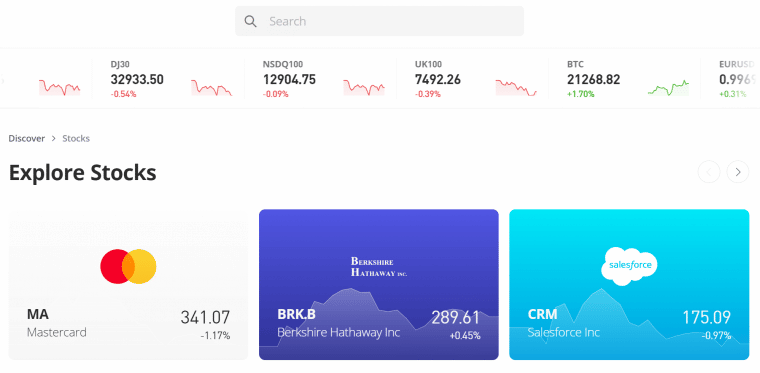

Whether it’s investing in startups blue-chip stocks are one of the most common types of investment and they’re an important part of any investment portfolio. Stocks offer exposure to the biggest companies in the US and around the world. Some even pay a dividend to offer investors steady income.

When investing in individual stocks, it’s important to choose shares of companies that investors know and like. If there’s a company that seems to be doing particularly well or that everyone is talking about, for example, that could be a stock worth investing in. Alternatively, investors can look at specific market sectors that they think are hot, like biotech stocks or 5G stocks, and invest in stocks from those sectors.

As for how to invest 2,000 dollars in stocks, it’s important that investors have a reliable stock brokerage. We recommend eToro, which charges 0% commission on stock trades and offers access to hundreds of US and international stocks. Find cheap stocks and investing early is one of the most popular strategies traders use when learning about value investing.

Additionally, you might be interested in reading our guide on how to invest in the best pre-IPOs for 2023.

4. ETFs – Invest in a Market Sector or Country

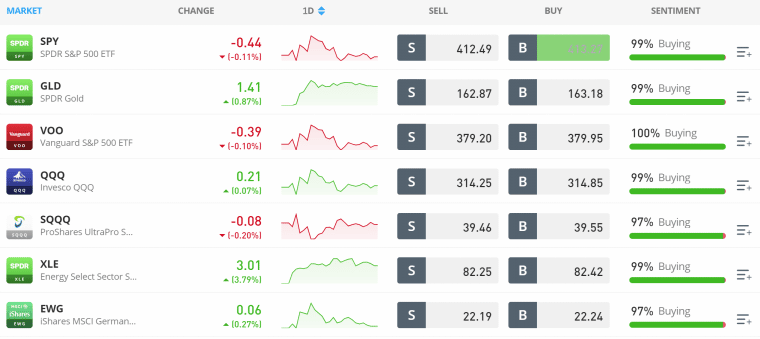

ETFs, or exchange traded funds, are baskets of stocks or other assets that investors can buy in a single transaction. When an investor owns an ETF, they have financial exposure to everything inside the ETF – whether that’s hundreds of stocks, dozens of cryptocurrencies, or something else entirely.

ETFs are often considered the best way to invest $2,000 because they provide built-in diversification. Instead of risking $2,000 on a single stock, investors can invest across an entire market sector, industry, or country. There are even themed ETFs that invest in topics like blockchain technology, space exploration, or renewable energy – such as sustainable investing funds.

In fact, there are so many ETFs that it can be hard to know where to start. Investors should first have an idea of what sector or topic they want to invest in, and then find an ETF that fits their needs. Be sure to check an ETF’s expense ratio, which is an annual fee that the fund charges in order to pay for management expenses. ETFs also provide access to a wide range of sectors including the energy sector. Many investors are looking to invest in carbon credits as the price of fuel and carbon continues to rise.

Investors can buy hundreds of ETFs commission-free at online brokerages like eToro.

5. 401(k) Plans – Put Money Away for Retirement

A 401(k) plan isn’t an investment in and of itself, but it’s worth including in our list of how to invest $2,000 because it’s so important for retirement. With a 401(k) plan, investors can put money into an investment account tax-free. All profits they make from investments in the 401(k) account are also tax-free. Investors only pay tax when they take money out of the account.

The catch to a 401(k) is that there are restrictions on when investors can withdraw money. These accounts are designed to promote retirement savings, so there are penalties if money is withdrawn before investors turn 55. So, any money investors put in a 401(k) plan should be invested for the long term.

Most investors receive 401(k) plans through their employer, and the options for investment may be limited. For example, many 401(k) plans only offer ETFs or mutual funds and don’t allow investors to pick individual stocks or invest in cryptocurrency. Investors have the option to open an Individual Retirement Account (IRA), which functions similarly to a 401(k) and offers more flexibility when it comes to choosing investments.

6. Crypto Interest Accounts – Earn Ultra-high Interest on Crypto

Crypto interest accounts are interest-bearing accounts where investors can earn money just for holding cryptocurrencies. They work similarly to savings accounts at traditional banks, except that the interest rates offered on cryptocurrency can be 10-100 times higher than what investors would typically receive for holding US dollars.

One of the nice things about crypto interest accounts is that they support a wide range of popular cryptocurrencies. So, investors can hold Bitcoin, Ethereum, Tether, or any other top altcoins and earn interest on them. Different coins have different interest rates, so it’s up to investors to build a portfolio of interest-earning tokens.

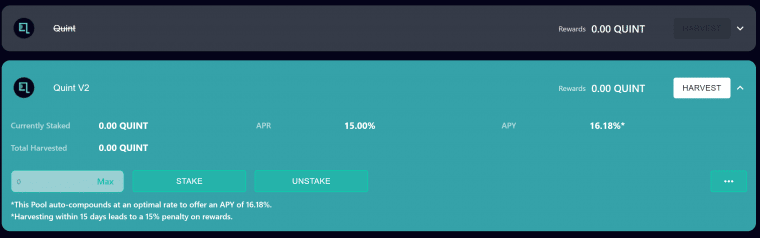

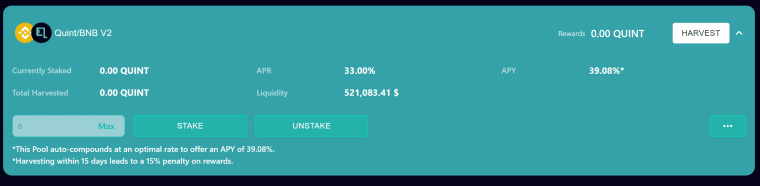

Investors who want to know where to invest 2,000 dollars in a crypto interest account should check out Quint. Quint is a new crypto project that offers up to 16.18% APY interest when investors hold Quint’s token, or 39.08% APY when they hold a combination of Quint and BNB tokens. Interest payments compound automatically, leading to even more interest in investors’ accounts over time.

7. Index Funds – Match the Performance of the Stock Market

Index funds are ETFs or mutual funds that are designed to track major stock market indices like the S&P 500 or NASDAQ. Index funds are widely used for retirement investing because they’re seen as a relatively safe bet – history has demonstrated that the stock market, on average, goes up by about 10% per year.

Index funds work by simply mirroring the composition of the indices they track. For example, the S&P 500 includes the 500 largest stocks in the US by market cap. So, an S&P 500 index fund includes shares of those 500 companies in the same proportions as they are represented by the index. If the S&P 500 goes up 1%, the index fund should also go up 1%.

When investing in index funds, be sure to check the expense ratio. The best index funds have expense ratios of 0.5% or less, and some offer expense ratios of 0.2% or less. Investors can find a wide range of popular index funds at brokerages like eToro.

8. Crypto Staking – Earn Crypto Rewards while Supporting Blockchains

Proof of stake (PoS) blockchains like those used by Cardano, Solana, and other major crypto projects require users to stake tokens to the blockchain. These users validate transactions and forfeit their stake if they act maliciously on the chain. If they act in good faith and keep the blockchain flowing, stakeholders are rewarded with more tokens.

Crypto staking, as this process is known, offers a way for investors to earn rewards from this process. When staking crypto, individual investors can contribute their cryptocurrency to a pool of tokens that’s used to keep a blockchain running. That pool then distributes rewards to everyone who contributed tokens.

Crypto staking rewards are often expressed as interest rates, and these accounts have a lot in common with crypto interest accounts. At projects like Quint, investors can stake crypto and earn rewards up to 39.08% APY. Other crypto staking platforms offer staking on a wider variety of tokens and variable interest rates for each coin.

9. Copy Trading – Trade Stocks, Crypto & More on Autopilot

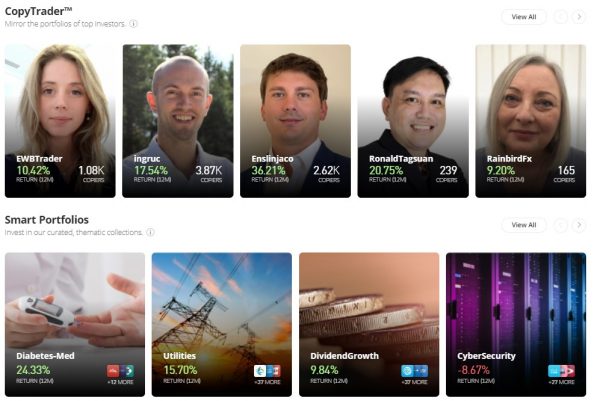

Copy trading is a feature offered by some brokerages that lets investors automatically copy the portfolios of more experienced investors. This can be a suitable option for beginner investors who aren’t sure what to invest in, but want to try to beat the market using advanced trading strategies.

With copy trading, investors can see an experienced trader’s strategy, trade history, and performance. If they like what they see, they can invest a certain amount of money to copy that trader’s moves. Whenever the trader buys or sells, the investor’s account will also buy or sell the same assets. Copy trading can be used for everything from stocks to ETFs to crypto.

One of the best places to try copy trading is eToro. At eToro, investors can start copy trading with as little as $200. That means that investors with $2,000 to invest can copy up to 10 different traders to hedge their bets across multiple different strategies.

10. NFTs – Invest in the Next Big Digital Artwork

NFTs, or non-fungible tokens, are unique tokens that offer ownership over a digital asset. NFTs are frequently used to buy and sell digital artwork, but they can also be used to provide exclusive membership in virtual clubs or to give players a financial stake in play-to-earn crypto games.

Some of the best NFT projects today include Bored Ape Yacht Club, Nouns, VeeFriends, and others. These projects have seen the value of their NFTs skyrocket since they were first minted, generating windfalls for early investors. While many new NFT projects flop, savvy investors can pick out top projects and potentially make a lot of money as demand for the NFT collection grows.

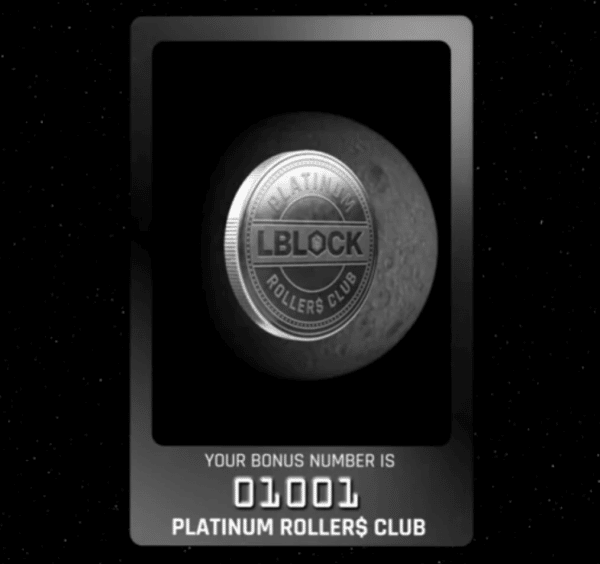

One of the best NFT collections to check out in 2023 is Lucky Block. Lucky Block is a play-to-earn crypto game that offers daily prize drawings. Investors in Lucky Block’s Platinum Rollers Club NFTs have a 1-in-10,000 chance of winning $10,000 every single day. Even those who don’t win can make money by loaning out their NFT.

Lucky Block NFTs can be purchased today at Launchpad, one of the top NFT marketplaces.

11. Commodities – Trade Oil, Gas, Coffee & More

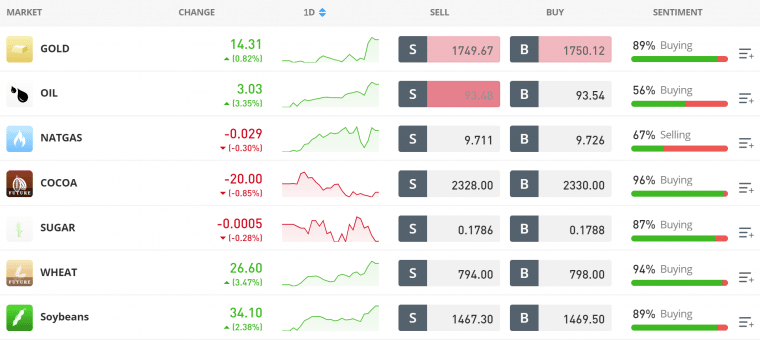

Commodities are physical goods like oil, gas, coffee, wheat, sugar, gold, copper, and more. They include energy materials, precious metals, building materials, and food supplies that are traded around the world. The market for commodities is typically global, so the price of these products depends on markets all over the world.

Investing in commodities can be tricky, especially for beginners. However, commodities trading can be potentially lucrative for those who understand how these markets work. It’s usually a good idea to focus on one specific commodity so that investors understand all of the dynamics behind it, as opposed to trying to trade multiple different commodities.

The simplest way to trade commodities is by using a broker that offers commodity CFDs (contracts for difference). One such broker is eToro, which offers low-cost trading on dozens of popular energy supplies, metals, and food products. eToro even lets traders apply leverage up to 20:1, vastly increasing the potential buying power of $2,000.

How to Choose the Best $2k Investments For You

Investors need to know the best way to invest $2,000 for their specific needs. In this part of our guide, we’ll explain how to invest 2,000 dollars based on several key factors.

Financial Goals

Before investing any money, investors should always think carefully about what their goals are. Some investors want to build up a nest egg for retirement, others want to invest to save up for a house, and others want to invest as a side hustle that supplements their income.

Each of these financial goals has a different timescale and may be better suited to investments with more or less risk. So, investors need to match their goals with their investment strategy and always keep an eye on how their investments get them closer to reaching their goals.

Risk vs. Return

One of the most important things investors need to consider when investing $2,000 is how they want to balance risk and return. In general, generating greater returns requires taking on more risk. If an investor wants to double their money in just a few months, they’ll probably need to invest in a high-risk asset that could also go to zero.

High risk, high reward assets include cryptocurrencies, individual stocks, and commodities. Lower risk assets include ETFs and index funds, which spread out risk across many different stocks.

Volatility

Another thing to consider is volatility. Volatility is a measure of how much the price of an asset swings up or down over a given period of time. More volatile assets may hit an all-time high one day and an all-time low the next, whereas low volatility assets have more stable prices.

High risk assets often tend to have high volatility, in part because investors can be jittery about their performance. For example, cryptocurrencies are known for being highly volatile compared to stocks. Importantly, this volatility can be an advantage for aggressive investors who want to try to time a big upswing.

Diversification

Long term investors may want to consider investing in multiple different assets when investing $2,000. In other words, they can build a diversified portfolio that balances risk and reward.

The advantage to this approach is that investors don’t have to put all their eggs in one basket. They might invest $500 in a high risk, high return cryptocurrency project like Tamadoge. They might invest another $500 across several of the best stocks to invest $2,000, and another $500 in index funds. Finally, they might invest $500 in crypto staking, which offers a steady income over time.

Where to Invest $2,000 – the Best Option?

Choosing where to invest $2,000 is a major part of investing. Investors need to decide whether to invest with one or more crypto projects, whether to use a crypto exchange, or what stock or ETF brokerage to use. Investors may also decide to split up their $2,000 and invest smaller amounts of money in multiple places.

We think the best place to invest $2,000 in 2023 is FightOut. This project offers a revolutionary Move-to-Earn fitness app that aims to reward its users for leading a healthy lifestyle. $FGHT is currently trading on its first presale round at a price of $0.0167 per token.

How to Invest $2,000 – FightOut Tutorial

Now that investors know how to invest $2,000, we’ll take a closer look at the best way to invest $2k in 2023: FightOut (FGHT), one of the hottest new crypto projects of the year.

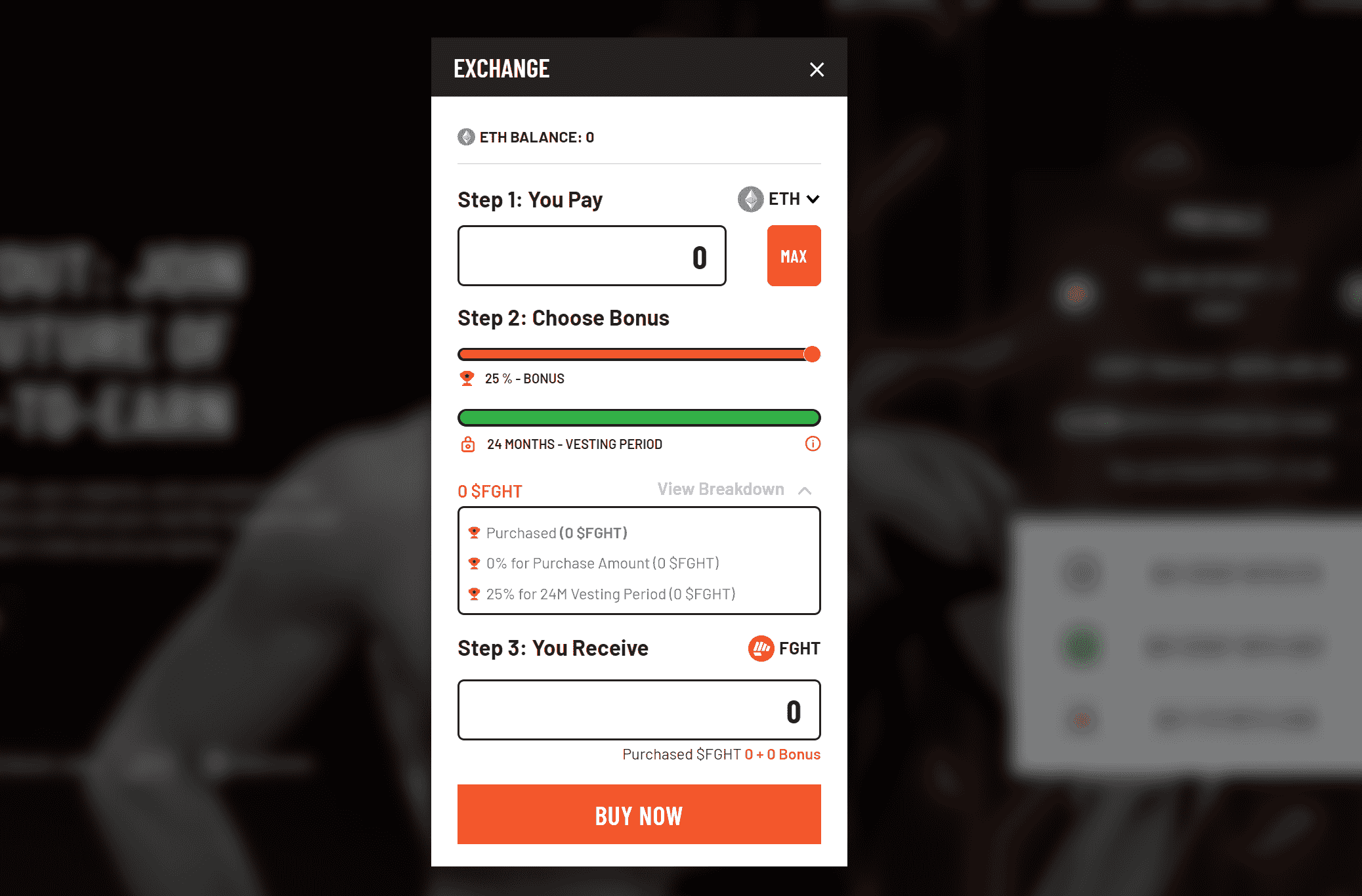

$FGHT is currently holding a crypto presale, so investors can purchase the token by following these steps.

Step 1: Wallet Set Up

Buyers must ensure that they have a crypto wallet like MetaMask ready. (Mobile users are recommended to download the TrustWallet)

Step 2: Connecting the wallet

After installing the wallet, investors should go to FightOut’s official presale page. Buyers should locate and click on the “BUY $FGHT NOW” button. Then, they must choose the wallet they have installed (eg Metamask or TrustWallet) and login to their wallets.

Step 3: Adding ETH/USDT

Ater logging into their wallets, buyers need to check if they have any ETH or USDT in their wallets. Herein, they also have the option to buy ETH with a credit card via Transak. After ensuring enough balance of ETH/USDT in their wallets, buyers can go ahead and click either on the “Buy $FGHT with ETH” or “Buy FGHT with USDT” button.

Step 4: Buying $FGHT

In this step, investors should enter the amount of ETH/USDT they would want to exchange in return for $FGHT tokens.

Step 5: Confirming the Transaction & Claiming Tokens

Now, buyers can confirm the transaction after ensuring the number of $FGHT tokens they would receive. Investors can claim these tokens based on the vesting period they choose to go for.

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

There are many approaches to investing $2,000, but we think the best way to invest 2,000 dollars in 2023 is to buy FightOut (FGHT).

This new cryptocurrency project has unique features that help users to earn rewards for completing workouts and other fitness-related movements. $FGHT is trading on presale at $0.0167 per token. After having already raised over $2.1 million in a few days, the token has displayed a huge upside potential in the coming times.

FightOut - Next 100x Move to Earn Crypto

FAQs

What should I invest $2k in?

What is the best way to invest 2,000 dollars?

How much can you earn by investing $2,000?

References

- https://www.ameriprise.com/financial-goals-priorities/taxes/how-are-investments-taxed

- https://www.investor.gov/introduction-investing/investing-basics/role-sec/laws-govern-securities-industry

- https://www.irs.gov/retirement-plans/401k-plans