Considering that checking and savings accounts still yield less than 0.1% in interest annually, an investment of $40k would be better spent in the financial markets.

This beginner’s guide will explore the best way to invest $40k in a risk-averse manner. We cover a variety of asset classes, including but not limited to crypto, stocks, ETFs, real estate, and 401 (k)s.

11 Best Ways to Invest $40k in 2023

The best ways to invest $40k in the current economic climate are listed below:

- FightOut – Overall Best Way to Invest $40K and receive M2E rewards

- Dash 2 Trade – Invest $40K in a Market-Leading Crypto Analysis Platform

- Stocks – Buy Individual Stocks and Shares

- Smart Portfolios – Invest in a Managed Portfolio That Tracks a Niche Market

- Crypto Staking – Enjoy Passive Income on Crypto Assets

- Tax-Efficient Accounts – Maximize Tax Breaks Available on Investments

- Index Funds – Instant Diversification via a Passive Investment Strategy

- Commodity ETFs – Invest in Global Commodities for Added Diversification

- Copy Trading – Passively Invest in a Seasoned Trader

- US Treasuries – Earn Income Every Six Months From the US Government

- NFTs – Invest in an Emerging Technology That is Gaining Traction

Each asset class listed above comes with its own risk and upside potential. Therefore, investors can read on to find out which of the best $40k investments highlighted above are right for their financial goals.

A Closer Look at the Best Ways to Invest $40,000

In this section of our guide, we will explore the 10 best ways to invest $40k.

We take a deep dive into each asset to explain the potential risks and rewards that need to be considered. We also explain the steps typically required to invest in the respective asset.

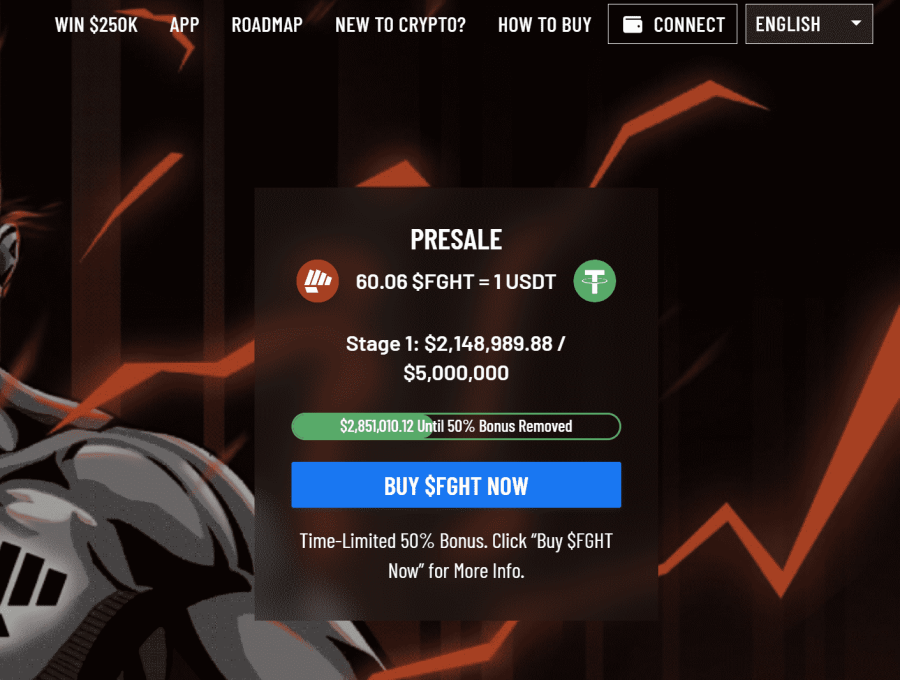

1. FightOut – Overall Best Way to Invest $40K and receive M2E rewards

The project has had a successful presale launch recently while it raised over $2.3 million USDT in a relatively short time. At the time of writing, its native token $FGHT can be bought at a discounted price of $0.0167 per token. Investors should consider buying the tokens while they still have a chance to grab them at a lower price.

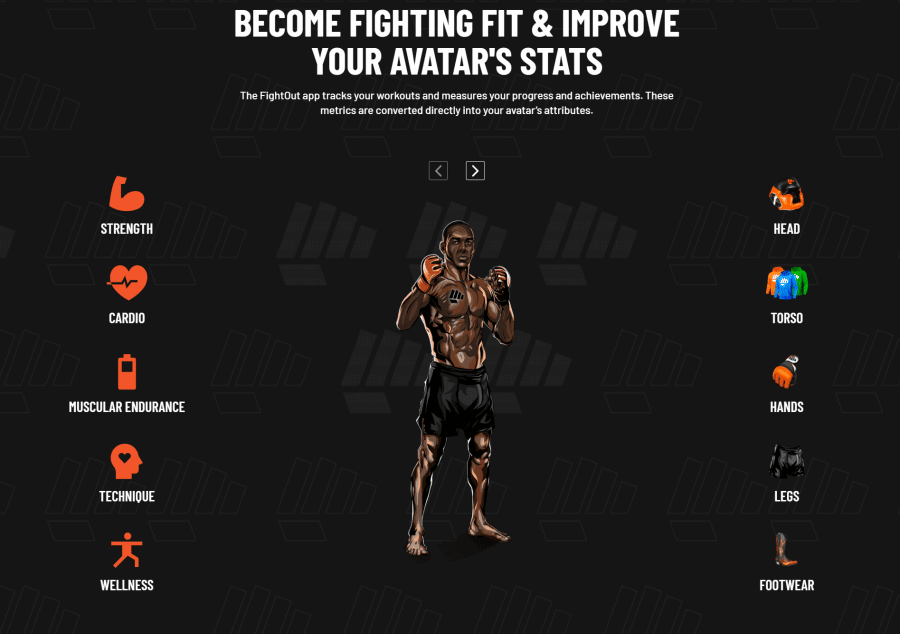

The project has created a one-of-a-kind app that promotes a fitness lifestyle and allows users to earn rewards by simply completing their workouts.

To make matters even more interesting, FightOut has built its own metaverse and has incorporated the elements of gamification into it. As a result, users will have a chance to create their own unique NFT avatars on FightOut’s platform. These avatars are also called soulbound avatars and will correlate to the user’s real-life fitness progress. Moreover, users also would get a chance to compete against other users of the project’s community.

FightOut has also come up with an effective mechanism to reward its users via its in-app currency called REPS. Buyers can use REPS to avail membership discounts, buy cosmetic NFTs to enhance their avatars, and buy similar products.

Investors can go through FightOut’s whitepaper to better understand its various features.

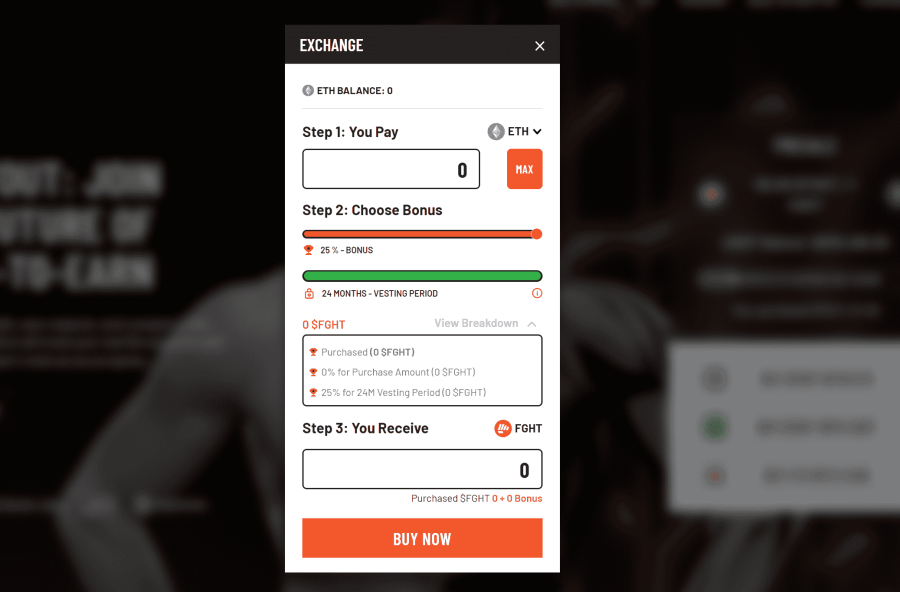

$FGHT Tokenomics & Purchase Bonuses

$FGHT is FightOut’s native token and is built on Ethereum’s network having a limited supply. Out of its total supply, 90% of the tokens will be available for purchase via the project’s presale stages.

In addition to participating in various tournaments and leaguers, investors can also buy REPS using $FGHT. Buyers using $FGHT to buy REPS would receive an extra 25% REPS.

Furthermore, investors buying $FGHT tokens in the presale stages are also eligible for purchase bonuses. They have an opportunity to get a minimum bonus of 10% requiring an investment of just $500 with 6 months of vesting.

$FGHT’s Presale Performance

FightOut has already caught investor attention as it saw raised over $2.3 million USDT in a relatively short time. Moreover, buyers have an opportunity to get up to 50% additional tokens as rewards during the ongoing presale stages.

Investors can consider entering FightOut’s Telegram to stay updated on the project’s latest developments.

| Presale Started | 14 December 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

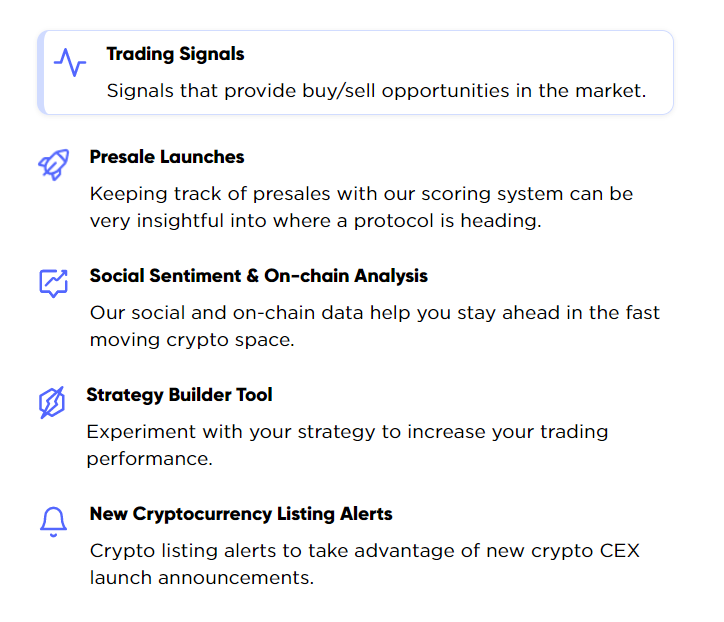

2. Dash 2 Trade – Invest $40K in a Market-Leading Crypto Analysis Platform

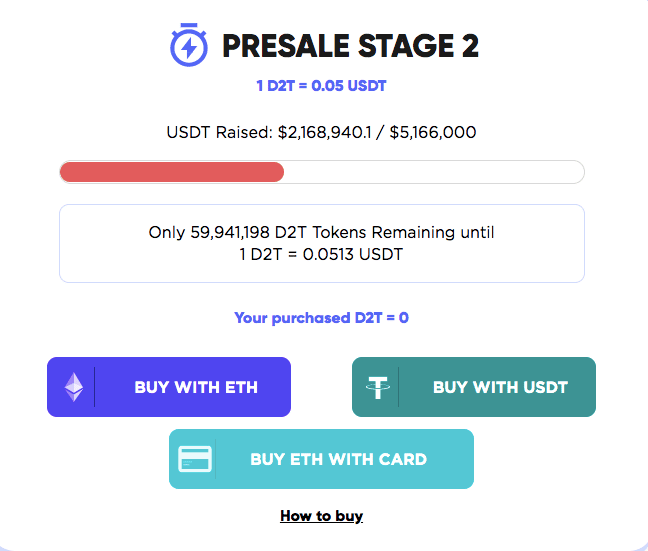

After the presale concludes, Dash 2 Trade aims to have raised $40 million – after which the dashboard will be released by Q1 2023.

Once the presale investors can access the D2T holdings, they will be able to purchase a monthly subscription package by selecting one of three tiers – the free tier, the starter tier or the premium tier. The last two offerings can solely be accessed by D2T holders – resulting in a monthly fee of 400 and 1,000 D2T, respectively.

Currently, D2T costs $0.05 per token, meaning the premium tier will cost exactly $50. However, the pricing structure of the presale will continuously witness an increase in the D2T valuation per presale round. By the final presale round, D2T will be trading at $0.0662 per token – meaning that 1,000 tokens will cost $62. Therefore, investors may want to quickly invest in the presale before the cryptocurrency rises by 32%. Another reason to join the presale is due to Dash 2 Trade’s $150K D2T giveaway – which can be won by a lucky investor who has joined the presale.

After launching on October 19th 2022, the D2T token presale has raised nearly $2.2 million in just 6 days. The second presale round will finish once the total amount raised crosses $5.1 million. According to the Dash 2 Trade whitepaper, the cryptocurrency can be leveraged to access trading signals, pricing alerts, backtesting features and even social & technical indicators. To stay updated with the latest news and developments regarding this project, join Dash 2 Trade’s Telegram Channel.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

| $0.0556 | $4,865,000 | 87,500,000 |

| $0.0580 | $5,075,000 | 87,500,000 |

| $0.0606 | $5,302,500 | 87,500,000 |

| $0.0635 | $5,556,250 | 87,500,000 |

| $0.0662 | $5,792,500 | 87,500,000 |

The table above highlights the D2T price change and token allocation for each of the 9 presale rounds. Read our how to buy Dash 2 Trade to get a detailed step-by-step walkthrough tutorial to access the presale right now.

3. Stocks – Buy Individual Stocks and Shares

Wondering how to buy stocks in 2023?To offset some of the risk typically associated with crypto products, investors should consider diversifying into other financial areas. In this regard, building a portfolio of stocks is perhaps the best way to invest $40k. In doing so, the investor will be buying a slice of their chosen companies.

This means that when a company performs well, in theory, its stock price will increase. When this happens, the value of the stock portfolio will rise. For instance, if the investor buys 10 stocks at $50 each, and then cashes out at $60, this would result in a profit of $100 (10 shares x $10 gains).

It goes without saying that the most challenging part of investing $40k in this market is knowing which stocks to buy. This is why seasoned investors suggest diversifying across many different stocks from a variety of markets, economies, and industries. Investors should also consider the many different types of stocks that operate in this space.

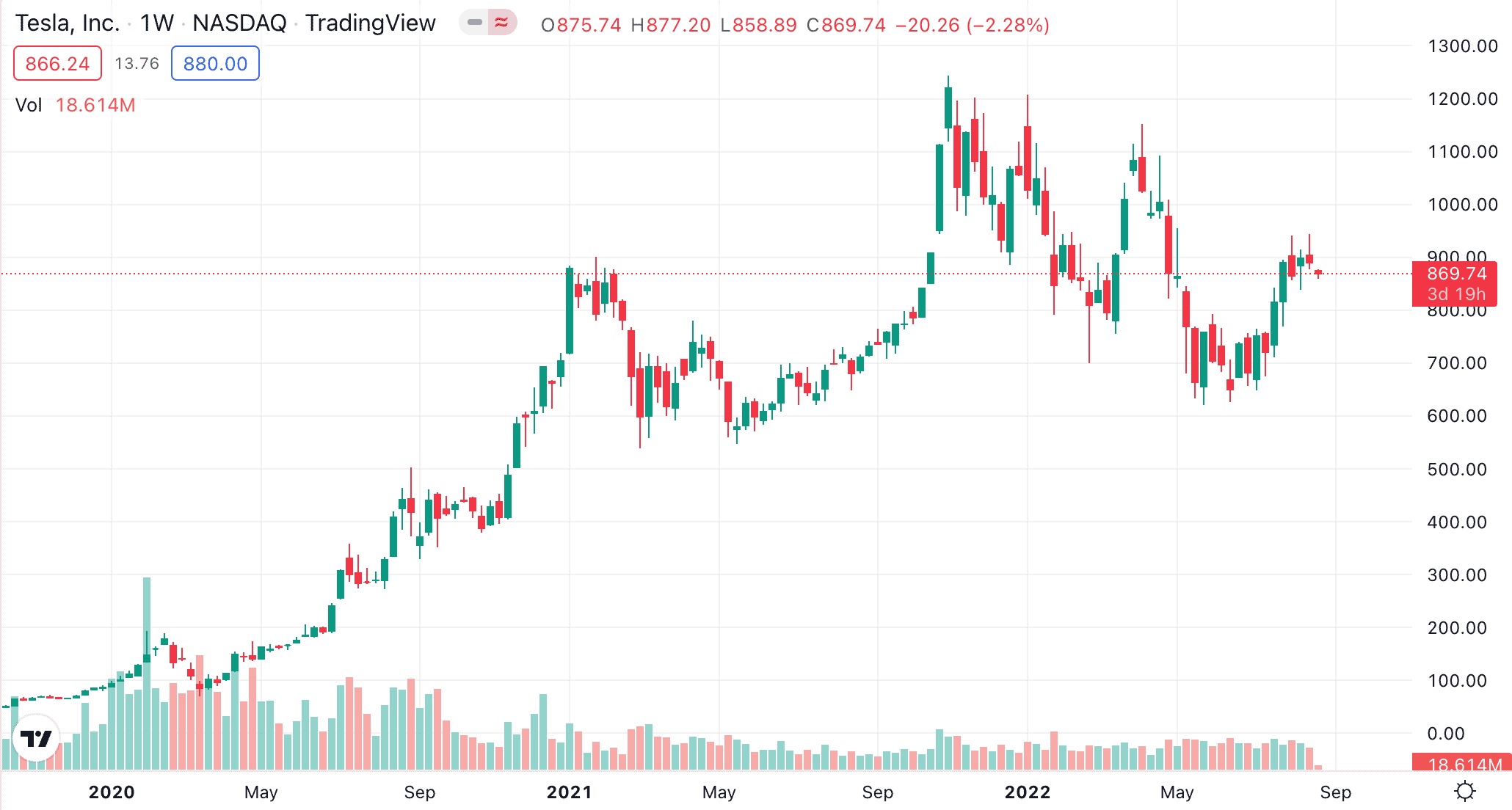

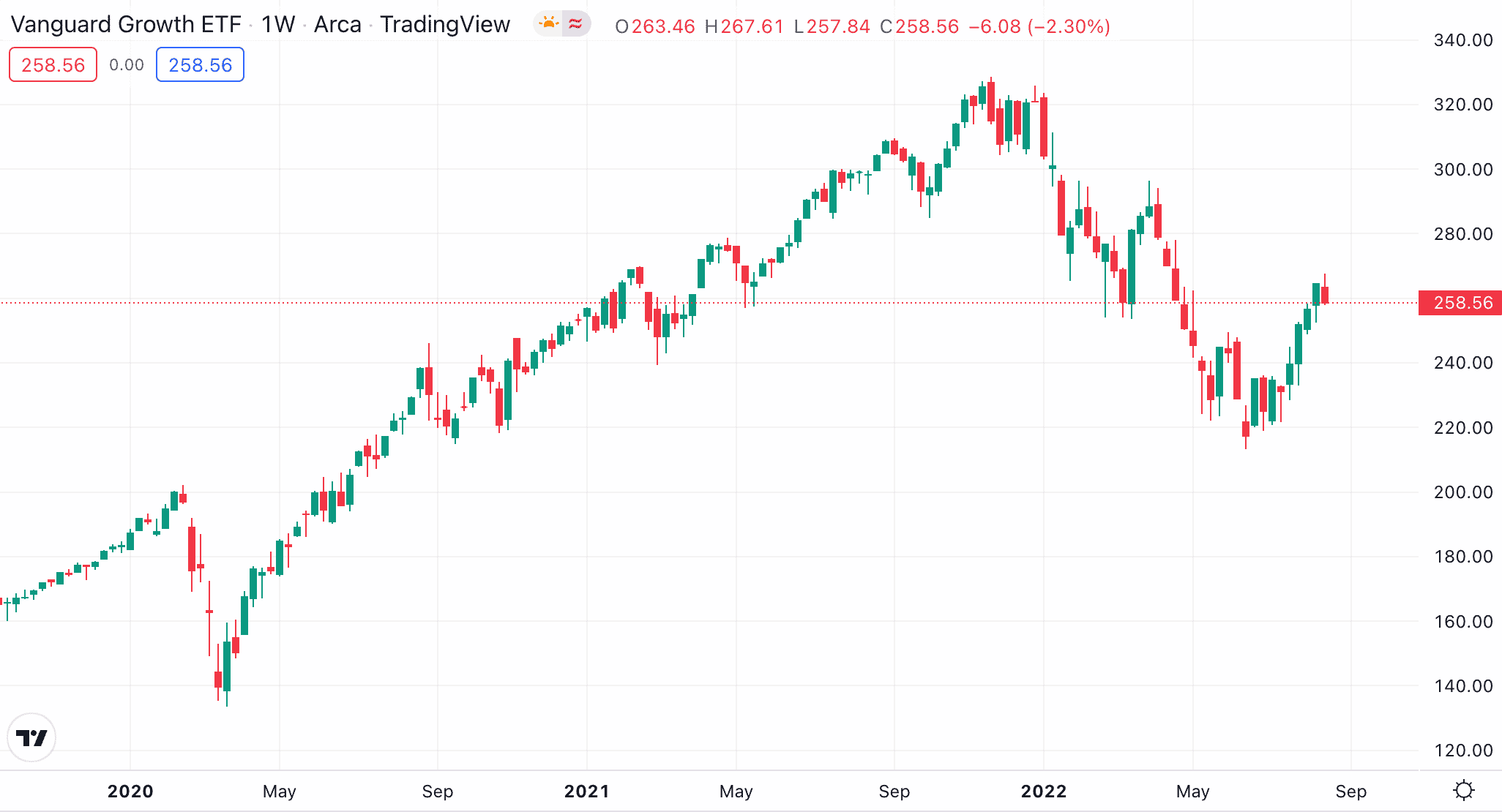

For example, those seeking the highest returns possible will often focus on growth stocks. These are young companies with a new or unproven business model and oftentimes will look to revolutionize a particular niche market. A prime example here is Tesla, which went from an electric car startup in 2003 to now the largest automaker globally.

This huge success has subsequently translated into Tesla stock exploding in value since its 2010 IPO – with gains of over 20,000% based on prices as of writing. However, growth stocks come with added risk, as not all companies within this space will succeed. For instance, take the likes of Uber and Grab – two growth stocks involved in ride-hailing and food delivery.

These stocks are down 30% and 75% from their 2019 and 2020 IPOs, respectively. As a result, those looking to invest in growth stocks for maximum upside potential should ensure that they are well diversified. Moreover, to counter the added risk, investors might consider looking at stocks that offer more conservative, yet consistent returns.

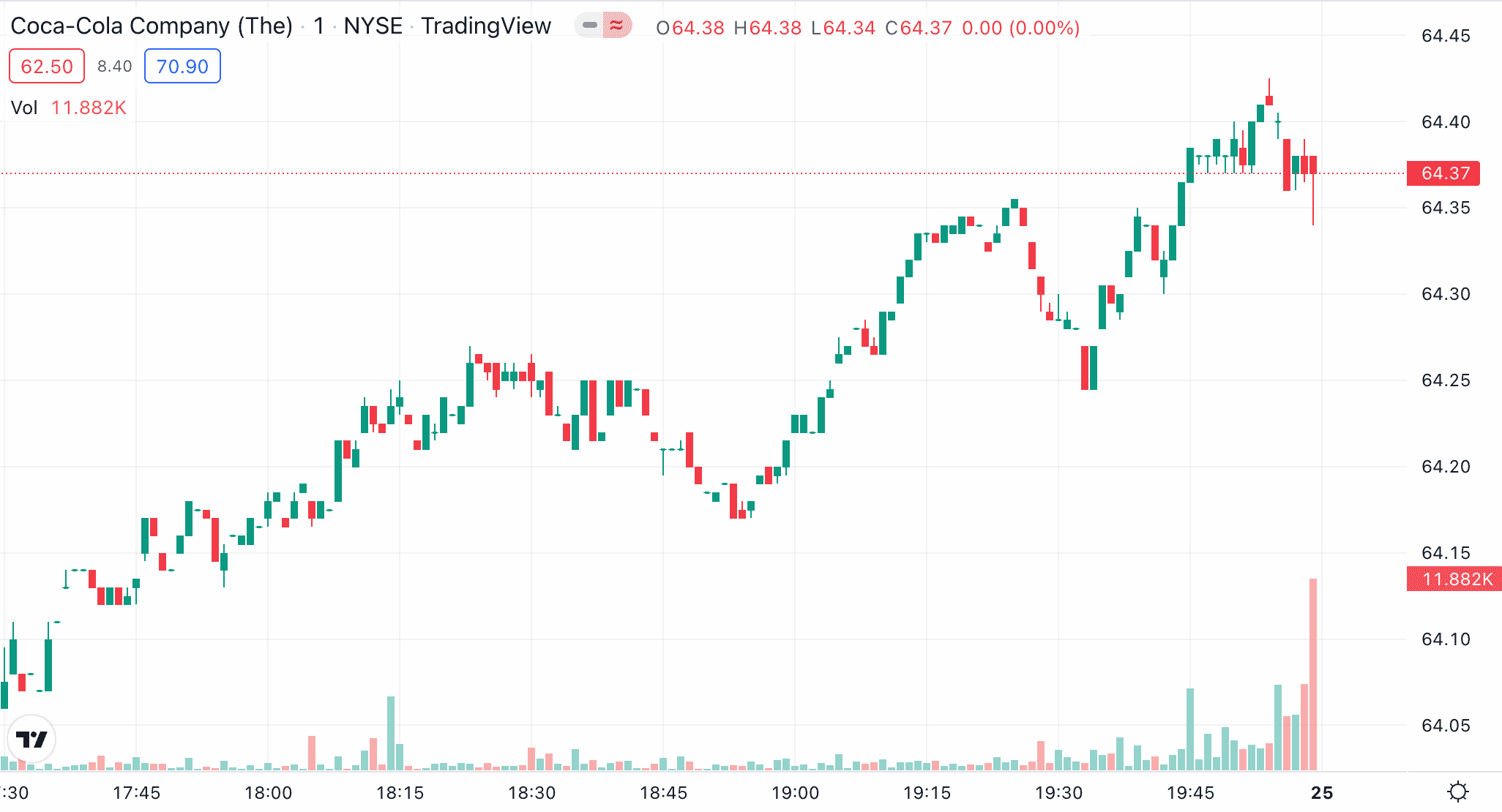

This might include blue-chip and dividend stocks. The former refers to companies with an established reputation that often covers several decades, alongside a large market capitalization. Examples of blue-chip stocks that are considered viable for risk-averse investors include Nike, IBM, Microsoft, Coca-Cola, Visa, American Express, and, Caterpillar.

While stocks of this nature often provide smaller investment returns, they have survived many bear markets and recessions. In the case of dividend stocks, these present companies that have sufficient levels of free cash flow to distribute a portion of retained profits to shareholders.

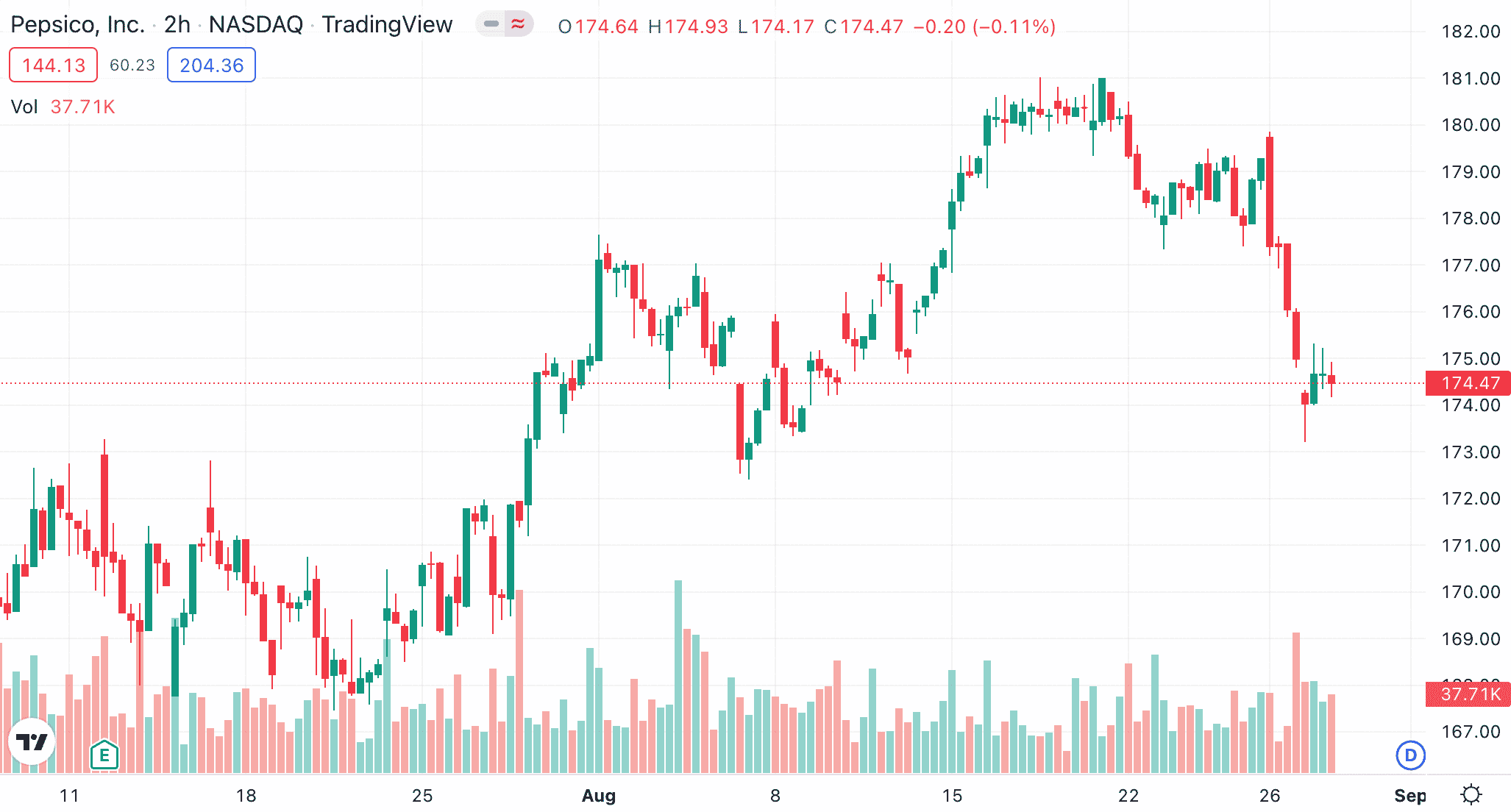

Some stocks in this space have been paying and increasing dividends for many decades. Examples include Kimberly Clark, PepsiCo, Hormel Foods, Target, Emerson Electric, and 3M. As we explain in more detail later on, it is also possible to buy an ETF that tracks a wide basket of leading dividend stocks.

To diversify outside of the US stock market, investors might also consider buying shares in foreign companies. For example, GSK and HSBC in the UK, Tencent Holdings and China Construction Bank in Hong Kong, and Volkswagen and Exor in Europe. As we shall continue to stress, the best way to invest $40k in the stock market is by building a diversified portfolio.

In order to achieve this goal, investors will need to choose a stock broker that offers low trading fees. Moreover, the chosen broker should support fractional investments. At eToro, for example, this SEC-regulated broker offers thousands of stocks from multiple US and international markets at 0% commission, and the minimum stake per trade is $10.

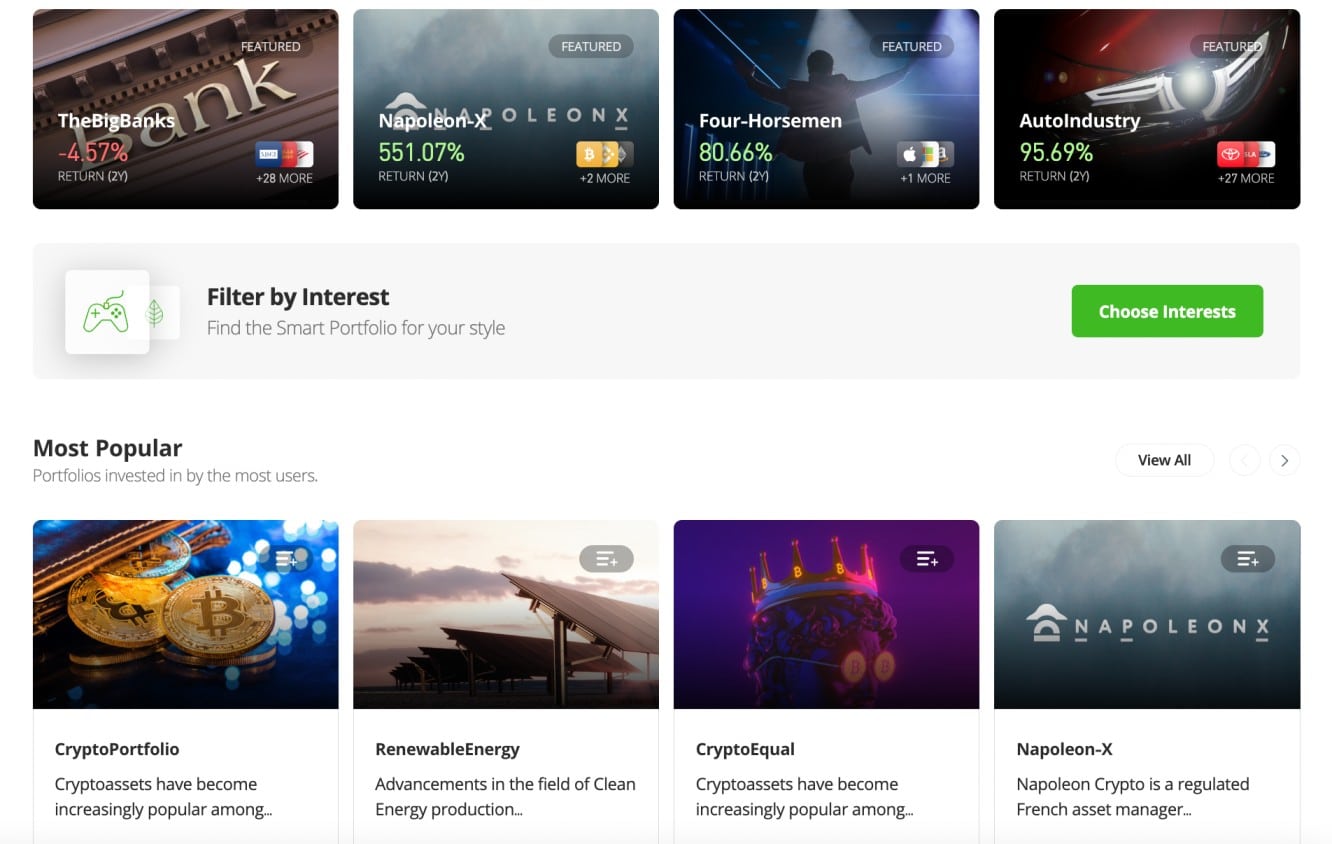

4. Smart Portfolios – Invest in a Managed Portfolio That Tracks a Niche Market

Another option to consider when assessing how to invest $40k is Smart Portfolios, which are offered by eToro. In a nutshell, Smart Portfolios are curated and managed by the eToro team, and they are tasked with tracking a particular market. The assets within each Smart Portfolio are rebalanced regularly, to ensure the fund objective remains on track.

This offers a completely passive way to invest in the financial markets, and diversification is possible too, considering that there are dozens of Smart Portfolios to choose from and the minimum capital requirement is just $500. Let’s look at some examples of Smart Portfolios to assess what markets and assets can be accessed.

First, one of the most popular Smart Portfolios offered by eToro is The Future of Power. As the name suggests, this Smart Portfolio offers access to a range of companies that are actively involved in the future of renewable energy. Stocks within the Smart Portfolio include Gevo, ReneSola, Consolidated Edison, SolarEdge Technologies, and Orsted.

Another Smart Portfolio that is popular on eToro is StartupNations. This offers access to a basket of growth stocks, which includes the likes of Spotify, Fiverr, Alcon, Jfrog, and Monday.com. Other Smart Portfolios supported by eToro focus on everything from advertising technology, Big Tech, and large global banks to high-yield dividend companies and crypto assets.

When investing in a Smart Portfolio, no additional fees apply. As eToro offers commission-free stocks, this ensures that investment costs remain low. Unlike conventional ETFs, eToro enables investors to add or remove assets from a Smart Portfolio. This ensures that the investor has the flexibility to follow their financial goals actively.

5. Crypto Staking – Enjoy Passive Income on Crypto Assets

Many investors are unaware that it is possible to earn passive income when investing in crypto assets. This can be achieved in a number of ways, albeit, staking appears to be the most popular. Staking requires the investor to ‘lock’ their funds for a predefined number of days and, in return, will receive interest.

For example, let’s say that the investor deposits 2 ETH into a 1-year staking pool that offers an APY of 25%. This means that after 1-year has passed, the investor will receive their original 2 ETH back, plus 0.5 ETH in interest. The gains on this investment could be extended further if the value of ETH increased while the tokens were locked in the staking pool.

Many view crypto staking as a no-brainer if the investor is planning to hold onto their tokens long-term. After all, if the tokens sit idle in a crypto wallet, the investor will not earn any income on the investment. However, by depositing the funds into a staking pool, this offers the opportunity to make gains on two fronts – growth and income.

In terms of yields, this will depend on several factors. For example, many staking pools offer the chance to select the desired lock-up period. Flexible plans pay the lowest APY as the investor can elect to withdraw their crypto assets at any time. On the other hand, longer-term plans will usually pay a higher APY.

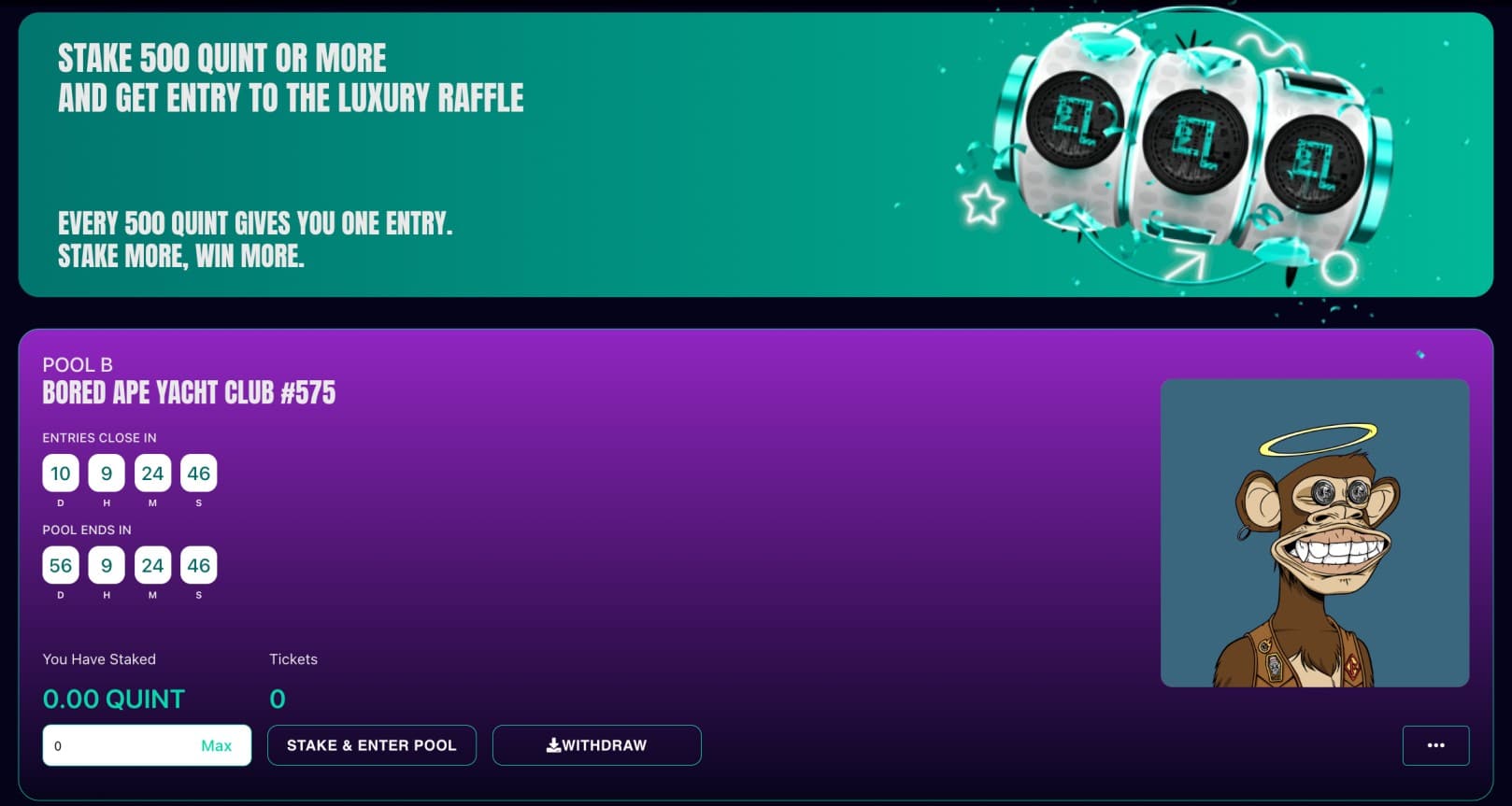

is because the investor will not have access to their crypto assets until the lock-up period has passed. The best place to invest $40k into staking is Quint. This up-and-coming project is building a variety of products and services within its ecosystem. At the forefront of this is its ‘super’ staking tool.

In a nutshell, this combines competition draws with conventional staking rewards. For example, Quint recently offered a super staking pool that not only generated interest for the investor, but the chance to win a $100,000 luxury watch. Each and every investor that staked at least 500 Quint tokens gained entry into the competition.

After the competition was drawn, Quint returned the original staking amount back to each investor, plus any subsequent rewards that were earned. This means that investors are incentivized to stake at Quint, as rewards will be generated irrespective of whether they win the competition.

6. Tax-Efficient Accounts – Maximize Tax Breaks Available on Investments

There are many ways to reduce or defer tax liabilities on investments made in the US. Limits will apply, and investors will need to consider which tax-efficient account is best for their personal circumstances. The first port of call for investors is to assess whether or not their employer offers 401 (k) plans.

401 (k)s enable workers to allocate some of their salaries into the financial markets. The range of markets available will be selected by the employer, albeit, this typically includes a small selection of ETFs and index funds. Moreover, some employers even offer matching contributions.

This means that the employer will match a small percentage of 401 (k) contributions made throughout the year. In most cases, this is 50 cents on the dollar, up to 6% annually. If matching contributions are offered, this should be maximized. The maximum amount that can be deposited into a 401 (k) is $20,500.

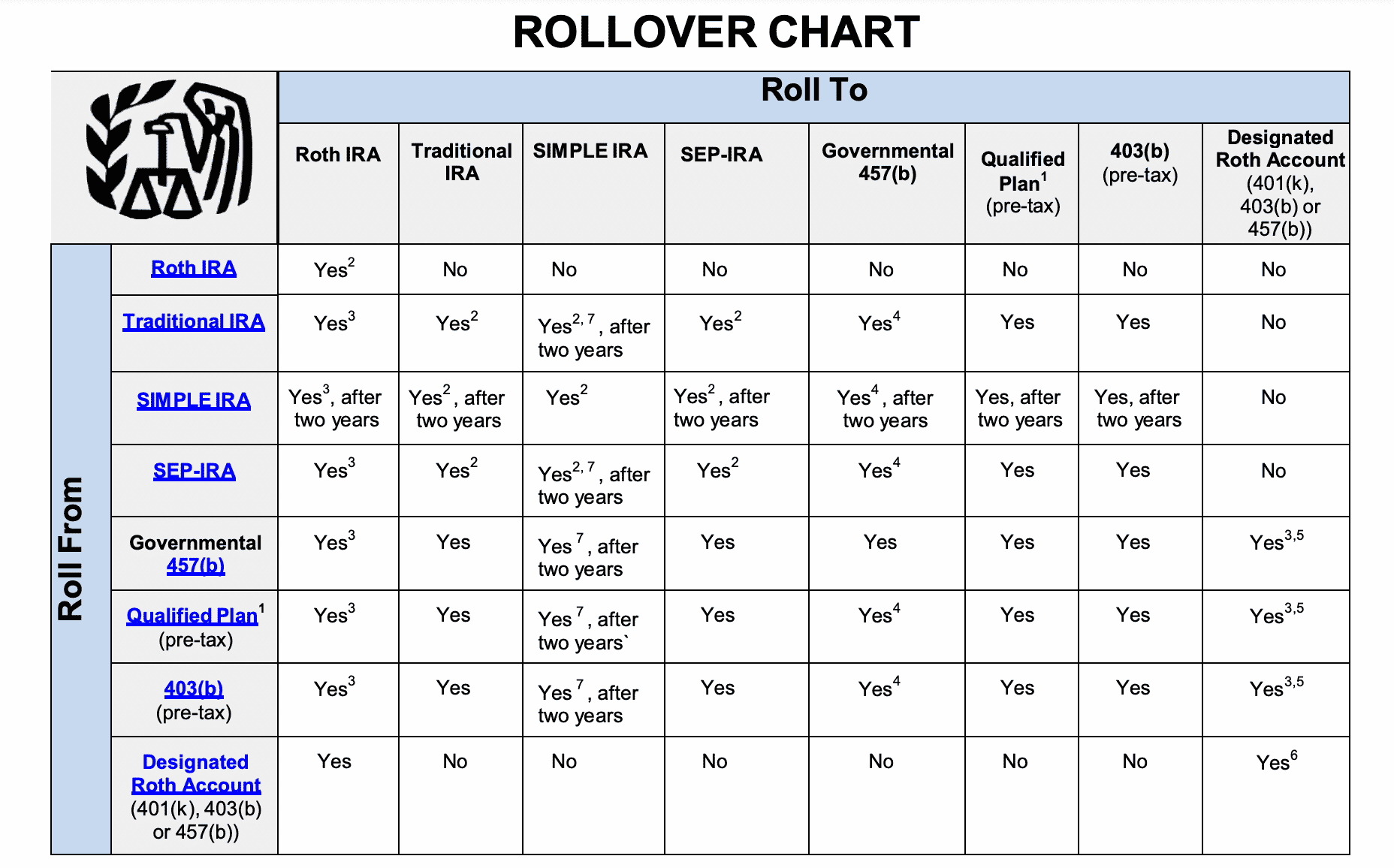

This limit increases to $27,000 if the worker is aged 50 or over. However, it should be remembered that 401 (k) investments must come directly from the payroll department, meaning that lump sums cannot be injected into the plan externally. On the other hand, IRAs – which are offered by brokerage firms, enable direct investments from the investor.

IRAs come with much lower limits when compared to 401 (k)s at $6,000 annually. Investors aged 50 years and above get an extra $1,000. The main benefit of opting for an IRA is that the investor will have access to a much wider pool of asset classes – as they will be dealing with a broker. With that said, investors can maximize both their 401 (k) and IRA limits should they wish.

Another important consideration to make is that both 401 (k)s and IRAs come in various forms. The two most common forms cover traditional and Roth plans. In the case of a traditional plan, the investor will not pay tax at the time of the investment. Instead, this liability is deferred when the investor begins to make withdrawals from their 401 (k) or IRA.

Younger investors will perhaps prefer a Roth plan, as the tax is paid on the investment at the source. And therefore, when it comes to making withdrawals from the Roth 401 (k) or IRA, no tax will be deducted.

7. Index Funds – Instant Diversification via a Passive Investment Strategy

Some investors will not have the time to actively research the market, or perhaps lack the required knowledge to do so. Either way, in this regard, index funds are perhaps the best way to invest passively. There are thousands of index funds in the market, all of which will look to track a particular group of assets.

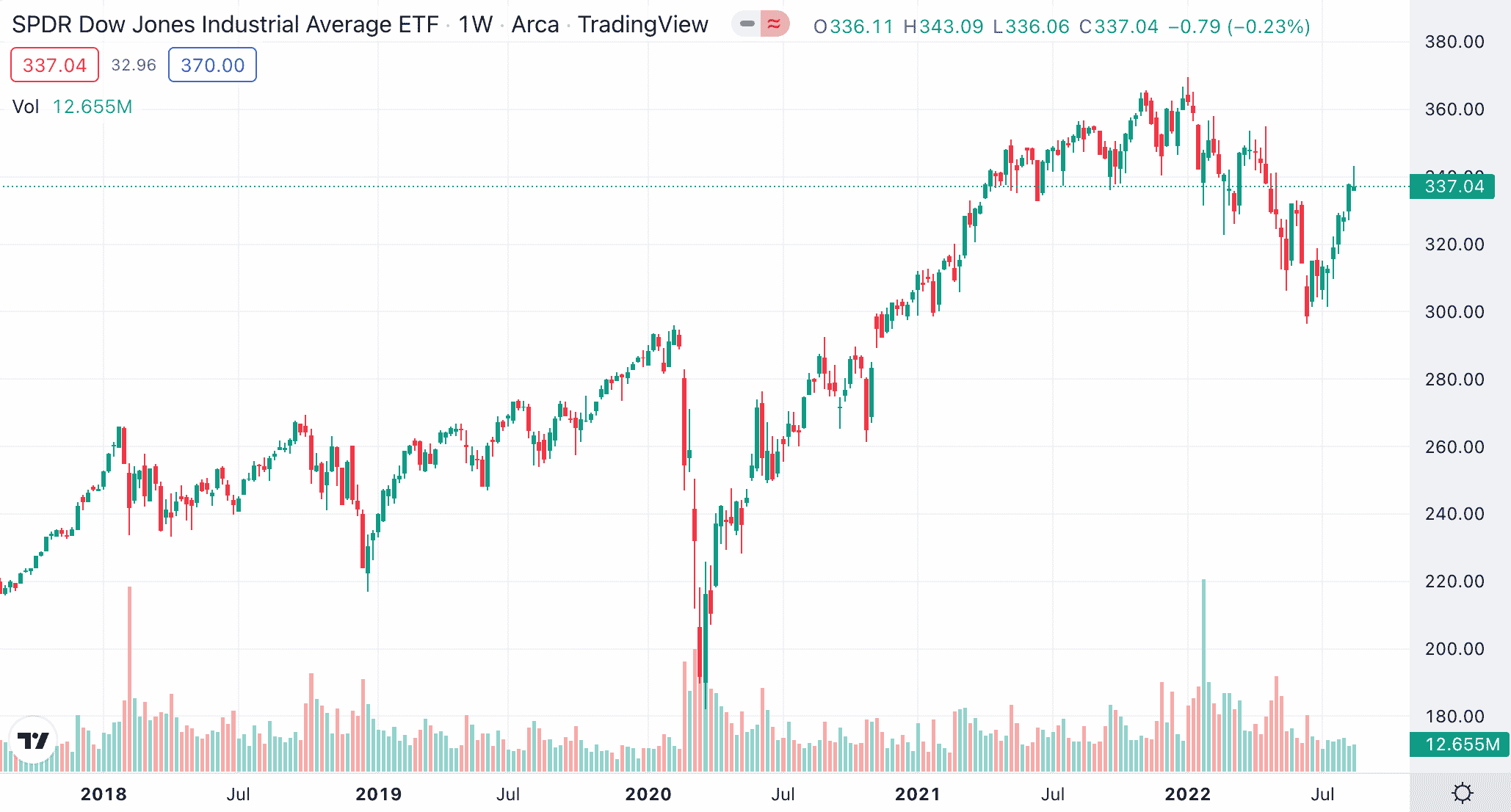

Crucially, index funds cover many asset classes, albeit, the most traded markets in this space focus on stocks and bonds. Perhaps the most popular index funds to explore are those that track the US stock market. For example, the Dow Jones tracks a selection of 30 blue-chip stocks – all of which yield quarterly dividends.

This includes the likes of Walmart, Boeing, Visa, Chevron, and Salesforce. By investing in a Dow Jones index fund, the investor will indirectly buy all 30 stocks, at various weights. For example, let’s say that the investor decides to allocate $40k into the Dow Jones. As of writing, Goldman Sachs and Home Depot carry a portfolio weight of 6.87% and 6.09%.

This means that of the $40k investment, the investor will own $2,748 and $2,436 worth of Goldman Sachs and Home Depot stock, respectively. Every three months, the Dow Jones index fund will be weighted. This means that the investor might own more or less of each stock, depending on market conditions at the time.

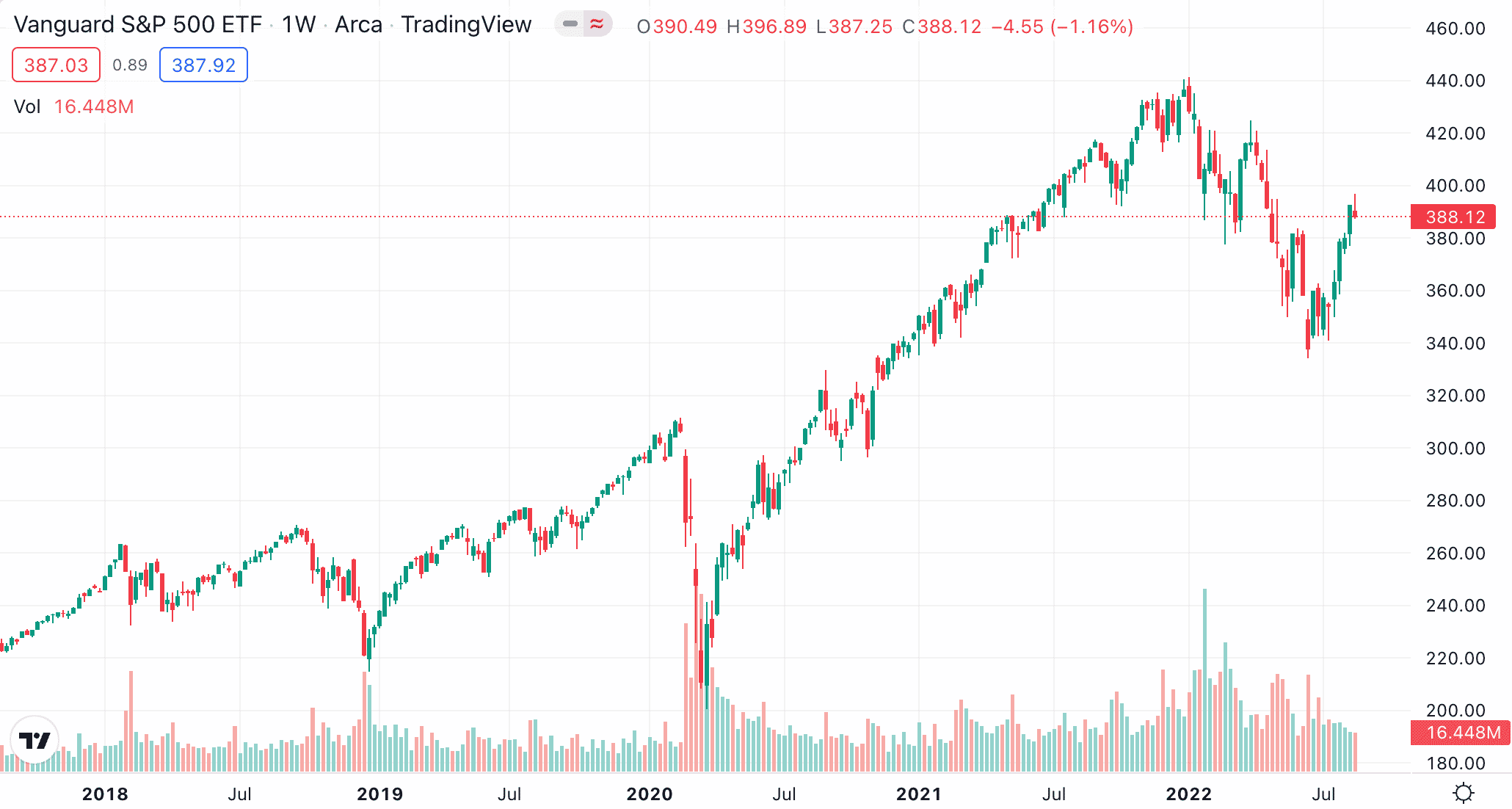

Although the Dow Jones is viewed as representative of the broader US economy, the S&P 500 index fund offer even greater levels of diversification. While the Dow Jones is represented by 30 companies, the S&P 500 consists of 500 large-cap stocks from virtually every industry and sector.

There is also a clear difference in how the Dow Jones and S&P 500 are weighted. While the former gives preference to companies with a higher stock price, the S&P 500 favors market capitalization. This means that the S&P 500 is heavily weighted to the largest companies in the US.

For instance, as of writing, the 10 biggest constituents of the S&P 500 index are Apple, Microsoft, Amazon, Tesla, Alphabet, Berkshire Hathaway, UnitedHealth Group, Johnson & Johnson, Exxon Mobil, and NVIDIA. Collectively, these 10 companies alone – in an index with 500 stocks, represent nearly 30% of the portfolio.

As such, to maximize a diversification strategy even further, investors might consider the Total Stock Market index fund. Put simply, through a single investment, this index fund includes each and every stock that is listed in the US. This means that the investor will have exposure to over 4,000 companies of various sizes.

In addition to stocks, investors might also consider index funds that track the bond markets. Once again, there are many options to choose from in this regard. For instance, some index funds will look to track corporate bonds that are issued by large-cap companies. Some will focus on high-yields, while others will look to track short-term US treasuries.

Either way, in order to invest in stock or bond index funds, the investor will need to go through an online broker. Each index fund will be operated by an ETF provider. For instance, to invest in the S&P 500, ETF providers like SPDR or Vanguard might be considered. At eToro, investors can access index funds via ETFs at 0% commission.

8. Commodity ETFs – Invest in Global Commodities for Added Diversification

Another option to consider when evaluating how to invest $40,000 is the commodity market. Think along the lines of gold, silver, oil, and wheat. Now, we should make it clear that there is no requirement to actually buy commodities, nor store them at home. Instead, the easiest way to invest in commodities is through an ETF.

As we mentioned earlier, some of the largest ETF providers in this space include SPDR and Vanguard. These two providers offer access to various commodity markets in a passive manner and with low fees. For example, someone wishing to gain exposure to gold can do so via the SPDR Gold ETF.

Other than a very small allocation of cash, this ETF is backed by physical gold bullion. Therefore, the price of gold will directly correlate with the value of this ETF. From the perspective of the investor, SPDR takes care of storage, logistics, insurance, and security. Moreover, as the SPDR Gold ETF trades on US exchanges, investors can sell their gold investments at any time.

And, to illustrate how cost-effective commodity ETFs can be, SPDR charges an expense ratio of just 0.40%. Those with an interest in an alternative precious metal – silver, might consider the iShares Silver Trust. There are also ETFs that offer access to the energy markets, namely oil and natural gas.

One such example is the SPDR S&P Oil & Gas Exploration & Production ETF. This ETF offers access to dozens of large stocks that are active in the oil and gas spaces, such as Texas Pacific Land, Devon Energy, Denbury, and Comstock Resources. The expense ratio of this ETF stands at just 0.35%.

Interestingly, the SPDR S&P Oil & Gas Exploration & Production ETF is one of the only commodity funds in this space that offers regular income. The reason for this is that oil and gas companies offer some of the best dividend yields in the market. On the other hand, when investing in commodity-backed ETFs, no dividend income will be earned.

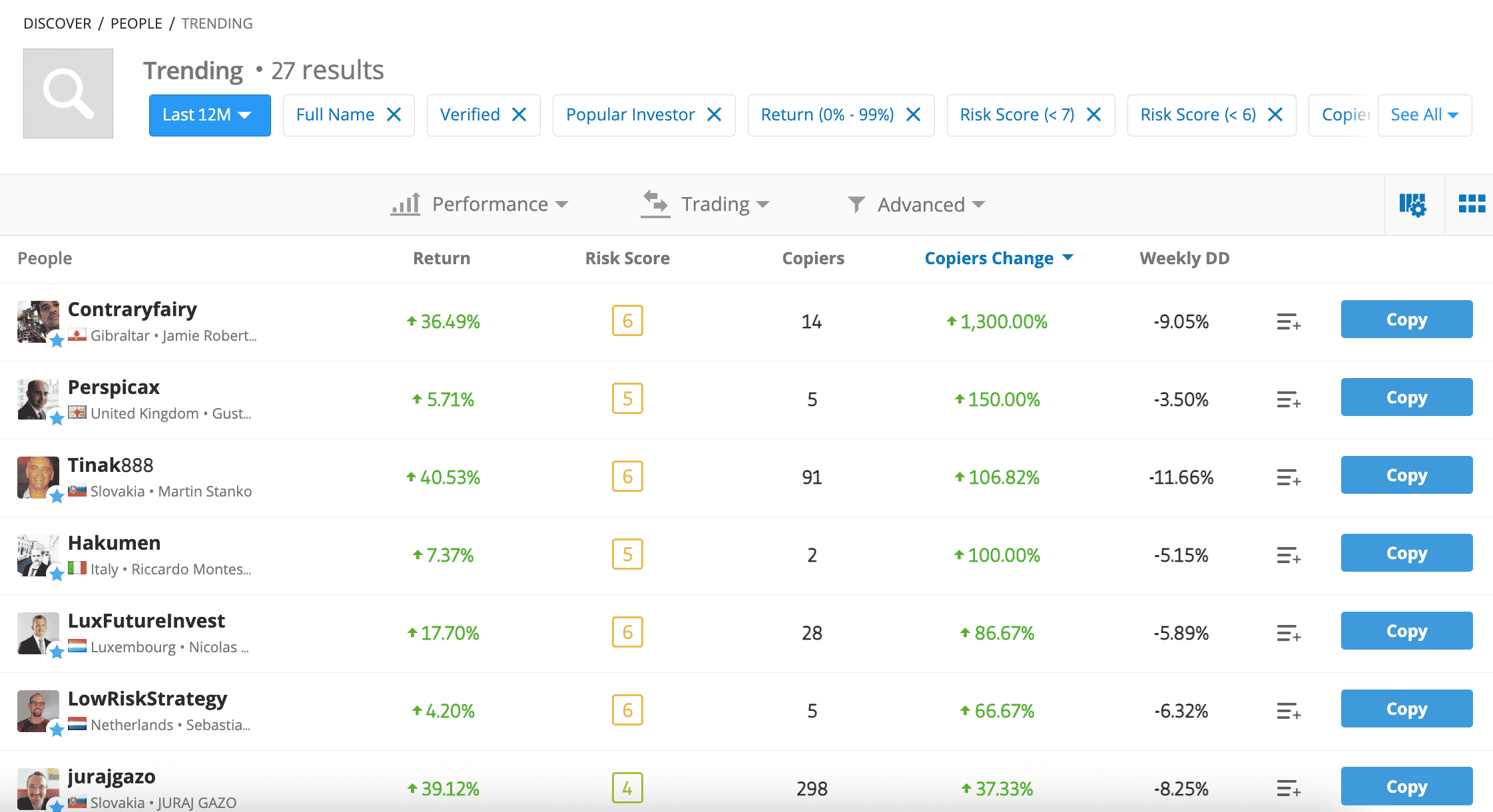

9. Copy Trading – Passively Invest in a Seasoned Trader

Copy Trading is another option to consider when assessing how to invest $40k. This is a product offered by eToro and a small number of other platforms. eToro offers an all-in-one service, insofar that it is both a brokerage and a Copy Trading platform. The main concept is the investor will allocate capital to a seasoned trader.

This means that all future buy and sell orders entered by the trader will be copied over the eToro user’s portfolio, automatically. Therefore, this promotes a passive investment strategy, even though many eToro traders are active investors. There are many thousands of traders that can be copied on eToro and the selection process requires some research.

For instance, investors might initially focus on traders that have generated a minimum annual return of 15% over the prior three years. It is also possible to filter traders by their risk score, which is generated by eToro based on the type of assets being traded and maximum daily and weekly drawdown levels.

Moreover, to copy a specific strategy, eToro users can evaluate the average trade duration. This highlights whether the individual is a day, swing, or long-term trader. eToro supports multiple asset classes on its platform, so investors can elect to copy an individual with expertise in forex, ETFs, stocks, commodities, and even crypto assets.

Either way, the minimum investment per trader copied at eToro is $200. There are no fees or commissions for using the Copy Trading service. Investors simply need to cover the respective commission and spread of the asset being traded. For instance, stocks and ETFs are commission-free at eToro, while forex and commodities operate on a spread-only basis.

In terms of how stakes work, this is based on a proportionate system. For example, let’s say that $2,000 is invested in a trader. If the trader risks 20% on an IBM stock trading position, the eToro user will automatically allocate $400 (20% of $2,000). Moreover, investors can elect to add or remove assets from their Copy Trading portfolio at any time.

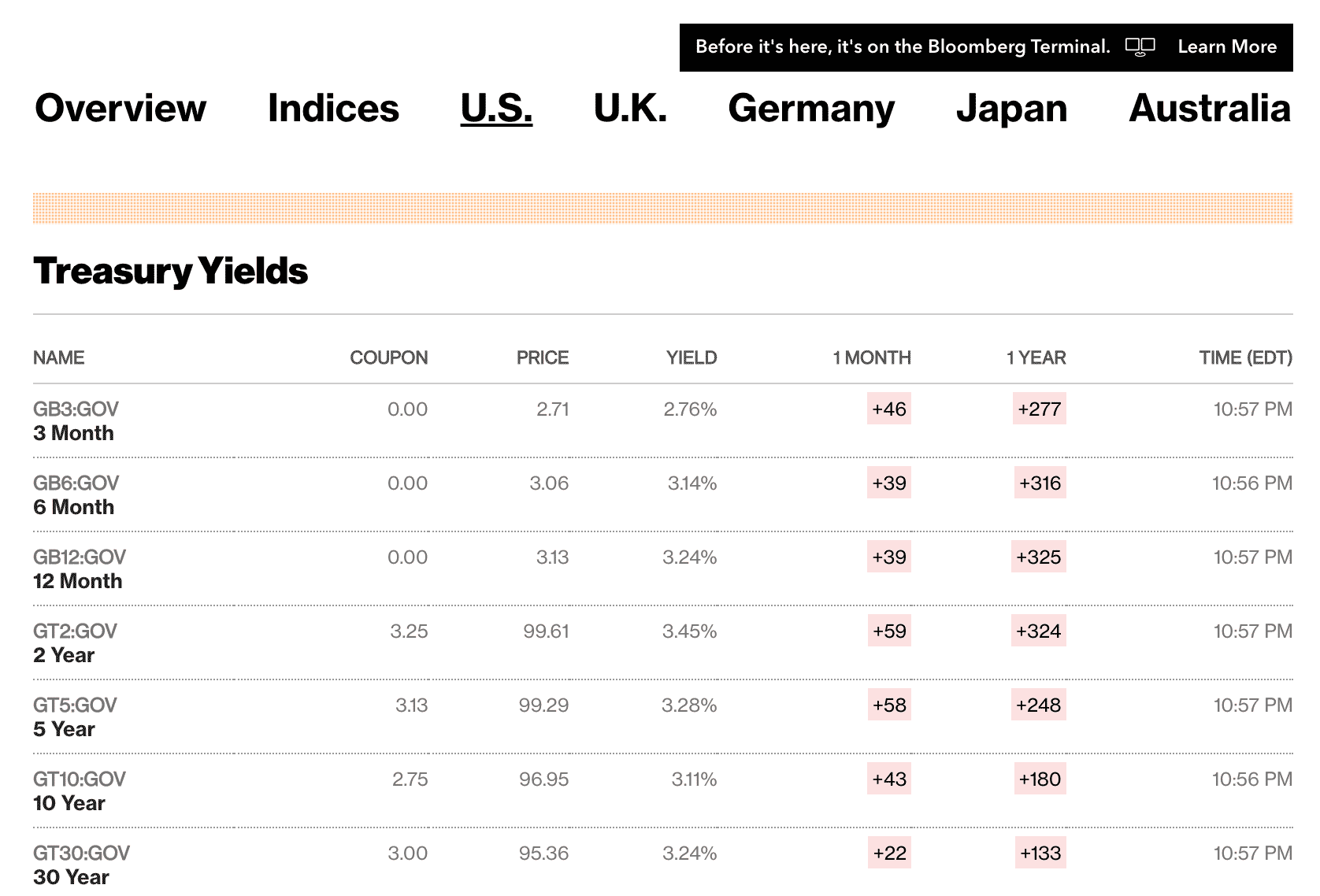

10. US Treasuries – Earn Income Every Six Months From the US Government

Those in the market for the best way to invest $40k in the most risk-averse way possible might consider US Treasuries. These are bonds issued by the US government, so are viewed as a safe way to generate a yield, albeit, a modest one. US Treasuries come with various maturity dates, ranging from three months to 30 years.

For the duration of the bond term, the investor will receive a coupon payment every six months. This will always be at the same amount, as US Treasuries are fixed-rate bonds. The holder of the US Treasury will receive their principal investment back at the end of the bond term. As such, this means that the money will be locked for the entire duration.

With that said, there is a highly liquid secondary market for US Treasuries. This means that investors have the option of selling their bonds to someone else. However, it should be remembered that the investor might get less than they originally invested. This will happen if the US government has since issued bonds at a more attractive yield.

For example, let’s say that the investor is holding a 10-year US Treasury with a coupon rate of 2%. However, if the US government then issues a 10-year bond at 3%, this difference will be factored in when trading on the secondary market. In terms of the yields on offer, as of writing, 2-year US Treasuries are offering the highest return at 3.42%.

Three-month bonds come with the lowest yield at 2.78%. There are several ways to invest $40k into US Treasuries. This includes completing the investment on the Treasury Direct website. It is also possible to invest through an online broker. Another option is to invest in an ETF that tracks various US Treasury maturity dates and yields.

11. NFTs – Invest in an Emerging Technology That is Gaining Traction

Non-fungible tokens – or NFTs, are blockchain assets that are associated with the ownership of an item. For example, we mentioned earlier that Tamadoge is building a P2E game that enables players to own virtual pets. Each virtual pet is unique from the next and is represented by an NFT stored on the blockchain.

It is also possible for NFTs to prove ownership of real-world assets, such as property or fine art. The most popular markets in the NFT space right are associated with virtual art and metaverse real estate. Regarding the former, NFTs from the CryptoPunk collection have sold for many millions of dollars.

This is also the case with the Bored Ape Yacht Club NFT collection. In the case of the metaverse, projects like the Sandbox and Decentraland have sold virtual plots of land for significant, multi-million dollar figures. This means that those buying the land early at an attractive entry price would have potentially made sizable gains on the sale.

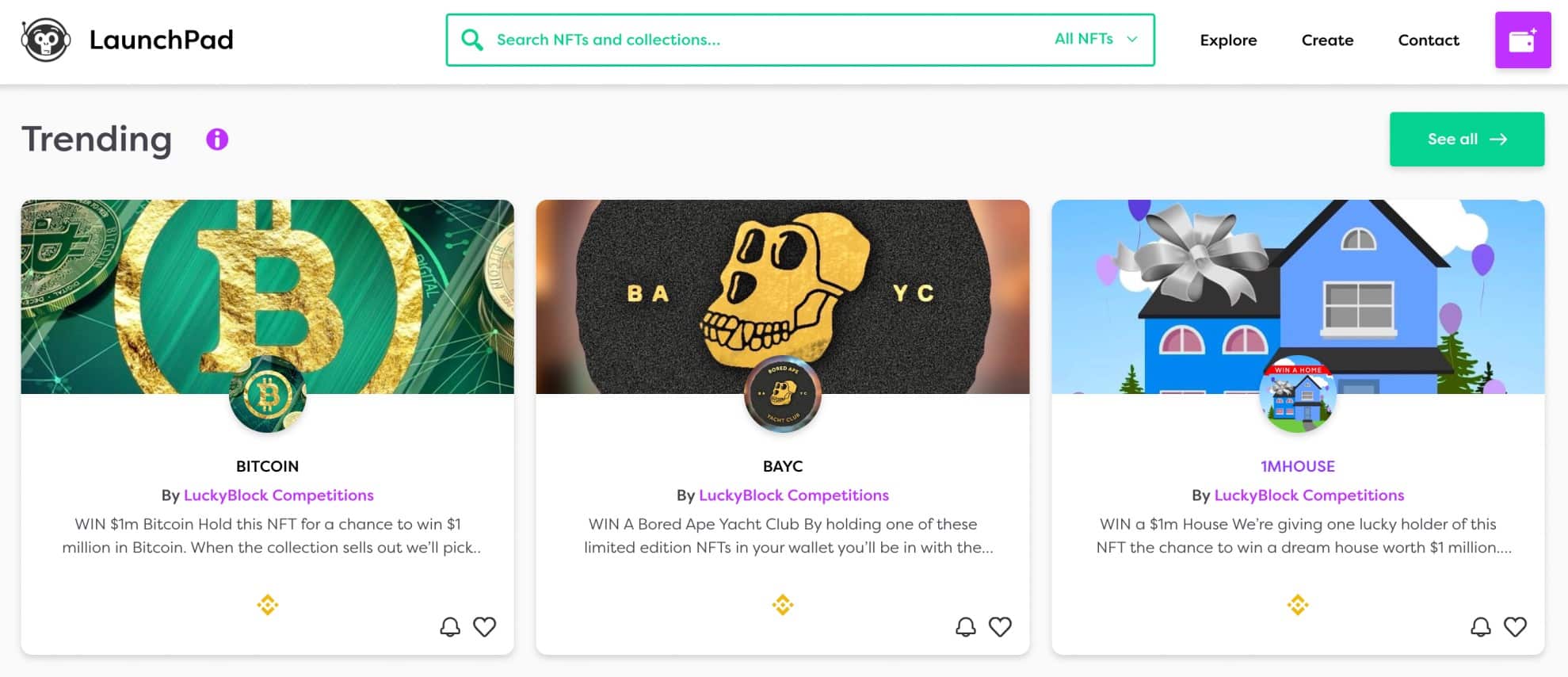

Another area of the NFT space that could be huge is linked to competitions and prize draws. For example, Lucky Block runs regular competitions that require participants to buy an NFT. For as long as the NFT is held, the participant will earn a passive income in the form of LBLOCk crypto tokens.

Once the NFT collection for the respective competition sells out, the draw will be made. LBLOCK rewards will continue to be paid even after the competition has concluded. Those looking to flip NFTs – which means buying a non-fungible token and selling it for a higher price, might wish to browse the Launchpad.XYZ website for investment ideas.

How to Choose the Best $40k Investments For You

Those with access to an investment fund of $40k have a significant number of options when it comes to choosing suitable assets. While this guide has discussed 10 core markets to consider, many others exist.

In this section, we offer some insight into the steps required when selecting the best way to invest $40k in a risk-averse manner.

Create an Investment Plan

The first step required when choosing the best way to invest $40k is to create an investment plan. This means setting some clear financial goals.

In other words, the investor should consider what they want to achieve from their investment endeavors – such as working towards a retirement plan or becoming financially independent in the next 15 years.

Ultimately, creating a plan will enable the investor to set realistic goals and targets, and most importantly, choose the right investment products.

Ever wondered how to gain exposure to the real estate market without committing all your investment funds into a single or few properties? This is where investing in REITs comes in. A business that owns, manages, or finances income-producing real estate is known as a real estate investment trust (REIT). REITs, which are similar to mutual funds, aggregate the capital of multiple investors. Retail investors can now generate dividends from real estate investments without having to own, operate, or fund any properties directly.

Active or Passive

Once a plan has been created, the investor should consider whether they wish to approach the financial markets in an active or passive manner.

Investing actively means regularly researching the markets, as well as placing more frequent positions. This will see the investor attempt to maximize their returns by outperforming the broader market and catching short-term trends.

However, many investors – especially beginners, might be more suitable for a passive strategy. This means that after the initial investment is made, the investor can sit back and allow their money to work for them.

Some of the best ways to invest $40k passively include index funds, bonds, and even eToro Smart Portfolios.

Risk

The next metric to consider when evaluating how to invest $40k is the amount of risk that should be taken. Now, it is worth considering a diversified approach to risk, which means creating a portfolio of various asset classes.

For example, the investor might consider allocating 10% of their $40k capital into higher risk/return assets like crypto and growth stocks. The next 40% could go into a variety of ETFs, while the balance might be held in low-risk bonds.

Either way, the portfolio split will be determined by the investor’s goals and, in many cases – their age. The reason for this is that younger investors will likely feel comfortable taking additional risks.

While those approaching the age of retirement will likely prefer investing in much lower-risk assets.

Historical Returns

On the one hand, the age-old saying that historical returns are not indicative of future returns will always remain true. However, historical returns do provide a lot of value, especially when it comes to assessing how to invest $40k.

For example, one of the most reliable ways to gauge the historical success of the broader stock market is to look at the returns of the S&P 500. Since its inception in 1926, the index has grown by an average of 10% per year.

Bitcoin and other crypto assets have a much shorter history. Nonetheless, many crypto assets – even over the prior couple of years, have witnessed unprecedented gains that the traditional stock markets cannot rival.

Income and Growth

Investors should also look to build a portfolio that targets both income and growth. The former refers to assets like bonds and dividend stocks, which offer regular incoming cash flow for the investor.

For example, when investing in dividend stocks, a payment will usually be received every three months.

- ETFs that track index funds like the S&P 500 offer a good balance of both growth and income.

- For instance, the value of the portfolio will rise in line with the growth of the stocks that are listed on the S&P 500.

- And, as many S&P 500 stocks pay dividends, this will result in quarterly payments for the investor.

At the other end of the scale, crypto assets like Tamadoge largely focus on growth maximization. This means that gains will come if the value of TAMA tokens increases in the open market.

Where to Invest $40k Right Now – The Best Option?

We found that one of the best ways to invest $40k is via crypto presales. This means that investors can buy into a new project before it has launched to the public.

This is not too dissimilar to investing in a stock IPO, as in many cases, early investors will see the value of the shares rise once it lists on a public exchange.

This is why we like the look of FightOut, which has just launched its first presale stage. The project offers a next-gen fitness app for its users that can be leveraged to earn M2E rewards. $FGHT is available for purchase at just $0.0167 at press time.

How to Invest $40k – FightOut Tutorial

Those wondering where to invest $40,000 right now might consider the previously discussed FightOut ($FGHT) presale.

Below, we explain the steps required to buy $FGHT tokens before the presale sells out.

Step 1: Download a Cryptocurrency Wallet

To begin with, buyers must download a cryptocurrency wallet. Investors should ensure to install a wallet like MetaMask on their web browsers. (Mobile users are recommended to download the TrustWallet)

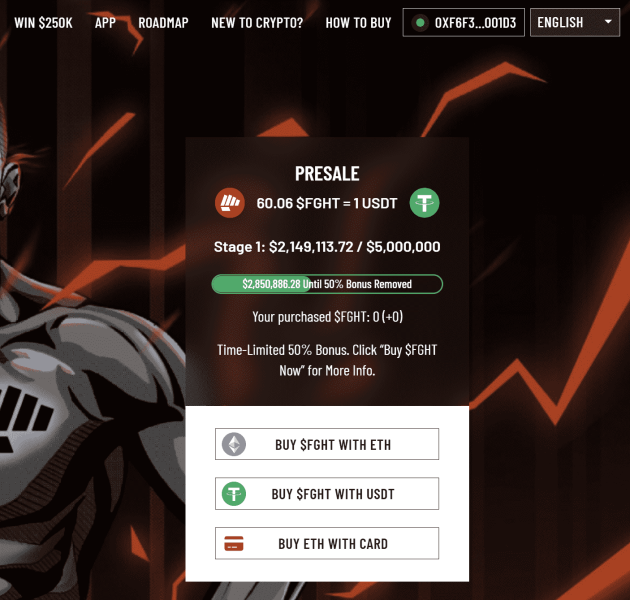

Step 2: Connect the Wallet

Now, buyers should head toward FightOut’s official presale page. Then, they should find and click on the $buy $FGHT NOW” button. Soon after, investors must choose the wallet they have installed (eg Metamask or TrustWallet) and then log in to their wallets.

Step 3: Top up ETH/USDT

Investors need to add enough ETH/USDT to their wallets to buy $FGHT. In this step, buyers also have the option to buy ETH via a credit card using Transak.

After adding the desired balance of ETH/USDT, investors can click either on the “Buy $FGHT with ETH” or “Buy FGHT with USDT” button.

Step 4: Buy $FGHT

In this step, investors need to mention the amount of ETH or USDT they would want to exchange in return for $FGHT tokens. Also, they can choose the corresponding vesting period and claim bonus tokens accordingly.

Step 5: Claim $FGHT

Finally, buyers can go ahead and confirm the transaction after ensuring the number of $FGHT tokens to be received. Investors can claim these tokens based on the vesting period they opted for.

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

In this guide, we covered the best ways to invest $40k into the financial markets. One of the best strategies to adopt would be to diversify the investment across multiple asset classes – including stocks, commodities, ETFs, and even managed portfolios.

In addition to this, it might also be worth considering growth investments, such as a cryptocurrency that has the potential to appreciate in the future.

We particularly like the prospects of $FGHT – a brand new cryptocurrency presale and the native token of FightOut. Its solution-oriented approach to solving critical issues in the Move-to-Earn space could induce high returns in the coming times. At the time of writing, $FGHT is available to buy for $0.0167 per token.

FightOut - Next 100x Move to Earn Crypto

FAQ

What is the best way to invest $40k?

What can I invest in with $40k?

References

- https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/investment/

- https://www.ibm.com/topics/what-is-blockchain

- https://www.investor.gov/introduction-investing/investing-basics/role-sec/laws-govern-securities-industry