Having access to $5,000 worth of cash offers the opportunity to invest in a wide range of assets and markets in a diversified manner.

In fact, considering that many online brokers now support everything from stocks and index funds to crypto and bonds – access to the financial markets has never been easier.

The purpose of this beginner’s guide is to explore how to invest $5,000 in the best way possible.

11 Best Ways to Invest $5,000 in 2023

Traders that are assessing how to invest $5,000 might consider one of the asset classes outlined below:

- FightOut – Best Way to Invest $5000 in 2023 in a Project that has Successfully Raised $2.1 million USDT

- Dash 2 Trade – Overall Best Way to Invest $5,000 in 2023

- Stocks – Invest in a Variety of Blue-Chip, Growth, and Undervalued Companies

- Index Funds – Get Instant Diversification to Leading Stock Indices

- Commodities – Invest in Cyclical Assets to Hedge Against Traditional Markets

- Crypto Staking – Earn Passive Income on Crypto Asset Investments

- 401k Plans – Maximize 401k Allowance and Matching Contributions

- ETFs – Track Multiple Assets and Markets Passively

- Crypto Interest Accounts – Generate a Yield on Crypto Holdings

- Copy Trading – Copy the Trades of an Experienced Investor

- NFTs – Buy, Hold, or Flip NFTs

Investing in high potential new crypto projects is our number one pick, with Tamadoge being a great example – click the link below to learn more.

We explore the above asset classes in detail in the subsequent sections of this guide. This will enable beginners to determine the best way to invest $5,000 for their financial goals and risk tolerance.

A Closer Look at the Top Ways How to Invest 5,000 Dollars

In order to determine the best way to invest $5,000 into the financial markets, investors need to consider their desired returns and how much risk they are willing to take to achieve this goal.

After all, some assets offer a more attractive upside potential than others, albeit, this generally results in a greater level of risk being undertaken.

Below, we offer some insight into how to invest $5k across 10 different asset classes and markets – we also have a guide on the best ways to invest $1,000 for a lower entry point.

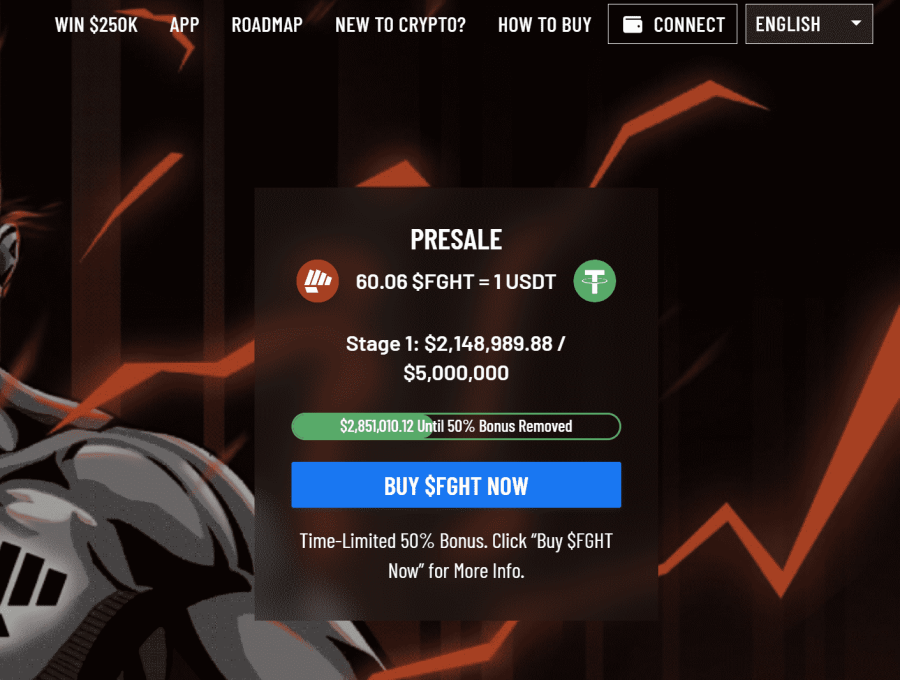

1. FightOut – Best Way to Invest $5000 in 2023 in a Project that has Successfully Raised $2.1 million USDT

FightOut witnessed an exceptional response from users and investors while raising over $2.1 million USDT in its first presale within just a few days.

At press time, FightOut’s native token $FGHT is available for purchase at a relatively low price of $0.0167.

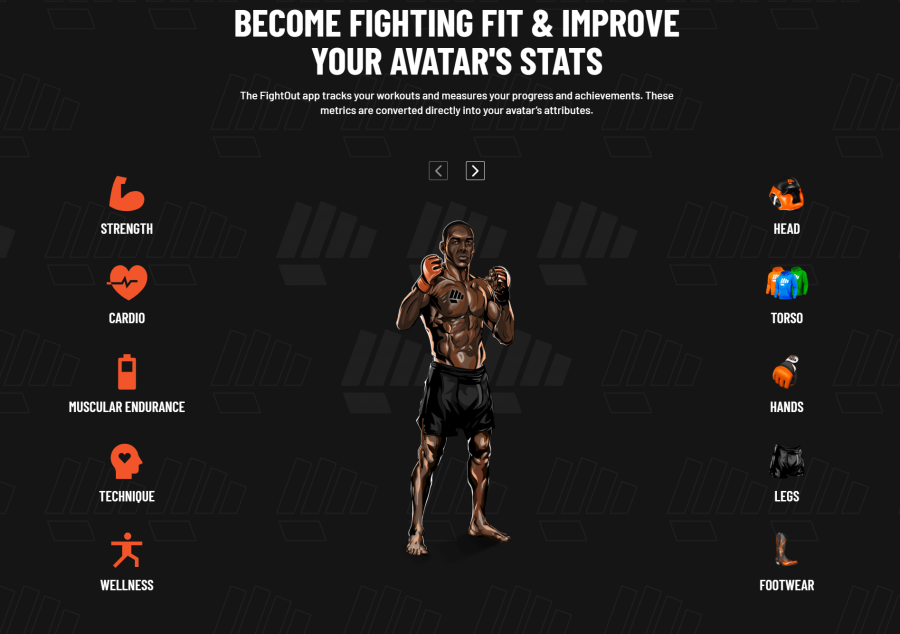

FightOut’s state-of-the-art fitness app enables users to earn rewards by doing their daily workouts, completing fitness challenges, and similar fitness-related tasks.

The project has devised a metaverse that gamifies fitness and incentivizes its users. In doing so, users can create their own soulbound NFT avatars in FightOut’s metaverse. These NFT avatars will reflect and grow in relation to the user’s real-life fitness performance. Additionally, the project allows users to compete with other community members in its metaverse.

FightOut has also created its in-app, off-chain currency known as REPS. This currency is used to reward users for completing their workouts and other in-app challenges. Also, users can use REPS to buy cosmetic NFTs for their avatars, membership discounts, and similar products.

Buyers can see the project’s whitepaper to understand the project’s features in-depth.

$FGHT Tokenomics

FightOut’s native token $FGHT is an Ethereum-based ERC-20 token. Out of its total limited supply, 90% of the tokens will be sold through the project’s presale stages.

$FGHT can be used to buy more REPS. Buyers would receive an additional 25% REPS if they use $FGHT to buy the in-app currency. Also, investors can use this token to take part in several tournaments and leagues.

Presale Performance & Purchase Bonuses

The project has already exhibited outstanding results in its first presale launch while raising over $2.1 million USDT in merely a few days. Buyers also have a chance to get up to 50% additional tokens as rewards during the ongoing presale stages.

Investors buying $FGHT during the presale stages will also get bonuses that start at 10% with an investment of just $500 and 6 months of vesting. Users can also get membership rewards when they stake more $FGHT tokens or stake them for a longer time.

Users can consider joining FightOut’s telegram to stay on top of the latest updates.

| Presale Started | 14 December 2022 |

| Purchase Methods | ETH, USDT |

| Chain | Ethereum |

| Min Investment | None |

| Max Investment | None |

2. Dash 2 Trade – Overall Best Way to Invest $5,000 in 2023

Currently, D2T is trading at $0.05 per token. Over the course of the 9 rounds, D2T would have eventually increased to $0.0662 in valuation, as it looks to accumulate $40 million. This is a 32.4% price increase compared to the ongoing level, meaning that the minimum investment amount would rise to $62 by the end of the presale. Users can purchase D2T to access the Dash 2 Trade’s premium package – which analyzes social sentiments and conducts on-chain analysis.

Investors can access pricing alerts, presale listing projects, auto-trading features and social & technical indictaors. Other exclusive strategies include a backtesting platform, risk profilers and new cryptocurrency listing alerts. Dash 2 Trade is hosting a $150,000 D2T giveaway, which will award a lucky investor who has purchased D2T during the presale.

Currently, D2T has collected over $2 million during the ongoing presale. The second presale round will end after the funds collected reach $5.16 in total. The third presale round will increase the price of D2T to $0.0513 per token. To get a detailed 0verview of the token allocations during the presale, view the table below.

| Price Stage | Amount Raised In Stage | Token Allocation |

| $0.0476 | $1,666,000 | 35,000,000 |

| $0.0500 | $3,500,000 | 70,000,000 |

| $0.0513 | $3,591,000 | 70,000,000 |

| $0.0533 | $4,663,750 | 87,500,000 |

| $0.0556 | $4,865,000 | 87,500,000 |

| $0.0580 | $5,075,000 | 87,500,000 |

| $0.0606 | $5,302,500 | 87,500,000 |

| $0.0635 | $5,556,250 | 87,500,000 |

| $0.0662 | $5,792,500 | 87,500,000 |

Subscribe to the Dash 2 Trade Telegram channel to stay tuned with the latest news surrounding this project. Read the Dash 2 Trade whitepaper to learn more about this cryptocurrency.

3. Stocks – Invest in a Variety of Blue-Chip, Growth, and Undervalued Companies

Many seasoned investors will argue that the best way to invest $5k is via the stock market. There are thousands of stocks listed in the US and even more on overseas exchanges. Furthermore, there are many different types of stocks that investors might consider when gaining exposure to this space. For example, some investors with high risk tolerances prefer to invest in startups.

For example, blue-chip stocks represent large, established companies that have dominated their respective industries for many years. Examples here would include Coca-Cola (beverage), Johnson & Johnson (healthcare and pharmaceuticals), Goldman Sachs (banking), and Walmart (retail). Blue-chips are considered less risky than other stock types, but returns are likely to be more limited. Therefore, you might be interested in learning how to invest in pre-IPOs.

This is because many blue-chip stocks have already reached their full potential in their respective markets, so there is only so much more future growth that can be achieved. In comparison, growth stocks represent companies that are still at the early stages of their development. In turn, the upside potential of a growth stock can be highly attractive.

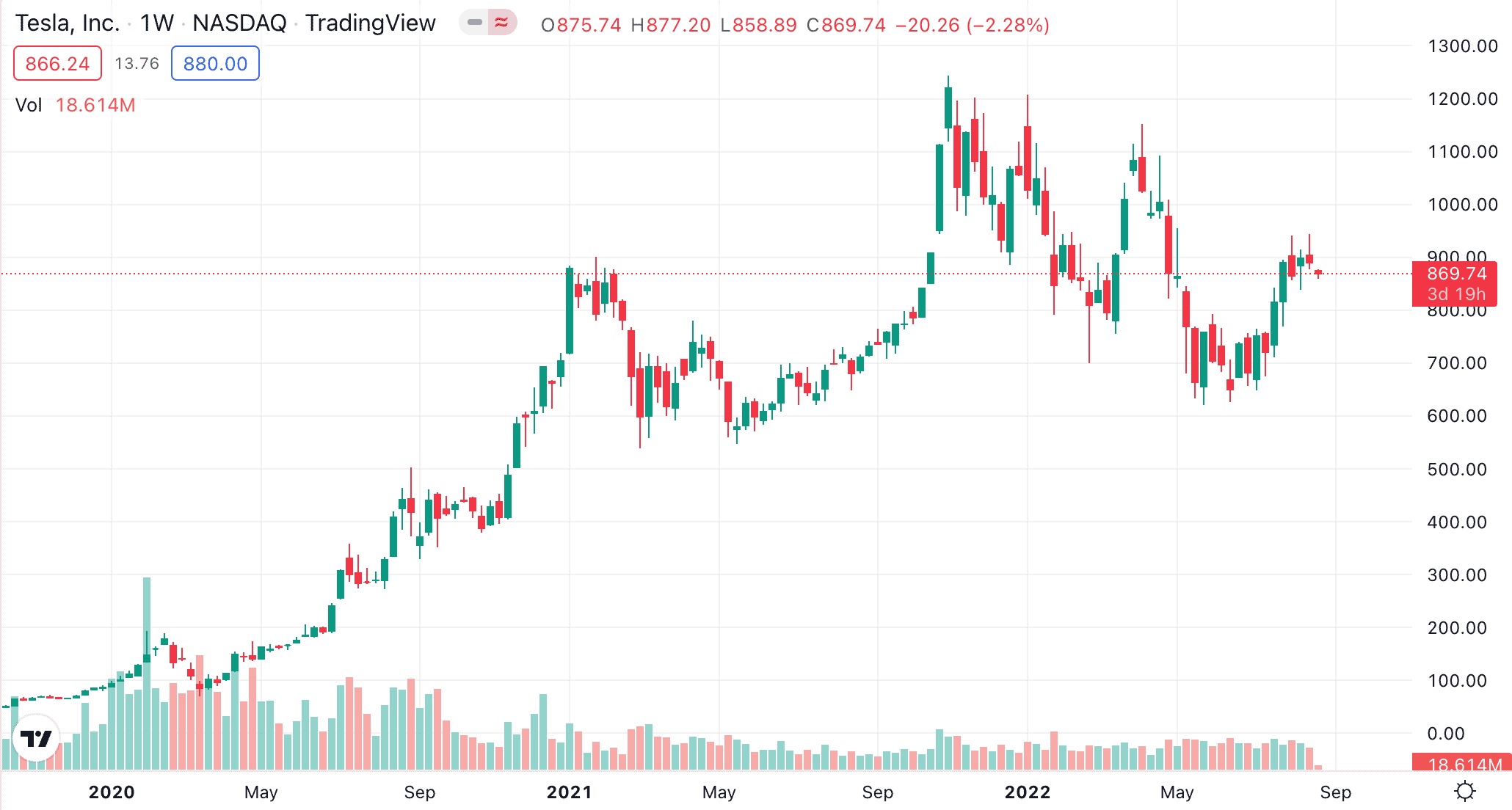

For example, Tesla is perhaps one of the biggest success stories in the growth stock space, with the electric car maker seeing the value of its shares increasing by more than 23,000% since its 2010 initial public offering (IPO). In today’s market, examples of growth stocks include Coinbase (cryptocurrency exchange), Grab (Asian super app), and Rivian (EV maker).

Although growth stocks offer the opportunity to target above-average gains, it should be remembered that companies operating in this space are largely unproven. This is perhaps because the underlying business model is yet to be validated by the broader markets or simply because the growth stock is yet to generate any profit.

Another area of the stock market to target with an investment of $5,000 is undervalued companies. These are stocks that have a market capitalization that is perceived to be below their true worth. Although branding a company as undervalued is subjective, the idea is to buy cheap stocks, with the view of profiting when the market value recovers.

One of the best ways to invest in undervalued stocks is during a so-called bear market, which means that the broader economy is weak. During bear markets, the majority of stocks – irrespective of their performance – decline in value. Another option is to consider dividend stocks. In doing so, the investor will receive a share of dividend payments every three months.

After choosing the best stocks to invest $5,000, the trader will need to open an account with an online broker. Consider choosing a broker that offers low fees and, just as importantly, fractional stocks. The latter will enable the investor to purchase a small fraction of a stock with just a few dollars.

This means that creating a diversified portfolio of blue-chip, growth, undervalued, and dividend stocks can be achieved with ease. At eToro, for instance, investors have access to thousands of US and foreign stocks at a minimum trade requirement of $10. Moreover, the eToro stock trading platform is commission-free for both buy and sell orders.

Learn More: Read our guide on how to invest 5,000 dollars in stocks without paying any commission.

4. Index Funds – Get Instant Diversification to Leading Stock Indices

Another way to gain exposure to the stock market is through an index fund. In fact, this option might be more suitable for beginners looking for the best $5,000 investments. The reason for this is that index funds are tasked with tracking a specific segment of the stock exchange, meaning that there is no requirement to research or select individual companies.

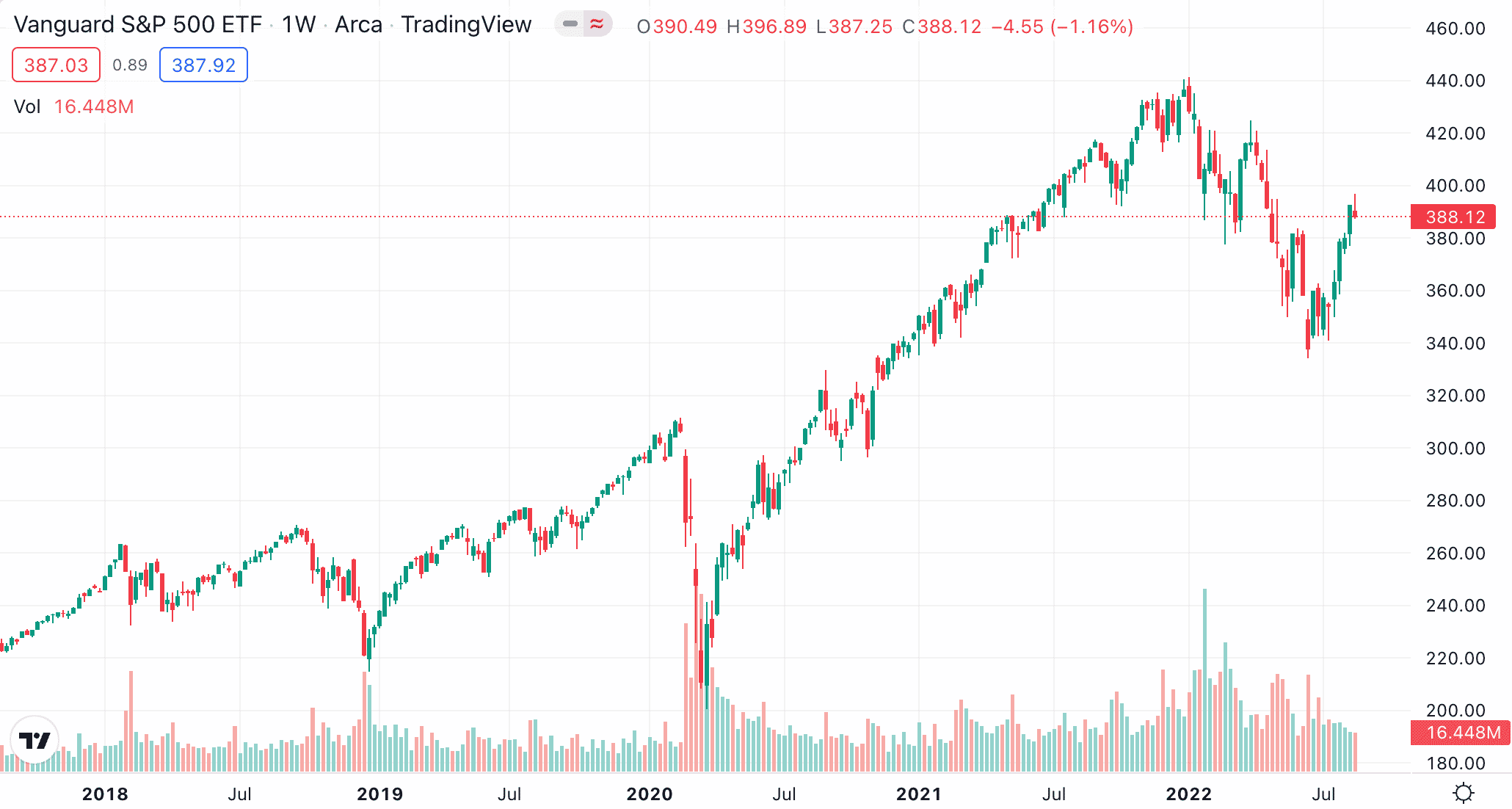

An example of a popular index fund is the S&P 500. This index fund tracks 500 large US companies at various weights. This means that larger companies contribute a higher percentage of the index fund portfolio – and vice versa for those with a smaller market capitalization. The logic behind this is that larger companies have a greater impact on the broader US economy.

For example, some of the largest companies contributing to the S&P 500 include the likes of Tesla, Amazon, Apple, Microsoft, and Alphabet (Google). Nonetheless, an investor can allocate a single investment to the S&P 500 and instantly gain exposure to 500 different companies. Furthermore, the index fund will be rebalanced every three months.

This means that the weighting of each company within the S&P 500 will be adjusted, based on updated market valuations. Moreover, if a company losses too much value, it might be replaced by another stock. In addition to the S&P 500, there are many other index funds that remain popular with passive investors.

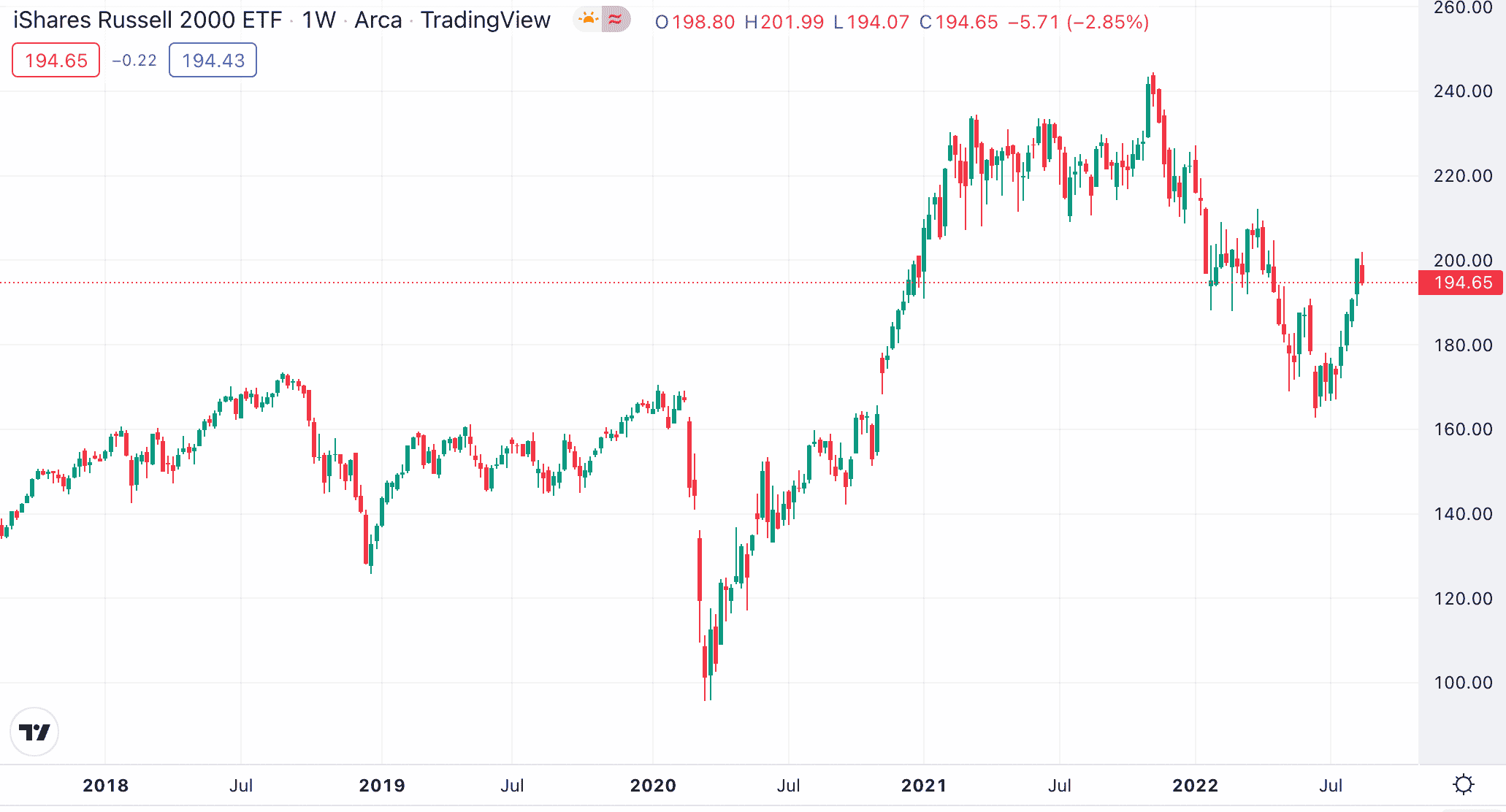

For example, the NASDAQ 100 tracks the 100 largest companies from the NASDAQ exchange – which is largely dominated by tech stocks. The Russell 2000 tracks 2,000 US-listed stocks with a small market capitalization, so this offers exposure to companies that are still growing.

Another option is the Total Stock Market index fund. In a nutshell, through a single investment, enables the investor to gain exposure to all US-listed stocks across small, mid, and large-cap companies. As such, the investor will indirectly buy more than 4,000 different stocks.

The value of the fund will be determined by the companies that represent the index. This means that when the broader stock markets are doing so, this will likely result in the index fund increasing in value. Any stocks contained within an index fund that pay dividends will be collectively distributed to the investor every three months.

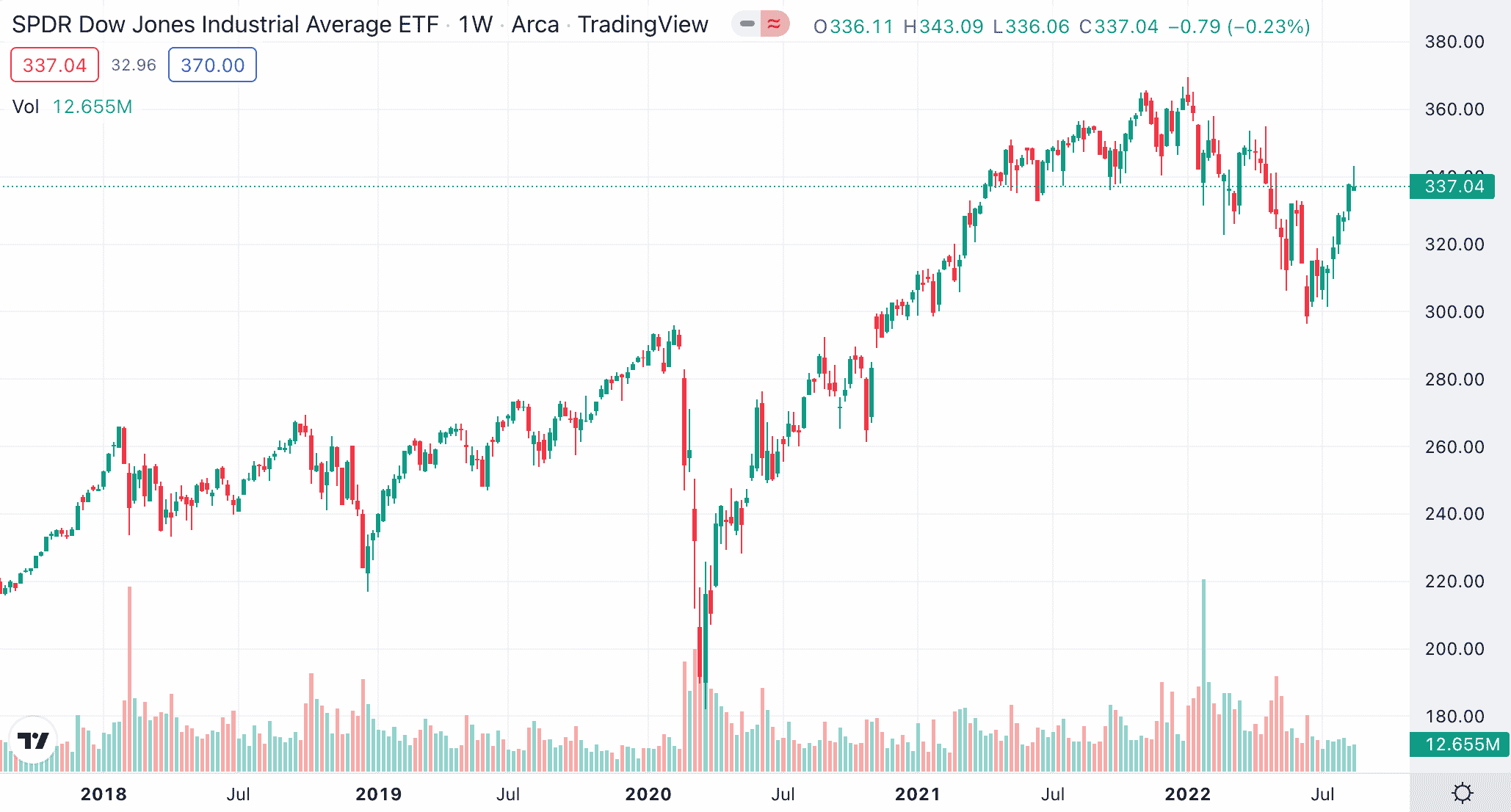

Those in the market for an index fund that generates regular income might explore the Dow Jones, as all 30 constituents have a dividend policy in place. This means that the investor can target both capital gains and income from an index fund investment. The minimum investment into an index fund will largely depend on the brokerage provider.

For example, when investing in the Total Stock Market index fund with Vanguard, the minimum capital outlay is $3,000. However, when investing through an online broker like eToro, the same position would require a minimum of just $10. Furthermore, eToro does not charge any trading commissions when buying and selling funds on its platform.

5. Commodities – Invest in Cyclical Assets to Hedge Against Traditional Markets

Traditionally, commodities were only accessible to retail investors in the conventional sense. In other words, buying physical bars and coins of gold and silver. The other option was to trade commodity futures, however, these are complex financial products that are far from suitable for beginners.

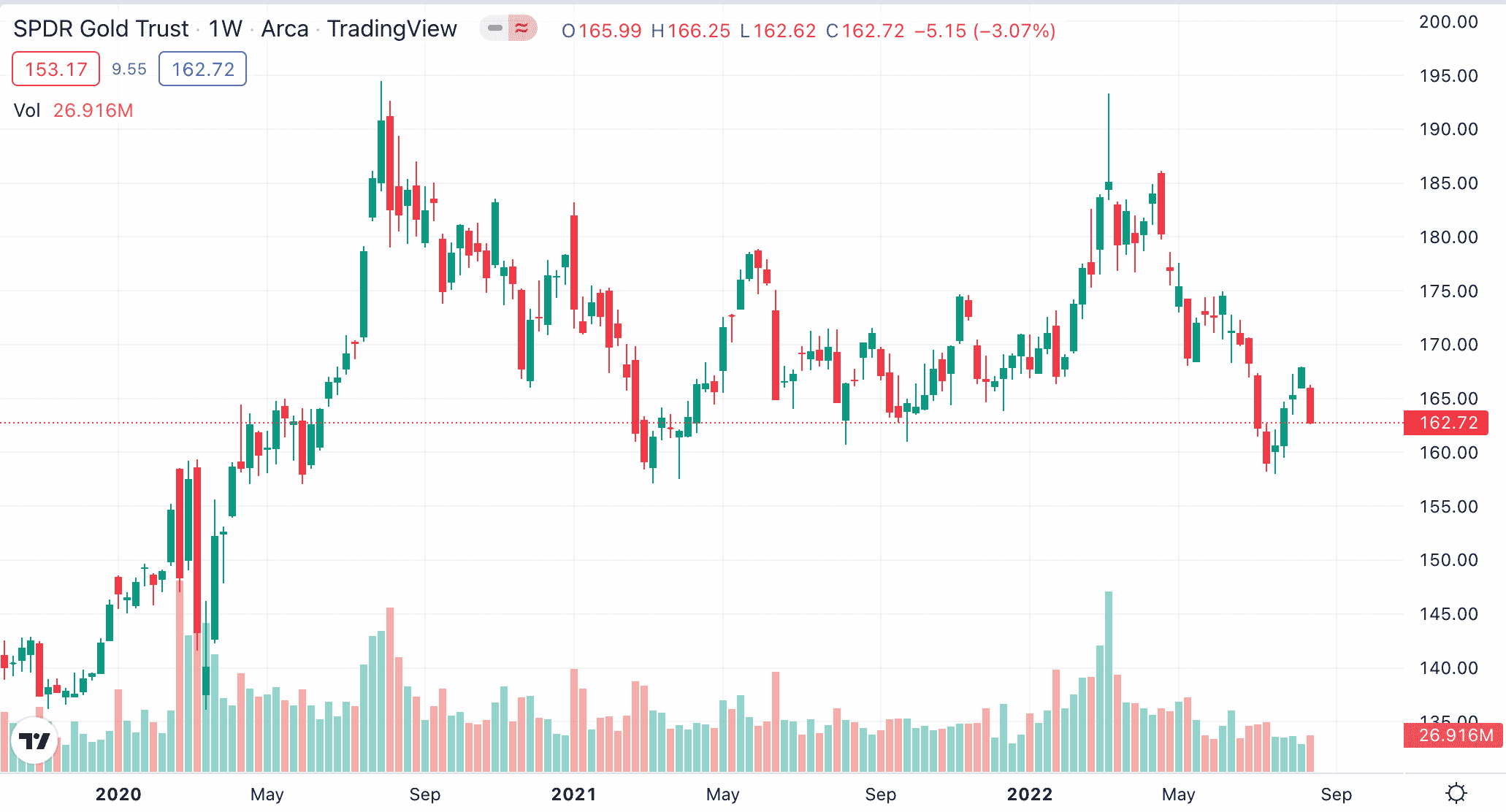

Fast forward to 2022 and it is now possible to invest in commodities at the click of a button via an exchange-traded fund (ETF). This means that the ETF provider will be backed by the commodity in question. One of the most popular commodities to invest in via an ETF is gold. It is viewed by many as a store of value that operates as a great hedging tool during times of economic stress.

For example, if the general sentiment is that a recession is looming, institutional investors will often turn to gold. Silver possesses similar traits to gold, insofar that this offers the opportunity to invest in a long-term store of value to protect wealth. With that said, more and more investors are now looking at the energy markets as a means to obtain further diversification.

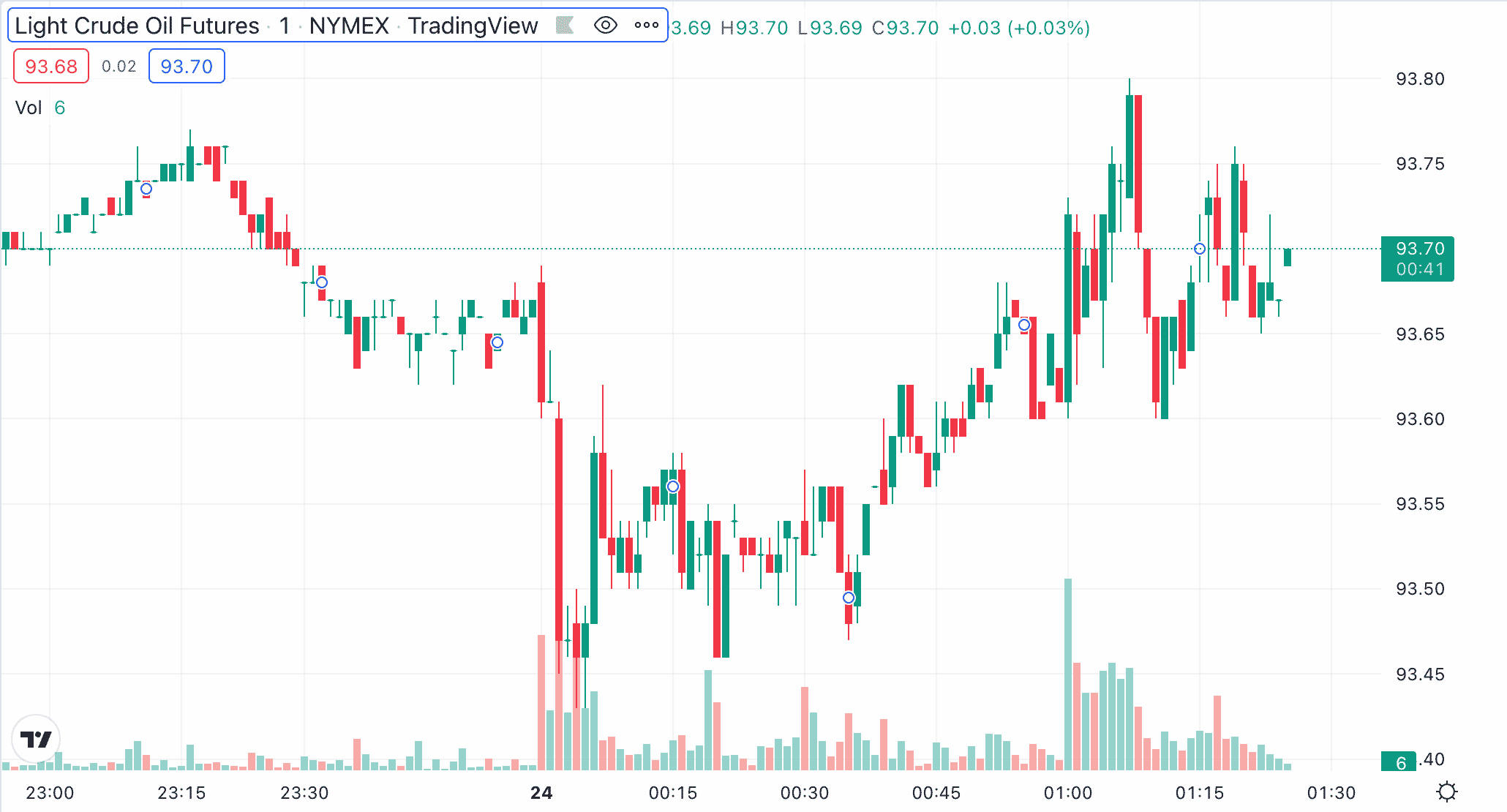

Oil is another great example here. In the midst of the pandemic in 2020, crude oil hit lows of $19 per barrel. Since then – owing to supply chain issues and the war in Ukraine, oil remains in the $90-110 per barrel region. This means that in just two years of trading, the value of oil has increased by more than 400%.

There are several ways to invest in energy commodities like oil. One option is to invest in an ETF that tracks leading oil stocks – such as ConocoPhillips, ExxonMobil, Chevron, Marathon Petroleum, and Shell. After all, in theory, when oil prices are high, companies operating in this space can generate larger profit margins.

The other option is to trade CFDs, which track the value of oil in real-time. This marketplace is supported by eToro, albeit, US clients cannot access CFD instruments. Nonetheless, when choosing the right financial instrument, investors can trade commodities in a flexible and liquid way.

The reason for this is that commodity ETFs, stocks, and CFDs can also be cashed out at any given time, during standard market hours. On the flip side, unless investing in a commodity-related stock, this asset class traditionally does not yield income. Furthermore, commodities are best suited for short-term investments, as the industry is cyclical.

Learn More: Read our guide on how to trade commodities.

6. Crypto Staking – Earn Passive Income on Crypto Asset Investments

Those in the market for passive income will likely know that traditional bank accounts in the US, Europe, and further afield rarely yield more than 0.5% annually. This means that by holding $5,000 in a savings account, the investor will make just $25 per year in interest. This is why many investors are now turning to crypto staking.

Crypto staking offers one of the best ways to invest $5,000 for the purpose of generating above-average returns. The original staking concept was exclusive to blockchain networks that operated a proof-of-stake (PoS) consensus mechanism. In simple terms, the investor would lock their crypto tokens in a PoS blockchain for a number of days, and receive interest in return.

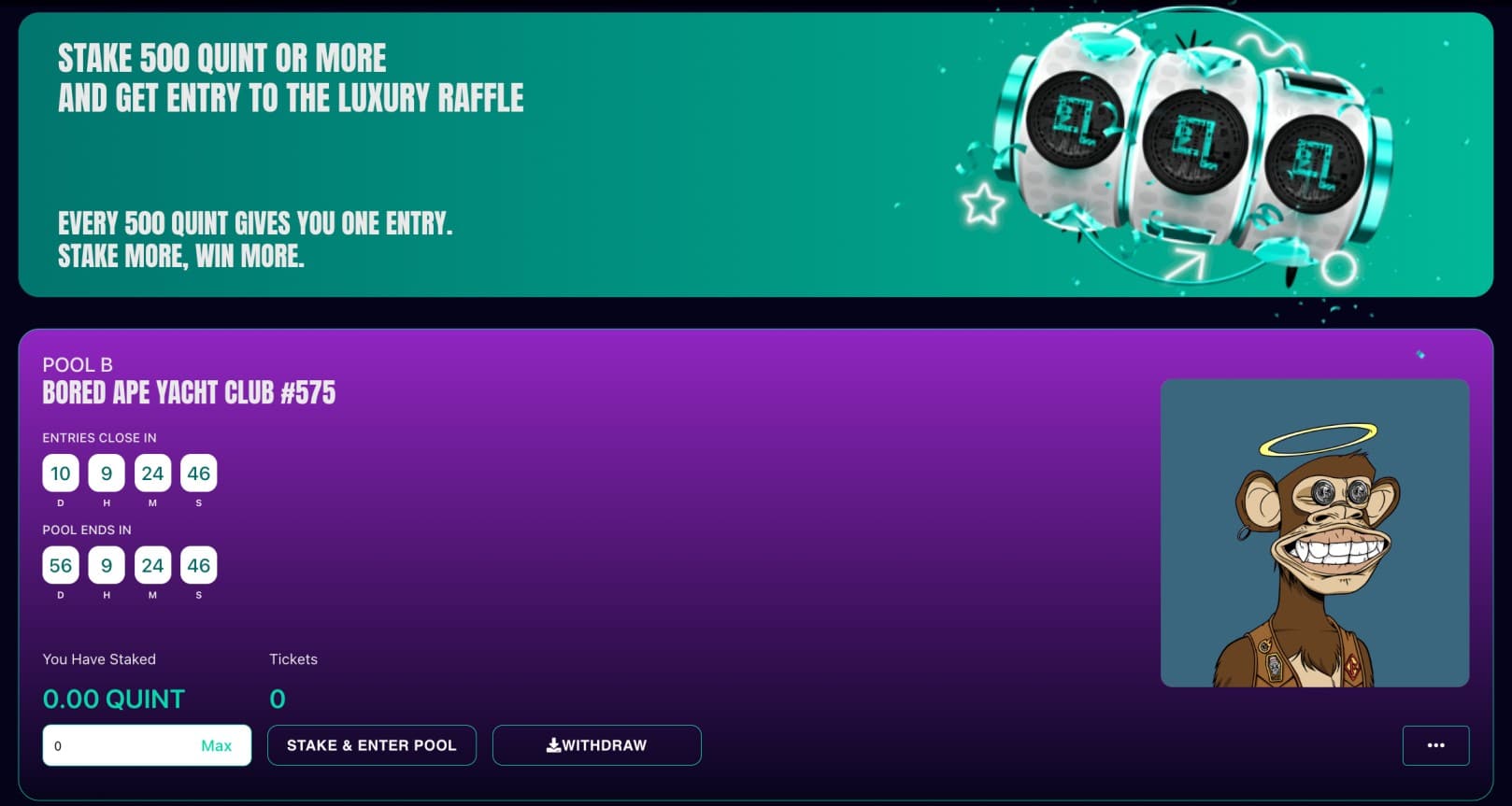

However, the more attractive interest rates are now offered by third-party staking platforms. For example, by depositing DeFi Coin (DEFC) tokens into the DeFi Swap exchange – investors can earn an APY of up to 75%. Another option is Quint, a decentralized ecosystem that offers ‘super’ staking tools.

In addition to being paid a yield on the investment, those staking at Quint will also receive a number of ticket entries for a specific competition. Recent competitions include a $100,000 luxury watch and a Bored Ape Yacht Club NFT, which also go for six figures. The more tokens that are staked by the investor, the more ticket entries they will receive.

After the draw is made, the winner will receive their prize. Furthermore, investors will then receive their original investment back plus any staking rewards earned. This means that investors will gain entry into lucrative competitions draws simple for staking. And, even if the investor does not win the competition, they will still generate a yield.

When it comes to staking terms, this varies from one platform to the next. For example, some platforms offer a variety of fixed and flexible terms. Flexible terms enable the investor to withdraw their tokens from the staking pool at any given, albeit, APYs will be less competitive. Fixed terms will see the tokens locked until the respective timeframe passes.

7. 401k Plans – Maximize 401k Allowance and Matching Contributions

US investors should consider opening and maintaining a long-term 401k plan. This is an investment account supported by many, but not all US employers. By allocating a portion of a salary into the 401k plan, the investment will attract tax benefits. Traditional 401ks, for example, enable investors to allocate funds without paying tax on the investment contribution.

This means that the tax that would have ordinarily been paid on the paid earnings will not be due until retirement. As such, the funds can grow over the course of time with the tax being deferred. The other option is a Roth 401k. The employee will pay tax on the earnings as they normally would. However, no tax will be payable when withdrawals are made during retirement.

The latter option is arguably the more suitable 401k plan for younger investors. Moreover, and perhaps most importantly, many employers will offer 401k matching contributions up to a certain limit. For instance, if the employee injects $5,000 into the 401k in a calendar year, and this falls within limits set by the employer, this will be matched with $5,000.

As such, matching contributions should be viewed as risk-free money. It should be noted that both traditional and Roth 401k plans come with annual limits that are set by the government each year. In 2022, the maximum annual 401k contribution amounts to $20,500. This is increased to $27,000 if the employee is aged 50 years and above.

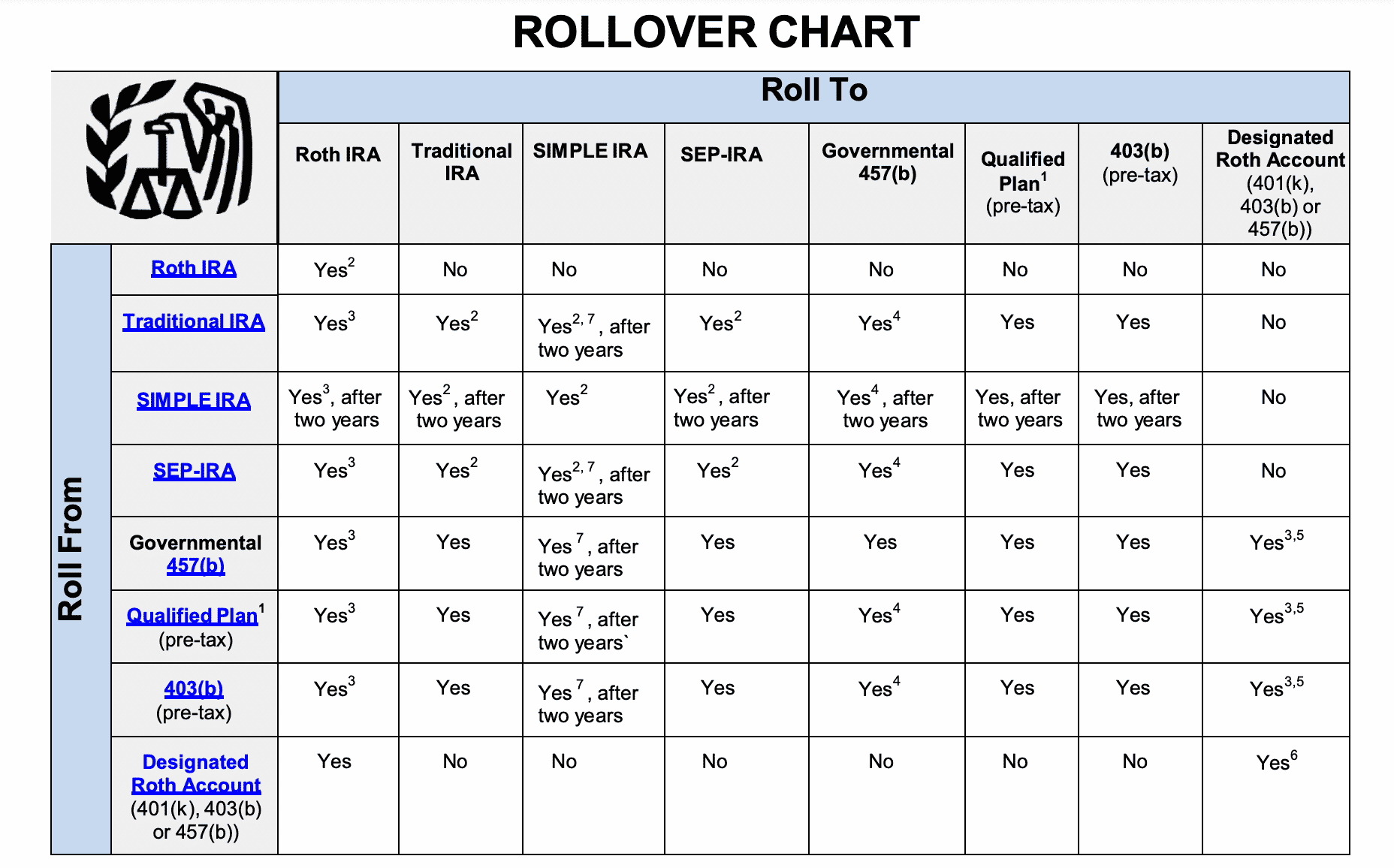

Those maxing out a 401k for the year, or working for an employer that doesn’t offer access to a plan, might instead consider an IRA. These also offer tax advantages when investing in the financial markets, albeit, IRAs are opened and maintained via an online broker. Just like 401ks, IRAs are available in both the traditional and Roth formats.

However, IRAs are limited to just $6,000 per year (or $7,000 for those ages above 50). On the flip side, IRAs offer access to thousands of markets across multiple asset classes. In comparison, 401k plans typically only offer access to a very select number of index funds or stocks.

8. ETFs – Track Multiple Assets and Markets Passively

In most cases, an exchange-traded fund (ETF) is tasked with tracking the value of an asset like gold, or a group of assets such as the S&P 500 or Dow Jones. In order to achieve this goal, the ETF will be backed with the respective asset(s). For example, an ETF that aims to track the performance of the Dow Jones index will purchase all 30 stocks.

Not only that, but the ETF will ensure that each stock purchase and holding is weighted to mirror the index. For instance, the iShares Dow Jones ETF, as of writing, is weighted with 6.5% worth of Apple stock, 5.3% in Microsoft, and 2.9% in Amazon. This ETF also carries 1.8% worth of Tesla stock, 1.33% in Berkshire Hathaway, and 1.3% in UnitedHealth Group.

When learning how to invest $5,000 into an ETF, the aforementioned Dow Jones example would appear as follows. Of the $5,000 investment, the investor would indirectly own $325 worth of Apple stock, $265 in Microsoft, $145 in Amazon, and so on. Every three months, the Dow Jones ETF will be reweighted, as will the percentage of each stock.

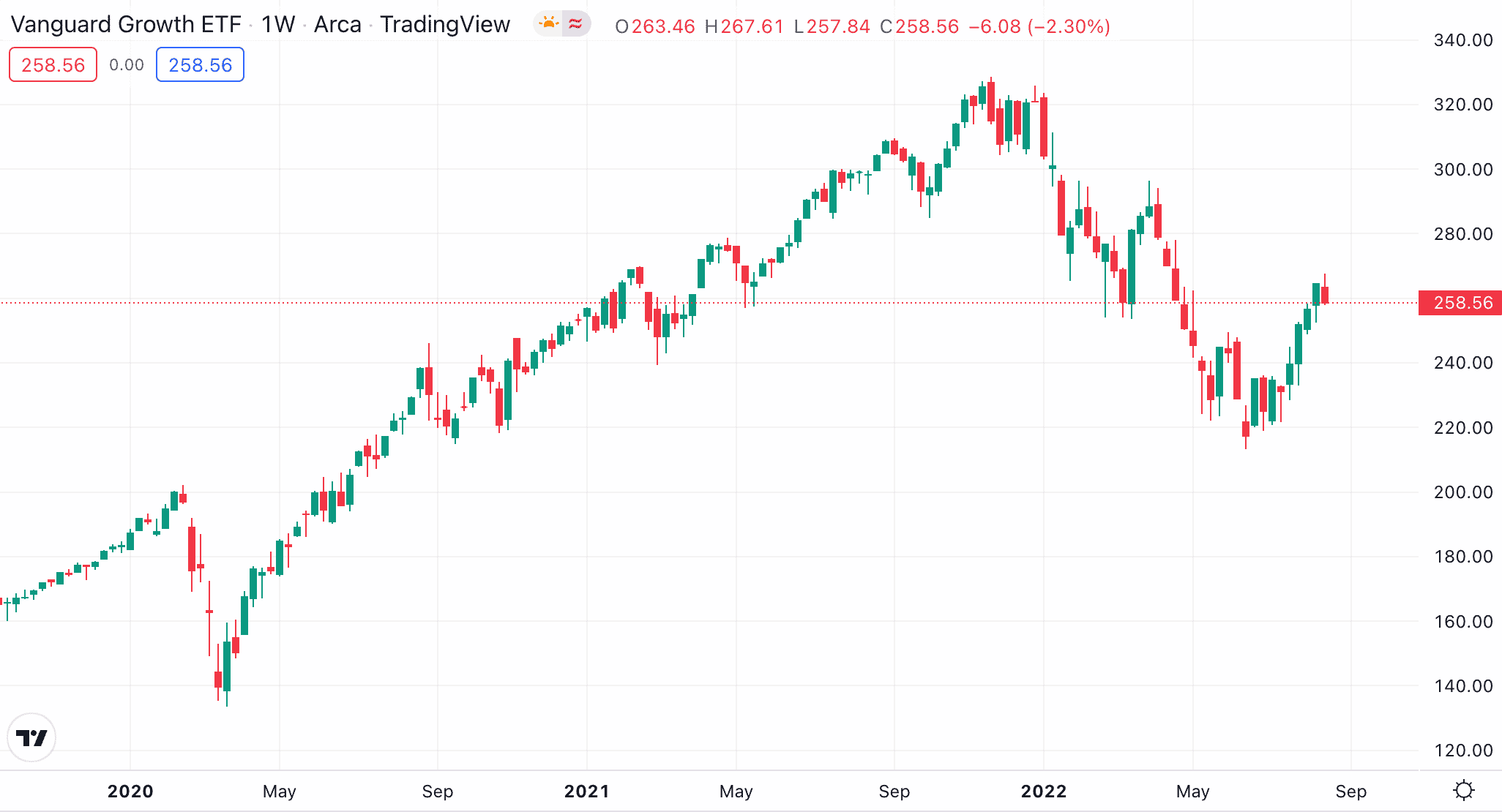

It should be noted that the Dow Jones is just one example of an ETF. From the stock market specifically, there are thousands of ETFs that track the performance of a wide range of index funds. This even includes ETFs that specifically track specific stock types – such as growth, dividend, or blue-chip companies.

Some ETFs will specifically track bonds. This might include government treasuries, corporate bonds, or a combination of the two. As noted earlier, it is also possible to invest in commodities like gold, silver, and oil via an ETF.

Either way, the vast majority of ETFs will look to track a market rather than outperform it. Those looking to make gains above the respective benchmark might therefore consider a mutual fund instead. When investing directly with an ETF provider, the minimum investment is often several thousand dollars.

Although this won’t be an issue with a capital outlay of $5,000, it doesn’t make sense to allocate the majority of funds to just one ETF. In comparison, when investing in an ETF at an online broker, much smaller account minimums are often supported. For example, eToro offers access to both US and foreign-listed ETFs from just $10 per trade.

Nonetheless, many ETFs will track assets that generate income. For example, ETFs that contain dividend stocks will receive a payment every three months. ETFs containing bonds typically receive a coupon payment on a bi-annual basis. Either way, ETF investors will be entitled to their share of any income generated.

Additionally, with the price of fuel and non-renewable energy skyrocketing some investors are investing in carbon credits as a way of capitalizing on the move towards net-zero.

9. Crypto Interest Accounts – Generate a Yield on Crypto Holdings

Another way to generate income on crypto investments is to open a specialist interest account. There are many providers in this space and supported coins, APYs, and lock-up terms will vary from one platform to the next. For example, we mentioned earlier that Quint offers ‘super’ staking pools, which offer a combination of both rewards and competition ticket entries.

Another option in this market is Crypto.com. This crypto exchange offers a variety of crypto interest accounts with three terms to choose from. There is a flexible account, which enables investors to withdraw their crypto tokens at any given time. This account, while more suited to those that might need access to their funds instantly, comes with the lowest APY of the three.

There are also one-month and three-month accounts, with the latter offering the best rate possible. Investors can further boost their APR by staking Cronos (CRO) tokens. This is the native token backed by Crypto.com. To offer some insight into potential yields, stablecoins like USDC attract an APY of up to 8.5%.

Bitcoin and Ethereum deposits at Crypto.com offer a yield of up to 5% and 6% respectively. Furthermore, all Crypto.com interest accounts receive their rewards on a week-to-week basis. This enables the investor to reinvest their payments back into the respective interest account to benefit from compound growth.

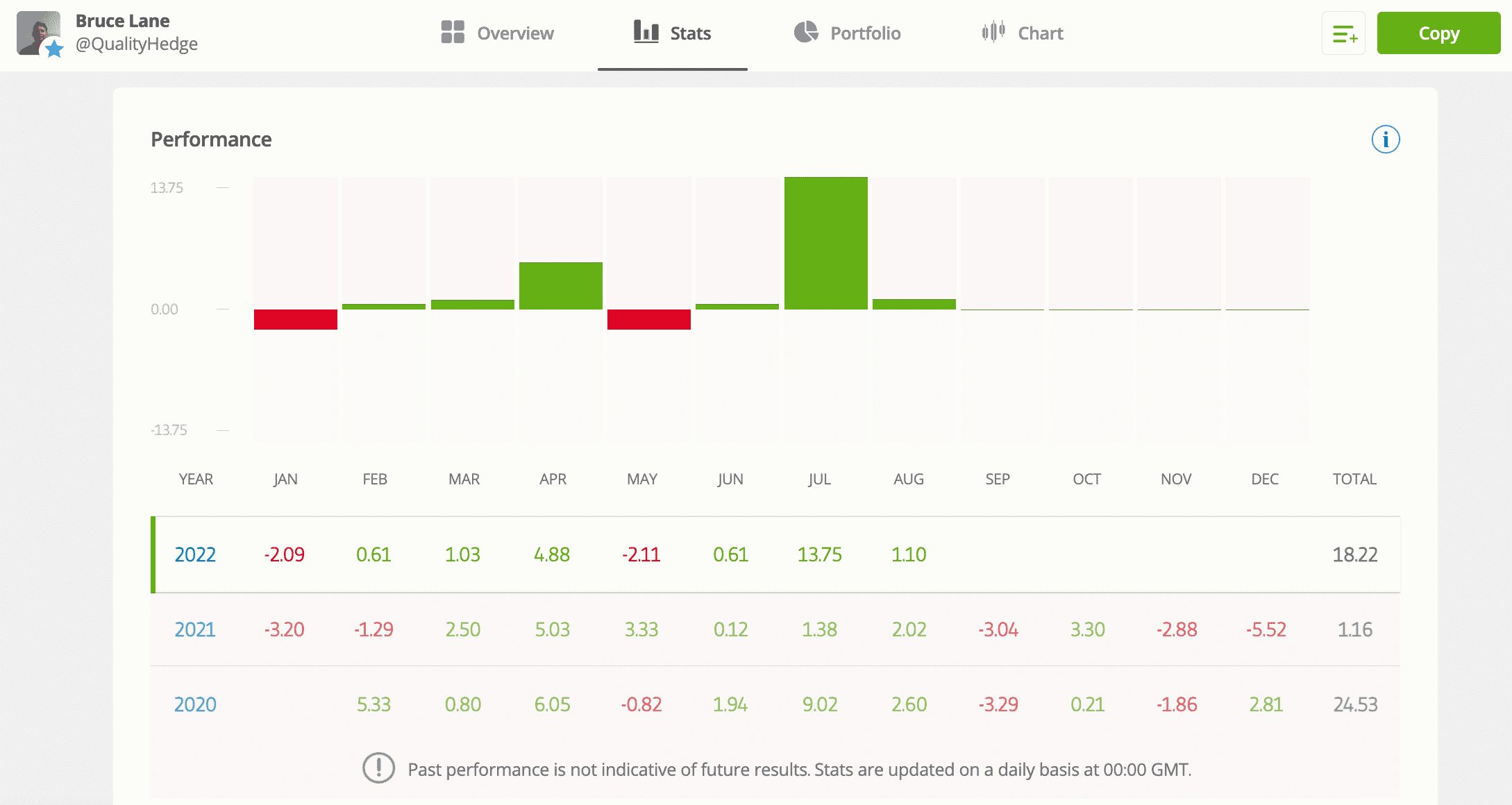

10. Copy Trading – Copy the Trades of an Experienced Investor

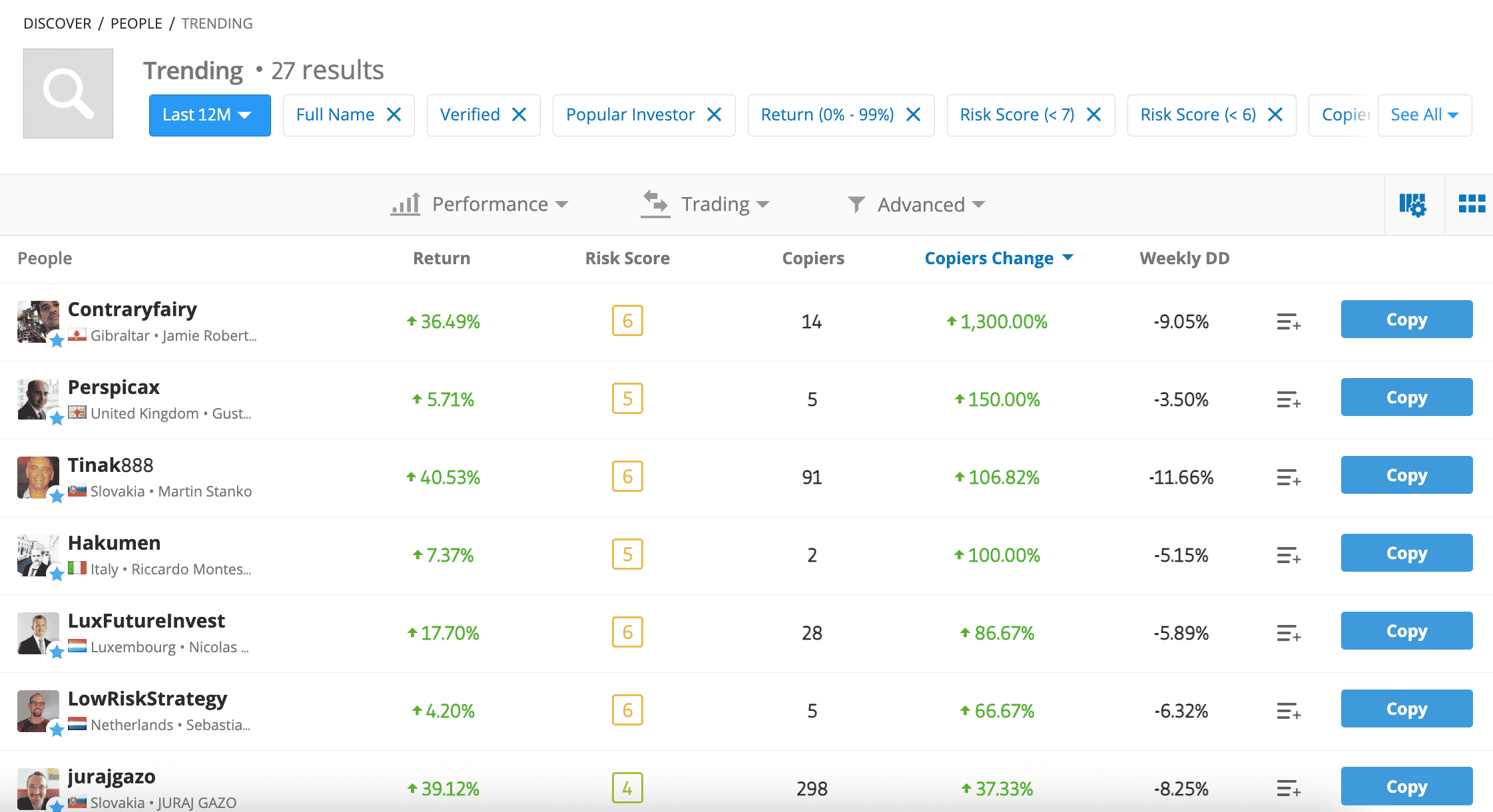

Copy Trading is another option to consider when exploring how to invest $5,000. This tool is offered by a number of online brokers, including eToro. At this broker, investors have thousands of traders to choose from. After making a selection, any positions that the trader enters will be copied over to the eToro user’s portfolio – automatically.

As a result, this is a passive way to actively buy and sell assets from the comfort of home. For example, let’s say that $5,000 is invested into an experienced stock trade that uses the eToro platform. The trader decides to risk 7% of their portfolio on Coca-Cola stock, and 9% on Tesla stock.

The same two trades will be carried over to the eToro user’s portfolio, albeit, at a stake of $350 (7% of $5,000) and $450 (9% of $5,000) respectively. If, for example, the trader cashes out their Tesla investment at a profit of 10%, the eToro user would have made a passive income of $45 (10% of $450) on this particular trade.

It is the responsibility of the investor to conduct their own market research and analysis. Crucially, however, the investor will be trading with their own money as they normally would. It’s just that eToro users can elect to copy their trades. This means that the process of choosing a trader to copy is extremely important.

To help with the decision-making process, eToro offers a fully-fledged data set that comes alongside filters. For instance, it is possible to view the monthly returns made by the trader for as long as they have been an eToro user. It is also possible to assess the trader’s preferred assets and markets, and the average trade duration.

Other metrics to assess include the trader’s risk score, maximum drawdown, and the number of followers. Investors utilizing the Copy Trading tool can add or remove assets as they see fit. Moreover, there is no time commitment to meet, so investors can cash out at the click of a button.

There is no limit to the number of people that can be copied, albeit, the minimum investment amounts to $200 per trader. This means that with a total capital outlay of $5,000, the investor could copy 25 different traders. There are no additional commissions or fees to pay when using the Copy Trading tool.

11. NFTs – Buy, Hold, or Flip NFTs

The final option to consider when evaluating how to invest $5,000 is to explore non-fungible tokens – or NFTs. Although NFTs have operated in the crypto and blockchain technology space for several years, the phenomenon truly took off in 2021. The main concept with NFTs is that they enable investors to represent ownership of an item but in a digital manner.

For example, let’s suppose that a real world property has two owners. This joint-ownership could be presented by two unique NFTs. Each NFT would be stored on the blockchain protocol, which ensures that ownership can be verified without any uncertainty. NFTs can represent just about anything.

Let’s take the hugely popular CryptoPunk NFT collection as a prime example. When this collection of 10,000 NFTs was minted in 2017, nothing was charged to buyers other than the blockchain network fee. Fast forward to 2021, and a single CryptoPunk NFT sold for more than 8,000 ETH – or about $23 million at the time of the sale.

While finding a hidden gem like the CryptoPunk NFT collection will be an extremely challenging task, there are still plenty of opportunities in this niche market. The main objective is to find a suitable NFT collection that has the potential to attract increased in demand at some point in the future. If the investor is able to achieve this, they might be able to flip the NFT for a profit.

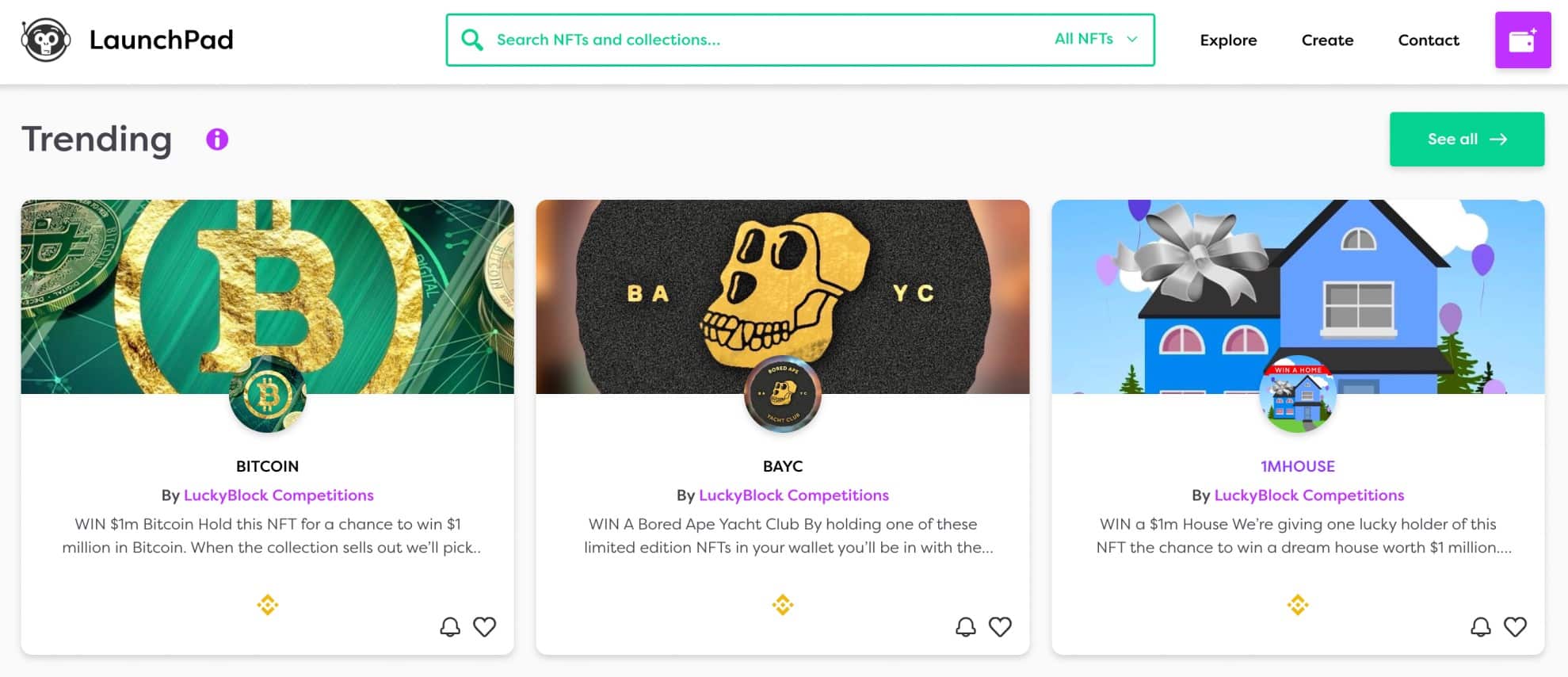

A popular marketplace to find up-and-coming collections is NFT Launchpad. This marketplace lists plenty of new NFTs, many of which can be purchased for a few hundred dollars. We came across Lucky Block on the NFT Launchpad, which offers an NFT collection that offers crypto rewards and entry into lucrative competitions.

For example, the ‘Bitcoin’ NFT backed by Lucky Block offers entry into a $1 million competition – paid in BTC tokens. There are just 25,000 NFTs in this collection and the draw will be made once all numbers have been purchased. Before and after the competition draw, Lucky Block NFT holders will continue to earn crypto rewards.

How to Choose the Best $5k Investments For You

Investors that are still searching for the best way to invest $5,000 will need to conduct additional research.

Consider the points outlined below when choosing the best $5,000 investments in the market today.

Target Returns

The first thing to consider when thinking of how to invest $5,000 is the type of returns that are sought. As we cover shortly, seeking higher returns will often result in more risk.

- Nonetheless, to offer some insight, a major stock market index like the S&P 500 has generated average annualized returns of 10% – with data dating back to 1926.

- In terms of individual stocks, growth companies like Tesla and Apple has witnessed gains of over 1,000% and 300% over the prior five years.

- Blue-chip stocks – such as Johnson & Johnson and Coca-Cola – have provided investors with more conservative returns of 27% and 41% respectively, over a five-year period.

Other asset classes, such as US treasury bonds, offer much more modest gains, but less risk.

On the other hand, crypto assets operate in the best-performing market over the prior 10 years, with some tokens generating gains of thousands and even millions of percentage points, but increased risk of losing capital.

Risk Tolerance

It goes without saying that investors should consider the amount of risk they are comfortable taking. The risk spectrum will largely depend on the asset and market that the investor decides to gain exposure to.

Some of the lowest risk assets to consider include US Treasuries and CD accounts. Both of these investments will typically generate a yield in the region of 1% to 3% annually. This will, of course, barely outpace the rate of inflation.

Medium risk asset classes include individual stocks. This risk can be reduced by investing in a broad range of stocks via an index fund.

High-risk asset classes include crypto, foreign-issued bonds from the emerging economies, and alternative investments like peer-to-peer lending and staking.

Active or Passive

The investor will also need to determine how much time they wish to commit to the maintenance of their investments.

For example, when investing in an ETF, index fund, or Copy Trading tool, this offers a passive way to approach the financial markets with limited input from the individual.

Once the investor has chosen a suitable investment, no further research or analysis will be necessary. Instead, the respective provider will ensure that the portfolio is rebalanced and reweighted regularly.

On the other hand, when investing in individual stocks or crypto, this typically requires a more hands-on approach.

It would therefore be wise for the investor to conduct frequent research into the respective markets to ensure that the portfolio still aligns with the original objectives and risk tolerance.

Short or Long-Term Objectives

Another metric to consider when assessing how to invest $5,000 is whether a short or long-term approach should be taken.

- For example, those with short-term goals might consider up-and-coming crypto projects like Tamadoge.

- The reason for this is that the project is currently engaged in its presale campaign.

- After that, the TAMA token will be launched on public exchanges, which oftentimes will attract an immediate wave of interest from crypto investors.

With that said, crypto is also viewed as a long-term investment – otherwise known as HODLing.

After all, those buying BNB tokens in 2017 at $0.11 and holding on until the crypto asset last hit an all-time high in late 2021 would have been looking at gains of over 600,000%.

Index funds should also be viewed as long-term investments, especially those that track established markets like the S&P 500 and Dow Jones.

Those in the market for shorter-term gains might also consider commodities. This trading space operates in a cyclical manner, which means that pricing is influenced by broader, external factors.

For instance, gold does well when the economy is performing poorly, and oil prices rocket when global tensions are on the rise.

Tax Obligations

When searching for the best way to invest $5,000, investors should also consider their tax obligations. The reason for this is that each asset class will have its own tax benefits and drawbacks.

For example, when investing in the stock market, tax only comes into play on realizable gains. This means that the investor would need to sell their stock investments at a profit in order for a tax obligation to come into force.

On the other hand, stock and ETF dividends, alongside bond coupon payments, will attract a tax liability straightaway. This is because the gains have already been realized – even if the funds are subsequently reinvested.

Where to Invest $5,000 – the Best Option?

In terms of where to invest $5,000, this will be determined by the asset. For example, stocks, ETFs, and index funds are typically traded at a traditional online broker. Established digital currencies like Bitcoin and Ethereum, on the other hand, are traded at crypto exchanges.

One of the best options is also FightOut (FGHT) – a native token that can be leveraged to have access to leading-edge features allowing users to earn rewards for their workouts. $FGHT is currently available on its first presale round for only $0.0167 per token.

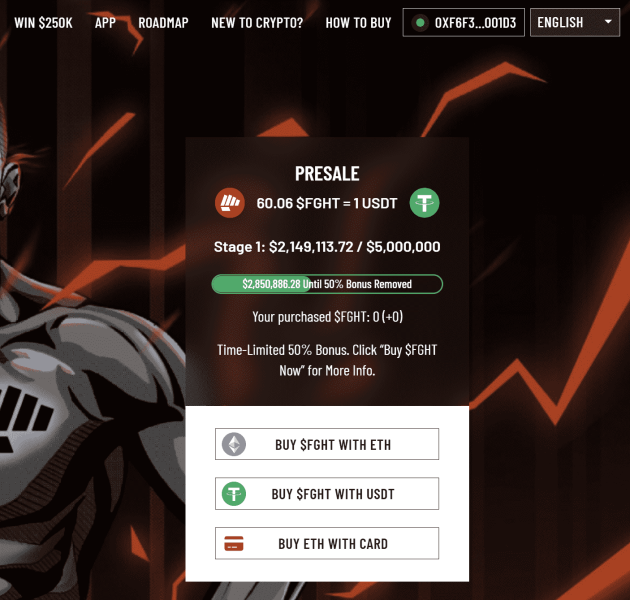

How to Invest $5,000 – FightOut Tutorial

This section of our guide on how to invest $5,000 will explain the steps required to gain exposure to the FightOut (FGHT) presale.

Step 1: Create a Crypto Wallet

Buyers should download a crypto wallet like MetaMask on their web browser. (Mobile users are recommended to download the TrustWallet)

Step 2: Connect the Wallet

Now, buyers must go to FightOut’s official presale page. Investors should then locate and click on the “BUY $FGHT NOW” button. Immediately after, they need to select the wallet they have installed (eg Metamask or TrustWallet) and login to their wallets.

Step 3: Purchase ETH/USDT

Investors must check if they have any ETH or USDT in their wallets after logging in to their wallets. Buyers also have the option to buy ETH with a credit card via Transak. After topping up an adequate balance of ETH/USDT in their wallets, investors can click either on the “Buy $FGHT with ETH” or “Buy FGHT with USDT” button.

Step 4: Buying $FGHT

Buyers must now enter the amount of ETH/USDT they would want to exchange in return for $FGHT tokens.

Step 5: Claim the $FGHT Tokens

In the final step, investors can confirm the transaction after checking the number of $FGHT tokens to be received. However, buyers can claim these tokens based on the vesting period they opt for.

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

Investors with a capital allowance of $5,000 have many assets and markets to choose from. Depending on the objectives of the investor, this might include a basket of stocks, ETFs, index funds, or even commodities like gold and silver.

However, we recommend FightOut (FGHT) as the best investment to make with $5,000. This new project’s solution-oriented features have paved a way for users to earn rewards while leading a healthy lifestyle. $FGHT is currently trading at $0.0167 per token. After raising over $2.1 million in a few days, the token is on a path to becoming one of the most promising crypto projects.

FightOut - Next 100x Move to Earn Crypto

FAQs

What is the best way to invest 5,000 dollars?

How much can you earn by investing $5,000?

References

- https://www.irs.gov/retirement-plans/401k-plans

- https://www.investor.gov/introduction-investing/getting-started/five-questions-ask-you-invest

- https://www.bbc.com/news/technology-56371912