Inflation has proven to be anything other than transitory. Consumers have been affected by higher prices in gas, food and other necessities. But investors have also been shaken by market crashes. A multi-year bear market seems imminent, but the good news is that investors can prepare themselves.

Knowing how to invest during inflation will help investors alleviate the blow of plummeting asset prices, and some strategies may even make their portfolios profitable. This guide explores where to invest during inflation and recession.

Best Investments During High Inflation

After comparing all the options available, we found the 10 best investments during high inflation.

- Crypto Projects – Providing Potentially High Rewards Coupled with High Risk

- Stocks – Traditional Investments in Large-Cap Companies

- Smart Portfolio – A Passive Income Stream Managed by Fund Managers

- Real Estate – Fractional Ownership in Real Estate via Blockchain Technology

- Non-Fungible Tokens – Digital Art with Capital Gains Potential

- Crypto Interest Accounts – Earn High Yields by Holding Crypto

- Index Funds – Diversify a Portfolio by Investing in a Range of Companies

- Precious Metals – Historically Effective Inflation Hedge

- Bonds – Low-Risk Investing Method

- Peer to Peer Lending – Lending Money with Interest

How to Invest During Inflation – 10 Best Methods Reviewed

Now that we’ve identified how to invest against inflation, let’s review each method in detail to determine the benefits.

1. Crypto Projects – Providing Potentially High Rewards Coupled with High Risk

Numerous crypto projects have proven to provide investors with high rewards.

Some cryptocurrencies lose more than 90% of their value in a bear market, so investors need to be able to stomach such crashes to avoid selling at the bottom. To increase the chances of receiving high returns, investors should get in on a crypto project during its presale stage. And that’s the current phase of the new crypto project – IMPT.

This Ethereum-based blockchain project aims to revolutionize the cryptocurrency sector by reducing carbon emissions. IMPT does this by partnering with businesses that are willing to offset a portion of the carbon emissions they have created by industrial production, transportation and more.

Businesses contribute a part of their sales margin to buyers via the IMPT platform – which is provided as IMPT tokens to individual buyers. The tokens can be collected and converted to Carbon Credits – which are tokenized NFT assets minted using smart contracts. The Credits are permits representing one ton of carbon dioxide emissions. Once a platform member receives a Carbon Credit NFT – they can be traded or burnt on the ecosystem.

Burning the tokens will not only promote sustainable investing but also allow the participants to earn free NFT creations minted on the IMPT network. IMPT tokens will also be used to participate in the platform’s DAO (decentralized autonomous organization), giving voting and decision-making rights to investors who stake the tokens.

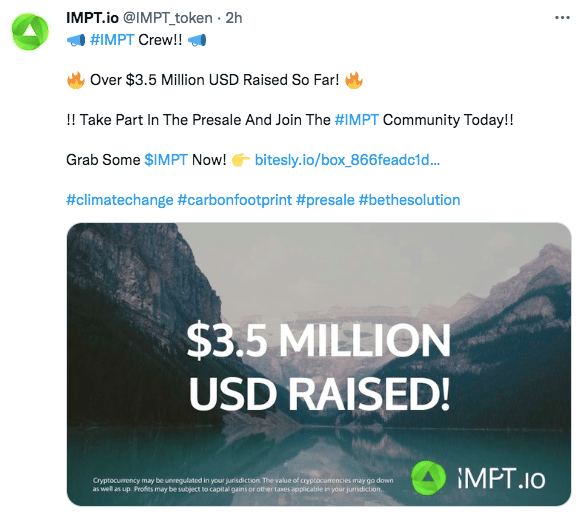

To participate in this project, you can purchase IMPT tokens on presale for only $0.018 per token. The first presale stage has listed 600 million tokens – of which more than 221 million have been sold, raising nearly $4 million. Interested readers can access the latest project updates by joining the IMPT Telegram channel.

See our full list of other potentially recession-proof crypto investments.

2. Stocks – Traditional Investments in Large-Cap Companies

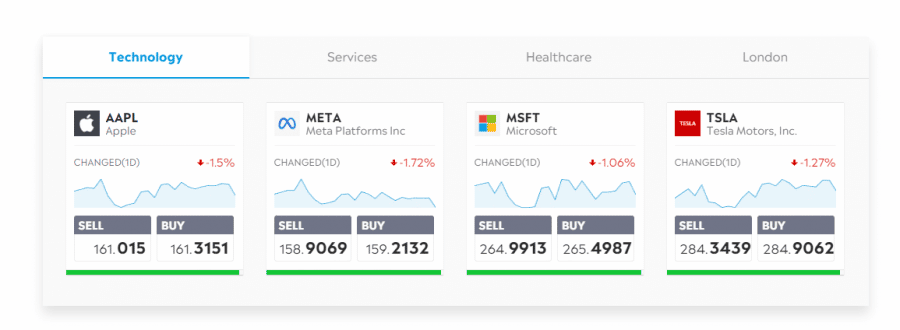

Investors wondering how to hedge against inflation may find a safe haven in stocks. Many investors regard stocks to be a less risky investment than cryptocurrencies because of lower volatility. While some investors opt for indices to diversify and reduce their risk even further, other investors opt for individual stocks.

Picking out stocks or investing in startups with the highest return potential can be challenging, especially when the security has been stagnant for a long period. One example of such a stock is Tesla. This security ranged for years before it finally spiked during the global lockdowns in 2020. Investors who bought Tesla stock in April 2020 watched it surge more than 1,600% by November 2021.

The best way to hedge against inflation is by picking stocks that provide capital gains and dividends. Investors can buy stocks on eToro at 0% commission and choose from more than 3,000 securities. What makes stock investments even more appealing with eToro is that it offers fractional ownership. Investors need only $10 to get started.

Safety is of the utmost concern for investors, so they’ll be glad to know that eToro is regulated by several regulatory bodies such as CySEC, US SEC, ASIC, FCA and FINRA. eToro also supports ESG investing.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Read more: Best Ways to Invest $250k

3. Smart Portfolio – A Passive Income Stream Managed by Fund Managers

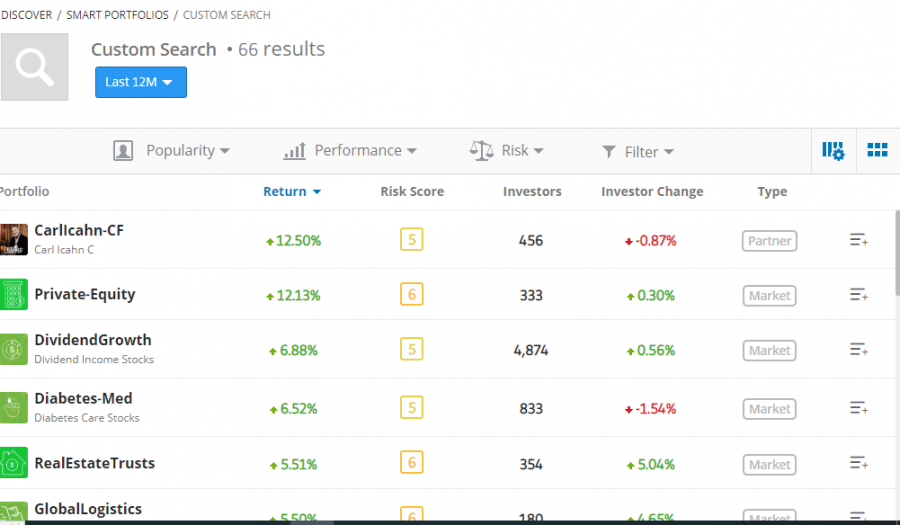

Knowing where to invest when inflation hits gives investors an upper hand over others. eToro has made investing easy by offering Smart Portfolio. No need for investors to try and determine which individual stocks may surge when a fund manager can choose a specific portfolio to provide fair returns.

Investors can choose between Top Trader Portfolios, Thematic Market Portfolios and Partner Portfolios. Each method contains its own approach and investing strategy. eToro offers a wide selection of portfolios such as RenewableEnergy, CryptoPortfolio and MobilePayments, to name a few. Their most recent addition was a DAO crypto portfolio.

Investors select the portfolio best suited for their needs by filtering assets, risk scores, industries and more.

Opting for this investment method is one way to earn a passive income potentially. A manager is responsible for rebalancing the portfolio periodically to achieve the highest returns. And the best part about this investment strategy is that it’s free. The only thing that investors need to do is deposit at least $500 to own a Smart Portfolio.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

4. Real Estate – Fractional Ownership in Real Estate via Blockchain Technology

Many investors wonder what to buy during inflation because it seems that any investment is risky. Real estate has proven that it will always appreciate. Its value may drop during economic hardships, but its price always appreciates long-term.

The main problem with real estate is that it’s expensive, so the barriers to entry are high. But are there any alternatives to investing in REITs? The good news is that blockchain technology has enabled businesses to offer real estate investments without investing large amounts of money. It’s possible for investors to have fractional ownership in real estate with as little as $100.

Because a minimal investment is required to own a fraction of real estate, investors aren’t subjected to credit checks.

Blockchain platforms such as EstateX enable investors to get a piece of real estate and potentially earn passive income. Investing in a project such as EstateX enables investors to get in on one of the best crypto presales because they can get the platform’s native token, $ESX, at low prices.

Other benefits of holding the ESX token include a chance to receive free tokens in an airdrop, exclusive NFTs, earn high annual percentage yields (APYs) and receive exclusive NFTs.

5. Non-Fungible Tokens – Digital Art with Capital Gains Potential

Non-Fungible Tokens (NFTs) are one way of investing during high inflation. NFTs have become extremely popular in the last few years, and they have been around since 2014. The latest hype due to celebrity ownership and endorsement of NFTs has resulted in some digital art selling for several million dollars.

The NFT market is set to grow by $147 billion by 2026. That means currently popular NFTs are likely to soar in value. But knowing the best NFTs to buy is challenging. Just because an NFT is expensive, it doesn’t mean its value will increase or that it’s even worth the asking price.

We found that investing in NFT projects that offer several ways to earn tends to increase an investor’s chance of making the right investment. A project we discovered meeting that criteria is Lucky Block.

This NFT platform enables investors to participate in prize draws and earn capital appreciation. Investors stand a chance of winning a house worth $1 million, a Lamborghini, $1 million in Bitcoin and video game consoles. To enter prize draws, investors have to buy LBLOCK, the platform’s native token.

Another way that investors have earned by holding LBLOCK is by capital appreciation. Several major exchanges such as LBank and MEXC have listed this coin. The result was a massive pump in price with new exchange listings. The good news is that LBLOCK is due for another listing. Its listing on Gate.io is scheduled for 1 September 2022. Is it possible that the coin will have another price pump with the imminent listing?

Read more: How to Invest $25k in 2023.

6. Crypto Interest Accounts – Earn High Yields by Holding Crypto

The choice of what to invest in during inflation can seem daunting due to the risk involved. But what if the risk was minimized? That’s what investing in crypto interest accounts aims to achieve. Think of crypto interest accounts as the digital version of fiat interest accounts. The only difference is that investors deposit cryptocurrencies and stand a chance of earning higher yields.

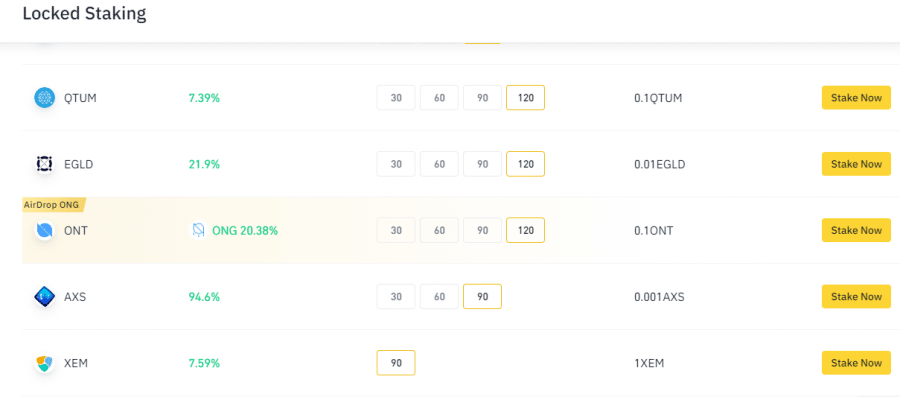

Investors buy crypto and deposit them into interest accounts, then earn a certain percentage of their coin holding after a specific period, usually a year. It’s similar to crypto staking, where investors lock in their coins on centralized exchanges and earn APYs.

Some exchanges enable investors to withdraw their assets whenever they please. Popular exchange Binance offers triple-digit returns for staking certain coins for 90 days. It’s usually altcoins that provide the biggest returns, whereas popular coins such as Bitcoin, Ethereum and stablecoins usually offer less than 10% interest per annum.

Cryptoassets are a highly volatile unregulated investment product.

7. Index Funds – Diversify a Portfolio by Investing in a Range of Companies

Investing during inflation can be a smart strategy, especially if prices have crashed. Investors picking individual stocks may have suffered the wrath of the stock market crash, but investment blows are alleviated if portfolio diversification is applied. Knowing what stocks to buy during inflation is difficult, so it’s best to diversify.

One way to diversify an equities investment is by putting money into an index fund. An index fund is usually a mutual fund or an exchange-traded fund (ETF), which is created by the fund manager and contains several assets.

Investors wondering what to invest in during inflation will find index funds appealing because the most popular ones have provided attractive returns and lower risk than most investments.

Investors are advised to invest in index funds with a regulated broker. Another benefit of index funds is that they usually have low management costs because they’re passive investments. Index funds track the performance of popular indices such as the S&P 500. The managers create funds that resemble popular indices with the goal of matching their returns, preferably outperforming them.

eToro enables indices trading. Traders can use leverage to open positions on indices such as the NASDAQ 100. See our guide to trading ETFs.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

8. Precious Metals – Historically Effective Inflation Hedge

Investing in commodities is sometimes a good way to hedge against inflation. Gold investors don’t have to wonder what to invest in during inflation because they’re already in one of the safest assets. A key reason that fund managers prefer to include gold in their portfolios is that its price tends to move counter to the stock market and the US dollar.

When the dollar loses value, gold’s price goes up. The big difference between cash and gold is that one can’t just print more gold. Cash is merely paper, and its value can drop to zero. Gold is always likely to have value, and it has proven throughout the decades to be an extremely effective hedge against inflation, recession and geopolitical uncertainty.

Many investors flock to gold during economic downturns and whenever the stock market is in turmoil. But investors have to know how to trade gold and the best platform to use. eToro is a regulated platform that offers gold and silver trading.

We’ve seen some stocks lose more than 70% of their value in several months, and the crypto market has crashed. The US was recently in a recession, so some traders believe that gold’s price rally is on the horizon.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

9. Bonds – Low-Risk Investing Method

When the stock market is crashing, investors wonder where to invest during inflation. Some turn to bonds. During recessions and stock market slumps, bond prices tend to rise.

Bonds are a fixed-income investment and issued by governments and corporations when they want to raise money. When investors buy a bond, they give an issuer a loan. The issuer commits to repaying the loan on a specific date. Interest also accrues on the loan, and the issuer usually pays it biannually.

Famous investors such as Ray Dalio include bonds in their portfolios. One of the reasons is that bonds are a low risk, but they also provide low returns. Bonds are favored by many investors because they provide stability and predictability during bear markets. Investors shouldn’t expect high volatility in bond prices.

Bonds maturing in two years or less are deemed short-term bonds. Some bonds can mature in 10 years and even 30 years. The longer the maturity period, the higher returns investors can make.

10. Peer to Peer Lending – Lending Money with Interest

The US Federal Reserve Bank has committed to fighting inflation. One of the ways it aims to do that is by raising interest rates. When interest rates rise, many investors sell their equities and cryptocurrencies because holding dollars is more attractive.

Investors can earn higher returns than usual by holding cash when interest rates rise. But during inflation, many people don’t have enough money to fund their lifestyles, so they opt for borrowing. Investors who have money can lend it to others and charge interest.

Peer to peer lending is one method of investing during stagflation. It may be a better option than putting the money into an interest-bearing account because banks usually offer low interest rates. Lending money to others enables lenders to stipulate the interest rates to borrowers.

How Does Investing During Inflation Work?

Many investors become conservative with their portfolios during periods of inflation and recession. It’s common for markets to be volatile during those periods and potentially go into a bear market. So most investors are apprehensive about investing their money into risky assets.

During economic hardships, investors prefer to sell securities and opt for inflation hedges such as bonds and gold. Some investors who still want a portion of the portfolio to consist of high-risk assets may opt for gold backed crypto.

Seasoned investors recommend a diversified portfolio and a large portion of it consisting of long-term bonds.

It might also be a good idea for some investors to keep cash on hand. The US Federal Reserve has already increased interest rates to fight inflation. And when interest rates increase, the dollar becomes attractive due to the returns received. Another benefit of having cash during hard economic times is buying assets at low prices because they have fallen.

Investors seeking risky assets should do their due diligence and ensure those assets offer a unique characteristic that makes them appealing to investors. An example would be Bitcoin having a finite supply of 21 million coins, whereas some cryptos have billions of coins in supply.

How to Find the Best Assets to Invest in During Inflation

Wondering what’s the best way to invest $100k? During inflation and recessions, economies and financial markets are in a slump and seem stagnant. Most assets prices have dropped, and it may seem to investors that it’s not the right time to invest. But the whole point of investing is to buy low and sell high, yet many investors are frozen by fear because they believe that prices will go even lower.

So how does an investor increase the chances of finding the best asset to invest in during inflation?

Choose Assets Proven to be Inflation Hedges

Most financial markets are in turmoil during economic hardships, but certain assets have proven that their prices increase during those times. Some of the assets that thrive during economic collapses are precious metals and bonds.

Both of these assets are considered to be low-risk investments, yet gold’s price spiked significantly during the 2008 financial crisis. There’s a finite supply of gold, and many countries stock up on gold during wars and recessions. It’s hardly arguable that gold will always have a value.

Knowing where to invest during inflation helps investors save a lot of money by avoiding risky and highly volatile assets. To avoid those issues, investors may consider having bonds as part of their portfolios.

During economic hardships, many investors are apprehensive about buying risky assets as they may incur high losses. Bonds are a great hedge against inflation as their prices tend to rise when the stock market is falling.

The great thing about Treasury bonds is that they’re guaranteed by the government. That ensures investors don’t risk losing their capital, and they can count on receiving the loan repayment at a specified date.

So that should provide investors with an extra layer of security. Investors also opt for bonds because they provide a predictable income stream.

Look for Assets in Presale

It’s a common misconception that the best prices for securities or cryptocurrencies are during initial public offerings (IPOs) or initial coin offerings (ICOs). The best time to buy assets is before it’s offered on the general market. Once most people find out about an asset, it’s usually too late to get the best prices.

Assets are best priced during presales. That’s the stage where only a small group of investors find out about the release of an asset through an invitation to purchase. Retail investors aren’t made aware of it, so they think that the asset’s lowest price is when it trades on the market.

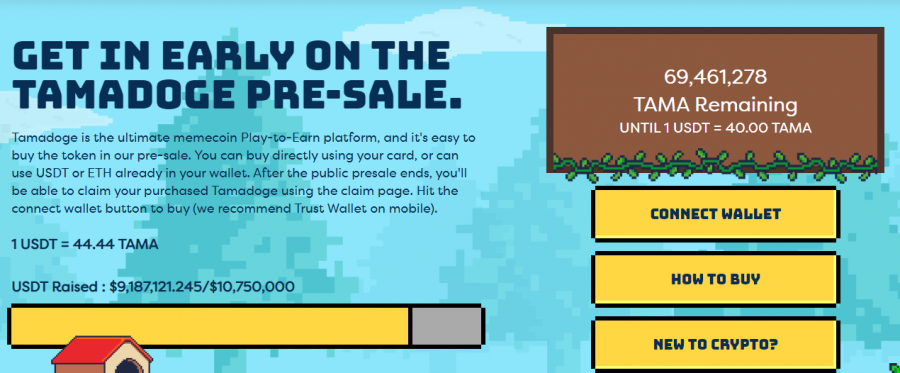

The prices charged for assets in presale are probably the lowest they’re ever going to be. Those rock-bottom prices may never be repeated. Investors who buy an asset at its lowest price significantly increase their chances of profiting handsomely. One of the assets currently in presale is Tamadoge.

This NFT project has proven to be a massive success already, having raised over $9 million in a few weeks. The high demand for the TAMA token has resulted in an LBank and Uniswap listing. That will give the coin even more exposure, and the increase in demand could result in a price pump.

Tamadoge’s developers have incrementally raised the price of the coin throughout the various stages of the presale. Yet, TAMA’s price is possibly the lowest it’s going to be since cryptocurrencies tend to gain value once they’re listed on exchanges because of the substantial increase in exposure.

Investors who want to keep up to date with this game’s latest developments can subscribe to the Telegram channel (admins will not DM you – beware of scams).

Diversify Into an All-Weather Portfolio

The All-Weather portfolio was popularised by the famous investor Ray Dalio. This portfolio tends to provide decent returns during favorable and unfavorable economic conditions. The portfolio’s title is a reference to surviving various market conditions because of its diversified nature.

Here’s how to invest during inflation in 2023: the All-Weather portfolio comprises of 40% long-term bonds, 30% US stocks, 15% intermediate bonds, 7.5% gold and 7.5% commodities.

Dalio favors that a large portion of the portfolio be long-term bonds as he believes they are a low-risk investment, and US stocks are his second favorite asset. So investors should always keep an eye on the best new stocks to ensure their portfolio can weather the brutal bear market.

How Much Does it Cost to Invest During Inflation?

Additional broker fees don’t apply. The only fees incurred are the spreads. And investors can start trading with only $10. Only non-USD deposits are charged a conversion fee of 0.5%.

Investors wanting to diversify their portfolios into crypto will need Ethereum to buy the TAMA token. eToro offers more than 70 cryptocurrencies and charges only 1% per trade.

Depositing funds into an eToro account is free and withdrawals cost only $5. The only other fee that investors should note is the inactivity fee. eToro charges $10 monthly after 12 months of inactivity. To avoid the charge, investors need to log in regularly.

Investors who are uncertain about the assets to choose can let a fund manager do all the hard work. A Smart Portfolio enables investors to diversify and potentially earn rewards from the periodic rebalancing, which the fund manager initiates. The best part about this service is that it’s free.

Forex investors wanting to trade only eToro will be charged only the spreads to open a position.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Top Tips for Investing During Inflation for Beginners

Investors can take several precautions to ensure they survive and possibly thrive with their investments during inflation.

Invest Only What You Can Afford to Lose

Regardless of how much risk management investors practice, profits aren’t guaranteed and losses are possible. During bear markets, some investors invest more money than they can afford to lose, hoping to recover their losses. That’s usually a bad strategy because they can incur even bigger losses.

Don’t go into debt or withdraw money from an emergency fund for investments. Investors should ensure that the amount invested won’t affect their lives adversely if they never saw that money again.

Know Your Financial Goals

Investors without financial goals are like ships without a crew, swayed by waves in every direction. It’s important that investors know the amount they want to make and the period to earn those returns. Knowing these two important metrics will lay the foundation for the kind of assets an investor will pick.

If an investor wants to become rich within only a few years, that usually means picking highly volatile assets with a history of providing significant returns. Investors who have a long-term plan and want to ensure they enjoy a comfortable retirement will choose assets aligned with their risk-averse appetite.

Financial goals will also help investors determine the amount of money to invest and how long to stay in the market.

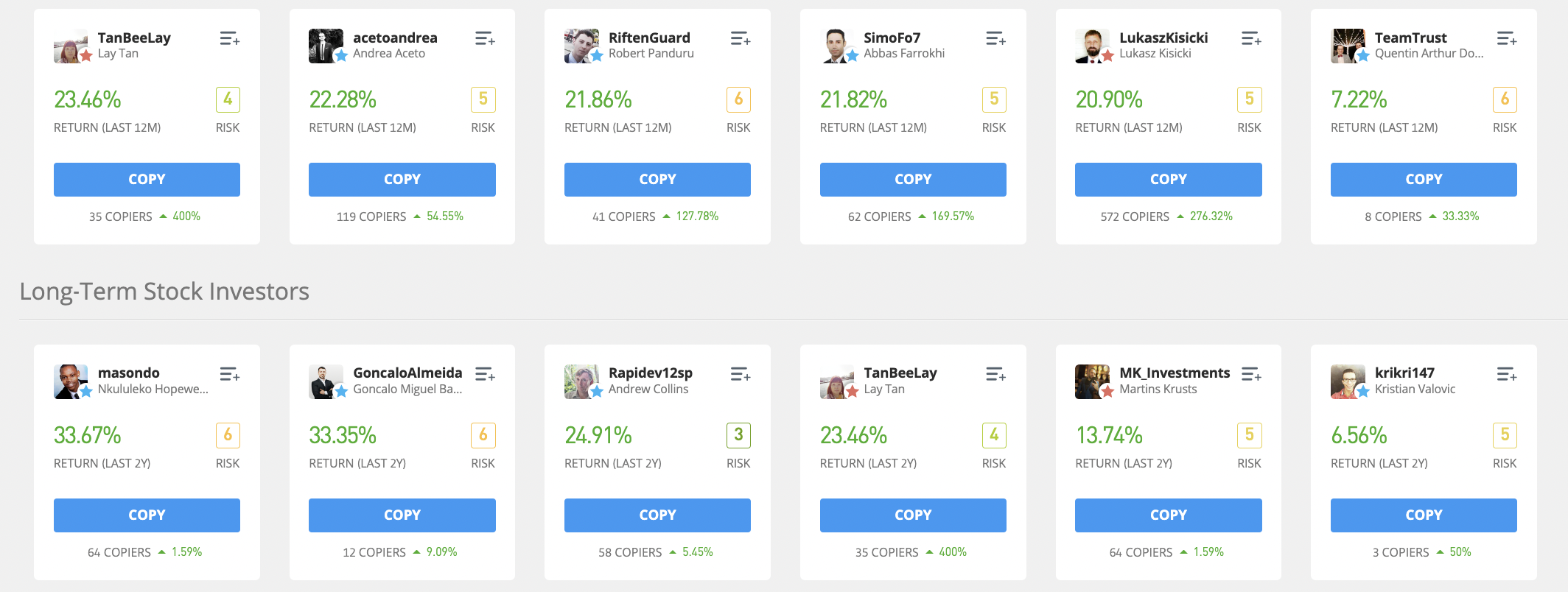

Copy Professionals

Getting a grasp of the investment basics takes time, and many beginners are jittery about buying assets even after prolonged research. The best way to succeed is by modeling the professionals who have achieved the results you seek.

Where to invest during stagflation is a dilemma many beginners encounter, but eToro has provided a simple solution. CopyTrading enables beginners to copy the trades of professionals. This is the perfect solution for investors who don’t have time to analyze markets or the skills to perform technical and fundamental analyses.

Some of the professional traders on eToro have provided higher returns than an interest-bearing bank account. And the best benefit of this service is that fees don’t apply. Beginners can choose whose trades to copy.

Another benefit of using this service is the ability to interact with traders. Beginners can learn from professionals and exchange ideas while making friends. In 2021 the average return on investment (ROI) from copytrading on eToro was 30.4%.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Dollar-Cost Averaging

One technique many investors use to minimize risk is by using dollar-cost averaging. This technique involves investing equal amounts of money at predetermined intervals, regardless of the price. Besides helping investors to become disciplined by developing the investing habit, dollar-cost averaging can lower the average amount spent on investments.

Most beginners are overwhelmed with emotions when investing, especially during volatile periods. But dollar-cost averaging helps beginners to exclude the emotional component when investing. Timing the market is one aspect of investing many investors are concerned about. With this strategy, beginners avoid market mistiming.

Account for Fees and Taxes

A common newbie mistake is failing to question all the fees involved in trading. Beginners should know how much the deposit, withdrawal, trading and any other fees are charged to receive profits. Some brokers charge such high fees that they significantly lower profits. The other problem with high fees is that they magnify losses.

Significant losses can dissuade beginners from carrying on with their investing journey. Another cost that many beginners fail to account for is taxes. Each region’s tax laws differ, so beginners should find out the tax implications of capital gains and income earned from investing.

Conclusion

Investors have several options for building a portfolio during inflation to ensure that it can weather severe economic downturns. We’ve highlighted what the all-weather portfolio consists of, but some beginners might also be interested in knowing how to invest in cryptocurrencies. After all, some investors have a risk-seeking appetite and want to capitalize on volatility to earn high rewards. But investors should be careful with volatile assets, as they may provide huge losses.

One of the crypto projects we’ve come across that beginners may want to invest in is IMPT. This Ethereum-based cryptocurrency aims to connect businesses with customers to reduce their carbon footprint. Particiapnts can purchase IMPT tokens on the presale to eventually buy, sell and burn Carbon Credit NFTs. IMPT is available to buy during the first presale round for just $0.018 per token.

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st

FAQ

Does inflation affect investment strategies?

What investments do well in inflation?

Is it good to invest during inflation?

How do you profit from inflation?

How do you prepare for inflation in 2022?

How long will high inflation last?

References

- https://www.bankofengland.co.uk/knowledgebank/what-is-inflation

- https://corporatefinanceinstitute.com/resources/knowledge/economics/inflation/

- https://www.bbc.co.uk/news/business-12196322