Widely regarded as a potentially disruptive technology, blockchain is often top of the list for investors looking to secure a stake in future-proof industries.

If you’re wondering how to invest in blockchain technology as a beginner, this one’s for you. We’ll dive into the ten most popular ways to invest in the blockchain niche, providing options for investors of all experience levels and risk appetites.

How to Invest in Blockchain – Top Methods

A Closer Look at the Best Ways to Invest in Blockchain

There are countless ways to get exposure to the blockchain industry, but we’ve boiled it down to ten of the very best options — using potential returns, ease of entry, and security as our criteria.

Let’s dive right in!

1. Enter into Cryptocurrency Presales

Cryptocurrency presales offer investors the opportunity to acquire a digital asset at the earliest stage of its life cycle. By buying cryptocurrencies before their exchange listings, investors can benefit from increased trading volumes and potentially higher upwards price momentum.

One of the best ways to do this is by joining the IMPT presale – an Ethereum blockchain-based carbon-neutral program. IMPT promotes sustainable investing by allowing participants to purchase and burn Carbon Credits – which represent a certain amount of C02 emissions that can be removed from the environment.

On the IMPT platform, Carbon Credits are tokenized assets which can be bought and sold with IMPT tokens – the native cryptocurrency. The Carbon Credit transactions are recorded on a decentralized ledger, offering more transparency and traceability of these tokens. Therefore, burning this NFT will nullify its existence without any chance of fraudulent activity.

The platform partners with businesses – who want to link up with environmental projects to reduce the carbon emissions that may have been produced by an excess of industrial production or transportation. The businesses and brands set aside a percentage of their sales margin and distribute it to buyers who access their products via the IMPT shopping platform. Buyers receive this in the form of IMPT tokens – which can be used to buy Carbon Credits NFTs.

By burning the NFTs, the platform will reward the individuals with new NFT creations which can be traded. The acquired NFTs will offer shared ownership between the Carbon Credit NFT burners and the artists who have created the new NFT designs.

With a total supply of 3 billion, 600 million coins are currently available during IMPT’s first presale round. After releasing on October 3rd 2022, IMPT has sold more than 221 million tokens in 10 days. One token can be purchased at just $0.018 per token.

Interested readers can join the IMPT Telegram Channel to stay updated with the news and developments surrounding this project that promotes Sustainable investing practices.

2. Invest in Utility Tokens

Tokens with strong utility tend to fare best long term since they inherently attract buyers looking to benefit from their utility. Whereas those with little-to-no utility often struggle to gain momentum since they lack intrinsic value.

The best blockchain projects to invest in are generally those that provide real utility and value to users. These can often be identified based on the number of users they have, their real-world impact, revenue streams, use cases, and other features.

For early-stage projects like Battle Infinity, a recently launched gaming and utility token that raised more than $5 million during its presale phase — which ended more than 2 months early.

The size and scope of the ecosystem surrounding its token, along with the size of the community and development budget can be used as indicators of its potential. These can generally be determined by performing some basic background research — such as reading relevant documentation, gauging its social media performance, and examining its token distribution schedule (tokenomics).

Take Tamadoge as an example, an exciting new crypto currently in the presale phase. Its whitepaper details the full scope of the tamaverse and paints a clear roadmap that shows the community what to expect in the coming months — such as initial centralized exchange listings in Q4 2022 and the establishment of a range of metaverse partnerships in early 2023.

Importantly, it provides concrete measures of success, which users can use to track its performance and more easily project how it will perform. The tokenomics are also transparent — with no surprise token unlocks and a large enough treasury to fund its long-term development.

Given that it has almost sold out its $8 million presale, it’s clear that the smart money is banking on a standout performance.

3. Speculate on Blockchain Stocks

The blockchain sector is as deep as it is wide and there are endless opportunities to invest in companies helping to expand the space, push the boundaries, and onboard new user demographics. Indeed, companies like NVIDIA Corporation and Advanced Micro Devices, Inc. (two GPU pioneers) are some of the best-performing stocks of all time.

If you’re not quite sure how to invest in blockchain stocks, you’ll find it’s easier than you might think. The popular multi-asset investment platform eToro is designed to make gaining exposure to stocks, cryptocurrencies, commodities, and currencies all under one platform.

As arguably the most comprehensive trading platform operating today, eToro allows you to buy, sell, and trade a huge range of popular stocks — including a wide range of blockchain stocks including Coinbase (COIN), NVIDIA Corporation (NVDA), CME Group (CME), and Block Inc. (SQ).

The platform benefits from a tiny $10 minimum stock trade requirement and allows you to own and trade fractional shares in literally hundreds of companies. Best of all, it’s commission-free — so you can begin investing in blockchain companies at the best available prices.

Wondering what the best ways to invest $250k are? With eToro you can invest in stocks, cryptos and other popular assets with fractional share investing.

78% of retail investor accounts lose money when trading CFDs with this provider.

4. Play Blockchain-Enabled Games

Blockchain-powered games have recently emerged as perhaps one of the most promising applications of blockchain technology.

They help deliver the unique benefits of blockchain technology to the more than 2.69 video game players worldwide while unlocking new opportunities and revenue streams for both video developers and players.

In the last two years, we have seen the popularization of play-to-earn gaming — a new niche that allows players to earn cryptocurrency rewards for their in-game achievements and progress.

Since blockchain games generally allow players to truly own their in-game items and monetize their in-game triumphs, they can be considered an evolution of the standard gaming model. Today, there are well over 1,000 play-to-earn games spread across several popular blockchain platforms.

BNB Chain is currently the best blockchain for gaming since it is low-cost, accessible, and hosts the vast majority of blockchain games, some of which are likely to go on to achieve meteoric growth in the months and years ahead. Indeed, some of the best blockchain games to make money are still in their early stages of growth.

This includes the popular Battle Infinity, which is pushing boundaries by providing the world’s first NFT-based fantasy sports game with full metaverse integration. It features a variety of NFT-enabled battle games that reward players for their achievements and can be considered one of the best blockchain games to earn crypto easily.

The IBAT token is already trading on the popular decentralized exchange PancakeSwap and on LBank.

Other games, like Tamadoge have garnered considerable attention in recent weeks thanks to its unique take on the play-to-earn model. The team behind Tamadoge is building an entire ‘tamaverse’ of arcade-style games, each of which will provide physical Tamadoge rewards and token prizes.

The platform’s strong fundamentals and robust roadmap make it a strong pick for those looking to benefit from the growth of the metaverse and blockchain gaming sector.

5. Invest in NFTs

Non-fungible tokens (or NFTs) have exploded in popularity in recent years, as their potential has become better recognized and tapped by pioneering creators, brands, and projects.

Being an incredibly powerful medium for creativity and utility, NFTs are a staple in the portfolios of many experienced traders. And it’s not difficult to see why.

Throughout 2021, some of the most popular NFT collections, including CryptoPunks, NBA Top Shot, and Bored Apes achieved incredible success, resulting in staggering gains for early investors.

As you might expect, the early bird often catches the worm when it comes to NFT investments — since participating in the original mint allows investors to get their hands on their favorite NFTs at the best possible prices.

Lucky Block, the popular NFT competitions platform, is currently hosting the mint for its first NFT collection known as the Platinum Rollers Club NFT. Since each NFT provides a free entry into every Lucky Block platinum competition, they’re selling out fast.

You can also invest in NFTs through one of the growing number of NFT marketplaces. Such as Crypto.com’s NFT marketplace — one of the best for beginners, since supports most popular NFT collections and hosts some of the most exclusive and sought-after drops.

Cryptoassets are a highly volatile unregulated investment product.

6. Stake Your Cryptocurrencies

A growing number of cryptocurrencies are secured using a Proof-of-Stake (POS) or Delegated Proof-of-Stake (DPoS) consensus system.

This simply means that users stake or securely delegate their assets to a validator, which is then randomly selected to participate in the block production and transaction verification process — keeping the blockchain running smoothly.

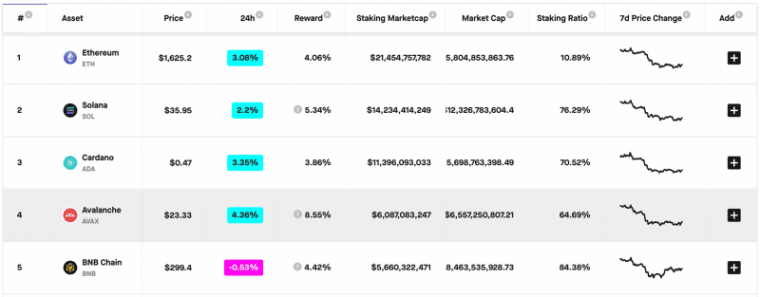

In return for helping to secure the network by staking/delegating their tokens, users receive token-based rewards. The exact APY can vary between staking providers and blockchains, but in general, you can expect to earn 4-10% for most staking coins (per StakingRewards). Rewards are paid out in the same asset that was staked, helping you grow your position with time.

Some more ambitious assets offer even higher staking yields. This includes DeFi Coin, which as of writing, offers up to 75% APY when selecting a 365-day staking term.

In most cases, you can stake your tokens directly from your native cryptocurrency wallet, e.g. using Daedelus wallet for Cardano (ADA) or Avalanche (AVAX) on the official Avalanche wallet. But this can be somewhat complicated.

A range of staking-as-a-service providers have emerged in recent years to help simplify the process, and in some cases, provide enhanced yields using a variety of clever DeFi integrations and services.

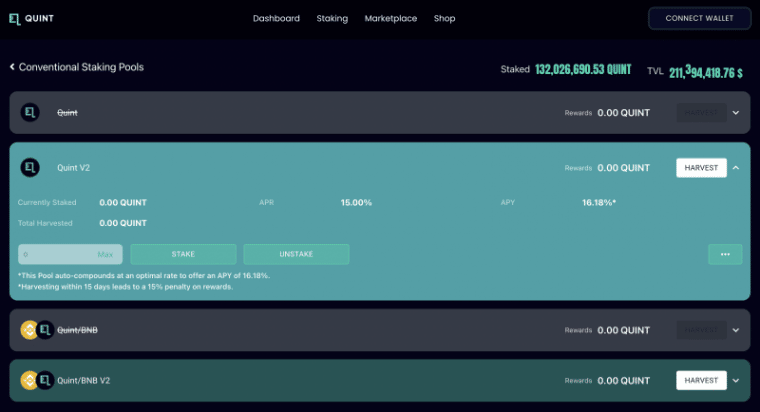

Some platforms, like Quint, also host their own reward pools, so be sure to check if the platforms behind the assets in your portfolio offer something similar.

7. Earn Interest on Your Crypto Holdings

If you are planning on holding cryptocurrencies long term. This one is for you.

Cryptocurrency savings accounts allow you to deposit your cryptocurrencies in return for a transparent and reliable yield — typically paid out in the same crypto you deposited, e.g. ETH yields more ETH, whereas USDC yields more USDC.

They generally work similar to the savings accounts offered by most banks in that you deposit your funds in return for a transparent interest rate. In some cases, you may be required to commit your deposit for a fixed length of time to earn interest or benefit from a higher rate.

These platforms are generally completely hands-off. After depositing your funds, simply sit back and wait for the interest to roll in.

As you might expect, these platforms generally leverage your deposits as part of their business strategy to earn a return — most of which is passed on to you. This might include facilitating collateralized loans, providing liquidity, market making, volatility trading, and various other income streams.

Unlike most traditional savings accounts, several crypto staking and savings providers feature auto-compounding, allowing your yields to stack up even faster. Quint is one such provider.

As always, consider shopping around to find the best rates and providers — these can change regularly!

8. Participate in Yield Farms

Yield farms have become incredibly popular among cryptocurrency investors in recent years thanks to their potential to provide impressive returns.

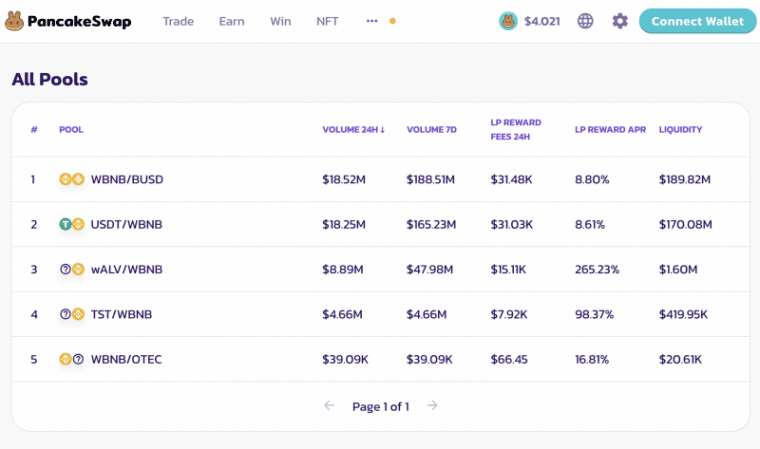

A relatively new innovation, yield farms allow you to stake a wide array of cryptocurrencies in return for rewards. They can vary considerably in the way that they operate, ranging from relatively simple yield farms like those found on PancakeSwap to more ambitious options like Quint.

For beginners first exploring how to invest in blockchain technology, yield farms represent an attractive option, since they tend to be simple to use and provide a clear indication of the expected yield.

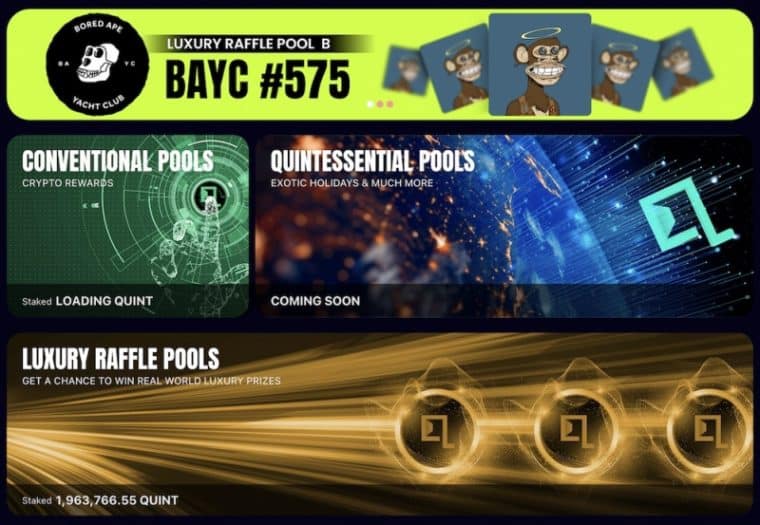

Most yield farms pay out yields in the form of cryptocurrencies, but Quint is beginning to shake up the model with its novel raffle-based yield farm solution. The platform allows users to stake their QUINT tokens to participate in a handful of different yield pools.

This includes conventional pools that pay out QUINT rewards at 15% APY (exc. compounding). As well as a luxury pool that allows users to enter a raffle for luxury prizes — with the current prize being an incredibly rare Bored Ape Yacht Club NFT.

Having already given away two Hublot Big Band Integral watches and with new Quintessential pools set to launch soon, Quint is definitely worth checking out.

9. Start Mining

Cryptocurrency mining remains one of the most popular ways to invest in blockchain.

The mining process is used to secure a class of cryptocurrencies known as “Proof-of-Work” coins. These cryptocurrencies require a decentralized network of specialized computers, known as miners, to solve complex cryptographic functions (known as a hash puzzle). The first miner to solve the puzzle is then able to process a batch of transactions for addition to the blockchain, earning a reward for their efforts. The process then repeats.

When the rewards are sizeable and the costs are low, cryptocurrency mining can be an incredibly profitable endeavor.

That said, you will need to consider a variety of factors to work out whether mining can be profitable for you. Some of these are briefly outlined below:

- Hardware acquisition costs and maintenance costs

- Competition

- Estimated rewards per hashrate

In countries with high electricity costs, mining is generally non-viable. But if you have access to cheap electricity and/or are able to set up a rather sizeable mining operation, then cryptocurrency mining can still be profitable in 2022.

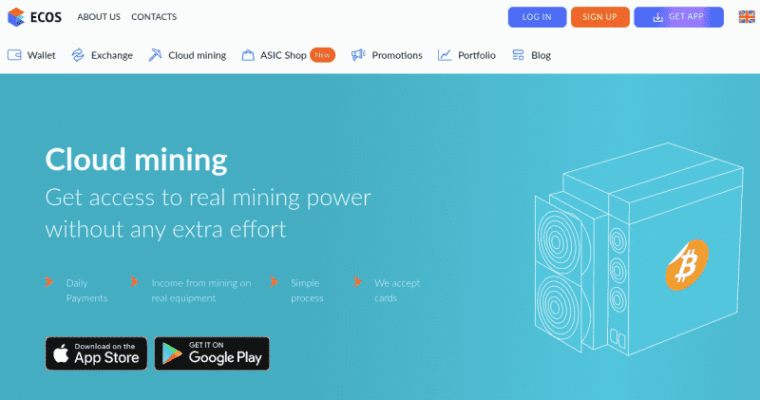

Bitcoin is currently the best blockchain cryptocurrency for beginners just getting started with mining, due to the wide availability of Bitcoin ASIC miners. There are also options for those that don’t want to maintain their own mining hardware — including cloud mining services like ECOS and Play-to-Earn games like Nova MiningVerse.

10. Take Part in IDOs

Initial DEX offerings (IDOs) are a relatively new crowdfunding system that allows regular people, including beginner investors, to purchase tokens in new projects at the best possible price before they list on an exchange.

Promising new projects can sell their tokens to the community through a decentralized exchange platform. These often have few to no barriers to entry, allowing practically anybody to take part.

In most cases, projects will be hand selected by the IDO launch partner, whether that be a decentralized exchange like PancakeSwap or a dedicated IDO launchpad like DAO Maker. These platforms typically do extensive fundamental research and risk analyses before hosting an IDO — ensuring the best Blockchain crypto investments are made available to their respective communities.

Some of the larger projects, including Tamadoge, opt to host their own IDO via their website.

Take a closer look at some of the hottest IDOs in our guide on the best crypto IDOs for 2023.

For those first getting to grips with how to invest in blockchain, IDOs are an incredibly attractive proposition, and some of the best performing cryptocurrencies of all time conducted an IDO sale before launch. This includes heavy hitters like My Neighbor Alice (ALICE), XCAD Network (XCAD), and more recently — Battle Infinity.

11. Become a Liquidity Provider

Over the last two years, the decentralized finance (DeFi) landscape has exploded in popularity, and there are now hundreds of DeFi apps and platforms spread across more than a dozen blockchains.

Many of these platforms allow users to take on the role of liquidity providers (or LPs) and earn rewards by doing so.

As the name suggests, liquidity providers provide liquidity to a platform or protocol. This liquidity is then used to facilitate the operation of the platform and liquidity providers receive a fraction of the platform’s revenue in return.

Popular decentralized exchanges like Uniswap, PancakeSwap, and DeFi Swap allow users to contribute liquidity to a range of pools, earning a fraction of any fees it generates through trades.

We recently covered the best decentralized exchanges, click here to read more!

Given that DEX trading fees can range from 0.1% per trade upward, sometimes with significant trading volume, it’s easy to see how trading fees (and hence yields) can quickly rack up.

If you’re asking yourself, “what is the best blockchain to invest in?”, consider checking out the DEX landscape before making your decision. Popular, feature-packed DEXes with good revenue-share options generally promote a healthy DeFi ecosystem — boding well for the associated blockchain and its liquidity providers.

Is Blockchain a Good Investment?

In many cases, absolutely. But as with all investments, you need to do your research and due diligence before deciding on the best blockchain projects to invest in — after all, not all projects are built equal.

Whether you’re looking at how to invest in the best gaming cryptos , utility tokens, yield farms, mining, web3 or something else, your success will always boil down to how well you manage your risk and consistently pick winners.

Luckily, there are a handful of strategies you can employ to outperform the market, these include:

1. Follow the money

You don’t always have to be first to win. By following in the footsteps of the ‘smart money’ you can often spot strong picks before others. Likewise, increasing volume and other indicators can indicate strength. Another popular option is to follow the crowd on online discussion forums such as Reddit. Some investors have even started looking for guides on how to invest according to Reddit.

2. Buy undervalued assets

Sometimes assets are fundamentally strong but overvalued. Instead, keep an eye on fundamentally strong but undervalued assets. These present a more attractive risk-to-reward ratio and can have better growth potential.

3. Consider all time horizons

Many cryptocurrency investors mistakenly believe that long-term investments are the only way to succeed. The truth is, a well-balanced portfolio typically includes short, medium, and long-term positions.

How to Invest in Blockchain – TAMA tutorial

Having gathered considerable hype and momentum, Tamadoge is quickly gaining recognition as one of the most promising projects of 2022.

The project recently completed its beta sale, raising an impressive $2 million as users scrambled to take part in the limited-time raise.

Now, Tamadoge is conducting its long-awaited pre-sale. But you’ll need to act quickly if you want to secure your TAMA before the public listing. As of writing, the sale is almost complete.

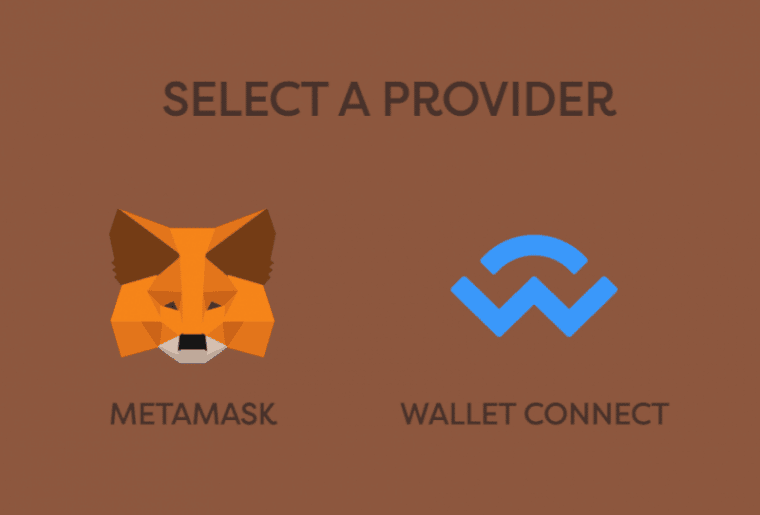

If you want to take part, you will be able to buy TAMA using ETH or USDT directly from your MetaMask or Trust Wallet.

Here’s how to take part using ETH:

Step 1: Connect Crypto Wallet

Head over to the Tamadoge pre-sale page. Here, click the ‘Connect Wallet’ option, select your wallet, and click connect when prompted.

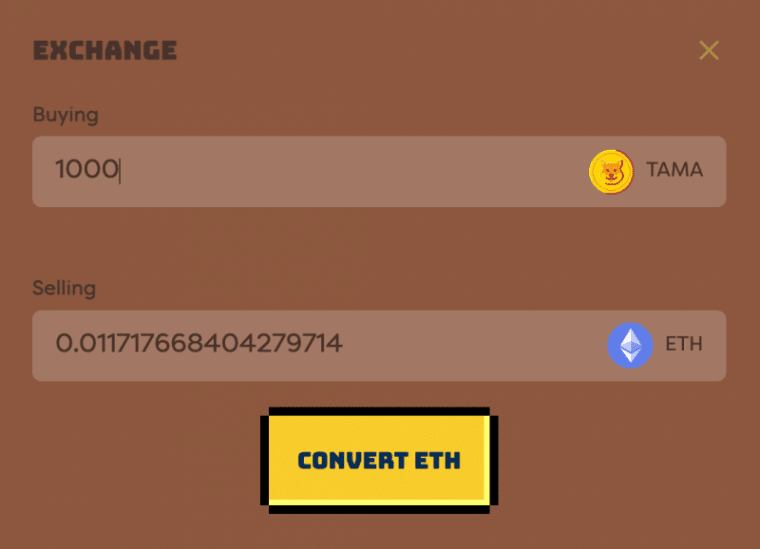

Step 2: Buy TAMA with ETH

Once connected, select the ‘Buy Tamadoge with ETH’ button and enter the amount of TAMA you wish to buy — bearing in mind there is a minimum purchase of 1,000 TAMA.

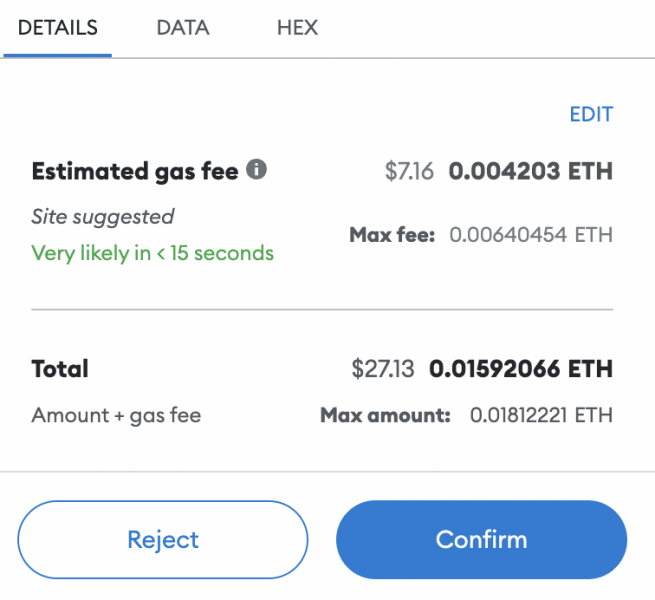

The exchange tool will calculate the equivalent amount of ETH. This is the amount of ETH you will need in your wallet to complete the swap (plus slightly more to pay for the transaction fee).

Note: If you don’t have any ETH, you can top up your wallet with ETH using bank transfer, debit card, Apple pay, and other payment methods via the ‘Buy ETH with card’ option.

Step 3: Convert ETH

When you are happy with the amount, click ‘Convert ETH’. This will open a transaction prompt on your connected wallet. Confirm the transaction to complete your purchase.

Step 4: Claim Your TAMA Tokens

Once Tamadoge completes its token generation event (TGE), you will be able to head over to its homepage and click the ‘Claim’ button. This will open a portal that will allow you to claim your purchased tokens.

Stay tuned to Tamadoge’s Telegram group for all the latest information about its TGE and listing date.

Conclusion

The blockchain industry has come a long way since its early days. Once relatively inaccessible and obscure, it is now a booming ecosystem of assets, products, and services that can be accessed by practically anybody with little effort.

We’ve covered some of the best ways to gain exposure to the growth of this burgeoning industry. But if we had to narrow it down to just one option, then IMPT takes the prize — the hype and scope of the project simply make it a no-brainer for investors.

After already collecting nearly $4 million in the first presale round, IMPT is looking to raise $10.8 million by the end of the first presale stage. This Carbon Offsetting program is selling IMPT tokens for only $0.018.

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st

FAQs

Can you invest in Blockchain?

Is buying blockchain a good investment?

How do I start investing in blockchain?

What blockchain is best to invest in?

What is the best way to invest in Blockchain?

What is the best Blockchain crypto investment?

References

- https://www.pwc.com/us/en/industries/financial-services/fintech/bitcoin-blockchain-cryptocurrency.html

- https://www.ibm.com/topics/what-is-blockchain

- https://www.coinbase.com/learn/crypto-basics/what-is-mining