The average retail investor believes that the best time to buy an asset is when it starts trading on major exchanges. But the smart money knows that most of the returns will be earned if the asset is bought before the initial public offering (IPO). Not many investors know the right strategy of how to invest in pre-IPO, but it can provide significant returns.

Investors wanting an upper hand over the rest of the market need to know how to buy pre IPO stock. This guide details how to invest in pre IPO companies, potential benefits and an alternative presale asset that could prove to be profitable.

How to Invest in Pre-IPOs – 4 Easy Steps

Buying pre-IPOs requires investors to follow 4 easy steps.

- ✅ Step 1: Open an Account with a Regulated Pre-IPO Broker – The first thing that investors need to do is visit the website or a regulated broker and open an account.

- 🔎 Step 2: Verify Accreditation Status – A regulated broker will require investors to verify their status as accredited investors before being able to access the platform.

- 💳 Step 3: Deposit Funds – After completing investment documents, investors need to fund their accounts, usually via ACH transfer or wire.

- 🛒 Step 4: Buy Pre-IPOs – Choose the desired assets to buy and then track and manage the investment portfolio.

Where to Invest in Pre-IPOs

A platform that makes pre IPO investing possible is EquityZen. It provides a marketplace for investors and shareholders. Investors can apply to buy shares in companies that may IPO, and shareholders can use it to sell shares.

EquityZen is home to more than 280,000 investors and shareholders who use this trading platform to trade shares of more than 400 companies. Investors wanting to buy pre IPO investments will first need to verify their status as accredited investors before searching for stocks.

If a company IPOs, EquityZen distributes shares or the cash proceeds to investors. It’s important to note that not all the companies on this platform will go public and even if they do, it doesn’t mean that they will be successful.

EquityZen enables investors to invest in SpaceX pre IPO, Uniswap, Rivian, Chyme and ByteDance, just to name a few. A key advantage of opting for this platform over others is that its proprietary technology enables lower minimums for investors and shareholders. Only $10,000 is required.

The fees applicable to investments are tiered and charged as a one-time sales fee. Investments of up to $500,000 are charged at 5%. From $500,000 to $1 million, the charge is 4%. And above $1 million, fees are 3% of the investment.

Making a purchase on this platform means that an investor has bought ownership in an EquityZen fund that owns shares in single or multi-company funds.

How Does Investing in Pre-IPOs Work?

Knowing the mechanics of how pre-IPOs work will help investors avoid pre-IPO investment scams and also choose the best pre IPO investment platform.

Raising Funds

One of the main reasons that companies offer shares in their companies before going public is to raise funds. Having an IPO doesn’t guarantee that a company will achieve its desired funding because markets are influenced by various factors.

A key advantage of offering pre IPO investments is that shares aren’t subject to market-related fluctuations. Companies can sell a high volume of shares to investors, and they stand a better chance of reaching their funding objectives than risking it only on IPOs.

High Entry Barriers

Retail investors can use pre IPO investing platforms to buy shares. The only problem with some platforms is that they require high funding to participate. So pre IPOs are usually restricted to high-net-worth individuals or institutional investors.

The SEC enables only accredited investors to access private offerings in the US. That means individuals with a certain net worth and proven market experience qualify.

Price of Pre IPO Shares

A key component of knowing how to buy an IPO before it goes public is the expected price per share. Companies listing shares pre IPO want to entice investors to buy into their project, so they reduce share prices to make them appealing.

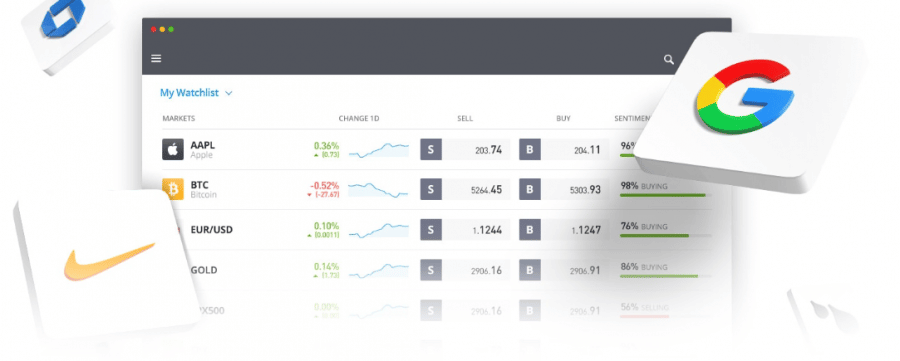

Coinbase Price Chart courtesy of TradingView

The problem with the prices of pre IPO stocks is that there’s no way of knowing how much the market is prepared to pay for them when the company goes public. Because of this uncertainty, companies offer their shares at discounted prices.

But further restrictions are placed on investors wanting to buy pre IPO shares. Companies don’t want these private buyers to immediately sell their shares when they IPO because it could cause the price to plummet.

To prevent that, companies offering pre IPO shares enforce a lock-in period. That means private buyers aren’t able to sell their shares in the short term.

Risks

One of the key reasons that investors prefer to buy pre IPO securities is because of the potentially high returns that investors can make. Profits aren’t guaranteed, so just because an investor has purchased pre IPO assets, it doesn’t mean that the stock will provide great returns.

A company may close down before it IPOs or the initial offering may be unsuccessful. As with any investment, investors should practice caution. Investors feeling uncertain about investing in pre IPOs can opt for a more secure option and search for the best upcoming IPOs.

How to Find the Best Pre-IPOs to Invest in

One of the reasons that retail investors don’t buy pre IPO securities is because they don’t know about them. The private sales are restricted to individuals with a lot of money or only institutional investors are invited.

Several pre IPO platforms have changed the game, as they’ve enabled retail investors to get involved.

Regulated Pre IPO Brokers

EquityZen is one example of a regulated broker that has provided a platform for accredited investors to be invited to early-round funding. Several platforms such as EquityZen provide a marketplace for investors and shareholders. But investors need to be cautious and ensure they buy stocks with a regulated broker.

Image courtesy of eToro

Investors should do background checks on pre IPO brokers by looking at client reviews to gauge customers’ experience. Another important check would be the number of companies a platform offers and the total volume of transactions completed. A large number of investments closed gives investors an indication of the number of clients that have used the platform.

Buy Directly from Companies

Buying shares, whether pre IPO or during, needs to be conducted through a regulated broker. But investors may possibly get access to cheap stocks if they get involved with the company as an angel investor or a venture capitalist.

Both options entail becoming a shareholder, but angel investors may also have a say in the way that the business operates. Being involved in the early-round funding puts the investor at a huge advantage over the rest of the market, and high capital appreciation is possible if the venture is successful.

Do Market Research

Networking is a powerful investing tool that may produce high returns. Connecting with the right people who know how to invest in pre IPO stocks is a game changer but finding them can be challenging. One way to track them down is by contacting banks, investment institutions and accounting firms.

If they don’t know any stocks that are in the pre-IPO stage, they might be able to put investors in touch with the right people. Investors can also attend company presentations or start-up pitch events. Being surrounded by people within the IPO industry is crucial to finding the right investments at the right time.

Crowdfunding platforms send out newsletters, notifying subscribers about companies seeking funding. Make sure to subscribe to those newsletters.

5 Best Pre-IPOs to Invest in Right Now

After discovering how to invest in pre IPO shares, investors want to know what pre IPOs to invest in. That depends on each investor’s goals, but we can provide some guidance by analyzing popular companies that have tremendous potential.

1. SpaceX

The company was founded by Elon Musk in 2002 and is a spacecraft manufacturer and a satellite communications provider, with the goal of enabling the colonization of Mars. SpaceX has contracts with the US government and aims to land NASA astronauts on the moon.

SpaceX shares are available for purchase on several regulated broker platforms, and EquityZen is one of them. So far, the total funding of SpaceX is $6.7 billion. Tesla Inc, an electric car company headed by Musk, provided investors with more than 1,600% returns when the stock rallied after the global lockdowns.

Is it possible that SpaceX also provides investors with tremendous returns if it IPOs?

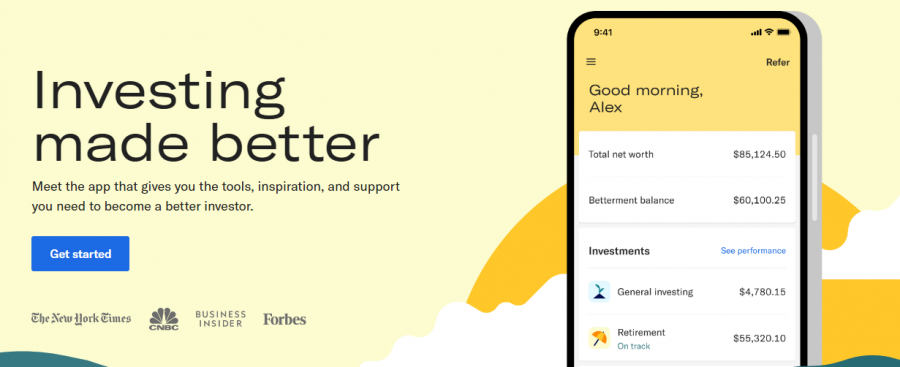

2. Betterment

Betterment is a mobile app that helps users become better investors. Users can deposit as little as $10 to start investing in assets suitable for their goals. The app helps users manage money by offering retirement planning solutions, guided investing and cash management.

This app enables investors to get automated and optimized tax strategies from investing in Betterment’s portfolios, consisting of exchange-traded funds (ETFs). Read our guide about how to trade ETFs.

Betterment has simplified investing and even its fees. Investors pay only one set fee, which is 0.25% annually.

This company has done exceptionally well with funding rounds. It raised $60 million in September 2021, bringing the total funding to $337 million.

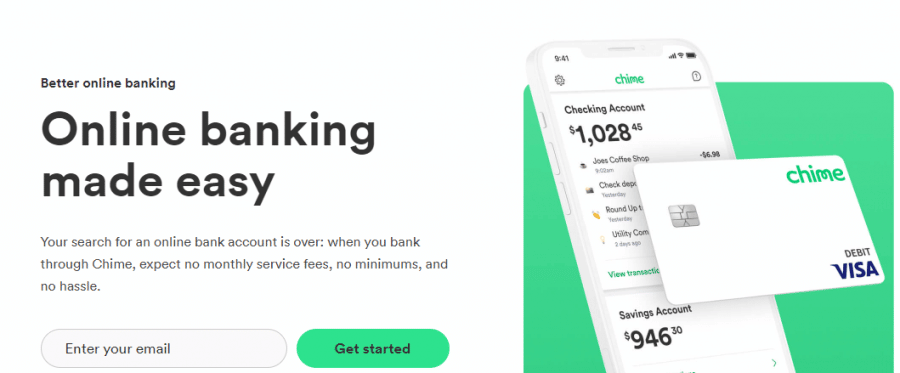

3. Chime

Founded back in 2012, Chime is a financial technology company offering fee-free mobile banking. The company’s model is to provide helpful, easy and free banking services to users while partnering with regional banks to design member-first financial products.

By doing so, Chime strives to create a competitive market that offers lower-cost options for average Americans not receiving high-quality banking services. Not all of the companies that may soon IPO offer presale shares, but Chime is available on EquityZen.

The total funding to date for Chime is $2.9 billion. Perhaps one of the reasons that investors are flocking to this project is that it offers users several benefits. Its banking app is convenient to use, yet its monthly account fees aren’t charged and it offers a fee-free overdraft of up to $200.

Some of the other benefits for members are being paid two days earlier with a direct deposit and depositing checks from anywhere with a snap photo.

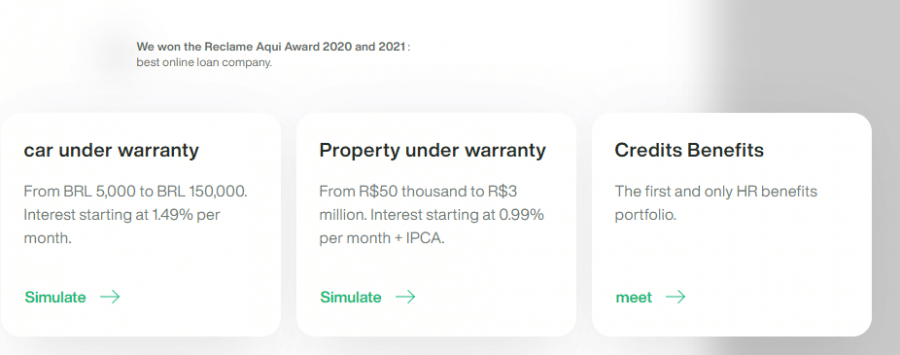

4. Creditas

Another company offering pre IPO shares is Creditas. It’s headquartered in Brazil and has been operational since 2012. It operates a digital platform that offers secured consumer loans. Creditas enables clients to use their assets such as cars, apartments or salaries as collateral to obtain a loan payable within 240 months.

One of the reasons that Creditas has attracted customers is that its interest rates are highly competitive. This fintech company has been extremely successful at early-round funding. The total funding for Creditas to date is $854 million. Its last round of funding concluded in January 2022, and Creditas managed to raise $260 million.

Creditas also provides corporate benefits such as payroll loans, hr materials and salary advances, to name a few. But its core focus is supplying car financing, property refinancing and other loans to individuals.

5. Avant

Since finding its roots in Chicago in 2012, Avant has blossomed into an online marketplace offering access to personal loans to consolidate medical expenses, debt and even vacations. The company uses big data and algorithms to streamline credit options.

Its services are available to US and UK Clients. This credit provider also offers emergency loans and a credit card to help customers pay unexpected bills. The loans offered usually range from $2,000 to $35,000, with an annual percentage rate (APR) from 9% to 35%.

Avant has held several funding rounds, and the company raised $325 million in the last round, held in September 2015. So far, Avant has raised $1.6 billion.

Stocks to IPO Soon

Knowing how to invest in pre IPO companies enables investors to invest early in an asset. The issue with pre IPO assets is that it’s not guaranteed to IPO. But what if investors were guaranteed that a popular stock would IPO? Although the share price might be higher than when it was in the pre IPO stage, a stock with a pending listing provides investors with a certain level of security.

Steinway

Investing in a company with a long history reduces investment risk, and Steinway falls into that category. Steinway’s piano manufacturing dates back to 1853, and its motto was to provide the music industry with the best-built pianos. The company has become one of the most powerful musical instrument companies.

Its financials have been solid, with 2021 figures revealing an increase in revenue of 29% and an improvement in net income of 14.5% to $59.3 million.

Steinway has ensured that it manufactures top-quality instruments and has dedicated itself to it by investing in innovation. It has incorporated technology backed by 18 patents in some pianos and enabled them to stream performances.

Once a stock IPOs, investors should consider using a regulated broker offering low trading fees to buy stocks.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Are Pre-IPOs a Good Investment?

Before investors think about which pre IPO investing app to use, they should consider if pre IPOs provide more risk than rewards.

Receive Potentially High Returns

Companies offering pre IPO shares entice investors with discounted share prices. That usually means pre IPO investors receive much better pricing than the rest of the market when it trades publicly.

The potential returns investors can make are significantly higher than buying when it IPOs. The other end of the spectrum is the risk, which is a pre IPO never being listed on exchanges. Investors also need to consider that option, as SpaceX is a popular pre IPO stock, but the company was founded in 2002 and still has not been listed.

Lock-in Period

Another factor investors need to consider about pre IPO stocks is the lock-in period. Companies don’t want investors who bought during the private sale to dump their stocks during the IPO. For that reason, they implement a lock-in period, preventing private investors from selling their shares.

Although pre IPO investors may have received better share prices during the early-round funding, they might not make the returns they hoped for because of the lock-in period. Most lock-in periods are short-term, but it’s vital that investors know the duration. Several popular companies had successful IPOs, but their stock prices plummeted in the subsequent weeks.

Adequate Funds

The reason most retail investors aren’t invited to early-round funding is that companies tend to sell large blocks of shares to raise money. It’s usually only high-net-worth individuals and institutional investors that have the adequate funds to partake.

Although it has become easier for retail investors to partake in pre IPOs, the barrier to entry is still high. They have to be accredited investors, possess market experience and have several thousand dollars to invest.

Pre-IPO vs Presale Cryptos – Which is the Better Investment in 2023?

Some people are wondering how to invest in pre IPO companies with just $50. Using only $50 to buy pre IPO shares is almost impossible due to high deposits requested by brokers. The good news is that investors need even less than that to get in on one of the best crypto presales.

We discovered IMPT, a new cryptocurrency project that is enabling individuals and companies to offset their carbon footprint. After connecting with thousands of brands and retailers that are partnered with IMP, buyers can access Carbon Credits by shopping on the IMPT shopping platform.

Carbon Credits take the form of permits – which represent an amount of CO2 emissions to be removed from the atmosphere. They are usually created by certified climate action projects that aim to reduce emissions. The businesses pledge a part of their sales margin to be used towards one of these programs. Whenever a user purchases products with the partnered companies, they receive the sales margin as IMPT tokens.

The tokens can be used to purchase Carbon Credits on IMPT – which are minted as individual NFTs. The Carbon Credits can be traded or burnt – which will nullify their existence from the decentralized ledgers they are stored on. Investors are rewarded for burning the Carbon Credits with new NFTs – which gives them shared ownership over the asset. Thus, investors can access one of the best carbon credit brokers and trade cryptocurrencies simultaneously.

Currently, IMPT is available to buy on presale for just $0.018 per token. With a maximum supply of 3 billion, 600 million coins have been listed during the first presale stage. You can purchase these assets before the price increases to $0.023 by the beginning of the second presale stage.

Conclusion

Instead of thinking about how to buy pre IPO Rivian stock, investors might want to consider a presale asset that has already raised millions of dollars. One of the top cryptocurrency presales to consider is IMPT – a new project aiming to reduce carbon emissions from the environment.

IMPT is available to purchase in its ongoing presale round for only $0.018 per token.

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st

FAQ

Can you buy pre IPO stocks?

Is it smart to invest pre-IPO?

Can you buy into a company pre-IPO?

Who can invest in pre-IPO companies?

Where can I find pre-IPO companies?

Can I sell pre-IPO stocks?

References

- https://www.beauhurst.com/blog/ipo-watchlist/

- https://www.sec.gov/smallbusiness/goingpublic