Commodities like oil, natural gas, and gold provide a great way to hedge your portfolio against the traditional stock markets. This investment scene is also suitable for short-term trading strategies due to its volatility and speculative nature.

In this beginner’s guide, we explain the ins and outs of how to trade commodities online. We also discuss the best online brokers to access this marketplace and which commodity trading strategies to be aware of before proceeding.

How to Trade Commodities – 5 Quick Steps

If you’re looking to learn how to trade commodities right now from the comfort of home – follow the simple 5-step walkthrough outlined below:

- ✅Step 1 – Choose a Commodity Trading Platform: You will first need to choose an online broker that enables you to trade commodities. eToro is the best platform for this purpose due to its large suite of commodity markets, low fees, and small account minimums. You can open an account with eToro in under two minutes by entering some personal information.

- 💳Step 2 – Deposit Funds: The minimum deposit required by eToro to start trading commodities is just $10 if you’re a US client. No deposit fees are charged on USD payments and you can fund your account with a bank wire, debit/credit card, ACH, or PayPal. Other payment types are supported.

- 📖Step 3 – Research the Market: Commodities are often volatile in nature so before you place a trade – be sure to research the respective market. You’ll need to consider fundamental research methods surrounding demand and supply, geopolitical events, broader economic indicators, and more.

- 🔎Step 4 – Choose Which Commodity to Trade: When you are ready to start trading commodities, use the eToro search bar to find your chosen market. Click on the ‘Trade’ button to populate an order box.

- 🛒Step 5 – Trade Commodities: Now you will need to enter the amount of money that you wish to invest in the respective commodity market. Click on the ‘Open Trade’ button to place your order.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Commodity trading is a lot more complex than simply buying stocks. As such, we would suggest that you read this beginner’s guide on how to trade commodities before you proceed.

Where to Trade Commodities – Top Commodity Brokers Reviewed

While finding a place to buy stocks is super easy, not as many online brokers offer support for commodities.

Even if your chosen platform or stock app does offer commodity markets, you need to explore the type of financial instrument that this is represented by – such as futures, options, or ETFs.

You also need to assess what fees apply when you trade commodities and what account minimums apply.

The process of deciding on where to trade commodities can be complicated – so in the sections below, you will find a list of pre-vetted brokers that stand out in this marketplace.

1. eToro – Overall Best Platform to Trade Commodities

US clients can also gain exposure to most commodity markets via relevant stocks. All commodity ETFs and stocks available on the eToro platform can be traded at 0% commission alongside tight spreads. Furthermore, the minimum investment per trade is a very affordable $10.

If you decide to diversify into commodity stocks or ETFs that are listed overseas, you will still benefit from eToro’s 0% commission policy. If you’re based outside of the US, eToro enables you to trade commodity spot markets and futures via CFD instruments. CFDs at eToro can also be traded with leverage and even short-sold.

Once you have selected a commodity trader with a proven track record, you can then elect to copy their investments into your own portfolio. This requires a minimum outlay of just $200 and no additional fees are charged. You can also access smart portfolios on the eToro website – which are managed and rebalanced on your behalf.

In addition to stocks, ETFs, and commodity-centric markets, eToro also allows you to buy cryptocurrency with low fees. Dozens of digital assets are supported – which includes the likes of Bitcoin, Dogecoin, Ethereum, BNB, Shiba Inu, and Solana. When you trade cryptocurrency here – your tokens will be safely stored in your eToro crypto wallet.

In terms of opening an account with eToro, this will require some basic personal information and the process should take you no more than a few minutes. US and UK clients are required to deposit just $10 while for other nationalities this stands at $50. Payments made in US dollars do not attract a deposit fee.

Ever wondered how to invest $1000 in 2023. eToro supports a wide range of financial assets for you to build a diversified portfolio. You can complete the registration, deposit, and trading processes online or via the eToro app for iOS and Android. eToro is now used by over 25 million traders from the US and beyond and the platform is approved and regulated by several tier-one licensing bodies. This is inclusive of the FCA, CySEC, and ASIC.

| Types of Commodity Markets | Commodity-centric stocks and ETFs, CFDs (non-US clients) |

| Trading Commission | 0% commission on commodity ETFs and stocks |

| Debit Card Fee | FREE for US deposits |

| Minimum Deposit | $10 |

What We Like

- Heavily regulated

- Super low trading commissions

- Fee-free US dollar deposits

- Deposit funds with a debit/credit card, e-wallet, or bank transfer

- Copy-trading tools

- Best app to trade commodities

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull - Buy and Sell Commodity Stocks and ETFs at 0% Commission

Moreover, a minimum trading requirement of just $5 is required. This is apart from digital currencies - which require a minimum trade of just $1. Webull also gives you access to stock options. This means that you can trade the future value of commodity-centric stocks without taking ownership upfront.

In turn, this will give you access to a much larger amount of trading capital. Another benefit of using Webull for your commodity trading needs is that the platform offers advanced charting tools. This is inclusive of technical and economical indicators and fully customizable pricing screens.

The Webull trading app is also popular in the US for its simple and optimized interface for both iOS and Android smartphones. To get started with a Webull account today, you can deposit funds via ACH fee-free. Bank wires are charged at $8 and $25 for deposits and withdrawals respectively. Nonetheless, no minimum deposit requirement is stipulated by Webull.

Read our eToro vs Webull comparison to evaluate which commodity trading platform is right for you.

| Types of Commodity Markets | Commodity-centric stocks, ETFs, and options |

| Trading Commission | 0% commission on all markets |

| Debit Card Fee | ACH (free) and bank wire ($8) deposits only |

| Minimum Deposit | $0 |

What We Like

- No minimum deposit

- Trade stocks and ETFs from $5

- Suitable for both beginners and experienced traders alike

Your capital is at risk.

3. Schwab - Access a Wide Range of Commodity Futures Markets

This is inclusive of trading gold, silver, oil, natural gas, corn, wheat, sugar, and more. When it comes to fees, Schwab charges from $2.25 for each futures contract that you trade. Minimum order sizes will depend on the respective commodities market and the type of account that you are on.

Schwab also has low margin requirements within its online commodity trading futures platform, which means that you can enter positions with a lot more than you have in available equity. The suite itself is packed with sophisticated technology and advanced tools - alongside commodity trading charts, profitability calculators, and economic indicators.

You will also find market insights in addition to educational materials. In addition to commodity mutual funds, Schwab also offers access to traditional stocks and ETFs, index funds, and much more. To open a standard self-directed account at Schwab, no minimum deposit is required.

| Types of Commodity Markets | Futures, options, and mutual funds |

| Trading Commission | From $2.25 per contract |

| Debit Card Fee | Not supported |

| Minimum Deposit | $0 on self-directed accounts |

What We Like

- Huge range of commodity futures and options

- Commodity-centric mutual funds also offered

- No minimum deposit on standard self-directed accounts

4. TD Ameritrade - Trade Hard and Soft Commodity Futures via an Advanced Platform

TD Ameritrade is another online broker that enables you to trade both hard and soft commodities via futures. If you're interested in gaining exposure to metals, TD Ameritrade offers everything from gold, silver, and copper to platinum, and palladium.

TD Ameritrade is also great in terms of trading energies, with the platform supporting futures markets on crude, WTI, and brent oil, as well as natural gas, RBOB gasoline, and heating oil. You can also access soft commodity trading markets like cocoa, coffee, cotton, orange juice, and sugar.

It is important to note that TD Ameritrade will only be suitable if you are an experienced commodity trader. Not only are many futures markets here settled in the physical commodity, but the thinkorswim trading suite is packed with complex tools and features. As such, this will appeal if you seek high-level fundamental and technical analysis indicators.

In terms of fees, TD Ameritrade follows a similar pricing model to the previously discussed Schwab, insofar that it offers futures at $2.25 per contract. You won't need to pay any routing or clearing fees, but exchange and regulatory charges will apply. Finally, TD Ameritrade accounts can take a few days to open, so bear this in mind if you are looking to trade commodities today.

| Types of Commodity Markets | Futures, options, and ETFs |

| Trading Commission | From $2.25 per contract |

| Debit Card Fee | Not supported |

| Minimum Deposit | $0 on self-directed accounts |

What We Like

- Trade hard and soft commodities via futures

- Commodity options trading and ETFs are also supported

- Competitive margin funding rates

5. Interactive Brokers - Global Commodity Trading Platform With Competitive Fees

Interactive Brokers is a popular trading platform that serves millions of clients from the US and beyond. This platform offers access to markets and exchanges in over 33 countries across 25 different currencies.

If you're looking to trade commodities here, you can do so through futures and options contracts. Some of the most traded commodities available on the Interactive Brokers platform include gold and silver, oil and natural gas, and plenty of agricultural products.

Fees are somewhat complex to understand at first grasp, as commissions depend on your chosen account type and the respective marketplace. Nonetheless, you can trade futures here from just $0.85 per contract - which is one of the most competitive rates that you will find in this space.

In a similar nature to TD Ameritrade, Interactive Brokers offers a highly advanced trading suite that will likely not appeal to beginners. Instead, this platform will only be suitable if you seek access to technical indicators, screeners, customizable charts, and real-time data feeds.

| Types of Commodity Markets | Futures, options, ETFs, mutual funds |

| Trading Commission | From $0.85 per contract |

| Debit Card Fee | Not supported |

| Minimum Deposit | $0 on self-directed accounts |

What We Like

- Trade futures from just $0.85 per contract

- Various commodity trading accounts to choose from

- Great reputation

Commodities Trading Explained - Overview

Commodity trading is a highly complex segment of the global investment industry. In its most basic form, the overarching concept is to speculate on the future value of a commodity like gold. If you predict its future price movement correctly, then you will make a profit.

The commodity trading industry is typically split into three segments across metals, energies, and agricultural products. This gives you plenty of options when it comes to finding suitable trading opportunities.

Although most commodities trade on a 24/7 basis, access to this marketplace will depend on the exchange that your chosen financial instrument is listed on.

Some of the most common ways to trade commodities online in the US are via futures and options. Non-US clients can access spot trading markets via leveraged CFDs. In terms of pricing, commodity valuations are driven by demand and supply just like traditional stocks and even cryptocurrencies.

However, the price action of commodities is heavily dictated by external factors surrounding geopolitical events and economic indicators. For example, due to increased tensions in Ukraine, oil prices continue to trade at record highs.

How Does Commodity Trading Work?

There is a lot to learn when understanding how to trade commodities - especially if this is your first time accessing this marketplace.

As such, this section of our guide will break down the key fundamentals of how commodity trading works that you need to be aware of before getting started.

Commodity Trading Markets

As noted above, commodity trading is split into three key markets - energies, metals, and agricultural products.

Examples of the most traded commodities from each marketplace are outlined below:

- Metals: Gold, silver, platinum, palladium.

- Energies: Oil, natural gas, heating oil

- Agricultural Products: Wheat, corn, sugar, coffee

Being able to trade commodities and make consistent profits along the way requires you to have an intimate understanding of the respective market.

As such, when learning how to trade commodities for the first time, it's best to focus on a specific asset - like oil.

This will enable you to have a firm grasp of what factors can influence the price of your preferred commodity and thus - enable you to approach the markets with your eyes wide open.

Commodity Trading: Stocks, ETFs, and Mutual Funds

You will also need to assess which financial instrument is best suited for your commodity trading skillset and financial goals.

Undoubtedly, if you are a complete beginner, then it's best to avoid complex financial derivatives like futures or options. Instead, consider starting off with stocks or ETFs that are specifically relevant to your chosen commodity market.

For example, if you want to take advantage of increasing global energy prices, you could add some of the best oil stocks to your investment portfolio. In fact, oil companies also represent some of the best dividend stocks in terms of yields.

Alternatively, if you want more correlation between your investment and that of the respective spot price of the commodity you wish to trade, then you might consider an ETF.

As a prime example, there are plenty of ETFs that are physically backed by silver bullion. As such, the price of the ETF will rise and fall in line with that of silver.

The other option you have is to invest in a mutual fund that tracks a specific commodity. Unlike an ETF, the mutual fund will actively buy and sell commodities with the view of outperforming the market.

Take note, if you're a beginner that wishes to trade commodities online via stocks or ETFs, you can do so at eToro without paying any commission and from a minimum investment of just $10.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Commodity Trading: Futures vs Options

If you have some prior experience in financial derivatives like futures and options, then this is another way that you can gain access to the global commodity markets.

For those unaware, both futures and options contracts enable you to speculate on the value of hard and soft commodities without you taking ownership upfront.

- This means that you can trade commodities on margin - meaning that you will have access to a lot more capital than you have in your brokerage account.

- For example, if you trade gold on 20% margin this means that a $10,000 stake would require an upfront capital outlay of just $2,000.

Moreover, futures and options allow you to choose from a long or short position. This means that you can attempt to profit from both rising and falling commodity prices.

In terms of the difference between futures and contracts, this centers on your financial obligations once the respective contract settles.

- When you trade commodity futures, you have a legal obligation to settle the contract once it expires. If you are trading futures that are physically settled and you fail to cash out before the expiry date - you will need to take delivery of the commodity.

- Options, on the other hand, do not require you to buy or sell the underlying contract at the point of expiry. This gives you much more flexibility - as if a commodity trade does not go to plan, you only lose the premium that you paid to execute the position.

As you can see, both futures and options can be extremely complex to understand as a complete beginner, which is why it is best to stick with stocks, ETFs, or mutual funds when gaining access to commodities for the first time.

Commodity CFDs

On the one hand, the most convenient way to trade commodities is via contracts-for-differences (CFDs). This is because CFDs simply mirror the value of the commodity spot prices in real-time, so it's just a case of predicting whether the market will rise or fall.

However, CFDs are prohibited in the US.

If, on the other hand, you are based in the UK, EU, Australia, or beyond - you can easily trade commodity CFDs at eToro at the click of a button.

The platform supports markets across dozens of energy, metal, and agricultural commodities and you can enter an order with a long or short position.

You can also trade commodity CFDs with leverage at eToro and overnight financing fees are both competitive and transparent.

Why Trade Commodities?

If you're not sure whether commodity trading is right for you - consider the main benefits that we discuss in the sections below.

Great for Short-Term Trading

Make no mistake about it - commodities are not suitable for long-term investments. On the contrary, commodities like oil and gold are highly volatile assets that operate in a cyclical market.

This means that commodities go through various cycles that can either be bullish or bearish. Whether prices go up or down will depend on external factors surrounding demand and supply, geopolitical events, and more.

With that said, if you have an interest in day or swing trading, then commodities are perhaps one of the best asset classes for this purpose. Crucially, there is never a dull moment in the commodity arena - so you will always have access to trading opportunities.

Hedge Against the Stock Markets

Another reason why you might decide to trade commodities is as a hedging strategy against the traditional stock markets. In fact, there is often a correlation between commodities like gold and that of the S&P 500.

For example, when the broader stock markets are down because of economic fears, the S&P 500 will see a decline. And in turn, investors will turn to gold as a way to hedge against this market downfall.

When it appears that the stock markets are ready to recover, gold will suffer as more capital is injected into equities. This is why during recessions - such as the 2008 financial crisis, gold was one of the best-performing asset classes.

More Suited for Fundamental Analysis

When you attempt to trade the short-to-medium term value of forex or cryptocurrencies, much of the focus is on technical analysis. For those interested in forex trading, our guide on the best forex signals may be of interest.

This means that you will be required to perform advanced chart and technical analysis - which can take a significant amount of time to master.

However, the price of commodities like oil and natural gas are dictated by external factors that are a lot easier to evaluate.

- For example, as we briefly noted earlier, increased tensions in Ukraine have resulted in financial sanctions on the Russian economy - which is one of the largest exporters of fossil fuels.

- This means that there is less supply of oil and natural gas available - which in turn, has resulted in record-high prices

As such, even if you are learning how to trade commodities online for the first time, you can give yourself the best chance possible of predicting the market simply by keeping abreast of global news developments. We cover this in more detail later in this guide.

Trade on Margin

In the vast majority of cases, your chosen commodity broker will enable you to trade on margin. This means that you are only required to put up a small percentage of the total trade value upfront.

This can be achieved when trading futures and options, and if you're based outside of the US - CFDs too.

Although trading commodities on margin allows you to amplify your potential gains, don't forget that this will also do the same to losing positions.

How to Make Money From Commodities Trading

In a nutshell, the main objective when learning how to trade commodities is to assess whether the price of the asset will rise or fall.

How you achieve this goal will depend on the financial instrument you opt for - such as futures, options, CFDs, stocks, or ETFs.

Nonetheless, here's a quick example of how you can make money from commodity trading:

- Let's say that you are trading commodities for the first time, so you decide to access this market via commission-free ETFs at eToro

- After performing some market research, you believe that gold is undervalued

- As such, you invest $2,000 into the SPDR Gold ETF - which is physically backed by gold bullion

- Your prediction was correct - an increased global demand for gold has resulted in the SPDR Gold ETF rising in value

- The SPDR Gold ETF has risen by 20% since you made the investment - so you decide to cash out

- On a stake of $2,000, your 20% profit amounts to gains of $400

It is important to note that when you invest in a secondary market to speculate on commodities - such as stocks or ETFs, the two instruments will never be correlated like-for-like.

For example, gold spot prices could rise by 25% while your chosen ETF might increase by just 20% over the same period.

Commodity Trading Hours

In order to trade commodities, you must enter a position on the exchange that the market is listed on. And as such, trading hours will ultimately depend on the respective exchange that you wish to access.

For example, oil futures can usually be traded 24 hours per day. But, depending on the exchange, certain restrictions might be in place. Moreover, trading hours can also depend on the commodity broker that you sign up with.

Commodity Price Movements

In its most basic form, commodity prices are based on demand and supply.

- When global demand for a commodity outweighs supply, prices will rise

- When global supply for a commodity outweighs demand, prices will fall

However, in order to determine what drives demand and supply, you need to dig deep into the fundamentals surrounding geopolitical and economic factors.

For example:

- The global supply of oil is largely dictated by the Organization of the Petroleum Exporting Countries (OPEC) - which has Saudi Arabia as its dominant decision-maker.

- If OPEC wishes to artificially raise global oil prices, it can collectively agree to reduce output.

- In turn, this will reduce the amount of supply in the market, and thus - prices will rise.

- On the other hand, if OPEC wishes to artificially reduce oil prices to fend off competition from the US or Iran, it can collectively agree to increase output levels.

The above example is just one of many. The most important thing to remember when learning how to trade oil commodities is that demand and supply will drive prices, which in turn, are determined by external factors.

You can attempt to predict future commodity price movements by keeping abreast of relevant news stories and developments surrounding your preferred asset.

What are the Best Commodities to Trade?

No two commodities are the same when it comes to pricing cycles alongside demand and supply. As such, you will need to do some homework regarding the best commodities to trade for your skillset and objectives.

If you need some inspiration, you might want to consider trading the following commodity markets.

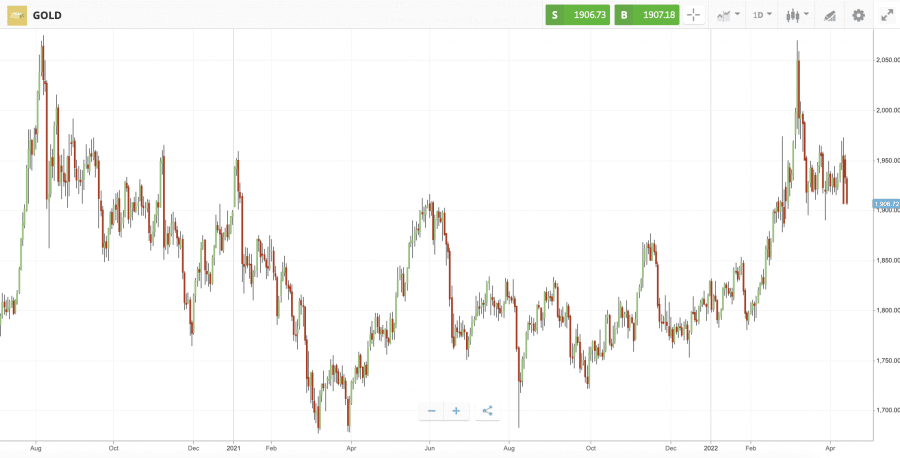

Gold

Gold is perhaps the overall best commodity to trade for a number of reasons. First and foremost, in terms of trading volume, gold attracts significantly more action than any other commodity in this marketplace.

As such, you will benefit from competitive trading fees and spreads, as a good number of instruments to choose from. The latter is inclusive of gold stocks, ETFs, mutual funds, futures, and options.

Another thing to note about gold is that prices are less reliant on geopolitical events. Instead, gold has a strong correlation to the stock markets.

Therefore, keeping an eye on how the S&P 500 and other major indices are performing will give you a great chance of predicting whether gold is likely to rise or fall in value.

Oil

Oil is the most demanded commodity globally from a consumer perspective, so it makes sense that it's also a great asset class to trade.

- As we mentioned earlier, oil prices are determined by demand and supply - which oftentimes, is manipulated by OPEC.

- Moreover, rising tensions in the Middle East or economic sanctions on major oil-producing countries like Russia and Iran can result in increased oil prices.

The easiest way to trade oil in the US is via an ETF like the United States Oil Fund. Alternatively, if you have some background experience with financial derivatives, oil futures and options are worth considering.

Copper

Copper is a major component used in electrical goods such as TVs, radios, home heating systems, and air conditioners. As such, demand for oil on a global basis is often high.

However, the value of copper is often determined by the strength or weakness of major importing nations. That is to say, when major importers of copper have a strong economy, this will result in higher demand for copper, and thus - global prices will increase.

The two best routes to trade copper are via a suitable ETF or by purchasing stocks in a company that mines the commodity.

Sugar

If you've got an interest in trading soft commodities, it's worth exploring sugar. Leading brokerage firm eToro notes that global sugar prices are up 10% over the prior year.

This is largely due to global supply issues that have made it harder to export the commodity and subsequently meet demand requirements.

Unlike gold and oil, finding a suitable sugar market is a lot more difficult. If you're based outside of the US, you can trade sugar CFDs at eToro. US clients might consider an ETF like the Teucrium Sugar Fund.

Natural Gas

In a similar nature to oil, natural gas is one of the most volatile commodities to trade. Moreover, natural gas prices are also largely dictated by geopolitical events.

With many western governments announcing that they will be banning or reducing natural gas imports from Russia due to its invasion of Ukraine, this commodity has since seen a major pricing rally.

Best Commodity Trading Strategies?

If this is your first time learning how to trade commodities futures, then you will likely know that this investment sphere can be complex to understand. This is why it's best to approach this market with a clear trading strategy in mind.

Below, we discuss the best commodity trading strategies to consider before getting started.

Geopolitical Analysis

The most effective way to trade commodities is by spending ample time researching the markets. More specifically, it's important to dedicate time to keeping abreast with key news and developments surrounding geopolitical events.

This will give you the best chance possible of assessing whether a commodity is likely to rise or fall in value - at least in the short term.

- For example, when Donald Trump announced in 2018 that the US would abandon a nuclear deal with Iran, this resulted in oil hitting its highest price since 2014.

- This would mean that Iran would struggle to export its oil to western economies.

- As Iran is a major oil exporter, this would result in global supply issues, and thus - the price of the commodity increased.

The best way to approach new geopolitical developments is to assess how the news will impact demand and supply. This will then allow you to place an appropriate order with your broker.

Output Figures and Stockpiles

Another strategy that will allow you to trade commodities effectively is to keep tabs on publicly released output figures and stockpiles.

The former refers to the amount of production achieved over a specific timeframe. For example, the number of tonnes that a major oil mining company reports for the month.

Stockpiles refer to the amount of a commodity that is held by a government or large corporation. For instance, although China does not release its gold stockpiles regularly, when it does, this can have a major impact on the value of the precious metal.

This is because if major economies begin to stockpile a commodity like gold, then this illustrates that the asset is in high demand on a global scale. In turn, the value of gold will likely increase.

There are many economic calendars that allow you to keep tabs on key commodity output and stockpile announcements.

Day Trading Commodities

You might also consider taking a day trading strategy when buying and selling commodities. The main objective here is to spot short-term trading opportunities throughout the day.

You will look to enter a buy or sell position and then close it a few hours or even minutes later. If successful, you will make small but frequent gains.

Day trading - although somewhat complex at first glance, can actually be approached in a risk-averse manner. This is because you can set stop-loss orders on all positions - which will ensure that you will never lose more than you had hoped.

Look for Support and Resistance Levels

Experienced commodity traders will look for notable support and resistance levels.

- For those unaware, a support level is a specific price that a commodity attracts interest from investors.

- This means that if the commodity is going through a short-term downward price movement, the support level will ensure that its valuation does not continue to decline.

- Resistance levels represent a price that prevents a commodity from going any higher due to increased short-sellers.

Ultimately, if you can identify verifiable support and resistance levels, this will allow you to enter suitable positions to profit from this trend.

Learn Technical Analysis

In addition to performing regular fundamental research, it is also a good idea to learn the art of technical analysis. This simply refers to the process of analyzing the pricing chart of a commodity over both the short and long-term.

There are dozens of technical indicators that enable you to evaluate factors surrounding volume, support and resistance, volatility, and more. You can then make informed decisions on which way the commodity is likely to move in the near future.

Is Commodities Trading Safe?

Commodity trading is a heavily regulated industry. In the US, for instance, this trading space is regulated by the Commodity Futures Trading Commission (CFTC).

This means that brokers offering access to commodity trading markets must abide by a range of regulations and investor protections.

As such, when choosing a broker to trade commodities online, ensure that it is adequately regulated. eToro, for example, is approved to operate in the US and it holds regulatory licenses with ASIC, CySEC, and the FCA.

Another thing to remember is that unless you are experienced, you should probably avoid trading commodity futures that are physically settled.

This is because holding onto a futures contract when it expires could mean that you are legally required to take delivery of the commodity. This is what sent WTI oil futures into negative territory in 2020.

Ultimately, newbies should consider that the best way to trade commodities online is via relevant stocks or ETFs that offer exposure to your chosen asset.

How to Trade Commodities - eToro Tutorial

Understanding how to start commodity trading doesn't have to be difficult when you use a beginner-friendly broker like eToro.

To place your first commodity trade in less than five minutes - follows the step-by-step tutorial below.

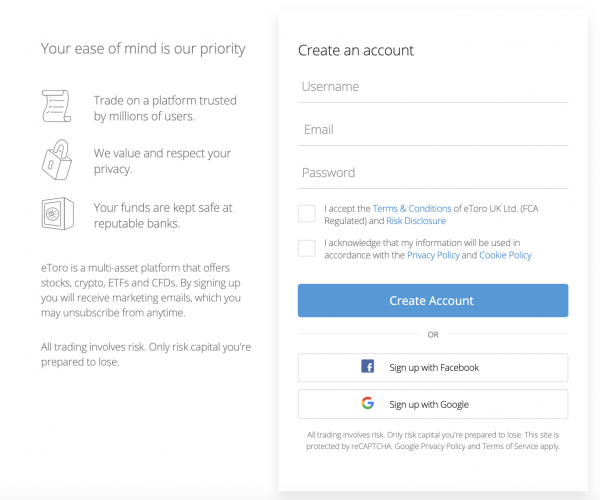

Step 1: Open an eToro Account

Visit the eToro website to register a trading account. In addition to your name and contact details, you will need to choose a username and password.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Next, you will need to get your account verified so that you can start trading commodities straightaway. For this, you will need to upload two documents. First, eToro needs a clear copy of your government-issued ID.

Second, you'll need to upload a proof of address issued within the prior three months. Plenty of documents are supported albeit most people opt for a digital bank statement.

Step 2: Deposit Trading Capital

You will, of course, need to add some capital to your eToro account before you can trade commodities. If you're a US or UK-based trader then you will only need to meet a $10 minimum. Most other nationalities are required to meet a$50 minimum.

You can choose from many payment types such as a credit/debit card, Paypal, Neteller, ACH, or a bank wire. Payments made into your eToro account in US dollars are exempt from deposit fees.

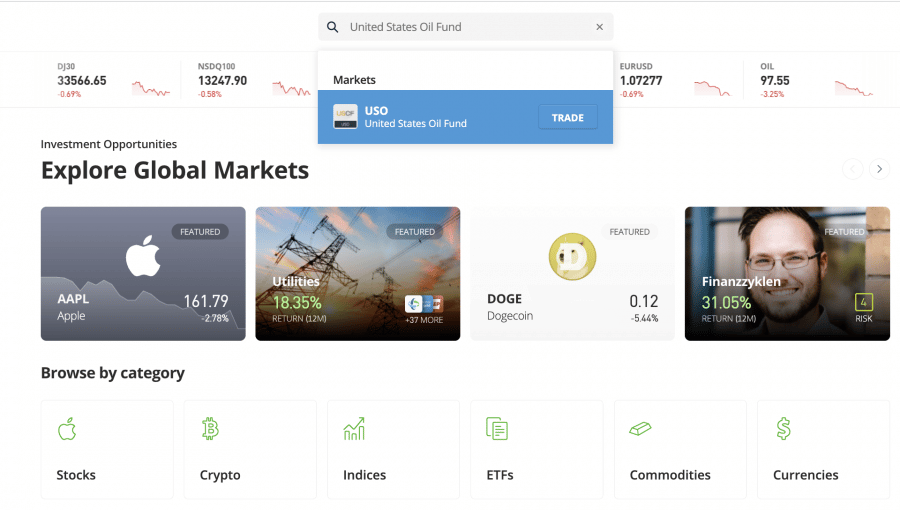

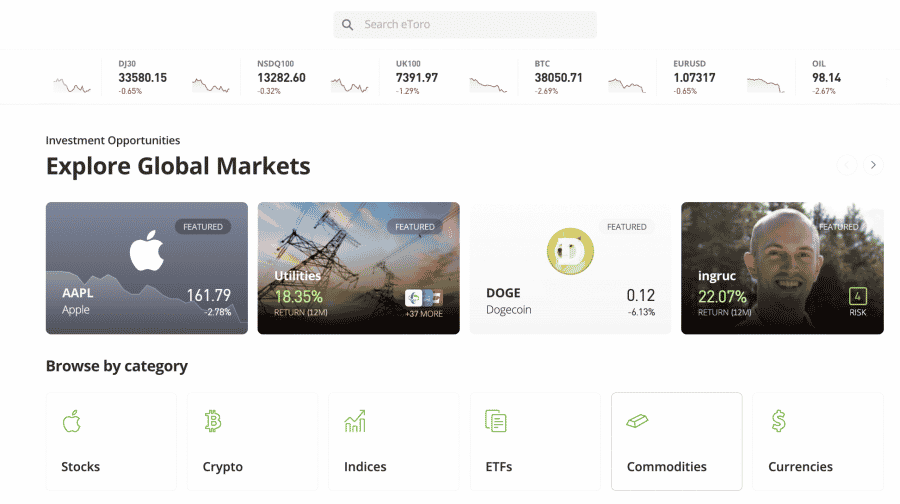

Step 3: Search for Commodity Market

Now that you have trading capital in your eToro account, you can search for the commodity market that interests you. Click on the 'Discover' button followed by 'Commodities'.

This will then show you the full list of commodities that you can trade in your region. You can also use the eToro search bar if you already know which commodity you wish to trade.

In our example above, we are searching for the United States Oil Fund ETF so that we can gain exposure to global oil prices.

Step 4: Place Trading Order

Once you click on the 'Trade button next to your chosen commodity market you will be presented with an order.

You will need to enter your desired investment stake and finally - click on the 'Open Trade' button.

Unless you set stop-loss and take-profit orders, the trade will remain open until you manually close it.

Conclusion

If you've got an appetite for volatility and higher levels of speculation, then learning how to trade commodities is something that is well worth exploring.

You will need to have a firm grasp of how to perform fundamental research - with a specific focus on geopolitical and economic news.

To start trading commodities right now, it takes just minutes to open an account with eToro. This popular broker offers access to dozens of commodity markets at competitive fees and the platform is easy to use - even for beginners.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.