The cryptocurrency markets are ideal for traders that wish to take advantage of ever-changing token prices and high levels of volatility. In this guide, you will learn how to trade cryptocurrency and make a profit as a complete beginner.

In addition to the basics, we will also walk you through the process of placing your first-ever cryptocurrency trading position with a regulated broker.

How to Trade Cryptocurrency – 5 Easy Steps

For a quick overview of how to trade cryptocurrency online, check out the step-by-step explainer outlined below:

- ✅Step 1 – Choose a Crypto Trading Platform: You won’t be able to trade cryptocurrency unless you have an account with a trusted platform. eToro is the overall best platform to trade cryptocurrency – not least because it offers dozens of digital assets in a regulated, low-cost, and user-friendly environment. You can open an account with eToro by entering some basic personal information.

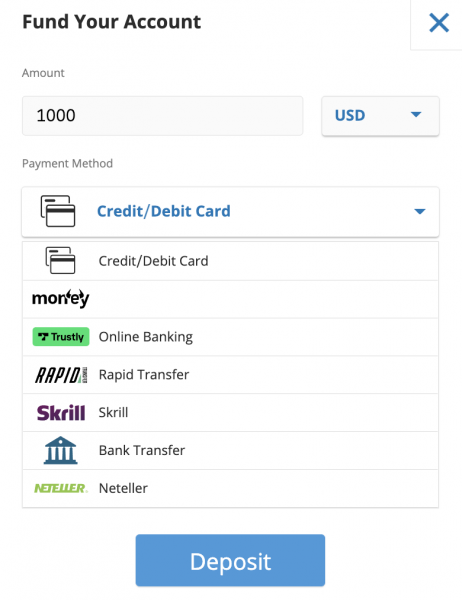

- 💳Step 2 – Deposit Funds: You will also need to make a deposit before you can trade cryptocurrency. At eToro, you can deposit funds easily via a debit/credit card or an e-wallet payment. ACH and bank wires are supported too. If you are depositing funds in US dollars then no fees apply and the minimum requirement is just $10.

- 📖Step 3 – Research the Market: Cryptocurrency trading requires you to research the market in order to find profitable investment opportunities. A good starting point is to look for digital assets that might be undervalued or about to break out.

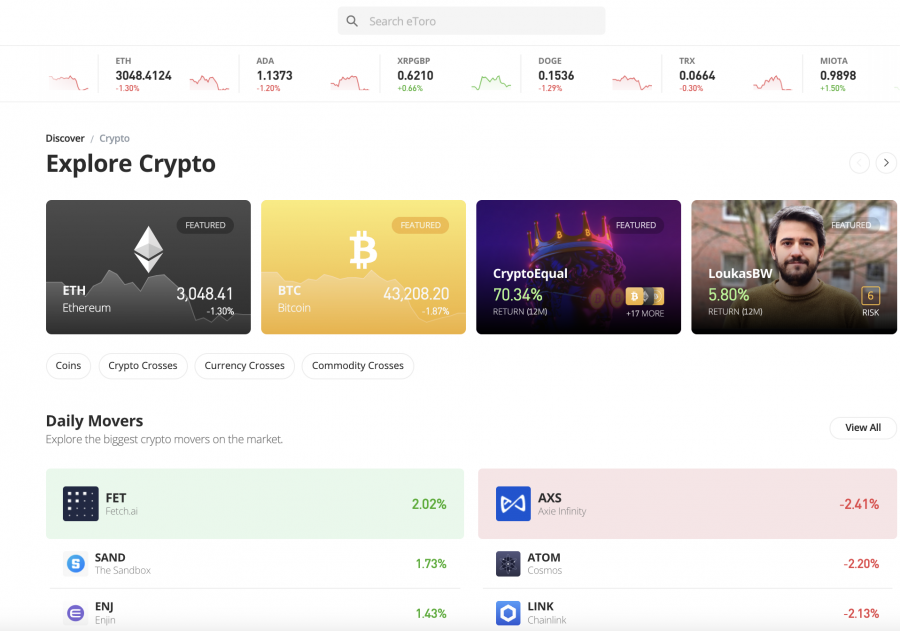

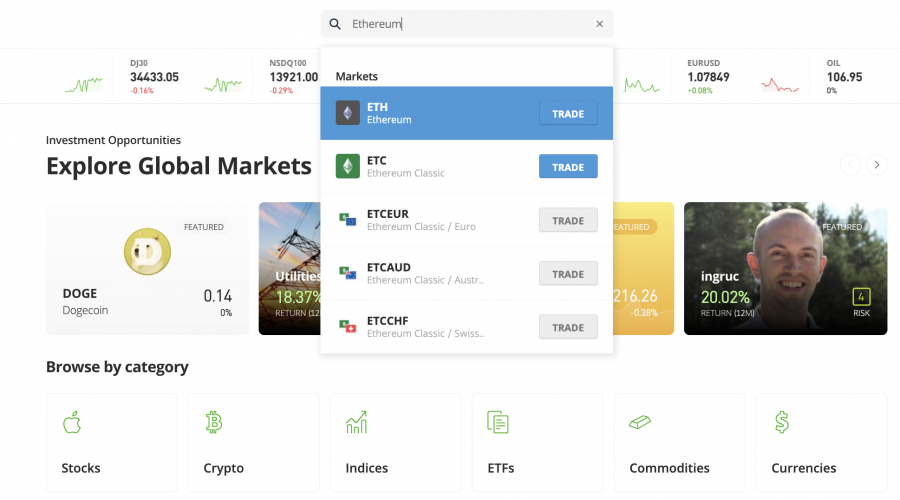

- 🔎Step 4 – Choose Which Crypto to Trade: Once you have researched the market, you can use the eToro search bar to find the cryptocurrency that you wish to trade. When you find the correct market, click on the ‘Trade’ button.

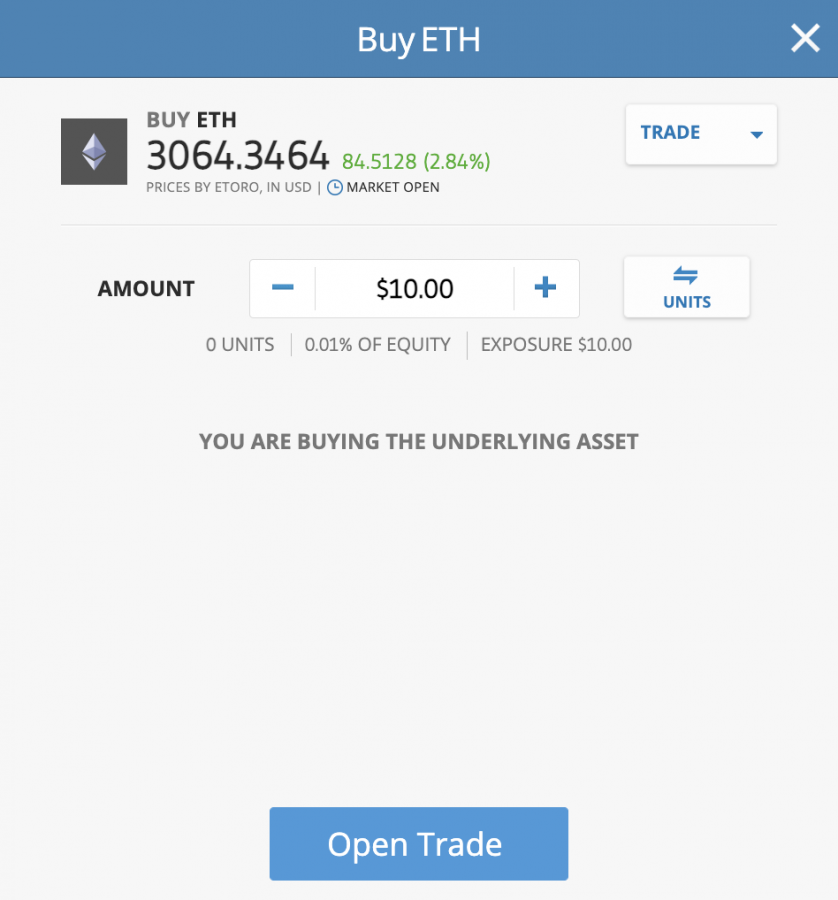

- 🛒Step 5 – Trade Crypto: The final step is to place a trading order. All you need to do here is enter your stake (from $10) and click on the ‘Open Trade’ button. The cryptocurrency markets are operational 24/7 at eToro, so your position will be executed instantly.

Cryptoassets are a highly volatile unregulated investment product.

As you can see from the above, learning how to trade cryptocurrency isn’t overly difficult.

However, in order to be a successful cryptocurrency trader that makes consistent profits, you need to have a firm grasp of how this market works. As such, we would suggest that you read this guide in its entirety before proceeding.

Where to Trade Cryptocurrency

As a beginner, it is crucial to understand the importance of choosing the right crypto exchange or broker.

After all, the platform will give you direct access to the cryptocurrency trading markets, so you’ll want to consider factors surrounding fees, supported pairs, tools, account minimums, and of course – safety. For those wondering how to invest $1000, the crypto market has been a popular choice amongst avid digital asset investors in the last few years.

If you’re still wondering where to trade cryptocurrency online – consider the platforms that we have reviewed below.

1. eToro – Overall Best Place to Trade Cryptocurrency

As such, you can be sure that you are trading cryptocurrency in a fair and legitimate environment. This top-rated broker requires just $10 to get started with an account – and the registration process takes less than five minutes. We also like that you have various payment options to choose from at eToro. Ever wondered how to day trade cryptocurrencies? Read our guide on the best scalping brokers to find which trading platforms offer the tightest spreads and fastest execution times.

This includes Visa and MasterCard payments, e-wallets like PayPal and Neteller, and ACH. All deposits and withdrawals that are made in US dollars are free of charge. In terms of supported markets, eToro is home to dozens of leading cryptocurrency assets including the best utility tokens. For instance, you can invest in Bitcoin, Ethereum, Dogecoin, Shiba Inu, Litecoin, YFI, Cardano, and BNB.

You will also find a variety of DeFi coins and metaverse crypto tokens, which is inclusive of Decentraland, The Sandbox, The Graph, AAVE, Compound, Uniswap, Chainlink, and SushiSwap. Best of all, each and every cryptocurrency hosted by eToro can be traded against the US dollar. As such, you won’t need to trade pairs that contain a stablecoin like Tether.

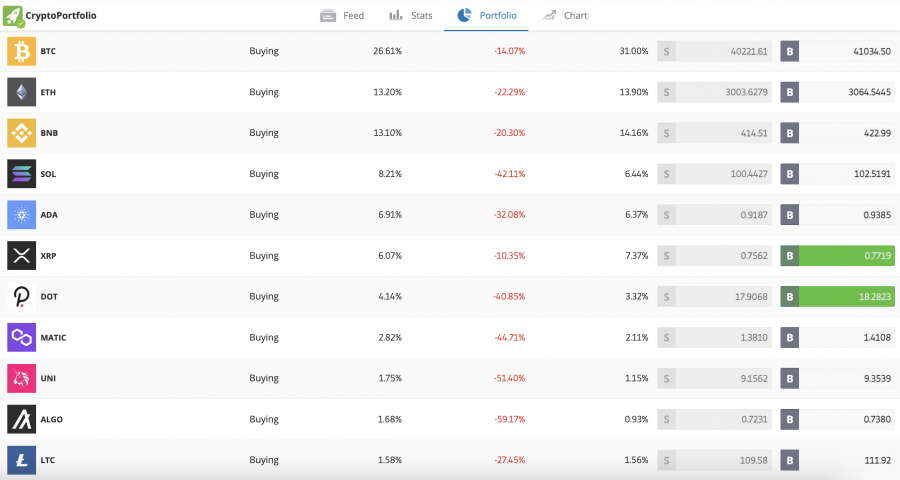

When it comes to fees, eToro offers a very simple and competitive pricing structure. In a nutshell, you will pay just 1% above the current bid/ask price for the cryptocurrency pair that you are looking to trade. We should also note that eToro offers copy trading tools. For those unaware, this enables you to copy the buy and sell positions of a successful cryptocurrency trader.

In other words, you can actively trade the digital currency markets without needing to do any research or place any orders. Another option you have – should you wish to trade cryptocurrency passively, is to invest in an eToro smart portfolio. These give you access to a diversified basket of assets through automated trading and there are several smart portfolios that focus exclusively on cryptocurrency.

For this reason, eToro is one of the best social trading cryptocurrency platforms on the market.

Another superb feature that we came across when reviewing the eToro platform is that it offers free demo trading accounts to all of its customers. This means that after you sign up, you can trade the cryptocurrency markets risk-free – as eToro will preload your demo account with $100,000 in paper money. This is a great tool for beginners to learn how to trade cryptocurrency.

You might also like the eToro crypto app for iOS and Android. This allows you to trade cryptocurrency on the move, check the value of your portfolio, deposit/withdraw funds, set up pricing alerts, and much more. Finally, eToro also enables you to invest in thousands of commission-free stocks and ETFs – should you wish to diversify your cryptocurrency trading portfolio.

| Number of Cryptos | 60 |

| Trading Commission | 1% plus market spread |

| Debit Card Fee | FREE |

| Minimum Deposit | $10 |

What We Like

- Heavily regulated

- Super low trading commissions

- Fee-free US dollar deposits

- Deposit funds with a debit/credit card, e-wallet, or bank transfer

- Copy-trading tools

- Can be used with the best crypto and forex signals

- Perfect for beginners

- Get started in less than five minutes

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Trade 250+ Cryptocurrency Markets With Low Fees

This includes everything from meme coins, DeFi tokens, stablecoins, and large-caps like Bitcoin and Ethereum. Having access to such a large library of markets is highly conducive for trading crypto - as you will never be short of investment opportunities.

Crypto.com also stands out for its low-fee policy. The most you will pay to trade cryptocurrency here is 0.40% per slide. You can reduce your commission by staking CRO tokens, which is the digital currency backed by the Crypto.com platform. Further discounts are on offer when you trade larger amounts throughout the month.

Crypto.com also offers the best app to trade cryptocurrency for both iOS and Android. This allows you to invest in cryptocurrency with US dollars. You can deposit funds instantly with both a debit/credit card and ACH, albeit, the latter is perhaps the best option as no fees are charged. Otherwise, you will pay a transaction fee of 2.99% should you wish to use Visa or MasterCard.

If you are thinking about taking a longer-term approach to cryptocurrency trading, Crypto.com offers savings accounts that pay you interest for as long as your tokens are deposited. You can earn up to 14.5% interest per year and various terms are on offer - including flexible, 1-month, and 3-month accounts.

If you want to amplify the value of your cryptocurrency purchasing power, you can also access loans here. You will be able to get an LTV of up to 50% at competitive rates and flexible terms. Finally, Crypto.com is also worth considering if you looking to gain exposure to NFTs. This is because the Crypto.com NFT marketplace offers thousands of unique tokens without any buyer fees.

| Number of Cryptos | 250+ |

| Trading Commission | Up to 0.40% |

| Debit Card Fee | 2.99% |

| Minimum Deposit | $20 |

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

3. Binance - Low Fee Exchange to Trade Cryptocurrency Pairs

The final exchange to consider when deciding on where to trade cryptocurrency is Binance. This platform is ideal for those of you that are searching for an exchange that offers huge liquidity levels and plenty of trading markets. In fact, Binance attracts tens of billions of dollars in volume each and every day.

If you're based in the US, you will have access to 80 cryptocurrencies. Otherwise, if using the global Binance website, then this extends to over 600 cryptocurrencies and 1,000+ markets. To fund your Binance account, you can deposit money via ACH or a domestic bank wire fee-free.

Debit and credit card payments are accepted too, albeit, US clients will pay 4.5% in fees plus an instant buy commission of 0.5%. When it comes to standard trading commissions - this is where Binance really stands at. This is because you will never pay more than 0.10% per slide. By holding BNB - the native token of Binance, or trading large volumes, lower commissions are offered.

Binance is also popular for its fully-optimized mobile trading app for iOS and Android. As the app connects to your main account, you can buy and sell digital currency pairs on the move. In terms of storage, your Binance doubles up as a crypto wallet. You can also download the Trust Wallet - which is backed by Binance, should you require a non-custodial storage option.

What We Like:

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection. The main premise of cryptocurrency trading is much the same as any other investment sector. For instance, just like stock trading, you will be buying and selling cryptocurrencies with the view of making a profit. You will be able to achieve this goal when you correctly predict the future direction of the market. For example, if you stake $1,000 on Bitcoin at $40,000 per token and the digital currency increases to $44,000 - this would represent gains of 10% - or $100. And, just like stocks, cryptocurrency prices are determined by demand and supply. As such, the value of a cryptocurrency token will change on a second-by-second basis. As we explained earlier, you will need an account with a cryptocurrency exchange or broker in order to access this marketplace. You also need to remember that cryptocurrencies are both speculative and volatile, so wild pricing swings should be expected. This makes the process of learning how to trade cryptocurrency even more important. One of the best ways to approach the market is to understand risk-management tools. For example, by deploying stop-loss orders on every cryptocurrency trade that you place, you will never lose more than you are comfortable with. Bankroll management is also important. This will dictate how much of your account balance you can risk on a trade, in percentage terms. In the sections below, we explain the fundamentals of how crypto trading works. Be sure to read through each section to ensure that you are able to enter this market with your eyes wide open. The first thing to note is that when you trade cryptocurrency, you will be speculating on 'pairs'. Each pair will contain two assets - which can be fiat or cryptocurrency, or a combination of both. For example, when you use a regulated broker like eToro, you can trade dozens of cryptocurrencies against the US dollar. This makes it easier to assess the current and future value of your chosen digital currency. However, when you use a cryptocurrency exchange that does not have the legal remit to deal with US dollars, you will likely be trading your chosen digital asset against a stablecoin like Tether. Tip: If this is your first time learning how to trade cryptocurrency - then it's best to start off with BTC/USD. This pair - which will see you trade the future value of Bitcoin against the US dollar, offers the most liquidity, least volatility, and tightest spreads. Once you have decided which cryptocurrency pair to trade, you then need to set up an order. As a beginner, you might want to start off with a market order - which allows you to place a trade instantly at the next best available price. When you feel more comfortable with how the markets work, you might then enter a cryptocurrency trade with a limit order. This enables you to specify the exact price that your order is executed. Moreover, you will need to specify your stake when placing a cryptocurrency trading order. This simply refers to the amount of money - in dollar terms, that you wish to risk on the position. When you invest in cryptocurrency, you are typically doing so as part of a long-term strategy. This means that you can buy a cryptocurrency and leave the tokens in your wallet for several months or years. As such, there is no requirement to actively analyze cryptocurrency prices and market trends. Cryptocurrency trading takes a different approach to investment, insofar that you will be looking to enter and exit positions on a shorter-term basis. Ultimately, while cryptocurrency investing is suitable for passive strategies, trading requires you to actively monitor and analyze the markets to stay ahead of the game at all times. There are many assets that you can trade as part of a short-term strategy. This includes stocks, forex, and even commodities like oil and gold. With this in mind, in the sections below, we explain why you might decide to trade cryptocurrencies as opposed to conventional financial instruments. In a similar nature to stocks, there are thousands of cryptocurrencies that you can buy and sell in the open marketplace. This means that you will never be short of trading opportunities. Moreover, there are cryptocurrencies to suit all financial objectives and appetite for risk. For example, if you are learning how to trade cryptocurrency as a complete beginner - then you might decide to stick with large-cap projects. This would include the likes of Bitcoin, Ethereum, and BNB - all of which carry huge market capitalization. On the other hand, if you seek higher levels of volatility, then you might look to trade smaller-cap cryptocurrencies like Compound, Chiliz, Enjin, and Dash. These projects each carry a market capitalization of under $2 billion. If you really have an appetite for high risk, you might even consider trading micro-cryptocurrencies that have a market capitalization of under $100 million. Another reason why short-term traders are now turning to cryptocurrency is that this marketplace is extremely volatile - especially in relation to traditional stocks. For example, it is not unusual for smaller-cap cryptocurrencies to increase in value by several hundred percent in just a single day of trading. At the other end of the scale, the value of a cryptocurrency can decline by over 90% in the same timeframe. Such huge pricing swings won't be suitable if you are just learning how to trade cryptocurrency. Instead, it's best to stick with the likes of Bitcoin and Ethereum, which, will rarely move in value by over 10% in a 24-hour period. Even short-term traders can target significant gains in a short period of time. This example is just one of many. The key point is that the cryptocurrency markets provide plenty of high-growth trading opportunities each and every day. Cryptoassets are a highly volatile unregulated investment product. There are a wide variety of ways to make money from the cryptocurrency trading markets - which we discuss in more detail in the sections below. The main way that seasoned cryptocurrency traders make money is via capital gains. This refers to the amount of profit that a trader makes from a specific position. You can work this out by subtracting the price that you paid for the cryptocurrency from the value at which you cashed the position out. For example: Don't forget, cryptocurrency exchanges are in the business of making money - so you will also need to factor in trading fees. Another way that you can make money trading cryptocurrency is to provide exchanges with some much-needed liquidity. This is more of a passive trading strategy, insofar that you won't actually be buying and selling digital currencies yourself. Instead, by depositing surplus tokens into an exchange, you will be paid interest. One of the best ways of achieving this is via crypto yield farming, which, in return for depositing cryptocurrency into a liquidity pool, will allow you to earn interest. In addition to the above, you can also make money from cryptocurrency trading via: The traditional stock markets operate during fixed hours from Monday to Friday. When trading cryptocurrency, however, you will be gaining exposure to a marketplace that never closes. This means that you can enter buy and sell positions 24 hours per day, 7 days per week. With that said, trading volumes dip significantly over the weekend. This will result in wider pricing gaps and lower levels of liquidity. As a beginner learning how to trade cryptocurrency for the first time, it's, therefore, best to avoid placing orders on Saturday or Sunday. Instead, it's wise to engage with the markets between Monday and Friday - which is where the vast majority of trading activity is undertaken. Cryptocurrencies are valued based on demand and supply. However, unlike the traditional stock markets, there is no single centralized exchange like the NYSE or NASDAQ. Instead, cryptocurrencies are traded across a wide variety of exchanges. And as such, there will always be a slight variation in prices between each provider. With that said, the forces of market arbitrators ensure that these pricing differences are minute. For example, as of writing, BTC/USD is priced at $16,871 on Coinbase. On Binance, the same pair is priced at $16,876. A difference of only a few dollars, a fraction of a percent. The best way to assess crypto price movements is to use a crypto price tracker site like CoinCodex or CoinMarketCap - which track real-time valuations across hundreds of cryptocurrency exchanges. According to CoinMarketCap, there are nearly 19,000 cryptocurrencies in circulation that can be traded online. If you're wondering which best altcoins to target when trading, consider the five tokens discussed below. Just a month later, Lucky Block hit an all-time high of over $0.09. This translates into gains of nearly 6,000%. As such, this is a great example of how a shrewd cryptocurrency trader can make unprecedented gains in a short period of time. Lucky Block - which is building the world's first decentralized lottery ecosystem, has since gone through a market correction. Therefore, you can still trade this digital currency while it is changing hands at a discounted price. Some analysts have forecast that the LBLOCK price could hit $0.025000 by 2025. Read our Lucky Block price prediction for further details.

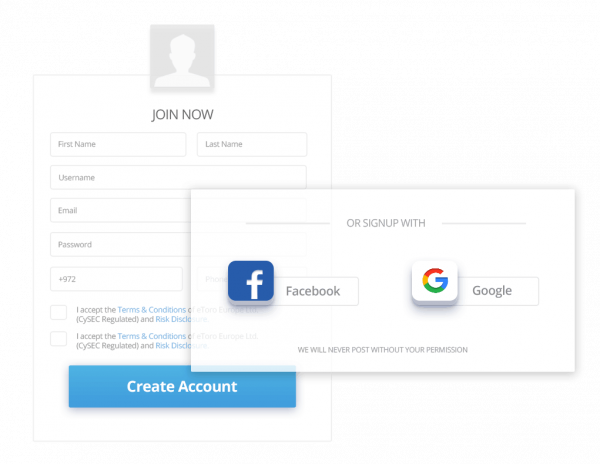

Cryptoassets are a highly volatile unregulated investment product. If you're somewhat unprepared for high levels of volatility, then perhaps the best cryptocurrency to trade as a beginner is Bitcoin. As noted earlier, when using a regulated broker like eToro, you can access BTC/USD - which will allow you to trade Bitcoin against the US dollar. BTC/USD trades for tens of thousands of dollars, albeit, you only need to meet a minimum trade size of $10 at eToro. In terms of volatility, BTC/USD has seen 52-week highs and lows of $68,700 and $28,800 respectively. Cryptoassets are a highly volatile unregulated investment product. In terms of valuation, Ethereum is the second-largest cryptocurrency. Naturally, attracts large trading volumes across most cryptocurrency exchanges, so you'll never struggle to find suitable levels of liquidity. Ethereum as a project offers a blockchain and smart contract framework for thousands of cryptocurrency tokens. As such, it's often the go-to blockchain for new projects to build their ecosystem. This is especially the case with metaverse projects like Decentraland and The Sandbox. Over the prior 12 months, Ethereum has increased in value by over 40%. Cryptoassets are a highly volatile unregulated investment product. Shiba Inu is essentially a meme coin - which means that its value is largely dictated by market speculation rather than anything tangible. With that said, the best meme coins are often sought-after by seasoned cryptocurrency traders that seek high levels of volatility. Shiba Inu most certainly fits this bill - especially when you consider its pricing journey since launching in 2020. That is to say, in less than two years of trading, Shiba Inu has increased in value by millions of percent. Cryptoassets are a highly volatile unregulated investment product. Stellar is an established cryptocurrency that was first launched in 2014. The platform allows users to benefit from fast and cheap transactions across any fiat currency. This cryptocurrency is ideal for trading on a budget, not least because it has never surpassed a market price of $1. Moreover, Stellar attracts above-average market volatility, so you will never be short of trading opportunities. Cryptoassets are a highly volatile unregulated investment product. It is important to come up with a strategy when learning how to trade cryptocurrency. Otherwise, you may as well throw a dice when attempting to determine which way the markets are likely to move. The best crypto trading strategies for beginners are discussed below. Before you even place your first cryptocurrency trading position, it is crucial to understand bankroll management. In a nutshell, this refers to the maximum amount of money that you can risk on a single trade. The amount is determined in percentage terms, against your current account balance. For example: Crucially, if you go through an extended losing run, your bankroll will be protected - not least because your maximum stake will reduce. For example, if your balance went down to $1,000, at 2%, you would only be able to stake a maximum of $20. Another commonly used strategy that is implemented by seasoned cryptocurrency traders is to ensure that stop-loss orders are always deployed. As we briefly noted earlier, this will ensure that you never lose too much money on a single trading position. As per the above example, if BTC/USD declines and it hits a price of $47,500, your trade will automatically be closed. This prevents you from experiencing further losses. As such, the most you can lose on a $1,000 stake is 5% - or $50. In addition to stop-loss orders, you should also look to lock in your profit target when the respective price is met. After all, the cryptocurrency trading markets can move at an extremely fast pace. For example, you wish to stake $1,000 on BTC/USD at an entry price of $ 50,000. You want to make a profit of 20% on this position. As such, you would need to set your take-profit order to $60,000. In a similar nature to the US stock markets, cryptocurrencies often move in sync with each over. That is to say, when broader markets are bullish, many cryptocurrencies go through a prolonged upward trend. And similarly, when the markets are bearish, most cryptocurrencies will enter a downward cycle. In entering a position at this price point, you'll be giving yourself an attractive upside target on a solid digital asset. If you don't have the skillset to analyze cryptocurrency prices, then it might be worth looking into a passive investment tool. this will allow you to trade cryptocurrency without needing to actively research the markets. One of the best ways of achieving this goal is via the eToro copy trading feature. This enables you automatically copy the same positions as a seasoned cryptocurrency trader of your choosing. You'll want to focus on traders that have an extended track record on eToro in terms of ROIs and risk management. The minimum copy trading investment required is just $200. Ever wondered how to day trade cryptocurrency? Crypto day trading is a specific strategy that requires you to enter and exit positions within a 24-hour period. This means that you will be looking to buy a cryptocurrency and then sell it a few hours later. In doing so, you will be looking to target smaller gains. However, as you will be placing orders much more frequently, these gains can quickly add up. Due to the tight profit margins that you will be working towards, both stop-loss and take-profit orders are even more important when day trading crypto. If you wish to day trade the cryptocurrency markets, the vast majority of your research will need to focus on technical analysis. This means looking for historical pricing trends and how they might influence the future direction of the respective cryptocurrency. Cryptocurrency trading is not risk-free from a variety of perspectives, it's important that you understand the steps that you can take to remain safe. First and foremost, the majority of cryptocurrency trading platforms are unlicensed. As such, in using an unlicensed platform, your funds are at risk. This is why we like eToro - which is regulated by several tier-one licensing bodies and approved to offer cryptocurrency brokerage services to US residents. Next, you need to think about the risks of losing money from your trading activities. We discussed these earlier in terms of bankroll management and ensuring that both stop-loss and take-profit orders are always deployed. Another safety measure that you need to think about is the storage of your cryptocurrencies. After all, when using a trading platform, the provider will be responsible for keeping your digital currencies safe. This is why it's important to assess what security controls the platform offers. For example, eToro offers a custodial wallet service that utilizes institutional-grade security practices. This means that you do not need to worry about keeping your own private keys safe. eToro also has an internal risk management department that is tasked with keeping its customers safe from financial crime. Cryptoassets are a highly volatile unregulated investment product. This guide has covered how to trade cryptocurrency in a risk-averse manner. If you're ready to put your newfound theoretical knowledge into practice, we are now going to show you how to get started with eToro. To recap, the eToro platform is regulated and you only need to deposit $10 to open an account. Moreover, trading fees are super-low and US clients can deposit funds with a debit/credit card or e-wallet without being charged. You will need to create a verified account before you can deposit money into the eToro platform. Enter your full name, email address, and phone number, followed by your desired username and password.

Cryptoassets are a highly volatile unregulated investment product. Click on the 'Create Account' button to proceed to the next step - which will require some additional personal information from you, alongside a quick overview of your prior trading experience. You will also be asked to upload a copy of your passport, driver's license, or state ID card. This ensures that your identity is verified as per KYC regulations. The next step is to deposit some US dollars into your eToro account - which you can do without paying any fees. If you want your deposit processed instantly, then select a debit or credit card, PayPal, Neteller, or any other supported e-wallet. Bank wires and ACH can take a couple of days to settle. The minimum deposit across all supported payment methods is just $10. Although you now have trading funds in your eToro account, it might be a good idea to start off in demo mode. This will allow you to practice trading cryptocurrencies in a risk-free environment. Your demo account will be preloaded with a balance of $100,000. All you need to do is switch over to 'Virtual Portfolio' mode. If you feel ready to start trading cryptocurrency with real money, switch back to 'Real Portfolio' mode. Then, use the search box to find the cryptocurrency that you want to trade. As you can see in the example image below, we are searching for Ethereum. You can also view the full list of supported cryptocurrencies by clicking on 'Discover'. Click on the 'Trade' button next to the cryptocurrency that you want to access. This will then populate an order - which we explained in great detail earlier in this guide. To reiterate, in addition to entering your stake, you will need to decide between a market or limit order. You also have the option of deploying a stop-loss and/or take-profit order. When you are ready to enter your position, click on the 'Open Trade' button. The cryptocurrency markets are volatile and speculative, which makes this investment sector ideal for short-term traders. In reading this guide, you should now know how to approach the cryptocurrency trading scene in a risk-averse manner. We've discussed many strategies that you can take to outperform the market - even as a beginner. If you want to trade cryptocurrency with real money right now - you only need $10 to get started on the eToro platform. Crucially, this popular platform gives you access to dozens of cryptocurrencies in both a regulated and low-cost environment.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Number of Cryptos

80+ (US clients)

Trading Commission

Up to 0.10%

Debit Card Fee

4.5% plus an instant buy fee of 0.5%

Minimum Deposit

Depends on the payment method

Cryptocurrency Trading Explained - Overview

How Does Crypto Trading Work?

Crypto Trading Pairs

Crypto Trading Orders

Crypto Trading vs Investing?

Why Trade Cryptocurrency?

Market Diversity

Volatility

Huge Growth Potential

How to Make Money from Crypto Trading?

Cryptocurrency Trading Capital Gains

Liquidity Provision

Other Ways to Make Money

Cryptocurrency Trading Hours

Crypto Price Movements

What are the Best Cryptocurrencies to Trade?

1. Lucky Block (LBLOCK)

2. Bitcoin (BTC/USD)

3. Ethereum (ETH/USD)

4. Shiba Inu (SHIB/USD)

5. Stellar (XLM/USD)

Cryptocurrency Trading Strategies

Bankroll Management

Stop-Loss Orders

Take-Profit Orders

Take Advantage of Market Dips

Trade Cryptocurrency Passively

Crypto Day Trading

Is Cryptocurrency Trading Safe?

How to Trade Cryptocurrency - eToro Tutorial

Step 1: Create an Account

Step 2: Deposit Funds

Step 3: Trade Cryptocurrency via Demo Account

Step 4: Search for Cryptocurrency

Step 5: Trade Cryptocurrency

Conclusion

Frequently Asked Questions on Cryptocurrency Trading

How do I trade cryptocurrency and make a profit?

What is the best way to trade crypto?

What is the best place to trade cryptocurrency?

How does crypto trading work?

Is cryptocurrency trading profitable?

How do you day trade cryptocurrency?

Read More: