ETFs are undoubtedly one of the most popular asset classes within the broader financial markets, offering investors the possibility of trading passively and actively. Not only that, ETFs are a great way to gain exposure to different sectors optimally whilst reducing the time you have to spend researching and analyzing individual equities.

This guide will discuss how to trade ETFs in detail, exploring the top platforms with the lowest fees, before showing you how to begin investing in ETFs today – all from your laptop, tablet, or smartphone.

How to Trade ETFs – 5 Quick Steps

If you’re looking to begin trading ETFs right away, the four quick steps below will walk you through how to trade ETFs on eToro – completely commission-free.

- Step 1 – Choose an ETF trading platform: As touched on above, we recommend partnering with eToro if you’re looking to trade ETFs, as you can invest commission-free and from only $10 per position.

- Step 2 – Deposit: After creating an eToro account and verifying yourself by uploading proof of ID and proof of address, click ‘Deposit’ and choose whether you’d like to fund your account via credit/debit card, bank transfer, or e-wallet.

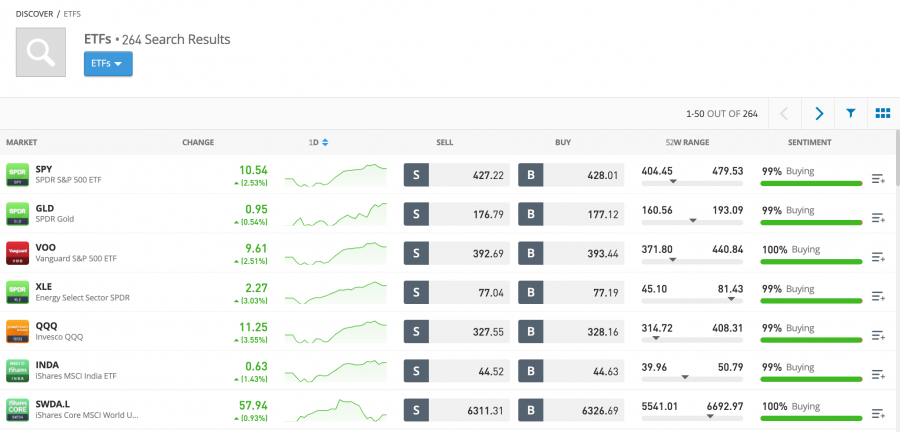

- Step 3 – Research the market: Now you can scour the market for the ideal ETF to meet your investment goals. Since eToro offers over 250 ETFs, there’s sure to be an asset that suits your needs.

- Step 4 – Choose which ETF to trade: Once you’ve found the ideal ETF, type its name or ticker symbol into eToro’s search bar and click ‘Trade’.

- Step 5 – Trade: An order box will now appear, in which you can enter your desired position size (minimum $10) and confirm your investment once you are happy with everything.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Where to Trade ETFs – Top ETF Brokers Reviewed

When researching how to trade ETFs online, the first thing you’ll need to do is find a trading platform or one of the best investing apps that is both safe and cost-effective. The majority of the best stock trading platforms will offer an assortment of ETFs to trade – with some even providing a commission-free fee structure.

To help your decision-making, we’ve narrowed down the universe of potential trading platforms to our top five – all of which will be reviewed below.

1. eToro – Overall Best Platform to Trade ETFs

eToro offers over 250 ETFs to trade from a wide range of different industries. Interestingly, eToro allows you to trade either real ETFs or ETF CFDs, although CFD trading options are only available outside the US. Another great element of the platform is that opening an ETF trade is completely commission-free – meaning that partnering with eToro is the cheapest way to trade ETFs if you are an active trader. This means you can learn how to trade gold via ETFs from the comfort of your own home. It’s also worth mentioning that eToro also lets you trade commodities, stocks and crypto with low fees.

This is also the case if you’re looking to buy stocks, making it easy to create a diversified portfolio. In terms of funding your account, eToro accepts all major credit/debit cards, along with bank transfers and e-wallets. Notably, eToro offers full support for PayPal, Skrill, and Neteller if you wish to deposit using those platforms.

eToro’s trading experience is also top-notch, as you can trade on eToro’s web-based platform or the dedicated mobile app. The latter is ideal if you’re looking to invest on the go and features two-factor authentication to boost security. Finally, eToro even has an ‘eToro Academy’ feature with guides, tutorials, and videos, helping streamline the trading process for newcomers.

Still unsure about the ETF trading process? Read our guide on What is ETF trading for more details.

Additionally, you might want to take a look at our guide on how to invest $1000 in 2023, especially since ETFs offer both active and passive investing.

What We Like:

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull – Top ETF Trading Platform with Low Minimums

This is the lowest minimum trade amount on our list, meaning Webull is ideal for investors looking to start small. The platform itself is heavily regulated in the US by the SEC and FINRA whilst also offering investor protection under the SIPC scheme. Creating an account with Webull is also very straightforward, as there is no minimum deposit threshold, and the process can be finalized in as little as one business day.

At present, Webull only accepts ACH deposits, although these are entirely free to make. There are also no fees to withdraw from your trading balance, and the funds can arrive in your bank account in as little as two days. Finally, the web trading platform is ideal for investors wondering how to trade ETFs on Webull over the longer term, as it is highly customizable and has a wide range of technical indicators to employ.

What We Like:

Your capital is at risk.

3. Charles Schwab – Best Place to Trade ETFs with High Security Levels

Like Webull, Charles Schwab allows you to invest in ETFs from as little as $5. This is also the case if you’re looking to buy Apple stock or any other US-based equity. In terms of fees, Charles Schwab also offers commission-free ETF trading, with margin rates of 8.3% per year if you wish to trade in that manner. Notably, Charles Schwab doesn’t charge any non-trading fees related to deposits, withdrawals, or inactivity.

There is no minimum deposit threshold for US-based clients, and the platform even offers an array of account types to choose from, such as a joint account or a robo-advisor account. US-based users can fund their accounts via check, ACH, or wire transfer, although credit/debit card deposits are unavailable. Finally, Charles Schwab offers both a web-based and mobile platform to trade on, both of which feature clear interfaces and a variety of order types.

What We Like:

4. TD Ameritrade – Highly-Respected Trading Platform with Streamlined Trading Experience

One of the great things about TD Ameritrade is that it offers two trading platforms – a mobile app or the popular ‘thinkorswim’ platform. The latter is highly regarded amongst traders as it features advanced order types, real-time price alerts, portfolio reports, customizable widgets, and more. In terms of fees, TD Ameritrade also offers commission-free ETF trading with no non-trading fees.

There is also no minimum deposit threshold with TD Ameritrade, although the platform only supports check, ACH, and wire transfer deposits. However, deposits and withdrawals are speedy, taking as little as one business day for the former. Finally, TD Ameritrade really excels when it comes to customer support, offering live chat, telephone services, and even a virtual assistant.

What We Like:

5. Interactive Brokers – Best Broker to Trade ETFs using Credit or Debit Card

The great thing about Interactive Brokers is that it offers an array of international markets – meaning there are approximately 13,000 ETFs available to trade. This includes assets from the UK, Europe, and Asia, making Interactive Brokers ideal for those looking to create a geographically-diversified portfolio. US-based users can trade US ETFs with no commissions, although non-US ETFs will come with a fee based on where they are located.

Interactive Brokers also offers one of the best stock apps on the market, with two-step authentication, price alerts, and a dedicated chatbot feature that you can use to execute trades. There is no minimum deposit amount with Interactive Brokers, and the platform even supports 23 different base currencies. Finally, Interactive Brokers is one of the few platforms supporting credit/debit card deposits for US clients, making it easy to fund your account instantly.

What We Like:

ETFs Trading Explained

Before you learn how to trade ETFs, it’s essential to understand what these assets actually are. ETF stands for ‘exchange-traded fund’ and is essentially what the name suggests – a fund traded on a stock exchange. Like mutual funds and hedge funds, ETFs work by pooling together capital and using it to track a specific index, sector, or commodity.

Thus, ETFs can provide a passive way to gain exposure to various assets, such as the best dividend stocks, the best Bitcoin ETFs, or a commodity like oil. (If you’d like to learn more about how to trade oil you can read our guide for more details.) However, many ETFs attempt to track the performance of major equity indices like the S&P 500 or the FTSE 100, which provides the investor with broad exposure to the top companies in a specific region.

Much like stocks, ETFs have a share price that fluctuates based on supply and demand. Investors can buy shares in ETFs and benefit from these price fluctuations by partnering with a respected broker or exchange. Finally, ETFs also have a built-in expense ratio, which is the costs associated with managing and operating the fund and tends to be passed on to the investors.

How Does ETF Trading Work?

Now it’s time to learn how to trade ETFs, which works similarly to equity trading. As touched on earlier, you will need to create an account with a trading platform that offers ETF trading, as it will act as the intermediary between you and the market. We recommend eToro for this, although most brokers will provide ETF trading options.

Since ETFs are listed on exchanges, shares in these funds can be bought and sold as if they were stocks. Notably, many brokers now offer fractional investing services, which means that you don’t actually have to purchase an entire share when ETF investing. Instead, you can buy fractions of a share, which is helpful if the ETF you are interested in has a high share price.

Once you have made your investment, you will be able to benefit from price appreciation driven by market forces. An example of this would be if you purchased an ETF when the share price was $100, then it rose to $200 over the following year. If you sold at the latter price, you’d have made a 100% return on your investment.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

ETF Trading: Futures vs Options

Although investing in ETFs outright is the most popular approach for retail investors, there are other ways to gain exposure to an ETF’s price movements. Two of the most common alternative methods are futures and options, which we will discuss below:

- ETF Futures: ETF futures contracts are a type of derivative investment product that means the investor is obligated to buy or sell shares in an ETF for a specific price on or before a certain date. These contracts are ideal for speculating on the value of an ETF or for hedging a position in another asset. However, since futures are often highly-leveraged, they can result in considerable losses if poor risk management is employed.

- ETF Options: ETF options are similar to futures, yet they give the holder the right (not the obligation) to buy or sell shares in an ETF for a set price on or before a specific future date. Like futures, trading options will provide exposure to the ETF’s price movements without having to own the underlying asset. Options form the basis of many speculation strategies, although often come with an upfront premium that must be paid to the writer of the option.

ETF CFDs

Many investors believe that the best way to trade ETFs is by using CFDs. CFD stands for ‘Contract for Difference’ and is a derivative product that allows traders to speculate on the price movements of an asset without having to own it. As you can imagine, CFDs are great for speculating on physical commodities like gold and wheat, as they help avoid the significant logistical challenges of owning the underlying asset.

However, CFDs can also be used for equity trading (such as if you were looking to buy Tesla stock) and ETF trading. The CFDs value fluctuates in line with the underlying asset – so if you owned a CFD based on Vanguard S&P 500 ETF, and the ETF rose in value, then your position would increase in value too.

It’s important to note that CFD trading is not available in the US due to regulation and is only available in countries like the UK and Australia. However, since many investors opt to buy and hold ETFs over the longer term, the US’s lack of CFD trading options doesn’t present too much of a hindrance.

Risk-seeking investors tend to believe that CFDs are the best way to trade ETFs because these contracts allow them to benefit from short-term price movements in a cost-effective manner. Finally, certain regions even allow short selling in relation to ETF CFDs, meaning that investors can trade both sides of the market.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Why Trade ETFs?

Whether you’re looking to swing trade ETFs or employ a more short-term approach, it’s wise to understand the benefits of investing in these assets. With that in mind, presented below are three of the main reasons to consider investing in ETFs:

Lower Fees Compared to Other Funds

Other types of investment funds, such as mutual funds and hedge funds, tend to be accompanied by higher ongoing fees since they are usually actively managed. Since ETFs are passive investments, many of the costs that mutual funds and hedge funds have do not apply – meaning ETF trading is more cost-effective than the alternatives.

Great for Diversification

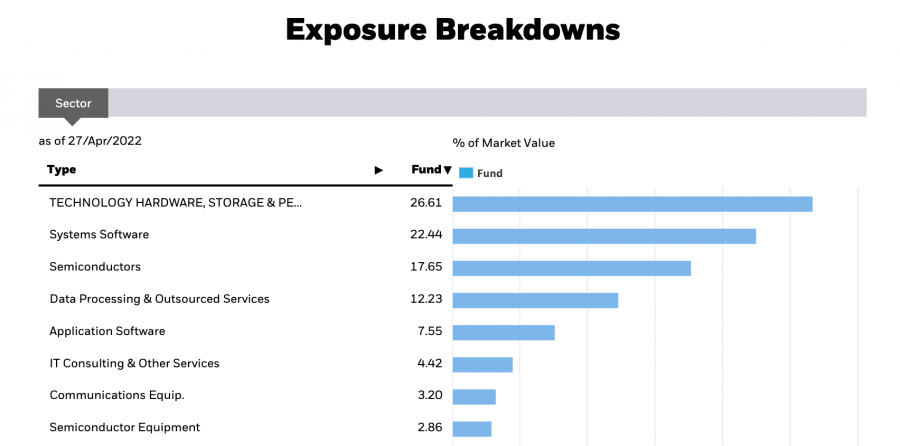

Some investors may wish to gain exposure to a specific asset or sector (such as the technology sector) yet do not possess the required knowledge or experience to create a diversified portfolio on their own. This is where ETFs can come in handy, as they are pre-made funds that allow investors to streamline the investment process and obtain exposure to a specific area of the market in a time-sensitive manner.

Easily Accessible

Finally, not only do the platforms reviewed earlier offer the safest way to trade ETFs, but they make the entire trading process incredibly accessible. ETFs have become increasingly popular with casual traders due to their accessibility, which has helped expand the universe of investment options. This is evidenced by data gathered from Statista, which highlights that over $10 trillion worth of assets is now managed by ETFs around the world.

How to Make Money from ETF Trading

Whether you’re learning how to trade leveraged ETFs or are simply looking to buy-and-hold over the longer term, it’s vital to understand how you can generate a return through these assets. There are two main ways to make money from ETF trading – capital gains and dividends.

The former works precisely the same way as with stocks, in that you make a profit when the price rises above your initial investment price. An example of this is provided below:

- You invested $1,000 in the SPDR Gold ETF when it was priced at $150

- Over the following year, the price of the SPDR Gold ETF rises to $300

- You decide to close out your position

- A total of $2,000 is returned to you (minus any applicable fees), representing a 100% return from your initial investment

As noted above, you can also generate money from ETF trading via dividend payments. Since ETFs invest in individual equities, some of which may pay a dividend, the fund will tend to receive regular cash payments from these equity investments.

If the fund is designated as an ‘income’ ETF, then these payments are redistributed back to the ETFs investors as a dividend. You can determine the level of income you can expect to receive by looking out for the ETF’s yield on its information page.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

ETF Trading Hours

Those who invest in cryptocurrency and trade NFTs can benefit from market hours that are open 24/7 – although this isn’t the case with ETF investing. ETFs will be available to trade during the same hours as the exchange they are listed on. There is also scope to trade the after-hours and pre-market periods, although this is only available with certain brokers and tends to come with higher volatility and larger spreads.

Found below are the trading hours for some leading stock exchanges:

- New York Stock Exchange (NYSE) – 9.30am to 4.00pm EST

- NASDAQ – 9.30am to 4.00pm EST

- London Stock Exchange (LSE) – 3.00am to 11.30am EST

ETF Price Movements

When learning how to swing trade ETFs, the term ‘Net Asset Value’ or ‘NAV’ is important to understand. As defined by Fidelity, the NAV is the most recent official value of the ETF and is based on the latest market close. This is closely linked to the ETF’s market price, or ‘share price’, yet the former is thought of as the most accurate representation of the ETFs value.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

However, from an investor perspective, you will mainly be interested in the ETF’s market price (share price). Although this may be close to the ETF’s NAV, it can often deviate due to factors such as supply and demand or news events. As with equities, an ETF’s share price will usually have a Bid and an Ask price, with a spread in between.

This share price will fluctuate during the day, allowing ETF investors to benefit from price increases and decreases. Countless factors can influence ETF price movements, although common ones include interest rate changes, data releases, and specific industry-related events.

What are the Best ETFs to Trade?

Presented below are five of the best ETFs to day trade and trade passively, ensuring you have a solid overview of your options within the market:

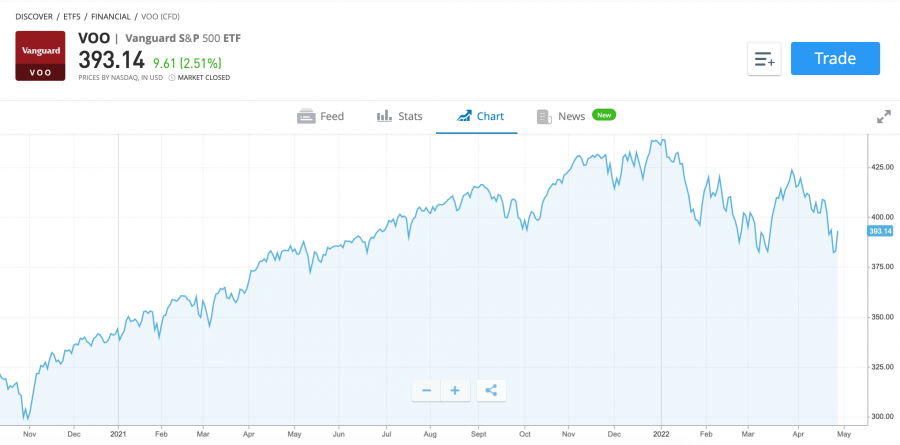

1. Vanguard S&P 500 ETF (VOO)

One of the most popular ETFs worldwide is the Vanguard S&P 500 ETF. According to Vanguard itself, the fund has total net assets of over $841 billion and holds over 500 equities, attempting to mirror the performance of the S&P 500 index. Due to this, investing in the Vanguard S&P 500 ETF will provide broad exposure to the 500 largest publicly-traded companies in the US.

This ETF has provided an average annual return of over 18% during the past three years and over 15% since its inception in 2010. The fund also has an expense ratio of only 0.03% and a yield of 1.34% – making it ideal for investors learning how to swing trade ETFs.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Schwab US Dividend Equity ETF (SCHD)

The Schwab US Dividend Equity ETF has been designed to mimic the performance of the Dow Jones US Dividend 100 index, which focuses on high-yield stocks based in the US. As such, this ETF is ideal for investors interested in generating a passive income stream since it offers an annual yield of 2.89%. Not only that, but the Schwab US Dividend Equity ETF also performs well from a capital gains perspective and has returned over 15% in each of the past three years.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

3. ARK Innovation ETF (ARKK)

The ARK Innovation ETF is one of the best ETFs to day trade since it is composed of a selection of the top growth stocks within the equity market. Although this year has been tough for the ARK Innovation ETF due to rising inflationary fears and rumoured interest rate increases, it has still performed exceptionally well historically. In fact, the Ark Innovation ETF even returned a remarkable 152.52% in 2021 when growth stocks were at their peak – making this ETF great for investors with high risk tolerance.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

4. Vanguard Total Bond Market ETF (BND)

As the name implies, the Vanguard Total Bond Market ETF seeks to track the performance of investment-grade US bonds, excluding inflation-protected and tax-exempt bonds. Unlike the other ETFs on this list, the Vanguard Total Bond Market ETF is more suited for investors looking to create a reliable income stream rather than benefit from share price appreciation. In addition, due to the nature of the bond market, this ETF is ideal for hedging against equity market volatility.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

5. SPDR Gold ETF (GLD)

Rounding off our list of the best ETFs to trade is the SPDR Gold ETF. This ETF is ideal for investors looking to gain exposure to the price of gold, which can be lucrative in today’s high inflation environment. Although it doesn’t offer a yield, the SPDR Gold ETFis great from a capital gains perspective and has generated a positive return in four of the last six calendar years.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Best ETF Trading Strategies

Now that you have a clear understanding of what ETFs are and how they work, let’s focus on the trading process. Detailed below are five of the most popular ETF trading strategies, all of which can prove lucrative if employed effectively:

1. Day Trading ETFs

Many investors wish to learn how to day trade ETFs, as this strategy can result in regular positive returns if conducted successfully. As the name suggests, this approach involves taking short-term positions in ETFs, aiming to benefit from small price movements. A typical day trade will last a few hours, although some positions may only last minutes or seconds.

Due to the short-term approach of this strategy, day traders typically are not looking for double-digit returns. Instead, they aim to generate small returns daily, which build up over time. Although this can result in the exponential growth of the trader’s capital, day trading is also considered one of the riskiest strategies due to the inherent volatility within the equity market.

2. Dollar-Cost Averaging

As defined by Forbes, dollar-cost averaging is when you invest small amounts in an asset over a more extended period, regardless of the price it is trading at. This is in stark contrast to many other trading strategies, which involve opening one position in an asset and then hoping that the price rises. Since dollar-cost averaging spreads out investments over time, it often lowers overall risk.

By following this approach, you will generate an ‘average price’ that you have invested at. The lower your average price, the better your returns will be if the asset’s value rises over the long term. In addition, dollar-cost averaging is ideal for avoiding human bias and emotion since it involves following the same structure, regardless of market conditions.

3. Passive Investing

Although perhaps not ideal for those wondering how to trade leveraged ETFs, passive investing can be an excellent approach for newcomers to the market or investors who don’t have time to monitor their positions actively. Investing passively removes the need to constantly conduct research and analysis, as the investment is placed and left without regular management.

Passive investing is best for ETFs that track market indices, such as the Vanguard S&P 500 ETF. Since these indices tend to exhibit positive annual returns, having a passive investment in this manner can be a great way of building up wealth over years or decades. Due to this, many investors opt to keep the bulk of their money in passively invested ETFs and just let them do their thing long-term.

4. Short Selling

Since ETFs follow the same rules as equities, certain trading platforms will allow you to short sell them. This process involves borrowing shares in an ETF and then selling them in the hope that the price goes down. Assuming price decreases, you would then repurchase the shares at the lower price and give them back to the initial lender – pocketing the difference as profit.

Due to the nature of short selling, this process is only offered by a few brokers and exchanges. Non-US residents can short sell easily through the use of CFDs, yet this is not an option in the States since CFDs are banned. Thus, short selling is best left to experienced traders with high risk tolerance, as the potential losses from short selling can theoretically be limitless.

5. Hedging

Rounding off our list of the best ETF trading strategies is hedging. If you are someone who invests in the best oil stocks regularly, you’ll already know the importance of hedging, as this process involves taking a position in an opposing asset to offset potential losses.

This can be thought of as ‘insurance’ against potential price decreases in the initial asset, although hedging will also result in lower returns if the asset increases in value. ETF options and ETF futures are two popular ways of hedging ETF investments, as they provide exposure to the asset’s price movements without having to own it.

Is ETF Trading Safe?

Our recommendation would be to partner with eToro, as the platform is regulated within the US by FINRA and FinCEN – two of the leading watchdogs for financial market trading. In addition, since eToro is used by over 24 million traders worldwide, this adds a significant degree of credibility to the platform.

Overall, whether you’re learning how to trade inverse ETFs or follow a day trading strategy, you’ll be glad to know that ETF trading is perfectly safe and conducted by thousands of investors every day. However, it’s still essential to follow proper risk-management strategies and only invest what you can afford to lose, as this will help improve your trading longevity.

How to Trade ETFs – eToro Tutorial

Before we conclude this guide on how to trade ETFs, let’s discuss the specifics of the investment process. As touched on earlier, it’s crucial to partner with a respected trading platform when making your investment, as this can ensure you trade safely and cost-effectively.

With that in mind, the four quick steps below will show you how to trade ETFs on eToro – all without paying a cent in commissions:

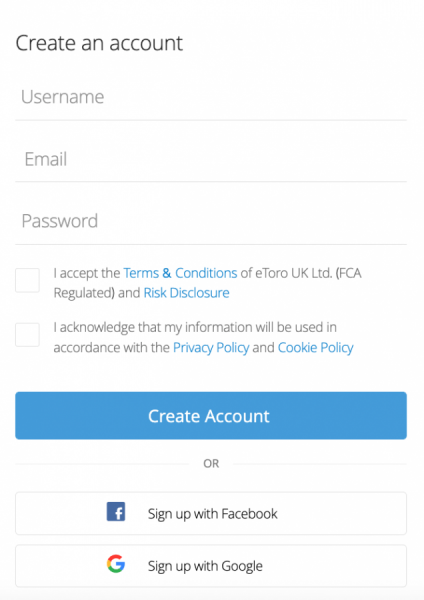

Step 1 – Open an eToro Account

Proceed to eToro’s homepage and click ‘Start Investing’. Enter a valid email address and choose a username and a password for your eToro login credentials.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

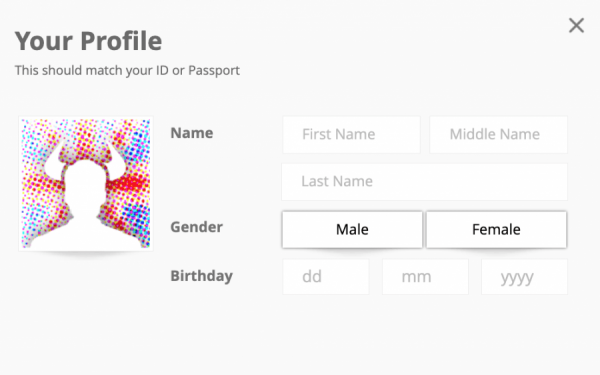

Step 2 – Verify Your Account

Since eToro is a heavily-regulated broker, new users must verify themselves before trading. To do so, click ‘Complete Profile’ and complete eToro’s KYC checks. You’ll then be asked to upload proof of ID (e.g. passport) and proof of address (e.g. bank statement) for verification purposes.

Step 3 – Make a Deposit

Click ‘Deposit’ and enter the amount you’d like to fund your account with (minimum $10). At present, eToro accepts the following deposit methods for US-based traders:

- Bank transfer

- Credit card

- Debit card

- PayPal

- Skrill

- Neteller

- Rapid transfer

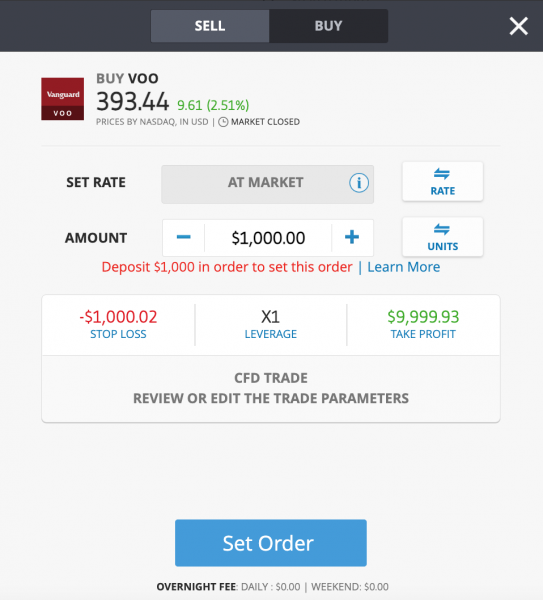

Step 4 – Trade ETFs

Enter the name or ticker symbol of the ETF you’d like to trade into eToro’s search bar and click ‘Trade’ when it appears. Enter your desired investment amount (minimum $10) in the order box, check that everything is correct, and click ‘Open Trade’.

Note: If the order box says ‘Set Order’, it means that the market is currently closed. You can still place the trade, yet it will only be executed when the market reopens.

How to Trade ETFs – Conclusion

In conclusion, this guide has presented an in-depth discussion on how to trade ETFs effectively, reviewing the top trading platforms available and exploring some of the most popular ETFs on the market.

We recommend partnering with eToro if you’re looking for the cheapest way to trade ETFs since you’ll be able to trade commission-free and from as little as $10 per trade. In addition, eToro is heavily regulated by FinCEN and FINRA, ensuring you’re offered a significant degree of investor protection.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.