If you’re looking to speculate on the future value of gold – there are many financial instruments that allow you to do this online.

Long-term investors will perhaps look for ETFs and gold-related stocks, while day traders will be more suitable for futures and options. In this beginner’s guide, we cover everything there is to know when learning how to trade gold.

This includes an overview of top gold trading platforms, which strategies to consider, and what markets are best suited for your skillset and financial goals.

How to Trade Gold – 5 Quick Steps

Trading gold online can be a very simple process when using a beginner-friendly platform like eToro. This low-cost trading site gives you access to a wide variety of gold trading markets alongside free USD deposits and small account minimums.

For a quick overview of how to trade gold online with eToro, follow the step-by-step guide below.

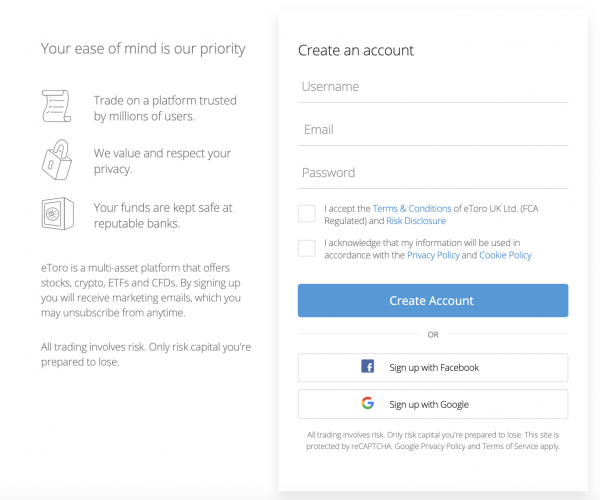

- ✅Step 1 – Register an Account With a Gold Trading Platform: First, you will need to register an account with your chosen gold trading platform. In the case of eToro.com, you can register an account in less than two minutes by entering your personal information and contact details, alongside a copy of your passport or driver’s license.

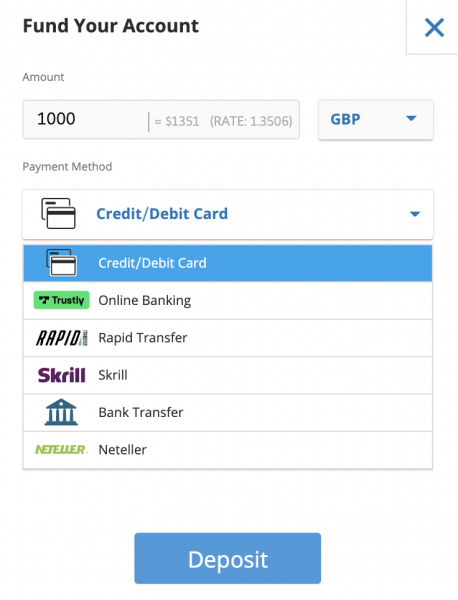

- 💳Step 2 – Deposit Funds: The minimum deposit when opening an account with eToro from the US or UK is just $10. USD deposits and withdrawals attract no transaction fees. You can deposit funds instantly with a debit or credit card, albeit, e-wallets, online banking, ACH, and more are supported too.

- 📖Step 3 – Research the Gold Trading Market: Like most commodities, the value of gold can be volatile and prolonged trends are not uncommon on the back of economic and geopolitical developments. As such, when learning how to trade gold, you will need to research the market before entering a position.

- 🔎Step 4 – Choose Which Gold Market to Trade: eToro supports a variety of gold markets. Long-term investors and beginners might opt for gold stocks or ETFs. If you’re based outside of the US, you can also trade gold spot prices via CFDs.

- 🛒Step 5 – Trade Gold: Click on the ‘Trade’ button and enter your stake – from $10. Click on the ‘Open Trade’ button to confirm your position.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

The above guide offers a quick insight into how gold trading works. With that said, you will find a much more detailed tutorial on how to trade gold with CFDs and more further down on this page.

Where to Trade Gold – Top Brokers Reviewed

One of the first steps that you will need to take is to decide where to trade gold in terms of choosing a broker.

This will require you to consider:

- The type of gold trading markets supported – such as ETFs, futures, options, or CFDs

- The minimum deposit requirement and any subsequent transaction fees

- The commissions charged when trading your preferred gold market

- Whether any notable gold trading tools are offered by the platform – such as technical indicators, leverage, or short-selling capabilities

Taking the above factors into account and more – below you will find an overview of the best places to trade gold online right now.

1. eToro – Overall Best Broker to Trade Gold

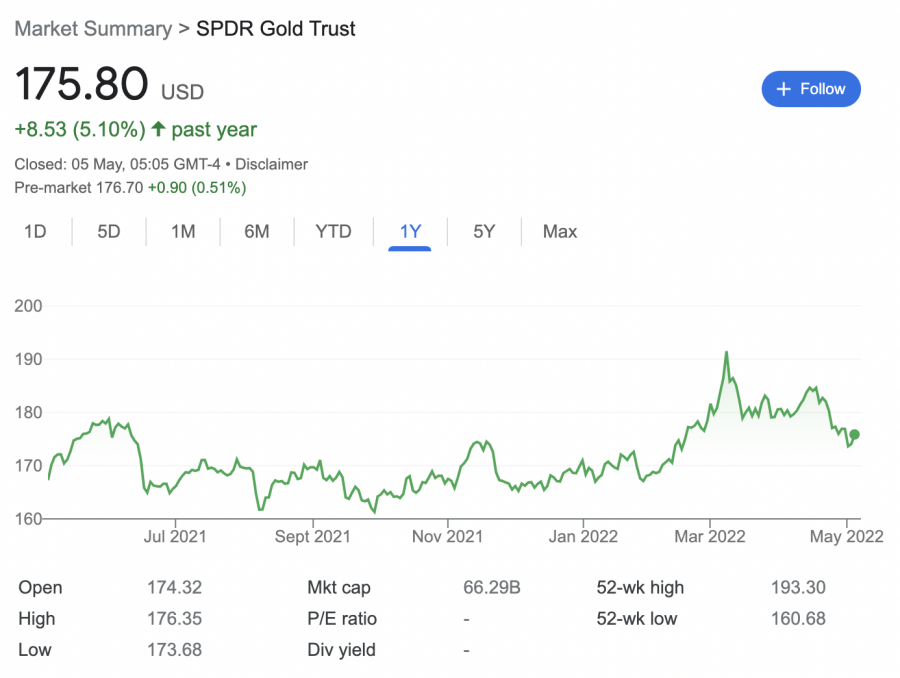

For instance, if you are a beginner that is looking to invest in gold for the long run, then you might consider the SPDR Gold ETF. This fund is mostly backed by physical gold bullion, which is a superb way to gain exposure to the precious metal in a passive way. Plus, all gold ETFs at eToro can be traded commission-free.

You might also consider investing in gold-related stocks – of which there are many to choose from on the eToro platform. Just like ETF, there are no commissions to pay when buying and selling stocks, and the minimum trade requirement is just $10. Moreover, for those interested in trading stocks and investing in ETFs eToro’s commission-free offering is also applicable to non-US gold stocks and ETFs – such as those listed in Europe and Asia.

Alternatively, if you are based outside of the US, the best way to trade gold on the eToro platform is via CFDs. When trading CFDs, this mirrors the real-time price of gold. CFDs at eToro can be traded with leverage of up to 1:20 and you also have the option of short-selling. Overnight financing fees will apply to gold CFD positions.

You can also access trading tools on eToro that allow you to invest passively. Both inexperienced and time-starved investors will appreciate the copy trading feature, which allows you to automatically mirror the positions of a seasoned pro. You can also invest in a pre-made smart portfolio that tracks a specific marketplace or industry.

We also like eToro for its fee-free USD deposits and withdrawals. Supported payment types are inclusive of e-wallets, Visa, MasterCard, ACH, online banking, and more. Crucially, eToro is authorized and regulated by the SEC and FINRA. It also holds regulatory licenses with CySEC, ASIC, and the FCA.

Once your eToro account has been funded, you might also look to trade cryptocurrency markets like Bitcoin or Dogecoin. Just $10 is required to access this marketplace and eToro supports dozens of leading digital tokens.

There’s also an eToro mobile stock app available to trade gold and other assets at the click of a button.

| Types of Gold Markets | Gold-centric stocks and ETFs, CFDs (non-US clients) |

| Trading Commission | 0% commission on gold stocks and ETFs |

| Debit Card Fee | FREE for US deposits |

| Minimum Deposit | $10 (for US and UK residents) |

What We Like

- Heavily regulated

- Super low trading commissions

- Fee-free US dollar deposits

- Deposit funds with a debit/credit card, e-wallet, or bank transfer

- Copy-trading tools

- Perfect for beginners

- iOS and Android app to trade gold

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull – Buy and Sell Gold Stocks and ETFs at 0% Commission

When you invest in stocks on the Webull platform or mobile app – which is available to download for iOS and Android, you will only need to meet a minimum stake of $5. Moreover, you will not need to meet a minimum deposit when you first open a Webull account.

As a result, Webull is suitable for all budgets and experience levels. In addition to stocks, Webull also gives you access to leading gold ETFs. As noted earlier, this will enable you to indirectly invest in gold in a passive manner. The other option you have is to trade your chosen gold stocks via options contracts.

This option will not only allow you to choose from a long or short position, but you can access trading capital that exceeds your Webull balance. After all, options only require a small premium upfront to enter a trade. Across all gold-centric stocks, ETFs, and options, you can access your desired market without paying any commission at Webull.

Webull also enables you to buy cryptocurrency assets and the minimum stake requirement is even lower at $1. This covers everything from Bitcoin and Dogecoin to Cardano and Shiba Inu. More experienced gold traders are also covered on the Webull platform, not least because it offers advanced charts and even technical and economic indicators.

If you’re torn between the two top trading platforms from our list you can find a more detailed analysis of both in our eToro vs Webull comparison review.

| Types of Commodity Markets | Gold-centric stocks, ETFs, and options |

| Trading Commission | 0% commission on all markets |

| Debit Card Fee | ACH (free) and bank wire ($8) deposits only |

| Minimum Deposit | $0 |

What We Like

- No minimum deposit

- Trade stocks and ETFs from $5

- Suitable for both beginners and experienced traders

Your capital is at risk.

3. Charles Schwab – Top Trading Suite to Access Gold Futures

One of the most flexible ways to trade gold online is via the futures markets. As a financial derivative, you might want to stay clear of futures unless you have prior experience. if you do, then Charles Schwab is one of the best platforms for this purpose.

On this platform, you will be trading gold futures that are listed on the New York Mercantile Exchange (NYMEX). This means that each contract size is worth 100 troy ounces. With that said, Charles Schwab also gives you access to gold futures contracts at 10 and 50 troy ounces each.

Either way, Charles Schwab allows you to start trading gold futures for just $2.25 per contract – in addition to regulatory and exchange fees. Outside of its futures division, Charles Schwab also offers access to gold stocks and ETFs. You can trade commodities like oil and silver too – should you wish to diversify into other markets.

Charles Schwab is also a great option if you wish to invest money into the financial markets passively. Not only does the platform offer pre-made portfolios and mutual funds, but you can also access tailored financial advice. With that said, specialist accounts that come alongside guidance will attract a higher minimum investment requirement.

| Types of Commodity Markets | Futures, options, gold-centric stocks, and ETFs |

| Trading Commission | From $2.25 per contract |

| Debit Card Fee | Not supported |

| Minimum Deposit | $0 on self-directed accounts |

What We Like

- Huge range of gold futures and options

- Gold-centric ETFs also offered

- No minimum deposit on standard self-directed accounts

4. TD Ameritrade – Day Trade Gold Derivatives Alongside Advanced Charting Tools

The thinkorswim suite offered by TD Ameritrade is aimed at highly experienced day traders that are comfortable using advanced tools. Accessible via your web browser or desktop software, thinkorswim offers economic indicators, customizable charts, screeners, custom order types, and more.

You can even access thinkorswim via the platform’s iOS and Android apps. In terms of its supported gold markets, TD Ameritrade is home to a wide selection of futures. This is inclusive of standard gold futures that are physically settled with a multiplier of either $100 or $10.

You can also trade mini gold futures with a multiplier of $50 that are settled in cash. Commissions mirror that of its parent organization – Charles Schwab, insofar that each gold futures contract will cost you $2.25 plus regulatory and exchange fees. In addition to futures, you can also trade gold here via stocks, ETFs, and options.

| Types of Commodity Markets | Futures, options, and ETFs |

| Trading Commission | From $2.25 per contract |

| Debit Card Fee | Not supported |

| Minimum Deposit | $0 on self-directed accounts |

What We Like

- Trade gold via futures contracts

- Gold options trading and ETFs are also supported

- Competitive margin funding rates

5. Interactive Brokers – Gain Access to US Spot Gold Trading Market

If you are looking for the best way to buy and own gold online via a top-rated trading platform, you might want to consider Interactive Brokers. This is because the platform gives you access to US spot trading markets. In simple terms, this means that your trade will be settled instantly.

And as such, when you trade gold at Interactive Brokers, you will be investing in the underlying commodity. The minimum trade size requirement stands at 1 ounce, which, as of writing, is worth in the region of $1,800. Moreover, this gold broker even allows you to request physical delivery of your gold trading investment.

Whether you receive this in bullion bars (1 kg) or coins (1 oz) will depend on how much gold you purchase. In addition to spot trading, Interactive Brokers also allows you to speculate on gold via futures and options. You will also find gold-related stocks and ETFs, so you’ve got plenty of options when choosing this platform.

| Types of Commodity Markets | Futures, options, ETFs, mutual funds |

| Trading Commission | From $0.85 per contract |

| Debit Card Fee | Not supported |

| Minimum Deposit | $0 on self-directed accounts |

What We Like

- Trade futures from just $0.85 per contract

- Various commodity trading accounts to choose from

- Great reputation

Gold Trading Explained – Overview

The process of trading gold can vary wildly depending on what your investment goals are.

- Nonetheless, in its most basic form, you will be looking to speculate on the future value of gold with the view of making a profit.

- Like most commodities, gold is quoted and traded against the US dollar. Most analysts and traders will assess the price of gold per ounce (oz).

- Its price movement is determined by global demand and supply and thus – will change as every second passes.

- This presents highly conducive conditions for both long and short-term traders.

As you will come to learn when exploring how to trade gold for the first time, you can buy and sell this precious metal without needing to own or store any bullion bars. On the contrary, you can gain exposure to the future value of gold via a number of popular trading instruments.

For beginners, you might consider investing in a suitable ETF, which is backed by physical gold bars. Gold stocks are also worth considering should you wish to invest in gold on a medium or long-term basis.

- Alternatively, if you have some prior experience with financial derivatives, you might consider trading gold futures or options.

- Non-US clients can also access CFDs, which track the market value of gold in real-time.

- Opting for gold derivatives will also give you the option of short-selling the precious metal and even trading with leverage.

Either way, when you trade gold online, your overarching objective is to predict whether the commodity will rise or fall. Your profit or loss will be determined by whether you speculated correctly and by how much, alongside the size of your stake.

How Does Gold Trading Work?

You will need to have a firm grasp of how to trade gold before you open an account with an investment broker.

Otherwise, you won’t know how to approach this market in terms of suitable financial instruments, risk-management strategies, and gold research methods.

Gold Trading Markets

Like most commodities, there is a standardized gold pricing system that is utilized globally. In the vast majority of cases, gold is quoted per ounce in US dollars. A small number of markets will opt to trade gold per kilo, and perhaps in another currency.

With that said, if you are learning how to trade gold for the first time, it’s best to view and analyze this market in dollars per ounce.

- For example, let’s supposed that gold is trading at $1,800 per ounce

- In order to trade, you will need to determine if the price of gold will rise or fall

- We’ll say that you stake $500 on gold increasing in value

- A few weeks later, gold is trading at $1,980 per ounce – which represents an increase of 10%

- On your $500 stake, you’ve made gains of $50

However, as we explain in much more detail in the sections below, the way in which you can trade gold online will vary considerably depending on the financial instrument that you opt for.

For instance, you can speculate on gold via the US spot trading markets, futures, options, ETFs, and even stocks. The instrument that you opt for will ultimately depend on your trading goals and prior experience.

Gold Trading: Stocks and ETFs

The first method to consider when deciding on how to trade gold is via a traditional asset class like stocks or ETFs. Starting with stocks, you will be investing in companies that operate in the gold industry. In many cases, this will be a gold mining company that is listed on a major US exchange.

You might also consider gold stocks from Canada, Australia, or Europe for added diversification. In terms of the pros, gold-centric stocks allow you to gain exposure to this precious metal indirectly and in a beginner-friendly way. Moreover, if using eToro for this purpose, not only can you invest in gold companies from just $10 per trade, but also without paying any commission.

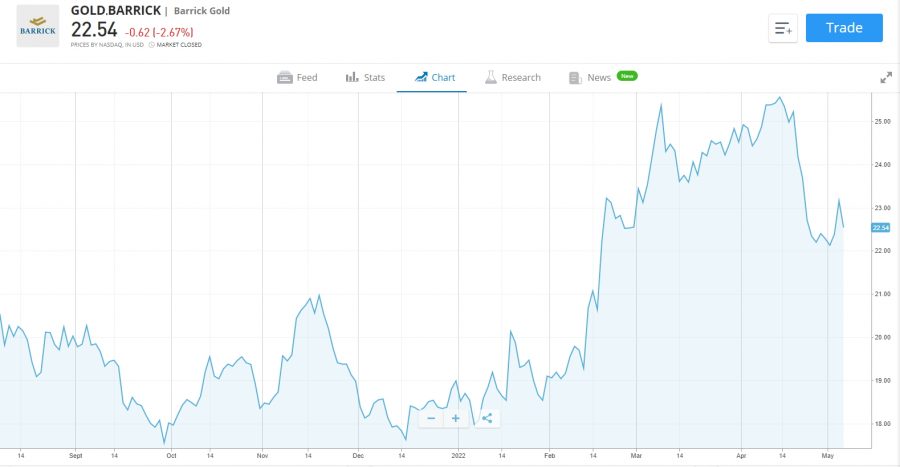

On the other hand, there will often be a huge disparity between the performance of your chosen gold-related stock with that of global spot prices. For example, according to the eToro brokerage data center, the spot price of gold has increased by 5.90% over the prior 12 months. During the same period, leading mining company Barrick Gold has seen its stock price increase by 4.72%.

In addition to stocks, beginners might also consider trading gold via a leading ETF. One of the best options here is the SPDR Gold Shares ETF. This ETF is physically backed by gold bullion, which means that it indirectly allows you to speculate on the precious metals passively. Moreover, there will be a much closer correlation between this ETF and spot prices when compared with stocks.

After all, the ETF physically owns and holds gold bullion, which will rise and fall in line with global prices. You can access this gold ETF at eToro. Just like the aforementioned gold-centric stocks, eToro offers ETFs at 0% commission and from a minimum trade requirement of just $10. Just remember, ETFs backed by physical gold do not yield dividends.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Gold Trading: Futures vs Options

If stocks or ETFs do not offer enough correlation for your liking, then you might need to consider trading gold through futures or options. Both of these financial derivatives are readily available at online brokers in the US, albeit, they do require an element of prior experience.

Moreover, while stocks and ETFs are great for long-term investments, futures and options are more suited for day or swing traders.

- One of the main benefits of trading gold through futures and options is that you will have access to margin.

- For instance, you might only need to cover a 5% margin to enter a trade, which means that a $10,000 position would require just $500.

- Furthermore, gold futures and options allow you to choose from a long or short position, which means that you can attempt to profit from both rising and falling commodity prices

- Futures and options are also similar because they will come with an expiry date – which is often three months.

The key difference between the two is what happens when the underlying contracts expire

In terms of how to trade gold futures on expiry, you have a legal obligation to settle the underlying contract. This will either be a physical settlement in gold or cash.

When holding options, however, there is no requirement to buy or sell the underlying contracts. Instead, if the trade does not go to plan, you will simply lose the premium. This is a small fee that you are required to pay to open your gold options position.

Gold Trading CFDs

You can also trade US spot prices without owning the underlying gold via CFDs. This type of derivative is not available to US clients.

Nonetheless, gold CFDs simply track the spot price of the precious metals. Therefore, all you need to do is to predict whether you think the price of gold will rise or fall.

If you’re wondering where to trade gold CFDs, eToro is a great option in terms of regulation, low fees, and access to leverage.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Gold Trading Forex

If you’re wondering how to trade gold in forex, this works pretty much the same way as CFDs. This is because you will be trading gold against the value of another currency – often the US dollar.

As such, in order to make a profit when learning how to trade gold forex, you will need to speculate on whether its spot value will rise or fall.

Why Trade Gold?

The gold trading markets won’t be suitable for all investor profiles – especially if you are looking to build a long-term portfolio of dividend-paying assets.

Nonetheless, in the sections below, we explore some of the key benefits that you will come across when learning how to trade gold.

Store of Value

Gold is the ultimate store of value. After all, gold has been used as a means to represent value for thousands of years. This is because gold is a finite asset class, which means that its total supply is limited.

As long as there is always demand for gold, this should ensure that the precious metal continues to retain its value over the course of time.

Hedge Against Falling Stock Markets

There is a historical correlation between gold and the stock markets. At the forefront of this is that when the stock markets are falling – the price of gold often moves in the opposite direction.

This is especially the case when there is economic uncertainty or the threat of a recession. Gold also performed well in the early stages of the pandemic, due to its status as a safe haven asset.

No Need to Own or Store Gold

Another benefit that you will come across when learning how to trade gold is that you do not need to worry about actually owning or storing the precious metal in order to gain exposure to its price.

Instead, there are a plethora of ways that you can trade gold online without ever needing to see or touch the commodity. This includes everything from gold futures, options, and CFDs to stocks and ETFs.

Gold is Volatile

If you are looking to become a day trader, then gold is a great asset class to focus on. Not only do the gold trading markets attract huge volume and liquidity, but the value of this precious metal can be overly volatile.

This will give you plenty of opportunities throughout the day to enter trading positions.

You can Trade Gold on Margin

If opting to trade gold through futures or options, you can access significantly more capital than you have available in your account. In fact, some of the best commodity brokers in this space require just 5% to open a position.

This means that a gold trade worth $20,000 would require an upfront balance of just $1,000.

How to Make Money from Gold Trading

The most obvious way of making money from gold is to buy physical bars and coins, and hope that its global value increases. If it does, and you decide to sell your gold, you will make a profit.

However, when trading gold online, you have access to a much greater number of investment opportunities.

For example, if you decide to buy gold stocks, you can make money in two ways. This covers an increase in the firm’s share price alongside quarterly dividends.

If opting for gold derivatives, you can make money by speculating on whether the price of the commodity will rise or fall. You can also amplify the value of your position by trading on margin.

Gold Trading Hours

The hours that you can trade gold will depend on the respective financial instrument and the exchange that it is listed on.

For example, if you decide to trade gold ETFs that are US-listed, standard trading hours of 9.30 am to 4 pm, Monday to Friday will likely apply.

On the other hand, if you decide to trade gold futures that are US-listed, then you can often trade much longer hours. Gold futures markets in the US typically open at 6 pm on Sunday and close at 5 pm on Friday.

Gold Price Movements

Gold prices on a global basis are determined by market forces. In addition to demand and supply, this also takes into account investor sentiment.

For example, we mentioned earlier that in the midst of the pandemic, gold performed very well. In fact, it was in August 2020 that gold last hit an all-time high of just under $2,100 per ounce.

The reason for this is that the broader markets turned to gold as a means to hedge against the economic fallout of COVI-19. Crucially, the price of gold goes up and down throughout the day, meaning that there are plenty of trading opportunities on the table.

What are the Best Gold Assets to Trade?

If you’re still wondering which gold asset class is best for you – consider the five financial instruments outlined below.

SPDR Gold ETF

If you’re a complete beginner in the world of gold trading, you might want to stick with an ETF. As noted earlier, the SPDR Gold ETF is great for this purpose, as its portfolio mainly consists of physical gold bullion.

All you need to do is meet a minimum investment of $10 to gain exposure to this ETF at eToro – and no commissions will apply. You can cash out your SPDR Gold ETF investment at any time during standard market hours, so you’ll never be short of liquidity.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Barrick Gold Stocks

Another great trading option for newbies is to consider investing in a leading gold mining company. At the forefront of this is Barrick Gold, which is listed on NYSE.

With over 16 operating locations in several countries and regions, this top-rated gold stock is up over 43% over the prior five years.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Gold Spot Price CFDs (Non-US Clients Only)

You can also trade the spot price of gold through CFDs. Although, as we mentioned earlier, this financial instrument is not available to US clients.

If you’re based outside of the US, you can trade the future price of gold with just a few dollars when using eToro for this purpose. You can also trade gold CFDs with leverage and you will have access to short-selling capabilities at the click of a button.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

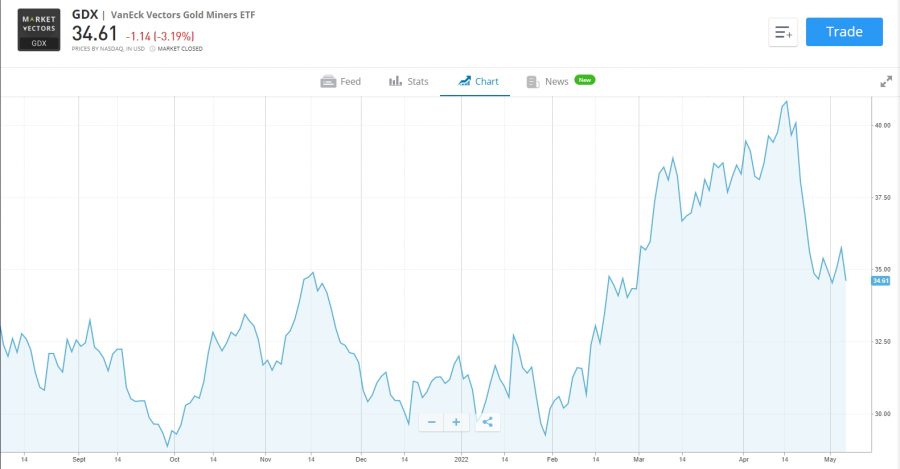

VanEck Vectors Gold Miners ETF

This fund takes a completely different approach to the aforementioned SPDR Gold ETF. While the latter is physically backed by bullion, the VanEck Vectors Gold Miners ETF gives you access to a diversified basket of gold stocks.

In fact, by investing in this ETF, you will indirectly own 57 gold mining stocks from a variety of markets. This includes mining firms in the US, Canada, Australia Brazil, South Africa, China, and more.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Kinross Gold

If you’re looking for a way to invest in gold via an undervalued stock, then you might want to take a closer look at

Kinross Gold. This large gold mining company is based in Canada, albeit, it has operations globally.

This is inclusive of mines in South America, Africa, and the US. Over the prior 12 months, Kinross Gold stock is down nearly 30%. As such, this allows you to buy this top-rated gold mining stock at a major discount.

You’ll also have access to a running dividend yield of over 2.3%, based on prices as of writing.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Best Gold Trading Strategies

In this section of our guide on how to trade gold, we’ll discuss a selection of strategies that you might want to consider if you are looking to gain exposure to this asset class for the first time.

Start Off With an ETF

The best strategy that you can implement as a newbie is to start off with an ETF that is backed by physical gold.

As previously noted, this simply requires an investment of $10 or more when using eToro – and your ETF portfolio will be managed on your behalf by a large-scale provider like SPDR.

As the ETF will be backed by physical gold, there should be a close correlation between spot prices and that of your chosen fund.

Learn the Relationship Between Gold and Stocks

We also mentioned earlier that gold often has an inverse relationship with the broader stock markets. In theory, this means that when the wider stock markets are up, gold prices will decline – and visa-versa.

In understanding how this inverse relationship works, you will give yourself the best chance possible of predicting the future value of gold.

Keep an Eye on Key Economic Indicators

Investors will often flock to gold during times of economic uncertainty, not least because the precious metal is viewed as a safe haven.

As such, when economic indicators are pointing to potential recession – such as rising inflation and unemployment levels, this could represent a good time to open a long trading position on gold.

Day Trade Gold to Take Advantage of Volatility

If you thinking about becoming a day trader, then you will want to focus on asset classes that offer plenty of trading opportunities. And gold is at the forefront of this thanks to the enhanced volatility that it attracts.

Moreover, gold is one of the most traded commodities globally, so there will never be any issues with liquidity.

Look Out For Gold Demand From Major Economies

Another great gold trading strategy that will help you determine future price movements is to look for indicators of increased demand from major economies.

For example, in recent years, the Chinese government has continued to increase its gold imports by a considerable amount. And when it releases new import figures, this often leads to a gold price rally.

Is Gold Trading Safe?

When you trade gold online, you are speculating on its future value – whether that’s a price increase or decrease. Either way, if you speculate incorrectly, then you will, of course, lose money.

As such, in order to trade gold safely, you should ensure that you have sensible risk management strategies in place. This should, at a minimum, include stop-loss orders and bankroll management tools.

Furthermore, you also need to consider the safety of the gold trading platform that you decide to open an account with. This is why we found that eToro is the best option in the market.

In addition to offering low fees and small account minimums, eToro is regulated by the SEC and FINRA, as well as by financial bodies in the UK, Cyprus, and Australia. Moreover, eToro supports fractional trading from $10 alongside stop-loss orders.

How to Trade Gold – eToro Tutorial

To place your first gold trading order right now, check out the step-by-step outlined below. In doing so, you will learn how to trade gold on the eToro platform in a low-cost and secure way.

Best of all, the setup process rarely takes more than a few minutes.

Step 1: Open an eToro Account

Visit the eToro website and click on ‘Join Now’ to open an account. You will need to enter your name, home address, nationality, and a variety of other personal details.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

You will also need to enter and verify your cell phone number.

Step 2: Deposit Trading Capital

If you’re based in the US, the minimum deposit at eToro is just $10. You can also deposit funds without paying any fees.

Supported payment methods at this broker include e-wallets, ACH, online banking, and debit/credit cards.

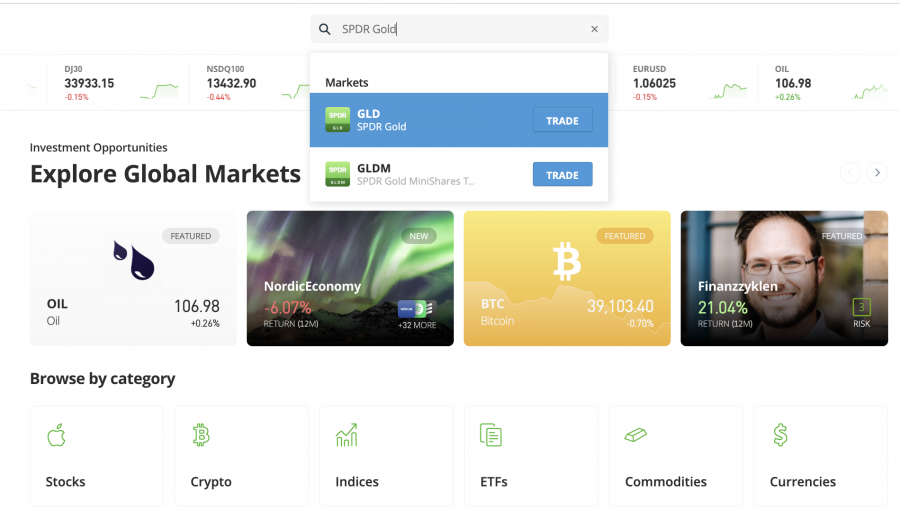

Step 3: Search for Gold Market

In the search bar, type in the name of the gold market that you are looking to trade.

In our example above, we are searching for the SPDR Gold ETF.

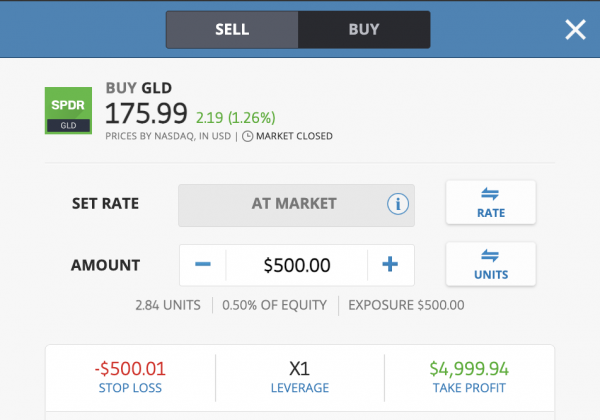

Step 4: Place Gold Trading Order

If you are trading gold stocks or ETFs at eToro, then the minimum stake requirement is just $10. You can enter your stake in the ‘Amount’ box and click on ‘Open Trade’ to confirm the gold trading position.

If the respective gold market is closed, click on ‘Set Order’ instead. eToro will then place your order when the market opens.

Conclusion

No longer do you need to buy gold coins or bars in order to gain exposure to this precious metal. On the contrary, this guide on how to trade gold has covered a variety of ways to access this market – including stocks, ETFs, CFDs, options, and futures.

You can begin trading your chosen gold market right at eToro, by opening an account and meeting a minimum fee-free deposit of just $10. Then, it’s just a case of searching for your preferred gold trading instrument and placing an appropriate order.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.