After hitting lows of sub-$20 a barrel in 2020, oil has since made gains of over 500% to surpass the $100 level. With that said, oil is still a highly volatile asset class, which will suit short-term traders.

In this guide, we explain how to trade oil online via futures, options, stocks, and ETFs.

How to Trade Oil – 5 Quick Steps

For a quick overview of how to trade oil in five simple steps – check out the walkthrough below:

- ✅Step 1 – Choose an Oil Trading Platform: The first step is to register an account with an online broker that offers oil trading markets. We found that eToro is a good option as it offers a variety of oil trading instruments across stocks, ETFs, and financial derivatives. From start to finish, it takes just two minutes to open an account with eToro.

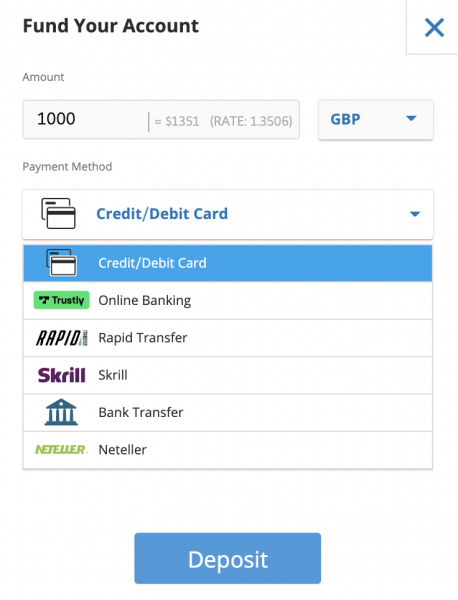

- 💳Step 2 – Deposit Funds: You can get started with a minimum deposit of just $10 at eToro if you are a US client. You won’t be charged any deposit fees when funding your account in USD and payment options are inclusive of debit and credit cards, e-wallets, and bank transfers.

- 📖Step 3 – Research the Oil Market: In order to speculate on the future direction of oil, you will need to research the market. As a beginner, it’s a good idea to read financial news reports and market insights with the view of assessing whether oil will rise or fall in value.

- 🔎Step 4 – Choose Which Oil Market to Trade: At eToro, US clients can trade oil stocks and ETFs. Non-US clients can also trade oil via CFDs.

- 🛒Step 5 – Trade Commodities: Finally, click on the ‘Trade’ button and enter the amount of money that you would like to risk on your oil trading position. Click on the ‘Open Trade’ button to place your order.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Where to Trade Oil – Top Futures & Options Brokers Reviewed

If you’re looking at where to trade oil online, you will need to do this through an online broker. Your chosen platform should give you access to the specific financial instrument that you wish to trade – such as the best oil stocks, ETFs, or derivatives.

Below, you will find reviews of where to trade WTI crude oil and other relevant markets from the comfort of your home.

1. eToro – Overall Best Platform to Trade Oil

As a beginner learning how to trade oil for the first time, stocks operating in this sector offer the best way to gain exposure to this commodity. Alternatively, you might consider investing in oil ETFs at eToro, such as the United States Oil Fund and the SPDR S&P Oil & Gas Exploration & Production ETF.

Regardless of which oil stock or ETF you want to trade, eToro will not charge you any commission. This means you can learn how to trade ETFs with some of the most competitive fees on the market. This is the case across both US and foreign-listed markets. Moreover, eToro only requires you to meet a minimum trade size of $10 – which allows you to gain exposure to oil without risking too much money.

If you are based outside of the US, eToro also allows you to trade oil CFDs – which mirror the real-world spot price of the commodity. This will also allow you to trade oil with leverage and even short-sell the asset when you believe its price will decline. Additionally, eToro also allows you to trade cryptocurrency assets like Bitcoin, Shiba Inu, Dogecoin, and Ethereum.

Another top-rated feature enjoyed by eToro clients is its copy trading tool. This offers a passive way to invest in the stock markets, as you will be copying an experienced trader like-for-like. For instance, if you invest $1,000 into a trader that allocates 10% of their portfolio into Saudi Aramco, you will automatically inject $100 into this oil company.

If you like the sound of automated investing, smart portfolios might also be of interest. These are professionally managed by the eToro team and there are many strategies to choose from. This includes everything from dividend stocks and the most undervalued stocks to Asian stocks and stay-at-home economy stocks. On the topic of stocks, eToro also lets you day trade stocks with low fees.

To open an account with eToro, US and UK clients are required to deposit just $10. For other selected countries, the minimum first deposit stands at either $50, $200, $1,000, and even $10,000 for users residing in Israel. Additionally, all deposits made using a bank transfer have to meet a minimum of $500. USD deposits and withdrawals are processed fee-free and supported payment types include ACH, bank wires, PayPal, Neteller, Visa, and MasterCard.

| Types of Oil Markets | Oil-centric stocks and ETFs, CFDs (non-US clients) |

| Trading Commission | 0% commission on Oil stocks and ETFs |

| Debit Card Fee | FREE for US clients |

| Minimum Deposit | $10 (for UK and US residents) |

What We Like

- Heavily regulated

- Super low trading commissions

- Fee-free US dollar deposits

- Deposit funds with a debit/credit card, e-wallet, or bank transfer

- Copy-trading tools

- Perfect for beginners

- iOS and Android app to trade oil

- Learn how to trade gold with a range of financial instruments

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

2. Webull – Buy and Sell Oil Stocks and ETFs at 0% Commission

Just like eToro, you will not pay any trading commissions when you buy and sell stocks or ETFs on this platform. Moreover, Webull supports fractional ownership from just $5 – or $1 when you buy cryptocurrency. Another way that you can gain exposure to oil at Webull is via stock options.

You should, however, have prior experience in financial derivatives such as options before you access this marketplace. Nonetheless, stock options allow you to enter much larger positions in comparison to what you have available in your Webull account, as you only need to cover the premium to enter a trade.

Webull also offers an advanced trading suite that will appeal to experienced investors that wish to analyze oil prices in real-time. You can also deploy chart drawing tools and economic indicators to perform technical analysis. Beginners will prefer the main Webull interface – which simply requires you to pick an asset and enter your stake.

To open an account with Webull, you will not be required to meet a minimum deposit. You can fund your account via a bank wire but this attracts a fee of $8. Fee-free deposits can be made with ACH. There is no support for debit or credit cards. Finally, Webull offers a mobile app for iOS and Android that is free to download and connects to your main account.

Read our eToro vs Webull review if you are still deciding which broker is best for you.

| Types of Commodity Markets | Oil-centric stocks, ETFs, and options |

| Trading Commission | 0% commission on all markets |

| Debit Card Fee | ACH (free) and bank wire ($8) deposits only |

| Minimum Deposit | $0 |

What We Like

- No minimum deposit

- Trade stocks and ETFs from $5

- Suitable for both beginners and experienced traders

Your capital is at risk.

3. Schwab – Access a Wide Range of Oil Futures Markets

You can trade crude oil futures here from just $2.25 per contract. You will have access to a huge range of investment tools and features that will enable you to predict the future price of oil. For example, Schwab offers a trading calculator to check your margin requirements, real-time charts, and market insights from industry experts.

There is no minimum deposit requirement at Schwab on standard self-directed investment accounts. But, if you are planning to trade oil on margin, then a $2,000 account minimum is required. Margin trading fees will apply for as long as your leveraged position remains open and at Schwab – this is typically very competitively priced.

| Types of Commodity Markets | Futures, options, oil-centric stocks, and ETFs |

| Trading Commission | From $2.25 per contract |

| Debit Card Fee | Not supported |

| Minimum Deposit | $0 on self-directed accounts |

What We Like

- Huge range of oil futures and options

- Oil-centric mutual funds also offered

- No minimum deposit on standard self-directed accounts

4. TD Ameritrade – Trade Oil Futures via an Advanced Platform

TD Ameritrade is another popular US-based broker that allows you to trade a variety of oil futures. When opening an account with this broker, you will have access to futures that track WTI crude, RBOB, Brent crude, and micro crude.

In terms of pricing, TD Ameritrade charges $2.25 per futures contract just like Schwab. TD Ameritrade offers a highly advanced platform called Thinkorswim – which was designed for futures trading. can access Thinkorswim online, through downloadable desktop software, or an app for iOS and Android.

All Thinkorswim platforms come packed with technical indicators, chart drawing tools, and advanced order types. In addition to futures, TD Ameritrade also gives you access to thousands of stocks – many of which operate within the oil sector. You can also access ETFs, options, mutual funds, forex, bonds, and more.

| Types of Commodity Markets | Futures, options, and ETFs |

| Trading Commission | From $2.25 per contract |

| Debit Card Fee | Not supported |

| Minimum Deposit | $0 on self-directed accounts |

What We Like

- Trade oil via futures contracts

- Oil options trading and ETFs are also supported

- Competitive margin funding rates

5. Interactive Brokers – Global Trading Platform With Competitive Fees on Oil Futures

The final option to consider when learning about where and how to trade crude oil is Interactive Brokers. This US-based brokerage site gives you access to oil futures at competitive fees – you’ll pay from just $0.85 per contract. Some of the most traded futures markets here include crude, e-mini crude, and soybean oil.

Just like Schwab and TD Ameritrade – Interactive Brokers is ideally suited for seasoned investors that seek access to a highly advanced trading suite. Technical analysis tools and comprehensive market insights are available and you can also trade oil on margin. Funding rates vary but are usually competitive.

At Interactive Brokers, you can also trade stocks and ETFs from thousands of markets and dozens of exchanges. Options, currencies, bonds, and funds are also offered by this platform. If you decide to invest in oil-centric stocks, Interactive Brokers supports fractional trading. US-listed stocks can also be traded commission-free.

| Types of Commodity Markets | Futures, options, ETFs, mutual funds |

| Trading Commission | From $0.85 per contract |

| Debit Card Fee | Not supported |

| Minimum Deposit | $0 on self-directed accounts |

What We Like

- Trade futures from just $0.85 per contract

- Various commodity trading accounts to choose from

- Great reputation

Oil Trading Explained – Overview

Oil is the most demanded commodity on planet earth. The global price of oil is determined by demand and supply – like any other asset. However, as a large percentage of global oil production output is controlled by the Organization of the Petroleum Exporting Countries (OPEC), prices are often artificially manipulated.

As such, when you trade oil, it’s always a good idea to keep tabs on anything that OPEC says and does. In terms of the basics, when learning how to trade commodities, you will be required to predict whether you think global prices will rise or fall. The two primary benchmarks to concentrate on are the West Texas Intermediate (WTI) and Brent crude.

If you are able to speculate on the future value of oil correctly – in terms of whether its price rises or falls, then you will make a profit. However, you need to think about what oil market is best suited for your skillset. For instance, those based outside of the US can easily speculate on the future price of oil via contracts-for-differences (CFDs).

This is a financial instrument offered by a variety of online brokers and they simply track the price of oil on a second-by-second basis. As US-based investors will not have access to oil CFDs, alternative markets include futures and options – both of which allow you to trade oil on margin.

With that said, futures and options are complex financial derivatives that often require you to open a margin account – which means that as per SEC rules, a deposit of $2,000 or more is required. If this is too much money for you to risk, then you might consider gaining exposure to oil via stocks or ETFs.

How Does Oil Trading Work?

Now that we have covered the basics, this section of our guide will take a much closer look at how to trade oil. This will ensure that you approach the oil trading markets with your eyes wide open.

Oil Trading Markets

There are many variations of oil that can be bought and sold.

- However, as noted above, the two most common benchmarks to focus on are the WTI and Brent crude.

- The former is the benchmark used in the US, while the latter is globalized.

If you are just learning how to trade oil for the first time, then the Brent crude market is perhaps the best option to start with.

This is because when you read market insights and research reports, analysis is typically concentrated on Brent crude prices.

Nonetheless, like most commodities, the price of oil is quoted in US dollars. Its value changes on almost a second-by-second basis based on global demand and supply.

Oil Trading: Stocks and ETFs

Choosing a suitable market and financial instrument is crucial when you are learning to trade oil. If you are a complete novice, then we would suggest staying clear of complex financial instruments – such as futures and options. Instead, a great way to gain exposure to the oil markets is via relevant stocks.

There are dozens of oil companies listed on US stock exchanges, which means that you can easily diversify. Stocks operating in this sector are heavily dependent on oil prices. As such, when oil prices rise, this often results in stocks from within this space rising. However, the price of oil and your chosen stocks will never correlate 100%.

Another way that you can trade oil as a beginner is to invest in a suitable ETF. One of the best options to consider is the United States Oil Fund. This ETF will track the WTI Light sweet crude oil prices. As a result, so you’ll have a much better chance of gaining exposure to ever-changing oil prices – but in a diversified manner.

Another top-rated oil ETF that you might consider is the SPDR S&P Oil & Gas Exploration & Production ETF. This ETF invests in over 60 companies that operate in the oil and gas industry – such as EQT Corporation, Antero Resources, and Southwestern Energy.

If you decide to invest in oil-centric stocks or ETFs, then eToro is the best place to achieve this goal. Not only can you invest in your chosen stock or ETF from just $10, but you won’t pay any trading commissions.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Oil Trading: Futures vs Options

The next option to consider when learning how to trade stocks is to access this market via financial derivatives like futures or oil. But, as noted earlier, futures and options are best suited for experienced investors that have a higher appetite for risk.

If you are completely new to derivatives, we explain how to trade oil futures and options in the sections below:

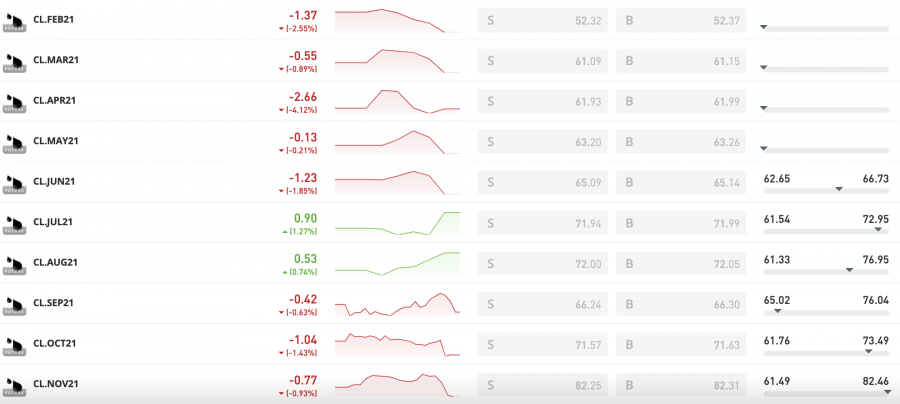

Trading Crude Oil Futures Contracts

In a nutshell, oil futures allow you to speculate on the value of oil without owning the underlying asset. Instead, you will buy or sell futures contracts based on whether you think the price of oil will rise or fall.

In order to do this, you will first need to assess what the strike price of the oil futures market is. Then, you need to predict whether the price of oil will be higher or lower on or before the futures contract expires.

In most cases, the duration of a futures contract is three months. If you predict correctly, you will make money on each futures contract that you hold – based on the difference between the strike and expiry prices.

With that said, most oil futures markets can be entered and exited before the contract expires – which offers greater flexibility.

Let’s look at a quick example of how oil trading works when utilizing futures:

How to Trade Brent Oil Futures

- The strike price of oil is set at $85 per barrel

- 1 futures contract amounts to 1,000 barrels – which means the value of your trade amounts to $85,000

- However, you are only required to put up 5% of the contract value – which is $4,250

- You think that in three months’ time, the value of oil will be lower than $85, so you decide to short-sell the strike price

- A few days before the contracts expire, you cash out your futures contract at a price of $70

- This means that you made a profit of $15 per barrel, or $15,000 (1 contract of 1,000 barrels x $15)

There are a couple of key takeaways from the above example. First, each oil futures contract contains 1,000 barrels, which means that you will be trading with a large sum of money.

Although many commodity brokers have a margin requirement of just 5%, some require 10%. Either way, you will need to outlay thousands of dollars.

Second, futures can typically be sold at any point from when the contracts are issued to their expiry date. As such, this offers great flexibility.

Oil Options

If you don’t want to allocate thousands of dollars to a futures position, then you might look to trade oil via options.

In some ways, oil options are similar to futures insofar that you are not required to own the underlying asset to place a trade. Moreover, you have the ability to go long or short on the future price of oil.

With that said, oil options are often viewed as less risky than futures because you are only required to pay a small premium to enter a position.

If you speculate incorrectly, the most that you can lose is the premium that you paid – which oftentimes amounts to just 5%. On the other hand, if you speculate correctly, you can exercise your right to buy or sell the respective options contracts.

To help clear the mist on how to trade Brent crude oil via options, consider the example below:

How to Trade Oil Options

- You are looking to go long on oil options at a strike price of $85

- There are 1,000 barrels of oil in an options contract

- Each options contract requires a non-refundable premium of 5% of the position size, so that’s $4,250 (1,000 barrels x $85)

- You decide to buy 1 contract

- Before the contracts expire, you decide to cash out when oil hits $105 per barrel

- This means that you made a profit of $20 per barrel, or $20,000 (1 contract of 1,000 barrels x $20)

- However, you also need to subtract the premium of $4,250 that you paid to enter the trade

- As such, your total profit amounts to

Now, if in the above example, the options expired at a price below the strike price of $85 – you would not have exercised your right to purchase the contract. And therefore – you would have lost your premium of $4,250.

This is why oil options are often favored by speculators, as the most that you can lose on an unsuccessful position is the premium.

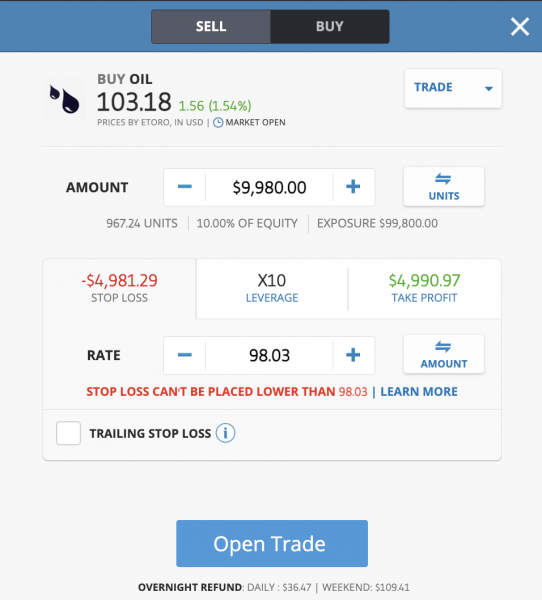

Oil CFDs

If you are based outside of the US – then the best way to trade crude oil is via CFDs. As noted earlier, CFDs are created and backed by online brokers and they are tasked with tracking the real-world price of oil.

As such, all you need to do is predict whether the price of oil will rise or fall. Unlike futures and options, oil CFDs never expire. While this does allow you to keep a position open for as long as you like, CFDs attract overnight financing fees.

Nonetheless, CFDs can be traded with leverage. In the UK, Australia, and in European Union countries, retail clients can often trade oil CFDs with leverage of 20x. This means that a $100 position is turned into a trade value of $2,000.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Why Trade Oil?

Oil trading won’t be suitable for all investment profiles – especially if you are looking to build a long-term portfolio in a risk-averse manner.

With that said, there are a number of benefits of trading oil – which we discuss in the sections below:

Oil is Volatile

Although oil is the most demanded commodity globally, its value is highly volatile. This is because the price of oil is determined by demand and supply.

- And, when you factor in the impact of OPEC production manipulation and external geopolitical events, oil can go up and down in value in a parabolic manner.

- On the one hand, this will not suit investors that seek solid assets that have the potential to grow perpetually over time.

- However, if you are a short-term swing or day trader, oil is one of the best assets to focus on.

After all, the value of oil moves in cycles and trends. Volumes are very high in the oil trading space too – which means that you will never have issues with liquidity.

Place Trades Based on Global Sentiment

In many ways, knowing whether oil is going to go on a prolonged upward or downward trend is something that can be achieved even if you are a complete beginner.

- For example, in the midst of the pandemic in early 2020 – global travel came to a near-standstill owing to increased entry restrictions and lockdown measures implemented by countries all over the world.

- As such, it goes without saying that the demand for oil hit record lows.

- In turn, this saw the price of oil drop to lows of sub-$20 per barrel in April 2020.

- Due to a lack of demand alongside broader supply chain issues, short-selling oil in early 2020 would have been a smart decision.

Another example:

- Many Western countries and regions – including the US, EU, and the UK, have placed strict sanctions on Russia in response to its invasion of Ukraine.

- As Russia is one of the largest exporters of oil – it goes without saying that this resulted in a prolonged upward trend.

Ultimately, even if you are learning how to trade oil for the first time, you can still determine which way the trend is likely to go by exploring issues that impact demand and supply levels.

Above-Average Gains can be Made

We mentioned just a moment ago that oil hit lows of sub-$20 per barrel in early 2020. Had you placed a long order at this price point and held on until 2022 when oil surpassed $100 per barrel, you would have been looking at gains of over 500%.

Even if you had entered the market by trading oil stocks, you would still be looking at sizable gains. For example, oil-centric stocks like ConocoPhillips and Shell are up 75% and 57% respectively.

Moreover, when you trade oil via financial derivatives like futures, options, or CFDs – you can apply leverage to your position.

How to Make Money from Oil Trading

Making money from your oil trading endeavours is dependent on how successful you are at correctly predicting the market. Moreover, the amount of money you are able to make will be dictated by the type of oil instrument that you decide to trade.

For example, if you decide to invest $5,000 into an oil-centric stock and the respective shares increase in value by 50%, you will be looking at gains of $2,500.

On the other hand, if you decide to trade oil via financial derivatives, then the amount you make will depend on the price of oil when you open and close the position.

- For instance, let’s say that you are based outside of the US and you decide to risk $2,000 on an oil CFD position.

- When you open the position, oil is priced at $40 per barrel.

- You keep the position open for a few days and close it when oil hits $50 per barrel.

- This translates into gains of 25% – so on a $2,000 stake, you make a profit of $500.

When trading oil via futures or options, your profit will depend on a variety of factors, such as the strike price, the value of oil when you close the position, and in the case of options – the premium that you paid.

Crude Oil Trading Hours

Crude oil trading hours will depend on the instrument that you are looking to gain exposure to and the market or exchange it is listed in.

For example, if you were to invest in oil-centric stocks and ETFs that are listed in the US, standard hours of 9:30 am–4 pm, Monday to Friday.

In the case of financial derivatives like futures and options that are listed in the US, you can typically trade from 6 pm to 5 pm, Sunday through Friday.

Oil Price Movements

Put simply, the price of oil is determined by the market forces of demand and supply. For instance, we mentioned earlier that the price of oil hit lows of sub-$20 in 2020. This was because demand for oil dried up as per COVID-19 restrictions and lockdowns.

Then, as global travel began opening up, demand for oil increased, and thus – as did its value. With this in mind, the best way to speculate on the future direction of oil is to keep abreast of key market developments.

Best Oil Trading Strategies

When learning how to trade oil, you will need to deploy a number of strategies to ensure that you begin your investment journey with your eyes wide open.

The best oil trading strategies for beginners to consider are discussed in the sections below:

Read Financial News

The best way to assess whether the price of oil is likely to rise or fall is to read financial news. You’ll want to look for stories and developments that can have an impact on the demand and supply of oil.

It is also a good idea to sign up for a financial alert service that notifies you when a relevant news story breaks.

Track OPEC Statements

When OPEC speaks, oil traders listen. In fact, if you are looking to take your oil trading endeavors seriously, then it is imperative that you tune in to live OPEC meetings – which are often available on its official website.

The key thing to look for is whether OPEC – and in particular, Saudi Arabia, gives any indication that there is going to be an alteration of production output.

Day Trading Crude Oil futures

You will also need to think about the type of trading strategy that you wish to implement when speculating on the future value of oil. Many speculators in this space will opt for a day trading strategy as the volatility of oil is perfect for short-term positions.

For instance, you might enter a long position on oil at 10 am and close it at 1 pm with gains of 2%. When day trading oil, US clients will need to opt for futures or options. If you’re outside of the US, then CFDs are a better option.

Stop-Loss Orders

When you consider how volatile oil is, it is important that you consider deploying stop-loss orders on all trading positions that you enter. As the name suggests, this will cap losing trades at an amount that you specify.

For example, if you want to avoid losing more than 10% of your stake on an oil trade, you can simply state this via a stop-loss order.

In doing so, if the value of your oil trade declines by 10%, then your broker will automatically close the position on your behalf.

Bankroll Management

Another risk-averse strategy to deploy when learning how to trade oil is with regard to bankroll management. This means limiting the amount of capital that you risk on each trade in relation to your current account balance.

For example, let’s suppose that you have a bankroll of $3,000 and you wish to limit your maximum trade size to 5% of your balance. This means that you must avoid risking more than $150 on a single trade.

This will ensure that you avoid burning through your trading capital. And, when you build your balance up, you can increase the size of your trade – as long as you stick with your bankroll management strategy.

Is Oil Trading Safe?

Oil trading is safe as long as you are registered with a regulated broker. eToro, for instance, is approved in the US and regulated by CySEC, ASIC, and the FCA.

This ensures that the broker meets a wide range of regulatory guidelines surrounding investor protections. On the other hand, you must ensure that you tread carefully when learning how to trade oil as a beginner.

- For a start, oil can be a highly volatile asset class – so you stand the chance of losing money if you do not make accurate market predictions.

- Moreover, if you decide to trade futures that are settled in physical barrels of oil – this can also present a risk.

- After all, if you are still holding the oil futures when they expire, you could be legally responsible for taking delivery of 1,000 barrels for each contract that you have.

This is once again why we suggest that you consider trading oil stocks as opposed to futures or options.

How to Trade Oil – eToro Tutorial

If you need some guidance on how to trade oil today – then this section of our beginner’s guide will walk you through the process step-by-step with eToro.

This platform offers lots of commission-free oil-centric stocks and ETFs, as well as CFDs for non-US clients.

Step 1: Open an eToro Account

You will need to open an account with eToro before you can start trading oil. This should take you a couple of minutes and will require you to enter your first and last name, email address, and cell phone number.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

You will also need to enter your social security number, residential status, and home address. To get your account verified, upload a copy of your passport or driver’s license.

Step 2: Deposit Trading Capital

Next, you will be asked to make a deposit so that you have equity to trade with. eToro supports a wide selection of deposit types – which is inclusive of debit and credit cards issued by Visa, Maestro, and MasterCard.

Several e-wallets are supported too – including Paypal and Skrill. You can also opt for a standard bank wire or ACH transfer.

In terms of fees, no deposit charges are implemented on USD payments. Otherwise, you will pay a small FX fee of 0.5%. The minimum deposit for US and UK clients is $10 and $50 for most other nationalities.

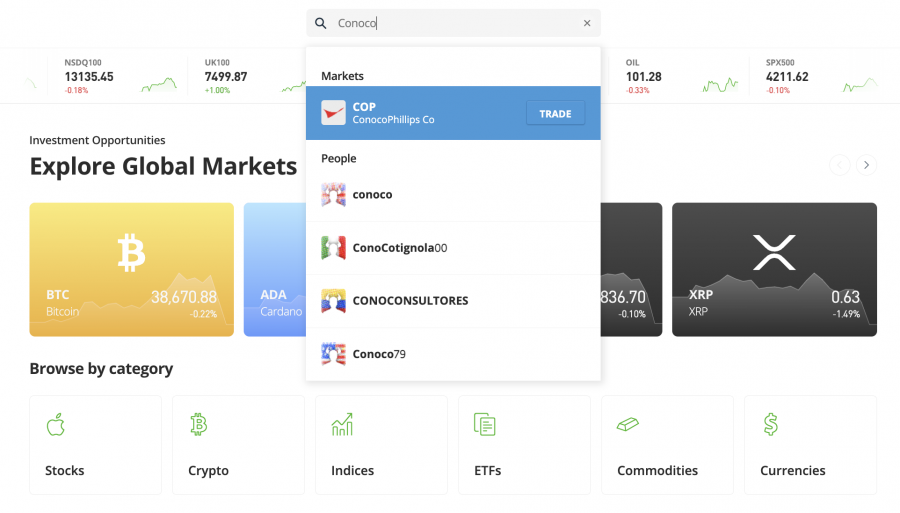

Step 3: Search for Oil Market

You can now find the oil market that you wish to trade via the search bar. In our example below, we are searching for ConocoPhillips – which is a top-rated stock that gives you indirect exposure to oil prices.

You can also see what oil markets are supported by eToro by clicking on ‘Discover’.

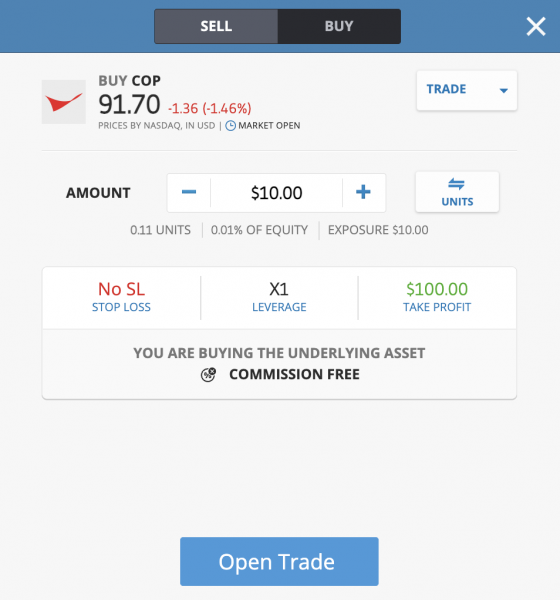

Step 4: Place Oil Trading Order

Click on the ‘Trade’ button to popular an order box. You will need to specify your total stake in the ‘Amount’ box. In our example below, we are risking the minimum amount of capital on this trade – which is $10.

You should also consider setting up a stop-loss order.

To place your order, click ‘Open Trade’.

Conclusion

If you want to learn how to trade oil – then you will be entering a marketplace that can be extremely volatile. This will, however, suit short-term traders that wish to speculate on oil market cycles and trends.

You also need to think about what type of oil market interests you – such as stocks, ETFs, futures, options, or CFDs. To start trading a variety of oil markets right now – you can open an account with eToro in under five minutes.

This top-rated broker offers super low fees and small account minimums – alongside charge-free deposits and withdrawals on debit/credit cards, e-wallets, and bank wires.

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.