Decentralized finance (DeFi) as an industry is growing at a rapid pace, with the DeFi ecosystem first reaching a valuation over $100 billion in mid 2021. DeFi projects are still in their infancy compared to traditional finance (TradFi) and undergoing a correction in 2023, so now could be a good time to invest in DeFi.

In this guide, we explain how to invest in DeFi across a number of popular methods – such as interest accounts, staking, farming, leveraged loans, and more.

How to Invest in DeFi – Top Methods

If you are learning how to invest in DeFi for the first time, some of the best ways to get into DeFi are:

- Invest in DeFi Coin (DEFC) – Undervalued DeFi Project in 2023

- DeFi Staking – Generate a Yield by Locking Your Tokens

- DeFi Savings Accounts – Earn Interest via a DeFi Savings Account

- DeFi Yield Farming – Earn a Share of Trading Fees by Providing Liquidity

- Invest in DeFi Stocks – Gain Exposure to DeFi via the Stock Market

- Secured DeFi Loans – Leverage Your Crypto Investments by 50%

- Get a DeFi Wallet – Store Tokens and Earn Interest via a DeFi Wallet

- Invest in DeFi Smart Portfolio – Pre-Made DeFi Portfolio Managed on Your Behalf

- Hold Stablecoins – Enjoy DeFi Rewards Without Volatility

- Invest in NFTs – Add NFTs to Your Portfolio via a DeFi Marketplace

The above DeFi investment products differ in nature when it comes to risk and potential return on investment (ROI). We’ll review these methods of investing in DeFi in this guide.

A Closer Look at the Best Ways to Invest in DeFi

All DeFi investments carry an inherent level of risk. Moreover, the DeFi investment that you choose will determine how the types of yields on offer and whether or not you need to lock your crypto tokens away for a certain number of days.

If you’re wondering how to invest in DeFi to maximize your potential gains – consider one of the 10 methods outlined below.

1. Invest in DeFi Coin – Undervalued DeFi Project in 2023

A simple and popular way to invest in decentralized finance is buy the best DeFi coins to your portfolio. This means that you will be investing in a DeFi project by holding its native digital currency.

Like all crypto tokens, the DeFi coins that you buy will be listed on crypto exchanges – some offer a bespoke DeFi portfolio as a way to invest in DeFi crypto assets, which we’ll review further down this list.

Holding DeFi crypto, the value of your investment will go up and down throughout the day – based on the market forces of demand and supply. According to CoinMarketCap, there are now over 540 DeFi tokens that you can buy. Each token and project will focus on a specific area of the decentralized finance industry, so you will need to do some research to pick the right coin for your portfolio.

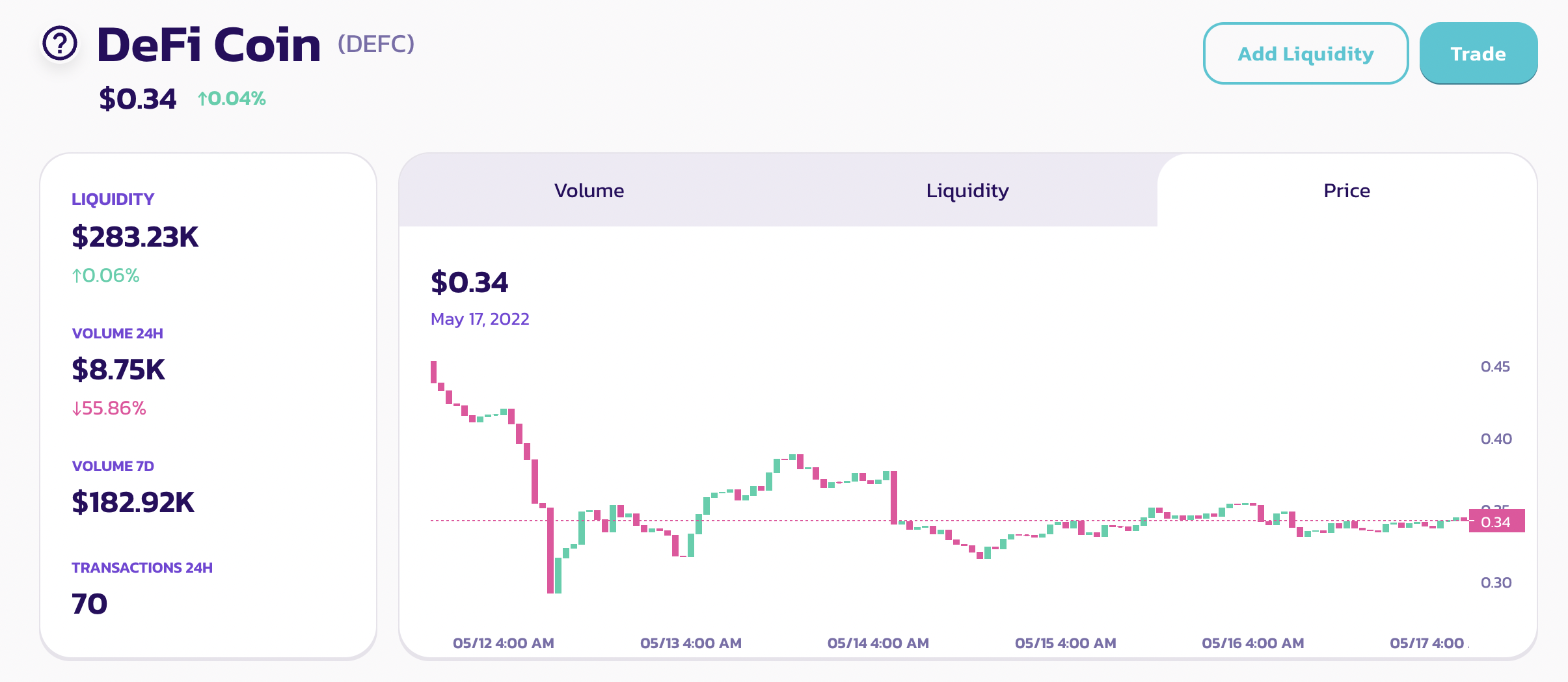

One undervalued project currently is DeFi Coin (DEFC) – which launched in 2021 and aims to become the go-to hub for all things decentralized finance. DeFi Coin is the native token of the DeFi Swap exchange, a decentralized exchange which offers a variety of decentralized applications (dApps) and tools.

For example, DeFi Swap allows users to buy and sell digital tokens without requiring a centralized entity. The platform also offers staking and yield farming services, which come alongside high-interest yields. DeFi Coin itself is built on top of the Binance Smart Chain and it carries an innovative taxation system that penalizes short-term market speculators.

The underlying smart contract does this by taxing sell orders at 10%. For instance, if you were to sell $5,000 worth of DeFi Coin on the open market, $500 would be tax, leaving you with $4,500. This $500 is then split into two and subsequently distributed between existing token holders and the DeFi Coin liquidity pool. As such, long-term investors are rewarded for their loyalty.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

2. DeFi Staking – Generate a Yield by Locking Your Tokens

Another popular method is to use a platform that supports crypto staking. The main concept of this way of investing in DeFi is that you will ‘lock’ your tokens for a certain time period. In turn, you will generate interest on the tokens you have deposited. DeFi staking is therefore a passive way to make your tokens work for you.

There are actually two ways in which you can achieve this. First, you can stake your tokens on a PoS (Proof-of-Stake) blockchain like Solana or Cardano. The tokens will then be locked into the respective blockchain and subsequently used to verify transactions. However, it must be noted that when you go direct with a PoS blockchain, it doesn’t tend to be the highest yield.

Instead, it’s much better to use a third-party staking platform that not only has a good reputation – but offers a high APY. In doing so, you will deposit your tokens into the provider’s smart contract, which, in turn, will be used to fund liquidity pools and loans. One of the best decentralized finance platforms for this purpose is DeFi Swap.

As a prime example, you can stake the platform’s native DeFi Coin and earn up to 75% on a 1-year lock-up term. If this is too long for you, DeFi Swap also offers 1, 3, and 6-month terms, albeit, at a lower yield. Nonetheless, there is no requirement to register an account, provide any personal information, or upload KYC documents when using DeFi Swap for staking.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

3. DeFi Savings Accounts – Earn Interest via a DeFi Savings Account

You may also consider crypto savings accounts as a way to invest in DeFi. The process entails depositing your idle crypto tokens into a savings account and in return you generate interest. This concept is much the same as a traditional checking or savings account that pays interest on USD or EUR deposits.

Unlike traditional USD and EUR deposits, DeFi savings accounts pay a high yield. This will depend on a variety of factors – such as the DeFi platform in question, which tokens you wish to save, and if you commit to a lock-up period. Some DeFi accounts pay higher rates when you stake their native token.

Aqru is a more simple crypto interest account provider. It recently lowered its yield during the May 2022 crypto market crash – DeFi yield can be affected by market movements. However it has no lock-up terms, deposits are flexible and investors are free to withdraw at any time until the yield rate recovers if they wish.

Those using Aqru earn interest deposited into their account daily, which then compounds as the balance increases – they earn compound interest.

Aqru supports Bitcoin, Ethereum, and stablecoin USD Coin (USDC). It takes just minutes to open an account with Aqru and if you do not have any crypto tokens to hand – you can actually deposit fiat money via a bank wire or debit/credit card. Visit Aqru.io to check the latest APY rate.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

4. DeFi Yield Farming – Earn a Share of Trading Fees by Providing Liquidity

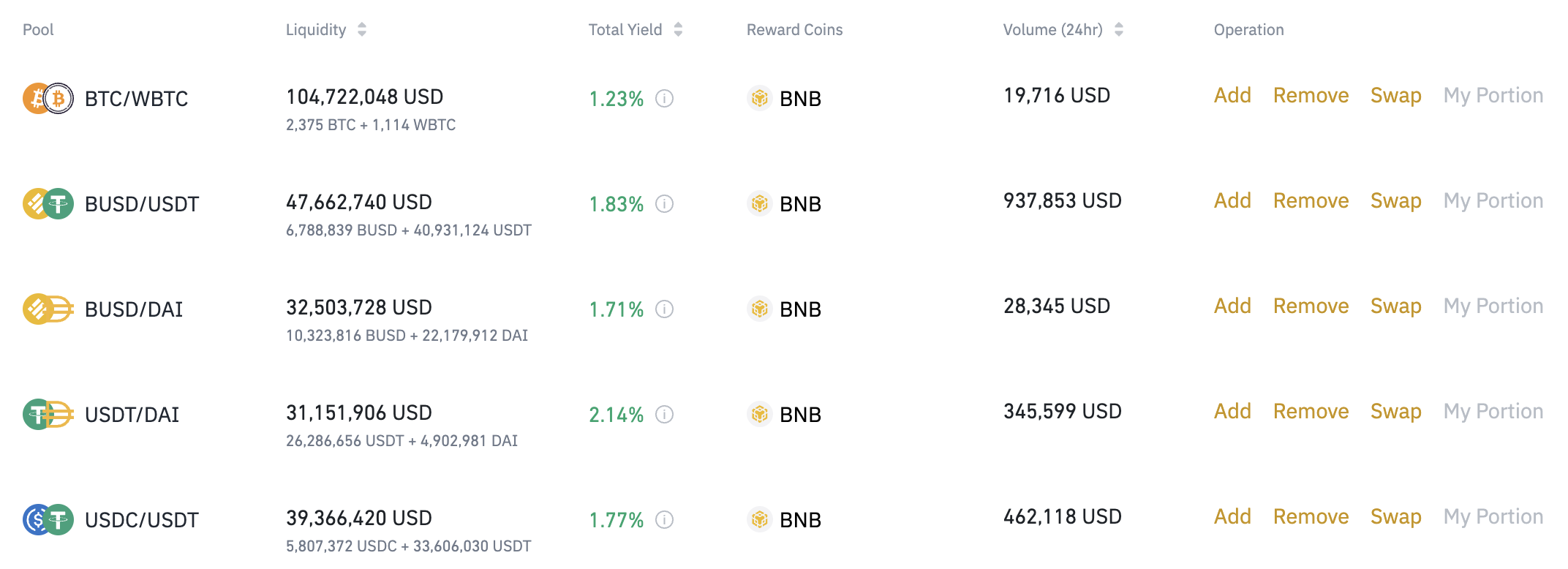

Next up on our list of the best ways to invest in DeFi is yield farming. This works in a somewhat similar way to the previously discussed staking. This is because you will be lending your idle tokens to a decentralized exchange of your choosing. However, the key difference is that you will be providing liquidity to the exchange.

Moreover, as liquidity allows buyers and sellers to trade without a third party, you will need to provide tokens for a specific trading pair. For instance, let’s say that you wish to add liquidity to CAKE/BNB. This means that you will need to deposit an equal amount of Pancakeswap (CAKE) and BNB in monetary terms.

In other words, if you add $1,000 worth of BNB, you will also need to add $1,000 worth of CAKE. In doing so, this will allow people of the respective exchange to swap BNB for CAKE in a decentralized manner – and vice-versa. Each buyer and seller that uses the respective liquidity pool will subsequently pay a trading fee.

And, as you have contributed liquidity to the pool, you will be entitled to a share of any trading fees collected. For example, let’s say that you deposit $2,000 in crypto, equally split between CAKE and BNB. In total, the pool for CAKE/BNB has $20,000 in liquidity. This means that your stake in the pool is 10%.

And therefore, if the pool collects $200 in trading fees on day one, your share will amount to $20. If you’re looking for the best place to invest in DeFi farming pools, consider DeFi Swap. As noted earlier, this DEX offers high-interest yields across both farming and staking in a user-friendly and trusted environment.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

5. Invest in DeFi Stocks – Gain Exposure to DeFi via the Stock Market

If you’re looking at how to invest in DeFi without actually touching cryptocurrency tokens, you’re in luck. That is to say, you can now gain exposure to the DeFi industry via the traditional stock markets. In a nutshell, you look to invest in stocks that are in some way, shape, or form involved in the growth of decentralized finance.

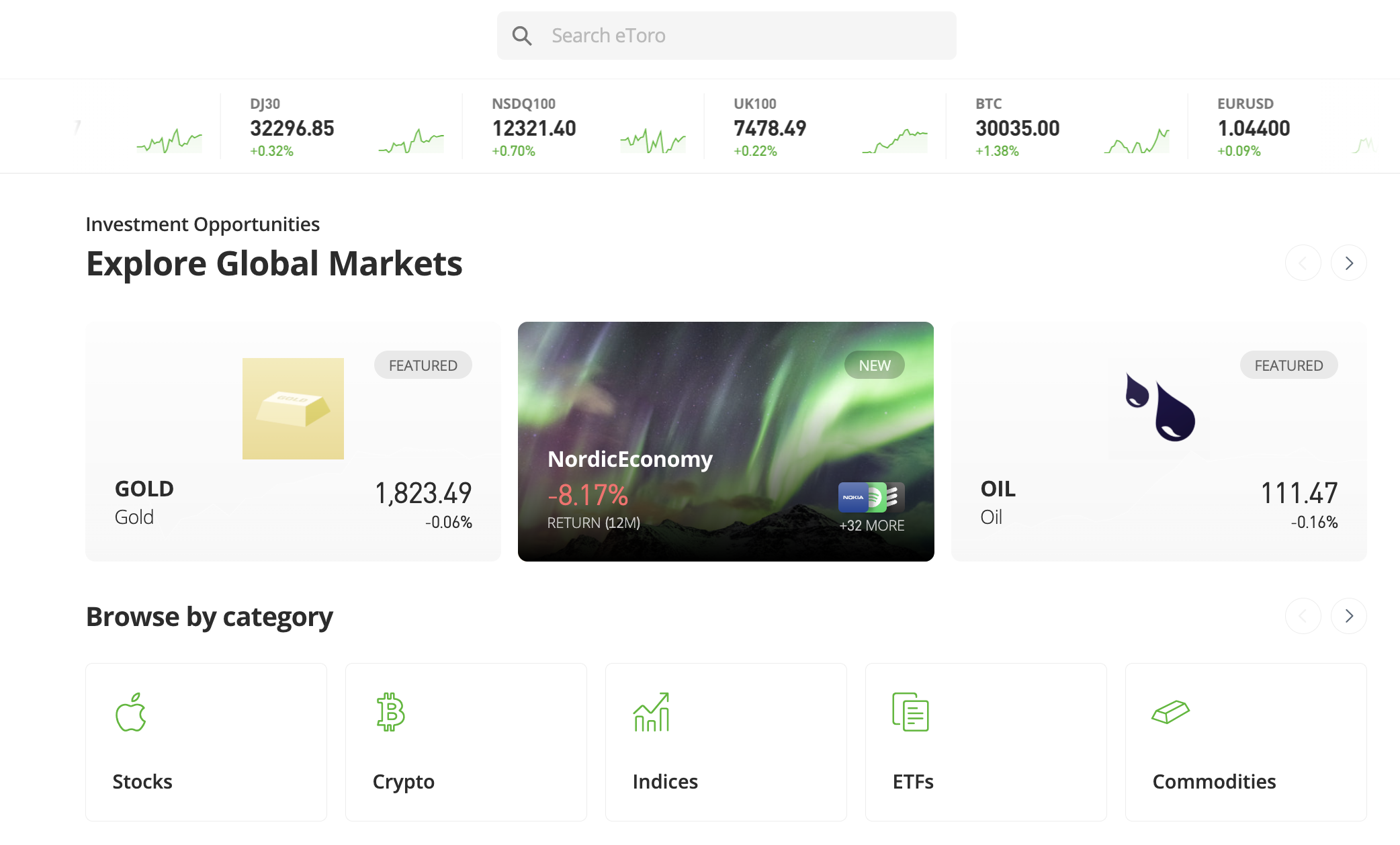

In doing so, you won’t need to buy cryptocurrency to speculate on DeFi, nor will you need to worry about exchanges or wallets. Instead, you simply need to open an account with a regulated stockbroker and purchase your chosen number of shares. One of the best trading platforms for this purpose is eToro.

This is because you can invest in DeFi stocks by depositing a minimum of just $10. Moreover, $10 is the minimum stock trade requirement, as eToro supports fractional shares. And best of all, regardless of whether your chosen DeFi stock is listed in the US or an international exchange, eToro will not charge you any trading commissions.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

6. Secured DeFi Loans – Leverage Your Crypto Investments by 50%

A core segment of the DeFi investment scene is that of crypto loans. Unlike traditional loans, you will not be going through a bank or financial institution. On the contrary, you can obtain a loan via a leading DeFi platform – meaning no third parties. Moreover, DeFi loans can be taken out instantly without the need for a credit check or any documentation.

This is because, in order to get a DeFi loan, all you need to do is deposit some collateral in the form of crypto tokens. Now, in terms of how to utilize DeFi loans from an investment perspective, the concept allows you to obtain leverage. For example, let’s suppose that you deposit $5,000 worth of Ethereum tokens into a DeFi loan site that offers an LTV of 50%.

This means that in return, you can borrow funds up to 50% of the value of your collateral – so that’s $2,500. This $2,500 can then be used to invest in other DeFi projects – such as tokens, stocks, or yield farming. Furthermore, and perhaps most importantly, you still retain full ownership of the $5,000 worth of Ethereum that you deposited.

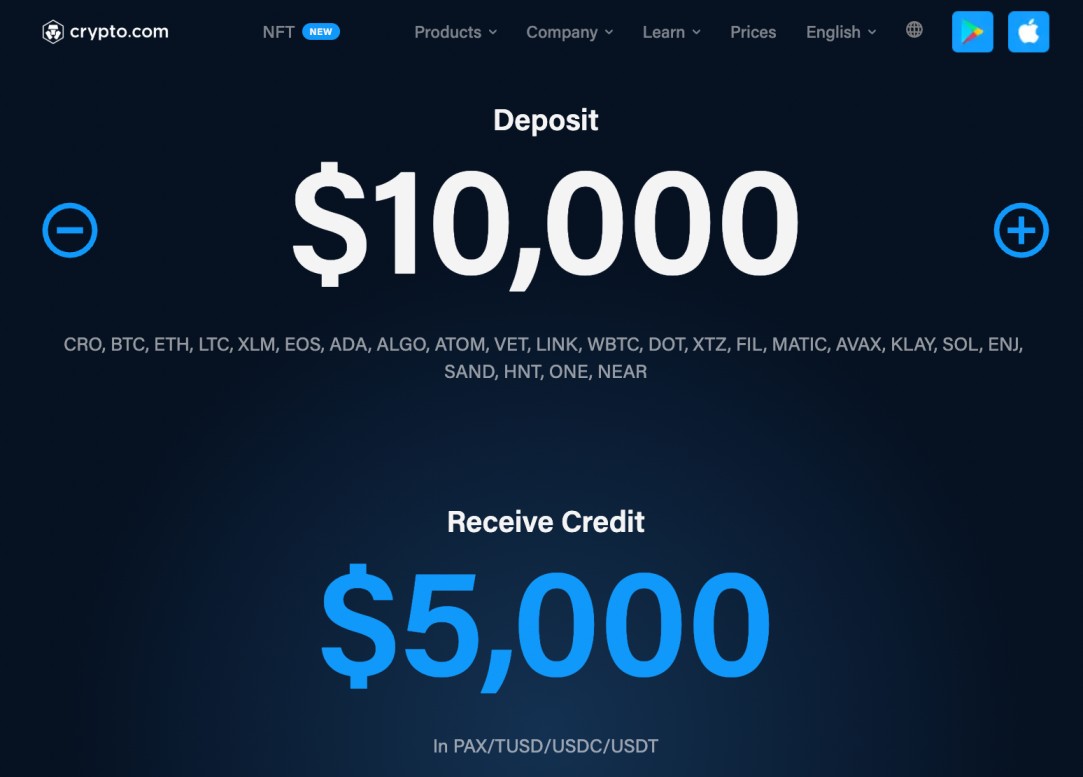

Therefore, if the value of Ethereum increases while the tokens are locked as collateral, you will still reap the rewards. As a result, crypto loans offer one of the best ways to raise finance when investing in DeFi. In terms of platforms, we like Crypto.com – which supports plenty of digital assets with an LTV of up to 50% alongside competitive interest rates.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

7. Get a DeFi Wallet – Store Tokens and Earn Interest via a DeFi Wallet

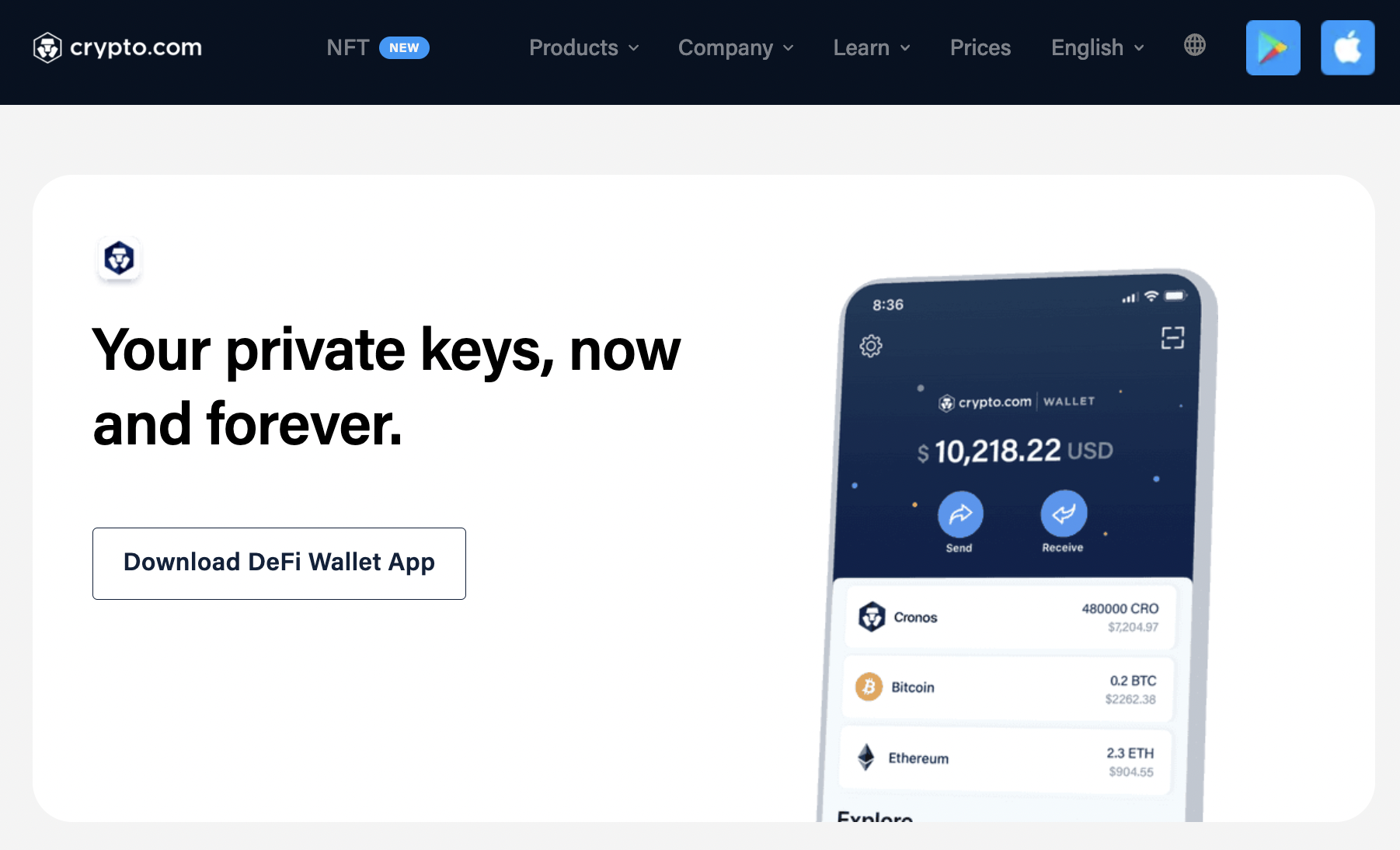

If you’re looking to invest in decentralized finance as part of a long-term strategy, then it is crucial that you get yourself a suitable DeFi wallet. In doing so, you will be able to store your crypto tokens in a non-custodial manner – just as they should be in the DeFi space. After all, non-custodial wallets ensure that you are the only person that has access to your private keys.

In comparison, when you keep your crypto investments in a centralized platform – the exchange in question will control your private keys and thus – your digital assets. We found that the best DeFi wallet in the market is currently being offered by Crypto.com. Not only does the Crypto.com wallet offer a safe storage facility, but you can access a range of DeFi services.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

8. Invest in DeFi Smart Portfolio – Pre-Made DeFi Portfolio Managed on Your Behalf

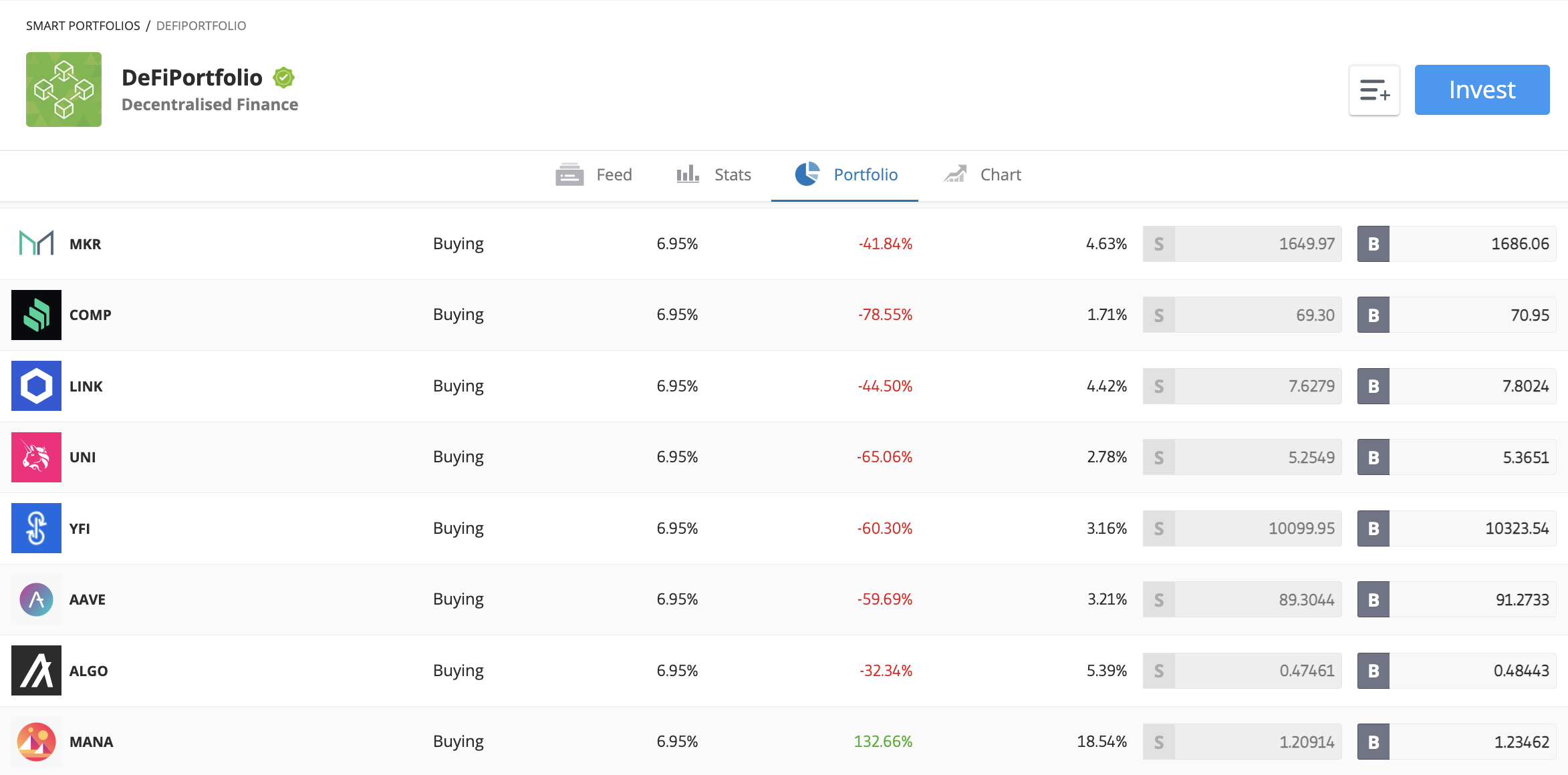

If you wish to invest in DeFi but you are a complete beginner that has little to no experience – then you might want to consider an option that requires personal zero input. And we found that one of the best options in this respect is to invest in the decentralized finance smart portfolio offered by eToro.

By investing in a smart portfolio at the heavily regulated platform eToro, you can gain exposure to DeFi without needing to choose your own assets or markets. This is because, through a single trade, you will be investing in a ready-made portfolio that focuses on leading DeFi coins.

This includes everything from Compound, Yearn.finance, and Decentraland to Basic Attention Token, Maker, and Chainlink. Your decentralized finance smart portfolio will be managed and maintained on your behalf by the eToro team. This means that the DeFi coins within your portfolio will be regularly rebalanced and reweighted.

The minimum investment required by eToro for this smart portfolio is just $500 and there are no ongoing maintenance fees. You have the option of cashing out your investment at any time – 24/7. Moreover, you can add or remove assets to your portfolio at the click of a button.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

9. Hold Stablecoins – Enjoy DeFi Rewards Without Volatility

One of the main issues that inexperienced investors have with the DeFi space is that oftentimes – volatility levels can be extremely high. This is because, on the one hand, it’s great being able to earn double or even triple-digit APYs on your idle crypto tokens. However, if the value of the respective tokens witnesses a major decline, you might end up losing money.

This is where stablecoins come in. Put simply, by opening a DeFi interest account that supports stablecoins, you can enjoy the benefits of high yields without worrying about volatility. This is because stablecoins are pegged to conventional fiat currencies like the US dollar or euro. USD Coin, for instance, is always worth $1 – give or take a minute fractional percentage.

With that being said, stablecoins are not totally risk-free – as we saw with the recent Terra USD saga. For those unaware, Terra USD lost its peg to the US dollar and even hit lows of sub$0.20. Nonetheless, by focusing on solid stablecoins like DAI or USD Coin, you can earn a highly attractive interest rate of 12% at leading platform Aqru. No lock-up periods are required.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

10. Invest in NFTs – Add NFTs to Your Portfolio via a DeFi Marketplace

The final option to consider from our list of DeFi investments is that of non-fungible tokens – or NFTs. For those unaware, NFTs represent unique digital tokens that prove ownership of an item. This could be anything from a house or soundtrack to an art collection. Either way, the NFT space is one of the fastest-growing segments of the DeFi industry.

After all, when you buy an NFT and add it to your wallet, you are the only person that has access to the underlying item. Moreover, by sticking with DeFi wallets – as discussed earlier, you will retain full control of your private keys. One of the best NFT investments in the market right now is being offered by Lucky Block.

This crypto gaming platform has released 10,000 NFTs via its primary listing. Each NFT costs the WBNB equivalent of $1,500 and will give you lifetime entry into its daily crypto draw. If your NFT number is drawn, you will win 2% of the jackpot prize. Once the Lucky Block NFT collection is sold, you also have the option of flipping it at an online marketplace.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Is DeFi a Good Investment?

Cryptocurrency and blockchain technology is expected to revolutionize a vast range of industries and sectors. And perhaps at the forefront of this is the traditional financial services market.

- That is to say, in the future, many commenters argue that services surrounding investments, loans, brokerage deals, insurance, and more will not require a traditional lender or bank.

- On the contrary, the aforementioned services can be achieved in a decentralized manner via DeFi providers.

- On the investment side of things, retail clients can now generate interest on their capital via crypto savings accounts, yield farming, staking, and more.

- And, if you seek access to funding, instant crypto loans can be obtained without credit checks or documents.

DeFi could represent a highly viable addition to your investment portfolio. As this guide has discussed, you can invest in DeFi through a number of popular channels and platforms. There are an extensive range of DeFi products that allow you to earn interest – each of which comes with varying risks and yields.

The May 2022 Terra (LUNA) crash and Bitcoin correction under $30,000 lowered the crypto and DeFi market cap making it potentially a good time to invest at a low price point.

Where to Invest in DeFi?

If you want to invest in DeFi because you believe that decentralized finance will eventually replace conventional service providers – then you will need to do so via a top-rated platform.

Although there are plenty of options in this market, we found that DeFi Swap is the overall best platform to access decentralized financial tools in a user-friendly manner.

DeFi Swap – Overall Best DeFi Lending Platform for 2023

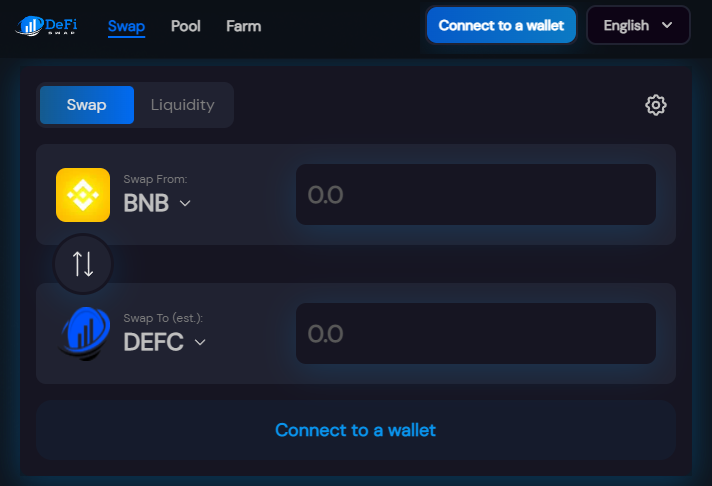

DeFi Swap is a decentralized platform that has been built on top of the Binance Smart Chain. As such, it is able to facilitate transactions not only without the need for a third party, but in a fast and low-cost manner. In choosing DeFi Swap as your go-to platform, you will have access to a variety of high-yield investment tools.

- First, you might consider utilizing its crypto farming feature, which allows you to provide liquidity for its decentralized exchange.

- In doing so, on each buy and sell transaction that goes through the pair that you provide liquidity for, you will earn a share of trading fees. This offers a great way to earn passive income on crypto tokens that would otherwise sit idle in a wallet.

- Next, you can also earn an APY of up to 75% through the DeFi Swap staking function.

- This comes with four options in terms of lock-up periods – 30, 90, 180, and 365 days.

- Additionally, you can also use DeFi Swap to access your favorite BSc tokens. That is to say, you can swap one token for another instantly – without needing to use a traditional crypto exchange.

Most importantly, there is no human interaction when transactions go through the DeFi Swap platform. On the contrary, transactions are executed via an audited and immutable smart contract. This means that if, for example, you opt for the yield farming or staking tool, your tokens will be returned to your wallet automatically once the respective term concludes.

We also like DeFi Swap as it is backed by the aforementioned DeFi Coin. As we discussed earlier, DeFi Coin rewards long-term holders by sharing 50% of the tax that it collects from sell orders. DeFi Swap is only at the very start of its decentralized finance journey, with a mobile app for iOS and Android as well as an NFT facility in the pipeline for 2023.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Conclusion

This beginner’s guide has covered some of the ways to invest in DEFi although there are many more – the DeFi ecosystem is continually expanding with new dApps being developed.

We reviewed a top 10 list of popular DeFi investment products including interest accounts, staking, yield farming, and leveraged loans.

With that said, perhaps the overall best way to invest in decentralized finance is to add some DeFi tokens to your portfolio. We like DeFi Coin (DEFC) for this purpose, which is backed by the decentralized platform DeFi Swap. You can buy DeFi Coin at its current low entry price from DeFi Swap, Bitmart or Pancakeswap.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.