This market insight discusses whether or not cryptocurrency is a viable investment in 2023. We explore the potential returns on offer for new cryptocurrency investors and what risks need to be taken into account before proceeding.

Read on to find impartial answers to the question – is cryptocurrency a good investment?

Before getting started, let’s review some of the key points that we found when exploring the question – is crypto a good investment in 2023?Is Cryptocurrency a Good Investment in 2023? Key Takeaway

Meta Masters Guild - Next Big Crypto Game

- Backed by Leading Game Studios

- Early Round Presale Live Now

- Low Hard Cap, No Vesting

- Playable NFTs, Rewards, Staking

- Solid Proof & CoinSniper Audited

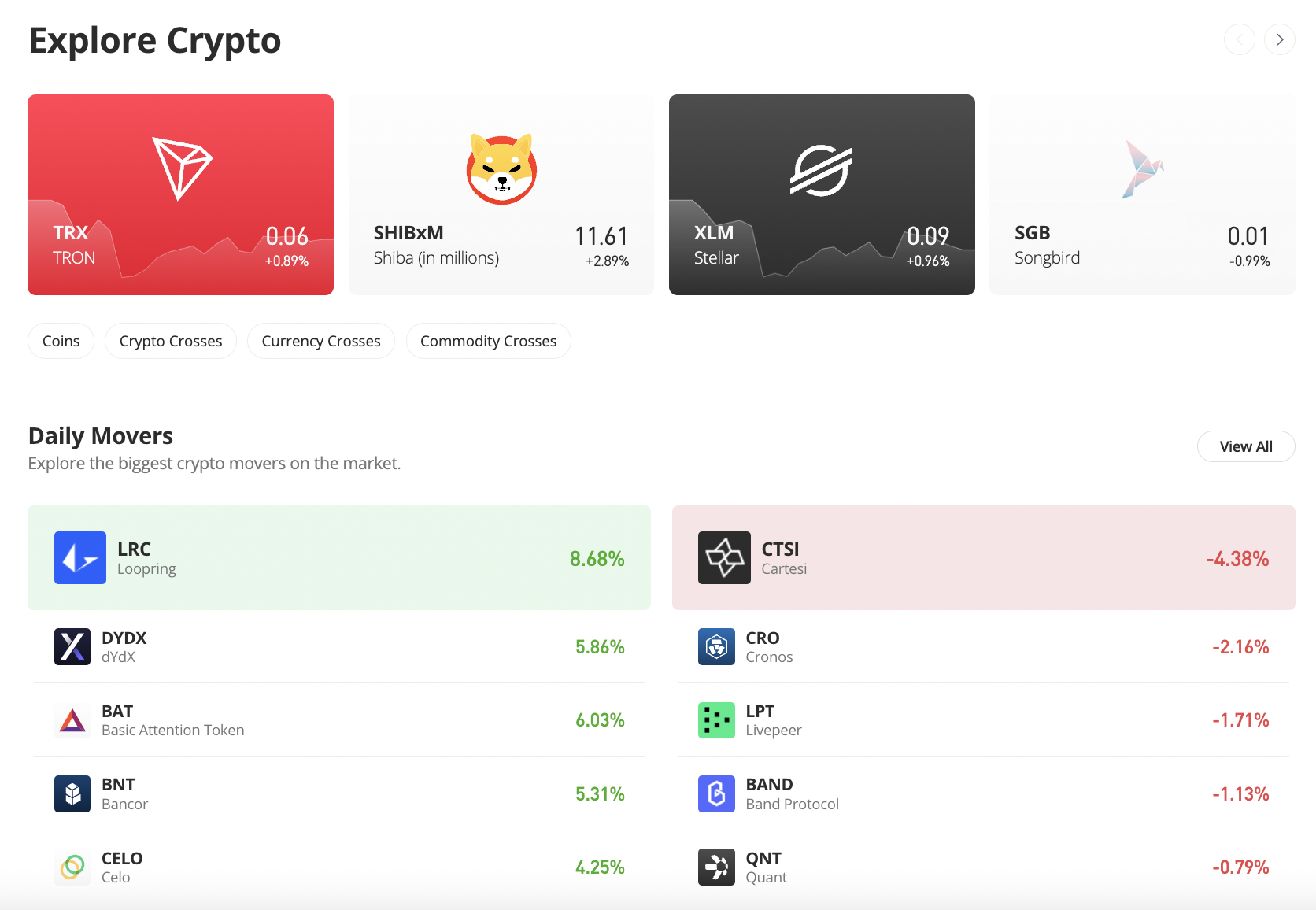

The Case for Crypto in 2023 – Reasons to Invest in Crypto Today

The only way to answer the question – is cryptocurrency a good investment in 2023, in an informed way is to consider both the benefits and drawbacks of this asset class.

Let’s start with some of the core reasons why cryptocurrency remains one of the fastest-growing investment markets.

High-Growth Investment Scene

It’s all about rapid, unprecedented growth in the case of many top cryptocurrencies. Long-term portfolios generally perform better when compared to short-term trading, but there are proven success stories across both strategies.

For example, Bitcoin was trading at just $1 in 2011, two years after its launch. Early investors that bought Bitcoin in 2011 will now be looking at life-changing gains.

For instance, even though the markets are currently bearish and Bitcoin is trading at a fraction of its former all-time high, current prices represent growth of 2 million percent, when compared to 2011.

More recently, many cryptocurrencies that were launched in 2020 have since become multi-billion dollar projects. Solana and Shiba Inu are two prime examples, with early investors generating significant gains.

Ultimately, while it is true that cryptocurrencies are speculative and overly volatile at times, this industry is attractive for its high upside potential.

Cryptocurrency Valuations in 2023 Are Low

So far, 2023 has seen a revival in cryptocurrency prices, with many digital assets witnessing sizable growth. However, when compared to previous all-time highs, the broader industry is still worth just a fraction.

- For investors entering the market today, this should be viewed as a positive.

- After all, why buy leading cryptocurrencies like Bitcoin and Ethereum at $69,000 or $4,900, when a discount of approximately 70% is on offer?

This strategy is known as buying the dip and it enables investors to purchase quality cryptocurrencies at a much lower entry price. If and when the next bull market begins, this will enable investors to enjoy a solid upside trajectory.

High-Quality Presales Offer an Attractive Upside

Crypto presales are a growing phenomenon in the digital asset investment scene. Presales are best compared to IPOs, albeit, investors will be gaining exposure to cryptocurrencies as opposed to company stock.

Presales will look to raise money to help meet build the project’s roadmap targets. By investing in a presale, a much lower token price is on offer when compared to the exchange listing valuation.

- Many crypto presales have various stages, each of which will sell a certain number of tokens.

- As each stage sells, the presale price will increase. As a result, investors that get in at the ground level will secure the lowest presale price possible.

- After the presale has sold out, the token will be listed on exchanges – enabling the general public to trade it.

- This ensures that early investors have a mechanism to cash out their gains in a fair and transparent marketplace.

Further down this guide, we analyze some of the best crypto ICOs to consider right now – including MEMAG, Fight Out, and C+Charge.

24/7 Access to the Markets and High Liquidity

Still attempting to answer the question – should you invest in cryptocurrency? If so, we should also note that cryptocurrency operates in a global trading marketplace that never sleeps.

This is because unlike commodities, stocks, and other traditional markets, cryptocurrency can be traded 24/7. Not only that, but the entire market capitalization of the cryptocurrency industry stands at over $1 trillion. Over the prior 24 hours alone, more than $60 billion worth of cryptocurrency trades have been carried out.

All of this means one thing – that the process of cashing out a cryptocurrency investment is both seamless and fast. This means that at any given time, an investor can convert their digital assets into so-called ‘real money’.

The Risks of Crypto in 2023 – Considerations to Make

Now that we have covered the core benefits of cryptocurrencies, let’s move on to the most pressing risks that need to be considered in 2023.

Wild Volatility

Volatility remains one of the biggest drawbacks of cryptocurrencies. While traditional commodity assets like gold and oil also experience volatility – pricing swings are a lot more parabolic in the digital asset space.

This means that from one day to the next, the value of a cryptocurrency portfolio can move widely to the upside and/or downside. Diversification and dollar-cost averaging can reduce the impact of volatility, as can creating a long-term strategy.

Financial Loss

Blue-chip stocks losing over 95% of their value is – although not impossible, is seldom seen. This is, however, the reality for many cryptocurrencies in this space.

- As such, investing in crypto is something that should only be considered if the funds are considered disposable income.

- In other words, investors should remember that they can lose some or even all of their capital when gaining exposure to cryptocurrency – so do tread with caution.

Stop-loss orders are worth considering in this regard, which is something offered by many online brokers and exchanges. Once again, diversification can also help reduce the odds of losing money.

Exchange and Wallet Hacks

Hacks are another risk to take into account when investing in cryptocurrency.

Regarding the former, if a cryptocurrency exchange is hacked – either by a remote attack or internal malpractice, investor funds are at serious risk of loss. There will likely be no recourse if this occurs.

To safeguard against this risk, only use regulated exchanges – such as eToro.

Storing cryptocurrency in a private wallet ensures that the investor has full control over their funds. However, just remember that bad actors are everywhere in this space – meaning that there is always the risk of being hacked.

Learning how to keep a crypto wallet safe from hackers is therefore crucial. For instance, always write down the backup passphrase of a wallet and never, under any circumstances, reveal it to anyone.

How do Cryptocurrency Prices Work?

The price of cryptocurrencies will rise and fall based on the market forces of demand and supply. For instance, after investing in a cryptocurrency, if demand from the markets for the respective token remains high, this will have a positive impact on its price.

This pricing mechanism is much the same when it comes to stocks, gold, bonds, and other traditional assets. Similarly, the cryptocurrency markets move in tandem with one another.

By this, we mean that when Bitcoin is witnessing an upward trajectory, this is all but certain to benefit the broader market. But when demand for Bitcoin is low, other cryptocurrencies will likely suffer too.

Why are Cryptocurrencies so Volatile?

First and foremost, the level of volatility that a cryptocurrency experiences will largely depend on how established it is and more importantly – its market capitalization. Once again, this thesis is much the same in the world of stock trading.

- For example, a large company like Apple – which has a market capitalization of over $2 trillion, will often rise and fall by just 2-3% a day.

- However, a small-cap stock that trades on the OTC markets can witness price movements of 20% or more.

- Bitcoin and Ethereum are essentially the Apple of the cryptocurrency markets, insofar as volatile is a lot lower when compared to small-cap coins.

- This is largely due to the amount of liquidity available in the market.

Crucially, long-term investors have no interest in volatility, as this is a short-term metric that can be ignored when holding for many months or years.

The Importance of Utility When Investing in Cryptocurrency

‘Utility’ is no longer a buzzword in the world of cryptocurrencies. On the contrary, the most successful projects in this space have real-world use cases.

Ripple, for example, is a global payments network that serves large banks. Its underlying cryptocurrency – XRP, provides liquidity for cross-currency swaps. Hence, XRP has utility, which is why it is a large-cap project.

Similarly, a contender for the best crypto presale of the year – Meta Masters Guild, is also a project that has real-world utility. Its native MEMAG token fuels the project’s play-and-earn concept through in-game rewards.

The key point here is that many of the 22,000+ cryptocurrencies in existence do not have any utility at all. Instead, these so-called ‘meme coins’ are simply created to generate hype and market speculation.

Ultimately, when creating a diversified portfolio of cryptocurrencies, it is wise to only focus on utility coins. This is especially the case for investors that deploy a buy-and-hold strategy in the long run.

Long-Term Cryptocurrency Investing vs Short-Term Trading

We have made several references to the importance of investing in cryptocurrency in the long run, rather than attempting to make quick and easy gains. One of the main reasons for this is that long-term investors have the potential to ride out short-term volatility.

- For example, in the midst of COVID in early 2020, market panic resulted in Bitcoin declining 50% from $10,000 down to $5,000 in a matter of weeks.

- Those who panic sold would, in most cases, have made a financial loss on investment. At the other end of the scale, long-term investors did what they do best – hold.

- And in doing so, subsequently witnessed a rapid reversal. By the end of the same year, Bitcoin was trading above $27,000.

- The same outcome happened with many other cryptocurrencies, including both established coins and newly launched presales.

Some investors, however, prefer to buy and sell cryptocurrencies in the short term. In this regard, presales are often of interest, as an immediate upside can be obtained once the token is listed on exchanges.

This can also be the case when a presale adopts a progressive pricing structure across multiple stages.

For instance, we mentioned earlier that MEMAG is one of the top presales in the market right now. This presale is offering its newly launched tokens at a 50% discount when compared to the exchange listing price.

Is Investing in Cryptocurrency a Good Idea? What the Experts Say

Still asking the question – Should I invest in cryptocurrency?

Here’s what some of the most prominent experts believe from within the crypto investment arena:

“I want bitcoin to go down a lot further so I can buy some more”‘ Mark Cuban

This is one of the most recent quotes from the billionaire owner of the Dallas Cowboys, Mark Cuban. Cuban is a strong proponent of cryptocurrencies and blockchain technology in general, and he is clearly enjoying seeing Bitcoin trade at a fraction of its prior all-time high price.

“If the price of bitcoin goes down, I lose money. I might pump, but I don’t dump. I definitely do not believe in getting the price high and selling or anything like that.” Elon Musk

Tesla CEO Elon Musk – one of the richest and most successful entrepreneurs globally, is another cryptocurrency bull. This is just one quote of many, but the key takeaway is that just like Mark Cuban, Musk is not afraid of short-term price declines in Bitcoin. On the contrary, Musk is in the cryptocurrency space as a long-term buy-and-hold investor.

“Bitcoin is digital gold – growing harder, smarter, faster, & stronger due to the relentless progression of technology.” Michael Saylor

Michael Saylor is yet another multi-billionaire that is a strong believer in the future of Bitcoin and other cryptocurrencies. In this quote, Saylor makes reference to Bitcoin’s characteristics as a store of value, just like gold.

However, as many from within this industry argue, Bitcoin is a more viable alternative to gold, especially in terms of transfers, fractionization, and storage.

Is Now a Good Time to Buy Cryptocurrency? Best 5 Crypto Investments for 2023

We mentioned earlier that broader cryptocurrency prices are still worth just a fraction of prior all-time highs. And as such, new entrants to this market can invest at a reduced price point.

Here are five cryptocurrency projects that stand out in the market, across both presales and established coins.

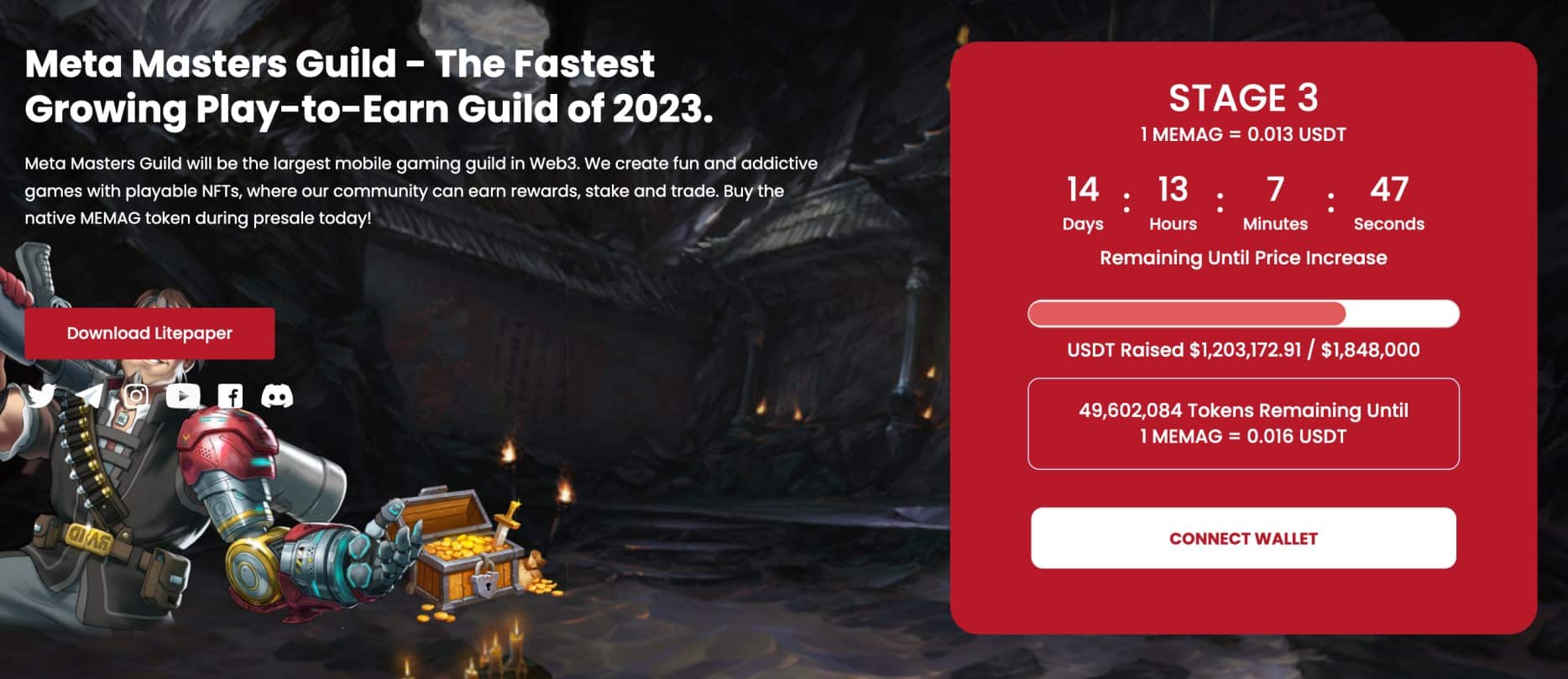

1. Meta Masters Guild – Presale Project Targeting the Blockchain-Based Mobile Space

Meta Masters Guild (MEMAG) is the first project that we like the look of. Its target market is the mobile gaming space, but with web3 technologies supporting its ecosystem. This includes the blockchain, alongside cryptocurrency, NFTs, and the metaverse. All games that are being built for the MEMAG framework will mobile-centric.

Mobile gaming is one of the fastest-growing niches in the video game industry, so MEMAG is well-primed for an early-mover advantage. Furthermore, and perhaps most importantly, MEMAG games utilize a play-and-earn system. This means that by playing games, users will earn crypto rewards – paid in GEMS.

As more GEMS are accumulated, users can make in-game purchases – such as NFTs, character upgrades, and other digital items. Or, GEMS can be swapped for MEMAG – the utility token of the Meta Masters Guild gaming ecosystem. MEMAG will trade on exchanges after its presale, so its play-and-earn games offer the chance to generate real-world monetary rewards.

The MEMAG presale has various stages to it, each of which increases the cost price for the investor. More than $1.2 million has already been raised and we are now in stage three. MEMAG can be purchased at $0.013 per token right now, but stage four increases the price to $0.016.

This means that there is a sense of urgency with this new cryptocurrency project. It takes just five minutes to invest in the MEMAG presale – all that is needed is a crypto wallet that is funded with either ETH or USDT. Read our guide on how to buy MEMAG during the presale launch.

For more information prospective buyers can join the MMG Telegram group and read the litepaper.

2. Fight Out – Fitness-Based M2E Rewards via the Metaverse

Seasoned cryptocurrency investors will often target high-growth niches that are yet to fully take off. One such example is the move-to-earn crypto concept being spearheaded by the Fight Out team. As the name implies, move-to-earn, or M2E, rewards users for staying fit, whether that’s by walking, running, or engaging in HiiT exercises.

In fact, the Fight Out ecosystem is being developed in such a way that all forms of fitness will be tracked and rewarded accordingly. With global attitudes towards health and fitness slowly but surely changing for the good, Fight Out could be one of the best cryptocurrency performers in the coming years.

Fight Out will offer access to its move-to-earn rewards system via a mobile app that connects to the blockchain. Moreover, there will also be a metaverse world that enables users to enter challenges, compete in competitions, and accumulate REPS tokens. REPS is the in-game reward currency.

REPS can be exchanged for FGHT, which is the utility token. Unlike other crypto reward ecosystems in this space, Fight Out has built a sustainable business model that will ensure it is economically viable in the long run. This is because in order to enter the Fight Out metaverse and earn rewards, users will need to pay a monthly subscription fee.

The Fight Out presale – which has already raised more than $3.4 million, offers the best way to gain exposure to this project. Prices as of writing amount to $0.01714 per FGHT token. As more money is raised, this increases the price. Expect the price to keep increasing until the presale sells out. When it comes, FGHT will be listed on a CEX at $0.0333.

Here’s our guide on how to buy Fight Out tokens via the presale.

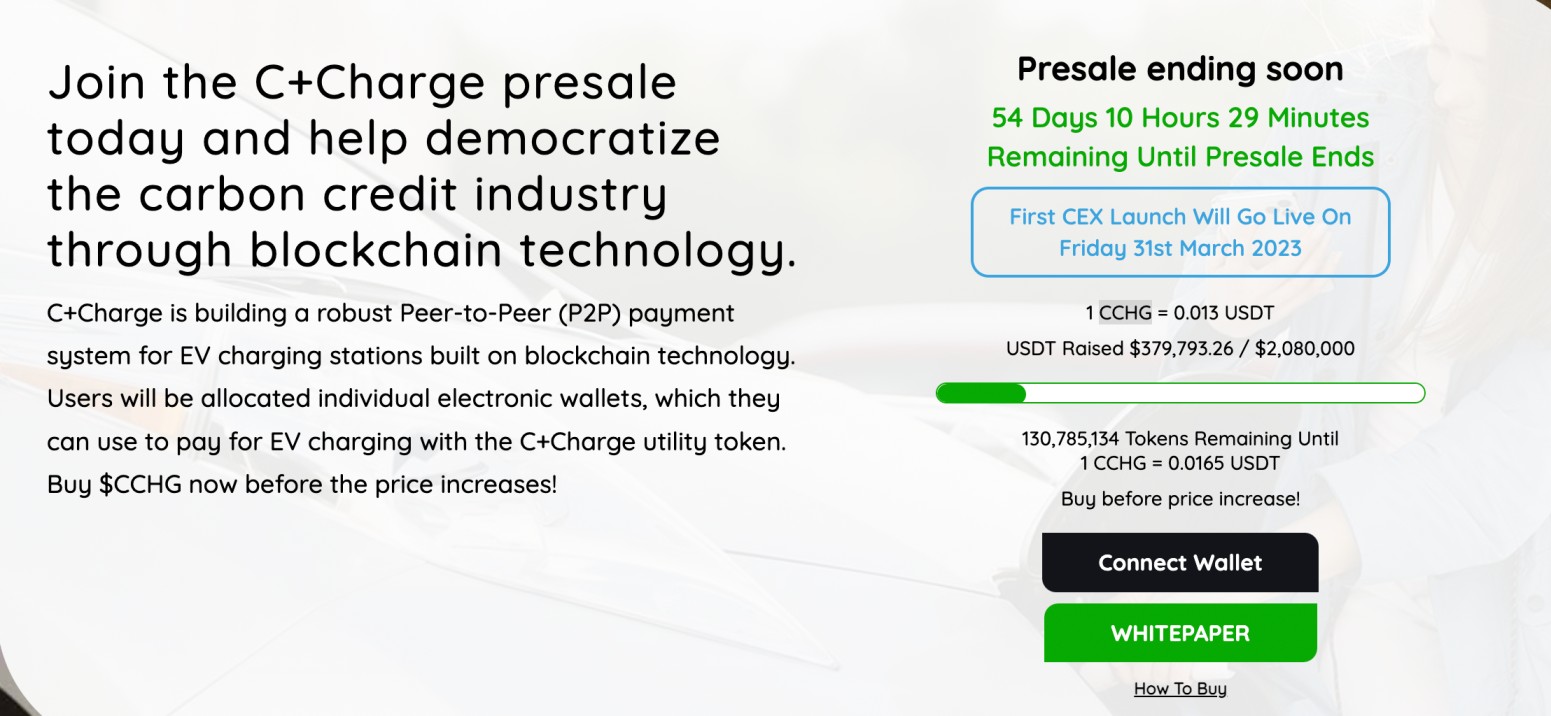

3. C+Charge – Incentivisation Infrastructure via EV Charging Stations

Another presale that we like the look of the C+Charge. From a diversification perspective, this project is involved in green and sustainable practices that incentive EV car owners. The main premise is that EV owners will receive rewards when charging their cars at a network location that is partnered with C+Charge.

The rewards are distributed in tokenized carbon credits – which are one of the hottest niches in the green community right now. This is because carbon credits are sought after by companies with emissions that exceed annual limits. Leading EV manufacturers and charging stations collectively generate billions of dollars from the carbon credits they have in excess.

But no longer are EV owners cut out from this growing market, as 1% of all charging purchases will be used to purchase and distribute carbon credits via the C+Charge app. Although it will take time for C+Charge to get its network set up on a global basis, the project is already in the process of forming notable partnerships.

The C+Charge presale is offering the project’s native token – CCHG, at the lowest price possible right now. In order to secure a price of $0.013 before this increases, presale investors will need to consider acting fast. The second-stage price of the C+Charge is set at $0.0165 – an increase of more than 25%.

Check out more about this sustainable crypto project by reading the whitepaper and joining the C+Charge Telegram group.

4. XRP – Large-Cap Cryptocurrency Fueling Interbank Transactions

XRP is one of the largest cryptocurrencies in this space in terms of market capitalization. Founded in 2012, it is also one of the most established cryptocurrencies. XRP is the native token of the Ripple project, which specializes in payment network technology for banks and financial institutions.

The core reason that banks are either using or considering Ripple is that the technology is significantly more efficient than legacy systems, such as SWIFT. Irrespective of the currency or location of the transacting parties, transfers take less than five seconds. Not to mention fees amount to micro pennies.

Ripple has already partnered with a sizable number of banks, with examples including SBI Remit (Japan), Itaú Unibanco (Brazil), Canadian Imperial Bank of Commerce (Canada), and Siam Commercial Bank (Thailand).

5. Bitcoin – The De-Facto Cryptocurrency That is Currently Undervalued

And of course – no cryptocurrency portfolio is complete without exposure to the world’s first and largest cryptocurrency of choice – Bitcoin. As noted earlier, Bitcoin has generated returns of over 2 million percent since 2011.

Although similar growth levels are now unlikely considering its market capitalization, Bitcoin still offers a lot of upside in the long run. This is especially the case in the current market, with Bitcoin trading at nearly 70% below its former all-time high.

This means that seasoned investors are now buying Bitcoin in their droves to take advantage of the current discount on offer. Some bullish investors believe that when the next upward cycle begins, Bitcoin could surpass $100,000.

Conclusion: Should I Buy Cryptocurrency Now?

This guide has answered the question – Is cryptocurrency worth buying? In summary, Bitcoin and other cryptocurrencies offer an attractive value proposition for investors that seek above-average returns. Naturally, the risks are significantly higher when opting for cryptocurrencies over traditional assets, but with the right strategy in place – investors can enter this market safely.

In addition to dollar-cost averaging, diversification, and having access to a secure wallet – exploring high-quality presales is a notable option worth considering. Presale investors are currently bullish on Meta Masters Guild, with the MEMAG token available to buy right now at a discounted price.

Meta Masters Guild - Next Big Crypto Game

- Backed by Leading Game Studios

- Early Round Presale Live Now

- Low Hard Cap, No Vesting

- Playable NFTs, Rewards, Staking

- Solid Proof & CoinSniper Audited