Is forex legit? Put simply, forex represents the largest trading market globally – with an estimated $6 trillion in daily volume. This means that traders can speculate on currency prices knowing that they are active in a credible and transparent marketplace.

For those still in doubt, the purpose of this guide is to assess the legitimacy of the forex trading market.

Is Forex Legit? Quick Answer

In a nutshell, just like stocks, commodities, and indices – forex is a legit trading sector. The overarching concept of forex is to speculate on the future direction of a currency pair.

- For instance, USD/CAD represents the exchange rate between the US and the Canadian dollar, respectively.

- Therefore, if USD/CAD is priced at $1.3201 – the forex trader must assess whether they believe this will rise or fall in the future.

- When the trader speculates correctly, a profit will be made.

Crucially, trillions of dollars worth of forex trades are executed each and every day. The vast majority of this volume is conducted by large banks and financial institutions. However, retail clients – which refers to non-professional traders, also have direct access to this marketplace via an online forex broker.

The best forex brokers in this industry are regulated by tier-one bodies – such as the CFTC and NFA (US), FCA (UK), and ASIC (Australia). Being such a heavily regulated market, forex enables traders of all shapes and sizes to speculate on currency prices in a safe and secure manner. This ensures transparency, leverage limitations, and fair trading practices.

All in all, when answering the question – is forex legit? – this industry is one of the most legitimate trading markets globally.

80.61% of retail investor accounts lose money when trading CFDs with this provider.

The Basics of Forex

In terms of the basics, forex trading is not too dissimilar to any other investment market – such as stocks. After all, the overarching objective is to make money, and this can be achieved by predicting the future value of the currency pair being traded. This is, however, easier said than done – considering that currency prices and exchange rates change as every second passes.

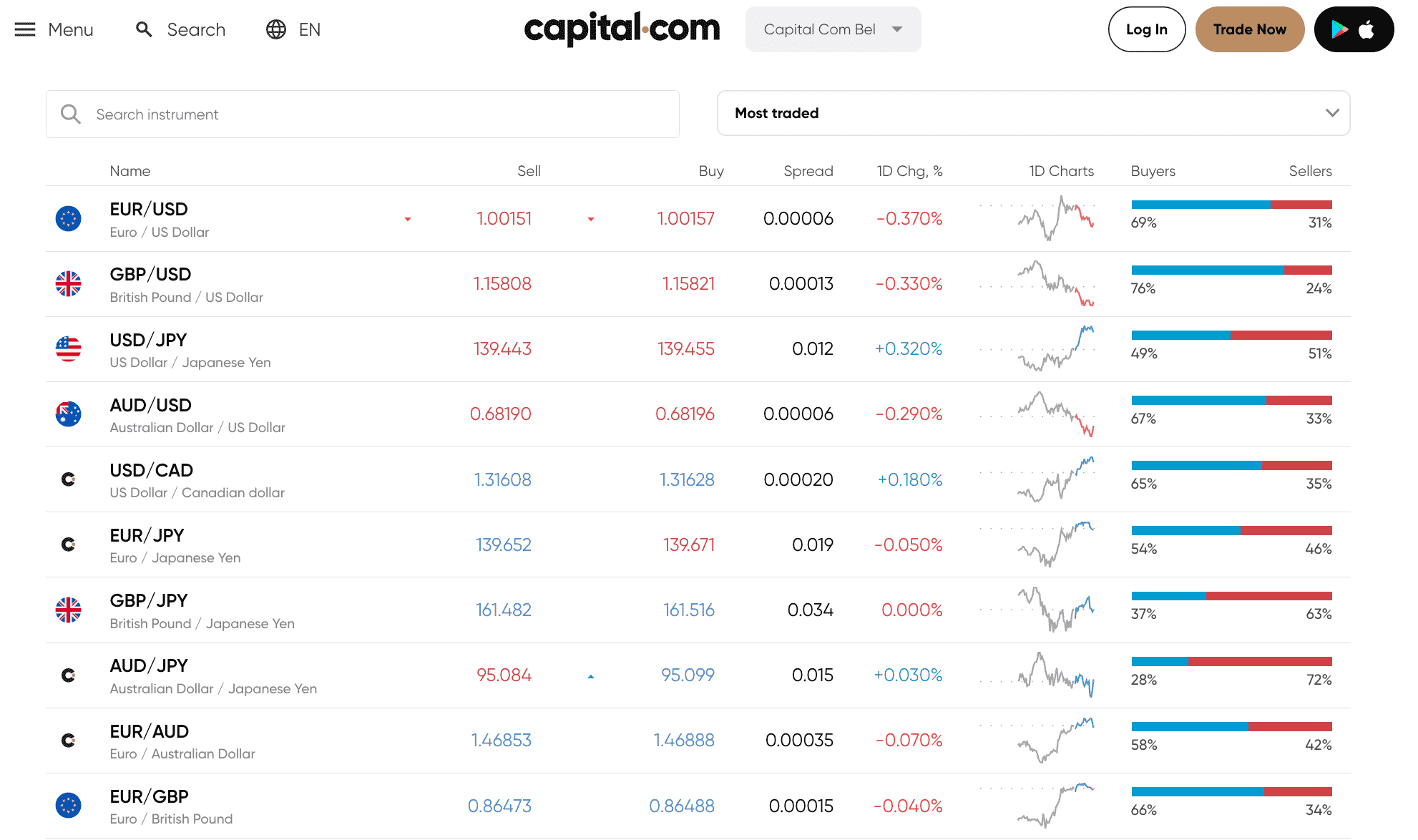

On the flip side, when compared to other trading markets, forex price movements are a lot less volatile. For example, in the 24 hours prior to writing, the exchange rate between GBP/USD has ranged from a high and low of 1.1471 and 1.1470, respectively. This represents a price movement of just 0.4% in a 24-hour period.

Nonetheless, forex traders will look to capitalize on the ever-changing exchange rates that the forex market presents. In order to enter a position, the forex trader will first need to choose a suitable pair and decide whether they think the exchange rate will rise or fall.

- For example, if EUR/USD is priced at 1.0178 – a buy order would indicate that the trader believes a price increase is likely.

- However, a sell order would indicate the opposite.

After placing the order, the trader will make a profit if they speculated correctly. The amount of realizable profit will depend on many factors, such as the stake, leverage ratio, spread, commission, and percentage change.

Most forex traders will target major and minor pairs, both of which will consist of strong currencies – such as the US dollar, euro, or British pound. Exotic pairs are also offered by forex trading platforms, which will consist of an emerging currency like the South African rand or Mexican peso.

Due to their lack of volatility and high levels of liquidity, majors are the best forex pairs to trade in forex as a beginner.

Moreover, there are many forex trading strategies to choose from, such as trend trading, day trading, swing trading, and even quant trading. It is, therefore, wise to choose a suitable strategy before getting started in the forex space.

Risks of Trading Forex

Now that we have assessed the question – is forex legit? – we can now explore some of the core risks that need to be considered before entering this marketplace.

Most Traders Lose Money

Is forex trading profitable? Being able to predict the future direction of a currency pair is no easy feat. There must be logic to the trading decision, otherwise, the forex trader is essentially gambling.

For instance, as of writing, the exchange rate between the US dollar and Japanese yen is $143.49. Readers should consider how they would determine whether USD/JPY will rise or fall.

After all, speculating incorrectly will result in a loss of funds. Therefore, traders must have a firm grasp of the many factors that can determine how forex prices are influenced.

Forex Analysis is Complex

Seasoned forex traders will utilize technical indicators when trading forex, such as the MACD and Bollinger Bands. Fundamental analysis is also useful for longer-term plays.

Areas to focus on in the fundamental research department include central bank interest rates, GDP levels, employment figures, and even commodity prices.

However, learning the intimate details of both technical and fundamental analysis can take many years. Therefore, forex traders should be prepared to dedicate ample time to this marketplace, should they wish to generate consistent profits.

Time Dedication

In addition to learning the intricacies of technical and fundamental analysis, traders will also need to dedicate ample time to the forex market. This is because the vast majority of successful traders in this space operate on a full-time basis.

This is because forex trading requires short-term plays, such as buying a pair and then selling it a few hours later. This is in stark contrast to stocks, which enables traders to invest over the course of several months or years.

As such, if the trader is unable to dedicate sufficient time to forex, they likely won’t succeed.

Potential for Profits When Trading Forex

There is, of course, plenty of opportunities to make profits when trading forex. After all, not only is forex the largest trading market for volume and liquidity, but the industry operates on a 24/7 basis.

Furthermore, forex prices change as each second passes, so there will always be an opportunity to enter a position. This is the case across all strategies, whether that’s via a day, swing, or scalping system.

- Beginners must, however, remember that when compared to stocks and commodities, currencies witness much smaller price movements – especially in the case of major pairs like EUR/USD and GBP/USD.

- For instance, we mentioned earlier that GBP/USD, over the prior 24 hours, experienced a price movement range of just 0.4%.

As a result, in order to make the forex trading process worthwhile, traders will need to consider their stakes.

- For example, making a daily profit of 0.4% on a stake of $1,000 would yield just $4 – and this is before factoring in spreads and commissions.

- This is why many forex traders opt to utilize leverage. For instance, the same 0.4% gain but with leverage of 1:50 would amplify a $4 profit to $200.

Note: Leverage should be utilized with caution due to the risk of liquidation.

Importance of Choosing Regulated Forex Brokers

As the world’s largest trading sector, it goes without saying that forex is heavily regulated. However, we should make the point that many online brokers active in this space operate without a suitable license.

Some platforms, are not licensed, and subsequently located offshore. As such, this also presents additional risk to the trader – before they have even entered a position.

After all, if the forex broker one day disappears and it isn’t regulated by a suitable tier-one body, then investors will likely lose any capital stored on the platform.

In comparison, forex brokers regulated by the likes of the FCA or CFTC must follow a wide range of strict guidelines.

This includes:

- Keeping client funds in segregated bank accounts away from the broker’s working capital

- Verifying the identity of all traders

- Limiting the amount of leverage that can be utilized

- Being transparent and fair on spreads and trading fees

- Engaging in regular audits

As per the above, using a regulated forex broker is super-important when assessing the legitimacy of this industry. Another reason to ensure that the chosen forex broker is regulated is that in some regions, investor protections are in place.

This means that if the unlikely happens and the regulated broker goes out of the business, any loss of funds could be covered up to a certain limit.

What to do Before You Start Trading Forex Safely

Simply opening a forex brokerage account and entering buy and sell orders will not result in long-term success.

On the contrary, it is important to have a plan of action in place – in terms of risk management, forex trading strategies, and ultimately – being educated on how forex prices work.

Below, we offer crucial tips that beginners should take into account before embarking on a forex trading journey.

Tip 1: Get Educated on the Forex Market

Before getting to the stage of opening a brokerage account and making a deposit, it is important to first create an education plan. By this, we mean learning what is forex trading and assessing what trading materials need to be researched so that the market is fully understood.

In addition to reading beginner-friendly guides like ours, it is well worth taking a forex trading course. This should teach the core principles of forex trading, such as:

- Pairs

- Spreads and overnight financing

- Leverage

- Order types

- Risk management

- Strategies

- and more

Once the basics have been covered, it is then important to begin learning about technical and fundamental analysis practices. This is crucial, as it will enable traders to understand what influences the value of a forex pair. And thus, smart and risk-averse trading decisions can be made. For more information on the basics of forex trading you can read our article on ‘what is a Pip in forex?‘

Tip 2: Open a Forex Demo Account

In conjunction with undergoing a forex course, beginners should also consider opening a demo account with a regulated and low-cost broker.

Both Capital.com and eToro – which we discuss shortly, offer free demo accounts that mirror live forex trading conditions. This means that instead of risking real money, traders can enter positions with ‘paper funds’.

It is wise to stay in demo mode until the trader begins making consistent gains. When the time finally arrives to begin trading in the real forex marketplace, only then should a deposit be made.

Tip 3: Choose a Suitable Forex Strategy

While in demo mode, traders should assess which strategy is best suited for their personal circumstances. For instance, those that do not have the time to actively research and trade pairs throughout the day might consider a swing or position trading strategy.

Swing trading enables the trader to keep a position open for several days or weeks. Position trading is even more flexible, with some positions remaining open for over a year.

On the flip side, those that wish to actively trade forex on a full-time basis might be more suitable for day trading. This means opening and closing several trading positions throughout the day.

Each strategy can be formulated and perfected in the aforementioned demo account facility.

Tip 4: Create a Risk Management Plan

Risk management in forex is super-important in all trading arenas – especially forex. After all, it is not feasible to expect each and every position to result in a profit. On the contrary, even the most seasoned of traders will encounter losing trades.

However, seasoned traders will always ensure that sensible risk management strategies are in place. This includes beginning with a bankroll management plan.

- For instance, beginners might consider limiting each position to 1% of the total bankroll.

- So, if the account balance stands at $2,000, at 1%, a maximum trade size of $20 can be entered.

Moreover, beginners should familiarize themselves with stop-loss orders. This should be applied to each trade that is entered, as stop-losses cap the amount of money that can be lost on a single position.

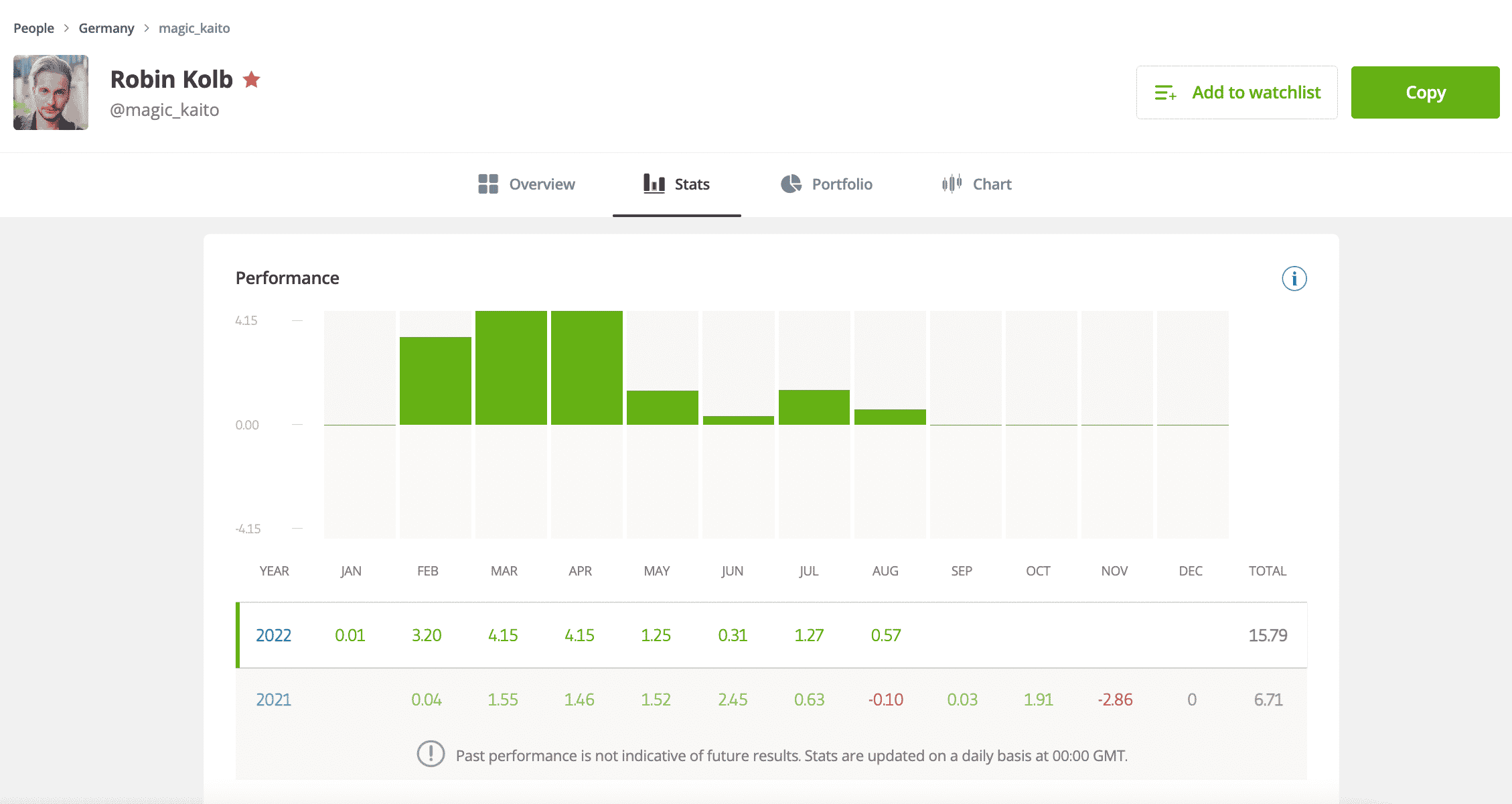

Tip 5: Consider Copy Trading

If the thought of learning technical analysis or formulating a trading strategy seems like a daunting and time-consuming process (which it is), it might be worth considering an alternative approach to the forex market.

This is where a Copy Trading tool can help.

In a nutshell, Copy Trading is a service offered by eToro and a select number of other platforms. It enables users to automate the trading process by electing to copy a forex trader that has proven experience in this space.

This means that users can sit back and trade forex without needing to have any experience or knowledge in this industry.

Learn more about how the best copy trading platforms offer a passive investment experience.

Most Legit FX Brokers

So far, we have answered the question – is forex legit and what should be considered before getting started? Now, we can progress to the next important step for beginners to take – choosing a legit forex broker.

Not only should the chosen forex broker hold a license with one or more tier-one regulators, but it should also offer low fees, tight spreads, great customer service, and support for many pairs and markets.

Below, we offer a brief overview of the best forex brokers in the regulated online space:

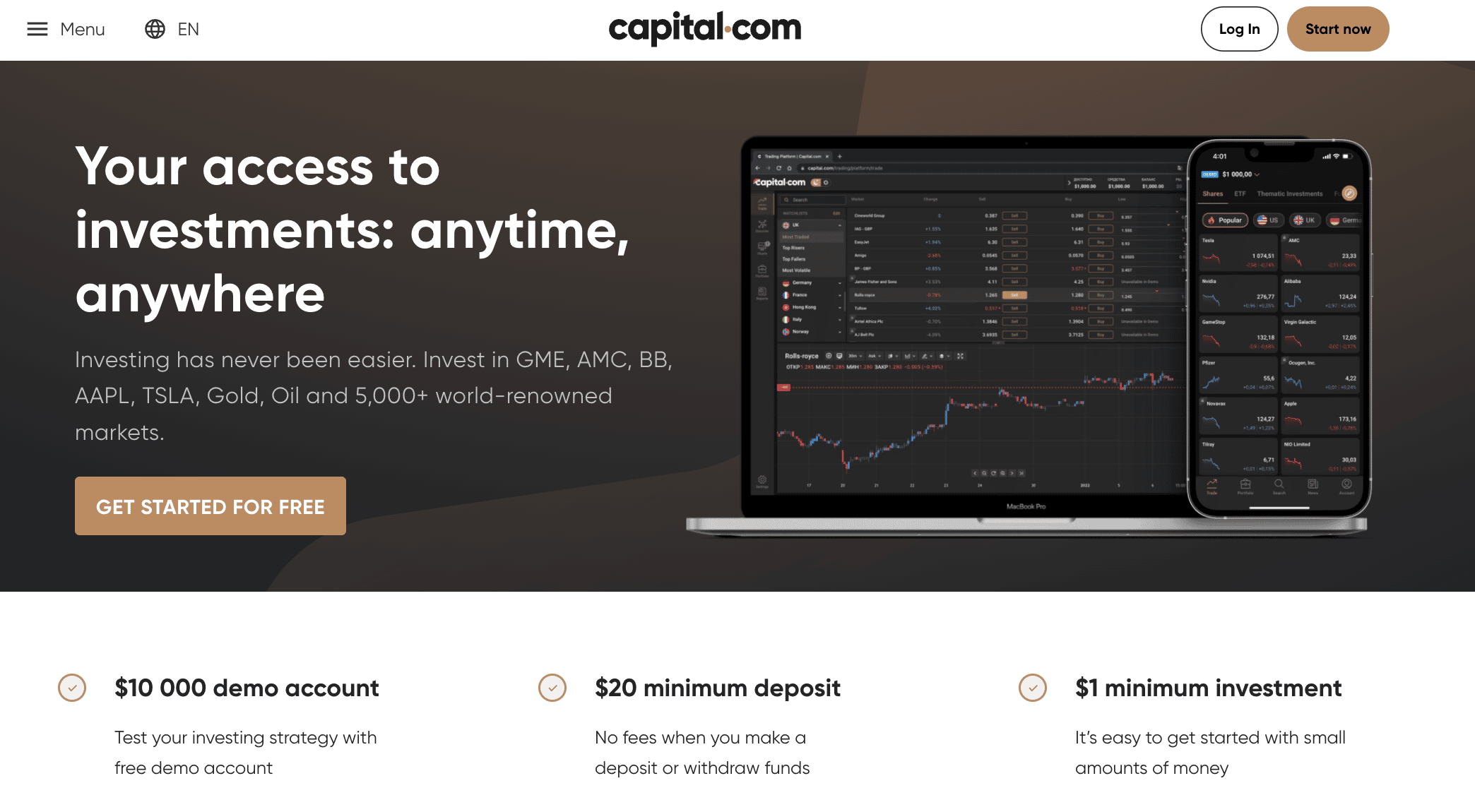

1. Capital.com – Regulated Forex Trading Platform With 138 Currency Pairs

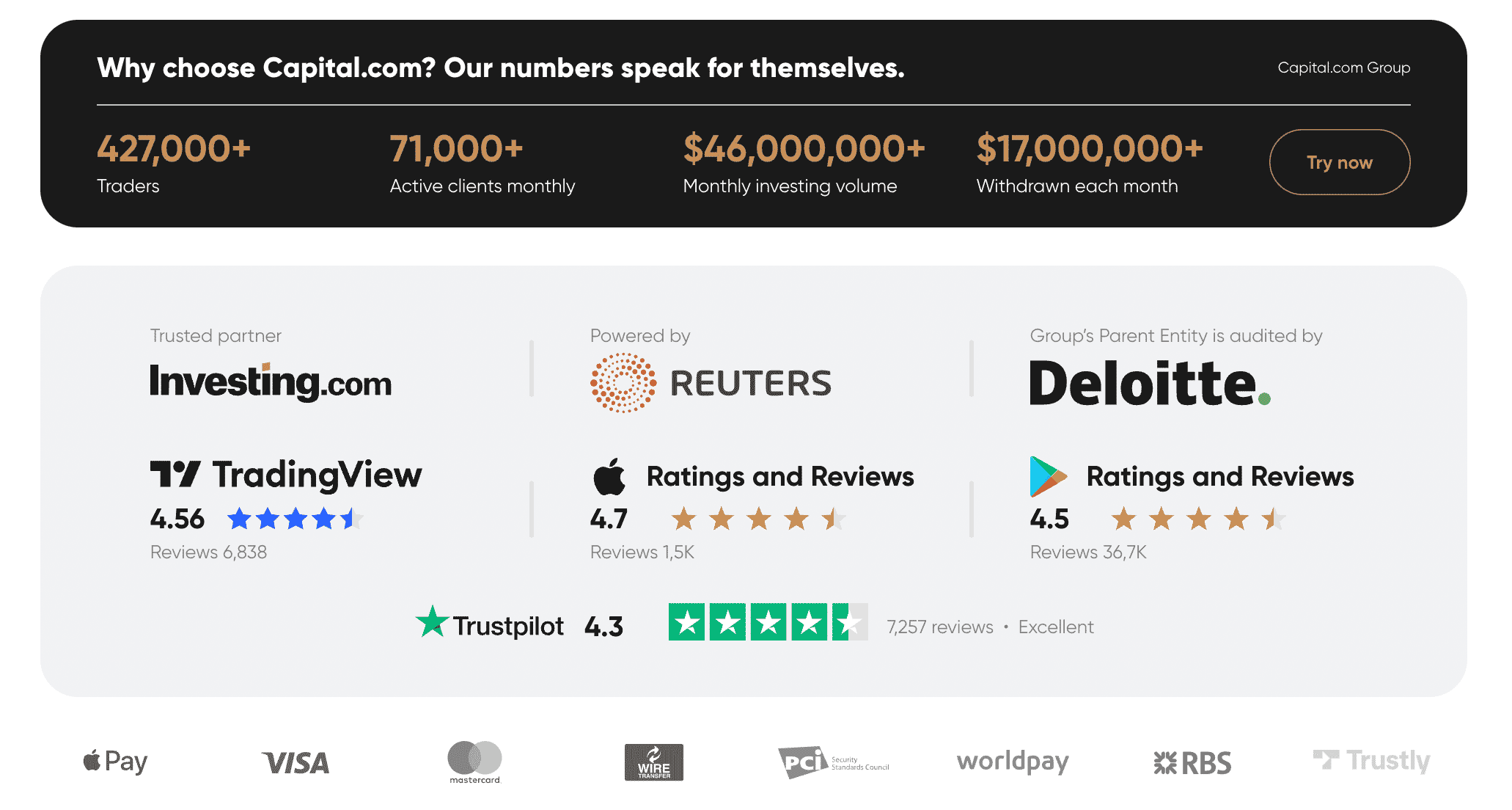

Capital.com is as legit as it comes in the forex trading space. First and foremost, this platform is regulated by the FCA, ASIC, CySEC, and NBRB. This offers regulatory oversight on multiple fronts. Capital.com is used by more than 400,000 traders and its parent company is audited by Deloitte.

On Google Play alone, for example, the Capital.com app has a rating of 4.5/5 over more than 36,000 individual reviews. In addition to its Android and iOS app, Capital.com offers its own native web trading platform. This comes packed with tools that will appeal to both technical and fundamental traders.

This includes everything from market insights and economic news to technical indicators and chart drawing tools. Capital.com is also considered a low-cost platform, not least because it does not charge any trading commissions. Spreads – which refer to the gap between the buy and sell price of a forex pair, start at just 0.6 pips.

There are no fees to open or maintain an account, nor to deposit or withdraw funds. Capital.com, when opting for an e-wallet or debit/credit card payment, requires a minimum first-time deposit of just $20 (bank wires require $250). On top of offering more than 138 forex pairs, Capital.com also offers commission-free access to stocks, ETFs, commodities, crypto, and indices.

Note: Capital.com is a CFD trading platform – which means that it cannot accept account applications from US clients.

Read our full Capital.com review here.

| Forex pairs | 138 |

| Minimum Lot Size | 0.01 |

| Leverage | 1:30 for retail clients |

| Deposit fee | None |

| EUR/USD spread | 0.6 pips |

| Commission | 0% commission |

| Overnight fee | Depends on market conditions |

| Copy Trading | Yes, via MT4 |

Pros

Cons

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

2. eToro – Regulated Forex Broker With Low Fees and a Copy Trading Service

In addition to offering a legit and transparent trading platform, eToro is popular for its low-cost pricing structure. As an alternative to charging commissions, eToro operates its forex trading department on a spread-only basis. Therefore, traders simply need to cover the spread – which starts at 1 pip on EUR/USD.

Moreover, when making a deposit in US dollars – which starts at a minimum of $10, there are no transaction fees to pay. This is the case across all supported payment types, which is inclusive of bank wires, debit and credit cards, PayPal, Neteller, and more. The minimum trade size at eToro is 0.01 lots – or 1,000 currency units.

Leverage is available at eToro too, with limits amounting to 1:30 for retail clients. eToro enables clients to trade forex via its website, which offers a smooth and user-friendly experience. eToro also offers a mobile app for iOS and Android. Best of all, the eToro Copy Trading tool enables clients to mirror the positions of an expert forex trader. Thus, this offers a passive trading service.

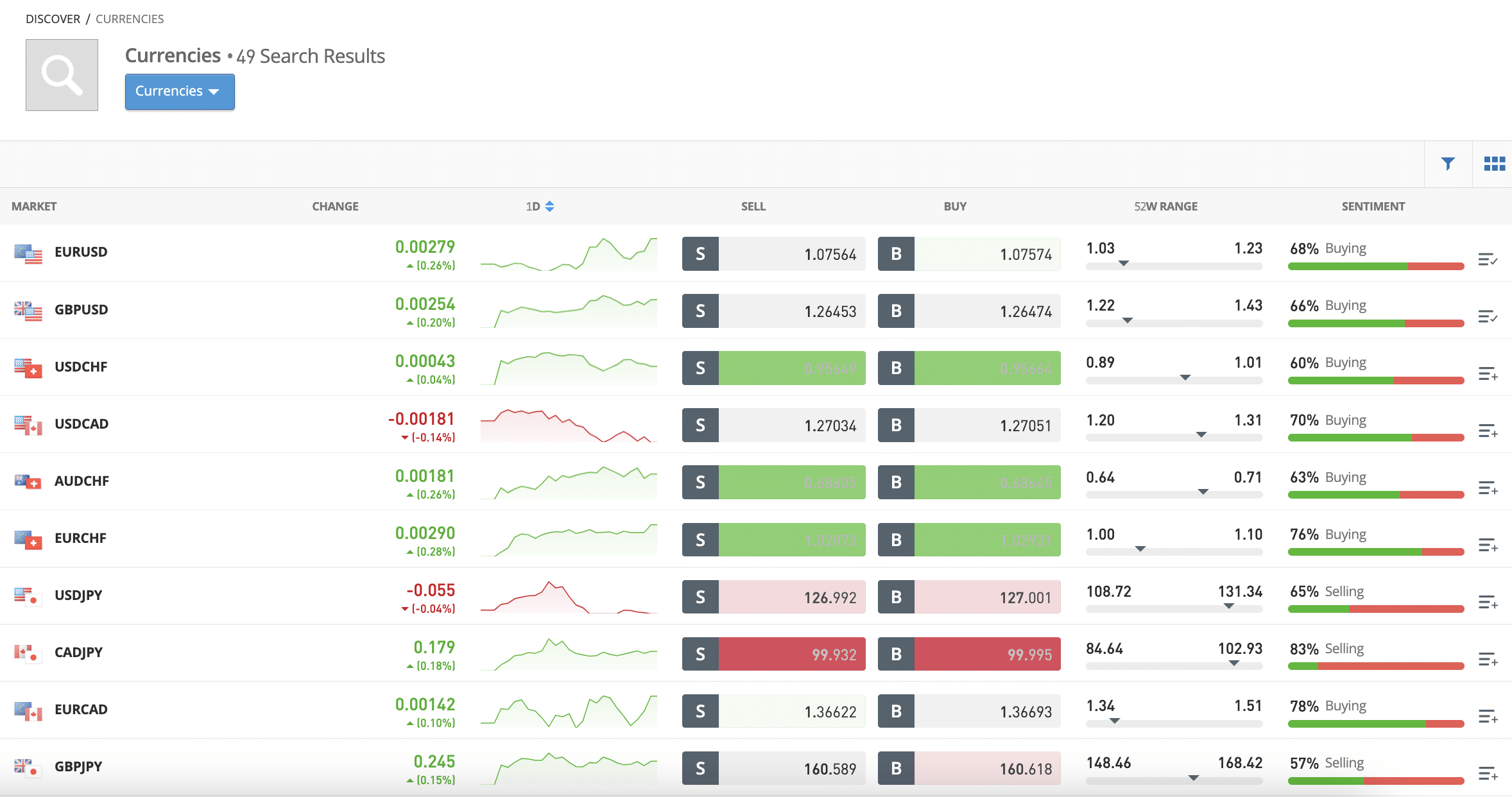

| Forex pairs | 49 |

| Minimum Lot Size | 0.01 |

| Leverage | 1:30 for retail clients |

| Deposit fee | Free for USD payments, otherwise 0.5% |

| EUR/USD spread | 1 pip |

| Commission | Spread-only |

| Overnight fee | Depends on market conditions |

| Copy Trading | Yes, proprietary Copy Trading tool |

Pros

Cons

78% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

In conclusion, this beginner’s guide has answered the question – is forex legit? As discussed, not only is forex legit, but it represents the largest trading market globally – far surpassing the volumes seen in the stock or commodity spaces.

However, it is important to ensure that traders select a regulated and reputable forex broker when entering this space. Capital.com is authorized and regulated by the FCA, ASIC, CySEC, and NBRB.

Not only is Capital.com heavily regulated and audited by Deloitte, but it offers commission-free forex trading with tight spreads.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.