Getting into mining requires investors to spend thousands of dollars on Litecoin mining software and hardware. The hefty upfront investment required for mining Litecoin makes it a risky venture, yet investors don’t need to take that option.

A less risky alternative is using mining platforms. Doing so means that investors deposit only the minimum required to start, and investors don’t waste time on setting up hardware. It’s quick and available to beginners who don’t want to incur high costs. But Litecoin mining should be done on the best mining platforms, which we reviewed. Let’s explore the different Litecoin mining pools and find out everything about Litecoin mining.

The 3 Best Litecoin Mining Platforms in 2023

Our search for the best Litecoin mining platform led us to three providers. Of the three, we found Ecos to be the top pick – as well as LTC it’s also one of the best BTC mining sites.

- ECOS – Crypto Mining Site Offering Tailored Contracts

- Crypto.com – Popular Exchange Offering Liquidity Mining

- Bybit – Great Platform for Cloud Mining

Cryptoassets are a highly volatile unregulated investment product.

A Closer Look at the Top Litecoin Mining Platforms

Investors who want to mine Litecoin need to analyze several factors about the platform to determine that it’s suitable. We’ve done the hard work of looking at every aspect of the best platforms offering mining and then compiled our findings in in-depth reviews.

After comparing all the platforms, we discovered that ECOS provides the best Litecoin mining contracts.

1. ECOS – Crypto Mining Site Offering Tailored Contracts

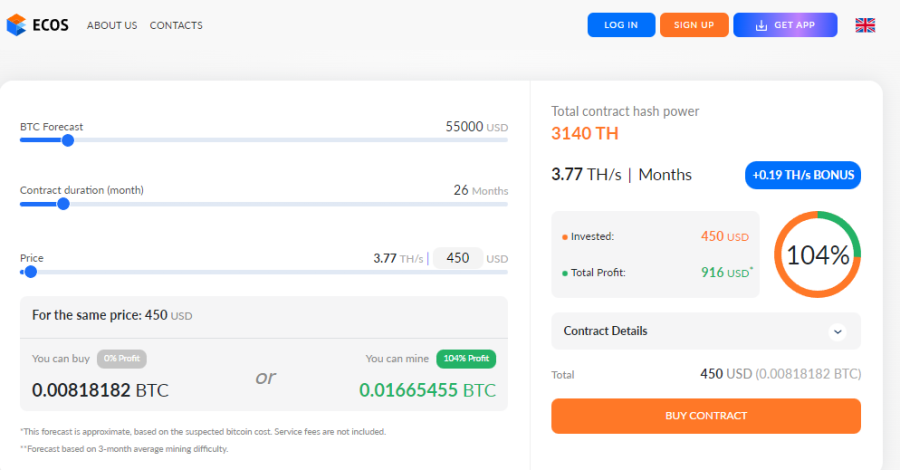

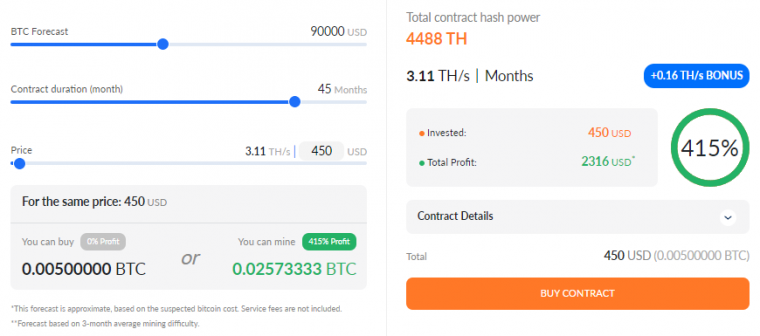

One of the benefits of using ECOS for mining is that it provides a mining contract calculator. Investors can use it to calculate their potential Litecoin mining profitability. Investors are also entitled to special offers for contracts over $5,000. The platform offers daily payments, and miners use real equipment to generate an income. ECOS accepts debit/credit cards for renting mining facilities for the desired period.

ECOS is responsible for providing the equipment, software, electricity, placement and maintenance on a turkey basis. Opening a contract with ECOS provides investors with several features. When opening a contract, investors can estimate the future value of cryptocurrency and stipulate the contract duration and price.

A key feature that separates ECOS from most mining platforms is that it offers a welcome bonus. Investors who register get a welcome trial mining contract. Once investors start mining, they’ll receive coins daily into their accounts. Investors can also use ECOS’s app to mine, and service fees depend on the custom contract.

Besides offering mining, ECOS offers an exchange and a secure crypto wallet.

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Popular Exchange Offering Liquidity Mining

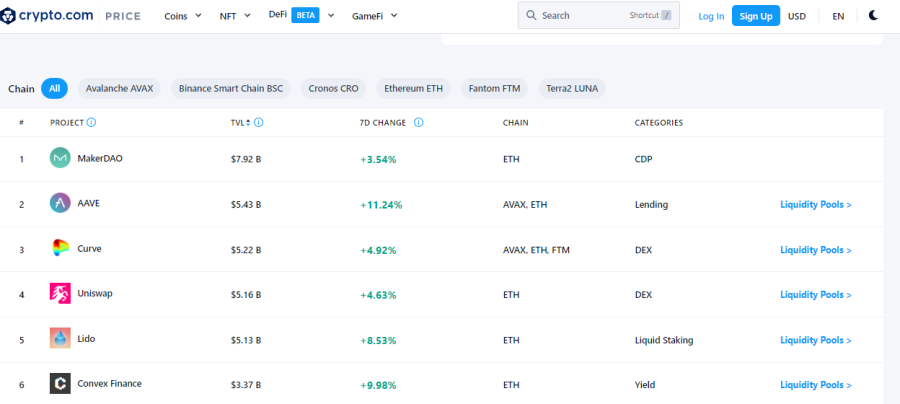

Crypto.com’s yield farming features the top 10 projects from each chain on the platform and provides a 7-day percentage change. The different chains offered are Avalanche, Binance Smart Chain, Cronos, Ethereum, Fantom and Terra2.

The great thing about Crypto.com is that it’s one of the biggest exchanges in the world. Investors don’t need to wonder where to buy Litecoin, as it’s available on this platform. Beginners can buy Litecoin (LTC) with a few simple clicks, and pro traders can incorporate advanced tools on this platform to enhance their technical analysis.

Crypto.com requires a minimum deposit of 100 USDC, which is equivalent to $100. Payment options are ACH, debit/credit cards and cryptocurrencies. Trading LTC means investors will incur a fee of 0.4% up to a $25,000-monthly trading volume. Once exceeding it, investors will pay 0.35% trading fees. Buying crypto with a card is charged 2.99%.

Investors can also stake coins on Crypto.com. The platform offers some of the best staking coins with an annual percentage yield (APY) of up to 14.5%. Stablecoins provide a 10% APY, and staking CRO, the platform’s native token, only offers a 4% APY.

We’ve written an in-depth guide titled what is DeFi yield farming.

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

3. Bybit – Great Platform for Cloud Mining

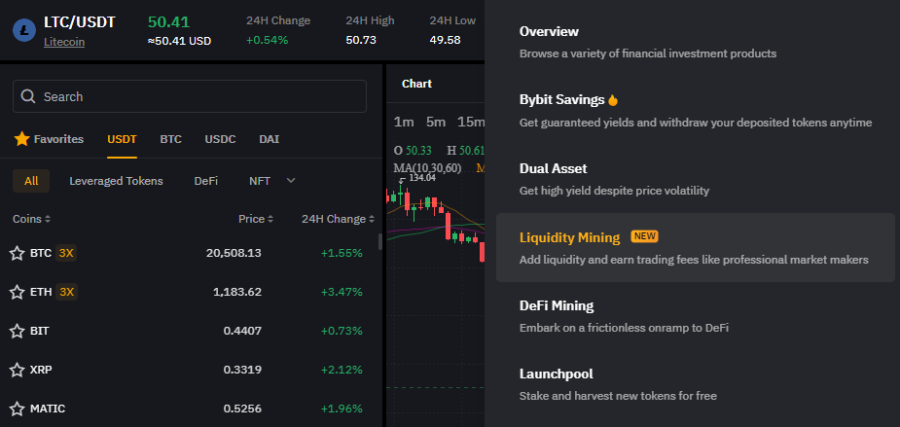

Bybit is another platform that enables investors to access liquidity mining. By using Bybit, investors add liquidity to earn yield derived from trading fees. Investors can also add leverage to increase their share of the pool and maximize yields.

The platform enables investors to add liquidity to the pool and claim the yield daily via liquidity provision. Bybit enables investors to add or remove liquidity at any time. Another great feature on this platform is DeFi mining. It involves choosing between different staking periods to stake USDT. A minimum deposit of 100 USDT is required, and a staking period of 7 days will provide a 3% to 5% APY. Opting for a staking period of 21 days offers a 10% to 12 APY, making Bybit one of the best DeFi staking platforms.

Bybit offers Litecoin trading and specializes in cryptocurrency deposits. But investors can opt for fiat funding, which is handled by third-party providers such as Banxa and XanPool. A minimum deposit of $20 is required. Withdrawal fees are applicable and based on the coin withdrawn.

Besides offering numerous GameFi, Metaverse and meme coins, Bybit also enables investors to its NFT marketplace.

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

How Does Litecoin Mining Work?

Before mining Litecoin in 2023, investors need to know how it works. That’s important to avoid wasting money. Only once investors know how LTC mining works can they decide if it’s for them.

Let’s first explain what Litecoin mining is.

Cryptocurrencies are decentralized assets, meaning a third-party such as a bank or a broker has no involvement in the transaction. The blockchain network is responsible for conducting cryptocurrency transactions. But somebody needs to record those transactions to provide verification and prevent duplicates. On the blockchain network, individuals who provide that service are called miners.

Miners are responsible for solving highly complex mathematical equations and receive a block reward for solving them. They close a block, then open a new one. Litecoin operates on a proof-of-work consensus mechanism. With Litecoin, miners solve the nonce, part of the hash. A hash secures the block, and a hashing algorithm encrypts the alphanumeric sequence of numbers. Once it’s solved, a miner is rewarded with a Litecoin.

The Connection

The first thing miners do is connect to the internet, thereby creating a global network. They compete with each other to solve the hash and can use as many mining programs as they please. Some miners opt for their own setup by investing in a Litecoin mining rig (computer), mining software and low-cost power supply. Others opt for mining platforms such as ECOS, Crypto.com and Bybit.

Miners need an application-specific integrated circuit (ASIC) mining machine to be competitive.

The chances of solving a hash with one computer are low, and investors may even struggle to keep up with the rest of the network with two computers. That’s one of the reasons it’s best to opt for a mining site that offers a high-speed data center.

Choose a Mining Pool

After miners are connected to the network, they have to choose a mining pool. Use the pool’s website instructions to connect to it. If a miner is using personal hardware and software, follow their instructions on how to mine, as well as the pool’s instructions.

Although challenging, mining for Litecoin on an app is possible. We found the best crypto apps on the market.

Mining

Litecoin mining works similarly to Bitcoin mining since LTC is a Bitcoin fork. It’s also possible to earn free Bitcoin. The difference is that Litecoin uses an algorithm called Scrypt to process hash functions. The block production on the Litecoin network is one block every 2.5 minutes. That results in the production of around 576 blocks per day.

Each block consists of a tranch of transactions executed. Litecoin miners solve the complex mathematical equation to validate the tranch of transactions. If a miner solves an entire block, they keep 12.5 LTC plus fees. Validating the block means confirming that all of its transactions are valid and can be posted to the ledger.

For those interested in other forms of crypto mining, we also wrote a Monero mining post.

Is Litecoin Mining Profitable?

Litecoin’s blockchain has revealed that the average block mining time is two minutes and thirty seconds. Litecoin mining definitely provides rewards to successful miners, but it’s important that investors analyze all the costs involved before getting into mining. It’s not for everyone because the initial start-up costs are high, especially if investors set up their own hardware and software.

Miners may need several ASICs to remain competitive in a pool; otherwise, miners can connect their ASIC to a mining farm, enabling a small miner to team up with a lot of hash power. Having a lot of hash power means that a miner has a higher chance of receiving a steady flow of block rewards from the machines.

If a miner isn’t able to solve an entire block, it’s still possible to receive some rewards through the mining farm. That happens when a mining farm solves a block, but a small farmer is entitled to a portion of the reward based on the hashing power that the farmer has contributed.

Miners opting to buy their own equipment would need to invest in top-of-the-range products to remain competitive on Litecoin’s network. The Litecoin Miner L7 costs $13,999. It’s vital that miners consider how long it will take them just to recover that cost if they’re capable of solving an entire block.

Another high cost associated with mining is energy. An ASIC uses a tremendous amount of electricity when a miner is solving a block. The estimate for the Litecoin Miner L7 daily energy consumption is $10. That’s the base that miners should consider. The more ASICs they connect, the higher the electricity bill. Miners need to factor in at least an additional $4,000 utility bill per year.

Opportunity Cost

Miners need to consider the amount of time they need to spend to recover their costs and make enough money to pay the bills. Although the reward for solving a Litecoin block offers miners 12.5 LTC and can take less than three minutes to do, those results aren’t guaranteed.

That is especially true for beginner miners. It may take a significant period just for a miner to recover the startup costs and then more time to achieve consistent profits. The one thing that is guaranteed is mining costs. Whether miners receive any rewards, they have to pay the electricity bills and possible ASIC repairs.

Beginner miners need to be realistic about the time and money they need to invest and compare that with a full-time job, which offers a guaranteed income. To avoid most of the startup costs, miners can opt for cloud mining with a platform such as ECOS.

Choosing this option will enable miners to save a tremendous amount of costs and have access to the best mining equipment. ECOS provides an all-in-one data center, increasing the chances that a miner will be profitable while decreasing their costs and minimizing efforts associated with buying and setting up mining rigs.

How to Mine Litecoin Easily

The best platform we found to mine LTC is ECOS. To make a miner’s journey easier, we provided a step-by-step tutorial on how to get started.

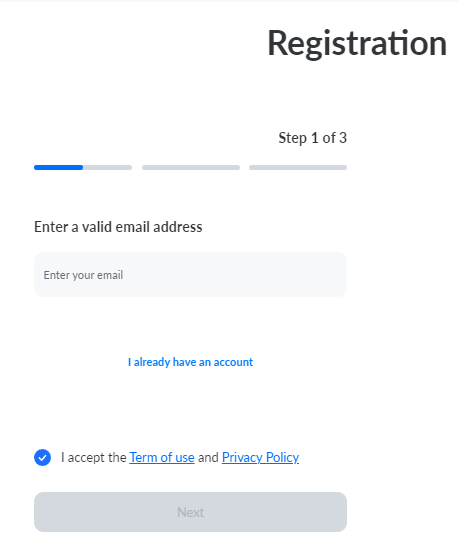

Step 1: Open an Account

Miners should visit ECOS.am, then click ‘Sign Up’ in the top right corner.

Type in a valid email, then click ‘Next’.

Step 2: Verify Account

Users need to input the code sent to their email addresses to verify their accounts.

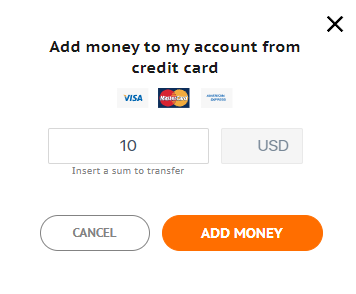

Step 3: Fund an Account

Once the system has logged users in, check the dashboard on the left side of the screen and click ‘Mining devices’. Then, look at the right side of the screen and click ‘Add money’ in the Account box.

Enter the amount to fund the account, then click ‘Add Money’.

Step 4: Buy a Contract

On the dashboard (left side of the screen), click ‘Buy Hash’.

After investors have customized the parameters, click ‘Buy Contract’.

Conclusion

Litecoin mining can be a profitable venture if miners choose the right path. We have detailed the process of how to mine Litecoin and the costs involved. Even more importantly, we have advised miners about key factors they need to consider before beginning the mining journey. Beginner miners who don’t want to risk their money on buying expensive mining equipment can opt for a mining platform.

We reviewed three mining platforms that were the top picks amongst the entire offering. But we felt that ECOS was the best platform for mining. The reason for our sentiment is that miners can start with a minimum threshold because ECOS provides a large data center with Antminer S19j Pro and 200 MW of electricity. It also enables miners to customize the contract they want to buy. Miners receive special offers for contracts over $5,000, and the platform offers daily payments and real equipment to generate an income. The platform accepts cards for renting mining facilities.

Cryptoassets are a highly volatile unregulated investment product.

FAQ

Can Litecoin still be mined?

Is Litecoin worth mining?

Is mining Litecoin legal?

How fast can you mine Litecoin?

Where can I mine Litecoin?

How do I mine Litecoin?

Read More: