Crypto loan sites allow you to borrow funds – either in the form of digital currency or fiat money, by putting up a security deposit in the form of collateral. This can be beneficial for raising capital quickly without needing to sell your crypto holdings.

In this guide, we review the five best crypto loan sites in terms of fees, LTV ratios, minimum and maximum requirements, and funding terms.

The Best Crypto Loan Sites 2023 List

Our research found that the five providers outlined below are the best crypto loan sites.

- Aqru – Overall Best Crypto Loan Site for Investors

- Crypto.com – Competitive APRs on Loans Against Cryptos

- BlockFi – Top Provider for Instant Bitcoin Loans at Low Fees

- Nexo – Over 30+ Tokens Supported for Crypto Collateral Loans

- YouHodler – High LTV Ratio of 90% on Crypto-Backed loans

Read on for our up-to-date reviews of the above crypto loan sites.

Top Bitcoin Loan Platforms Reviewed

When choosing the best Bitcoin loan platform for your requirements, you need to check what interest rates you will be required to pay, as well as what terms and conditions apply to the funding agreement.

Moreover, it’s also wise to consider the LTV ratio offered by the site, as this will dictate how much you can borrow against your security deposit.

The five best crypto loan sites that offer favorable terms on the aforementioned factors are reviewed below.

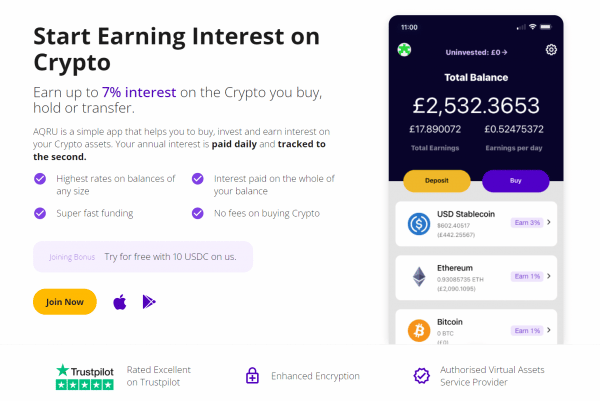

1. Aqru – Overall Best Crypto Loan Site for Investors

If you’re looking for the best crypto loan site to make money with cryptocurrency – look no further than Aqru. This yield farming crypto platform allows you to earn an attractive yield of up to 7% on stablecoins. Moreover, if you’re currently holding an allocation of either Bitcoin or Ethereum, Aqru will pay you 1% per year.

Not only is this one of the best yields in the market, but all Aqru crypto savings accounts are offered on a flexible basis. This means that your digital assets do not need to be locked away for a certain number of days or weeks, so you can request a withdrawal at any time. Aqru notes that it is able to offer such attractive APYs on its crypto interest accounts as it uses your digital currency to fund loans to both institutional and retail clients.

In other words, those using the crypto loan facility at Aqru will pay a higher rate of interest when compared to the APY that you are offered. We also like Aqru for its simple but highly intuitive mobile app – which can be downloaded free of charge via the App Store and Google Play. This connects to your main Aqru account, so investors can assess the value of their crypto savings accounts at any time. And finally, Aqru also supports fiat currency deposits – so you can get started even if you don’t own any crypto. For more information be sure to read our best crypto banks guide as well.

Read our Aqru review to find more about this crypto loan site.

| APR on Crypto Loans |

|

| Min & Max Deposit Limits | €100 (£110.80) minimum; no maximum stated. |

| Lock-In Period | No lock-in period; flexible withdrawals offered |

| Security & Regulation Features |

|

| Additional Rewards Offered | N/A |

| Interest Frequency | Daily |

Cryptoassets are a highly volatile unregulated investment product.

2. Crypto.com – Competitive APRs on Loans Against Cryptos

If you’re searching for the best crypto loan sites to borrow funds quickly and at competitive rates, look no further than Crypto.com. Although you might know this popular platform for its user-friendly exchange services and as one of the best places to spend Bitcoin, Crypto.com is also one of the leading providers of both crypto lending facilities and interest accounts. When using this platform to take out a crypto loan, no credit checks apply.

Instead, like most of the crypto loan sites we came across, Crypto.com simply requires you to put up a security deposit. In terms of the specifics, Crypto.com offers an LTV of up to 50%. This means, for example, to borrow $1,000 worth of crypto, you would only be required to put up $500 as collateral. Another thing to note about Crypto.com loans is that your fees will depend on whether or not you are happy to stake the platform’s native digital currency – CRO.

For instance, the APR on stablecoins averages 12% without staking crypto. While you can get this down to 8%, you would need to stake a whopping $40,000 worth of CRO tokens. When it comes to supported loan markets, this is where Crypto.com really stands out. This includes everything from Bitcoin, Ethereum. Litecoin, and EOS to Cardano, Chainlink, Polkadot, and Solana. Finally, and just like Aqru, Crypto.com offers a browser-based platform and an iOS/Android app. Furthermore, you’ll also have access to one of the best crypto credit cards on the market.

For more details read our in-depth Crypto.com credit card review as well.

| APR on Crypto Loans | 8-12% |

| Min & Max Deposit Limits | 50% loan-to-value (LTV) |

| Lock-In Period | Flexible; can make payments anytime |

| Security & Regulation Features |

|

| Additional Rewards Offered | APR decreases as the amount of CRO staked increases. |

| Interest Frequency | Monthly |

Cryptoassets are a highly volatile unregulated investment product.

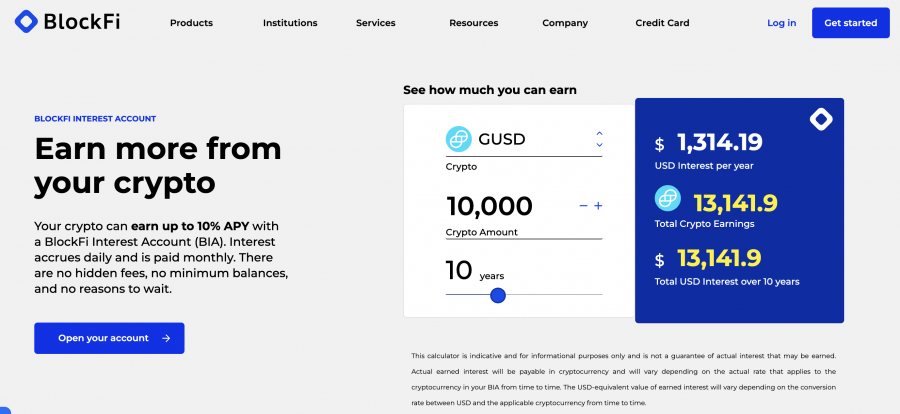

3. BlockFi – Top Provider for Instant Bitcoin Loans at Low Fees

BlockFi is great is your looking for a crypto lending platform. If you’re looking to access instant Bitcoin loans at low fees, BlockFi is one of the best sites in the market for 2023. In a nutshell, by putting up collateral at an LTC of 50%, you can borrow Bitcoin at a superb APR of 4.5%. Moreover, your instant Bitcoin loan can be agreed at a term of up to 12 months, so this gives you plenty of flexibility when it comes to repaying the funds.

What we also like about this top-rated crypto lending site is that you can repay your loan early without incurring a financial penalty. In addition to Bitcoin, BlockFi also supports Ethereum, Litecoin, and PAX Gold. This list of supported digital assets is, however, thin on the ground when compared to the likes of Crypto.com. Nevertheless, we would argue that BlockFi is a great option if you are looking for an all-in-one crypto ecosystem.

For instance, not only does the platform allow you to access low-fee crypto loans, but you also earn interest on idle digital currencies. Moreover, BlockFi offers a top cryptocurrency exchange that allows you to buy and sell crypto tokens at the click of a button. You might even consider applying for the BlockFi credit card, which allows you to buy products and services online or in-store with your crypto holdings. You’ll also get cashback of 1.5% on eligible purchases.

Ever wondered how to earn free Bitcoin in 2023? Read our full guide today to learn more.

| APR on Crypto Loans | Varies; starts from 4.5% |

| Min & Max Deposit Limits | 50% loan-to-value (LTV) |

| Lock-In Period | Flexible; can make payments anytime |

| Security & Regulation Features |

|

| Additional Rewards Offered | No penalties when repaying early |

| Interest Frequency | Monthly |

Cryptoassets are a highly volatile unregulated investment product.

4. Nexo – Over 30+ Tokens Supported for Crypto Collateral Loans

Nexo is one of the best crypto loan sites when it comes to supported tokens for the purpose of providing collateral. In total, you can choose from over 30+ digital currencies when setting up your security deposit, which offers great flexibility. This includes everything from Bitcoin, Ethereum, Solana, and Tether to Uniswap, Dogecoin, The Graph, and Decentraland.

In terms of the required LTV for your security deposit, this will depend on the respective coin. For example, if you’re using Bitcoin or Ethereum for your collateral, the LTC stands at 50%. However, if using a less liquid coin like The Graph or Decentraland, this is reduced to 30%. Nevertheless, we like the fact that Nexo allows you to choose the asset that you receive your borrowed funds in – as more than 40+ fiat currencies and dozens of digital tokens are supported.

When it comes to fees, pricing, you won’t pay any origination fees to apply for a loan. APRs will range from 0% to 13.9%, but the specific rate will depend on several factors – such as the length of the loan and which asset you wish to borrow. We also like Nexo for its instant approval service, and that you can choose your own repayment schedule. This means that you won’t get tied to a monthly repayment date – as you do with traditional loans.

| APR on Crypto Loans | From 0% to 13.9% |

| Min & Max Deposit Limits | 20% to 50% loan-to-value (LTV) |

| Lock-In Period | Flexible; can make repayments at any time |

| Security & Regulation Features |

|

| Additional Rewards Offered | Premium interest rates if you are a Gold or Platinum client |

| Interest Frequency | Daily |

Cryptoassets are a highly volatile unregulated investment product.

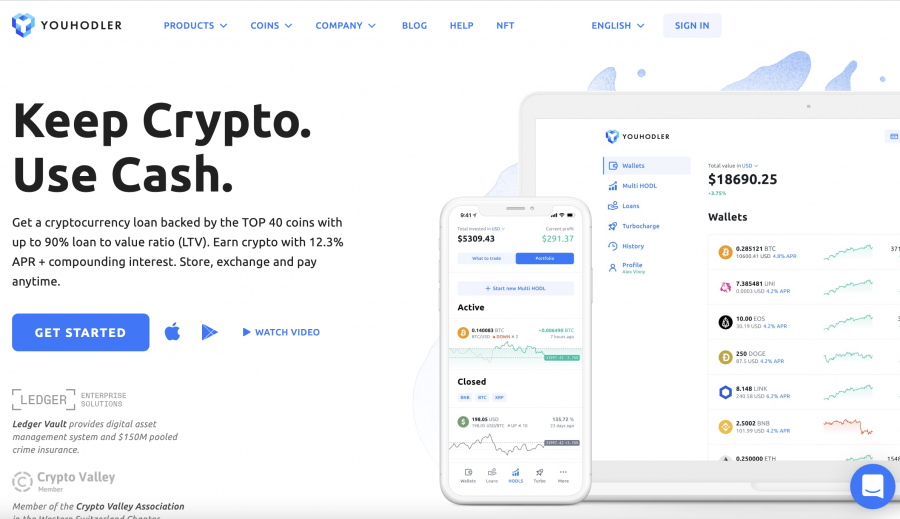

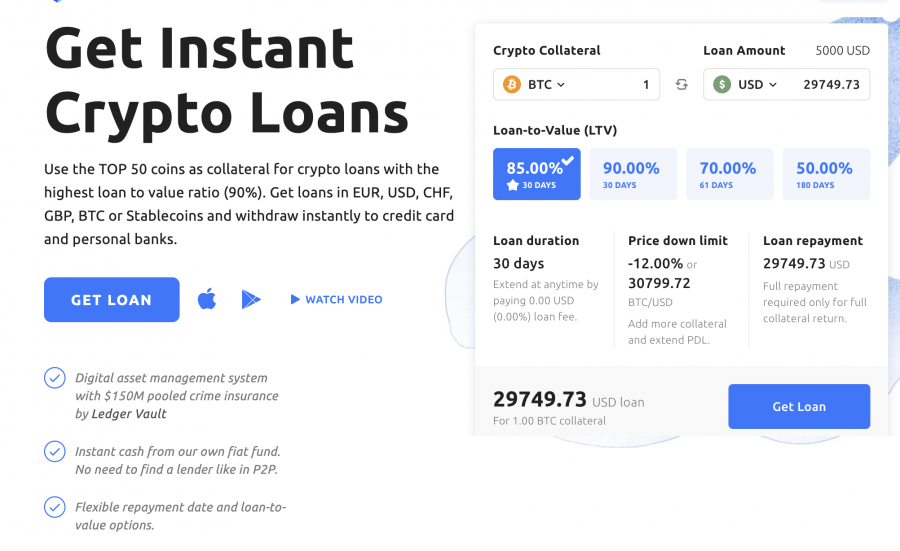

5. YouHodler – High LTV Ratio of 90% on Crypto-Backed loans

We also like YouHodler for its support of over 40+ digital assets, plus a wide range of fiat currencies. This means that you can put crypto up as collateral, and receive either fiat money or digital tokens in return. When borrowing funds via the YouHodler website, the minimum requirement is just $100. Moreover, APRs will depend on a variety of metrics, such as the token you use as collateral, the asset you receive as part of the loan, and the length of the term.

YouHodler does, however, offer a really simple online calculator that informs you of the different rates for each specific metric. Moreover, we like the fact there YouHodler offers unlimited loan terms, meaning that can set your own repayment plan. To ensure that your LTC ratio stays within the limits accepted by YouHodler, it’s worth downloading the app to your smartphone. In doing so, you can keep tabs on whether or not you might need to top up your security deposit – based on market conditions.

| APR on Crypto Loans | Varies depending on term and token used as collateral |

| Min & Max Deposit Limits | From 50% to 90% loan-to-value (LTV) |

| Lock-In Period | Flexible; can make repayments in crypto at any time |

| Security & Regulation Features |

|

| Additional Rewards Offered | APR decreases depending on term and collateral chosen |

| Interest Frequency | At the end of the loan |

Cryptoassets are a highly volatile unregulated investment product.

How Do Crypto Loans Work?

If you’re new to the concept of crypto loans, this section of our guide will explain the basics.

First and foremost, in order to get a crypto loan, you need to go through a third-party provider – such as those reviewed in the sections above.

Each provider will specify terms surrounding the loans on offers – such as APRs and repayment dates. The crypto loan provider will also state the maximum LTV available, and which tokens you can use as collateral.

It’s best that we explain these core terms in more detail so that you have a firm grasp of how crypto loan sites work before opening an account.

Collateral

In a nutshell, if you’re wondering how crypto loan sites can instantly approve your funding request without running a credit check on you – this is because all agreements require collateral.

This means that you will need to provide a security deposit before you can get your hands on the funds. And, the percentage amount required will depend on the LTV.

Before we get to the specifics of the LTV, we should note that the best crypto loan sites for 2023 offer a wide range of assets that can be used as collateral.

This means that if the digital token you are currently holding is supported, you won’t need to go through an exchange to obtain an eligible cryptocurrency.

Receiving Asset

What we also like about the best crypto loan sites in the market is that you have the freedom of choosing whether you wish to receive your funds in fiat money or digital tokens.

For example, if you’re looking to take out a crypto loan because you need access to cash and you don’t want to liquidate your digital token holdings, you can elect to receive your funds via a bank transfer.

Or, if your motivation for taking out a loan is to increase the amount of cryptocurrency you own (more on this later), you can elect to receive the funds in digital tokens.

APR

Crypto loan sites are in the business of making money, so in order to borrow funds, you will need to pay interest. This will be displayed in terms of an APR (Annual Percentage Rate) percentage.

The lower the APR, the more competitive the loan agreement is for you.

LTV

The LTV (Loan to Value) stipulated at crypto loan sites refers to the amount of capital that you can borrow in relation to the size of your collateral.

For example, at Crypto.com, you can access LTVs of up to 50%. And as such, should your security deposit amount to $2,000 in Bitcoin, you can receive a loan of up to $1,000.

At YouHodler, the LTV stands at up to 90%. This means that for the same security deposit of $2,000, you can borrow up to $1,800.

Types of Crypto Loans

There are several different variations of crypto loans that you will come across in the online domain, which we cover in more detail in the sections below.

Crypto Collateral Loans

Other than the odd exception, virtually all of the crypto loan sites that you come across will require collateral. After all, this is the only way that the platform can approve a loan without running a credit check on you.

Crypto Loans Without Collateral

If you’re looking for crypto loans without collateral, you will be disappointed. This is because, in the current landscape of crypto-backed financing, all platforms require a security deposit to be able to approve the loan.

The only exception to this rule is that a small number of platforms allow institutional investors to obtain crypto loans without collateral. However, this requires a highly in-depth process that in addition to credit checks, requires a full host of documentation.

With that said, as the capabilities of decentralized finance (DeFi) continue to improve, there is every chance that in the very near future consumers will have access to crypto loans without collateral, credit checks, or verification documents.

Another thing to note is that a select number of platforms are now offering anonymous bitcoin loans. However, none of these platforms have a solid reputation in this industry. As such, when using the best crypto loan sites in the market, you will need to go through a quick KYC process after you register.

Crypto Flash Loans

There is another slight exception to the rule of not being able to access crypto loans without collateral. This is because several DeFi platforms now support a concept known as crypto flash loans.

In a nutshell, this allows you to borrow crypto via a smart contract agreement without needing to put up a security deposit.

However, these short-term crypto loans do come with a caveat – if the funds are not repaid within the agreed timeframe, the smart contract will reverse the transaction.

Custodial vs Non-Custodial Crypto Loans

The next thing to consider when learning how crypto loans work is whether you wish to go through a custodial or non-custodial platform.

- In Layman’s Terms, if you go through a custodial crypto loan site, this means that you are using a centralized platform.

- In other words, the platform will take care of deposits and withdrawals, the distribution of loan funds, repayments, the setting of interest rates and LTVs, and more.

- All of the five best crypto loan sites that we reviewed today offer a custodial service.

At the other end of the spectrum, non-custodial crypto loan sites are decentralized. This is because the funding agreement is executed by a smart contract – just like we explained in the above section on crypto flash loans.

How to Minimize Risk with Crypto Lending

The crypto lending space is still relatively new compared to traditional lending options, which can mean that there is an added degree of risk when you try to attain the higher yields on offer. Since crypto lending involves putting your crypto in the hands of third parties, there is always a chance that these parties default, leaving you out of pocket. However, there are certain strategies you can employ to lower the chances of this happening.

Firstly, you can sign up and deposit your crypto with multiple DeFi lending platforms rather than just one. This approach will allow you to ‘spread the risk’ across various platforms, which means that if one were to experience a non-payment or default, the chances are that the others will help balance it out. Most of the best crypto apps that offer these services ensure that the sign-up process is streamlined, making it quick and easy to diversify in this manner.

Another thing you can do is to only partner with established and reputable platforms. These platforms ensure that the third parties using your crypto are monitored and evaluated beforehand, which reduces the chance that non-payment may occur. Finally, certain platforms may even have a ‘reserve fund’ deployed if a borrower defaults, which adds another layer of protection for lenders.

What Cryptos Can I Loan?

In terms of what digital tokens you can use to obtain a crypto loan – this will ultimately depend on your chosen platform. For instance, while some of the crypto loan sites we reviewed earlier support dozens of digital tokens, some only accept a select few as collateral.

With that said, virtually all leading crypto loan sites will allow you to cover your collateral payment in Bitcoin and Ethereum. Stablecoins such as Tether and USDT is often supported too.

- If you are currently holding a less liquid digital asset and your chosen crypto loan site supports it – you might find that this impacts your LTV ratio.

- For instance, over at Nexo, Bitcoin security deposits will give you access to a maximum LTV of 50%. However, when depositing Decentraland, this is reduced to 30%.

The good news is that if your preferred platform doesn’t support the digital currency you currently hold – or the respective asset does not offer your desired LTV, a simple solution is in place.

That is to say, you can simply swap the tokens you currently hold into a large-cap digital asset like Bitcoin.

How to Loan Cryptocurrency?

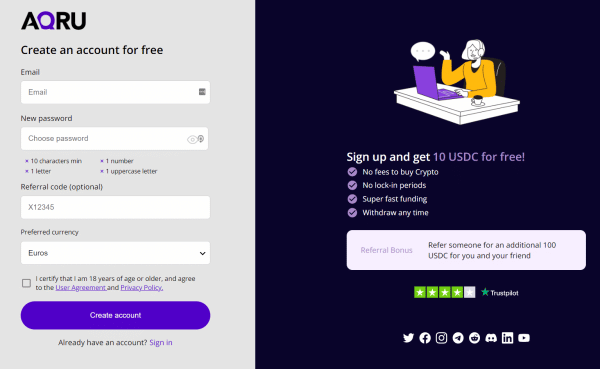

If you’re ready to loan cryptocurrency so that you can start generating interest on your idle digital token holdings, the walkthrough below will get you set up with Aqru in under five minutes.

Step 1: Open an Account

We mentioned earlier that legitimate crypto loans sites will always require you to open an account. And in this respect, Aqru is no different.

As such, the first step is to visit the Aqru website and provide the platform with your personal information.

Next, you will need to go through a very quick verification process, which simply requires you to upload some ID.

Step 2: Deposit Crypto or Fiat

Once you’ve opened an account, you will be asked to deposit some funds. Aqru allows you to deposit Bitcoin, Ethereum, and several stablecoins. You can also deposit fiat money at a minimum of €100.

Step 3: Earn Interest From Crypto Loans

Once you have made a crypto deposit, you will start earning an APY of 1% on Bitcoin and Ethereum and 7% on stablecoins.

If you funded your account in fiat money, you can select the crypto savings account that you wish to convert the funds to.

Are Bitcoin Loans Safe?

From the perspective of both borrowers and investors, crypto loans are never 100% safe. This is why the best crypto loan sites are able to offer much more favorable terms when compared to traditional financial institutions.

For example:

- If you use a crypto loan site to borrow money, then you will need to deposit your digital tokens as collateral. The obvious risk here is that you are trusting the respective website to keep your security deposit safe.

- As an investor, the main risk to keep in mind is that your funds will be used to facilitate crypto loans. And, like any loan agreement, there is always the risk that the borrower will default.

Crucially, this is why it is important to do your homework before you select the best crypto loan site for you. Moreover, to reduce your risk of loss, consider diversifying across more than one platform.

Conclusion

In summary, the best crypto loan sites form a bridge between borrowers and investors.

If you’re looking to borrow money, your application will be approved instantly without credit checks or documentation outlining your financial standing. Instead, you simply need to make a security deposit in the form of collateral.

On the other hand, if you’re looking to make your digital tokens work for you via competitive APYs, Aqru allows you to earn up to 7% per year by depositing stablecoins.

Start earning interest today by opening an Aqru account in under five minutes.

Cryptoassets are a highly volatile unregulated investment product.