When trading on margin (otherwise referred to as leverage), this allows investors to amplify the size of their stake.

However, as margin trading essentially results in the investor borrowing funds from the respective broker, fees will apply for as long as the leveraged position remains active.

In this guide, we compare the best low margin rate brokers in the market today, not only in terms of funding fees, but supported asset classes, leverage limits, and more.

The Top 10 Lowest Margin Rate Brokers List

Below, a summarized list of the 10 best low margin rate brokers can be found:

- Capital.com – Overall Best Low Margin Rate Broker

- eToro – Low-Cost Broker With Transparent Margin Rates Displayed in USD

- XTB – Low Margin Rates with Leverage up to 500:1

- Libertex – Top CFD Trading Platform With Leverage on All Supported Markets

- AvaTrade – Heavily Regulated Broker With Margin Trading Accounts

- Skilling – High Leverage Limits for Non-EU Traders

- Interactive Brokers – One of the Best Low Margin Rate Brokers for US Clients

- Charles Schwab – Entry-Level Margin Fee of 1.825% + Base Rate

- Fidelity – Low Margin Rates for High-Volume Traders

- M1 Finance – Investment App With Margin Rates of Between 3.5% and 5%

- E*TRADE – Commission-Free Stock Trading Alongside Margin Accounts

Reviews of the lowest margin rate brokers listed above can be found in the following sections.

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

1. Capital.com – Overall Best Low Margin Rate Broker

Capital.com is the overall best low margin rate broker in the market today. It also doubles up as both the best low spread forex broker in 2023 and the best crypto margin trading exchange. This platform specializes in contracts-for-differences (CFDs), which means that US clients are not eligible to open an account. Most other nationalities, however, will have access to thousands of leveraged markets.

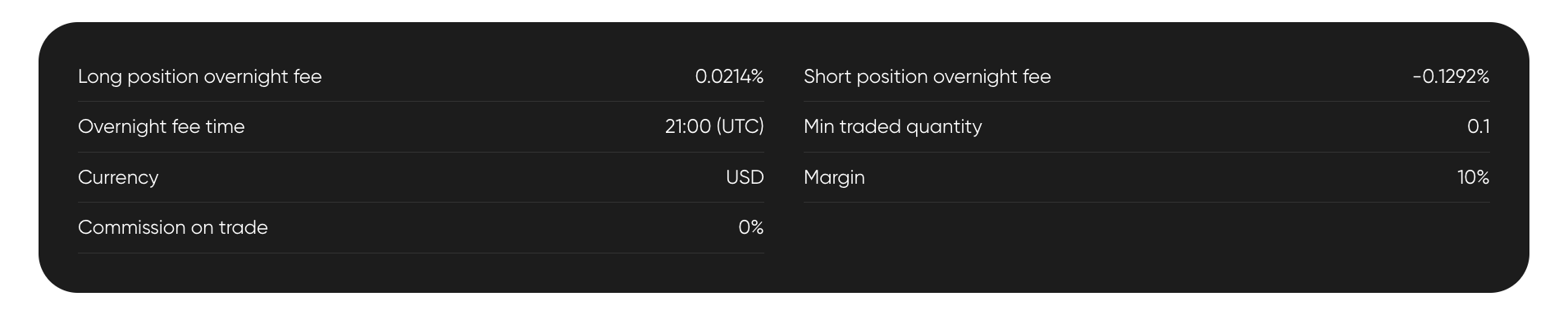

This includes everything from forex, commodities, and ETFs to stocks and cryptocurrencies. As all markets are backed by CFDs, leverage can be applied at the click of a button. In terms of margin rates, this is dependent on the specific asset and market being traded. Moreover, rates also depend on whether the trader is going long or short on the position.

For example, if going long on gold, the trader will pay a competitive margin rate of 0.0105%, while short-sellers are charged 0.0096%. When trading a major forex pair like EUR/USD, however, long and short orders are charged at 0.0080% and 0.0021% respectively. Do note that margin rates at Capital.com can and will change depending on market conditions at the time of trading.

Nonetheless, we like that the platform clearly states what the margin rate amounts to on each individual market. Another reason why we found that Capital.com ranks number one on our list of brokers with the lowest margin rates is that it does not charge any standard trading commissions.

Instead, the platform operates a spread-only model. Deposits and withdrawals are fee-free across all supported payment types. This is inclusive of debit/credit cards, bank transfers, and e-wallets. Leverage limits at Capital.com will depend on the asset, investor profile, and country of residence. With that said, retail clients are typically capped to limits of 1:30 on major forex pairs.

Other assets will invariably come with a lower leverage limit. Capital.com is regulated by multiple financial bodies, including the FCA, ASIC, NBRB, and CySEC. Therefore, this is also one of the best trading platforms for safety. New users can open a Capital.com account in less than five minutes – which includes the KYC process.

| Margin Rate | Depends on the instrument. From 0.0021% on EUR/USD as of writing. |

What We Like

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. eToro – Low-Cost Broker With Transparent Margin Rates Displayed in USD

We like that eToro offers thousands of stocks and ETFs at 0% commission. Those looking to trade on margin can do so via CFDs. Once again, this means that eToro will not be suitable for US clients – unless opting for non-leveraged stocks, ETFs, or cryptocurrencies. Wondering how to trade commodities with low margin rates? eToro is a leading broker that offers CFDs across a wide range of financial instruments.

Nonetheless, one of the main reasons why we like eToro is that it clearly displays its margin rates in dollars and cents when setting up an order. When the trader makes adjustments to the order – such as increasing or decreasing the stake or leverage amount, this will automatically update the margin rate.

This is outlined in terms of the daily and weekend rate. This ensures that margin traders know exactly what they will be paying to keep a leveraged position open overnight. eToro is also great for passive investment tools, which includes a Copy Trading feature. This allows the trader to mirror the investments of a successful eToro user.

To open an account with eToro, just $10 is required when users are based in the US. Payments – which include both deposits and withdrawals, in USD are not charged any fees. eToro, just like Capital.com, is heavily regulated. The platform is licensed by the SEC, FINRA, CySEC, FCA, and ASIC. Demo stock trading accounts with $100k in paper funds are also offered by eToro.

Read More: Our comprehensive eToro review can be found here.

| Margin Rate | Depends on the instrument. Example – a $50 stake on EUR/USD at 30x leverage will cost $0.11 per day, and $0.33 over the weekend. |

What We Like

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider

3. XTB – Low Margin Rates with Leverage up to 500:1

There’s more to XTB than just cheap margin, of course. This brokerage offers a custom trading platform for web and mobile called xStation 5. It’s easier to use than competing platforms like MetaTrader 5 and offers dozens of built-in technical studies to help traders find opportunities. Trade entry is built into xStation 5 and traders are able to customize the amount of leverage they apply to each trade.

Importantly, XTB doesn’t charge commissions on any CFD trades. The broker makes money through spreads, which start from 0.1 pips for forex trading and are typically around 0.3% for stock trades. There’s no minimum deposit required to open an account at XTB and traders have an opportunity to test out this brokerage using a free demo account.

Margin Rate

Depends on the instrument. EUR/USD has a rate of 0.0103% for long positions and 0.004743% for short positions.

What We Like

Your capital is at risk. 76% of retail investor accounts lose money when trading CFDs with this provider

4. Libertex – Top CFD Trading Platform With Leverage on All Supported Markets

Leverage limits here will depend on the country of residence of the user. With that said, some nationalities will have access to leverage as high as 1:500 – even when holding a retail client status. When it comes to margin rates, just like Capital.com, this will depend on the specific financial instrument being traded.

To offer some insight, as of writing, EUR/USD comes with a rate of 0.0489% when going long. However, those going short will actually receive a margin rebate of 0.00006%. The specifics will be dictated by current market conditions at the time of placing the order. Nevertheless, Libertex clearly displays the rates for both long and short positions next to each supported instrument.

| Margin Rate | Depends on the instrument. Long positions at 0.0489% on EUR/USD as of writing. Shorts get a rebate of 0.00006%. |

What We Like

Your capital is at risk. 70.8% of retail investor accounts lose money when trading CFDs with this provider.

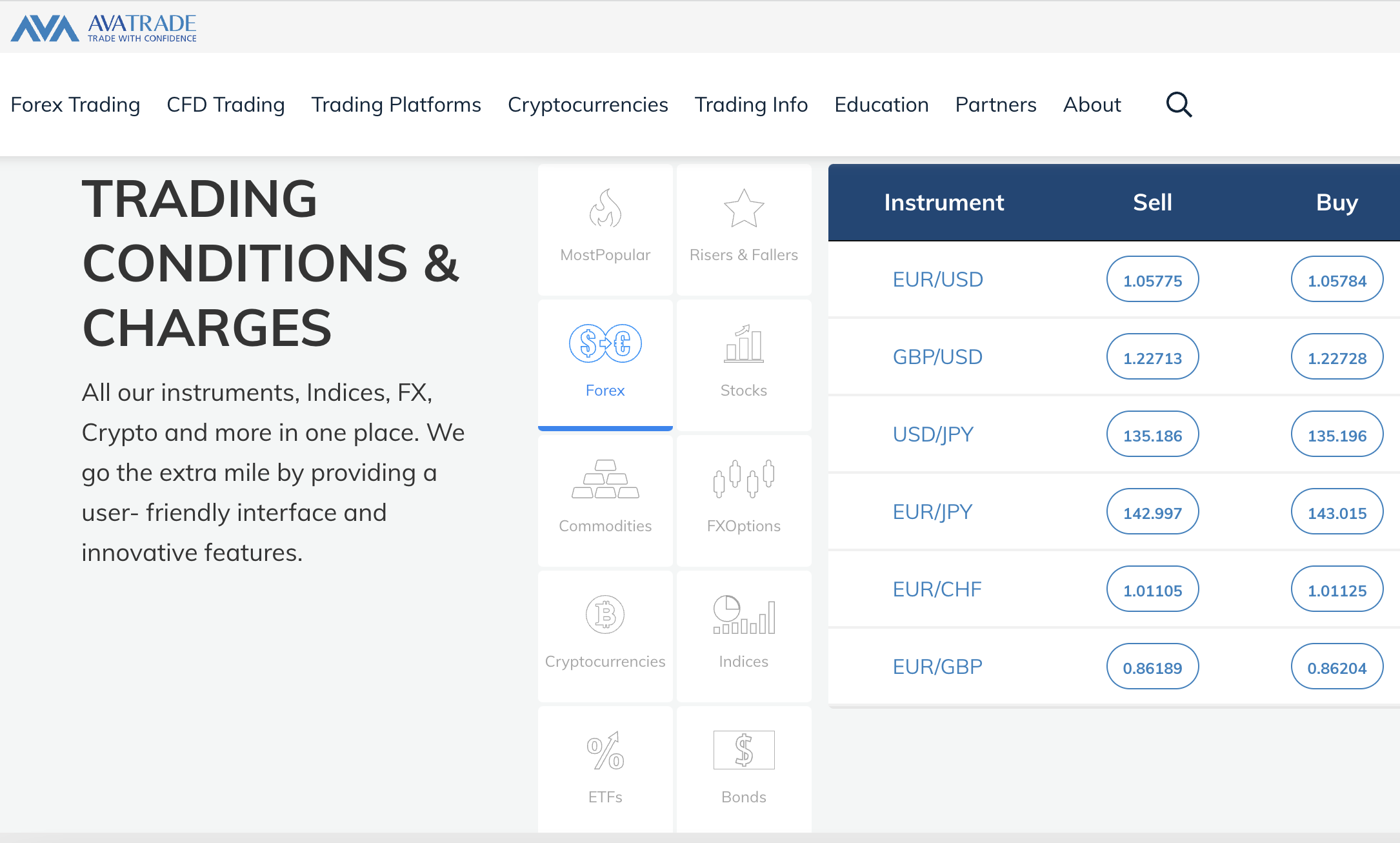

5. AvaTrade – Heavily Regulated Broker With Margin Trading Accounts

Markets at this broker include indices, cryptocurrencies, stocks, ETFs, hard metals, energies, and more. When it comes to fees, no commissions are charged by AvaTrade. Spreads are very tight in most cases, especially when trading major forex pairs. When trading with leverage at AvaTrade, margin rates are dependent on several variables.

This includes the asset class and whether the trader is going long or short, as well as current market conditions. As an example, when trading EUR/USD, long positions, as of writing, will pay a margin rate of 0.0077%. Short selling positions, on the other hand, will not pay any margin fees at all. These rates are in addition to the spread, which on EUR/USD, starts at 0.9 pips.

| Margin Rate | Depends on the instrument. Long positions at 0.0077% on EUR/USD as of writing. Shorts pay no margin fees. |

What We Like

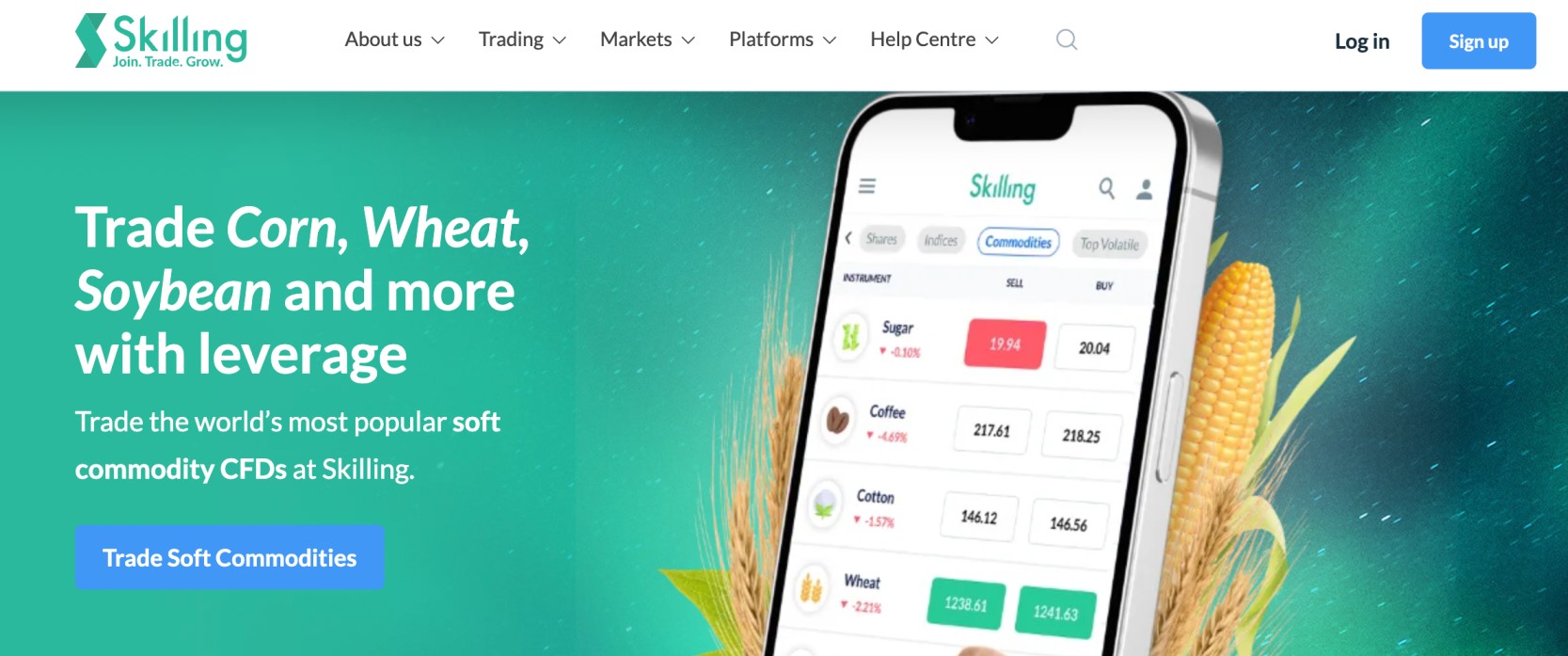

6. Skilling – High Leverage Limits for Non-EU Traders

Skilling is a CFD trading site, so again, US clients will not be accepted. The platform supports many markets and asset classes, which are inclusive of stocks, indices, cryptocurrencies, and commodities. We like that traders have the option of buying and selling instruments online, via the Skilling app, or through MT4.

Upon exploring the fee department of Skilling, many tradable markets are offered on a zero-commission basis. However, forex and gold attract a commission of $30 for every $1 million traded. Overnight financing fees are calculated based on the asset, mark-up, and LIBOR rate. As of writing, EUR/USD longs pay -0.9915 points, while sellers get a 0.1112 point rebate.

| Margin Rate | Depends on the instrument and LIBOR rate. As of writing, EUR/USD longs pay -0.9915 points, while sellers get a 0.1112 point rebate. |

What We Like

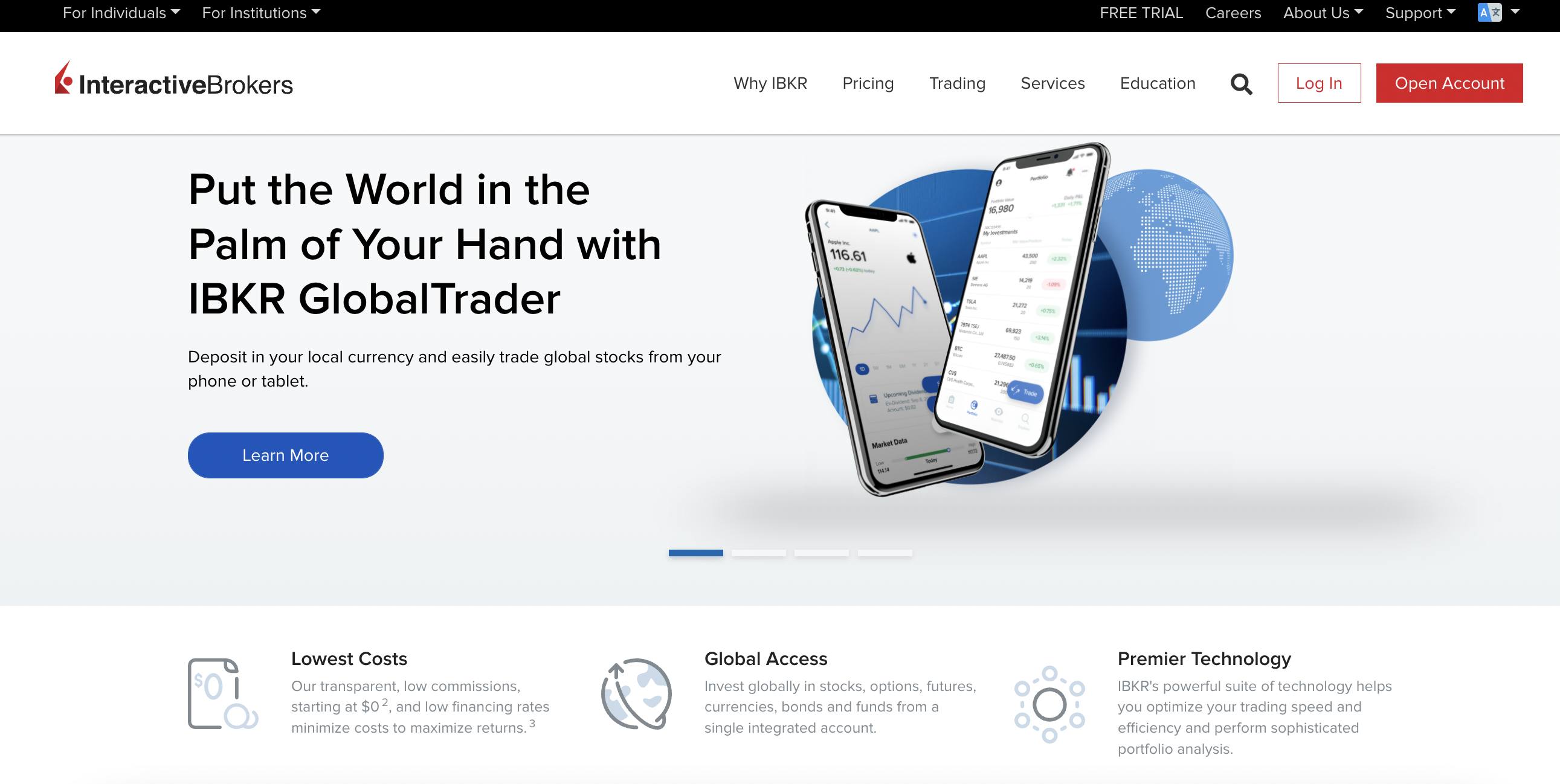

7. Interactive Brokers – One of the Best Low Margin Rate Brokers for US Clients

Interactive Brokers is one of the best low margin rate brokers for those based in the US. After all, unlike the other platforms discussed thus far, Interactive Brokers offer leverage in the traditional sense. This means that margin facilities can be accessed without trading CFDs.

In terms of its margin rates, Interactive Brokers operates a tiered pricing model. This means that the more being traded in a 30-day period, the lower the rate. Those trading less than $100k each month on the IBKR Lite account will pay a margin rate of 4.08% (BM + 2.5%). Those on a IBKR Pro account will pay 3.08% (BM + 1.5%).

It is also important to note that there is a minimum floor of 0.75% on margin loans at Interactive Brokers. Moreover, the platform notes that if financing is not pre-arranged, an additional 1% fee can apply – which will be added to the spread.

When trading US stocks, clients need to meet an initial margin requirement of 25% of the stock value (lower of $2,000 or 100% of purchase price). Finally, this provider is also one of the lowest margin rate futures brokers in the market.

| Margin Rate | Interactive Brokers margin rates start at 4.08% (BM + 2.5%) on IBKR Lite accounts for monthly volume of below $100k. A minimum floor of 0.75% on margin loans. A possible fee of 1% on loans that are not pre-arranged. |

What We Like

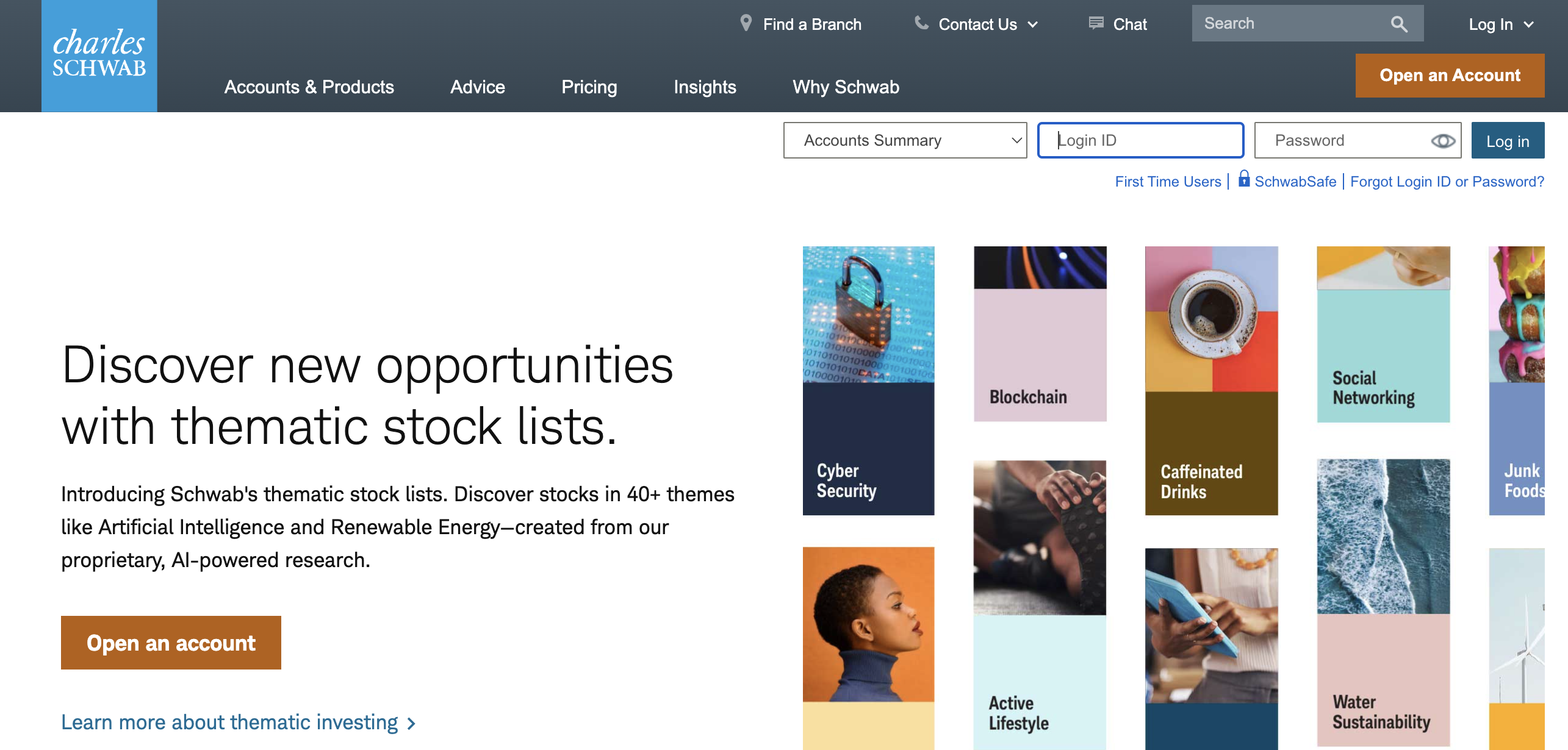

8. Charles Schwab – Entry-Level Margin Fee of 1.825% + Base Rate

Those looking to trade financial instruments with leverage can do so at Charles Schwab – on the proviso that standard margin balance requirements are met. In terms of fees, Charles Schwab adds a mark-up to its variable margin rate, which, as of writing, amounts to 8%.

Those trading below $25k each month will pay a fee of 1.825%. This means that when added to the base rate, an effective fee of 9.825% is implemented. By trading higher volumes, a lower mark-up is added to the margin pricing structure. Those trading above $500k each month have access to preferential rates.

| Margin Rate | Mark-up plus the standard base rate of 8%. Monthly volumes of below $25k will pay a mark-up of 1.825%. This amounts to an effective margin rate of 9.825%. Lower rates are offered on higher volumes. |

What We Like

9. Fidelity – Low Margin Rates for High-Volume Traders

Fidelity is another global brokerage house that is popular with US clients. The broker supports pretty much every asset class imageable, which covers thousands of US and international stocks, ETFs, mutual funds, bonds, derivatives, and more.

We found that Fidelity is one of the best low margin rate brokers for those trading large volumes throughout the month. This is because rates become more competitive as volumes increase. For example, if trading less than $25k per month, an effective margin fee of 9.825% is charged, which is 1.25% above the base rate.

However, those trading above $50k will be offered a discount, which amounts to 0.2% below the base rate. The absolute best margin rate on offer is available for those trading $1 million or more each month. In this case, the investor will get a margin fee that is 3.075% below the base rate.

| Margin Rate | A total volume of below $25k each month will result in an effective margin rate of 9.825%. The lowest rate on offer, which requires $1 million in monthly volume, stands at 5.50%. |

What We Like

10. M1 Finance – Investment App With Margin Rates of Between 3.5% and 5%

M1 Finance bills itself as a super app. Available on both iOS and Android devices, the M1 Finance app offers traditional investment accounts, alongside the ability to borrow and spend via a single platform.

After choosing a suitable strategy and risk tolerance, M1 Finance allows investors to access the financial markets in an automated and commission-free manner. When it comes to margin funding, M1 Finance offers highly competitive rates.

In fact, depending on account volumes, rates of just 3.5% – 5% will be charged. Margin accounts on M1 Finance allow the user to access a 40% line of credit. We also like that in the vast majority of cases, margin funds can be accessed in minutes, and payment terms are semi-flexible.

| Margin Rate | Variable margin rates of between 3.5% and 5% – depending on account volumes. This results in a line of credit worth 40% of the portfolio value. |

What We Like

11. E*TRADE – Commission-Free Stock Trading Alongside Margin Accounts

The final platform to consider from our list of brokers with the lowest margin rates is E*TRADE. One of the best features of this broker is that it allows US investors to buy NYSE and NASDAQ-listed stocks at 0% commission. This is also the case with US-listed ETFs and options.

Those wishing to trade on margin at E*TRADE will need to ensure that they maintain a balance of at least $2,000. In terms of rates, this will depend on the amount of capital traded within a 30-day period. The highest margin rate charged – which is based on monthly volumes of $10,000 or below, is rather pricey at 10.45%.

This amounts to 2.5% above the base rate. The most competitive margin rate on offer – which requires a monthly volume of at least $250,000, stands at 8.45%. This amounts to 0.5% above the base rate. In addition to DIY investing, E*TRADE also offers managed accounts. The core portfolio plan, for example, requires a minimum deposit of $500 and an annual fee of 0.30%.

| Margin Rate | Effective margin rate of 10.45% on monthly trading volumes of $10,000 or less. The best margin rate on offer – at 8.45%, requires a monthly volume of at least $250,000. |

What We Like

Top Low Margin Rate Brokers Compared

To recap on the low margin rate brokers discussed above, refer to the comparison table below:

| Broker | Margin Rate Explained | US-Friendly? |

| Capital.com | Depends on the instrument. From 0.0021% on EUR/USD as of writing. | No |

| eToro | Depends on the instrument. Example – a $50 stake on EUR/USD at 30x leverage will cost $0.11 per day, and $0.33 over the weekend. | Yes, but not on margin accounts |

| XTB | Depends on the instrument. EUR/USD has a rate of 0.0103% for long positions and 0.004743% for short positions. | No |

| Libertex | Depends on the instrument. Long positions at 0.0489% on EUR/USD as of writing. Shorts get a rebate of 0.00006%. | No |

| AvaTrade | Depends on the instrument. Long positions at 0.0077% on EUR/USD as of writing. Shorts pay no margin fees. | No |

| Skilling | Depends on the instrument and LIBOR rate. As of writing, EUR/USD longs pay -0.9915 points, while sellers get a 0.1112 point rebate. | No |

| Interactive Brokers | Starts at 4.08% (BM + 2.5%) on IBKR Lite accounts, monthly volume of below $100k. A minimum floor of 0.75% on margin loans. A possible fee of 1% on loans that are not pre-arranged. | Yes |

| Schwab | Mark-up plus the standard base rate of 8%. Monthly volumes of below $25k will pay a mark-up of 1.825%. This amounts to an effective margin rate of 9.825%. Lower rates are offered on higher volumes. | Yes |

| Fidelity | A total volume of below $25k each month will result in an effective margin rate of 9.825%. The lowest rate on offer, which requires $1 million in monthly volume, stands at 5.50%. | Yes |

| M1 Finance | Variable margin rates of between 3.5% and 5% – depending on account volumes. This results in a line of credit worth 40% of the portfolio value. | Yes |

| E*TRADE | Effective margin rate of 10.45% on monthly trading volumes of $10,000 or less. The best margin rate on offer – at 8.45%, requires a monthly volume of at least $250,000. | Yes |

Providers from our list of brokers with the lowest margin rates can change their pricing structure at any time. As such, be sure to check what fees apply when searching for the lowest margin rates brokers.

What is Margin Trading?

Margin trading allows investors to open a position with more capital that is available in a brokerage account. Otherwise referred to as leverage, trading on margin essentially requires the individual to borrow funds from their broker.

And in turn, the broker will charge a margin rate. Similar to interest on a loan, the margin rate payable varies from one provider to the next. In some cases, this will be displayed as an annual percentage rate.

Moreover, many brokers that offer margin accounts will base their funding fees on monthly volumes. This means that lower rates are offered to those that trade higher amounts throughout the month.

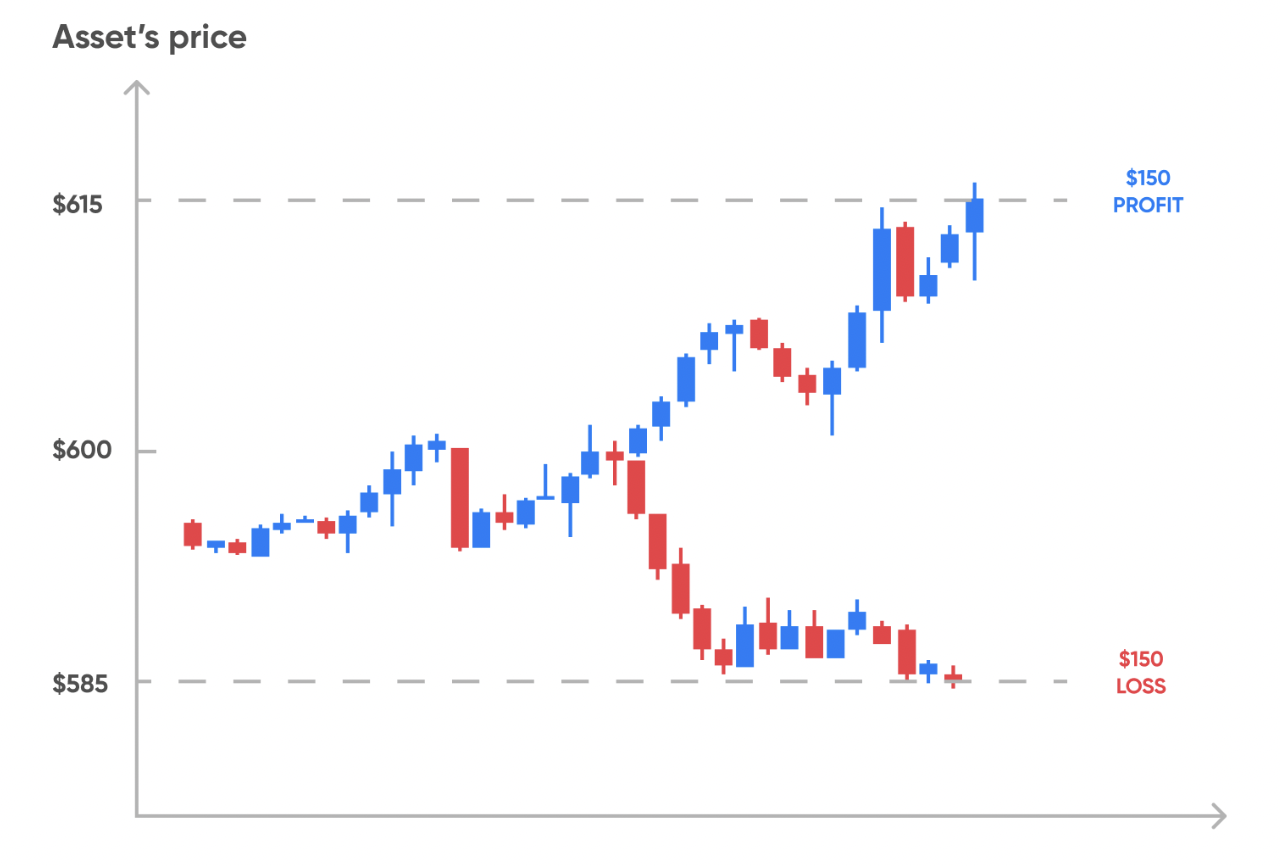

On the one hand, margin trading is great for those that wish to amplify the size of their position. However, traders always run the risk of being liquidated if the margin position does not go to plan.

Before this happens, the trader will receive a margin call from their broker. This will notify the trader – typically via email, that they are running close to the liquidation point.

If additional funds are not added to the margin account and the value of the position continues to decline, the broker might be forced to close the trade. When this happens, the trader will lose the margin balance that they applied to their brokerage account.

Note: Some of the lowest margin rates brokers discussed today have a ‘base’ percentage in place. The broker will then add a mark-up to this base rate.

Leverage

When using a CFD broker, which are not accessible to US clients, margin is referred to as leverage. This follows the same concept, but utilizes a multiplier (e.g. 5x) or a ratio (e.g. 1:5).

For example, let’s suppose that the trader decides to stake $100 on a stock trading position with leverage of 1:5. This would amplify the position from $100 to $500.

And, in this example, because a $500 position requires a stake of just $100, the margin on this trade amounts to 20%.

Margin and Leverage Limits

In terms of how much margin and leverage an investor can obtain, this will depend on a wide variety of metrics.

This includes the:

- Country of residence that the trader is from

- Whether the trader is a retail or professional client

- The asset class being traded

To offer some insight, US retail clients can typically access margin of up to 50% when buying stocks. This means that for every $1,000 staked, $1,500 worth of stocks can be purchased.

However, the general rule of thumb in the US, as per SEC regulations, is that the retail client must hold a minimum margin balance of $2,000 at all times.

Outside of the US, limits will vary. For example, retail clients from the UK, European Union, and Australia will be able to access a maximum leverage limit of 1:30 on major forex pairs, and less on other assets.

Oftentimes in other regions, we found that no limits are in place at all when we were searching for the lowest margin rates brokers.

This means that retail clients can often obtain leverage limits of up to 1:1000 – sometimes more. Inexperienced traders should be advised that applying high leverage limits is extremely risky.

What is Considered a Low Margin?

Margin rates vary considerably depending on the broker of choice. In terms of what constitutes a low margin, M1 Finance is perhaps the benchmark in this industry, with a maximum rate of 5% charged to clients.

However, M1 Finance is extremely limited in the financial products that it offers. Nonetheless, anything above 10% annually should be viewed as expensive when obtaining margin.

After all, the trader would need to make at least this amount from the investment alone in order to generate a profit. Outside of the US, margin trading is typically conducted via a CFD broker.

In this marketplace, variable margin rates are the standard. This means that margin rates can and will change depending on market conditions, as well as the specific asset being traded.

Furthermore, CFD brokers will most commonly have two separate margin rates – one for those going long and another for short-sellers. One side of the trade might pay a fee, while the other gets a rebate.

For example, in the image above, the margin rates on crude oil CFDs at Capital.com are displayed. The rates indicate that those going long on crude oil will pay a margin fee of 0.0214%. While those going short will get a rebate of 0.1292%.

Conclusion

In summary, margin accounts can be an invaluable tool for those that wish to amplify the value of an investment position.

However, traders should be aware that margin requires the individual to borrow capital from their broker. Therefore, margin fees will apply.

We found that overall – Capital.com is one of the best low margin rate brokers in the market today. Not only does the platform offer competitive margin rates, but all supported markets can be accessed at 0% commission alongside tight spreads.

Your capital is at risk. 78.91% of retail investor accounts lose money when trading CFDs with this provider