The Monero blockchain platform needs users to validate its transactions. That’s the responsibility of miners. They play a pivotal role in ensuring duplicates are avoided and Monero transactions are validated. But Monero mining is an expensive activity if users opt for buying their own equipment.

A more affordable alternative is doing it on mining platforms. Users can start immediately and only risk their initial deposit, as opposed to buying expensive equipment and spending a lot of time on setting it up. The Monero mining platforms we reviewed make mining this privacy coin convenient. We’ve also detailed the process of mining Monero (XMR) and covered the expenses involved and potential profitability.

The 3 Best Monero Mining Platforms in 2023

It’s unnecessary for investors to buy expensive Monero mining software when they can opt for renting at more affordable rates from the three mining platforms we’ve reviewed. After reviewing three mining platforms, we found ECOS to be the best option.

- ECOS – Crypto Mining Site Provides Custom Contracts

- Bybit – Popular Platform for Cloud Mining

- Crypto.com – Global Exchange Offering Liquidity Mining

Cryptoassets are a highly volatile unregulated investment product.

A Closer Look at the Top Monero Mining Platforms

Much like Monero, investors buy Dash because of the privacy that the coin provides to users on the blockchain. Mining for Monero has become much easier thanks to several sophisticated platforms.

1. ECOS – Crypto Mining Site Provides Custom Contracts

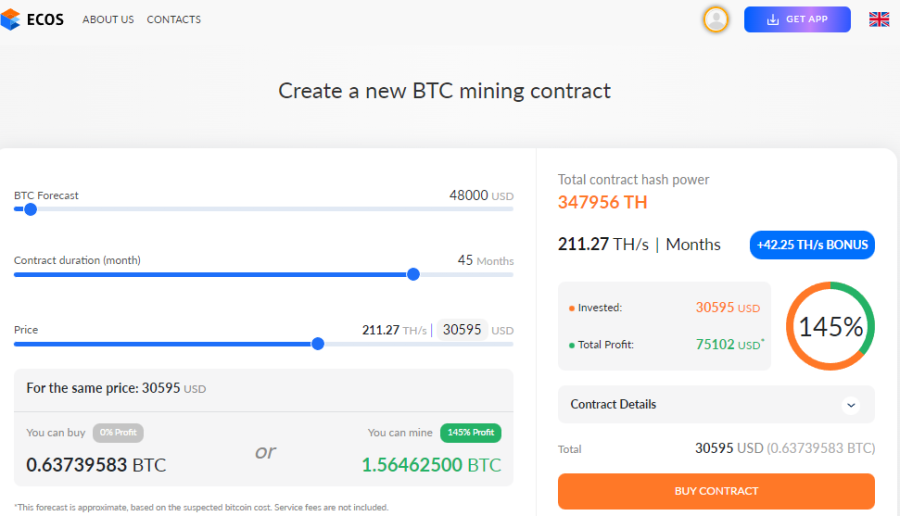

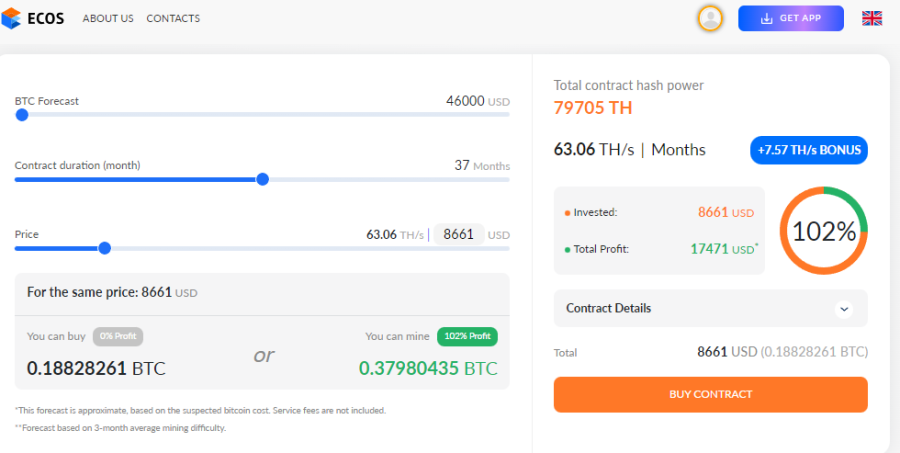

ECOS enables miners to customize their contracts. Miners set the parameters of the contract, thereby determining their potential profit. That also enables miners to invest the amount that they’re comfortable with, but bonuses are available for contracts over $5,000. The platform has also provided a free welcome trial mining contract. It offers beginner miners a trial of the platform and a feel for mining benefits.

Opting for mining with ECOS means miners have access to equipment, software, electricity, placement and maintenance. The fees miners pay are determined based on the contract size, and ECOS enables miners to use debit/credit cards to pay fees. To open a contract, miners need to forecast the price of a cryptocurrency to mine, set the contract duration and the price for the contract. ECOS pays coins daily into miners’ accounts.

ECOS enables mining on one of the best crypto apps.

What We Like:

2. Bitstamp – Popular Platform for Cloud Mining

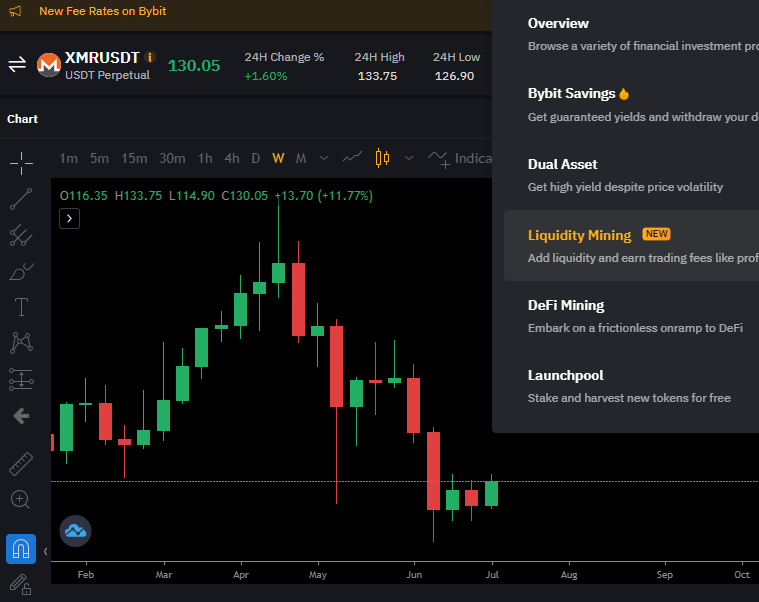

Whether investors are looking to access liquidity mining, staking or a cryptocurrency exchange, Bybit offers it all. Bybit specializes in cryptocurrency pairing and offering miners to earn a yield by adding liquidity. The platform also enables investors to increase their pool share by using leverage. Bybit miners enjoy significant freedom to add or remove liquidity from a pool whenever they please.

Miners wishing to make passive income from Bybit can do so by using DeFi mining on the platform. That feature enables miners to access several staking pools, all USDT (Tether). DeFi miners need to deposit at least 100 USDT to participate. Various staking periods are offered, 7 days, 14 days and 21 days. The annual percentage yield (APY) depends on the staking period. At the time of publishing the article, we noticed that pools that provided the highest returns were sold out. The only one available was a 14-day staking period providing 4% to 6% APY.

Monero investors can also invest in XMR by using the Bybit exchange. The simplest way to trade on Bybit is by depositing cryptocurrencies. The platform enables investors to fund their accounts with fiat, but it doesn’t handle it. That’s the responsibility of third parties such as XanPool and Banxa. The taker and the maker pay 0.10% for trading fees. Investors will also incur withdrawal fees, which are dependent on the coins withdrawn.

Bybit also offers Launchpool, enabling investors to stake and earn coins for free. The platform calculates yield daily based on the number of tokens staked in each pool and in proportion to the number of tokens staked by respective participants.

What We Like:

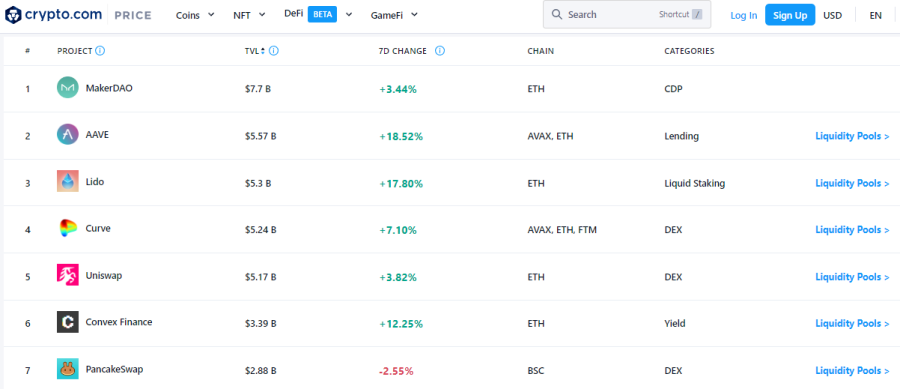

3. Crypto.com – Global Exchange Offering Liquidity Mining

Investors have numerous options for liquidity mining. The projects offered include Ethereum, Fantom, Binance Smart Chain, Avalanche, Terra2 and Cronos. The platform tracks the changes in each project, and some have increased by more than 18% in seven days. Monero mining isn’t supported on this platform but it may be soon, considering Crypto.com supports so many other projects. Crypto.com offers one of the best staking platforms, enabling investors to earn up to 14.5% APY. Another earning potential is 10% for stablecoins and 4% for staking CRO, the platform’s native token.

Crypto.com offers more than 250 cryptocurrencies on its exchange. Traders pay 0.4% trading fees and can fund accounts via ACH, debit/credit cards and cryptocurrencies. Investors need to deposit at least 100 USDC to start trading. Buying cryptos with a card is enabled, but it carries a 2.99% fee.

This platform offers one of the best DeFi wallets, an NFT marketplace and 10x leverage trading. The best part is that the platform is simple enough for beginners to use, yet it offers pro traders advanced tools to combine several strategies and get the most out of their technical analysis.

What We Like:

Cryptoassets are a highly volatile unregulated investment product.

How Does Monero Mining Work?

The crypto ecosystem has grown tremendously, and mining is one aspect of it that is flourishing. It’s become so popular that some miners have used the best Bitcoin mining sites to generate significant returns. Monero mining in 2023 is almost exactly like mining Bitcoin, but a few key differences exist.

The Monero network depends on proof-of-work mining to achieve distributed consensus. Blockchain is a decentralized platform functioning without third-party payment providers such as banks. Users on the blockchain transact by sending cryptocurrencies on the network. But somebody needs to verify transactions to ensure they’re legit and no duplication occurs. That’s the role of Monero miners.

The aim of Monero mining is to solve the nonce, which is part of the hash. A hash is responsible for securing a block on the blockchain. Miners are responsible for solving an alphanumeric sequence of numbers that a hashing algorithm encrypts. By solving that complex equation, Monero miners verify transactions and earn XMR coins as a reward.

Miners have two choices to verify XMR transactions: buy their own equipment or join a mining pool.

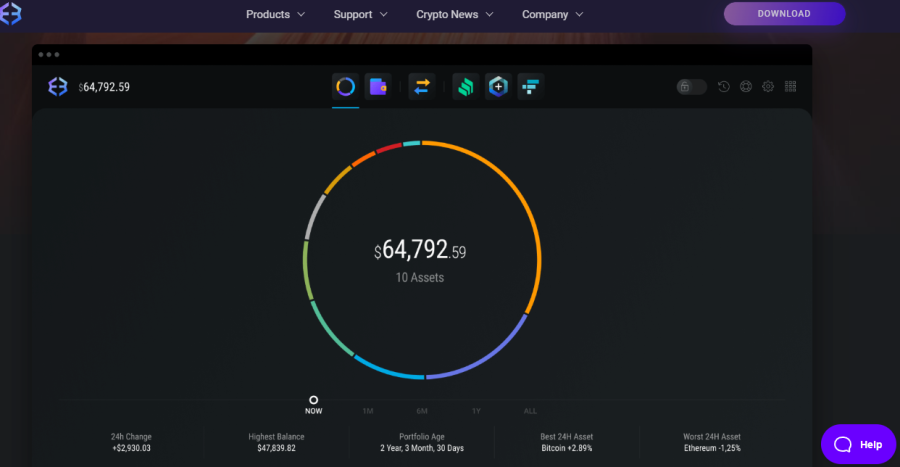

Choose a Monero Wallet

The key reason for Monero mining is to earn XRM, and they receive them in wallets. Miners can opt for an Exodus wallet. It enables miners to send, receive and swap more than 200 cryptocurrencies. We’ve done an in-depth Exodus wallet review. This wallet provides staking functionalities and even NFT functionality, enabling investors to buy NFTs since the wallet is connected to an in-house exchange.

Install Hardware and Software

Miners need to connect their hardware and download the software. It’s important to install a graphics card and mining software. Monero miners also have to set up their hardware, so it’s best to opt for a Monero mining rig (computer).

It’s possible to use a regular computer’s Central Processing Unit (CPU). But miners need to consider the hash rate, which is a time-based process. Miners operating on devices providing slow processing power will struggle to keep up with other miners after connecting to the network.

Usually, miners invest in an application-specific integrated circuit (ASIC) to contribute the most to mining pools. But the Monero network is slightly different. The Monero community built an algorithm to make ASICs resistant to Monero mining. That way, miners can’t build advanced hardware to be competitive. They have to use CPUs or GPUs.

Instead of spending money on expensive hardware and software, miners can opt for mining platforms. ECOS provides miners with high-quality hardware and even electricity. Miners hire the data center from ECOS for any period they desire.

Readers might also be interested in our best Litecoin mining platforms guide.

Mining

A new block appears on the Monero network every two minutes. Once miners solve the complex equation to validate transactions, they receive 1.26 XMR for every block added to the blockchain.

It’s important that miners join the right mining pool to increase their chances of profitability. The top three mining pools control over 80% of the Monero hash rate. Miners need to ensure their hardware can keep up with the rest of the pool to remain competitive.

Is Monero Mining Profitable?

Beginner miners need to account for all the costs involved in mining. It’s important to determine the costs to set up one’s own hardware and software. The cheaper option is to opt for a mining platform such ECOS, which leases out a data center consisting of hardware and software.

Although it’s possible to mine a Monero block within two minutes, beginners shouldn’t expect those results until they’re well familiar with Monero mining pools and how the whole process functions. It’s also important to know all the costs involved.

Hardware and Software

Miners need mining software and hardware. Opting for a graphics processing unit (GPU) may be the more expensive choice, but some GPUs may provide more hash rate. Some miners have said that CPUs are more efficient. And we know that efficiency is key to ensuring Monero mining profitability.

Reaching optimal profitability means using a device providing the most hash rates. The mining process is much easier when using a device with high processing power. Miners should also consider investing in some of the best cold storage crypto wallets.

Electricity

One of the main benefits of opting for a mining platform such as ECOS is that it provides equipment and electricity. Miners don’t even need to worry about maintaining mining pools. But miners who opt for their own set up will consume a significant amount of energy.

Miners should budget a few thousand dollars per year of electricity to mine Monero.

Opportunity Cost

Receiving 1.26 XMR frequently for Monero mining may sound appealing, but it’s not guaranteed. Miners compete against each other, and the ones with slow equipment and lackluster pools may earn fewer profits than successful miners, if any at all.

Miners should calculate all the costs involved in mining and compare that amount to what they could realistically make. It’s going to take miners some time to recoup the costs for the startup phase while electricity consumption is charged every month. Determining how much time needs to be spent mining every month is important because beginners need to compare that to having a full-time job. Some miners spend a tremendous amount of time and money on mining Monero but don’t make enough to pay their bills.

To minimize costs, miners should opt for a mining platform. The initial investment is much lower than buying the equipment, and mining platforms provide support.

How to Mine Monero Easily

Before even choosing Monero mining contracts, miners need to register for an account with a mining platform. We found the best mining platform to be ECOS. So we detailed a step-by-step guide on how to start mining.

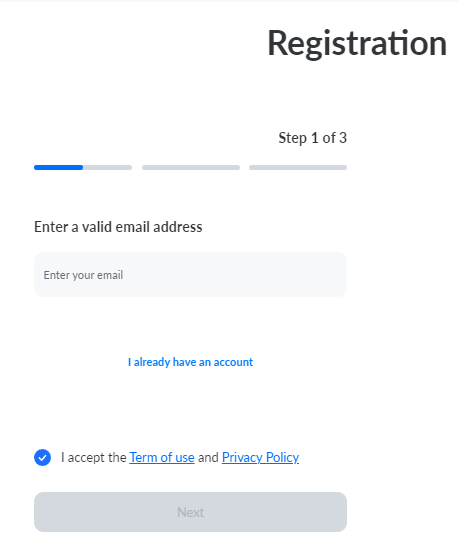

Step 1. Open an Account

The first step is to visit ECOS.am and click ‘Sign Up’ in the top right corner. Type in an email and then click ‘Next’.

Step 2: Account Verification

ECOS will send a verification code to the email registered with. The user needs to input that code, then click ‘Next’.

Step 3: Fund an Account

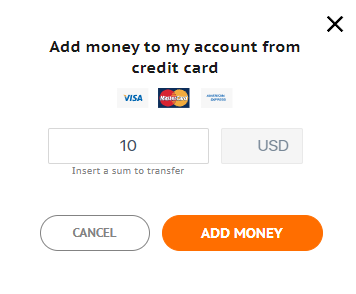

The system will log the user in after inputting the code. On the left side of the screen is the dashboard. Click ‘Mining devices’. On the right side of the screen is an Account box. In the box is an ‘Add money’ link, click it.

The next step is to input the amount of US dollars to fund the account. Then click ‘ADD MONEY’ to complete the transaction.

Step 4: Buy a Contract

To buy a contract, click ‘Buy Hash’ on the left side of the screen in the dashboard. The contract form enables users to set their preferred parameters for contract duration and price. The fees are based on those parameters.

Conclusion

One of the key things that separate profitable miners from struggling ones is choosing the right method to mine. While some miners are profitable by setting up their own equipment, beginner miners are probably better off using a mining platform. It requires less capital to start, which means miners will risk less. But what mining platform makes that possible?

We found that ECOS is the ultimate platform for beginners and experienced miners. It enables miners to lease a data center containing high-quality equipment such as Antminer S19j Pro and 200 MW of electricity. The best part about this platform is that it enables miners to customize contracts. Mining with ECOS means having access to equipment, software, electricity, placement and maintenance. ECOS even takes care of pool maintenance.

The same way new users get a Coinbase Sign Up bonus, ECOS offers a free trial mining contract. Beginners get a taste of mining on the platform, and contracts over $5,000 also come with a bonus.

Cryptoassets are a highly volatile unregulated investment product.