To start off our unbiased review of Pepperstone, below is a summary of its advantages and disadvantages:

Pepperstone Review: Pros & Cons

Pros Cons

81.18% of retail investor accounts lose money when trading CFDs with this provider.

Tradable assets

Pepperstone offers 1200+ instruments across forex, index CFDs, commodities, cryptocurrencies, shares, and currency indices – with a variety of educational materials for beginners to learn to trade as well as market analysis reports for traders of all experience levels.

Forex

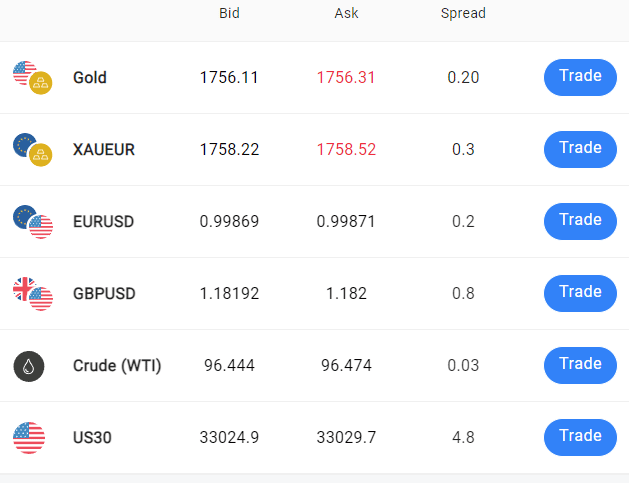

FX traders have access to up to 200:1 leverage and can trade forex majors (such as EUR/USD), minors and exotics with low spread – Pepperstone’s Razor account has a 0.0 pips spread and low commissions.

Index CFDs

Trading is supported on the price movement of fourteen major international stock markets with zero commission and leverage of up to 200:1.

Commodities

Pepperstone also offer access to a wide range of commodities trading, also with leverage of up to 200:1. Trade commodity futures including Gold, Silver, Crude Oil, Natural Gas, cocoa, coffee, cotton, orange juice, and sugar with the option to trade on USDX. See our guide to trading commodities.

Crypto

Pepperstone users can buy and sell CFDs (contracts for difference, i.e. margin trading) on five major crypto assets including Bitcoin with leverage up to 20:1 without the need for a crypto wallet or the use of an external crypto exchange.

Shares

In terms of stocks and shares, Pepperstone traders can trade anything from meme stocks to blue chip companies and household brands – across 23 equity index markets on up to 20:1 leverage.

Currency Indices

The most traded currency index is the USDX and Pepperstone traders can trade that as a CFD with leverage of up to 100:1.

81.18% of retail investor accounts lose money when trading CFDs with this provider.

Pepperstone Fees & Commissions

Pepperstone commissions are zero for Razor accounts except for CFD trading on Forex and Shares. For MT5 and MT4 users, micro lots are rounded down or up.

Pepperstone Trading Fees

Visit the Pepperstone website for a full trading fee breakdown for each market and the average spread. Below is the minimum spread depending on account level:

| Cryptocurrency | Stocks | Indices | Forex | Commodities | |

| Fee Type | Spread | Spread | Spread | Spread | Spread |

| Example | Bitcoin – 17+ | Facebook – 0 + market spread | US 500 Index, 0.4+ | GBPUSD – 0+ | Spot Gold ($) – 0.05+ |

Pepperstone Non-Trading Fees

Pepperstone charges a small swap rate – a rollover interest rate (earned or paid) for holding positions overnight and funding the position.

| Fee Type | Fee Amount |

| Inactivity Fee | None |

| Deposit Fee | None |

| Withdrawal Fee | Only international telegraphic transfer (TT) fees |

81.18% of retail investor accounts lose money when trading CFDs with this provider.

Pepperstone Platforms

Pepperstone’s supported trading platforms include:

- TradingView

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

Is Pepperstone User-Friendly?

Pepperstone’s trading platforms are integrated seamlessly with their WebTrader, and advertised as reliable with fast execution – as well as being compatible with Windows and Mac OS for desktop, iOS and Android for mobile devices and tablets.

That description matches user reviews and testimonials on Trustpilot where Pepperstone has an excellent rating.

Pepperstone Social Trading

Pepperstone’s social trading partners include:

- DupliTrade

- MetaTrader Signals

- Myfxbook

Pepperstone Charting and Analysis

Pepperstone offers trading tools including Autochartist and Smart Trader for MT4 and MT5.

Combined together they offer hundreds of technical indicators for technical analysis (TA) and market predictions in the short term.

See our guide on how to day trade for more useful tools.

Pepperstone Account Types

Pepperstone offer both a standard retail account and a premium client service – which high volume retail traders can also apply and qualify for.

Premium clients receive:

- Access to ATP premium discounts

- Advanced market insights

- Priority client support

Pepperstone Pros also receive invitations to premium events, more advanced trading tools and VPS solutions, and their own account manager.

The requirement to qualify is on the high side – $15 million in notional monthly volume, either in forex, commodities or shares trading.

81.18% of retail investor accounts lose money when trading CFDs with this provider.

Pepperstone Payment Methods

Pepperstone support the following deposit and withdrawal methods:

- Visa

- Mastercard

- POLi

- Bank transfer

- BPay

- PayPal

- Neteller

- Skrill

- Union Pay

Pepperstone Minimum Deposit

Pepperstone doesn’t state any set minimum deposit in its FAQ section or terms, but recommends depositing at least AUD $200 or equivalent in other currencies.

Pepperstone Withdrawal Times

Pepperstone’s website states that:

‘Withdrawal forms received after 21:00 (GMT) will be processed the following day. If these are received before 07:00 (AEST) they’ll be processed on the same day. Funds can only be returned to a bank account in the same name (or joint) as your Pepperstone trading account due to third party transaction regulations.’

Withdrawals made by bank transfer can take longer, approximately 3-5 business days unless there are unforeseen circumstances during which withdrawal times may be longer, such as support requesting additional verification documents for anti money-laundering (AML) regulations.

Pepperstone Demo Account

To paper trade risk-free for practice Pepperstone offer a demo account. Traders opening a virtual account will be able to trade the normal markets with virtual funds before proceeding to trade with a live trading account.

Pepperstone Customer Support

Pepperstone offers both WhatsApp and live chat support 24/5 on business days.

Pepperstone Licensing & Security

Pepperstone Markets Limited is a fully licensed company, regulated by The Securities Commission of The Bahamas.

Find the company registration number in the website footer – 177174 B | SIA-F217.

Pepperstone Accepted Countries

Pepperstone is open to the following countries. Also listed are Pepperstone’s restricted countries:

| Accepted Countries | Restricted |

| Australia | Canada |

| China | Japan |

| Germany | United States |

| Hong Kong | |

| India | |

| Ireland | |

| Malaysia | |

| Netherlands | |

| Singapore | |

| South Africa | |

| United Arab Emirates | |

| United Kingdom |

How to Start Trading with Pepperstone

Follow the steps below to get started using Pepperstone to trade:

Step 1: Create an Account

To create an account with Pepperstone visit the Pepperstone website and go through the registration process. It takes just a couple of minutes and requires only basic details like a name and email address.

Alternatively log in as an individual using a Facebook or Google Plus account.

81.18% of retail investor accounts lose money when trading CFDs with this provider.

Step 2: Verify Account

Submit one of the following forms of government ID:

- Driver’s licence

- National ID card

- Passport

Also include proof of address, which can take the form of:

- A utility bill

- A bank or credit card statement

- A council tax bill or rates bill

- Tax statement

- Driver’s licence (with photo) showing address and expiry date

- Another government or financial institution-issued document

Step 3: Deposit Funds & Trade

Make a first deposit using one of the standard payment methods listed earlier in our Pepperstone review.

Choose an asset from the homepage or navigation menu and click ‘Trade’ or browse the latest market reports and financial news for trading tips and potentially profitable setups.

Conclusion

Since its founding in 2010 in Melbourne, Australia by a team of experienced traders committed to improve online trading, Pepperstone seems to have achieved that – virtually all its online reviews are positive and it has built up a good reputation in online trading circles.

The only drawback is US traders not being accepted however that is common in the industry. Learn more about Pepperstone at their official website pepperstone.com which caters to beginner, intermediate and advanced traders, offering all the tools and educational content they need to proceed, even video podcasts.

81.18% of retail investor accounts lose money when trading CFDs with this provider.