Traders feel comfortable investing with a regulated broker that offers several asset classes and competitive fees. Plus500 Australia is a CFD provider that offers traders all those benefits and much more. Our Plus500 Australia Review 2023 goes in depth about this broker’s offerings and how traders benefit.

Let’s find out everything traders want to know about Plus500 Australia before getting started.

Plus500 Australia Pros & Cons

Traders reading online reviews of Plus500 will notice a lot of positive feedback from customers. We featured the aspects customers like about this popular CFD broker and mentioned some limitations.

Pros

Cons

79% of retail investor accounts lose money when trading CFDs with this provider.

Tradable assets

Cryptocurrencies

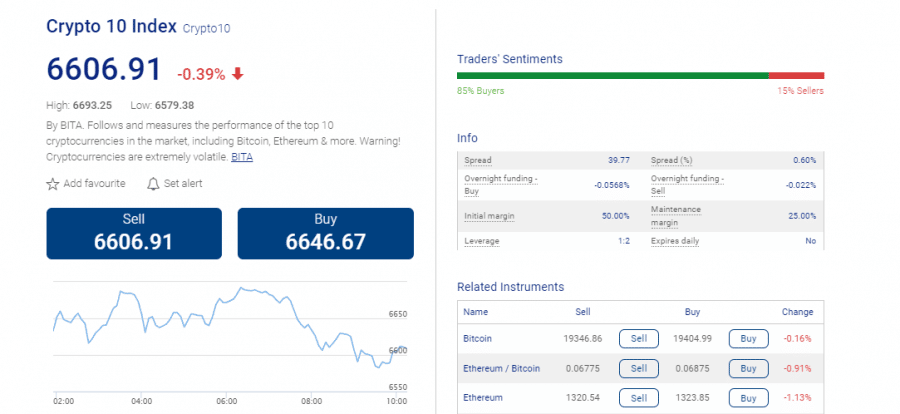

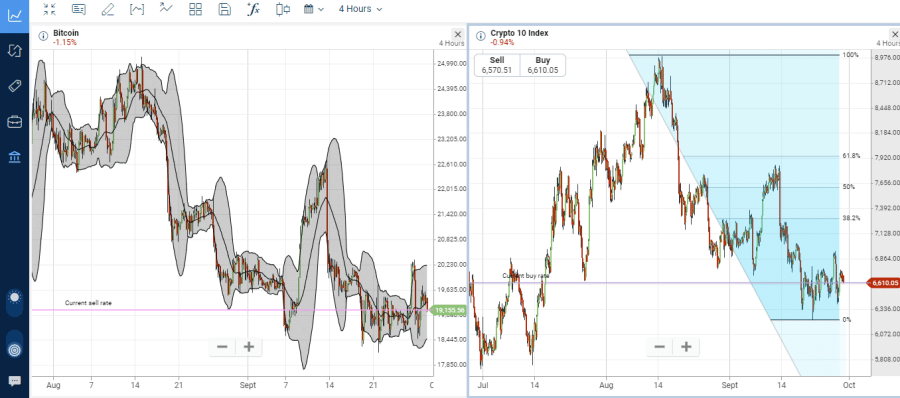

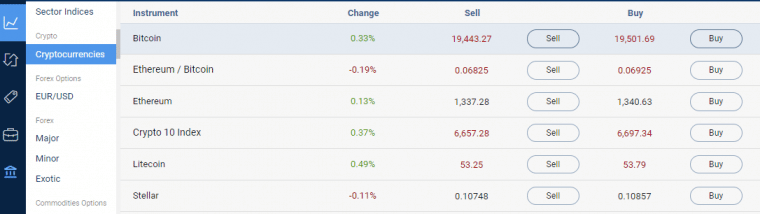

Wondering how to buy Bitcoin in Australia? Plus500 Australia provides traders with access to 17 cryptocurrencies. Besides the main crypto, traders can buy or sell CFD cryptos such as Chainlink, Filecoin and Polkadot. An Ethereum/Bitcoin pair is also available.

A key distinguishing feature of this crypto platform from most other brokers is the trading of the Crypto 10 Index. The index consists of the 10 best cryptocurrencies and follows and measures their performance.

Plus 500 doesn’t charge commissions for crypto trading, but it enables leverage 1:2. Besides the 24/7 support, Plus500 Australia provides news and market insights — ideal for traders wanting to incorporate a fundamental analysis.

Traders need only AU$200 to start trading around the clock, except for one hour on Sundays when the platform is offline. For those just starting out in the world of cryptocurrency trading, our article on how to avoid tax on crypto in Australia is a must read.

Stocks

Choosing Plus500 Australia to buy shares provides access to the most popular global stocks. Apart from the common markets, traders have access to shares in South Africa, Greece, Hong Kong, Japan and more. Also available for trading are cannabis shares.

Traders can take advantage of 1:5 leverage to increase their positions. This trading strategy is more suited for advanced traders who understand risk management. Commissions don’t apply to stock trading on this platform. Traders pay for spreads, which vary. A popular stock such as Tesla has an average spread of $2.

Traders can make use of the guaranteed stop feature on this platform. It helps traders avoid slippage by automatically closing a trade, even when the price action moves significantly against a trader.

Forex

Plus500 Australia is considered by many traders to be one of the best forex brokers, offering more than 60 currency pairs. Traders have access to majors, minors and exotics. Opening large positions is possible because of the 1:30 leverage offered.

Commission also doesn’t apply to Plus500 forex pairs. A popular pair such as EUR/USD has an average spread of 0.8 pips. Overnight funding applies to buy and sell positions. Plus500 Australia requires a maintenance margin 0f 1.67%.

An additional benefit of trading forex with this broker is that it provides an events calendar, highlighting important global economic events affecting currencies. It provides the time of the event and ranks it according to the degree of impact it could have on prices.

ETFs

Traders can choose from more than 60 ETFs on Plus500 Australia. Popular ETFs such as VXX Volatility and SPDRUSA500 are available without commission. The average spread on VXX is $0.32. A leverage of 1:5 is available and a maintenance margin of 10% is required.

Plus500 Australia has made ETF trading convenient for traders of all skill levels by providing a platform that enables trades to be easily opened, yet it contains advanced features for professionals to incorporate.

Indices

Indices are also available on this platform at 0% commission. Traders can opt for country indices in markets such as China, France, Poland, Italy and Australia, to name a few. The other option is sector indices. Besides the Crypto 10 Index already mentioned, traders can open positions in the Real Estate Giants Index or the Cannabis Stock Index. Seven sector indices and more than 20 country indices are available.

A leverage of 1:20 is available for indices. Trading the USA 500 index incurs traders a $0.7 spread, with a maintenance margin of 2.5%. Plus500 Australia implements negative balance protection.

Commodities

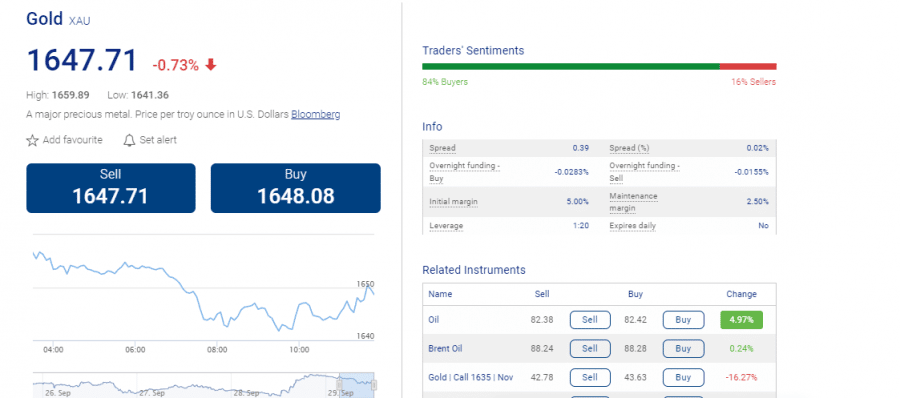

Another asset class available for trading on this platform is commodities. Some of the popular assets available are gold, silver and oil at a leverage of 1:20. Plus500 Australia could be considered as one of the best gold trading brokers, as it offers an average spread of $0.4 for gold spot trading.

To enjoy 1:20 leverage, traders must ensure a maintenance margin of 2.5%. Just over 20 commodities are available for trading, including cocoa, wheat, natural gas and corn.

Options

Traders can use call or put on more than 100 options on Plus500 Australia. Key information about trading options is available in the FAQ section on the website. It offers detailed content about how to get started.

The platform enables traders to use 1:5 leverage. Trading Oil Call 8 has a spread of $0.09 and requires a maintenance margin of 10%.

Plus500 Australia Fees & Commissions

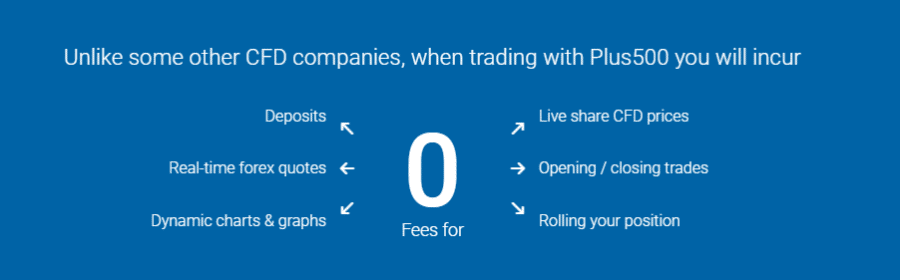

One of the major benefits of using Plus500 Australia for trading assets is the fees. Not only does this best trading platform not charge commissions, but its spreads are highly competitive. In fact, they offer some of the lowest spreads for certain assets.

Let’s look at some of the most popular assets traded and the fees incurred on this platform.

| Asset Class | Asset | Spread | Commission | Overnight funding – buy | Overnight funding – sell |

| Crypto | Bitcoin | $58 | 0% | -0.0568% | -0.022% |

| Stocks | Tesla | $2 | 0% | -0.0645% | -0.0453% |

| Forex | EUR/USD | 0.8 pips | 0% | -0.0112% | -0.0001% |

| ETFs | VXX | $0.32 | 0% | -0.043% | -0.0302% |

| Indices | USA 500 | $0.7 | 0% | -0.0201% | -0.0073% |

| Commodities | Gold | $0.4 | 0% | -0.0283% | -0.0155% |

| Options | Oil Call 80 | $0.09 | 0% | 0% | 0% |

79% of retail investor accounts lose money when trading CFDs with this provider.

Non-Trading Fees

Besides the overnight funding fees, traders may incur additional fees as well. One of them is the currency conversion fee. It’s charged when a trader has opened a position of an asset that trades in a different currency from the funded account. The fee reflects in real time in the unrealized profit and loss of an open position.

Implementing a guaranteed stop order also incurs a fee. Although this type of stop order is great for avoiding slippage, it is subject to a wider spread because a trader’s position is guaranteed to close at the rate requested.

Another fee that applies to traders who don’t trade often is the inactivity fee. Traders who haven’t logged into their accounts for three consecutive months are charged USD 10 per month until they log in.

Unlike most brokers, Plus500 Australia doesn’t charge deposit or withdrawal fees. In certain instances, traders may incur a deposit/withdrawal. That usually happens for international cards or bank transfers with a non-supported currency for accounts.

Plus500 Platforms

Plus500 is not an MT4 or MT5 broker. Instead, it uses proprietary software as its web platform. The platform is quite different from MetaTrader, as it has its own unique design and is accessible from multiple devices. Traders can use smartphones, web browsers, tablets and Windows PC.

The web platform is easily accessible by just registering an account. No need to go through the entire download process that would occur if traders downloaded a platform such as MetaTrader.

Is Plus500 User-Friendly?

One of the main benefits of using the Plus500 web platform is simplicity. Traders will easily get a feel for the platform by following the options on the screen. The asset classes are organised under each other in the left column, and popular assets are listed above the chart.

Opening a trade is as simple as clicking the buy or sell button on the desired asset. The navigation tools make it convenient to perform the desired action. Plus500 Australia didn’t use any fancy trade lingo that’s unfamiliar to new traders. The entire platform is designed to enable any trader to open positions with a few clicks.

Although the platform is convenient for new traders, it also caters to expert traders because it enables them to incorporate advanced tools to optimise their trading strategies.

A chart is available below the quotes so that traders can easily place a trade after doing a technical analysis. The market insight and news alerts that the platform provides enable traders to incorporate fundamental factors with the technicals.

Plus500 Charting and Analysis

To position themselves well in the market, traders use charts and tools to determine market direction. The charts are versatile. Traders can expand them for a full-screen view or contract them to combine them with quotes.

Different time frames are available. Traders can choose between the different chart types such as line, candle and mountain. A broad range of advanced strategies is available such as Bollinger Bands, MACD, price oscillators and the vortex indicator.

Multiple chart views enable traders to compare assets. Some of the tools available on this platform are Fibonacci retracements, Gartley, Pitchfork, as well as the standard ones — channel and lines.

Traders can get market insights from published pieces on Plus500’s website, but integrating a third-party automation tool cannot be done directly. However, real-time alerts are available via email, SMS and push notifications of prices and percentage changes. Also, Plus500 provides a market sentiment, depicting the percentage of buyers and sellers on each asset. The alerts feature can also notify traders of changes in market sentiment.

Plus500 doesn’t offer algorithm trading or automated trading via professional traders. Traders need to be constantly active on the web trading platform, otherwise, it logs the user out after a short period of inactivity.

Plus500 Account Types

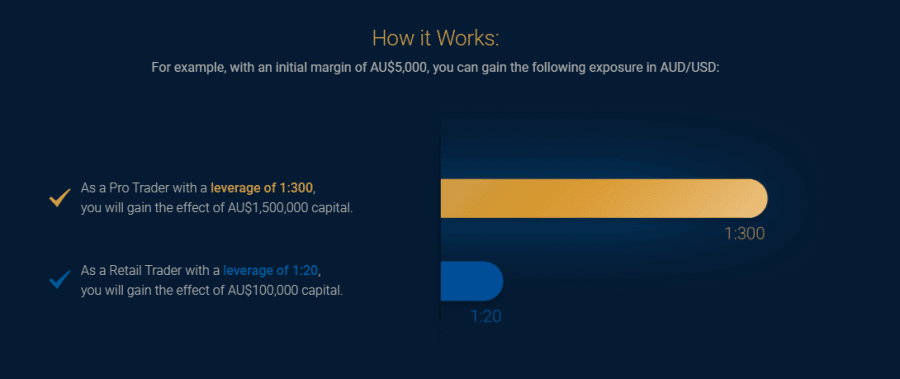

Two accounts are available on Plus500: retail and pro. Several benefits are provided to pro account users. One of them is leverage. Retail accounts usually have leverage of 1:20 and even lower, depending on the asset traded. Pro account holders receive leverage of 1:300.

Besides keeping most of the benefits offered to retail account holders, pro account holders may be eligible for rebates.

Traders need to meet certain criteria to apply for the pro account. One criteria is to have net assets of at least AU$2.5 million. The other criteria is that the trader’s income for the last two financial years needs to be at least AU$250,000 annually.

When applying, traders need to submit a certificate by a qualified accountant to ensure the legitimacy of their application.

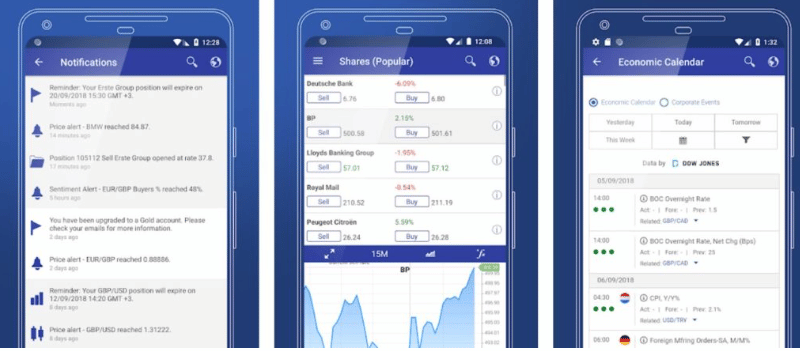

Plus500 App Review

The Plus500 app has an intuitive user interface that offers the key features found on the web platform. Traders can easily place trades at the touch of a button while analyzing the chart and following the economic calendar. The app also provides push notifications of the trader’s personal settings.

Real-time quotes are available and so are all the assets featured on the web platform. Traders with queries can get clarification via the 24/7 support in the app.

Plus500 Payment Methods

Having numerous payment options lowers the barriers to entry. The other benefit is that traders can compare the fees associated with each method and choose the most suitable one.

The payment options Plus500 Australia offers are:

- Visa

- Mastercard

- Bank transfer

- Paypal

- Skrill

- BPay

- Apple Pay

- Google Pay

- Poli

Plus500 Minimum Deposit

Plus500 Australia requires traders to deposit at least AU$200. That’s ideal for traders who don’t want to risk too much money upfront.

Plus500 Withdrawal Times

After traders have submitted a withdrawal, Plus500 Australia needs 1 to 3 business days to process it. The withdrawal passes several stages during that period. Once the broker has processed the withdrawal, it may take 3 to 7 business days for it to reflect in the trader’s account.

Plus500 Bonus & Promos

At the time of writing, Plus500 Australia didn’t offer any bonuses or promos.

Plus500 Demo Account

Traders who want to test the platform before going live can use the demo account. The Plus500 demo account is free and provides access to real-time markets while offering all the features and assets found on the live account.

Traders usually receive AU$60,000 for demo trading. When the balance falls to about AU$300, the initial balance is automatically reinstated by the system.

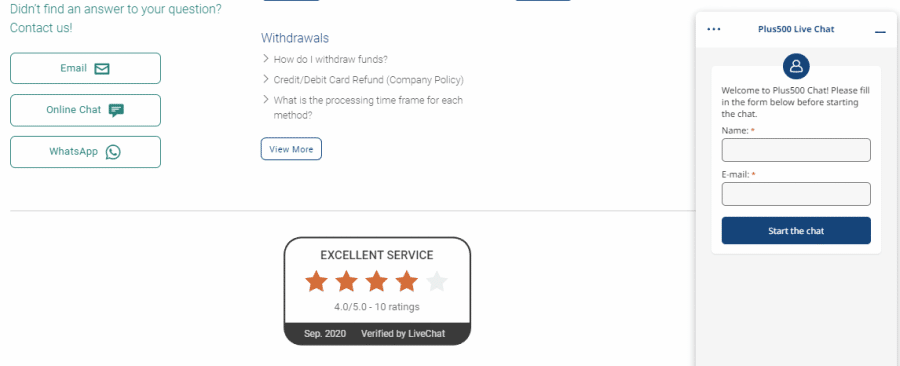

Plus500 Customer Support

The last thing traders want is to wait long for their queries to be attended to, especially crypto traders that trade on weekends. That’s the reason Plus500 has made its support available 24/7. The first port of call for traders should be the FAQ. It contains a wealth of information about the platform and trading.

Traders who haven’t found a resolution in the FAQ section can contact support via email, online chat or WhatsApp. An agent joins the chat within a few minutes online and provides feedback. Email support also provides prompt feedback but can take several hours during busy periods.

Plus500 Licensing & Security

This broker is heavily regulated. Besides being licensed in Australia by ASIC, it is also regulated by the FCA, CySEC, MAS, AFSL, FSP and FMA. Being regulated by so many authorities shows that this broker is serious about upholding high financial ethical standards.

How to Start Trading with Plus500

To make the process more simple, we provided a step-by-step guide about how to trade on Plus500 Australia.

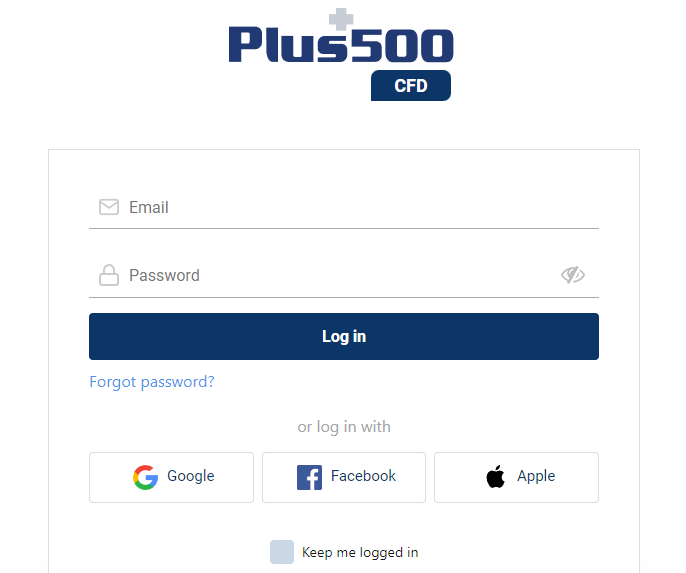

Step 1: Open an Account

Visit Plus500 Australia’s website and then select ‘Start Trading Now’ on the homepage. Input an email and a password.

Step 2: Verify Account

Plus500 Australia requires users to register their accounts by inputting their personal information and uploading government-issued documents. To verify documents, users should follow the next step, which also details how to deposit funds.

Step 3: Deposit Funds

Click the ‘Funds’ icon on the left, then click ‘Deposit’. Users who haven’t registered their accounts will first be prompted to do that before being able to deposit funds.

Step 4: Search for Asset

Use the top left scroll list to find the desired asset to trade. We searched for Bitcoin under cryptocurrencies and then clicked ‘Buy’.

Conclusion

Plus500 offers traders several asset classes and more than 2,000 instruments. Traders can access global markets for stocks, indices, ETFs, commodities, options, cryptocurrencies and forex. Trading benefits include 0% commission, competitive spreads, news and market insight, and alerts.

Traders needing assistance can reach out to the 24/7 support center or attend Plus500’s trading academy to hone their skills. Advanced traders can opt for the pro account to access additional benefits such as 1:300 leverage. On-the-go traders can use the Plus500 forex trading app, which contains the key features of the web platform.

79% of retail investor accounts lose money when trading CFDs with this provider.