With over 2,800 tradable instruments, Plus500 is a multi-asset CFD trading platform and a registered company on the London Stock Exchange (LSE).

This Plus500 UK review will analyse the popular trading platform in-depth by reviewing the available features, trading costs, assets, and more.

Plus500 UK Pros & Cons

Before trading on Plus500, investors should get a good grasp of the benefits and weaknesses of this platform. Therefore, the sections below conduct a Pros & Cons analysis of one of the most popular trading platforms in the UK.

Pros

- CFD trading on 2,000 + Financial Instruments

- Low Spreads on EUR/USD FX Pair

- Maximum Leverage Up to 1:30

- 24/7 customer support

- Accessible via PC, smartphones and tablets

Cons

- No Cryptocurrency CFDs in the UK

- Hefty minimum deposit (£100)

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Disclaimer: Plus500UK Ltd authorized & regulated by the FCA.

Plus500CY Ltd authorized & regulated by CySEC

Tradable assets

Launched in 2008, Plus500 is a CFD (Contracts for Difference) broker, offering thousands of CFD trading options across a vast asset class. Since the inception of this platform, Plus500 has received over $800 billion in trading volume, with over 300 million positions opened.

Here’s a list of the different financial instruments available to trade with CFD options on Plus500:

- Cryptocurrencies

- Forex

- Stocks

- ETFs

- Commodities

- Options

- Indices

Cryptocurrencies

Plus500 supports cryptocurrency CFDs – a method to speculate on the future price movements of the digital currency without holding the underlying asset. However, the volatility and uncertainty of the cryptocurrency markets make it an unpredictable investment.

This has resulted in CFD cryptocurrency trading being banned for all retail investors in the UK – a decision made by the FCA (Financial Conduct Authority). While the platform may not support the option to buy cryptocurrency in the UK, CFD crypto trading is an available feature for Plus500 users from other countries.

Investors can buy Bitcoin, Ethereum and other popular digital assets by applying up to 1:2 leverage. Thus, any potential profits or losses have the potential to multiply when applying leverage. Cryptocurrency trading with Plus500 can be made available after making a £100 minimum deposit.

Investors can access 17 different cryptocurrencies with Plus500, including popular crypto pairs such as BTC/ETH.

Stocks

Stocks are another important financial asset that investors can trade with Plus500. Notably, the platform supports some CFD trading for some of the biggest shares from the UK, US, Italy, Japan, Hong Kong and other countries.

UK investors can trade local stocks such as Royal Mail, Lloyds Banking Group and easyJet with up to 5x leverage. The Plus500 fees for CFD shares trading exempts any stamp duty taxes and charge a low spread per trade.

Investors can open new positions in some of the biggest companies, such as Amazon and Apple, which accessing various risk management tools.

For example, the Trailing Stop feature allows investors to lock in a certain amount of profits. After opening a new trade with a Trailing Stop, the position remains open as long as the price moves in favour of your trade. Once the price changes direction (by a specified amount of pips), the position closes automatically.

Over 1,900 CFD stock options can be accessed via Plus500 trading. Looking to trade shares? Read our How to Buy Shares UK guide to learn more.

Forex

One of the popular forex brokers in the UK, Plus500 offers over 60 CFD FX trading options – including minor, major and exotic pairs. Plus500 forex trading also supports CFD options for popular pairs such as EUR/USD, EUR/GBP and GBP/USD.

Investors can access a maximum of 1:30 leverage on forex trading with Plus500. A simple £100 investment can effectively turn into £3000 worth of capital via leverage trading. The platform takes a low spread of 0.00008 pips on the popular EUR/USD pair. Furthermore, overnight fees may be applied as well.

One of the notable CFD brokers in the UK, Plus500 offers 24-hour Forex trading CFD options to investors. Traders can also access advanced tools including Stop Loss, Guaranteed Loss and Stop Limit to minimize losses on their Forex pairs.

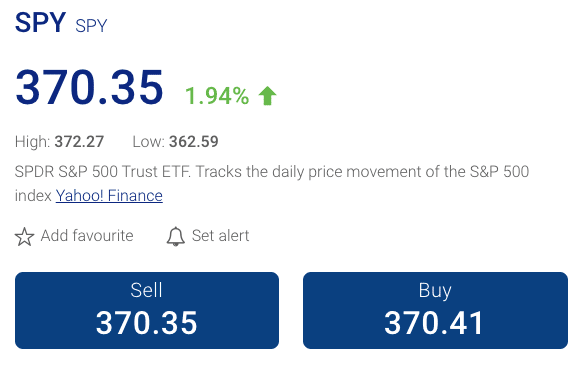

ETFs

Short for Exchange Traded Funds, ETFs are a combination of a wide range of stocks and bond options. Plus500 allows investors to trade ETF CFDs from some of the most popular trading markets – including the USA, UK, Germany and more.

For example, Plus500 investors can trade CFD options of the SPY ETF – an exchange traded fund based on the S&P 500. Trading this particular CFD with Plus500 attracts a low spread rate of 0.06 pips. Investors can even increase the value of their holdings by accessing up to 1:% leverage on ETF CFDs. Along with SPY, investors can access over 100 CFD ETFs with Plus500.

Interested readers can check out our eToro review UK, to learn more about other trading platforms offering ETFs.

Commodities

A multi-asset trading platform, Plsu500 also provides CFD trading for popular commodities. Popular commodities such as Gold, Oil and Silver can be accessed through Plus500. For example, Oil CFDs attract a 0.04 spread. Buyers can also access up to 10x leverage when trading CFD commodities on Plus500.

Indices

Trading indices offer investors the unique opportunity to access a combination of various shares from a particular exchange. Therefore, you can trade indices of different countries – which gives you exposure to the nation’s top-performing assets.

For example, the FTSE 100 is a market index that comprises the 100 largest companies on the London Stock Exchange.

With Plus500, you can access indices such as the USA 500, Swiss 20, Germany 40 and more. Investors can access up to 1:20 leverage when trading CFD indices on this brokerage.

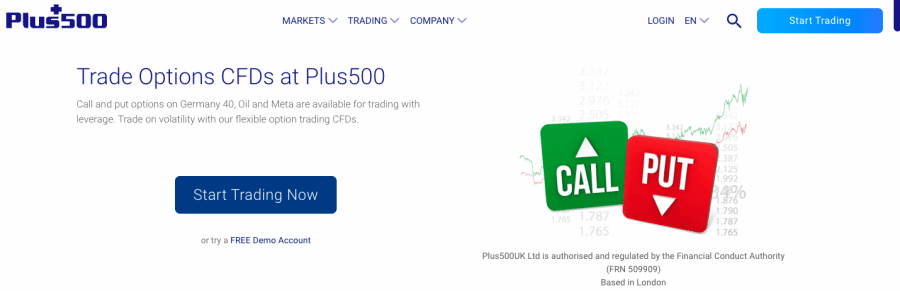

Options

Options trading is a phenomenon where trades can speculate on the future price movements of an asset. An options contract gives the trader the choice, but not an obligation, to buy/sell a particular asset at a specified price and time.

Options contracts are of two types – Calls and Puts. A call option allows a trader to buy the asset, while a Put enables the trader to sell an asset. Plus500 allows traders to take out Call and Put options for popular commodities, indices and shares.

A maximum of 5x leverage can be applied when trading options with this brokerage.

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Plus500UK Ltd authorized & regulated by the FCA. Plus500CY Ltd authorized & regulated by CySEC

Plus500 UK Fees

To better understand the main fees involved with this brokerage, our Plus500 UK review will provide a detailed list of all the additional costs & fees associated with the multiple asset classes.

Trading Fees

Here’s a list of the trading fees we will be covering:

- Spread: Firstly, we will cover the spread rate – which specifies the difference between an instrument’s buy and sell rate.

- Overnight Funding: When investors hold a particular CFD after the markets close, an additional overnight funding fee may be added and subtracted from your position. We cover the overnight funding costs for a buy-and-sell position.

- Spread Percentage: After dividing the spread by the average daily range of a currency pair, we can calculate the spread percentage. This gives investors a better understanding of the spread costs per transaction.

To make things straightforward, the table below highlights the different fees for the most popular instrument per asset class.

Note: We have not mentioned the fees for cryptocurrency CFDs since the asset is not a trading option in the UK.

| Asset Class | Spread | Spread Percentage | Overnight Funding (Buy/Sell) |

| Stocks (Apple) | 1.12 | 0.74% | -0.0516%/-0.03624% |

| Forex (EUR/USD) | 0.00008 | 0.01% | -0.0112%/-0.0001% |

| ETFs (SPY) | 0.06 | 0.02% | -0.043%/-0.0302% |

| Commodities (Oil) | 0.04 | 0.05% | -0.0283%/-0.0155% |

| Indices (Germany 40) | 1.97 | 0.02% | -0.0146%/-0.0128% |

| Options (Call -EUR/USD) | 0.00068 | 6.91% | – |

Non Trading Fees

The table below lists all the non-trading fees that Plus500 charges from investors.

| Deposit Fee | None |

| Withdrawal Fee | None |

| Inactivity Fee | $10 per month (Beginning after 3 months of inactivity) |

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Plus500UK Ltd authorized & regulated by the FCA. Plus500CY Ltd authorized & regulated by CySEC

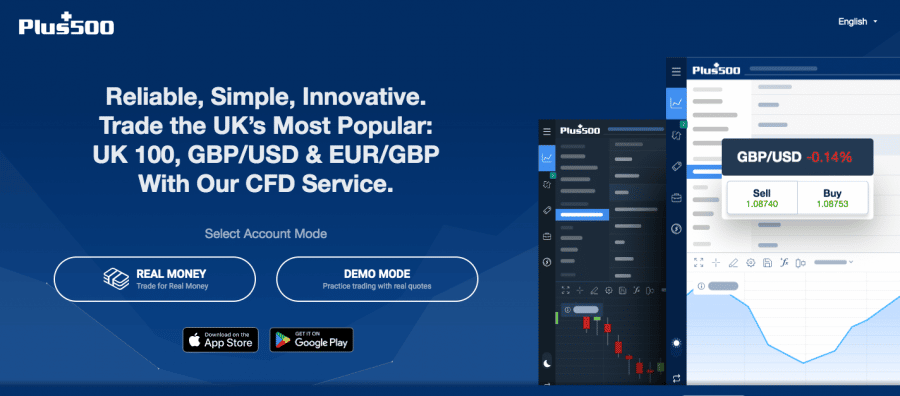

Plus500 Platforms

To get a better idea of how to access this trading platform, we will cover the available platforms that the brokerage offers.

WebTrader is the Plus500 web platform. Offering a streamlined experience and making trading simple and efficient, WebTrader is compatible with multiple devices, including Windows, smartphones and tablets.

The Plust500 web platform offers a wide range of technical charts and graphs which investors can leverage. We will go into detail about the platform characteristics later on. Unlike other brokerages, Plus500 does not offer the MetaTrader 4 trading platform or similar alternatives.

Is Plus500 User-Friendly?

Through the WebTrader proprietary platform, Plus500 offers users a simple-to-use and straightforward trading process. Firstly, WebTrader allows users to access Plus500 on the web, via the app and on PC.

Along with a well-designed user interface, investors can access various technical tools to help in the trading process – such as price charts and risk management tools.

Plus500 provides a trading academy to support investors where users can learn trading basics via eBooks and ‘How To’ tutorial videos. A ‘markets insight’ section is also available, which offers the latest news from the global markets. Thus, traders can stay updated and make well-informed decisions with Plus500.

Investors can access free and real-time alerts by email or SMS if they want to stay on top of the market. Push notifications are sent to investors, comprising price alerts, price changes and buyers’ sentiments.

The platform provides free real-time quotes on all indices for CFD index trades. Finally, investors can also access demo accounts for an unlimited period of time with Plus500. The Plus500 demo account allows investors to test their CFD trading strategies by investing in real markets with virtual currency.

This feature allows users to access the platform first-hand without risking real funds.

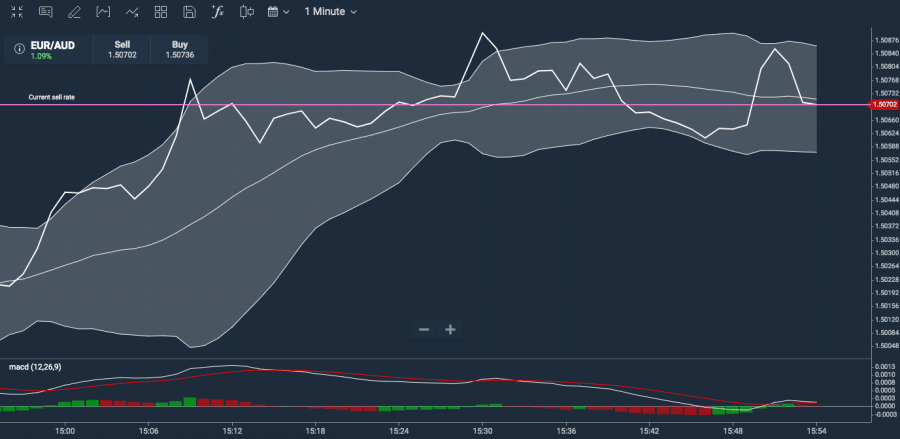

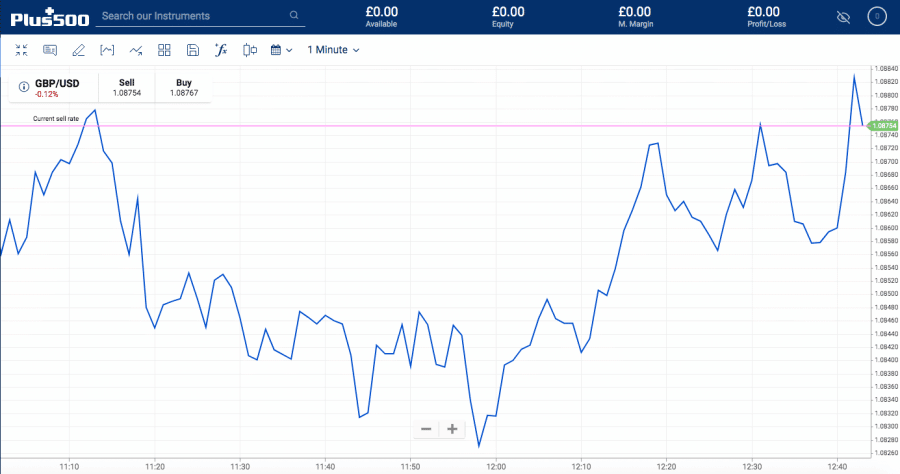

Plus500 Charting and Analysis

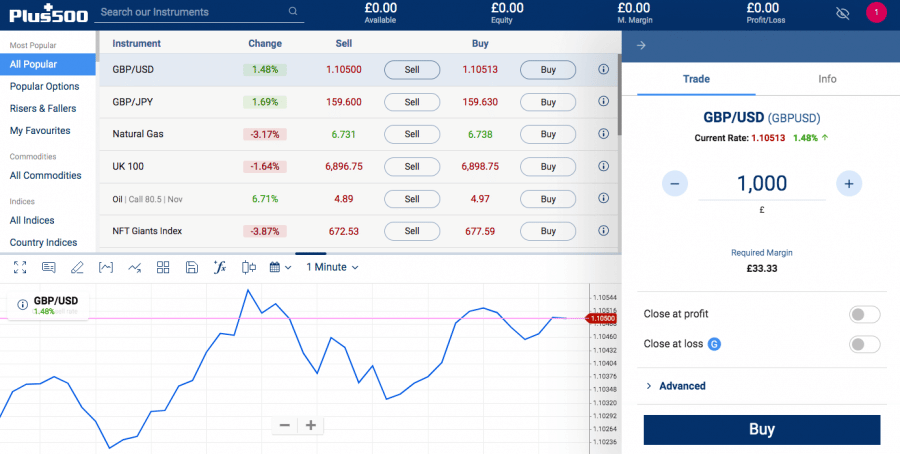

When trading CFDs, investors are looking for a variety of charting and advanced technical features to assist them in their trades. Plus500 supports various risk management tools, allowing investors to minimize losses while trading CFDs.

For example, investors can access the ‘Close at Profit’ and ‘Close at Loss’ tools when opening a new trade. This tool allows the platform to automatically close a trade according to a pre-set maximum or minimum limit. Thus, investors can cash out after receiving a certain amount of profit or minimize their losses and close the trade before the position falls further.

Each financial instrument also comes with a price chart to view historical prices and decipher new trading patterns. The common indicators available to use on Plus500 include moving averages, Bollinger bands, and Relative Strength Index (RSI), among others.

Plus500 Account Types

Plus500 provides three different types of accounts that investors can utilize. Let’s take a closer look at the available options:

Demo Accounts

As mentioned above, the Plus500 demo account provides a means of trading the live markets without risking any real assets. Investors trade using virtual currency and get the opportunity to analyze CFD trading strategies in a safe manner. There is no extra charge for accessing the demo account, and it’s free to use anytime.

Other Plus500 reviews also highlight the relevance of a demo account for trading platforms. Demo accounts also allow live trading options such as applying leverage, accessing technical indicators and more.

Retail Accounts

Retail accounts can be used after making a minimum deposit of £100. Investors can access maximum leverage of up to 1:30 and begin trading after creating a quick KYC (Know Your Customer Process).

Professional Accounts

Professional accounts can be accessed to enjoy more advanced trading options. Investors first need to have sufficient trading activity in the last 12 months to access a professional account. A minimum of 10 transactions, of sufficient amount, must have been paid per quarter over the previous four quarters.

Investors must also require a financial instrument portfolio of over £500,000. Finally, investors must have also worked in the financial sector for a minimum of 1 year. The designation must be one which would require knowledge of the related transactions and services.

Investors can access higher leverage options of up to 1:300 with a professional account.

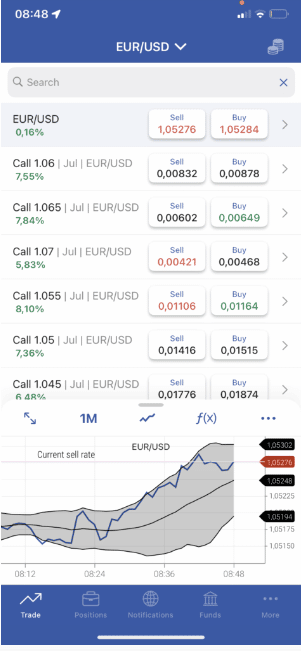

Plus500 App Review

CFD trading in forex and shares markets may require investors to regularly access their trading accounts to adjust trades, open new positions and close orders. Therefore, the Plus500 app provides a convenient means of accessing the Plus500 proprietary platform 24/7 at any place.

Accessible at the click of a button, the Plus500 app gives investors the option to receive push notifications and set price alerts to assist them with their trades. Just like the Plus 500 web platform, the app offers all 2,000 + CFD trading options on the available financial instruments.

Boasting a straightforward interface, investors can change between their trading tabs to their account funds to their app notifications in a single tap.

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Plus500UK Ltd authorized & regulated by the FCA. Plus500CY Ltd authorized & regulated by CySEC

Plus500 Payment Methods

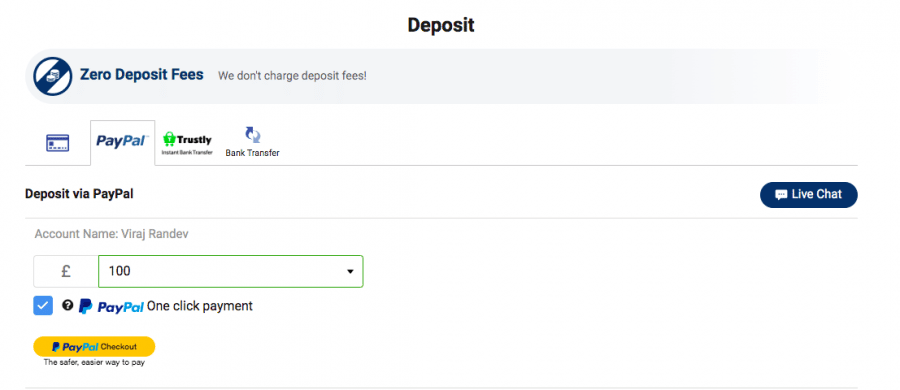

Plus500 makes account funding quick and straightforward for investors. In the UK, investors can begin trading by accessing several payment methods such as:

- Debit/Credit cards (Including VISA and MasterCard)

- Bank Transfer (direct bank to bank funds transfer)

- E-wallets including PayPal and Skrill

Plus500 Minimum Deposit

As mentioned above, retail investors must make a minimum deposit of £100 with credit/debit cards or e-wallets. The minimum deposit with bank transfers is £500. Traders are allowed to make a maximum deposit of £35,000 on Plus500.

Plus500 Withdrawal Times

On Plus500, withdrawals can take between 3-7 days, depending on the payment method and the processing time of the third-party remitter. The platform typically processes a withdrawal request in 1-3 days after conducting security checks before verifying the request.

Plus500 Bonus & Promos

Currently, Plus500 does not provide any bonus or promotional schemes.

Plus500 Demo Account

As mentioned above, Plus500 does have a demo account for investors to use free of charge. Since CFD trading can be unpredictable and risky, a demo account offers the same features as the live account without risking any real funds.

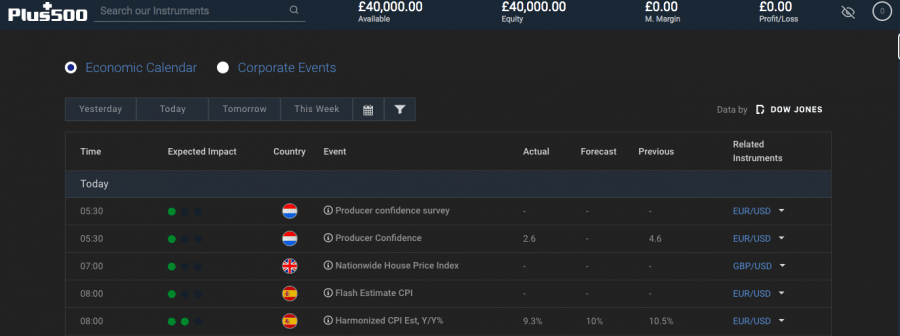

Investors can begin trading on the demo accounts with virtual funds and access all the charting options, technical indicators, economic calendar and other features that the WebTrader platform provides. The demo account can be accessed 24/7 and can easily be switched over from the standard Plus500 account.

The account comes with £40,000 in virtual funds.

Plus500 Customer Support

To ensure customer satisfaction, Plus500 provides 24/7 assistance via email, online chat and telephone.

The reviews of Plus500 highlight the users’ faith in the platform. Plus500 has received a 4.2 (out of 5) average rating from the 10,725 customers who rated the platform on Trustpilot.

Plus500 Licensing & Security

A safe and secure trading platform, Plus500 UK is regulated by the Financial Conduct Authority (FCA) – the conduct regulator for around 50,000 financial services firms and financial markets in the UK. Since the platform is obligated to abide by the regulations set in place by this regulator, investors can be assured that the platform keeps their best interests in mind.

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Plus500UK Ltd authorized & regulated by the FCA. Plus500CY Ltd authorized & regulated by CySEC

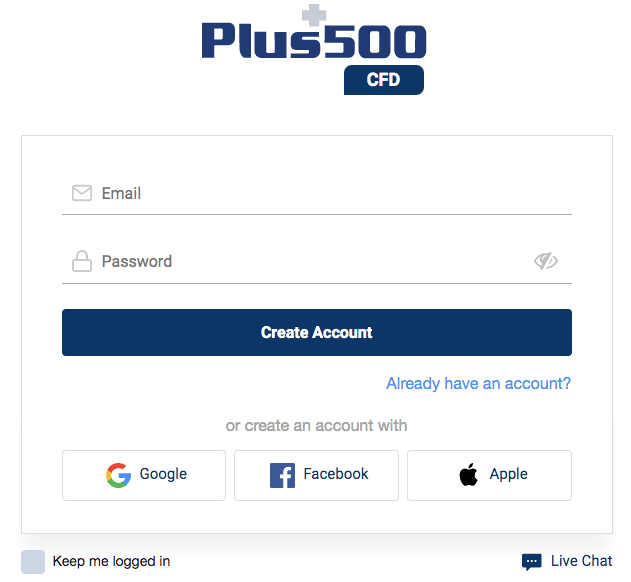

How to Start Trading with Plus500

The sections below provide investors with a step-by-step guide on how to begin trading with Plus500.

Step 1: Create an Account

Head over to the Plus500 website, enter your email address and create a password.

Click on ‘create account’ to continue.

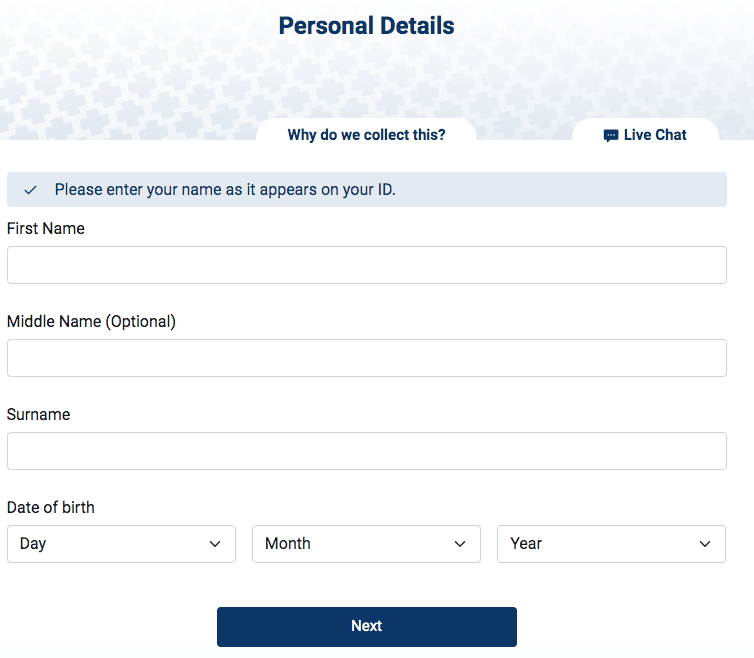

Step 2: Verify Your Account

Before trading, investors must verify their accounts by providing their full names, country of residence and address proof. Plus500 will also require proof of identity confirmation – provide a passport or a driver’s license.

Complete the verification by providing a proof of address forms such as a bank statement or utility bill.

Step 3: Security Questions

To analyze an individual trader’s experience, Plus500 asks a list of security questions. Some questions include the traders’ income, job designation, past trading experience and more. Confirm the details and sign the terms and conditions to continue.

Step 4: Deposit Funds

After verifying the account, Plus500 will allow investors to deposit money into the account.

Select your preferred payment methods, such as credit/debit cards, bank transfers or e-wallets. Insert the minimum deposit of £100 (£500 for bank transfers) to continue.

Step 5: Begin Trading with Plus500

After the money has been credited, investors can begin trading CFDs on multiple financial instruments. Search for your preferred instrument on the search bar and hit enter. For example, in the picture below, investors will see an order creation box on their screens’ right-hand side.

Enter the amount you wish to deposit in the trade and click on ‘Buy’.

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Plus500UK Ltd authorized & regulated by the FCA. Plus500CY Ltd authorized & regulated by CySEC

Conclusion

Plus500 is a popular CFD trading platform, offering over 2,000 + CFD trading instruments such as Forex pairs, stocks, indices and more. Our Plus500 UK review has covered everything from the available account types, minimum deposits and fees per individual asset class.

To access various financial instruments in the UK, begin trading with Plus500 using the link below.

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Plus500UK Ltd authorized & regulated by the FCA. Plus500CY Ltd authorized & regulated by CySEC