What makes a good NFT marketplace? That usually comes down to trading fees, royalties, and range of NFT collections. As of 2022, two of the largest non-fungible token marketplaces are OpenSea.io and Rarible.com.

Both provide an accessible platform to NFT creators and artists of all types. Both represent the qualities of an ideal NFT marketplace by being inclusive, transparent, and deliver creators and investors maximum gains.

Rarible vs Opensea Summary

Cons

Cons

Cryptoassets are a highly volatile unregulated investment product.

Which one of them is the better NFT marketplace overall and worth your time though? Both Rarible and Opensea are competing neck-to-neck on various aspects. In this Rarible vs Opensea comparison guide we’ll review the pros and cons of both platforms to help you decide which one to buy and sell NFTs on.

What is OpenSea?

Let review one of the most popular NFT marketplaces of all time (considering the young age of crypto arts), Opensea, and why it has a good reputation among those that invest in NFTs and mint them.

It started back in January 2017 to cater to one particularly rowdy series of NFTs – the Cryptokitties. But everything from its intuitive interface and the community’s response was so great that the platform evolved and added all types (mostly) of non-fungible tokens.

Opensea marketplace logo

As such, with time and the incoming of new NFT enthusiasts looking for a safe, easy-to-use, and transparent place to list their arts, OpenSea evolved into a kind of mecca for NFTs and is now one of the largest NFT marketplaces.

Opensea Blockchains

Opensea was built on the Ethereum blockchain, has a decentralized approach, and acts as a peer to peer (P2P) marketplace for NFT users. It provides the infrastructure to the users that they can leverage to mind and trade their non-fungible tokens.

Not wanting to encumber itself with the energy-hogging Ethereum blockchain and wanting to give room to eco-friendly, albeit less popular chains, Opensea now also provides multi-chain support. These blockchains include Polygon and Klaytn.

The Polygon platform enables communication between differing ETH supported Blockchains. Founded in India in 2017 and previously known as MATIC, this blockchain deals with the most significant pain points that have always plagued Ethereum – high gas fees and network congestion due to high demand.

Chains on Opensea marketplace

On the other hand, Klaytn is a Kakao-backed blockchain focusing on gameFi – gaming finance. It is primed to be an integral part of the metaverse and is evolving into the gaming ecosystem’s chain of choice.

The addition of this chain has allowed Opensea to host in-game assets and virtual lands as valuable tokens to the platform.

Hosting different chains has unchained Opensea to host NFTs of widely differing varieties, including memes, virtual lands, trading cards, in-game assets, crypto art, blockchain domain names, and collectibles.

Advantages of Opensea

Another reason that Opensea has become the “apple of the eye” of many NFT enthusiasts is its simplistic approach to trading. Doing away with a coding-based interface that plagued many initial online NFT shops,

Opensea instead has opted for intuitiveness and ease-of-use. Artists with no experience in coding have an easy time creating and hosting their NFTs. And as most trade interfaces are click-based, trading on the platform doesn’t require any technical knowledge either.

Also to ensure that these creators can lucratively list and trade their projects, Opensea takes a decentralized approach to trade – removing intermediaries from the equation.

Opensea supports over 150 different crypto wallets. More are expected to added in the future. The value of Opensea in the crypto and NFT space has soared by:

- Simplifying the trading approach to even novice artists to list their NFTs

- Taking a broader approach to Non Fungible Tokens

- Adding the perks of decentralization

- Permitting multiple wallets for transactions

- Having a simple-to-operate interface

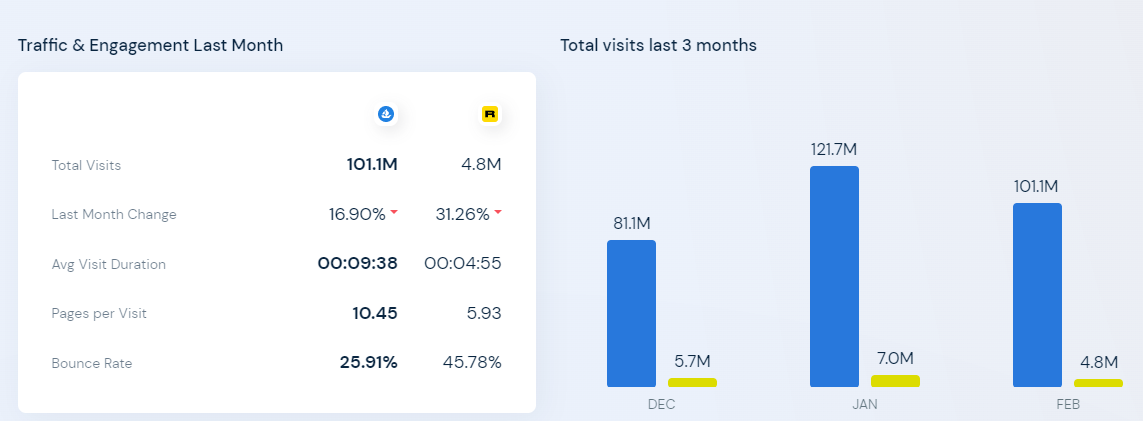

In early 2022, the platform had over 600,000 users. According to SimilarWeb – a popular website traffic analyzer – Opensea is getting over 120 million visitors per month.

Cryptoassets are a highly volatile unregulated investment product.

What is Rarible?

Rarible is not so different from its counterpart, Opensea, so drawing Rarible vs Opensea comparisons are difficult. They both follow the same business strategy of inclusivity, offering an intuitive interface and being accessible to beginners. They host most new NFT projects and cater to many types of NFT creators.

Rarible NFT marketplace logo

Following along the lines of decentralization and P2P transactions, Rarible also has NFT gifting and minting options, the same as its closest competitor.

Having the format of peer-to-peer transactions allows Rarible to have a dynamic ecosystem with a plethora of creators ready to sell an array of NFTs.

So, in this sense, Rarible is taking inspiration from Opensea to create a dynamically evolving blockchain-powered trading infrastructure where no NFT is left behind.

Rarible Wallets

Rarible currently supports five NFT wallets for trading, fewer than Opensea.

Since Rarible is a relatively new marketplace, launched in the early 2020s in Moscow by Alexie Falin and Alexander Salnikov, it has only the following wallets available for NFT trading:

Metamask

Metamask is one of the earliest and the most trusted crypto wallets – popular among the first and the latest entrants of the Blockchain space. A multi-chain wallet, it is not confined to only Ethereum.

Rainbow Wallet

Rainbow wallet gained traction among the NFT enthusiasts for its inclination to have a more user-friendly approach. However, it is suitable for those with the exclusive need for an Ethereum wallet.

Coinbase

Like Metamask, Coinbase sports multi-currency support, including Ethereum and Bitcoin. Coinbase, sporting a beginner-friendly interface, has gained much traction among new and old blockchain ecosystem visitors.

Fortmatic

Now rebranded as Magic, Fortmatic is an alternative to web3 wallets. Meant for outsiders of blockchain, it relies on users’ phone numbers and email IDs for identification.

While the inclusion of four wallets might be considered limiting, there is another form of payment option Rarible has opted for that has left it open to complete outsiders – credit cards for payments.

Introducing a conventional payment method has magnetized the marketplace, attracting new entrants to the blockchain – ones that have always been curious about the chains but were chained out due to the lack of technical understanding of the field.

Cryptoassets are a highly volatile unregulated investment product.

Rarible NFT Range

While this marketplace hosts a wide array of NFTs, we can categorize the types of non-fungible tokens it deals with in two categories:

Blockchain-based art

Conventional NFTs making rounds in the Ethereum Blockchain, ones that have gained the most attention. They can be memes, gifs, static arts, pixelated artworks, in-game assets, etc.

Crypto domains

Like the OpenSea, Rarible is no stranger to hosting crypto-domains. These are smart contact suits – software written on a publicly-appearing blockchain. These domains are leveraged as naming registries for crypto wallet addresses within the blockchain space.

By taking a multi-chain approach, Rarible hosts NFTs of Ethereum, Flow and Tezos.

Rarible Blockchains

Flow is touted as a high-performance blockchain explicitly designed to create non-fungible tokens that are in-game assets, crypto games and other applications. Dapper Labs, the same team behind NBA top shots and infamous game, CryptoKitties, conceived Flow when CryptoKitties halted the operations of Ethereum due to the sheer volume of requests.

Tezos is a blockchain network tethered to the native $Tez or $Tezzie tokens. Unlike standard mining operations, Tezos is a chain that rewards users based on the proof-of-stake mechanism. An open-source network, Tezos allows the users to govern the chain.

That user-led governance is where Rarible diverges from Opensea. Unlike Opensea, Rarible takes the concept of decentralization truly to heart.

Chains on Rarible marketplace

All the economy of the Rarible platform; everything from the profits generated, NFT selected to the interface created is tethered to a Rarible-native token known as $RARI.

Distributed among those placing their NFTs on the platform, $RARI tokens give the users the reins of the platform’s control. It was created to empower the users of the platform and to realize the goal of Rarible – to evolve into a DAO-driven platform, an open marketplace for the NFT space that changes and grows with time by taking the inputs of the $RARI holders.

Advantages of Rarible

To keep the transactions clean and take the community aspect of the platform even further, Rarible takes a non-custodial approach to the NFTs. To put it bluntly, Rarible has no way to funnel out any commission from the NFT profits.

Even with so many drastic approaches to make the platform as user-friendly and user-led as possible, Rarible only gets around 10,000 visitors on its platform. Now, before we move further, let us take a deep dive into what $RARI is, for it can be a decisive factor for you to choose between this and the Opensea.

$RARI is a governance token, meaning that holding it gives you the voting rights that govern Rarible, the decentralized NFT marketplace. It aligns with the desires of the Rarible developers to create a marketplace untethered by the greed of the few.

However, despite being an idealistic approach, it will take some time to fully form. Currently, this $RARI powered Decentralized Autonomous Organization is limited to the following:

Trading fees

Trading fees is one that the creators have to pay the platform to leverage the platform’s attributes to trade their NFTs. In Rarible’s case, the community decides what the trading fees will be.

New features

Rarible is relatively new and thus is ripe for new developments and features. Rarible, to remove the vicious feedback cycle, has given the right to decide the platform’s features to the community.

Enhancing decentralization

Decentralization is an evolving concept that takes time to fully realize. While some aspects of the platform are decentralized, others are still under the developers’ control to maintain the platform’s integrity. However, the voters get to decide the level of decentralization $RARI can afford.

Content Curation

It is one that we can consider a revolutionary step towards decentralization. The community gets to decide which NFTs to be displayed on the platform. Arts with more votes get to be at the top display, earning more attention from the visitors and more profits.

These voting rights are not absolute, and they have an advisory instead of a binding nature. They merely take in the voices of the community as “feedback” rather than a fundamental law. However, most of the decisions made on the platform have all been democratic so far. So, there is still hope yet.

Also taking up the concept of marketplace liquidity mining. Rarible used $RARI to attract new users by incentivizing NFT trading. It distributed 75000 $RARI tokens per week to the NFT listers of the platform to give them a voice in governing the platform.

And this move bore fruit for this platform as in September 2021, Rarible has ten times the same volume as Opensea – no small feat considering the ubiquity of the Opensea Marketplace.

Not just decentralization, but a new and innovative approach within the NFT space catering to both old and new creators, has allowed Rarible to cannibalize visitors from the giants like the Opensea.

Rarible vs Opensea Compared

So far, we have taken a glance at what these NFT marketplaces have to offer. They have separate essences, and both are to empower NFT creators in different ways. However, the main point of this article is to help you decide between the two. We will draw a comparison between Opensea and Rarible.

Key stats related to both marketplaces

And to make that comparison more fruitful, let us first separate the similarities between the two.

Opensea vs Rarible – Similarities

Both marketplaces support multiple blockchains to create a diverse NFT ecosystem.

NFT marketplaces customize their infrastructure to cater to specific blockchains. Thus, users can only interact with NFTs that exist on the blockchain supported by the marketplace. For example, an Ethereum- based marketplace will cater to the ETH-based NFTs.

However, as time has passed and developers have started to see the detriment to sticking with a single blockchain, more NFT ecosystems are now ripe for exploration. Thus, there are Marketplaces catering to multiple chains – Opensea and Rarible, both among them.

Opensea allows the visitors to access Ethereum-based NFTs and tokens based on Polygon and Klaytn. On the other hand, Rarible’s enhanced chain repertoire consists of Flow, Tezos, and Ethereum. Thus, as far as multi-chain blockchains are concerned, Opensea and Rarible have taken a strategic approach. Both understand that users are branching out of the Ethereum blockchain, and thus, these platforms have no qualms about creating a diverse NFT ecosystem within their marketplace.

Both cater to a broader Niche of NFTs

Non-fungible tokens are evolving at a breakneck speed. Not confined to 2D-pixelated arts anymore, these tokens are now taking forms that range from full-fledged photographic artworks to pieces of virtual lands and In-game assets that add value to and personalize the metaverse.

And in this case, both Rarible and OpenSea host a wide array of NFTs. One quick visit to the platforms and you will come face to face with everything from memes to fashion designs to crypto arts and much more. It is a never-ending list, and so is the potential of these platforms.

Both provide gasless minting to motivate NFT creators

It is hard to maintain the mileage of the NFT space without paying the network validators their due. Without them, the proof of chain might cease to exist. Many think that these “gas fees” are valid, attributing the high energy costs to run and maintain the Ethereum blockchain. However, the rising number of visitors to the blockchain means more intensive operations and, thus, rapidly increasing gas fees – a quick way to make the entrants of the NFT space lose interest.

Opensea and Rarible, desiring the opposite of this situation and wanting to bring more people into the NFT ecosystem, have implemented the lazy or gasless approach. Therefore, you can mint on these marketplaces in peace without worrying about the gas fees.

Both have a 2.5% trading fee

If there is no concept of minting – gas fee – how does Opensea and Rarible generate revenue to stay afloat? The answer lies in trading fees. Users have to pay a set percentage of the revenue generated from the NFT-sale. In the case of both Opensea and Rarible, there is a 2.5% trading fee.

Security is questionable in both

Despite tooting the horn of decentralization wherever prevalent, blockchain has always had a problem with security. The libertarian approach of “giving control to the people” has had many positive aspects. But the negative ones that are there are undeniably more disturbing.

Rarible and Opensea both have had their share of fraudulent incidents. In Rarible’s case, there was the fraudulent minting of $RARI, while in the case of Opensea, the recent smart contract exploit led some users to lose their NFTs to a phishing attack.

Both are trying to consolidate more security measures. However, the nature of decentralization might push a secure future of blockchain a bit farther. If you’d prefer to buy and trade NFTs on a large crypto exchange, check out our reviews of those:

Cryptoassets are a highly volatile unregulated investment product.

Differences between Opensea & Rarible

The core of differences between Rarible and Opensea is how they integrate users into the marketplace. The original ideology of Rarible is to give marketplace control to the users. This ideology has allowed it to gain a significant crowd in a short timeframe.

Since more users joined the platform within a short time, Rarible became motivated to take a democratic approach to govern the platform. It uses a democratic process to manage the infrastructure.

On the other hand, you have OpenSea, a decentralized yet traditional platform, and it has a broad scope and a multi-chain approach that sets the precedence for future NFTs. However, the control of the marketplace still lies in the hands of the few.

Decentralization

Both Opensea and Rarible rely on blockchain infrastructure so that users are not inconvenienced by the need for intermediaries.

However, when comparisons are drawn, Rarible is more decentralized. The Users are treated as the platform’s stakeholders, and they are issued $RARI governance tokens – instruments to control various aspects of the marketplace.

OpenSea does not have a fully decentralized model. The decision-making process is left to the developers, which has attracted much criticism recently, especially with their handling of the current policy that restricted the number of NFTs a user can place.

This decision was reversed, but it still doesn’t change that Opensea is not interested in establishing decentralized governance for the marketplace.

Royalty Fee

The allure of passive income motivates NFT creators to list their tokens. When listing their NFTs, the creators can add a clause that allows them to earn a percentage of revenue generated by the NFT on a secondary marketplace.

Opensea and Rarible have taken a different approach to this. Opensea has restricted the Royalty fee to 10%. Rarible, on the other hand, has provided leeway to the NFT creators, allowing them to set the royalty fee as high as 50%.

Rarible vs Opensea – The Verdict

Deciding between the two is difficult as they both host some of the best NFTs to buy. They both have a 2.5% trading fee. Both have had security issues in the past.

You might choose to use both, and other marketplaces on secure crypto exchange such as Binance. Overall choosing the right NFT marketplace for you might depend on several factors:

- Your familiarity with the space – both marketplaces can suit your requirements if you are a beginner. Both take an inclusive approach and thus, have made the interface intuitive

- Your position in the NFT ecosystem – how much you want to integrate with the NFT space. Do you want to become an NFT stakeholder desiring to have a say in the operations of the space? Or, are you just a crypto artist passing by and looking for a place to list your creations and profit from them? Rarible allows for the highest NFT royalties for creators

- Your payment method – Opensea caters to those with Crypto wallets. Rarible, on the other hand, has also integrated credit card payments to attract true outsiders of blockchain.

Both Opensea and Rarible have their strengths and weaknesses. To choose the one suitable for you, ask yourself how you want to interact with the marketplace and how much farther you want to dive into this ecosystem.

Cryptoassets are a highly volatile unregulated investment product.