Periods of market volatility are a standard element of the ‘economic cycle’, meaning investors must be prepared to shift their approach to deal with pricing changes. During volatile periods, certain stocks don’t perform as well, whereas others are relatively resistant – meaning it’s a good idea to get an overview of the investment situation before a recession occurs.

With that in mind, this guide discusses several stocks that do well in a recession by exploring the ways in which they can withstand bearish investor sentiment. We’ll also cover several factors to consider when investing during a recession before highlighting a popular broker that offers potentially recession-proof stocks.

The decision to invest in stocks during a recession shouldn’t be taken lightly, as equity prices can be highly volatile and may move in ways that don’t make sense initially. Furthermore, stocks in specific industries may be particularly susceptible to recessionary effects due to their debt position or target market. However, presented below are eight stocks that do well during a recession, as noted by various leading media outlets. We’ll discuss each of these stocks in the following section, covering the ways in which they are able to withstand adverse recessionary effects.

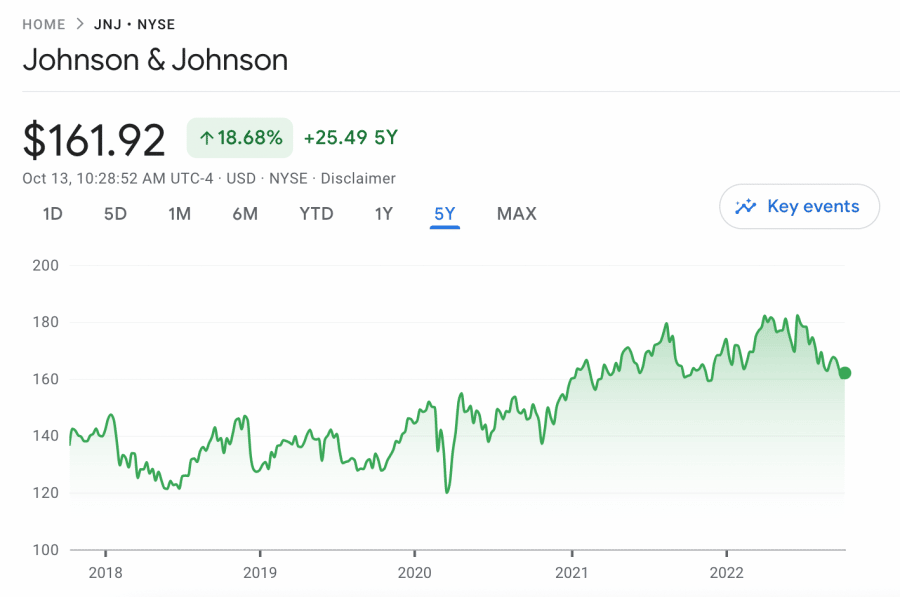

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. Those wondering how to invest $1,000 (or any amount) during a recession must know which stocks are particularly susceptible to the ‘market cycle’. The market cycle refers to periods of growth and decline that occur in the stock market – with the latter usually resulting in slowed (or reduced) revenue and net income for many companies. With that in mind, let’s take a closer look at the potentially recession-proof stocks listed above – as many analysts and market commentators believe these companies are well-suited to dealing with the turbulence caused by market cycles. Like many biotech stocks, Johnson & Johnson is also heavily involved in R&D to promote human health and well-being. Aside from the pharmaceutical side of things, the company also has a foothold in the consumer health segment, producing and marketing various over-the-counter medicines and beauty products. Johnson & Johnson often features on lists of stocks that do well in a recession due to its diversified product range. Moreover, the company has been around since 1886, meaning it has survived over 15 major recessions. The main reason is that consumers still need the products Johnson & Johnson offers, regardless of the prevailing economic conditions. According to Forbes, many consider JNJ shares a ‘safe haven’ during recessionary periods due to this consistent level of demand and strong credit rating. What’s more, JNJ shares fell by just 21% during the 2008-2009 financial crisis, whereas the S&P 500 fell by 54%, highlighting the company’s resilience.

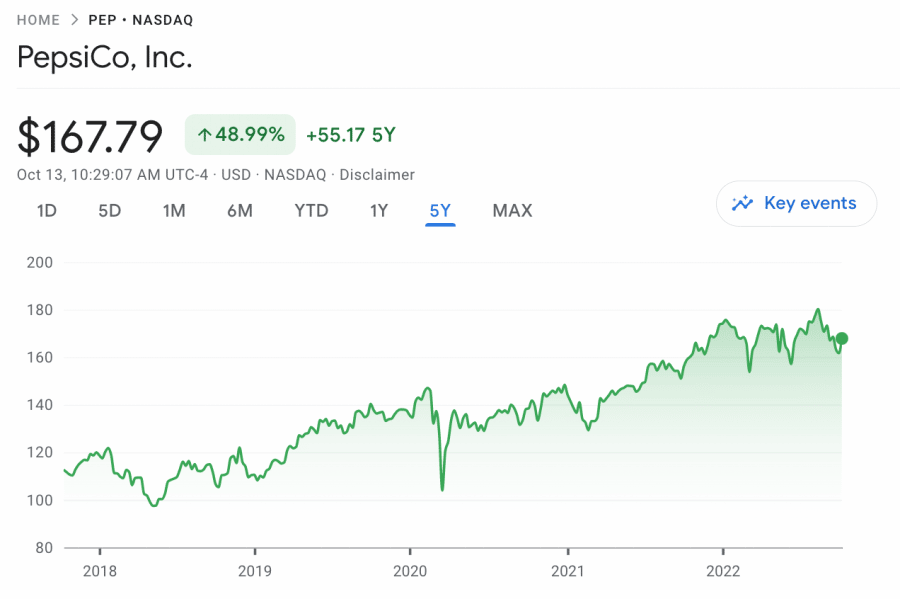

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. This global behemoth makes its money by producing, distributing, and marketing all of its own products. Moreover, PepsiCo is well-known for its regular acquisitions, as the company tends to buy any food and beverage brand that is beginning to gain a significant market share. PepsiCo appeals to those looking to buy stocks during a recession because the company’s products may even experience an uptick in demand during challenging economic periods. When a country is in recession, people tend to stay at home and avoid eating out, instead opting for snacks and other accessible foods – like the ones that PepsiCo markets. PepsiCo is already performing relatively well in this down phase of the market cycle, with the company’s Q2 2022 earnings results noting a 5.2% increase in revenue. Adjusted earnings per share (EPS) also beat analysts’ estimates – highlighting how resistant PepsiCo is to rising inflation levels.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. Procter & Gamble has made a name for itself as one of the most popular dividend stocks – providing comfort to investors during times of recession. At the time of writing, PG shareholders receive a quarterly dividend of $0.9133 per share. This equates to a yield of 2.8%, which is nearly 1% higher than the S&P 500 average. Much like Johnson & Johnson and PepsiCo, Procter & Gamble offers consumer necessities, meaning the company will retain strong demand in times of recession. Moreover, Procter & Gamble is in the midst of a share buyback scheme and has purchased over $1.25bn of its own shares in the past two quarters. This is an excellent way for companies to prop up the share price and tends to be viewed as a bullish signal. Finally, the company even had free cash flow (FCF) of $13.67bn in fiscal 2022, according to Macrotrends – highlighting that it has the cash position to sustain any headwinds.

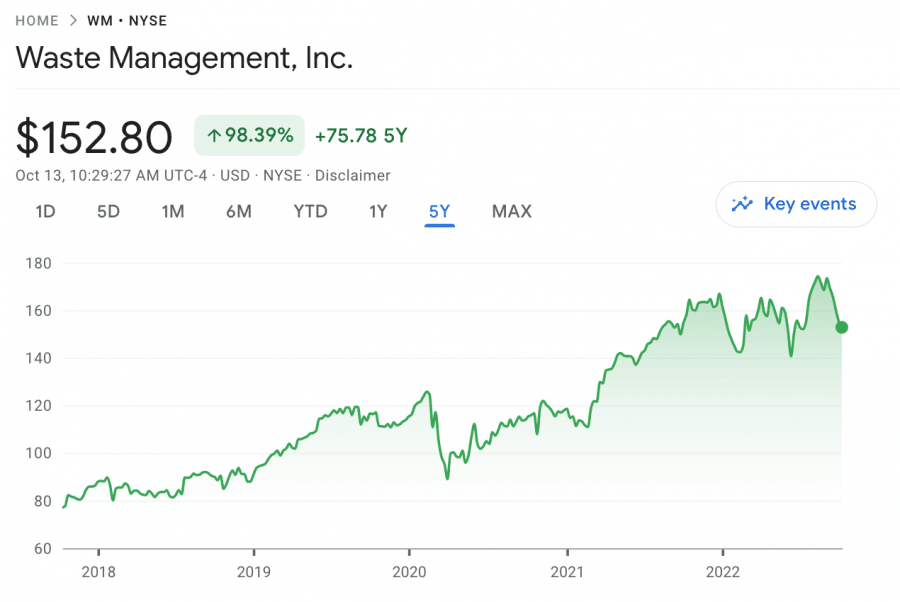

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. WM is consistently on lists of the most undervalued stocks due to the nature of the service that the company provides. Regardless of whether there’s a recession or not, people still need their waste collected. Since Waste Management has a market share of over 53%, the company is in a prime position to satisfy these needs. Many analysts consider Waste Management one of the top recession-proof stocks due to its resilience. This is evidenced by WM shares returning 4.8% during the financial crisis of 2008, whereas the S&P 500 was down over 36%. Moreover, the WM share price has risen 102% in the past five years, highlighting that it can weather any storm. Finally, Waste Management also pays a dividend of $0.65 per quarter, equating to a yield of 1.7%. Since the company’s executives have now increased this dividend for 18 straight years, WM shares are suitable for investors looking to gain a recurring income stream during times of recession.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. According to Statista, British American Tobacco was the third-largest tobacco company in the world in 2021, generating over $97bn in revenue. Like many tobacco companies, British American Tobacco has opted to pay a pretty hefty dividend to compensate for operating in an ‘unethical’ industry. BTI shareholders currently receive a dividend per share of 54.45p, distributed every quarter. This provides a yield of 6.7% – significantly higher than the FTSE 100’s average dividend yield of 4.15%. Much like the other companies on our list, BTI shares are popular during a recession because demand for cigarettes and tobacco is inelastic. Regardless of the economic conditions, people still need to smoke, meaning British American Tobacco’s sales remain relatively stable. This means that the company’s share price tends to bounce back quickly during recessionary periods.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. Due to its lineup of diversified brands, Kraft Heinz tends to be relatively recession-resistant. Moreover, the company is in a great position to increase the price of its products in line with inflation since they are consumer necessities. In its recent Q2 2022 earnings report, although overall sales were down 0.9%, Kraft Heinz noted a 7.2% increase in international sales year-over-year (YoY). This helped the company make a net profit of $265m, thanks to management’s decision to lower the debt burden in previous years – meaning Kraft Heinz saved vast amounts on interest payments. Even though 2022 has been challenging for most companies, the KHC share price is only down by 1% at the time of writing. What’s more, KHC shares took just four months to supersede the lows experienced in March 2020 at the onset of the COVID-19 pandemic – highlighting its ‘bouncebackability’.

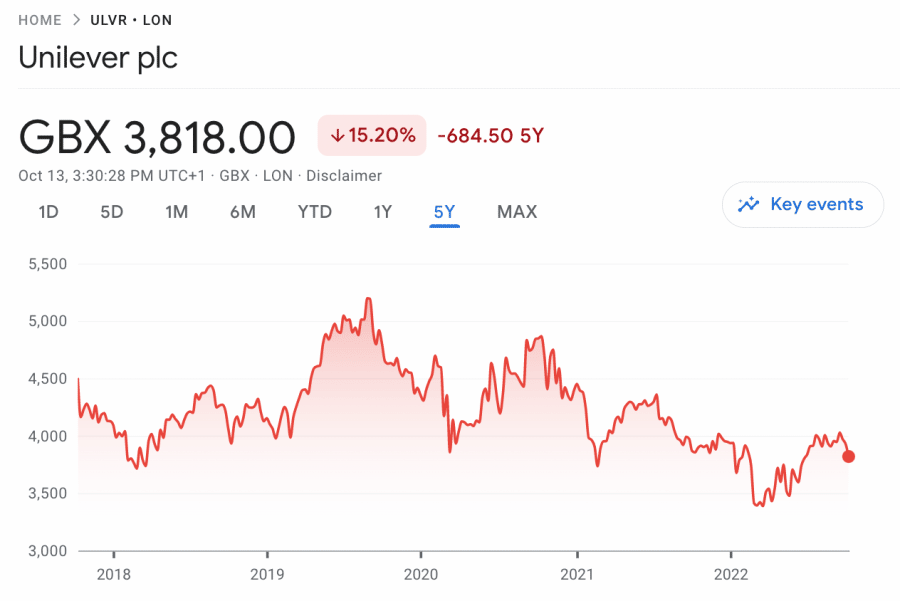

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. One of Unilever’s main strengths is that it owns a variety of household brands. These include Dove, Axe/Lynx, Ben & Jerry’s, Omo/Persil, and Magnum. Due to this stellar lineup, Unilever was able to generate €54.44bn ($53.15bn) in revenue during 2021 – a 3.39% increase from 2020. Since Unilever produces an array of consumer staples, demand for the company’s products is relatively inelastic. This has meant that annual revenue has been between €50bn and €55bn in each of the past five years. Although this may not seem like impressive growth, it highlights how stable Unilever’s demand and sales are. Now that Unilever has a foothold in many emerging markets worldwide, over 2.5bn people use the company’s products daily. Combine this with a dividend yield of 3.72%, and it’s clear why many analysts believe Unilever is one of the most-effective stocks to buy during a recession.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. Those researching how to invest according to Reddit will often see McDonald’s pop up in threads discussing recession-proof stocks. This is because the MCD share price has been shown to be highly resilient. For example, the MCD share price has fallen by just 8% YTD at the time of writing, whereas the S&P 500 is down by nearly 24%. McDonald’s can withstand recessions because it is considered a ‘cheap’ fast food chain, meaning consumers can still afford to eat at McDonald’s, regardless of the economic conditions. Moreover, McDonald’s still spends heavily on advertising and has a huge brand presence – meaning it’s the most likely to withstand economic headwinds. The company has also benefitted from the rise in popularity of home delivery apps like Uber Eats and DoorDash, which aided the company during the COVID-19 pandemic. Finally, McDonald’s still had over $1.8bn in cash reserves at the end of Q2 2022, as reported by Yahoo Finance, meaning the company has a financial safeguard from any extended periods of economic decline. Readers may also be interested in our guide to recession-proof crypto assets.

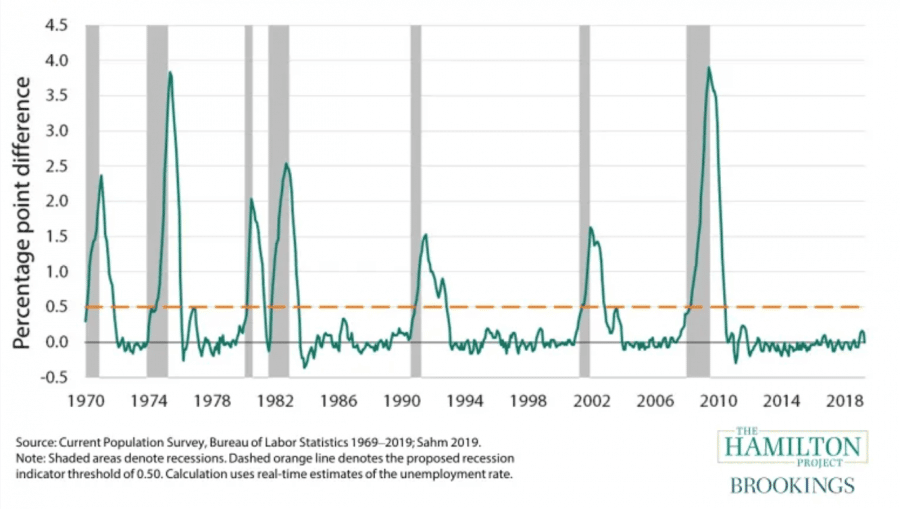

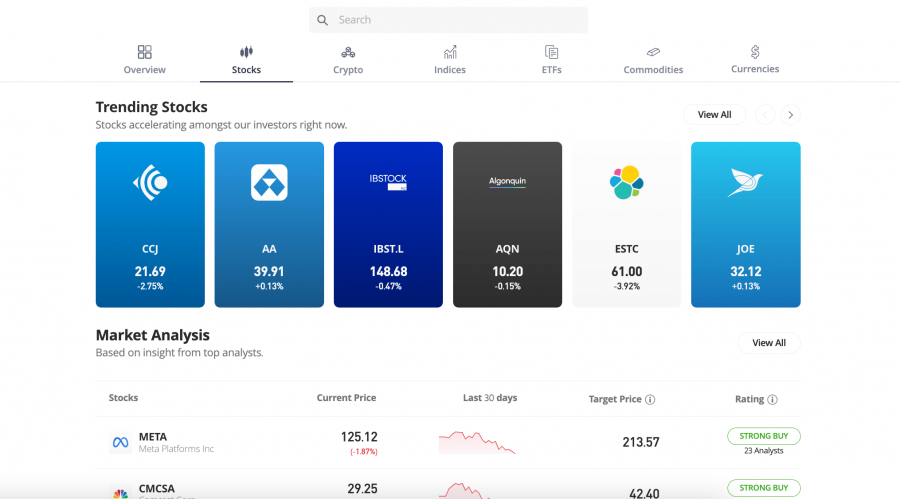

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. Before looking for stocks that outperform in a recession, investors must understand what a recession actually is and how it affects specific industries. According to The Economist, a recession is a period of significant decline in economic activity. In turn, this leads to reduced output and investment. As an added effect, recessions also cause net income to fall for many businesses, causing higher unemployment. However, quantifying a recession can be challenging – because different countries have different ways of determining when they are in a recession. For example, the UK government defines a recession as two consecutive quarters of negative gross domestic product (GDP) growth. On the other hand, some Asian countries believe this measure is too ‘basic’ and utilize additional metrics to identify periods of economic decline. Due to these contrasting approaches, it can be challenging to know when a country is truly in a recession. So how do recessions affect stocks? Regardless of whether an investor is seeking cheap stocks, dividend stocks, or penny stocks, it’s important to note that prices can be highly volatile during recessionary periods. Since recessions affect demand for products in many industries, this tends to result in reduced profits – which are viewed as a bearish signal by the market. Moreover, many investors seek out ‘safe haven’ assets during a recession, meaning they liquidate their equity positions in favor of assets like gold. This can lead to a broad sell-off in the stock market, which causes further downward pressure on prices. Although many people opt to invest in bonds during a recession as a way to lock in a guaranteed rate of return, there are still ways that equity investors can protect themselves from the high level of market volatility. With that in mind, detailed below are four of the main things to consider when investing during a recession: Perhaps the most important thing to bear in mind when investing during a recession is to seek out the shares of companies operating in resilient industries. The most popular recession-proof stocks come from sectors with ‘inelastic’ demand, meaning demand remains relatively stable regardless of the economic conditions. Some examples of resilient industries include consumer stables, tobacco, waste management, and even fast food. Although not all of the companies that operate in these industries will be immune to recessionary effects, many are capable of withstanding the headwinds effectively. Another approach investors may wish to take is to purchase dividend stocks. As the name suggests, these stocks pay dividends either quarterly, bi-annually, or annually – ensuring shareholders are able to receive a consistent level of income. This income can be vital during a recession, as it helps prop up the total returns of investment portfolios. However, it’s also important to note that, due to decreased profits, some companies may opt to cut dividends – or even remove them altogether. Thus, investors mustn’t rely entirely on dividend income since it may not be as ‘permanent’ as expected. Whether investors are looking to invest $2,000 or $20,000, it’s crucial to have an overarching strategy that informs stock-picking decisions. Notably, the strategy that may have worked during times of expansion may not necessarily work during a recession – so it’s always wise to have a ‘Plan B’. One of the most popular approaches during a recession is to utilize dollar-cost averaging. This involves investing a specific amount in an asset at regular intervals, thereby removing the emotional component of trading. By taking this approach, investors can build up a solid position in the asset whilst benefiting from lower entry points. Finally, there are certain assets that are probably best avoided during a recession since they are hit harder than most. Growth stocks are particularly susceptible to economic decline, as the related companies rely heavily on profits to fund R&D and develop new products. When these profits are reduced, it hampers these actions. Tech stocks are a prime example of equities that struggle during a recession. Although bit hitters like Apple and Amazon will always have demand, more niche companies can be adversely affected when consumers have less discretionary income. As a result, their revenues can take a hit – which inevitably affects the share price. Most trading platforms will offer stock trading services, meaning investors have an array of options in this regard. However, through extensive research and testing, we’ve found that eToro is a suitable option for investors looking to buy or sell stocks during a recession. eToro is one of the world’s largest online trading platforms, serving over 28 million clients globally. Much of eToro’s superb reputation is derived from its high level of safety. This is bolstered by regulation from tier-one organizations like the FCA, ASIC, CySEC, FinCEN, and FINRA. Investors can buy stocks on eToro with no commissions since eToro includes its fees in the market spread. This spread remains competitive across the board and is especially tight for highly-traded equities. eToro users can trade over 2,000 stocks from more than 15 markets, ensuring there’s always an array of opportunities on offer. eToro’s minimum deposit threshold is just $10, with users able to fund their accounts via credit/debit card, bank transfer, or e-wallet – including PayPal, Skrill, and Neteller. Deposits are free if made in USD, whilst the platform doesn’t charge any withdrawal or monthly account fees. Finally, eToro’s ‘CopyTrader’ feature can also be helpful to those looking to invest during a recession. This feature enables users to automatically copy the trades placed by high-performing eToro traders. Since many of these traders have produced double-digit returns in recent years, this can give beginners a solid chance of market success.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. In summary, this article has explored a selection of potentially recession-proof stocks, highlighting what they do and why they are so resistant to economic decline. Ultimately, no company in the world is entirely immune to recessions. The nature of economic cycles means that most companies will have to deal with headwinds. However, by reviewing the information presented in this guide, investors can have a clearer idea of which companies may be best-suited for periods of economic turmoil. 8 Potentially Recession-Proof Stocks in 2023

A Closer Look at Stocks That Have Outperformed a Recession

1. Johnson & Johnson (JNJ) – Popular Recession-Proof Stock in the Pharmaceutical Sector

2. PepsiCo (PEP) – Recession-Resistant Stock in the Food & Beverage Industry

3. Procter & Gamble (PG) – Top Dividend Stock for Times of Recession

4. Waste Management (WM) – Resilient Stock with Regular Dividend Increases

5. British American Tobacco (BTI) – Leading Tobacco Company with Inelastic Demand

6. Kraft Heinz Co (KHC) – Popular Stock for High-Inflation Environments

7. Unilever (ULVR) – Consumer Staples Company with Vast International Presence

8. McDonald’s (MCD) – Fast-Food Giant with a Strong Cash Position

What Happens to Stocks in a Recession?

Things to Consider When Investing During a Recession

Seek ‘Recession-Proof’ Industries

Think About Investing in Dividend Stocks

Opt for a More Suitable Investment Strategy

Avoid High-Volatility Assets

Brokers That Offer Potential Recession-Proof Stocks

Conclusion

FAQs

Which stocks do well in a recession?

What are some recession-resistant stocks?