All forms of forex trading will invite an inherent level of risk, and ultimately – even seasoned investors will encounter regular losses.

However, when adopting sensible risk management strategies, exposure to financial loss can be significantly reduced.

In this beginner’s guide, we discuss 10 approaches to risk management in forex that can be implemented today.

Best Forex Risk Management Tools & Strategies – Top 10 List

Beginners learning about risk management in forex for the first time might consider the 10 tools and strategies outlined below:

- Deploy a stop-loss order – Limit potential losses on each position placed

- Set up a take-profit order – Lock in profits by stipulating a target exit price

- Market knowledge – Traders should become an expert in their preferred markets

- Start with a demo account – Trade forex in live market conditions without risking money

- Avoid trading with high leverage – Keep leverage limits in check to avoid large losses

- Always opt for limit orders – Choose the entry price that a position should be executed

- Utilize a forex trading app – Never be more than a click away from the forex markets

- Bankroll management – Limit stakes in relation to the brokerage account balance

- Risk-reward ratio – Stick with a suitable risk-reward ratio when entering trades

- Be aware of trading fees – Avoid losing money on winning trades because of fees

The best thing about risk management in forex is that all of the above strategies and more can be implemented collectively. This will give traders the best chance possible of trading forex in a risk-averse manner.

Read on to find the answer to the question – what is risk management in forex and what strategies are best utilized?

Best Risk Management Strategies in Forex Reviewed

In this section of our guide, we will take a deep dive into the 10 best risk management in forex, in terms of strategies and tools.

Be sure to read through each explanation to ensure that proper risk management in forex is undertaken.

1. Deploy a stop-loss order – Limit potential losses on each position placed

The first and perhaps most important tool to consider when assessing risk management in forex is stop-loss orders. As the name implies, the purpose of this tool is to prevent losing positions from spiraling out of control. In a nutshell, the trader can achieve this goal by specifying the price at which the losing forex trade should be closed.

This is stipulated at the point of creating the respective forex order. In its most basic form, let’s suppose that a forex trader is going long on EUR/GBP. They have identified that a suitable stop-loss order should be executed at 2% below the entry price. This means that should the trade value decline by 2%, the broker will close the position.

Irrespective of how much further the price declines, the trader will have already closed the position at a 2% loss. However, when setting up a stop-loss order, the exit point needs to be stated in terms of the asset price and not the percentage amount. With this in mind, let’s look at a more realistic example of deploying a stop-loss order when trading forex.

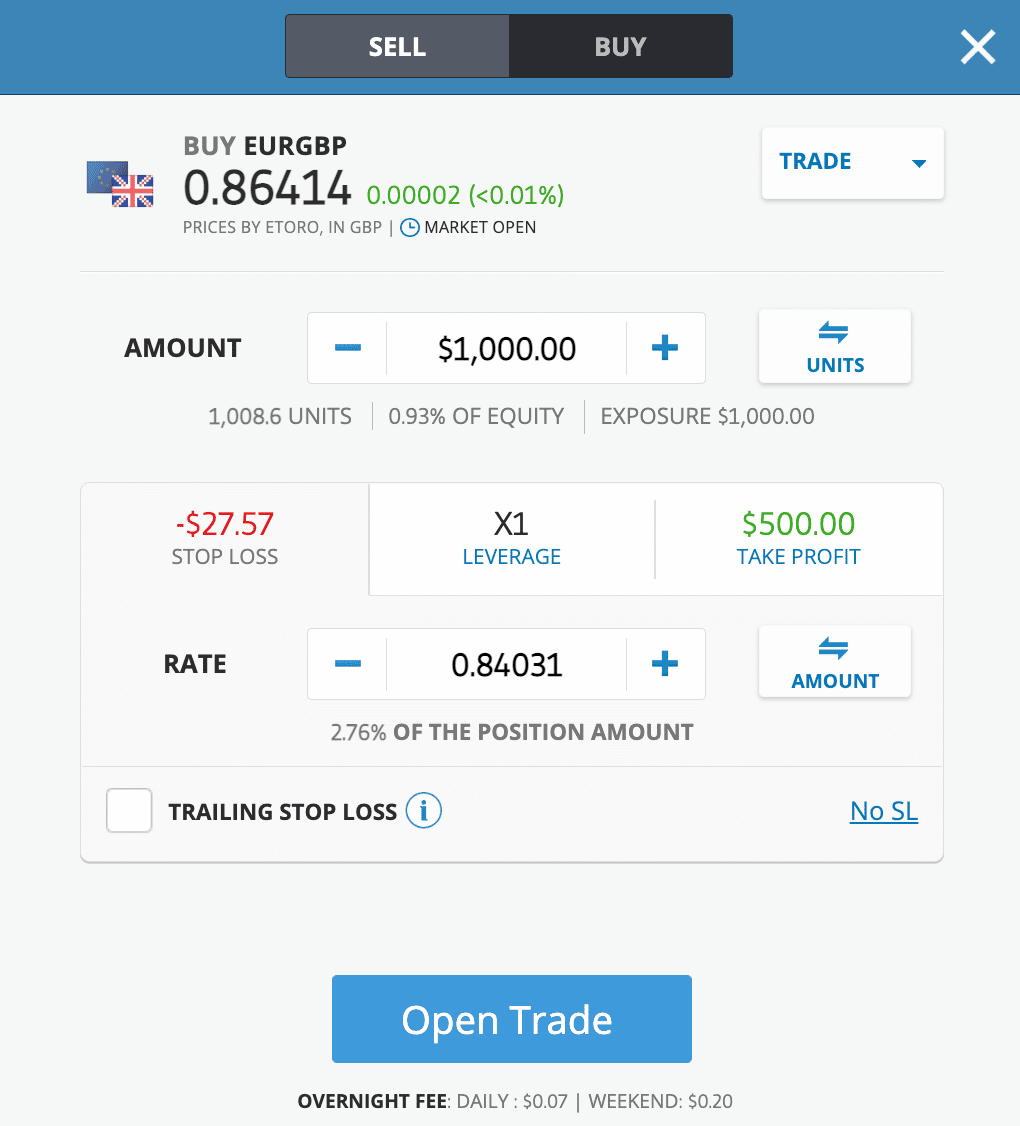

- The trader is going long on EUR/GBP with an entry price of 0.86414

- $1,000 is staked on this position

- The trader wishes to cap their losses to 2.76% of this trade

- As such, the stop-loss order is created at 0.84031

- This means that if EUR/GBP hits a price of 0.84031, the trade will be closed at a 2.76% loss

In terms of what level to set the stop-loss order, there is no right or wrong order. For instance, some traders will implement a 1:3 risk and reward ratio, respectively. This means that the forex trader will look to make gains of 3%, while only risking 1% of the staked amount. Therefore, in this example, the stop-loss would need to be deployed at 1%.

Another thing to remember is the direction of the stop-loss order. For instance, those going long on a forex pair would need to set the stop-loss below the entry price. While short-sellers, on the other hand, would need to place the stop-loss order above the entry price.

- Furthermore, and perhaps most importantly, it is crucial to note that stop-loss orders are far from guaranteed.

- By this, we mean that when the forex markets are overly volatile, the stop-loss order might fail to get matched.

- If this happens, the stop-loss will not be honored by the broker, and thus – the value of the position will continue to decline.

- Only when the trader manually closes the position will they be able to exit the trade.

There are two additional safeguards that can be taken in this respect. First, the best forex brokers in this space offer ‘guaranteed’ stop-loss orders. In this scenario, irrespective of market conditions, the broker must honor the stop-loss price. This will, however, result in the trader paying a high fee, which is usually built into a wider spread.

Second, the trader can also set up price alerts in the event that a guaranteed stop-loss is not offered by the broker. This will notify the trader via email, SMS, or push notifications when a certain price has been triggered. This would then allow the trader to watch over the trade manually.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. Use a take-profit order – Lock in profits by stipulating a target exit price

If you’ve ever asked yourself the question ‘is forex trading profitable?‘ then you’ll be pleased to learn that there are certain orders you can put in place to help hedge against potential losses and market volatility. Once the stop-loss position has been specified by the trader, there is one more element that should be taken into account – the take-profit order. Put simply, take-profit orders work in a very similar way to the aforementioned stop-losses – but in reverse. That is to say, instead of protecting losses, the trader will be locking in their target profit level.

- For example, let’s suppose that the trader believes that the British pound is about to enter a prolonged downward trend against the US dollar.

- They suspect that the decline of GBP/USD could be as much as 4% over the next day or two.

- However, to reduce the risk of this position, the trader wants to exit the trade at a profit of 3%.

In order to achieve this goal, the trader could, of course, sit at their device for hours on end – subsequently waiting to exit the position once the 3% profit target has been met. A more efficient and risk-averse way to do this, however, is by setting a take-profit order. This will instruct the broker to close the trade when its value increases by 3%.

Take-profit orders not only ensure that the trader doesn’t have the manually watch over the markets. On the contrary, they are ideal for locking in a profit target that is only just about triggered. For example, let’s say that although the trader set a take-profit of 3% on a short position, the trend only declined by 3.2% before reversing.

Had the trader missed this rapid trend reveal, they likely would not have been able to lock in their gains without the aid of a take-profit order. In order to calculate the required take-profit price, the trader should first determine whether they are going long or short.

Those going long should deploy the take-profit above the entry price. Short-sellers should deploy the take-profit below the entry price.

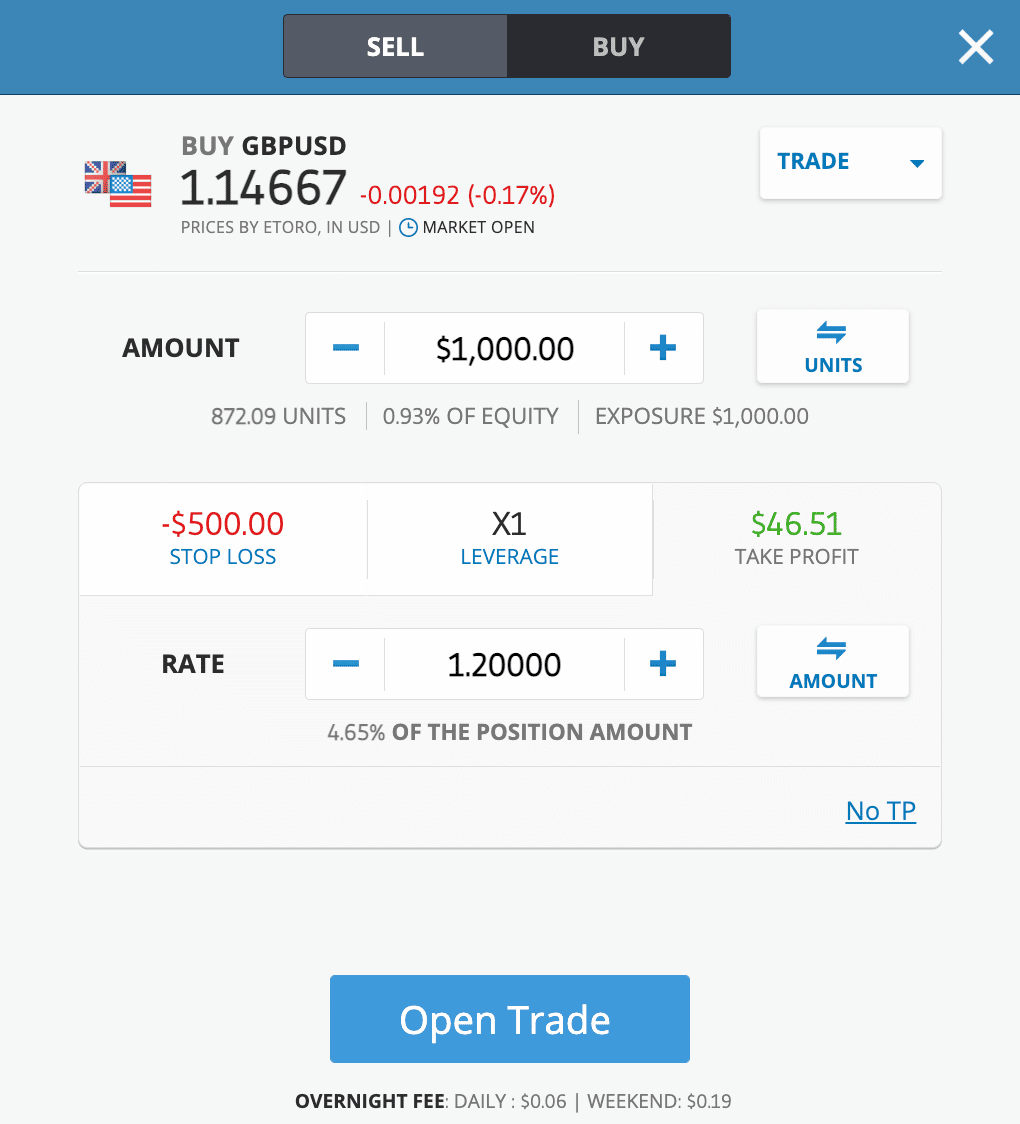

- For example, in the image above, we can see that the trader is going long on GBP/USD at an entry price of 1.14667.

- They speculate that a suitable profit margin on this position is 4.65%.

- Therefore, the take-profit order is set at 1.20000

- If GBP/USD increases to 1.20000, the broker will close the position automatically and the trader will secure gains of 4.65%

Just like stop-losses, we should note that take-profit orders are never guaranteed by forex brokers. However, unlike stop-losses, rarely do online brokers offer a ‘guaranteed’ take-profit. If a take-profit order is not executed by the broker, this will likely be because of extreme volatility. The broker should, however, look to close the trade at the next best available price.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

3. Market knowledge – Traders should become an expert in their preferred markets

What is Forex trading? We can’t stress the importance of becoming an expert in the forex market being traded. On the one hand, some forex brokers offer more than 100 tradable pairs, which is great for market diversification. However, being a master in each and every currency pair is an unlikely thesis. After all, no two forex pair relationships are the same.

With this in mind, to follow risk management in forex, the trader should hone in on a small selection of pairs. This will give the trader the best chance possible of becoming an expert in the respective pairs, as opposed to becoming a Jack of all Trades and a master of none.

A good starting point here is to focus on major pairs. As we explain in more detail later, majors attract the greatest levels of volume and liquidity. As a result, these marketplaces are often less volatile than minors and exotics, and spreads are usually more competitive.

So that begs the question – how to use proper risk management in forex in terms of education? Well, the internet is jam-packed with free educational resources. Therefore, there should be no requirement to actually pay for a course – at least while learning the basics. Moreover, the best trading platforms in the forex space offer in-house educational tools.

Understanding the basics of forex trading is also an important factor to consider when trying to manage risks. Our article on ‘what is a pip in forex?‘ is just one example of several educational articles we have on the topic of forex investing.

For instance, at eToro, beginners will have fee-free and unfettered access to a wide range of forex trading guides and educational videos. The eToro Academy also hosts regular webinars and podcasts, which enables beginners to tap into the expert knowledge of seasoned currency traders.

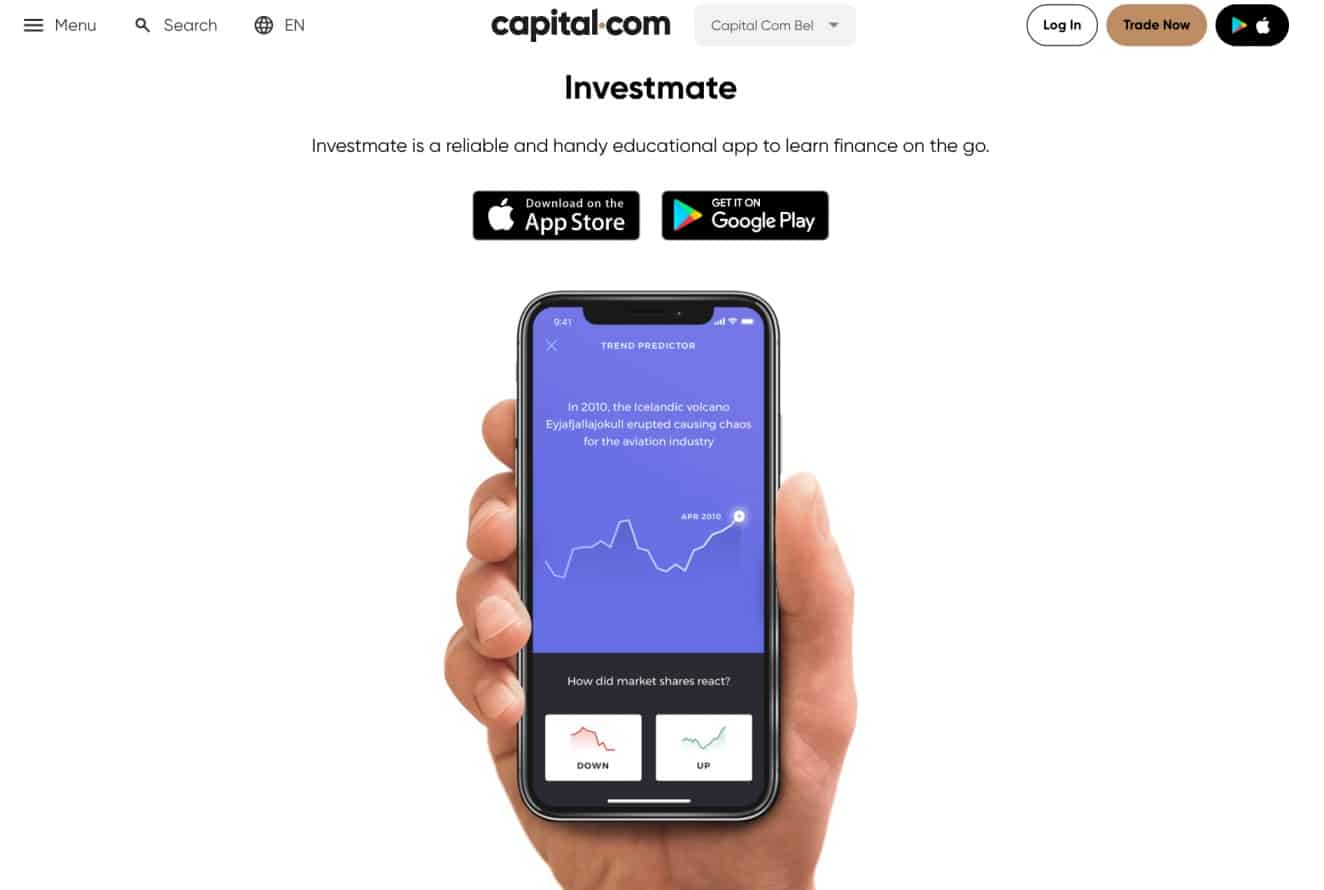

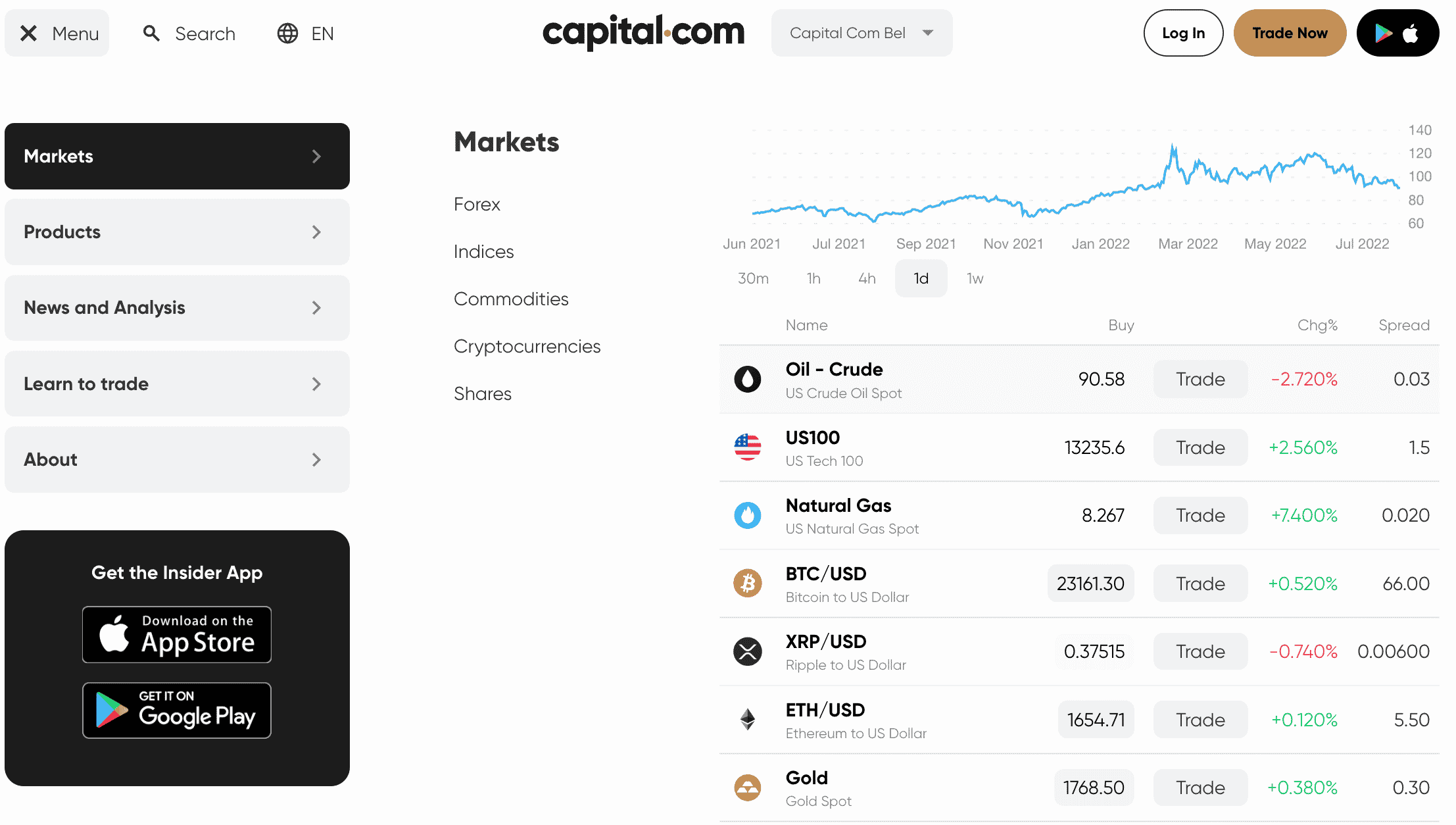

Another platform that is strong in forex trading education is Capital.com. In addition to its online educational materials and tools, Capital.com has developed and launched a proprietary mobile app for forex traders to learn on the move. The InvestMate app for iOS and Android even comes with a selection of mini-courses and quizzes.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

4. Start with a demo account – Trade forex in live market conditions without risking money

One of the best tools available when learning how to use risk management in forex is demo accounts. In fact, demo accounts enable traders to learn the ropes of forex trading without risking a single cent of capital. On the contrary, demo accounts come pre-loaded with ‘paper money’. As such, each and every trade that is placed is executed in a risk-free environment.

It is important for beginners to choose a demo account provider that is offered by the forex broker they actually plan to use. After all, demo accounts are not only great for learning core forex trading concepts, but also for getting to grips with the brokerage platform itself.

Furthermore, the demo account should come with a suitable amount of paper trading funds and, ideally – come without any time restrictions. For instance, the forex demo accounts offered by Capital.com and eToro come pre-loaded with $10,000 and $100,000, respectively.

At eToro, there is no limit in terms of the duration of the demo account. This means that traders can switch between ‘real’ and ‘virtual’ portfolios at the click of a button. However, other forex brokers in this space will often only provide access to their demo trading facility for 30 days – sometimes less.

It is also important for the trader to choose a demo account that actually mirrors live market conditions. This will ensure that the trader has access to realistic trading experiences – in terms of price action, analysis, volume, liquidity, and more. Once the trader is comfortable with their chosen forex strategy, only then should they consider trading with real funds.

Learn More: Read our beginner’s guide on demo trading accounts in the market today for stocks and forex.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

5. Avoid trading with high leverage – Keep leverage limits in check to avoid large losses

Next up in our guide on risk management in forex is leverage. Now, leverage can be both a blessing and a curse – depending on the outcome of the forex trading position. For those unaware, leverage is a crucial tool in the forex trading space for those without access to large sums of capital.

After all, currencies are traded in lots of 100,000 units. Meaning, that 1 lot of EUR/USD would require an upfront stake of €100,000 – or about $99,000. Naturally, the vast majority of traders – perhaps other than financial institutions, hedge funds, and banks – will not be in the market to trade six-figure sums.

Instead, casual traders will need to utilize leverage. Fortunately, when trading at a beginner-friendly forex broker like eToro, the minimum stake requirement is 0.01 lots, which means $1,000 on a standard US dollar-denominated pair. Moreover, retail clients can obtain leverage of 30:1 on major pairs at eToro, which brings the total stake down to just over $33.

However, regulated brokers will cap the amount of leverage accessible to retail clients for good reason. After all, leverage will amplify both winning and losing forex traders. This is why, as a beginner, it is best to limit the amount of leverage applied to a trade. Crucially, traders should stick with standard retail client limits.

We say this because some online brokers – which are typically located offshore, will offer much higher leverage limits to retail clients. We have come across high-leverage forex brokers offering multiples of 1,000x and more, which represents a significant amount of risk to be taking.

Another thing to remember is that leverage can result in the trade being liquidated. This will happen if the value of the forex trade declines by a certain amount. For instance, entering a position worth $50,000 with leverage of 50:1 would only require a stake of 2% – or $1,000. However, if the trade value declines by 2%, the broker will liquidate the position and keep the $1,000 stake.

Furthermore, and perhaps most importantly, some offshore brokers do not offer negative balance protection. This means that if the trader loses more than they have in their account balance, they might be liable to pay the difference back to the broker. This means that the trader will become indebted. As such, this should be another reminder to always stick with regulated brokers.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

6. Always opt for limit orders – Choose the entry price that a position should be executed

Earlier on in this guide on risk management in forex, we explained the importance of deploying both stop-loss and take-profit orders. To reiterate, this will ensure that losses are capped and that profits are locked in. However, there is one more decision that needs to be taken when setting up a risk-averse forex order.

That is to say, the trader will need to choose from either a market or limit order when setting up the trade. A market order enables the trader to execute the position instantly, at the next best available price. However, don’t forget that the forex market prices change as every second passes. Therefore, market orders are all but certain to attract slippage.

In a nutshell, slippage refers to the gap between the price at the time the position was placed against the actual executed order. For example, the trader might aim to buy GBP/USD at 1.1500 but the result of slippage means that the order was executed at 1.1510. This represents slippage of 10 pips.

With this in mind, traders should instead opt for a limit order when attempting to master risk management in forex trading. Put simply, a limit order enables the forex trader to choose the price that the trade should be executed. For instance, GBP/USD is trading at 1.1510 but the trader wants to enter a long position only when it drops to 1.1475.

If and when GBP/USD hits a value of 1.1475, the forex broker will execute the position. This risk management strategy ensures that the trader enters the market at the most favorable price possible. It also highlights that the trader is entering positions with a lot of thought, with the view of maximizing gains.

For instance, the trader might have identified that although EUR/USD has been in a prolonged downtrend for several days, a market correction is very likely. The best way to profit from this thesis is for the trader to enter a suitable limit order at the price at which the market correction is estimated to occur (perhaps based on the RSI).

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

7. Utilize a forex trading app – Never be more than a click away from the forex markets

Although not traditionally associated with risk management in forex, we can’t stress enough how important it is to have access to a trading app. The vast majority of forex brokers have designed their own native trading app for both iOS and Android devices, and this will connect to the main account of the user.

As a result, the trader can access their account 24/7, irrespective of where they are, simply by opening the app. Let’s look at an example of why trading apps are super important in the context of forex risk levels.

- Suppose that the trader has a long position on GBP/CAD

- The UK government has just announced an unprecedented quantitative easing program, which will subsequently devalue GBP

- As a result, GBP/USD begins to decline in value at a rapid pace and due to the extremely volatile market conditions, the trader’s stop-loss order is not executed

- Fortunately, the trader can open their forex app to close the position manually

However, as per the above example, if the trader did not have access to a forex trading app, they would not have been able to close their declining position. Instead, they would have had to wait until they had access to their primary desktop device. Having access to a forex app offers many other benefits than just being able to close a losing order.

For instance, there might come a time when the trader is on the move and they notice a major red flag on the EUR/USD chart. As such, they can attempt to capitalize on this by creating a new order via the trading app. Moreover, the best trading apps in this space provide conventional analysis tools that have been optimized for smaller screens.

This even includes the ability to perform technical analysis. Another forex risk management tool that goes hand-in-hand with an app is the ability to set pricing alerts. For instance, if the trader wishes to be alerted when GBP/USD hits 1.17000, a notification will be sent to their phone in real time.

Learn More: Read our comparison guide of the 10 best forex trading apps.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

8. Bankroll management – Limit stakes in relation to the brokerage account balance

Bankroll management is a tried and tested strategy when it comes to preserving forex trading capital. In a nutshell, the main concept of this forex risk management strategy is that stakes should be capped based on the trader’s balance. This ensures that the trader never risks too much money on a single trade – no matter how confident they are.

For example, let’s suppose that the trader deposits $10,000 worth of capital into their forex brokerage account. Moreover, the trader has elected to deploy a bankroll management strategy that limits stakes to 2% of the account balance. This means that on a balance of $10,000, the maximum trade that can be placed on an individual position is $200.

Let’s then say that the trader is on a good run of form, and thus – they now have a balance of $15,000. This means that the maximum trade size has increased in line with the balance, up to $300. In the following month, however, the trader has since entered a prolonged losing streak and subsequently, the balance has dropped to $7,000.

This means that stakes are now limited to $140, which is 2% of the $7,000 balance. Crucially, the idea here is that when the trader organically increases their balance, they have the freedom to trade with a higher stake. Equally, when the balance declines because of poor trading decisions, bankroll management ensures that stakes are reduced.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

9. Risk-reward ratio – Stick with a suitable risk-reward ratio when entering trades

In addition to bankroll management, the importance of creating a risk-reward threshold is super important when trading forex as a beginner. While experienced traders that have a firm grasp of technical analysis will look to set their own entry and exit points, this won’t always be feasible for a newbie.

Instead, having a solid risk-reward ratio in place will ensure that the trader can enter and exit positions in a risk-averse manner. In its most basic form, this will entail selecting two key percentage ratios. First, the trader will need to decide how much risk they are willing to take on each position. This might, for example, be 1% of the total stake.

This would mean that for every $100 staked, the trader would not want to lose more than $1. As we covered earlier, the best way to achieve this is through a stop-loss order. Second, the trader will need to decide how much profit they wish to make on each trade that is entered. A common threshold here is 3%.

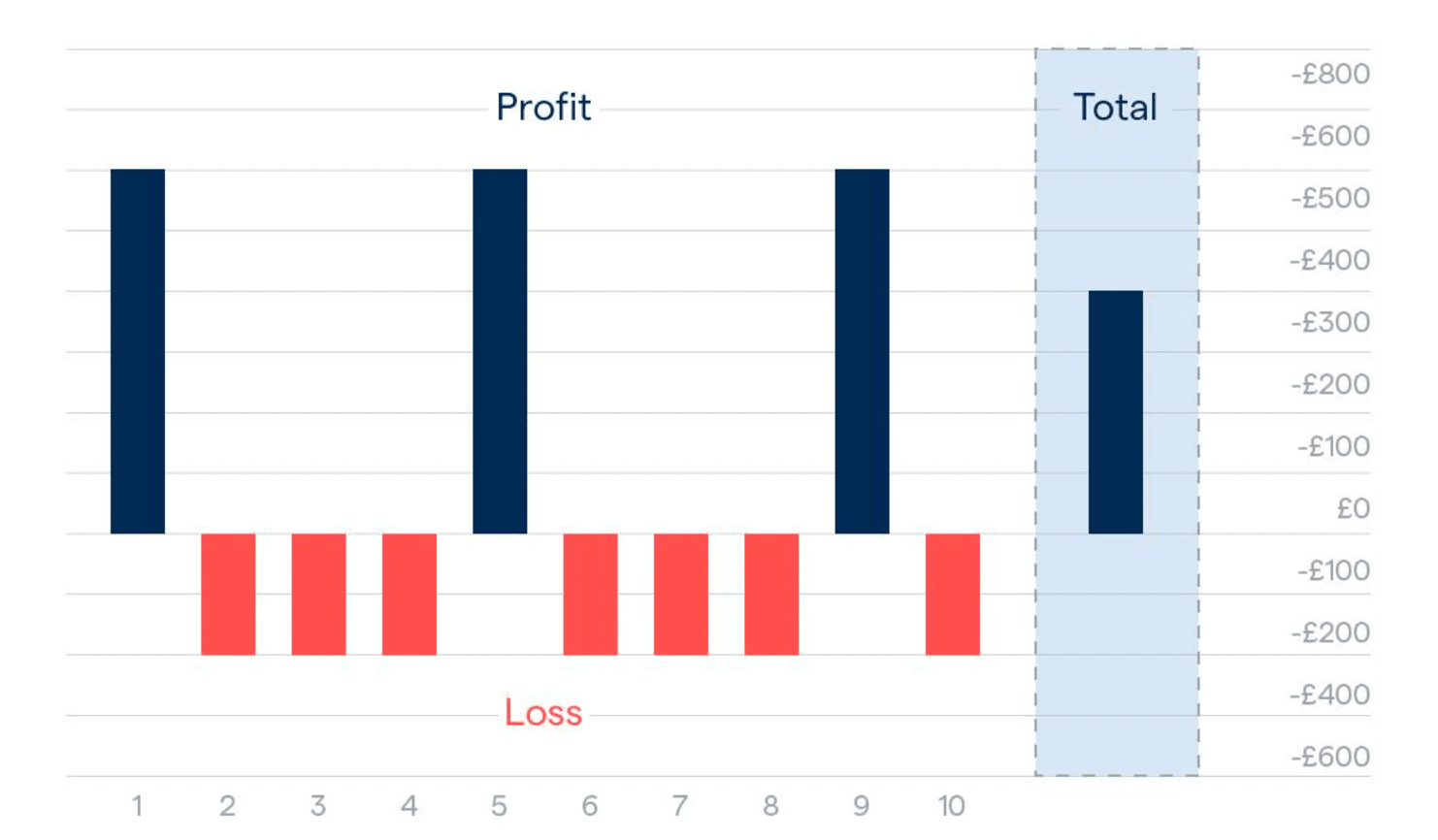

Either way, this can be executed via a take-profit order when entering the position. In this example, a risk-reward ratio of 1:3 has been opted for, which is common in the forex trading space. This means that for every $1 risked, the trader wishes to make $3. As a result, over the course of 10 trades, a profit will still be made even if 7 are losing positions.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

10. Be aware of trading fees – Avoid losing money on winning trades because of fees

The final area that we will discuss today in this guide on risk management in forex is with regard to trading fees. Put simply, inexperienced investors will often enter the forex market without having any grasp on the fees they are paying. This is a crucial mistake to make, as fees will ultimately eat into potential profits.

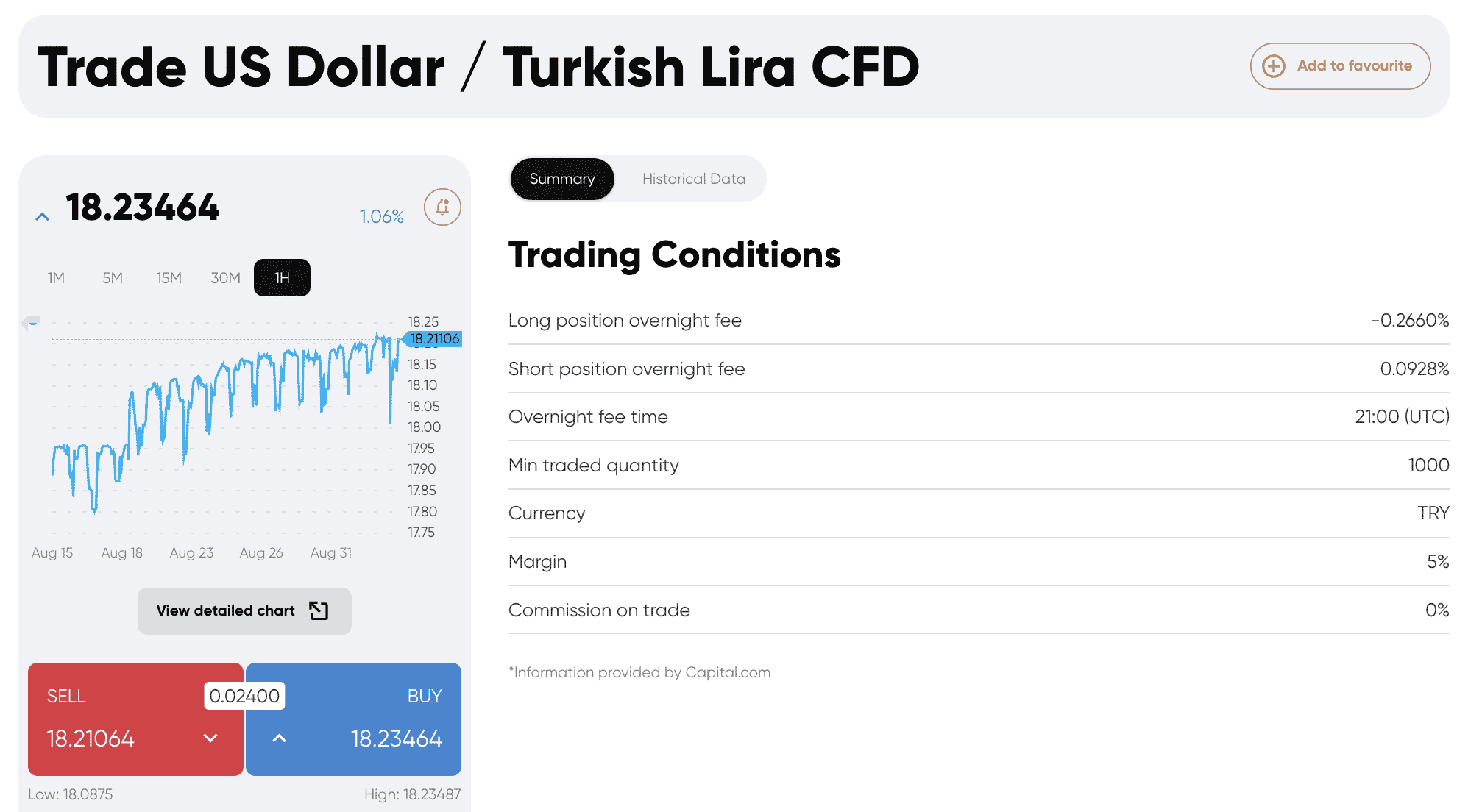

As a result, in order to rectify this risk, traders should ensure that they know the intimate details of what spreads, commissions, and overnight financing charges their chosen broker will implement. First and foremost, the spread is an indirect fee, so to speak, as it represents the gap between the bid and ask price of a currency market.

For instance, let’s say that the trader is speculating on an exotic pair like USD/TRY, which has a spread of 3%. This means that as soon as the position is open, the trader will immediately be 3% in the red. Thus, a position of $100 would already have declined to $97 the very second the trader is open.

As a result, gains of 3% on this position will need to be made just to get back to the break-even point. Spreads also need to be taken into account when the trading position is closed. Traders should also be aware of what commissions are in place at the chosen forex broker. This might be charged as a percentage of the total order size or a flat fee.

Another trading cost that is often not taken into account is the swap fee. Otherwise referred to as overnight financing, this is a fee charged when the forex position remains open after standard market hours. To avoid this fee, the trade will need to be closed manually. With that said, some forex brokers offer swap-free accounts, albeit, these typically come with wider spreads.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Where to Trade With Forex Risk Management Strategies in 2023

In order to utilize the 10 forex risk management strategies that we have discussed today, it is crucial to find a suitable broker. For instance, the forex broker will need to offer multiple order types, including stop-losses, take-profits, and limits.

In addition to offering low and transparent fees, the forex broker will need to offer a demo account, access to educational tools, and a proprietary mobile app that connects to the trader’s main account.

Below, we offer reviews of a small selection of brokers that are ideal for risk management in forex.

1. Capital.com – 0% Commission Forex Trading With a Variety of Risk-Management Tools

The first forex trading platform to consider for the purpose of risk management practices is Capital.com. This platform is regulated by the FCA, ASIC, NBRB, and CySEC – so Capital.com users can buy and sell forex pairs in safety.

Capital.com requires a minimum deposit of just $20 when adding funds with a debit/credit card or e-wallet, which is ideal for bankroll management. Bank wires are perhaps best avoided, as the minimum requirement jumps to $250. There are no deposit or withdrawal fees charged at Capital.com on any supported payment types.

After the account is funded and verified, Capital.com users have access to 138 forex pairs. Each and every major, minor, and exotic pair can be traded on a 0% commission basis. Capital.com is also very transparent when it comes to spreads and overnight financing fees – both of which are displayed when clicking on a forex pair.

Spreads start at 0.6 pips when trading EUR/USD at Capital.com, which is competitive. When it comes to placing a trade, Capital.com supports multiple order types. This includes orders related to risk management in forex, such as stop-losses, take-profits, and, limits. Capital.com offers leverage, but this is in line with regulated markets.

For instance, most retail clients at Capital.com will be capped to leverage of 1:30 when trading major forex pairs. Capital.com also offers that all-important demo account. This comes loaded with $10,000 in paper funds and it mirrors live market conditions. There is also a strong educational facility on the Capital.com website.

This includes forex trading guides and videos, as well as a dedicated mobile app that comes with the quizzes and courses. All educational content at Capital.com is offered for free. To ensure that the forex markets are never more than a click away, Capital.com offers a popular trading app for iOS and Android. Capital.com also offers CFDs via stocks, indices, crypto, and more.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. Just like Capital.com, this ensures a safe, secure, and risk-averse trading environment for all. We like that US and UK clients will only need to meet a minimum first-time deposit of $10. Those based outside of the US/UK will need to deposit $50 or more. USD payments are fee-free, across both deposits and withdrawals. As noted earlier, it is important to assess the forex risk management lot size when choosing a broker. In the case of eToro, this stands at just 0.01 lots. eToro also offers retail clients leverage of up to 1:30 on majors and 1:20 on minors/exotics. This reduces the total stake requirement to enter a trade and most importantly – negative balance protection is in place. The latter ensures that the trader will never owe eToro money when a leveraged trade goes wrong. In terms of fees, eToro operates a spread-only pricing structure when it comes to forex, commodities, and indices. Real stocks and ETFs are commission-free, while crypto assets like Bitcoin and Ethereum attract a fee of 1% per slide. Spreads at eToro are variable, meaning they depend on broader market conditions. EUR/USD and EUR/GBP, for example, start at 1 pip and 1.5 pips, respectively. What we really like about eToro is that its overnight financing fees are not only transparent but clearly displayed in dollars and cents when setting up an order. For example, by typing a $1,000 stake into a EUR/GBP order box without leverage, eToro notifies us that the daily and weekend funding fees amounts to $0.20 and $0.61, respectively. By changing any of the aforementioned parameters, the overnight funding rate will update in real time. eToro is also known for its simple yet intuitive trading tools. This includes ProCharts, which offers a user-friendly way to perform technical analysis through economic indicators. eToro also offers a Copy Trading service that promotes passive investing. Users simply need to choose a trader and an investment stake ($200 minimum), and all future forex positions will be mirrored. eToro also offers a demo account feature, which, as we noted earlier, is crucial for risk management in forex. There is no time limit on the demo account and all users have access to $100,000 in paper trading funds. Finally, eToro offers a mobile app that is compatible with iOS and Android devices.

87% of retail investor accounts lose money when trading CFDs with this provider. The key takeaway today is that risk management in forex is crucial for long-term success. Whether that’s by placing stop-loss and take-profit orders, deploying a bankroll management strategy, or utilizing a demo account – the tools discussed today can help mitigate the risks of losing money. Overall, the best broker for executing risk management strategies is Capital.com. Beginners can get started with the risk-free Capital.com demo account in under five minutes, which comes preloaded with $10,000 in paper funds.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

Forex pairs

138

Charting

Proprietary, MT4, TradingView

Leverage

1:30 for retail clients

Deposit fee

None

EUR/GBP spread

1.5 pips (as of writing)

Commission

0% commission

Overnight fee (as of writing)

-0.0074% (long), 0.0025% (short)

2. eToro – User-Friendly Forex Broker With Low Fees and Top Features

Forex pairs

49

Charting

Proprietary, ProCharts

Leverage

1:30 for retail clients

Deposit fee

0.5% on non-USD payments, otherwise free

EUR/GBP spread

From 1.5 pips

Commission

Spread-only

Overnight fee (as of writing)

$0.20 per day on a $1,000 EUR/GBP long position. $0.61 over the weekend.

Conclusion

FAQs

What is the best risk management in forex?

How is risk management used in forex?

What is a risk management forex calculator?

What are forex risk management charts?

How do you set up risk management in trading?

What is the safest leverage in forex?

How do you manage forex risk for consistent profit?