There are many asset classes to trade online, albeit, stocks and forex typically dominate the attention of retail investors.

So that begs the question – what is the difference between forex and stock trading and which marketplace is a popular choice to target as a beginner?

In this Stock Trading vs Forex Trading comparison, we explore what each market offers in terms of upside potential, risk, and required strategies.

Stock Trading vs Forex Trading – Which is More Profitable?

To begin this Stock Market vs Forex Trading explainer, let’s start with the basics.

First and foremost, stock trading is the process of buying and selling company shares with the view of making a profit. The vast majority of stock investors will hold onto their shares for many months or years. Hence, stock trading is highly conducive for long-term investors.

- Profits can be made in two forms when trading stocks.

- First, if the value of the stock increases, the investor can sell the shares at a profit.

- For instance, let’s say that an investor buys 10 Tesla shares at $200 each and cashes out at $300.

- Across 10 shares, this would amount to a profit of $1,000.

- Second, many stocks pay dividends.

- This will see the company distribute some of its retained profits to stockholders, which is usually on a quarterly basis.

- This offers a passive way to generate income when trading stocks.

Now onto forex.

- The foreign exchange or forex market is the largest trading sector globally.

- It is estimated that each and every day, more than $6 trillion worth of currencies are traded.

- The main concept with forex is to assess whether an exchange rate between two currencies will rise or fall.

- Let’s take GBP/USD as a prime example. This currency pair consists of the exchange rate between the British pound and the US dollar.

- If GBP/USD is priced at 1.1604, the trader needs to assess whether this will rise or fall.

- When the trader predicts the correct movement of a forex pair, they will generate a profit.

- Unlike stocks, forex trades on a 24/7 basis.

But is forex trading profitable? In terms of what is more profitable in the context of stock trading vs forex, the latter will witness much lower levels of volatility. For instance, major currency pairs rarely move by more than 0.5% in a trading day.

Stocks, however, can move by double-digit percentages over the course of a day, and by even more over weeks or months. In terms of the relation between stocks and forex, there is little, if any, correlation between the two.

For instance, the stock markets are directly correlated to the strength of the economy. In the case of forex, currency exchange rates are typically determined by geopolitical events, such as interest rate hikes.

With that said, when the global economy is on the decline, this typically results in a strong US dollar in addition to falling stock prices.

Note: Is forex trading riskier than stocks? Not necessarily. As we discuss in more detail shortly, both forex and stocks present an inherent level of risk.

Best Stocks and Forex Pairs to Watch in 2023 – Top 10 List

In this section of our Stock Trading vs Forex Trading comparison guide, we will highlight some of the most popular markets in these two investment scenes.

Check out the list below, which highlights five popular stocks to trade:

- Tesla – One of the Most Popular Stocks for Retail Investors to Trade

- Devon Energy – Gains of 140% in Just 12 Months of Trading

- Coca-Cola – Dividend King That has Increased its Annual Payment for 60 Consecutive Years

- Meta Platforms – Leading Tech Stock With a Huge Market Correction of Over 50%

- Coinbase – Volatile Growth Stock for High-Risk Traders

Next, we highlight five popular forex pairs to trade:

- EUR/USD – Most Traded Forex Pair Globally

- GBP/USD – Prolonged Decline Since 2016 Might Appeal to Longer-Term Traders

- USD/TRY – Hugely Volatile Pair for High-Risk Traders

- USD/CHF – Stable Forex Pair During Volatile Times

- USD/ZAR – Volatile Currency Pair That Continues to Appreciate in Value

Top 10 Stocks and Forex Pairs Reviewed

Those looking for some inspiration on what stocks to buy and which forex pairs to trade will find the following sections useful.

Let’s start with stocks.

Tesla – One of the Most Popular Stocks for Retail Investors to Trade

Tesla was founded in 2003 and it is now the largest car maker globally. Tesla is best known for its electric vehicles (EVs), albeit, this large-cap stock has a range of other growing divisions. This includes proprietary artificial intelligence (AI), which fuels its driverless car technology. Tesla is also involved in mega-watt batteries, charging stations, and solar energy.

Tesla went public in 2010, opting for the NASDAQ exchange. Since then, Tesla has gone on to become one of the largest companies in terms of market capitalization. In fact, since its IPO, Tesla stock has grown by over 20,000%. In August 2022, Tesla shareholders voted for a 3-for-1 stock split. This makes Tesla stock more affordable.

With that said, brokers like eToro support fractional share trading. This means that it is possible to invest just $10 into Tesla stock, rather than paying over $250 for a full share. Although Tesla management is considering introducing a dividend policy, this is yet to be the case. Nonetheless, Tesla stock has generated returns of over 1,000% in the prior five years of trading.

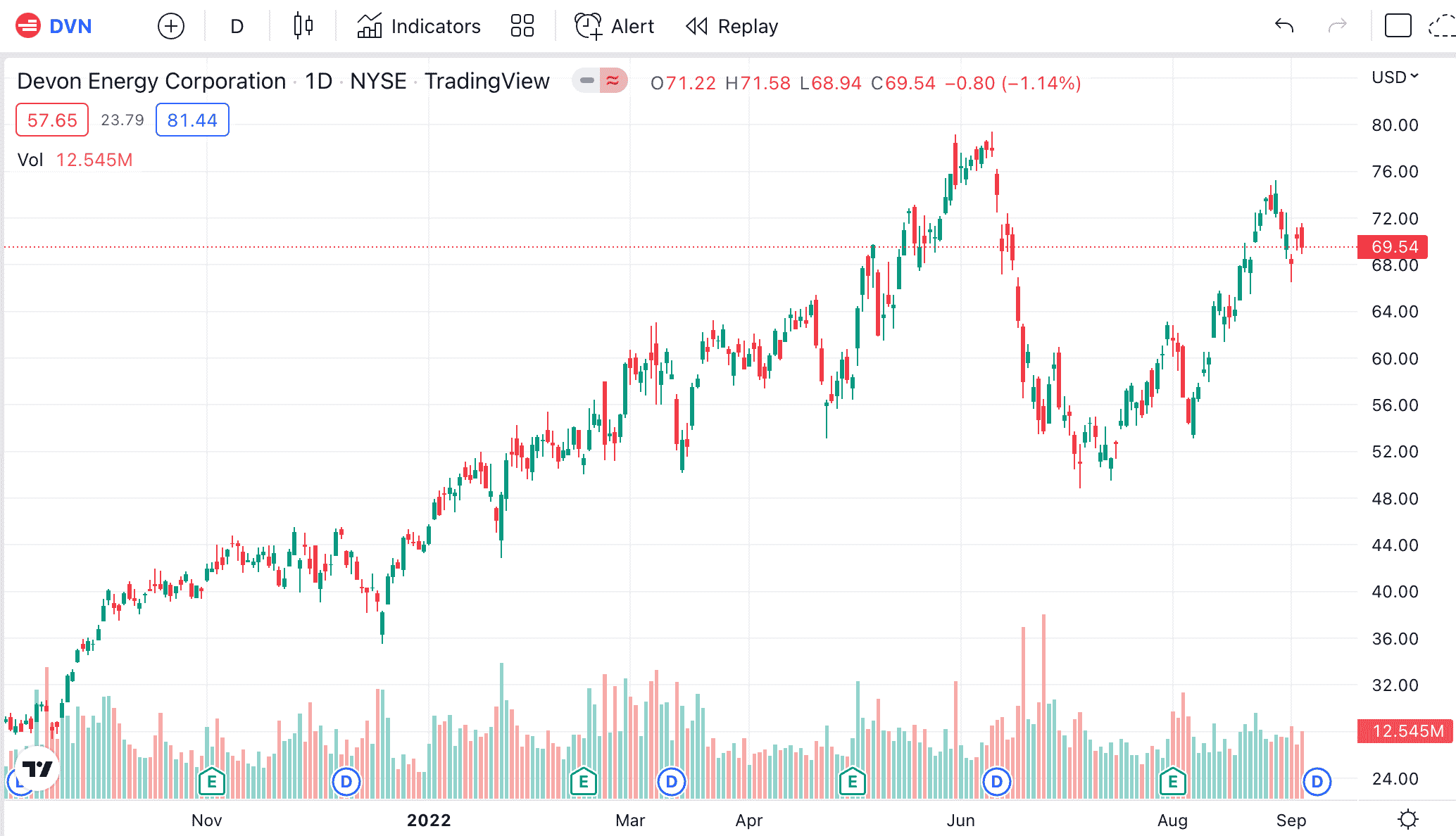

Devon Energy – Gains of 140% in Just 12 Months of Trading

Devon Energy will perhaps suit short-term investors that are looking to generate above-average gains. The reason for this is that Devon Energy operates in a cyclical sector – oil. Based in the US, Devon Energy was founded in 1971. The firm specializes in hydrocarbon exploration and as such – has benefited tremendously from rising energy prices.

After all, this enables oil stocks like Devon Energy to generate higher margins. In fact, based on growth over the prior 12 months, Devon Energy is one of the best-performing stocks on Wall Street – with gains of nearly 140%. In comparison, the S&P 500 has declined by 13% over the same period.

Not only has Devon Energy generated sizable capital gains over the prior year, but it is also a top dividend payer. Based on prices as of writing, Devon Energy stock is offering a running dividend yield of 6.70%. Moreover, the firm is carrying a P/E ratio of just 8.8 times, which is low considering the amount of growth it has generated over the prior year.

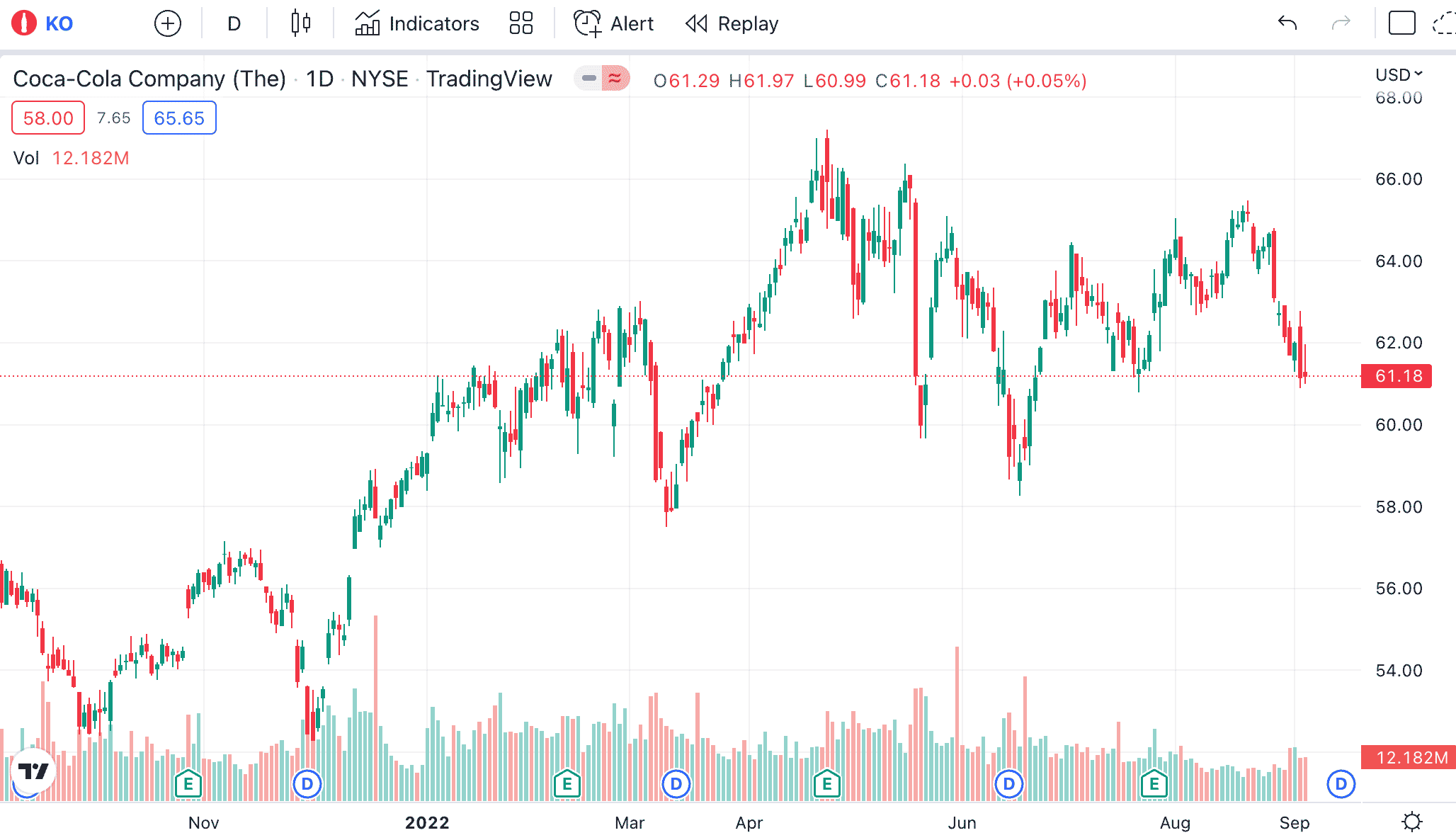

Coca-Cola – Dividend King That has Increased its Annual Payment for 60 Consecutive Years

Income seekers will often search for the best dividend stocks with the view of generating wealth passively. One of the most popular stocks on Wall Street for this purpose is Coca-Cola. This beverage giant is a solid dividend king, not least because it has increased the size of its annual payment each and every year for six consecutive decades.

This means that even during multiple recessions and stock market corrections, Coca-Cola has continued to increase its dividend. This should illustrate the robustness and stability of Coca-Cola’s global business model. In terms of its stock price performance, Coca-Cola has outperformed the broader market over the prior year.

As noted, while the S&P 500 has declined by 13% over the past 12 months, Coca-Cola stock has increased by nearly 10%. Perhaps one of the main reasons for this is that Coca-Cola is defined as staple stock – meaning that it sells products that remain in demand even during times of economic uncertainty.

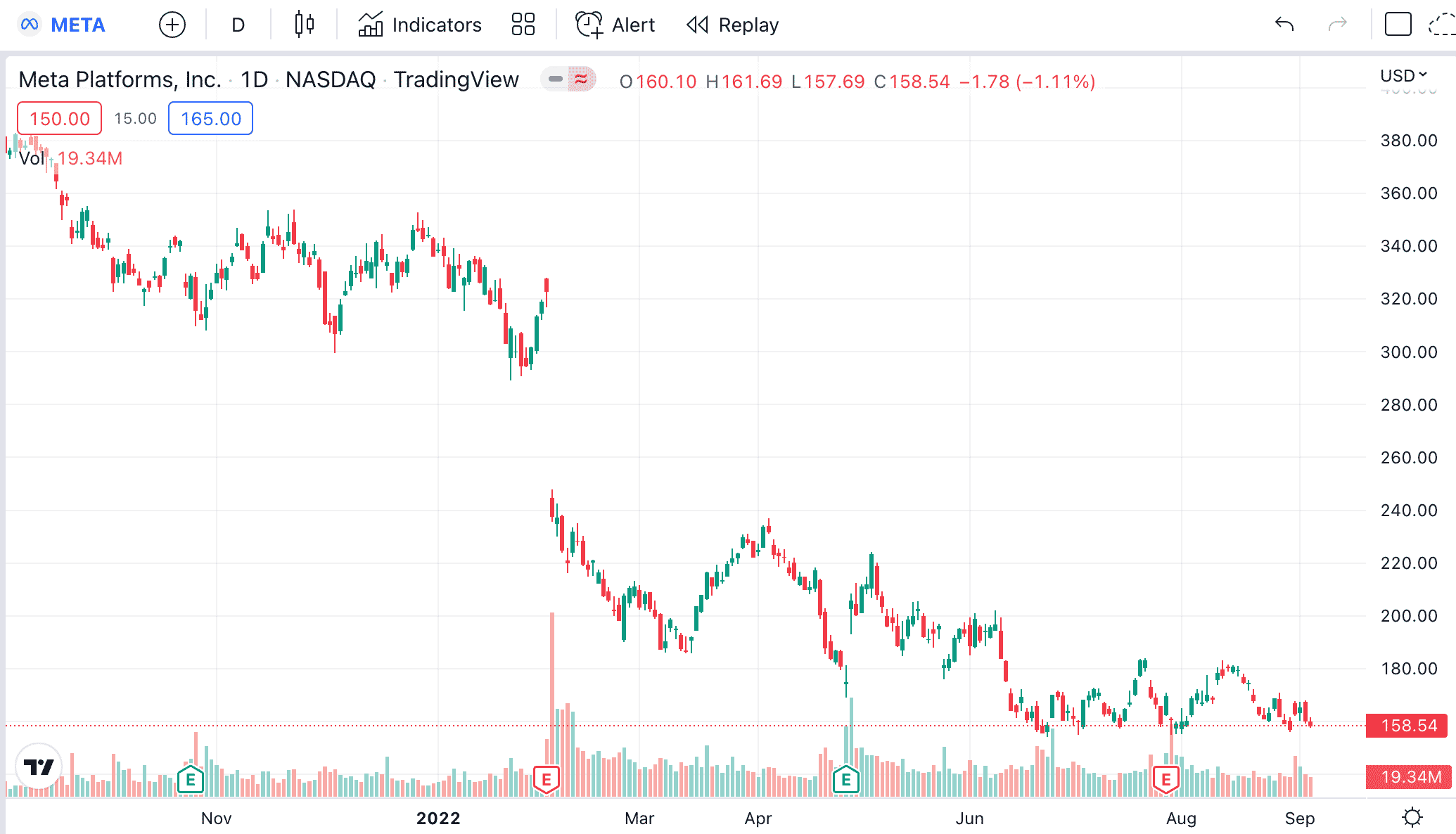

Meta Platforms – Leading Tech Stock With a Huge Market Correction of Over 50%

While the S&P 500 has dropped by 13% over the prior year of trading, the downfall for Meta Platforms has been significantly greater. Meta Platforms, formally trading as Facebook, has seen the value of its stock decline by more than 50% in just 12 months. Perhaps even more alarming is the fact that over a five-year period, Meta Platforms stock is down 7%.

Over the same timeframe, the S&P 500 has grown by nearly 60%. As a result, Meta Platforms continues to underperform the broader stock market. However, it is important to remember that Meta Platforms is the parent company of the most prominent social media platforms globally.

This means that across the likes of Facebook, Instagram, and WhatsApp, it is estimated that more than 2.8 billion people globally use at least one Meta Platforms product each and every day. This means that Meta Platforms have access to more than 35% of the world’s population on a daily basis. Therefore, a discounted entry price of more than 50% for those looking to buy Meta stock could appeal to value seekers.

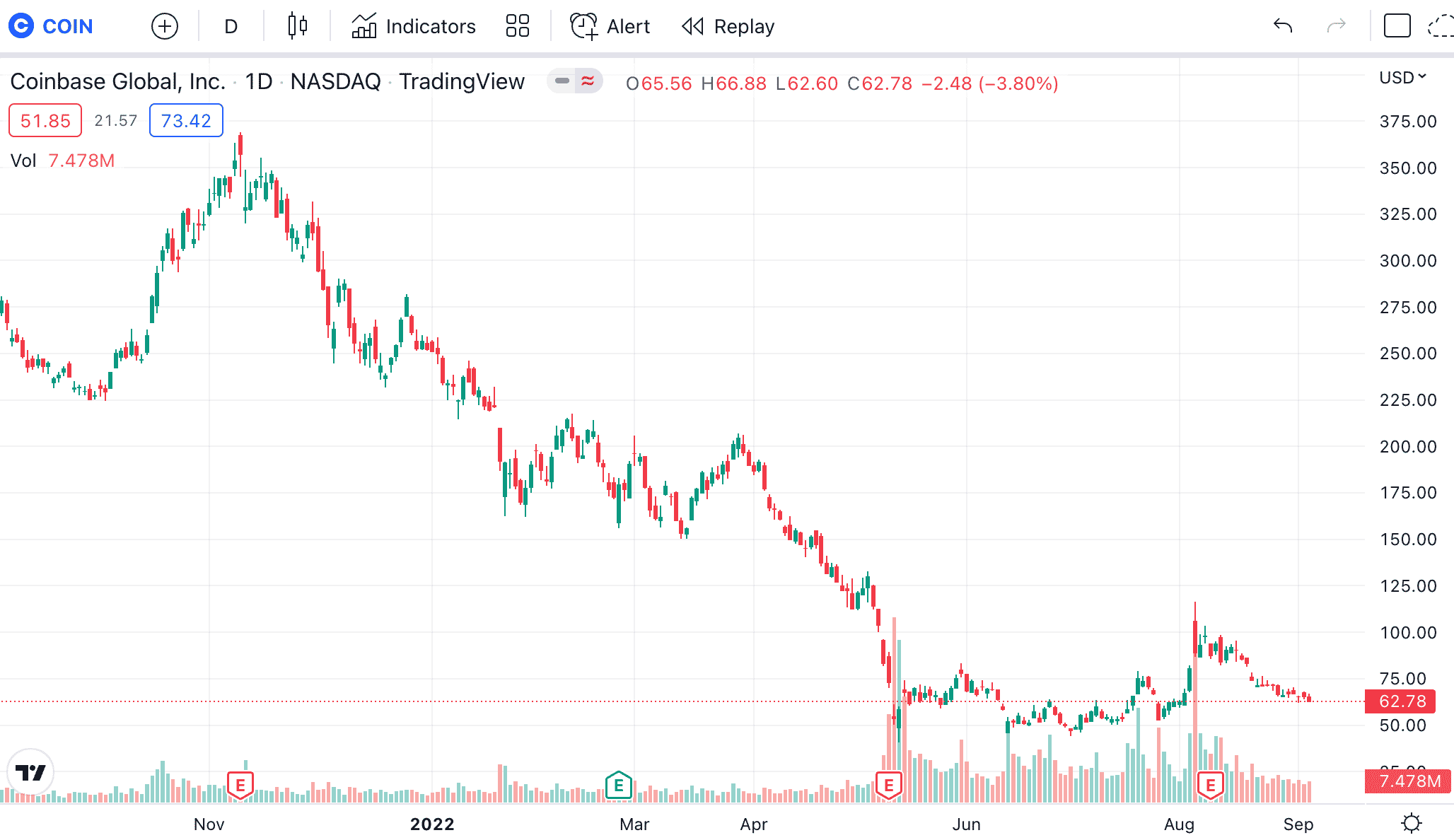

Coinbase – Volatile Growth Stock for High-Risk Traders

Those in the market for volatile stocks to trade might wish to explore Coinbase. Founded in 2012 and going public as recently as 2021, Coinbase is one of the largest crypto exchanges globally, with nearly 100 million verified clients on its books.

However, Coinbase is also a super-volatile stock which might also suit short-term speculators. For instance, in just one week of trading, Coinbase stock has witnessed lows of $62 and highs of $69. Over the same period, the stock has declined by 7%. However, within this timeframe, Coinbase stock was, at one point, up over 8%.

Over the longer term, the outlook for Coinbase has been nothing short of a disaster. Since its 2021 IPO, for instance, Coinbase stock is down more than 80%. Much of this decline has been a result of the crypto bear market, which has seen the likes of Bitcoin and Ethereum drop by over 70% since hitting all-time highs in late 2021.

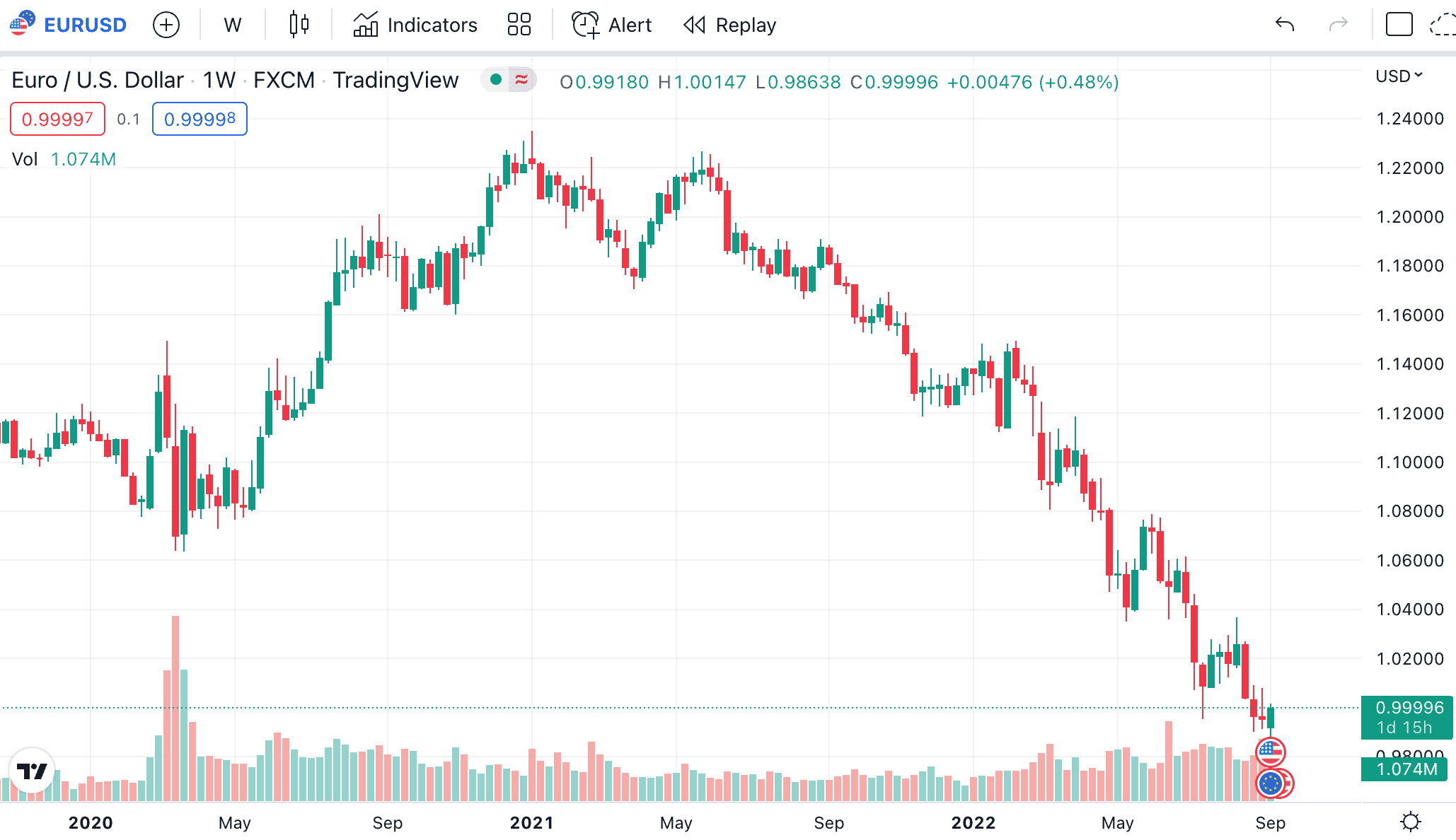

EUR/USD – Most Traded Forex Pair Globally

Now that we have covered stocks, we will now discuss a range of different forex pairs that are popular with many types of traders. Let’s start with EUR/USD – which is the most traded forex pair globally. This makes sense considering the sheer size of both the US and the European Single Market, not only in terms of population but economic strength.

Nicknamed the Fiber, EUR/USD is generally considered the most stable forex pair in terms of volatility. However, this hasn’t been the case in 2022. As the US dollar continues to get stronger, alternative currencies like the euro are witnessing the exact opposite. So much so that recently, EUR/USD dipped below parity.

This means that the euro, as of writing, is now worth less than the US dollar. Over the prior 12 months alone, this so-called stable currency pair has declined by more than 16%. With that said, at current pricing levels, longer-term forex traders might consider the euro to be oversold. A return to the 1.18 level, where it was 12 months prior to writing, would require an upside of 20%.

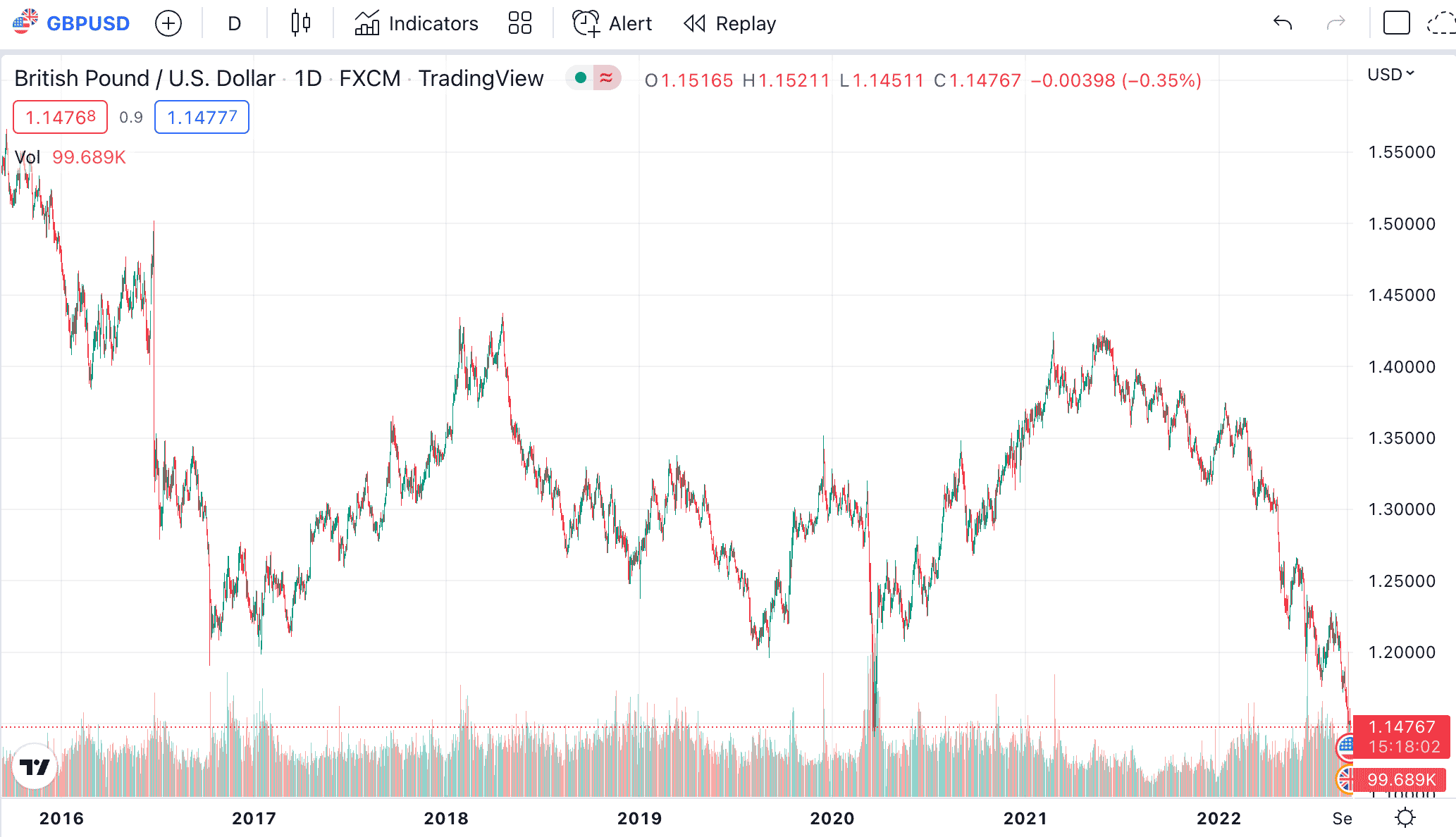

GBP/USD – Prolonged Decline Since 2016 Might Appeal to Longer-Term Traders

Although forex trading isn’t typically associated with longer-term plays, the decline of GBP/USD might interest positional traders. As we briefly noted earlier in this Forex Trading vs Stock Trading comparison, positional traders will often keep a currency position open for more than a year.

This will be the case when a forex pair is displaying signs of a prolonged upward or downward trend. To offer some insight, GBP/USD was trading at more than 1.55 in 2016. This means that for every 1 British pound traded, 1.55 US dollars would be returned. However, fast forward to 2022 and, as of writing, 1 British pound gets just 1.14 US dollars.

This represents a decline of more than 25%. Although this might not appear a significant downfall, it certainly is when the strength of both currencies is factored in. Nonetheless, just like the euro, speculative traders might view the British pound as heavily undervalued. Crucially, however, it remains to be seen where GBP/USD will find a support zone.

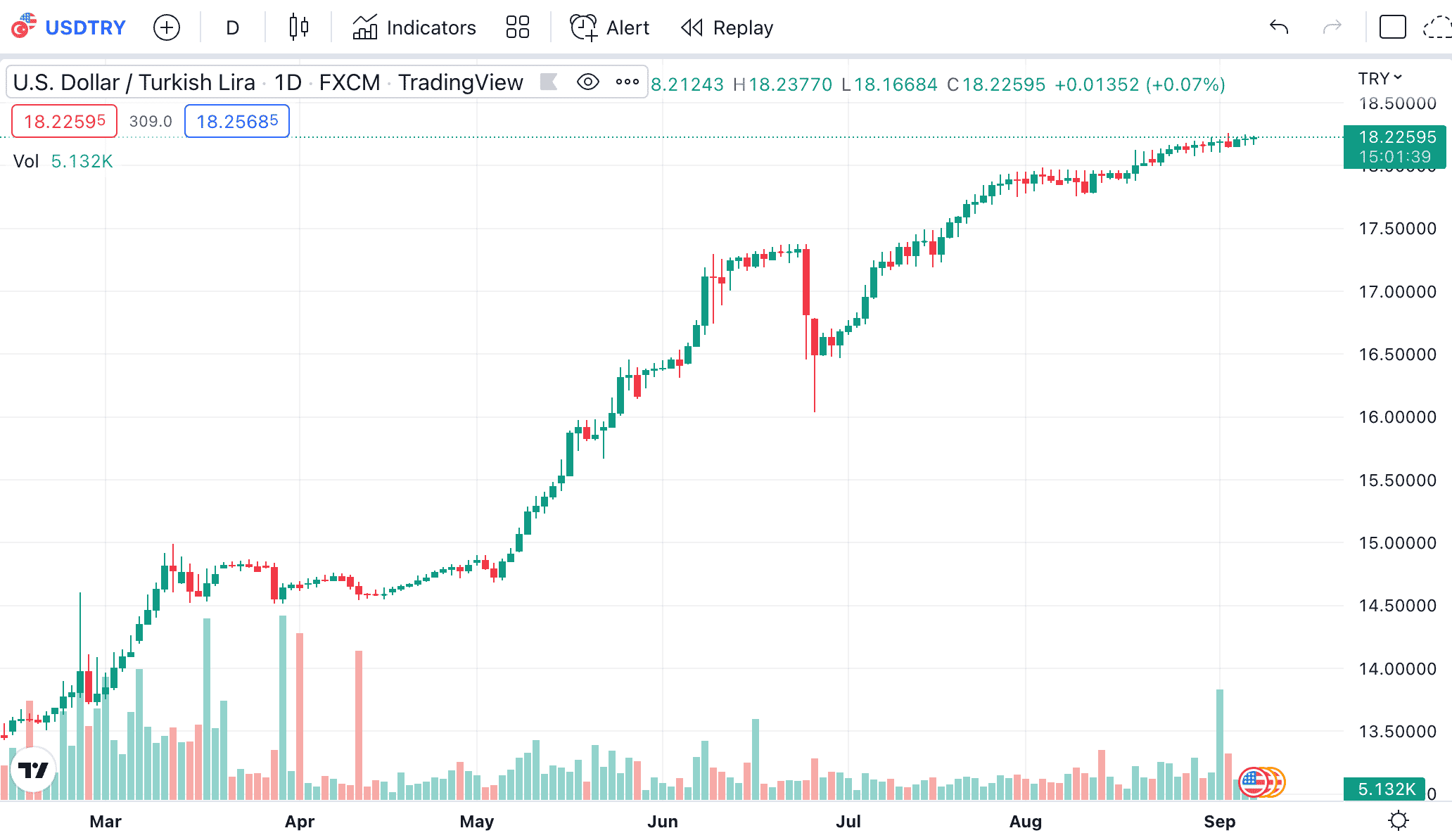

USD/TRY – Hugely Volatile Pair for High-Risk Traders

While EUR/USD and GBP/USD are major pairs, USD/TRY sits within the exotic category. This is because the Turkish Lira is an emerging currency. As such, there is little demand for the Turkish Lira on the global stage. This means that when trading an exotic pair like USD/TRY, traders should expect vast levels of volatility.

USD/TRY, in particular, is one of the most volatile pairs in the market right now. On the one hand, the US dollar continues to get stronger in response to uncertain economic conditions. In the case of the Turkish Lira, this emerging currency continues to decline in value. This is largely because of the state of the Turkish economy, in addition to ever-increasing inflation levels.

In July 2022, for example, it was reported that the Turkish Lira witnessed inflation levels of nearly 80%, year-over-year. Crucially, over the prior 12 months of trading, USD/TRY has increased by more than 120%. In simple terms, this means that the US dollar now gets 120% more Turkish Lira when compared to just a year previous.

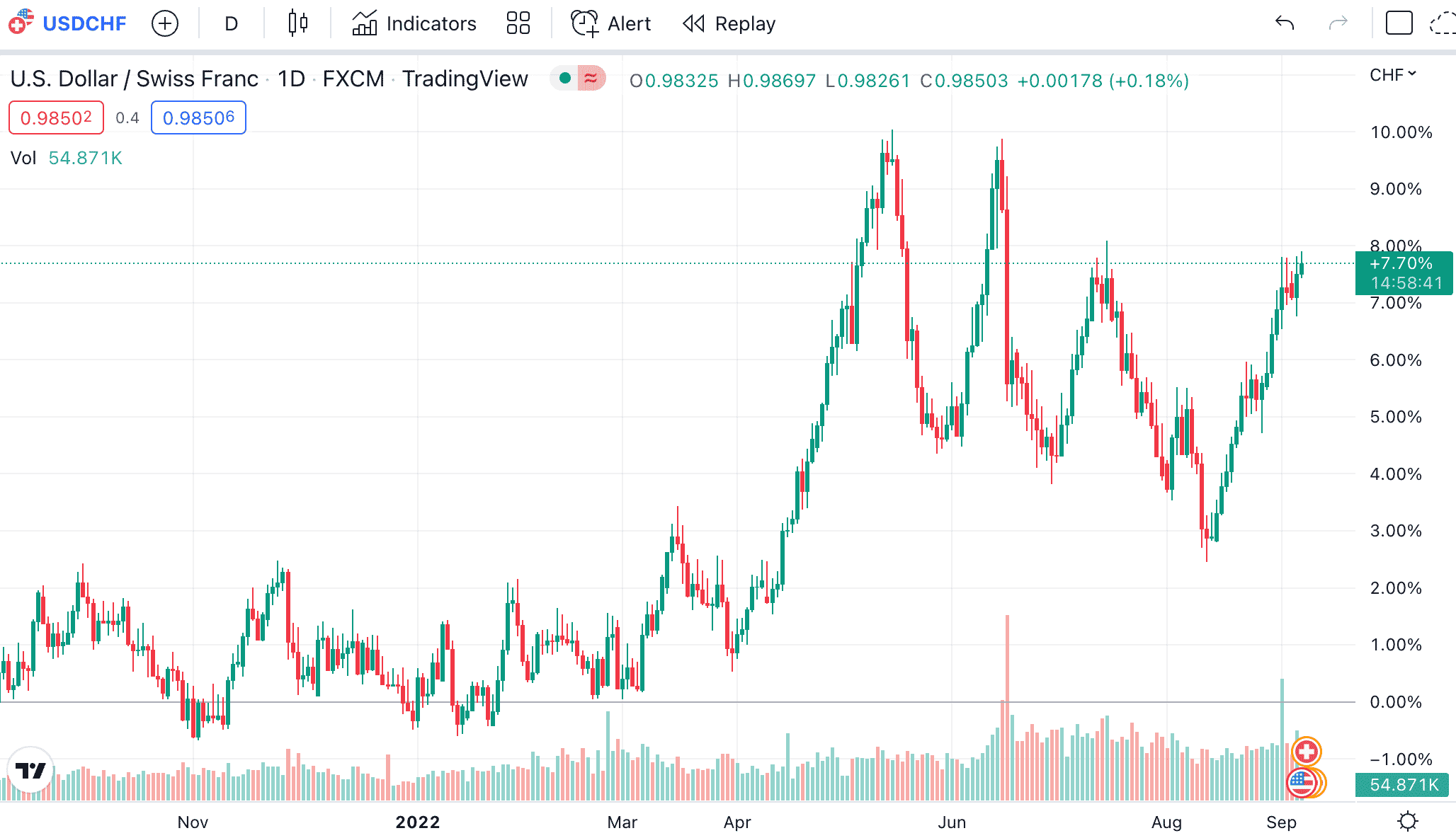

USD/CHF – Stable Forex Pair During Volatile Times

USD/CHF consists of the US dollar and the Swiss franc. Although Switzerland has a relatively small economy in global terms, it is often viewed as a safe haven during times of economic uncertainty. As a result, the swiss franc is a solid and reliable currency.

Over the prior 12 months of trading, USD/CHF has increased by just over 7%. This represents modest volatility when compared to other major pairs, such as GBP/USD.

Zooming out from the chart, however, USD/CHF has moved by just 2.6% over a five-year period. This is perhaps as stable as it gets in the forex trading space and thus – this pair might appeal to low-risk traders.

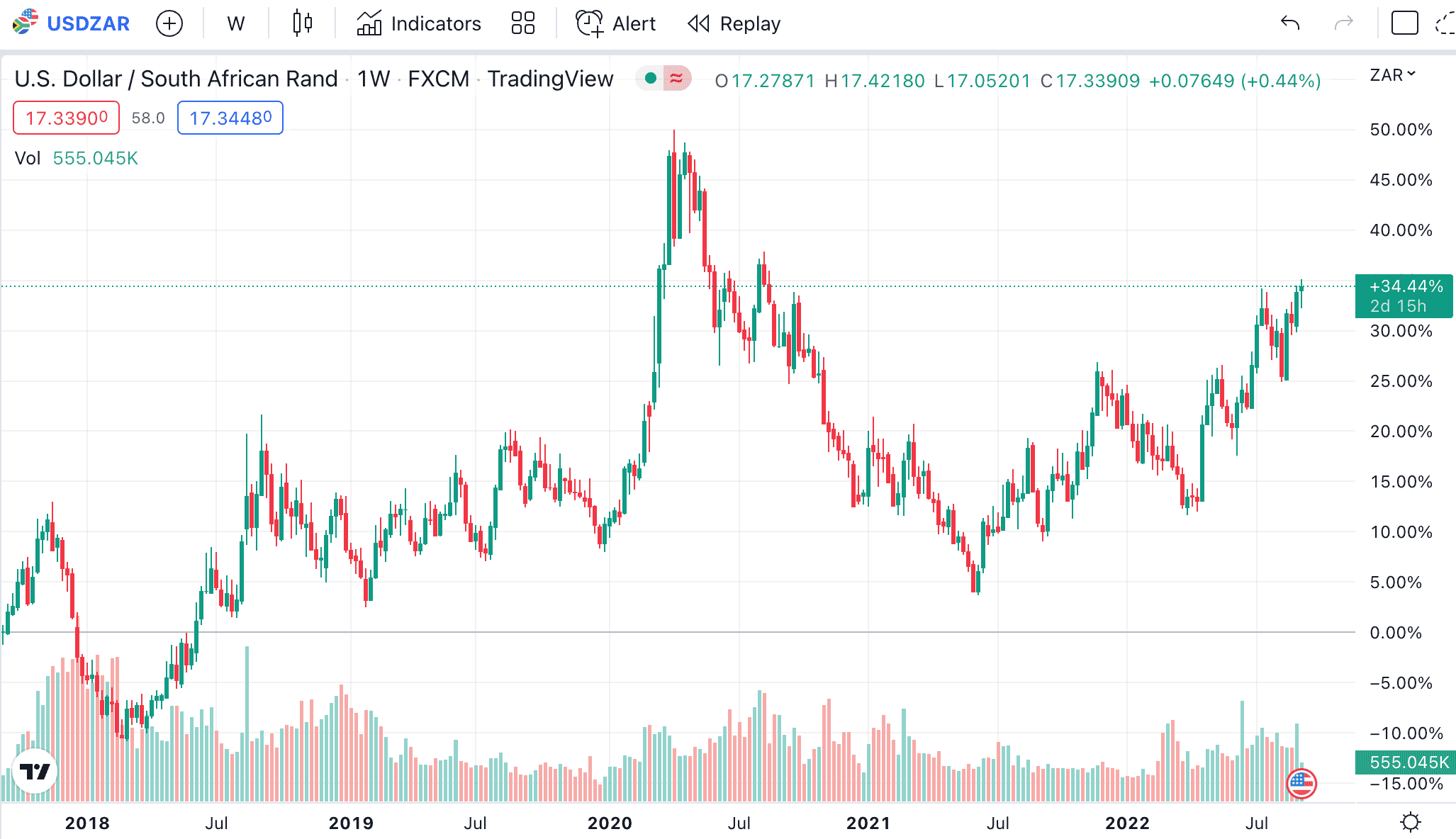

USD/ZAR – Volatile Currency Pair That Continues to Appreciate in Value

In a similar nature to USD/TRY, the exchange rate between the US dollar and the South African rand is extremely volatile. However, USD/ZAR continues to remain in an upward trend, as it has done for several years.

This means that over the course of time, the value of the US dollar consistently outpaces the South African rand. For instance, over just 12 months of trading, USD/ZAR has increased by over 21%.

Over a five-year period, the increase of USD/ZAR has appreciated nearly 35%. Extended trends like this will appeal to long-term currency speculators that are happy to keep positions open for many months and years.

Where to Trade Stocks and Forex in 2023

Now that we have answered the question – what is forex trading vs stock trading? – we can now discuss brokers.

Below, we explore where to trade stocks and forex in a regulated and low-cost environment.

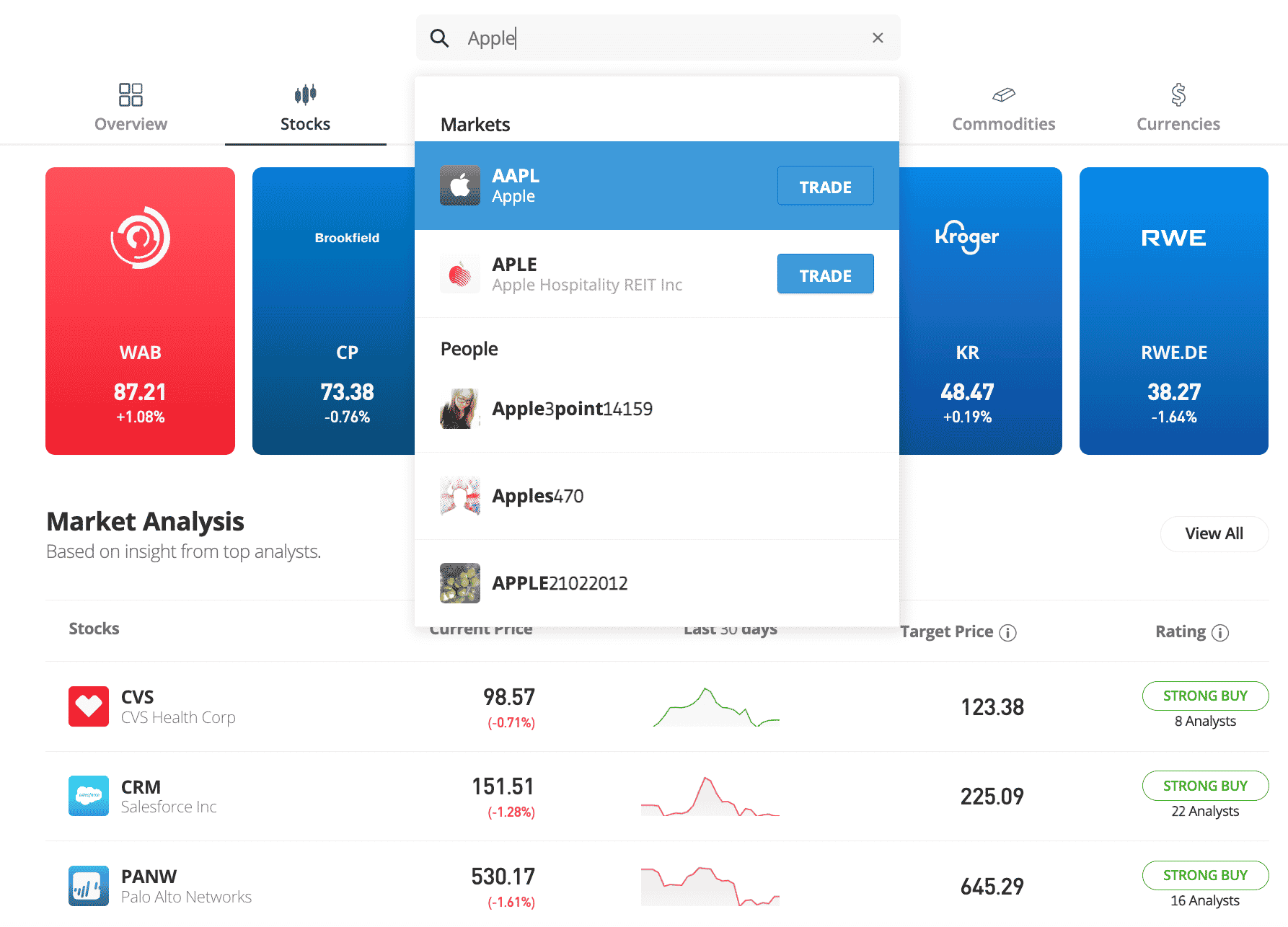

1. eToro – Regulated Broker With Thousands of Forex and Stock Markets

eToro offers access to more than 2,500 stocks. This includes markets from the US, UK, Hong Kong, Germany, France, Italy, and more. When buying and selling stocks here, there are no commissions to pay. Moreover, the minimum stock trade at eToro is just $10. This is the case for all stocks, regardless of their share price.

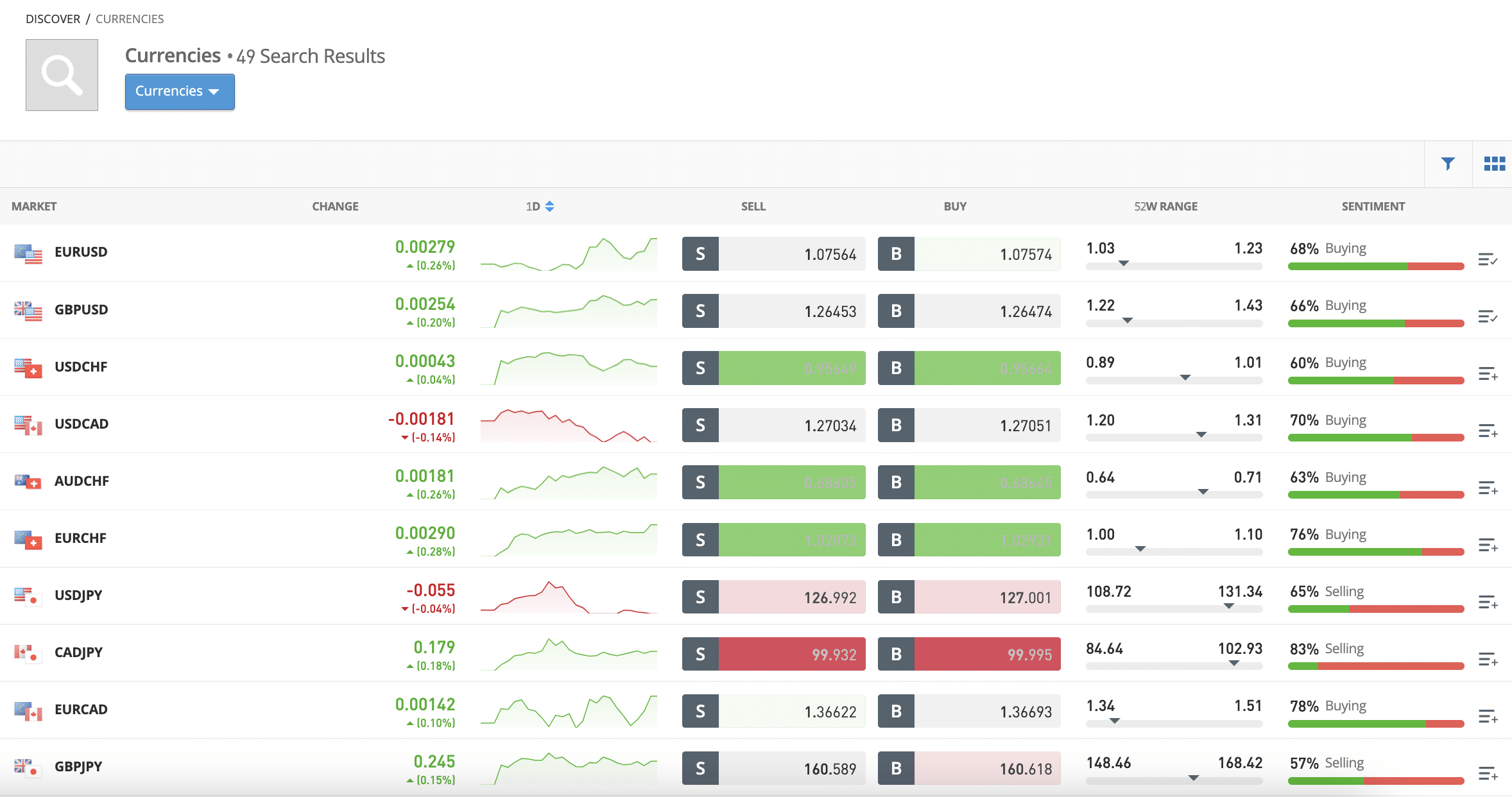

When trading forex here, eToro clients will have access to 48 pairs. This is largely made up of major and minor pairs, albeit, some exotics are supported. This includes the two exotic pairs that we discussed earlier – USD/TRY and USD/ZAR. Forex at eToro can be traded on a spread-only basis. EUR/USD spreads start at 1 pip. Higher spreads should be expected on exotic pairs.

In terms of minimums, eToro supports lot sizes of 0.01. This means that traders can access lots of 1,000 units, rather than the standard 100,000. Moreover, eToro supports leverage. Nonetheless, this means that trading a 0.01 lot of currency at 1:30 leverage would require a total stake of just $33.33.

In addition to stocks and forex, eToro also offers access to commodities, indices, crypto, and ETFs. To open an account with this broker, just five minutes of time is required. After verifying the account, a deposit can be made with a debit/credit card, Paypal, Neteller, Skrill, WebMoney, or a bank wire. eToro is licensed by the SEC, ASIC, CySEC, and FCA.

Finally, and perhaps most importantly, eToro offers a Copy Trading tool and SmartPortfolios. The latter enables clients to invest in a basket of stocks, which have been hand-picked by eToro. Smart Portfolios are professionally managed. Copy Trading enables clients to ‘copy’ the investments of a seasoned stock or forex trader. Both of these tools come without additional fees.

| Forex pairs | 49 |

| Stocks | 2,500+ |

| Leverage | 1:30 on forex, 1:5 on stocks |

| Deposit fee | 0.5%, or FREE on USD payments |

| EUR/USD spread | 1 pip spread, 0% commission |

| Cost of trading Apple stock | $0.15 spread, 0% commission |

| Charting | Native web trader, mobile app, ProCharts |

| Regulation | FCA, ASIC, CySEC, SEC |

Pros

Cons

78% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

This Stock Trading vs Forex Trading comparison has explored the mechanics of each market. While stocks are more popular with long-term investors, forex is favored by short-term market speculators.

Regardless of whether the investor prefers stocks or forex, a suitable brokerage account will need to be opened. At eToro, it is possible to trade 49 forex pairs and thousands of stocks via a single platform.

Moreover, both forex and stocks can be traded at 0% commission and to get started with an account today – a minimum of just $10 is required.

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.