Looking to put together an all-together greener portfolio of assets? Sustainable investments in the financial markets are increasing in popularity and there are plenty of funds to consider in this regard.

Therefore, the purpose of this guide is to explore 10 popular sustainable investing funds to watch in 2023.

Below is a list of popular sustainable funds to watch in 2023: Read on to learn more about each of the above sustainability funds as well as how to invest in clean energy in 2023. eToro is one example of a popular regulated broker that offers sustainable funds to invest in.

To gain exposure to this industry, investors can take a closer look at a range of funds, including sustainable ETFs, bonds, and indices. Below, investors will find core metrics of each fund, such as its long-term objectives and top stock holdings by weight. Investors looking for sustainable funds who are also interested in digital assets of the future may wish to explore IMPT. The IMPT platform is part of an ecosystem that is built on the blockchain. Its own native crypto token is preparing to go on presale. According to the IMPT whitepaper, this project has already secured over 10,000 well-known retailers to join its mission for a sustainable future. This includes the likes of HP, Apple, and Microsoft, as well as fashion retailers such as Hugo Boss, Topshop, Chanel, Hermes, and many more. IMPT is passionate about reducing and offsetting global warming and it also offers incentives for those who reduce their carbon footprints. Carbon credits are minted into NFTs – which means that both ownership and the sale/transfer process is facilitated by the blockchain. Individuals, governments, social organizations, manufacturers, and other companies are invited to use the IMPT platform. Anyone can easily measure their carbon footprint as the platform works on a simple points system. It also scores individuals and companies based on their activity and how much of their carbon footprint has been offset. IMPT digital tokens can be bought using either fiat funds or one of the supported crypto assets. As noted, IMPT tokens can then be used to purchase carbon credit NFTs. These NFTs can be traded within the marketplace on the platform. Furthermore, it’s possible to earn crypto tokens just for shopping on the IMPT platform. To stay up to date with this project and get more information, check out the IMPT Telegram channel.

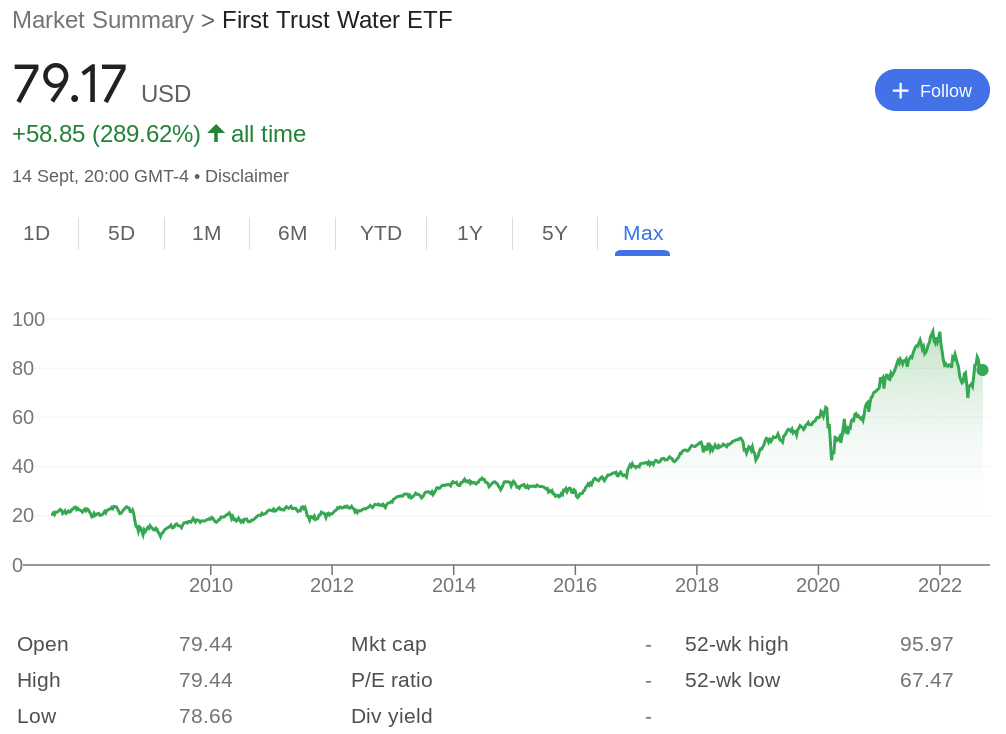

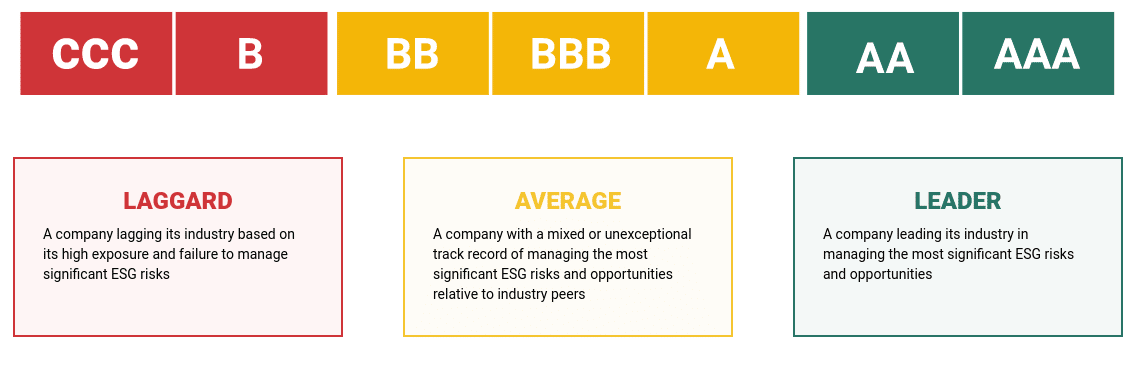

The First Trust Water ETF is benchmarked to the ISE Clean Edge Water Index. As such, this is one of the most popular sustainable ETFs to provide investors with a way of gaining exposure to the shortage of drinkable water. That is to say, a lack of clean water is a sad reality for some parts of the globe and therefore – the companies within this sustainable investment fund aim to help with this problem This sustainable fund’s list of holdings includes: We’ve listed the top six holdings by the percentage held in the fund. According to MSCI sustainable fund ratings, a total of 49% of First Trust Water’s holdings have an ESG score of AAA or AA, while 2% have a B or CCC. For those asking ‘what is ESG investing?‘ we have a complete article on ESG investments for 2023. At the time of writing, the fund is home to 36 businesses and has net assets of $1.26 billion. This includes sectors such as industrials, technology, utilities, and health care. These companies make money by offering solutions for things like purification and filtration, infrastructure, water testing, distribution, treatment, and pumps to mention a few. The fund has a remarkably good track record and is well-positioned thanks to its chosen portfolio of firms. This should assist the earth in reducing the harmful effects of pollution, population expansion, and global warming. The First Trust Water fund was created in 2007. Based on this fund’s price at the time of writing, First Trust Water has gone up by almost 80% over the previous five years of trading. MSCI ESG Rating: AAA

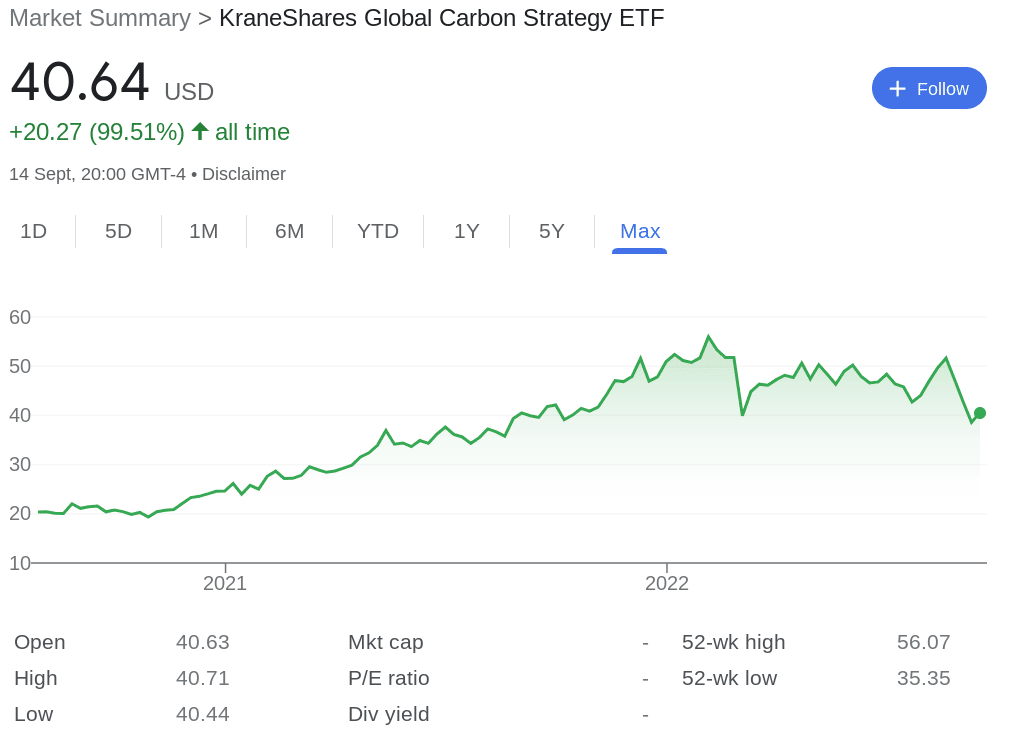

78% of retail investor accounts lose money when trading CFDs with this provider. Those looking for sustainable ETF funds with a wish to invest in carbon credits might prefer the KraneShares Global Carbon Strategy. This ETF is benchmarked to the IHS Markit Global Carbon Index. The sustainable index fund tracks the most actively traded carbon credit futures contracts and provides comprehensive coverage of cap-and-trade carbon allowances. Some of the components of the KraneShares Global Carbon fund include: The fund holds net assets of over $819 million. The index offers a fresh way to manage risk and gain exposure to carbon futures while promoting ethical investing. The KraneShares Global Carbon ETF now covers the four main cap-and-trade schemes in both North America and Europe. This comprises the Regional Greenhouse Gas Initiative (RGGI), California Carbon Allowances (CCA), and United Kingdom Allowances (UKA). As such, KraneShares Global Carbon often profits when the price of carbon emissions rises. In contrast, businesses with significant carbon footprints typically suffer. As we said though, it’s crucial to research any potential sustainability investment fund opportunities in full. Nonetheless we assessed this sustainable fund’s performance on the stock market and found that KraneShares Global Carbon began trading as recently as 2020. Since then, the fund has increased by almost 100%, based on its price at the time of writing. MSCI ESG Rating: N/A – Undisclosed

78% of retail investor accounts lose money when trading CFDs with this provider. Ethical investing is also possible with the iShares Global Clean Energy ETF. The goal of this Blackrock sustainable fund is to replicate the investment performance of an index made up of international clean energy stocks. This includes almost 100 stocks that focus on having a positive impact on the world for future generations. Specifically, iShares Global Clean Energy makes investments in firms operating in the biofuels, geothermal, wind, hydroelectric, ethanol, and solar sectors of the worldwide green power sector. Furthermore, iShares Global Clean Energy holds enterprises that create the equipment and technology needed in the process. The index committee chooses the holdings of the fund and all must pass strict criteria. Some of the holdings in this Blackrock sustainable energy fund include: The iShares Global Clean Energy fund is weighted by market capitalization and exposure score under a number of restrictions. It reconstitutes itself every two years. Moreover, the ETF is one of the largest sustainable funds on this list. At the time of writing, across its 98 holdings, iShares Global Clean Energy has over $5.7 billion in net assets. According to sustainable fund analysis by MSCI, 38% of this Blackrock sustainable energy fund’s investments have an ESG score of AAA or AA. Only 5% have a B or CCC. This fund was created in 2008. Although this sustainable fund performance in the chart above doesn’t look very appealing, we found that in a shorter timeframe of five years, it has increased by around 147%. MSCI ESG Rating: AA

78% of retail investor accounts lose money when trading CFDs with this provider. The Invesco Solar ETF invests in renewable power and tracks the MAC Global Solar Energy Index (SUNIDX). At least 90% of the fund’s total assets are allocated to securities, global depositary receipts (GDRs), and American depositary receipts (ADRs), which make up the index. For those unaware, the sustainable index fund SUNIDX focuses on solar and wind energy stocks and Invesco Solar merely tracks it. In order to account for relevant taxes for non-resident investors, the index is calculated using net returns. Furthermore, it is diversified across value chains, locations, and technologies. We’ve listed some of the components of this ETF below: The net assets in this sustainable investing fund’s portfolio equate to around $2.7 billion and there are 53 stocks included. Our analysis found that 14% of Invesco Solar’s holdings have an ESG score of AAA or AA. 6% have a B or CCC – as per MSCI ESG ratings. The inception year for this fund was 2008. In terms of its performance, at the time of writing, Invesco Solar is trading almost 300% higher than it was five years ago. MSCI ESG Rating: A

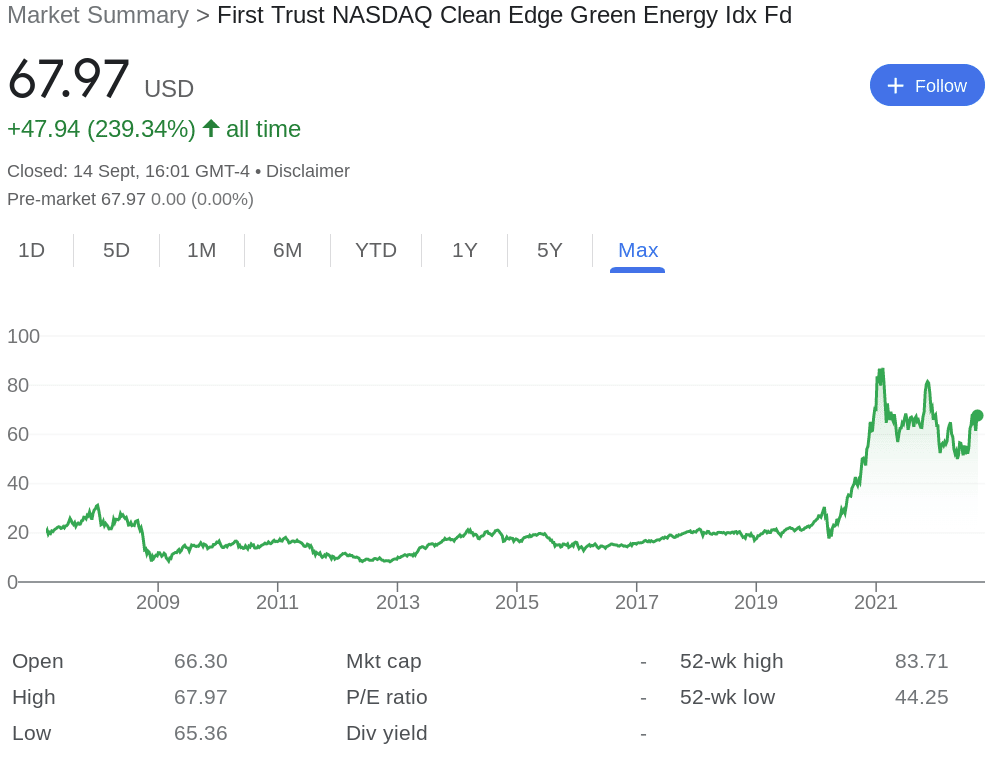

78% of retail investor accounts lose money when trading CFDs with this provider. This is one of the most sustainable index funds in the market for those interested in green investment funds and energy companies within the US. First Trust NASDAQ Clean Edge Green Energy has a sizable portfolio of publicly traded companies in the renewable energy sector. The eligible US companies included must be in the business of one of the four core subsectors of distributing, producing, developing, or installing. This also considers energy storage and conversion which includes hybrid batteries. Holdings of First Trust NASDAQ Clean Edge Green Energy also include those within the sustainable energy intelligence industry (for instance, smart grids). Advanced materials that lessen the need for petroleum products or enable clean energy and renewable electricity generation (wind, solar, geothermal) are also included. Here are some of the stocks included in this sustainable investing fund: As with the rest of the reviews in this guide, we’ve also noted the MSCI sustainable fund ratings. Here’s how First Trust NASDAQ Clean Edge Green Energy ranked -an ESG rating of AAA or AA is assigned to 14% of the sustainable index funds holdings, while a B or CCC rating has been given to just 3%. First Trust NASDAQ Clean Edge Green Energy was made public in 2007. This sustainable investing fund has increased by 254% over the five years prior to writing this guide. MSCI ESG Rating: A

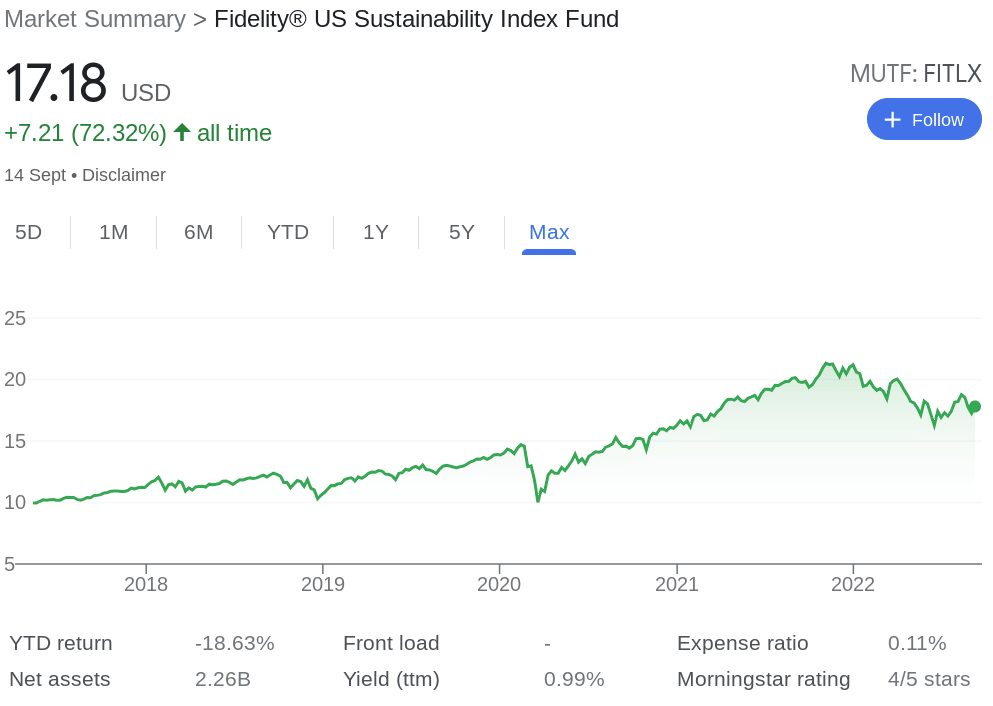

78% of retail investor accounts lose money when trading CFDs with this provider. Fidelity sustainable investment funds such as FITLX are potentially advantageous for investors who are drawn to firms that are socially or ecologically responsible. The Fidelity US Sustainability Index Fund only holds securities with excellent MSCI ESG ratings. This fund’s benchmark is the MSCI USA ESG Leaders Index. The rating and weighting of the firms included in this US-focused Fidelity Sustainable fund are diverse and are made up of large and mid-cap US companies. To be included in the Fidelity US Sustainability Index Fund, companies must be both ecologically and socially responsible. Below are just some of the stocks held in this sustainable mutual fund: There are 25 holdings in this fund. A total of 51% of the Fidelity Sustainable fund’s holdings have an MSCI ESG Rating of AAA or AA, while none have a B or CCC. In terms of performance, this fund has been around since 2017 and has seen an increase of over 72% as of the time of writing. MSCI ESG Rating: AAA

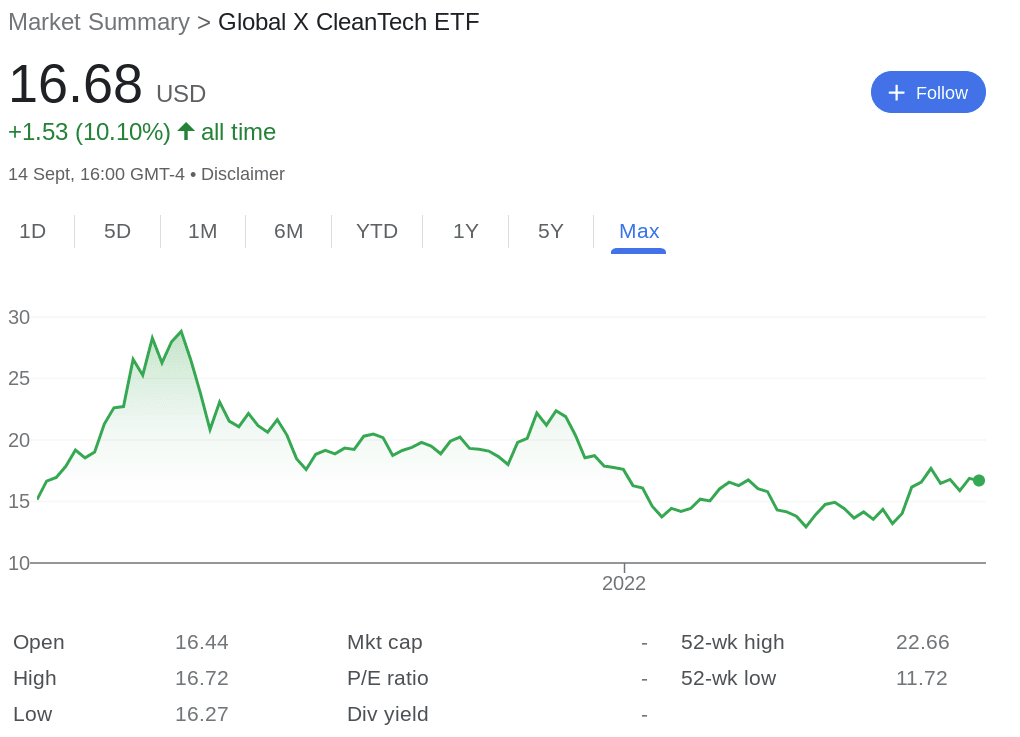

78% of retail investor accounts lose money when trading CFDs with this provider. Global X CleanTech ETF aims to mimic the Indxx Global CleanTech Index’s price and yield performance, prior to fees and charges. In a nutshell, the Global X CleanTech ETF seeks to invest in businesses that stand to gain from the rising use of technology that prevents or lessens adverse environmental effects. This comprises businesses engaged in the improvement of home and commercial energy efficiency and those that specialize in the creation of renewable power. Other holdings in Global X CleanTech concentrate on the creation and distribution of pollution-reducing goods and services and the deployment of smart grids. Some of the largest holdings in this fund can be seen below: The CTEC fund holds net assets worth just $124 million. Nonetheless, 22% of the holdings within the CTEC portfolio have an MSCI ESG score of AAA or AA. Meanwhile, 9% of the stocks in this portfolio of assets have a B or CCC. The Global X CleanTech ETF has been listed since 2020. It has increased a little over 10% since its inception. MSCI ESG Rating: A

78% of retail investor accounts lose money when trading CFDs with this provider. Launched in 2001, this BGF sustainable energy fund invests at least 70% of its total assets internationally. Notably, there are numerous different units, albeit, for the purpose of this analysis we focus on A2 USD. Some of the sustainable energy businesses included in this fund are those that work with alternative energy sources and clean power-related technology. This covers suppliers and creators of renewable energy technologies, as well as those for infrastructure, alternative fuels, and energy efficiency. Some of the holdings in this BGF sustainable energy fund include: There are 49 holdings in this Blackrock sustainable fund. According to MSCI, 0% of the holdings in the fund have an ESG score of B or CCC, while 56% have a rating of AAA or AA. Moreover, this is another example of one of the largest sustainable funds on the market, not least because it has an asset net value of over $6.3 billion. This fund adheres to the Global Industry Classification Standard. This means it will not invest in businesses that fall within certain industry classifications. This includes any companies that focus on the exploration and production of oil and gas, or coal and consumables. MSCI ESG Rating: AA

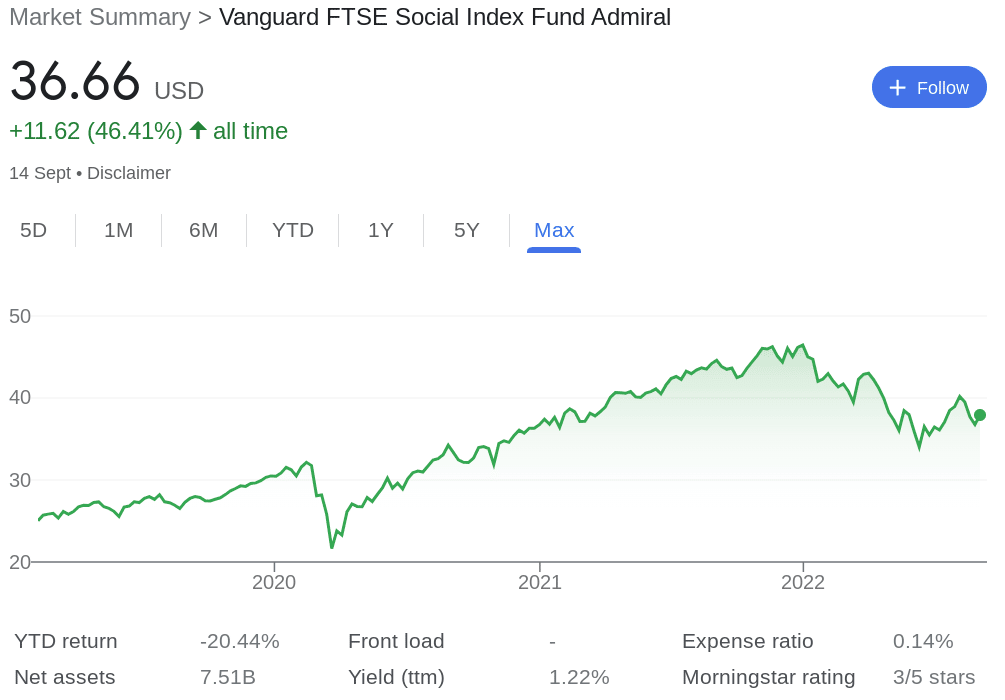

78% of retail investor accounts lose money when trading CFDs with this provider. The Vanguard FTSE Social Index Fund tracks the FTSE4Good US Select Index. Notably, the ethical stock investing objectives of this mutual fund are met without losing the advantages of a market-cap-weighted, broadly diversified portfolio. Strict exclusionary ESG filters are applied by the Vanguard FTSE Social Index Fund in order to cull out firms engaging in contentious industries. This prevents it from failing to meet the diversity standards of the FTSE or bypassing the corporate sustainability principles of the UN Global Compact. This Vanguard sustainable fund’s holdings include: The net assets in this sustainable investment fund have a value of almost $14 billion. The ESG rating of 32% of Vanguard FTSE Social Index Fund’s holdings are AAA or AA. Only 2% of stocks were given a B or CCC ESG Score. Vanguard FTSE Social Index Fund has been around since 2019. Based on its price at the time of writing, the fund’s price has increased by over 46% since its inception. MSCI ESG Rating: AAA

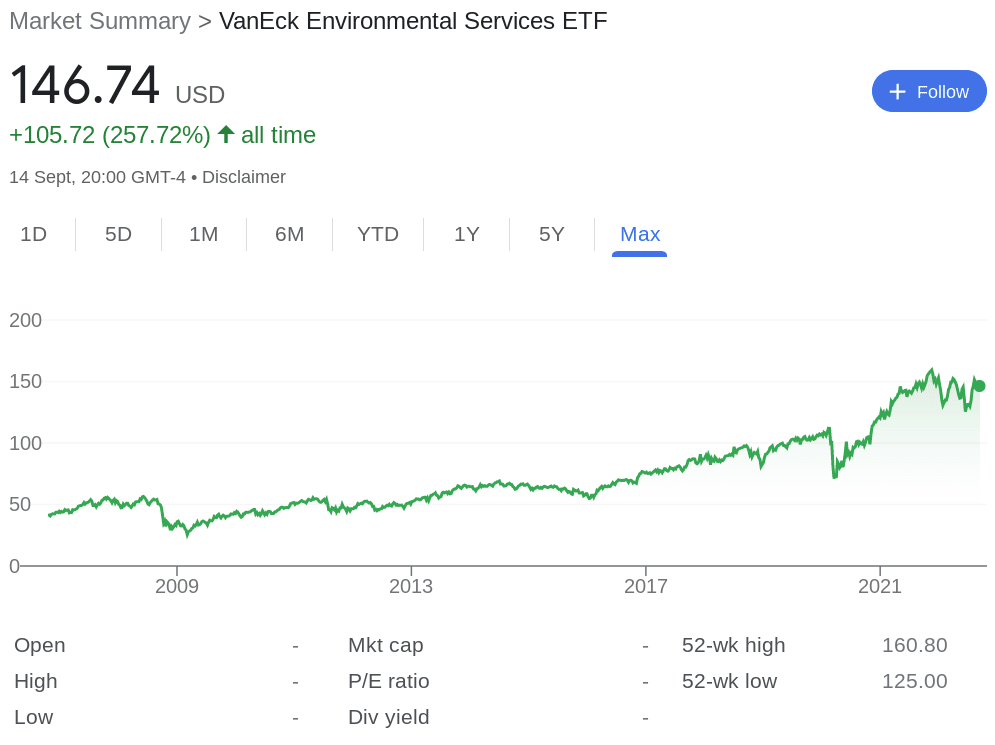

78% of retail investor accounts lose money when trading CFDs with this provider. The VanEck Environmental Services ETF closely monitors, before fees and costs, the price and performance of the NYSE Arca Environmental Services Index (AXENV). The fund monitors the overall performance of businesses engaged in soil remediation, wastewater management, trash collection, transfer, and disposal, recycling, and environmental consultancy. Only businesses that adhere to the UN Global Compact’s principles for human rights, labor, the environment, and anti-corruption are included in VanEck Vectors Environmental Services ETF portfolio. We’ve listed a handful of VanEck Vectors Environmental Services ETF holdings below: In total, there are 22 holdings in the VanEck Vectors Environmental Services ETF. The sustainable index fund holds net assets of $72 million. In terms of MSCI ratings, 26% have an ESG score of AAA or AA, while 14% have been rated a B or CCC. Based on the price of the fund at the time of writing, VanEck Vectors Environmental Services ETF has risen by over 78% over five years. MSCI ESG Rating: AA

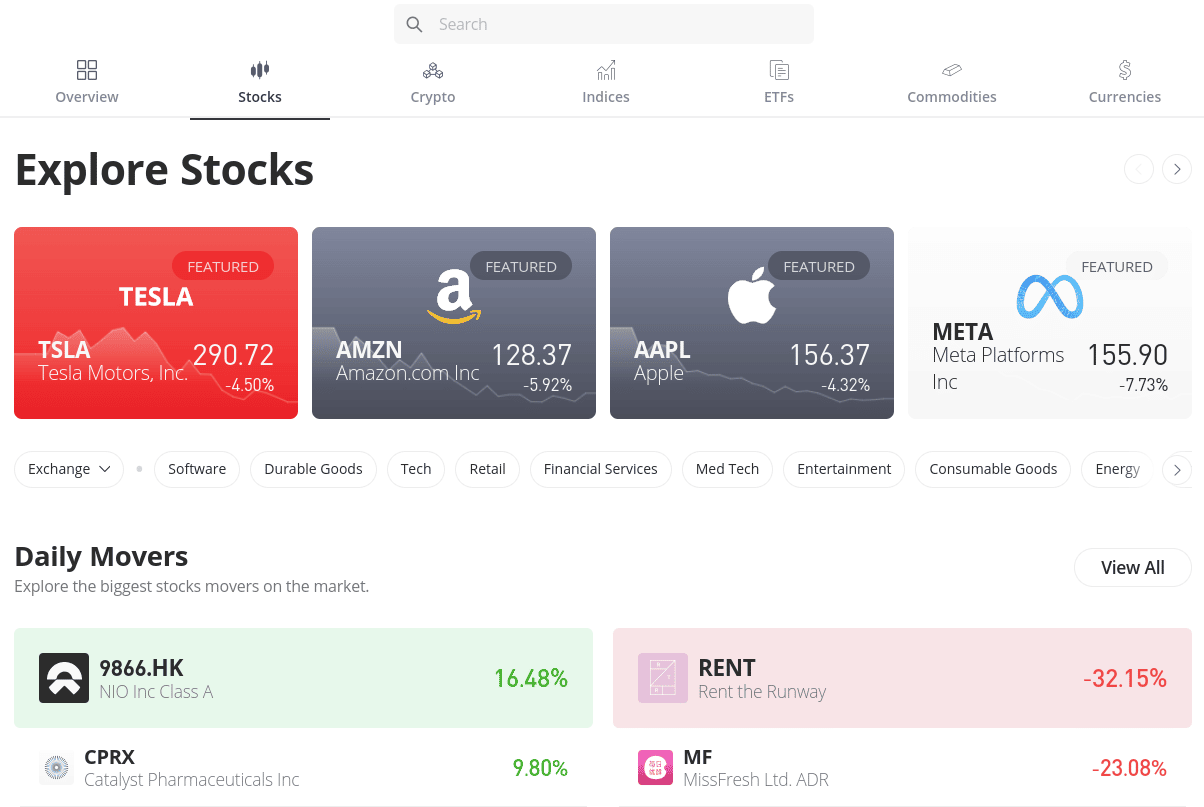

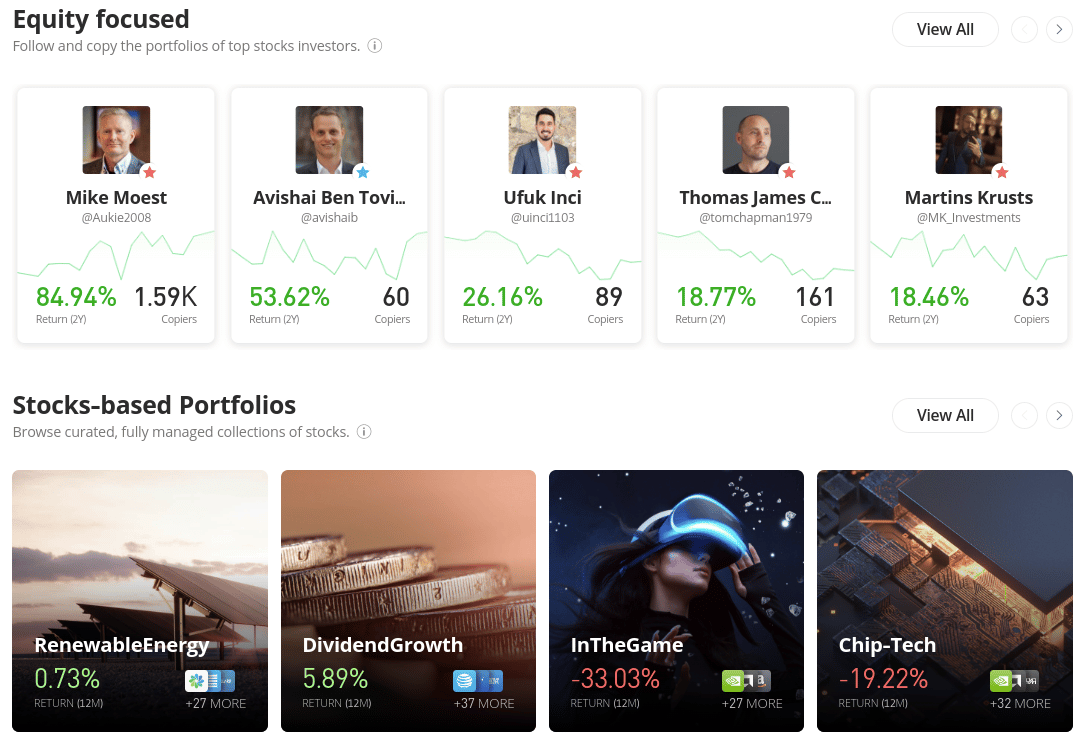

78% of retail investor accounts lose money when trading CFDs with this provider. Most sustainable funds include investments based on their social impact using environmental, social, and corporate governance standards. This falls back to the ESG ratings we’ve talked about throughout this guide. Due to the growing need for societal and environmental change, sustainable investing is becoming more and more popular. Since this pattern doesn’t appear to be slowing down, sustainable investors could expect to see an increase in the number of such funds as time goes on. ESG ratings/scores provide traders and investors with access to additional information that is typically not taken into account in conventional financial research. The success of most sustainable funds will be greatly impacted by factors like their exposure to human rights and climate change for instance. Here’s some more information about how MSCI sustainable fund ratings work: More than 8,500 firms use MSCI ESG Ratings (an estimated 14,000 issuers including subsidiaries) to develop ESG scores and measures for over 53,000 multi-asset class sustainable mutual funds and ETFs globally. More than 680,000 equity and fixed income instruments are used in the process. ESG has advanced from the marginal to the mainstream in the last 10 years in the same fashion that socially responsible investing has. Investors and businesses have noticed requests for transparency, more regulation, and a general demand for better standards. As such, a higher number of sustainable funds have been created in recent years. A sustainable investing fund is something to think about including in portfolios for those who are interested in both financial performance and being socially responsible. The capital of multiple investors is combined when they invest in a sustainable fund. Depending on the type, on their behalf, a fund manager buys, sells, or holds investments. All funds are composed of a variety of investments, in this case, sustainable assets. Here are some types of sustainable funds: To offer some insight into what’s available, this guide has analyzed a wide variety of sustainable investing funds. This ranged from mutual funds like Fidelity US Sustainability and Vanguard FTSE Social, to ETFs like First Trust Water and iShares Global Clean Energy. Scroll up for a recap on the 10 sustainability funds that have been analyzed. In this section, we’ve included a review of a popular trading platform that offers various sustainable investing assets with low or no commission – many of which were discussed in our top 10 list. eToro is also registered as a legitimate money services business in the US with FinCEN and is a member of FINRA. Some of the popular assets featured in our earlier sustainable funds list can be found on the eToro trading platform. The broker also lists a range of other markets, inclusive of commodities, currencies, indices, and equities. All sustainable ETF funds are offered without commission and the same goes when investing in stocks on the platform. The platform also offers a range of eco-friendly crypto coins for investors who may want to try something that’s completely different – but at the same time, come with sustainable qualities. There is a 1% commission fee payable when buying and selling digital currencies. eToro is a pioneer of Copy Trading. This is a feature of the platform that allows investors to follow traders from around the world and mirror their buy and sell orders automatically. Here’s how it works – the investor chooses a trader to copy based on asset preference, location, risk, gains, and more. Next, the investor allocates a minimum of $200 to Copy Trading. Until the investor elects to stop copying the trader, all of the orders placed will be automatically mirrored in proportion to the amount invested. Investors could also take a look at the range of Smart Portfolios managed by eToro. Sustainable Smart Portfolios include Future of Power, Driverless, and Renewable Energy. There are also curated collections of stocks from other industries as well as those focused on cryptocurrencies. Sustainable fund analysis can be found by clicking on the asset and viewing the chart, as well as utilizing the social trading aspect of the platform and looking under the ‘Research’ tab. The eToro platform isn’t difficult to use, however, a demo trading account is available for complete newbies. Traders can strategize in a risk-free way as the virtual account is loaded with $100k in paper funds. The minimum deposit is $10 for US clients and there is a variety of payment types to choose from. We found this to include ACH, wire transfers, and e-wallets like PayPal.

78% of retail investor accounts lose money when trading CFDs with this provider. In summary, this guide has talked in detail about the most popular sustainable investing funds to watch in 2023. To name a few, this included First Trust Water ETF, First Trust NASDAQ Clean Edge Green Energy Index Fund, and Fidelity US Sustainability. Sustainable funds allow investors to create a diverse and socially and environmentally conscious portfolio. Diversification is, however, important in this growing marketplace. Although not a fund, we rank IMPT as the best sustainable investment asset right now – click below to learn more.

11 Popular Sustainable Funds to Watch in 2023

A Closer Look at Sustainable Funds

1. IMPT – Best Sustainable Investment Asset

2. First Trust Water ETF (FIW)

3. KraneShares Global Carbon ETF (KRBN)

4. iShares Global Clean Energy ETF (ICLN)

5. Invesco Solar ETF (TAN)

6. First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

7. Fidelity US Sustainability Index Fund (FITLX)

8. Global X CleanTech ETF (CTEC)

9. BGF Sustainable Energy A2 USD

10. Vanguard FTSE Social Index Fund (VFTAX)

11. VanEck Vectors Environmental Services ETF (EVX)

What are Sustainable Funds?

How Sustainability is Ranked in Investment Funds

Why do People Invest in Sustainable Funds?

Types of Sustainable Funds

Regulated Stock Brokers Offering Sustainable Funds

eToro – Regulated Stock Broker With 0% Commission and Copy Trading Tools

Conclusion

FAQs

What is a sustainable investment fund?

What are examples of sustainable funds?

Is there a sustainable ETF?