The Chinese shopping app, Temu, has been at the top in US app stores for quite some time.

The mobile shopping application peaked at the top of the American App Store rankings in September and has been there ever since, topping the charts for free apps on the Google Play Store since December 29, 2022.

On January 3, Temu regained the top rank in the Apple App Store, which it has held ever since.

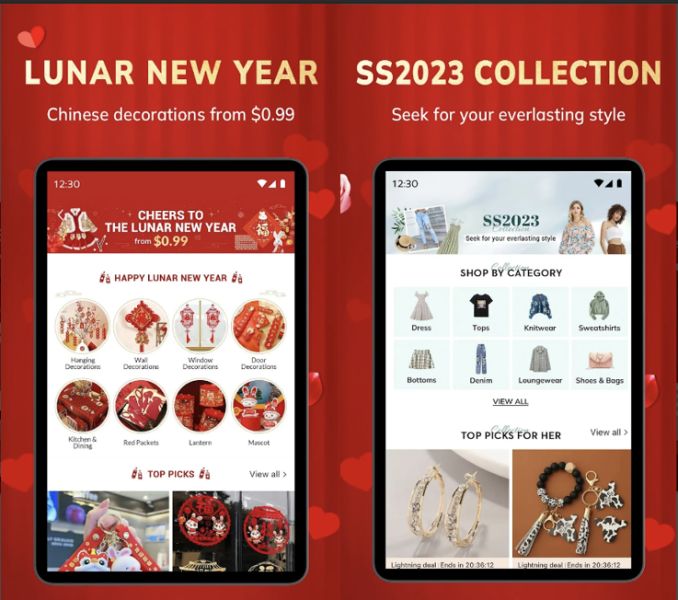

Temu offers low-cost factory-to-consumer items and access to a wide choice of products, notably quick fashion. However, Temu’s marketing effort appears to generate the most recent installs.

According to app intelligence company Sensor Tower statistics, the US was Temu’s largest market in November, with little over 5 million installs.

The business now claims that the app got 5 million installs in the US alone in January, up 19% from 4.2 million in the preceding 22 days, from December 10 to December 31.

As per Sensor Tower, Temu has achieved 19 million permanent installs on the US App Store and Google Play, with over 18 million coming from the US.

Following the expansion, Temu has surpassed Shein as the number of daily installs leader. According to the firm, Temu had an average of 43,000 daily installs in the US in October, while Shein had an average of 62,000 installs.

Shein saw around 70,000 more average daily installs in November than Temu did, and Temu averaged 187,000 installs in December compared to Shein’s 62,000.

Is Temu Following TikTok’s Lead?

The upsurge of the shopping app is an example of how TikTok survived years of rapid expansion to become the most downloaded app worldwide in 2021.

According to Sensor Tower, the video app had over 2 billion lifetime downloads, including those from its Chinese sister app Douyin. The total number of installs for TikTok apps has hit 4.1 billion.

Similar to Temu, TikTok’s early development was largely fueled by marketing budgets. By primarily using Snapchat, Instagram, and Facebook’s proprietary advertising networks, the video app expanded internationally and domestically.

TikTok built a following by making an upfront investment in user acquisition, which improved its capacity to tailor its “For You” stream with recommendations.

Thanks to this investment, this algorithm improved over time in determining which videos would draw the greatest interest, making TikTok among the most additive apps.

Although Temu’s popularity is well below TikTok, it uses a similar growth approach. The company spends a lot of money on advertising to get new customers, which it then uses to personalize the purchasing experience.

Temu’s version of a “For You” page that encourages visitors to browse trending things “Selected for You” is one of the site’s key features.

According to the ad library for Meta, Temu served around 8,800 ads this month alone across all of Meta’s platforms. The advertisements promote the purchase of Temu as well as extremely discounted goods, including $13 shoes, $5 jewelry, and $4 shirts.

Temu’s installs increased because of these advertisements, which has helped the program rise to the top of the “Top Free” rankings in the App Store, which are greatly influenced by number and download speed, among other things.

It’s understandable why Temu continues to be the most downloaded mobile app in the nation after strategically launching before the holidays, spending heavily on promoting the app and its affordable products, and relying on its discovery approach.

Discuss This Article

Add a New Comment /Reply

Thanks for adding to the conversation!

Our comments are moderated. Your comment may not appear immediately.