Before you go through the process of buying crypto, you need to make sure that you have a secure and user-friendly wallet to hand. Not only will this ensure that your crypto tokens are kept safe – but you’ll have the ability to send and receive funds with ease.

In this guide, we review the very best crypto wallet providers in the market today.

The Best Crypto Wallets List

Here’s a list of the top crypto wallets for this year – from our market research:

- eToro – Overall Best Crypto Wallet of 2023

- Binance – Best Crypto Wallet App for Trading

- ZenGo – Leading Web3 Crypto Wallet

- Coinbase – One of the Best Crypto Wallets for Beginners

- Huobi – Top Bitcoin Wallet App for Earning Interest on Crypto

- Trezor – Secure Bitcoin Hardware Wallet

- MetaMask – Best Crypto Wallet for Web3 Applications

- Trust Wallet – User-friendly Wallet that Supports NFTs

- Kraken – Popular Crypto Exchange That Doubles up as a Wallet

- Electrum – Great Bitcoin Wallet Account for Multi-Currency Portfolios

- Luno – Best Bitcoin Account for User-Friendliness

- Exodus – Free Bitcoin Wallet for Desktop and Mobile

- Ledger Nano X – One of the Safest Crypto Wallets to Buy

You will find detailed reviews of the best crypto wallet providers by scrolling down.

The Best Bitcoin Wallets Reviewed

Although we explain how to choose the best Bitcoin wallet for your requirements later – here’s a quick recap of the most important factors that you should consider:

- Security and safety

- Fees to send and receive crypto

- User-friendliness

- Device type – e.g. mobile, desktop, hardware, or online

- Additional features such as exchange and swap services

The reviews that you will find below of the best crypto wallets take the above core metrics into account.

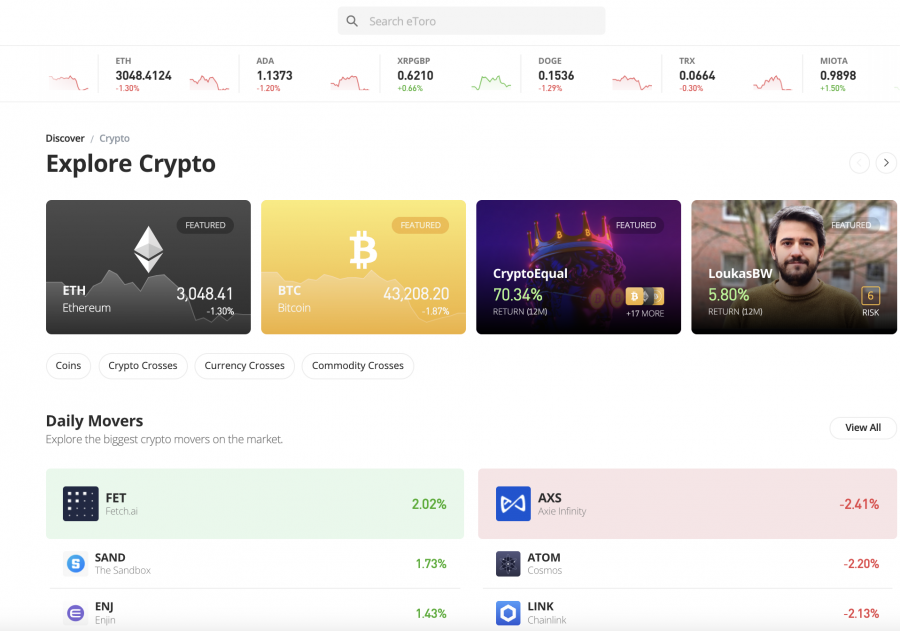

1. eToro – Overall Best Crypto Wallet of 2023

If you’re looking to buy Ethereum, Bitcoin and other trending altcoins you’ll find eToro to be one of the best options available in 2023. eToro is a leading crypto broker that is regulated by the SEC, ASIC, FCA, and CySEC. The platform allows you to buy and sell crypto in a super-low manner and also doubles up as a top-rated wallet. At eToro, you can keep your digital token investments in your account portfolio, which offers the ultimate balance of safety and convenience.

Moreover, when you get around to cashing out your crypto investments, you can do this instantly without needing to transfer tokens between wallets and cryptocurrency exchanges. Alternatively, you might also consider downloading the eToro Money Crypto Wallet, which comes in the form of a mobile app. This gives you more control over your digital assets without compromising on user-friendliness or security. In fact, the eToro Money Crypto Wallet itself is licensed by the GFSC.

A handy feature of the eToro Money is that if you were to forget your login credentials or lose your private keys, the provider can help you regain access. Moreover, the wallet also allows you to swap digital currencies without leaving the app. This covers more than 500+ crypto pairs. Both the web and mobile wallet offered by eToro give you access to brokerage services too. In fact, you can buy more than 40+ crypto assets on a spread-only basis from just $10. For example, if you want to buy Solana you’ll only have to pay a spread of 2.9%. Similarly, if you decided to buy Axie Infinity you’d only pay a spread of 2.9%.

And, as eToro is a regulated entity, the provider supports fiat deposits and withdrawals. As a US client, you can deposit dollars for free across plenty of supported payment methods – which include debit/credit cards, e-wallets, and ACH. eToro also offers social and copy trading features. The former allows you to network with other eToro investors by leaving comments and even liking posts. The copy trading tool allows you to mirror the positions on an expert trader-like-for-like.

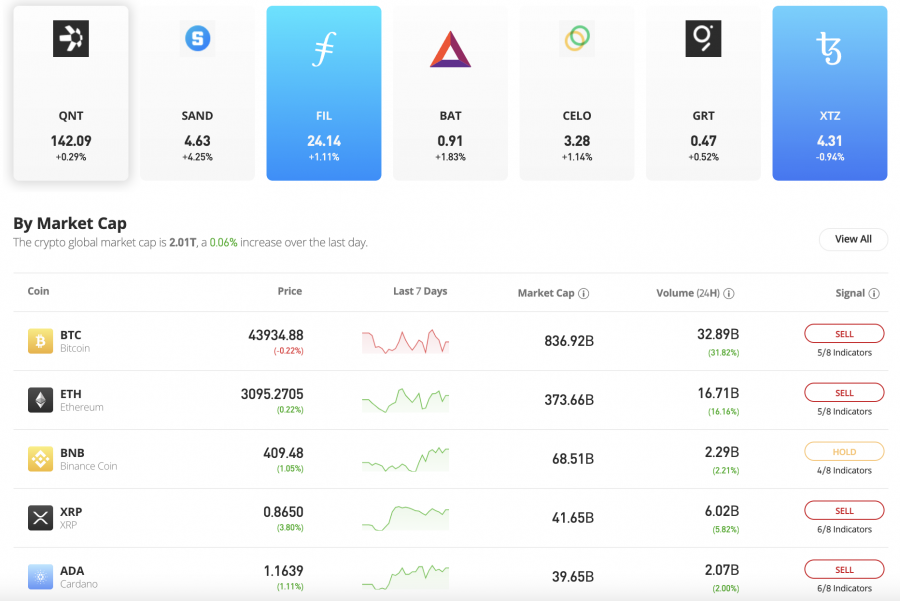

Consequently, with an eToro trading account you can build a diversified portfolio of cryptos, stocks, ETFs, and more. From the comfort of your own home you could buy the best new cryptocurrencies such as the Graph, and Celo with tight spreads.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

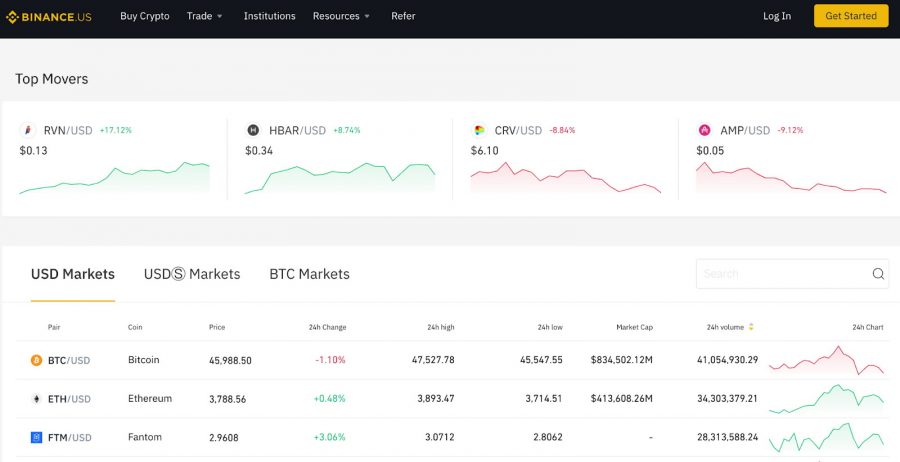

2. Binance – Best Bitcoin App for Trading

Binance is a major player in the cryptocurrency and blockchain technology arena. Not only does it offer the best altcoin exchange in terms of trading volume, but it is also behind a multi-billion dollar crypto-asset – BNB. Moreover, Binance even has its own network chain that hosts thousands of decentralized tokens. As such, Binance is arguably the best Bitcoin wallet for those seeking both storage and trading services.

Many investors will use the main Binance web wallet for storing their tokens, as this offers great convenience. You can connect the web wallet to the Binance app, which allows you to keep track of your investments on the move. Both of these options are custodial wallets, which means that Binance will safeguard your private keys on your behalf. The other option is to download the Trust Wallet to your mobile phone – which is also backed by Binance.

As a non-custodial wallet, this option gives you full control over your private keys and backup passphrase. Do note that this means in the event your wallet is compromised or you misplace your private keys, Binance won’t be able to help you regain access. Nevertheless, Trust Wallet also gives you access to decentralized apps such as Pancakeswap. This allows you to access up-and-coming tokens that operate on top of the Binance Smart Chain. As such, Binance is a great place to buy popular altcoins such as AAVE, Polkadot and Quant with low fees.

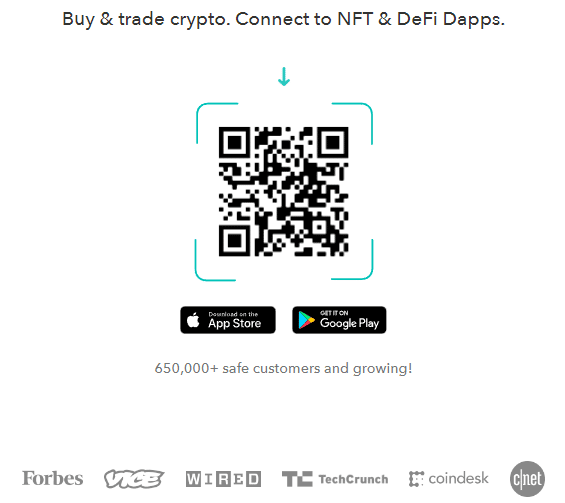

3. ZenGo – Leading Web3 Crypto Wallet

As well as supporting storage of crypto and NFTs, ZenGo wallet can be used to trade on Uniswap, earn yield through Lido, game in The Sandbox, and explore the world of Dapps (decentralized apps).

As the ZenGo website states – ‘we like to think of WalletConnect as a safe ‘magic’ bridge to the infinite Web3 cosmos’ – WalletConnect is their tool to integrate the ZenGo wallet with Dapps.

The ZenGo crypto wallet is compatible with both Android and iOS mobile devices and comes complete with industry leading security protocols including 3-factor authentication and 3D biometric encryption. ZenGo have positive reviews in TechCrunch, CoinDesk and several other crypto and DeFi news publications.

4. Coinbase – One of the Best Crypto Wallets for Beginners

Much like Binance, Coinbase is also behind one of the largest crypto exchanges in the market – with the provider now hosting over 70 million client accounts. The platform primarily targets its services to those with little to no experience of buying, selling, or storing digital tokens. Many users will elect to keep their crypto investments in the main Coinbase web wallet – which comes packed with security features.

For instance, when you attempt to log into your Coinbase account, not only do you need to provide a password – but you’ll also need to go through two-factor authentication. This means that a code will be sent to your mobile device on each login attempt. Moreover, Coinbase claims to keep 98% of all client digital assets in cold storage. This means that the vast bulk of digital currencies held by the platform is kept offline.

Other security features offered by the Coinbase wallet include IP whitelisting. In simple terms, this means that should you try to log into your account from a new IP address, you will need to go through an additional security check. Although the Coinbase wallet is both secure and user-friendly, we should note that the platform isn’t ideal for those looking to buy and sell crypto. This is because standard trading commissions amount to 1.49%. And, if using a debit/credit card, this fee is increased to 3.99%.

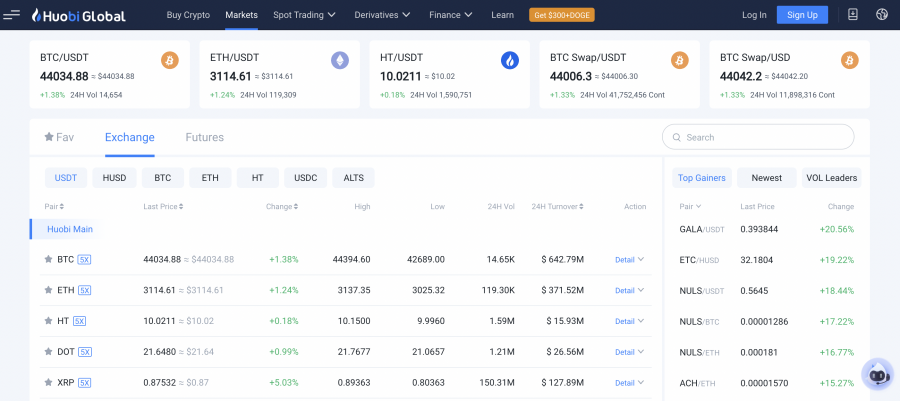

5. Huobi – Top Bitcoin Wallet App for Earning Interest on Crypto

Although Huobi primarily operates as a crypto exchange, the platform does double up as a web and mobile app. If opting for the former, you will be keeping your digital tokens in your main Huobi account, which means that you won’t have access to your private keys. Instead, Huobi will safeguard your wallet and funds on your behalf. This option is ideal for short-term traders that seek instant access to their digital funds.

The other option you have is to download the native Huobi Wallet app, which is compatible with both iOS and Android. Unlike the web option, this wallet is non-custodial. Once again, this means that you and only you will have access to your private keys and this – you will retain full control of your crypto tokens. the Huobi Wallet app supports a wide range of tokens – including but not limited to Bitcoin, Dogecoin, Polkadot, Bitcoin Cash, XRP, EOS, and more.

In fact, the wallet also offers support for ERC-721 NFTs and a full suite of DeFi tokens. With that said, perhaps the most interesting thing about Huobi is that the platform allows you to earn interest on your crypto investments. The specific rate payable will depend on several factors – such as the digital asset in question and whether or not you are happy to lock the tokens away for a certain period of time. Finally, if trading on the Huobi exchange, you will pay a commission of 0.20% per slide.

6. Trezor – Secure Bitcoin Hardware Wallet

All of the crypto wallets that we have reviewed thus far come in the form of a mobile app or web storage. Trezor, on the other hand, offers a hardware wallet – meaning that you will be storing your crypto assets on a physical device. For those unaware, hardware wallets are by far the more secure way of storing digital tokens. For a start, hardware wallets like Trezor are kept offline at all times.

And as such, this makes remote hacking attempts almost if not entirely impossible. Moreover, in order for the Trezor wallet to be accessed for the purpose of sending tokens, you need to physically enter the PIN that you created when you first set up the device. After a certain number of incorrect attempts, the timelock feature will kick in. This means that the waiting time between each subsequent PIN attempt will double.

As such, if your Trezor wallet is stolen, you will have enough time to recover your funds from an external device. This can be achieved by entering your Trezor backup passphrase onto another wallet. Although Trezor offers institutional-grade security on your crypto investments, this option won’t be suitable if you plan to regularly send and receive funds. This is because you need to have the physical device with you to authorize the transaction. Finally, Trezor costs in the region of $85 to buy.

Another cryptocurrency wallet that has been turning heads for its unrivaled security features is the Exodus wallet. For more details you can read our Exodus wallet review today.

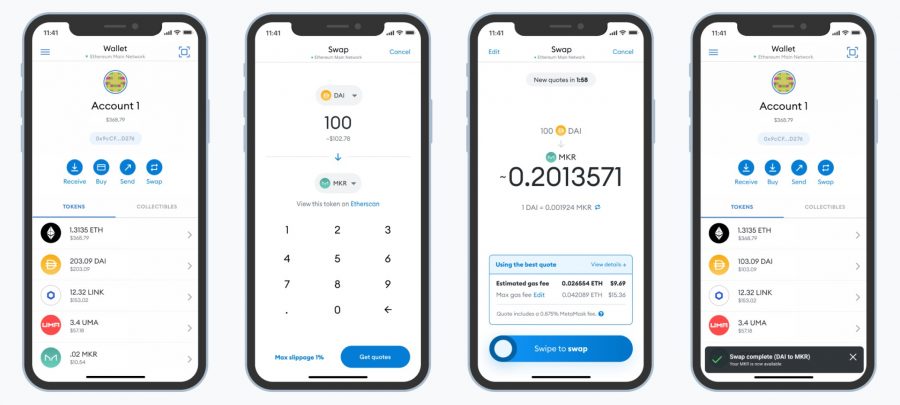

7. MetaMask – Best Crypto Wallet for Web3 Applications

MetaMask is a self-hosted wallet, so only you have access to your encryption keys. You can install the wallet on iOS and Android devices or directly in your Chrome, Firefox, Brave, or Edge web browser for easy access.

MetaMask can store any ERC-20 tokens, including NFTs, and it has a built-in decentralized exchange to facilitate token swaps. The exchange is simple to use, but it has a few advanced features to help you minimize network fees and ensure you’re getting the best possible price when swapping cryptocurrencies.

8. Trust Wallet – User-friendly Wallet that Supports NFTs

On top of that, Trust Wallet lets you stake your cryptocurrencies to earn interest. You can stake coins like BNB, Kava, Cosmos, Algorand, and Tezos and earn interest rates up to 11% APY. There are no lock-in periods with Trust Wallet and the platform doesn’t take a commission on your staking rewards.

Trust Wallet also has a built-in dApps browser, allowing you to use this wallet for a wide range of Web3 applications. You can connect to crypto games, NFT marketplaces, DeFi platforms, and more. Trust Wallet offers dApps from both Binance Smart Chain and Ethereum.

The Top Crypto Wallets Compared

If you read through the above reviews of the best Bitcoin wallet providers for 2023 – then you will know that each option comes with its pros and cons.

For a quick recap of our findings, check out the comparison table below.

| Wallet | Supported Coins | Fee Structure | Fee for Sending Bitcoin | Mobile App? |

| eToro | 75+, Plus 500+ Pairs | Free, Spread-Only on Trades | Blockchain Fee | Yes |

| Binance | 1,000+ Markets | Free to Download, 0.1% on Trades | 0.0005 BTC | Yes |

| Coinbase | 100+ | Free to Download, 1.49% on Trades | Blockchain Fee | Yes |

| Huobi | 200+ | Free to Download, 0.2% on Trades | 0.0001 BTC | Yes |

| Trezor | 1,800+ | Free to Download, 0.2% on Trades | Blockchain Fee | No |

What is a Bitcoin Wallet?

In its most basic form, a Bitcoin wallet allows you to store your digital currency investments. The wallet that you opt for will connect to the blockchain network, which allows you to send and receive tokens at the click of a button. There are many types of crypto wallets – each of which offers a different level of security and convenience.

Moreover, some wallets offer additional features, such as the ability to buy, sell, and swap crypto assets. Perhaps the most popular storage option is that of a mobile wallet – which can be downloaded to your smartphone via an iOS or Android app. You do, however, also have the option of storing your tokens via desktop software, at an online exchange, or on a hardware device.

As we cover in more detail shortly, wallets can either be custodial or non-custodial. The latter means that you are the only person that has access to the private keys and backup passphrase of the wallet. In turn, should your wallet become comprised, forget your PIN, or you misplace your private keys – then you will not have anyone to turn to.

On the other hand, custodial wallets do not give you access to your private keys, and thus – you will be entrusting your funds to a third party. This is typically an exchange or broker. This option can be both convenient and safe – as long as you are using a trusted custodial like eToro – which is regulated by the SEC and several other tier-one licensing bodies.

If you’re more interested in DeFi tokens than Bitcoin, see our guide to DeFi wallets.

Why You Need a Crypto Wallet

The best Bitcoin wallet providers in this space will offer three core functions – storage, and the ability to send and receive funds. Without a wallet, you will not be able to engage with the crypto markets.

- For example, let’s suppose that you buy Bitcoin from an online exchange.

- As soon as the purchase is complete, the exchange will add the tokens to your web wallet.

- In turn, you can then leave the tokens on the exchange or elect to send the funds to a wallet that is controlled by you.

- And, if opting for the latter, you need a private wallet to receive the Bitcoin tokens.

In this sense, crypto wallets operate much like a conventional checking account. For example, you will open a checking account with a financial institution – which then allows you to deposit US dollars.

You can keep your money in the checking account for as long as you want in the safest that your capital is secure. Moreover, if you want to send US dollars to another person, you need to have a checking account to be able to do this. And, for the person to receive the funds from you, they also need to have a checking account.

Crucially, these processes are much the same as a crypto wallet. The only difference is that you are storing digital assets instead of fiat money, and sending and receiving funds to a wallet as opposed to a checking account.

How do Crypto Wallets Work?

In the sections above, we have explained the very basics of how crypto wallets work in practice. However, you will need to have a much more intimate understanding of crypto storage before getting started.

With this in mind, below we explore the core fundamentals of what you need to know about crypto wallets before proceeding.

Private Keys and Backup Phrase

First and foremost, let’s start with the security of a crypto wallet. We mentioned earlier that traditional current accounts and somewhat similar to crypto wallets – and this is also the case with security.

- For instance, in order to access your current account online, you would be required to enter a password.

- In the case of a crypto wallet, you will also need to enter a PIN of some sort to gain access.

- If you were to forget your online banking password, you would need to contact your financial institution.

- But, with crypto wallets, there is nobody to contact.

- Instead, you would be able to recover your wallet by entering the private key.

This private key is unique to your wallet and typically comes in the form of 64 characters – covering both lower and upper case letters, alongside numbers.

However, to make things easy, most wallet providers convert your private keys into a backup phrase – which is usually 12 random words.

If somebody discovered what your backup passphrase is, they would be able to access your wallet from any device. This is why you are advised to write your backup passphrase down onto a sheet of paper and keep it somewhere super-safe.

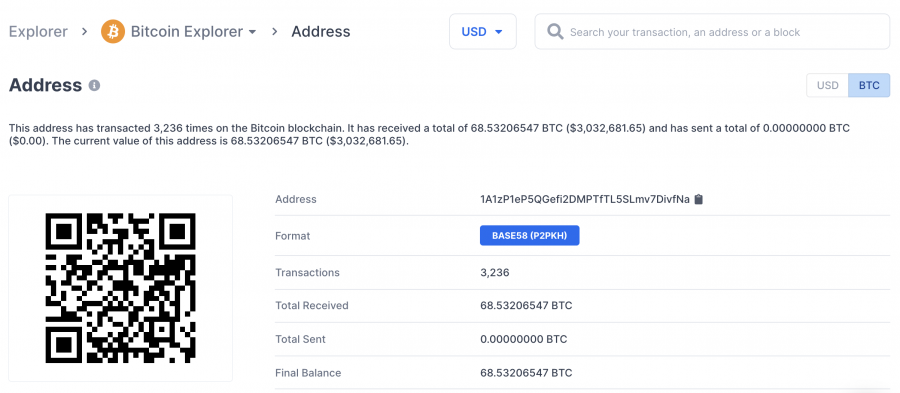

Crypto Wallet Address

Now that we’ve covered the ins and outs of private keys and backup passphrases, we can move onto crypto wallet addresses. In a nutshell, your crypto wallet address allows you to receive funds.

As a comparison, if you wanted to receive funds into your checking account, you would need to forward your unique bank account number to the sender.

In the case of a crypto wallet address, this comes in the form of a long string of characters, which is not too dissimilar to a private key. However, unlike a private key, you can send your crypto wallet address to other people, as this simply allows them to send you funds.

Here’s an example of what a Bitcoin wallet address looks like:

1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

Interestingly, the above wallet address belongs to Satoshi Nakamoto, who is the anonymous founder of Bitcoin.

Although at first glance, Bitcoin addresses look overly complex to the eye, the good news is that the best Bitcoin wallet providers offer a QR code feature. This allows the sender to scan your unique barcode, which corresponds to the wallet address in question.

Fees

When you use your crypto wallet to send funds to another address, you will invariably need to pay a fee. This is because transactions are verified by ‘miners’, which receive rewards in the form of crypto for contributing their time and resources.

The specific fee will vary depending on the crypto being sent and how busy the respective network is. Nevertheless, when you send funds from your wallet, the fee will be deducted from the transaction value.

Types of Bitcoin Wallet Accounts

In this section of our guide, we will discuss the different types of crypto wallets that you can choose from.

Software Wallets

If you’re not using a hardware device – such as those offered by Trezor or Ledger Nano, then you will be storing your crypto assets in a software wallet. This means that you are able to connect to the blockchain network remotely – either through a crypto app or desktop software.

The latter is popular with developers and those that wish to engage with the blockchain ledger directly. However, mobile wallets are considerably more user-friendly and convenient, as you can access your crypto tokens no matter where you are located.

In fact, mobile wallets still offer a great level of security on your funds. For instance, before you can open your crypto wallet app, you will first need to bypass your smartphone screen lock. After that, you will then need to enter the PIN for your crypto wallet. Most mobile wallets also offer real-time notifications when funds are received, which again, offers great convenience.

In August 2022 Solana mobile hot wallets were affected by a $5 million exploit, such as Phantom wallets and Slope wallets that are commonly used in-browser via Chrome extensions. Our top crypto wallet recommendations on this guide are exchange wallets that were unaffected by that hack.

Hardware Wallets

We briefly discussed hardware wallets earlier when we reviewed Trezor. To recap, hardware wallets provide the most secure storage option in the crypto space. Regardless of the provider, the wallet is kept offline at all times. This is why hardware wallets are referred to as cold storage, as they are never connected to live servers. For more details read our guide on the best crypto cold wallets in 2023.

Furthermore, even if your hardware wallet was stolen, it would still be extremely difficult for the thief to access your crypto assets. This is because they would need to know the PIN that you created when you set the wallet up. In the meantime, you could regain control of your hardware wallet remotely by entering your backup passphrase via another device.

In doing so, you could transfer your crypto tokens to another address, which would make the stolen hardware wallet redundant. With that said, it goes without saying that in using a hardware device, the process of sending and receiving funds can be cumbersome. After all, you would need to have the hardware device with you in order to transact.

Paper Wallets

Paper wallets are not as commonly used anymore, albeit, they are still worth considering as they offer a great level of security. The main concept is that you will print both your Bitcoin wallet address and private keys onto a sheet of paper.

These two credentials will not be connected to a specific wallet, so your crypto funds are essentially stored offline at all times.

- This means that in order to send your tokens to another address, you would first need to obtain a wallet.

- Then, you would need to import the private keys that you previously printed into the new wallet – which would subsequently transfer the tokens.

- This option, although secure, is cumbersome when it comes to sending funds.

Paper wallets, can, however, be a great option for long-term investors. Just make sure that you keep the sheet of paper containing your private keys super secure.

How to Choose the Best Cryptocurrency Wallet for You

So now that you know how wallets work, you can now begin the research process to assess which provider is right for you. Although this can be a time-consuming process, it’s best to check off each of the important variables discussed below.

Security

Security should be at the top of your list when searching for the best crypto wallets. In many cases, the level of security on offer will depend on your preferred wallet type.

- For instance, if you’re in possession of a hardware wallet, then you can be confident that this offers the overall best security on your digital funds.

- If, however, you are using a web wallet, then you will need to do a bit more digging.

- For example, in using the eToro web wallet, you know that your funds are safe because the provider is authorized and regulated by the SEC, ASIC, FCA, and CySEC.

- In using a web wallet like Kucoin, however, no regulatory protection is in place.

In the case of Bitcoin wallet apps, make sure that the provider offers security in the form of a PIN or biometric login. Another security feature to look out for is two-factor authentication. This requires you to enter a code that is sent to your registered phone or email address when you attempt to log into the wallet.

Custodianship

We mentioned earlier that some wallet providers offer custodial services, which means that the provider will be responsible for safeguarding your private keys.

On the one hand, this means that should you forget your login credentials, you can contact the respective platform to regain access to your account. However, you need to be 100% sure that you are using a credible wallet provider, not least because they will have full access to your crypto assets.

If you elect to use a crypto wallet that comes in the shape of a non-custodial service, this means that you will be the only person with access to your private keys and backup passphrase. But, again, if you misplace this vital information, your wallet could be hacked, and thus – you will not have anyone to turn to.

As such, you need to think long and hard about custodianship when choosing the best crypto wallet for your needs.

Wallet Type

You also need to choose the best wallet type for your goals and level of experience.

In a nutshell, if you favor an equal balance of convenience and security – and you plan to send and receive funds regularly, the best crypto wallet for you might come in the form of a mobile app.

If, however, you want to prioritize security over all other metrics – perhaps because you have a high-value crypto portfolio, a hardware wallet might be more suitable.

Trading and Swaps

We found that the best Bitcoin wallet providers – in addition to storage and transactional services, also allow you to trade digital currencies. For example, in choosing eToro as your go-to wallet provider, you will also be able to buy and sell crypto without needing to leave the platform. Purchases can even be facilitated with a debit/credit card, as eToro is a regulated entity.

Moreover, if you download the eToro Money Crypto Wallet to your smartphone, you can access 500 digital currency pairs. This means that you can swap one digital token for another without leaving the wallet. With that said, if you choose a crypto wallet that doesn’t offer trading and swapping services, then things can get a bit challenging further down the line.

For instance, let’s suppose that you are holding Bitcoin in a basic mobile wallet. As the price of Bitcoin continues to rise, you want to cash out your profits back to US dollars. However, as your chosen wallet doesn’t offer trading services, you need to transfer the BTC tokens to a third-party exchange in order to complete the swap.

User Experience

If you are new to digital currencies and blockchain technology, then it goes without saying that you should select a crypto wallet that offers a user experience that caters to beginners. Some of the best crypto wallets for this purpose include the likes of eToro and Coinbase.

This is because you are guided through the entire process – such as how to send and receive funds. On the other hand, you might find that some crypto wallets are designed for those with experience in this space. This is often the case with desktop wallets, so do bear this in mind.

Fees

We briefly mentioned earlier that when you send crypto tokens to another wallet, you will need to pay a fee. This fee is determined by the respective blockchain and will increase and decrease depending on how busy the network is.

Crucially, the best crypto wallets allow you to send funds at the current network rate, meaning that they do not add a mark-up. Some providers, however, charge a flat transfer rate irrespective of the fee demanded by the network at the time of the transaction.

For instance, at Binance, you will be charged a flat rate of 0.005 BTC to send Bitcoin to another wallet. As of writing, this amounts to approximately $22. As such, sending small amounts to Bitcoin would not be financially viable when using the Binance wallet – not least because this fee remains constant irrespective of the transaction size.

Alerts and Portfolio Valuation

Another thing to check in your search for the best crypto wallet is if the provider offers real-time transaction alerts. For example, if you receive a payment into your wallet, it would be handy if a notification pops up on your phone.

Moreover, the best wallet providers in this space also give you real-time data on the valuation of your crypto portfolio – based on your preferred currency.

Supported Coins

Choosing the right crypto wallet will also depend what cryptos you want to invest in – we’ve written guides on Cardano wallets and XRP wallets for example. Our top wallet recommendation, eToro, supports Cardano staking rewards – find a step by step guide on how to set up an eToro wallet below.

How to Get a Bitcoin Wallet

In reading this guide up to this point, you should now have an intimate understanding of how the best crypto wallets work – and which type of storage option is right for your needs.

In this section, we will show you how to get started with eToro – which, as per our research, came out as the overall best crypto wallet for security, convenience, features, user experience, and regulation.

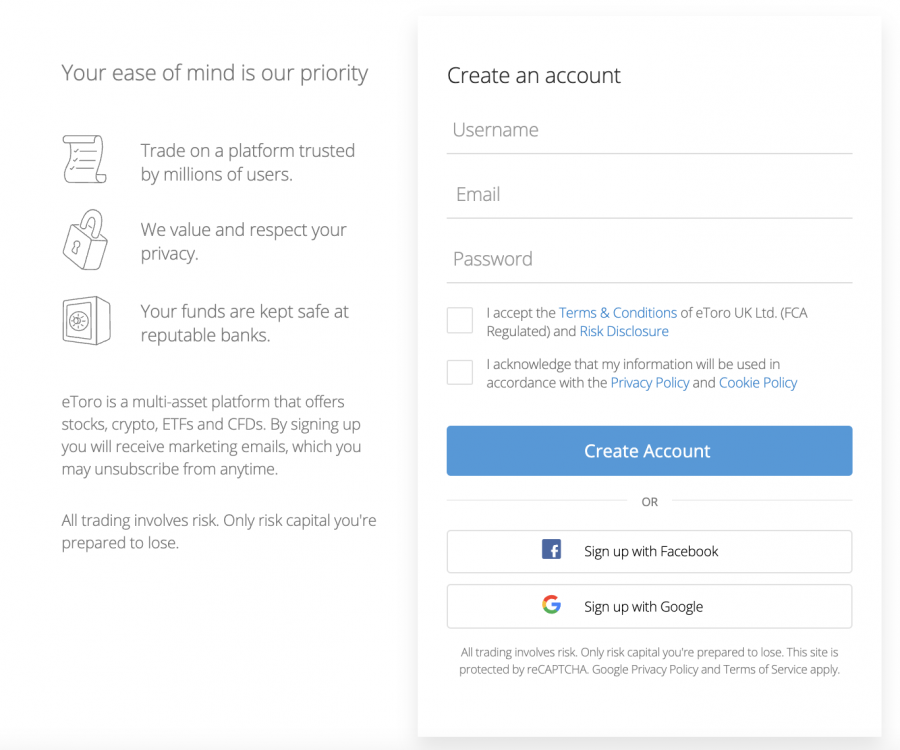

Step 1: Open an Account

In order to use the eToro Money Crypto Wallet, you will need to first register a free account on eToro.com. The provider needs to collect some personal information and contact details from you because it is regulated by the SEC and other licensing bodies.

Moreover, eToro is required to comply with regulations surrounding anti-money laundering, so you will also be asked to upload a copy of your passport or driver’s license. State ID cards are also accepted.

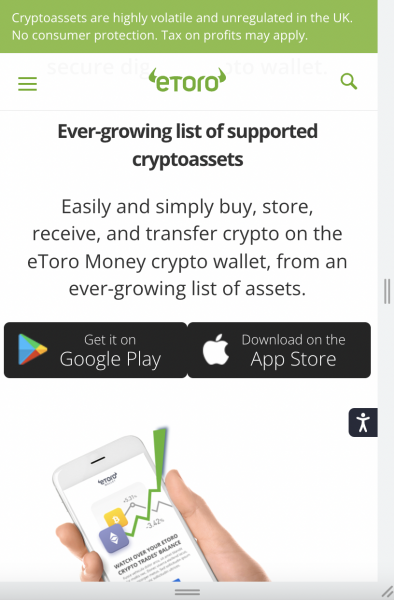

Step 2: Download eToro Money Crypto Wallet App

Now that you have verified your account, you can proceed to download the eToro Money Crypto Wallet app.

The application is available to download for free from both Google Play and the App Store.

Note: The username and password that you created when you registered with eToro will be used to log into your crypto wallet.

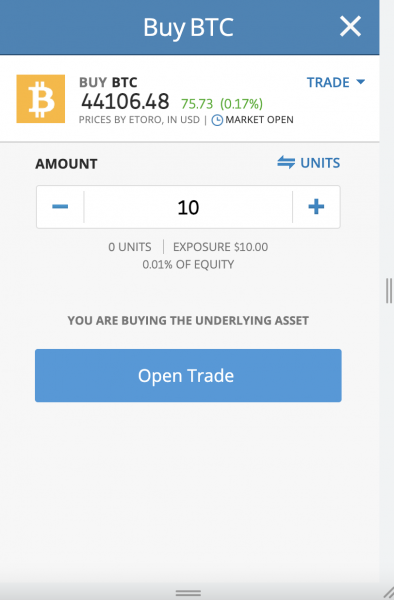

Step 3: Add Assets to Crypto Wallet

Now that you have logged into your eToro Money Crypto Wallet app, you will need to add some digital funds. If you already have some tokens stored elsewhere, simply copy your wallet address via the eToro app and complete the transfer.

Otherwise, as you have already verified your eToro account, you can buy cryptocurrency via the app with a debit/credit card or e-wallet. In doing so, eToro will only charge you the spread (from 1%) and the minimum stake is just $10. This means you can buy Bitcoin with eToro from as little as $10. No deposit fees are charged to US clients.

Conclusion

This highly comprehensive beginners guide has explained every nut and bolt regarding crypto wallets. In addition to reviewing the best crypto wallets in the market, we’ve discussed the many different storage options to choose from and how to select a trusted provider yourself.

In summary, our research findings concluded that eToro offers the overall best crypto wallet for 2023. Not only is the provider safe, regulated, and used by over 20 million people, but you can use the wallet to buy and sell crypto with US dollars at industry-leading prices.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

FAQs on Crypto Wallets

What is a crypto wallet?

How do I set up a crypto wallet?

What is the best crypto wallet?

What is the best wallet to store Bitcoin?

What is a cold crypto wallet?

Is Coinbase a good wallet?

What is the best hardware wallet?

Which crypto wallet has the lowest fees?

Read more: