Understanding what lots are in forex is key to exercising proper risk management when trading the world’s largest financial market. While there is a diverse range of terminology to know in the foreign exchange market, understanding Lots can make a huge difference in learning how to grow a trading account.

This article explains what is a Lot in forex, the difference between mini lots, micro lots and standard lots and how to calculate what a lot size is for effective position sizing and proper risk management.

What is a Lot in Forex?

Forex lots represent the number of currency units a trader wants to buy or sell. Lots help to standardize the trade size in the foreign exchange market across different trading platforms and the best forex brokers.

When understanding what are lots in forex it is also important to know that there are different lot sizes that represent a fixed number of currency units a trader can purchase. The value of 1 lot in forex is standardized based on the forex lot size being traded.

For example, 1 box of eggs may either come with 6 or 12 eggs inside the box. The box is the lot size and that represents a fixed number of eggs the buyer is purchasing. So, what are lot sizes in forex? This is explained in the next section.

A Closer Look at Forex Lot Sizes

Lots in forex trading are categorized into four different sizes: standard, mini, micro and nano. In order to determine what is a lot size in forex trading and how much each lot represents, it’s important to learn more about each of the four types of lots.

1. What is a Standard Lot in Forex?

A standard lot in forex trading represents 100,000 units of currency. This is the standardized size when trading 1 standard lot for all forex traders, across all platforms and the best forex brokers.

Standard Lot Trading Example

Let’s say the exchange of GBPUSD was trading at $1.5000. Buying 1 standard lot of GBPUSD would mean purchasing 150,000 units of currency ($1.5000 * 100,000 units).

This means to purchase 150,000 units of US dollars (the terms or quote currency) the trader will need 100,000 units of British pounds (the base currency) to do so.

2. What is a Mini Lot in Forex?

Forex mini lots represent a fixed number of currency units. 1 forex mini lot is the equivalent of 10,000 units of currency.

Forex Mini Lot Trading Example

Let’s say the EURUSD exchange rate was trading at $1.2000. Buying 1 mini lot of EURUSD would mean purchasing 12,000 units of currency ($1.2000 * 10,000 units).

This means to purchase 12,000 units of US dollars the trader will need 10,000 units of the base currency (euros) to do so.

3. What is a Micro Lot in Forex?

A micro lot in forex trading represents 1,000 units of currency. Trading with micro lots is more common for beginner traders as the small units of currency size equate to smaller profits and losses while they learn how to trade the market properly.

Forex Mirco Lot Trading Example

Let’s say the AUDUSD exchange rate was trading at $0.5000. Buying 1 micro lot of AUDUSD would mean purchasing 500 units of currency ($0.5000 * 1,000 units).

This means to purchase 500 units of US dollars the trader will need 1,000 units of Australian dollars to do so.

4. What is a Nano Lot in Forex?

A nano lot in forex trading represents 100 units of currency.

Forex Nano Lot Trading Example

Let’s say the NZDUSD exchange rate was trading at $0.8000, then how much is a micro lot in forex trading NZDUSD? Buying 1 nano lot of NZDUSD would mean purchasing 80 units of currency ($0.8000 * 100 units).

This means to purchase 80 units of US dollars the trader will need 100 units of New Zealand dollars to do so.

Forex Lots Explained

| Forex Lot | Number of currency units |

| Standard | 100,000 |

| Mini | 10,000 |

| Micro | 1,000 |

| Nano | 100 |

How are Lot Sizes Calculated?

Lot sizes are standardized across the industry. However, a common question among beginner traders is how much is a lot in forex to determine profit and loss. This does vary among the different currency pairs available but is the same among the major currency pairs in the forex market.

When trading a major currency pair such as EURUSD, GBPUSD, AUDUSD or NZDUSD a 1 pip movement in the market would be worth the following amounts in monetary terms:

- 1 standard lot = $10.00

- 1 mini mot = $1.00

- 1 micro lot = $0.10

- 1 nano lot = $0.01

This means that when trading 1 standard lot then every 1 pip movement in the exchange rate would equal a $10.00 profit or loss. A 5 pip move would equate to a $50 profit or loss (5 * $10.00). Whether it is a profit or loss depends on whether or not you chose the right direction of market movement – higher or lower. This raises the question ‘what is a Pip in forex?‘. FX pairs are quoted in Pips with 1 Pip being equal to 1 basis point.

Understanding what is 1 lot in forex can be broken down using an example.

Let’s say the EURUSD exchange rate was trading at 1.2000. The currency pair is calculated to 4 decimal points which equates to $0.0001 and the trader wanted to purchase 1 standard lot.

Then, ($0.0001 / 1.2000) * 100,000 units = $8.33 * 1.2000 = $10 per pip value. So, every 1 pip move using 1 standard lot will equate to a $10 profit or loss.

Picking a Lot Size When Trading Forex

Choosing the correct lot size when trading foreign exchange is important as it directly affects the level of risk in a portfolio. The more units of currency being traded, or the higher lot size in a trading strategy, will lead to larger gains but also larger losses making it more high risk.

As trading involves both winning and losing, risking too much on just one single trade has a greater chance of wiping out your trading account balance. Many beginner traders tend to start at small lot sizes first to build the right skills and then grow the lot size with more experience and confidence.

Where to Start Forex Trading – Popular Forex Brokers Reviewed

While there are many different forex brokers around, there are only a few which provide a high level of safety for your funds, low fees, easy-to-use platforms and expert trading tools to help with your trading decisions.

Below is a list of just a few popular forex brokers that fit the bill.

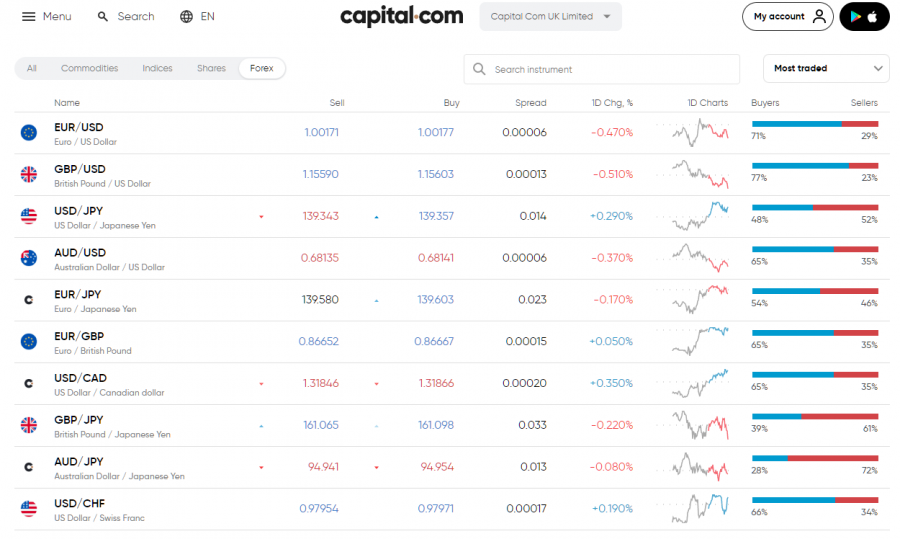

1. Capital.com – Trade 100+ Forex Pairs with 0% Commission

Capital.com is a Forex and CFD broker regulated by the UK Financial Conduct Authority (FCA), Cyprus Securities & Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).

The broker prides itself on offering zero commissions for trading, deposits, withdrawals, quotes or educational materials. This means traders can deposit and withdraw funds via debit/credit cards, bank transfers or e-wallets without any commissions.

Not only does Capital.com offer zero commission trading, but the spread cost of trading is very competitive. For example, the spread for trading EURUSD is just 0.6 pips. Traders can access more than 138 forex pairs and thousands of other instruments covering stocks, indices, commodities and cryptos.

Capital.com offers users the ability to trade the market using CFDs, or contracts for difference. This is a product which allows traders to speculate on the price direction of a market and potentially profit from both rising and falling markets.

CFDs also provide traders with the ability to leverage their position size through the use of margin trading. This means traders can open larger positions using a smaller deposit which can help amplify profits but also losses.

What is a lot in forex trading with Capital.com? The lowest lot size Capital.com offer is 1,000 units of currency or 1 micro lot.

Capital.com also provides access to a web trading platform, mobile trading app, the popular MetaTrader desktop platform and a full range of research, education and analytical tools such as the Fibonacci retracement. The platforms offer traders the ability to trade the world’s global financial markets with in-built technical analysis and fundamental analysis tools.

The minimum amount to open a trading account and start trading with Capital.com is $20.

| Forex Pairs | 138 |

| Minimum Lot Size | 1,000 units (1 micro lot) |

| Max. Leverage | 30:1 for retail clients |

| Deposit Fees | Zero |

| EURUSD Spread | 0.6 pips |

| Overnight Position (1 micro lot) | -0.0021% long / +0.00059% short |

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

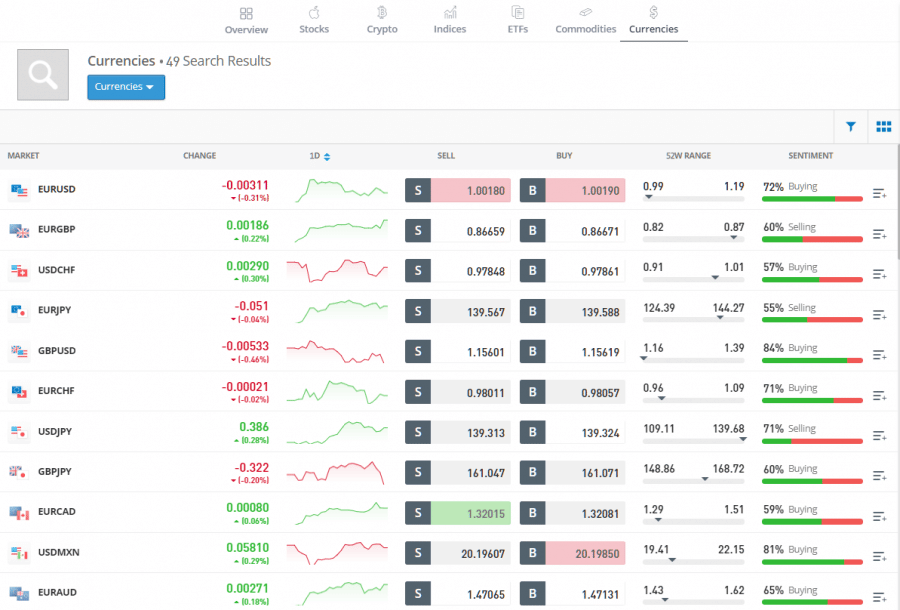

2. eToro – World’s Largest Forex Copy Trading Platform

eToro is the world’s largest copy trading and social platform that is regulated by the FCA, CySEC, ASIC and many others. The platform offers the ability to trade CFDs on thousands of markets covering stocks, indices, commodities and 49 currency pairs.

The lowest lot size eToro offers is 1 micro lot (1,000 units of currency). The spread of EURUSD averages around 1 pip but traders can also access CFDs to potentially profit from rising and falling markets while utilising leverage to amplify profits and losses.

While there are no deposit fees, accounts can only be opened in US dollars which may result in a 0.5% currency conversion fee if depositing funds in any other currency. There is also a small withdrawal fee of $5.

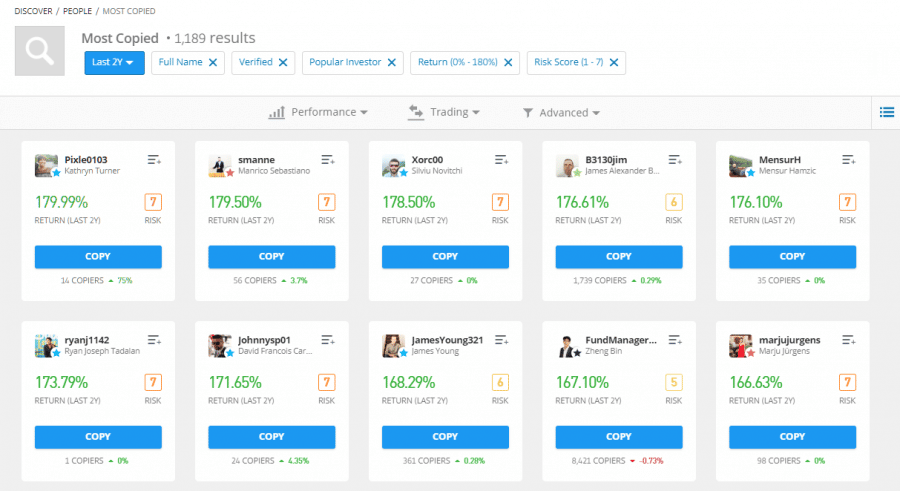

With eToro, traders can access the world’s largest social trading community. This enables traders to communicate ideas, research and trades with other members. Furthermore, users can also copy the exact trades of other profitable traders through the copy trading feature. eToro is regarded as having the best copy trading platform in the world with more than 20 million users.

This enables traders to build a more passive income stream while learning how successful traders operate in the market. The eToro investment management committee also provide Smart Portfolios which allows investors to invest in different market themes such as cybersecurity, drone tech, DeFi and so on.

eToro provides access to a live and demo account as well as the eToro Academy which is full of educational materials on trading the financial markets. Funds can be deposited using bank transfer, debit/credit card or e-wallets such as PayPal and only takes a minimum of $10 to open an account.

| Forex Pairs | 49 |

| Minimum Lot Size | 1,000 units (1 micro lot) |

| Max. Leverage | 30:1 for retail clients |

| Deposit Fees | Zero (USD) |

| EURUSD Spread | 1 pip |

| Overnight Position (1 micro lot) | -$0.10 long / +$0.04 short |

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion

While choosing the correct lot size for trading positions is important, trading with the right broker is arguably even more important. The broker should be regulated for safety and transparency, offer low fees, state-of-the-art trading platforms and a simple way to calculate your lot sizes for proper risk management.

Capital.com is a broker that fits this bill of best broker of 2022. Not only is it regulated by the FCA, CySEC and ASIC but there are zero fees for trading, deposits and withdrawals. Furthermore, the trading tickets allow traders to see their overall position size and margin requirements.

Opening an account with Capital.com only takes a few minutes and can be done with a minimum deposit of just $20.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.