ESG investing has become a popular strategy with morally-responsible investors, as it provides a framework for identifying assets with strong environmental, social, and governance principles. As an added benefit, many ESG investments are also effective from a capital gains perspective, thanks to their unparalleled longevity.

This guide explores the topic of ESG investing in detail, discussing what this strategy is and the various types of ESG-friendly assets. We’ll also showcase how to identify suitable investments before highlighting how investors can buy these assets today – all from just $10.

ESG Investing Explained

So what is ESG investing? The meaning of ESG investing can differ depending on the source, but broadly speaking, it refers to an investment strategy where assets are chosen not just on their returns potential but also their impact on the world.

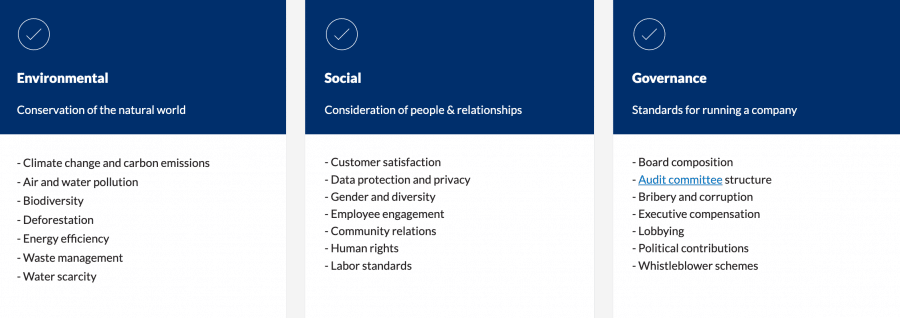

Specifically, those who invest in ESG assets will use three criteria to determine their impact – environmental, social, and governance. In a sense, ESG investing is much like ethical investing, except this framework allows assets to be given a ‘score’ for each of the three elements. This score is then added to provide the asset’s overall ESG score.

We’ll explore how each of these elements is evaluated in the following section. Fortunately, numerous leading financial analytics firms focus solely on providing well-researched ESG scores for the world’s leading companies. Refinitiv is a great example, as this firm’s scores are often cited throughout the finance industry.

Although investing in ESG companies limits the potential assets that a morally-responsible investor can consider, it allows them to positively impact the world through their investment activities. Companies with a high ESG score are often at the forefront of the push against climate change or are proponents of safe labor practices. Thus, by investing in these companies, investors can actively aid in their growth – boosting their positive effects.

However, it’s not enough to just buy stocks in ESG-focused firms – investors must keep tabs on an asset’s ESG score over time. Evaluations are conducted regularly, so just because an asset had a high ESG score in the past doesn’t mean it will still have one. Due to this, ESG investments often require more extensive research and analysis than other types.

ESG Ratings Break Down

ESG and responsible investing have become more prevalent in the wake of the COVID-19 pandemic, as investors worldwide understand the need to combine capital gains with positively impacting the world. According to Statista, the value of assets in ESG-friendly ETFs reached a staggering $391 billion in 2021 – up from just $5 billion in 2006.

But what actually separates these assets from the rest? To answer this question, let’s take a closer look at the three components of ESG investments:

Environmental Factors

The first section of any ESG investing certification focuses on environmental factors. As expected, this section analyzes how a company or fund affects the planet – whether that be positively or negatively. Assets with a positive impact are given higher scores, while those with a negative impact score lower. For more information on impact investing then users can read our article on what is impact investing.

Many elements are considered when analyzing an asset’s environmental impact. These could include its carbon footprint, decarbonization policies, renewable energy use, or recycling practices. Some ESG companies to invest in also purchase carbon offsets to reduce their contribution to global warming.

Finally, analysts looking at a company’s environmental impact will also look for partnerships with leading bodies that look to make a positive change. For example, Amazon’s website notes partnerships with institutions like the LEAF Coalition that help protect the world’s rainforests.

Social Factors

The second component of an asset’s ESG score is social factors. Even the best new stocks now focus on their social impact, given the universal rise in awareness brought about by social media. Broadly speaking, an asset’s social impact relates to how the company treats its employees, suppliers, local community, and other stakeholders.

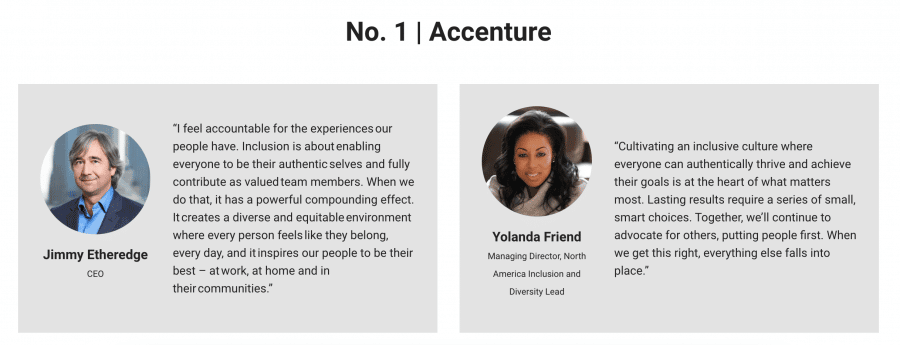

ESG investing companies will ensure their social impact is positive by treating employees well and providing safe working practices. Diversity and inclusion play a prominent role in a company’s social rating, with employee engagement also considered.

ESG investing strategies may also consider companies that actively try to make social change through lobbying the government or donating to leading institutions. Those who invest in stocks with an ESG-focused strategy can often identify a company’s social impact simply by searching its name and looking for the most-read news articles over the past year.

Governance Factors

Finally, an asset’s certificate in ESG investing also considers governance factors. These factors relate to the company’s upper echelons – specifically on how the executives act and how ethical they are. Analyzing a company’s governance may also consider how these executives are compensated and whether their pay is too high.

Diversity also comes into play here – if a company’s board is considered diverse, it’ll receive a higher governance score. There may even be some crossover between governance and social factors, as the former evaluates how much the executives emphasize morally-responsible policies.

Governance analysis also assesses whether a company has had any run-ins with the law or ignored prevailing regulations. Those who have opted to buy Tesla stock in the past will remember the enormous fine Elon Musk received from the SEC for claiming he would take the company private. This negatively affected Tesla’s governance score on ESG analytics sites.

How Does ESG Investing Work?

Investing in ESG funds or stocks is similar to ‘normal’ investing because prior research and analysis are conducted on whether the asset is viable from a financial gain perspective. However, ESG investing adds an extra layer of analysis by ‘filtering’ assets based on their ESG score.

The previous section highlights the various elements considered when delivering an asset’s ESG score. A popular ESG investing strategy is only investing in assets with an ‘AAA’ rating – the highest score possible. As defined by MSCI, these assets are considered ‘Leaders’ in their field.

However, those wondering how to invest $1,000 (or any amount) in ESG-friendly will often find that the number of AAA-rated assets is limited. Due to this, AA-rated assets can also be considered, as these still exhibit positive environmental, social, and governance elements. Some traders even consider ESG investing equally as important as socially responsible investing.

Finally, ESG investing is an unending strategy, since investors must regularly check their assets’ scores to see if anything has changed. We discussed this briefly earlier in the article, but scores can change periodically as new policies are implemented. As a result, active portfolio management is a crucial part of ESG investing.

Types of ESG Investments

The best investment apps and trading platforms make ESG investing easy since they offer hundreds (if not thousands) of assets to trade. But what asset classes can actually be considered ESG-friendly? Let’s take a closer look at five of the most popular ones below:

Cryptocurrency

ESG-focused investors may also wish to buy cryptocurrency, as this asset class has improved its reputation in recent years from a financial sense. Bitcoin’s colossal energy usage initially harmed crypto’s reputation, yet the emergence of ‘Proof-of-Stake’ (PoS) chains has drastically reduced many blockchains’ energy requirements.

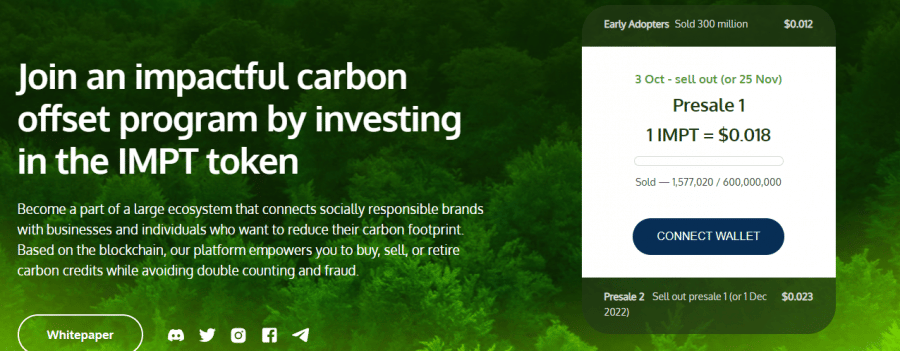

As a result, the greenest cryptocurrency projects now have a minimal carbon footprint – making them appealing to ESG investors who focus on the environmental side of things. One project that has made waves in this area is IMPT – which looks to completely revolutionize the carbon credits market.

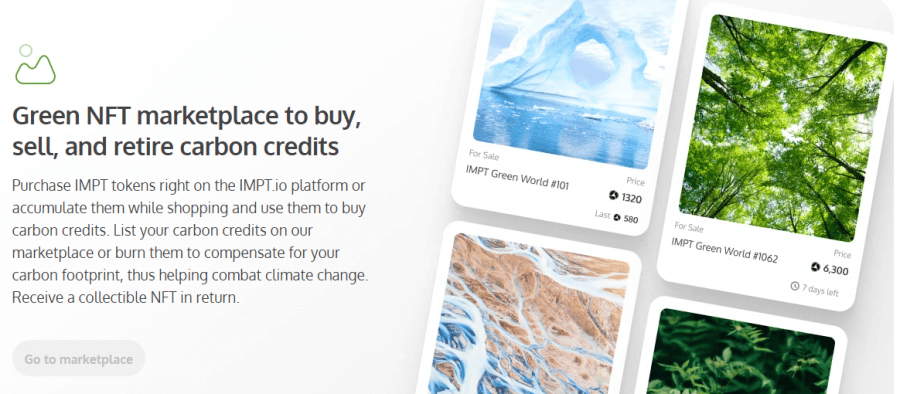

The IMPT whitepaper states that this ecosystem is built on the Polygon blockchain, which is one of the lowest-energy blockchains in operation. Within this ecosystem, individuals can earn ‘IMPT Points’ through everyday shopping. Individuals can then exchange these points for carbon credits, which are structured as NFTs.

Once a carbon credit is acquired, the individual can sell it for financial gain or opt to retire it – effectively removing CO2 from the atmosphere. Individuals who take this approach will be rewarded with a unique digital artwork NFT, which can also be sold. Since this approach makes it much easier for individuals to gain exposure to the carbon credits market, IMPT looks likely to be one of the hottest cryptocurrency projects of 2023.

The latest information about this project is available on the IMPT Telegram channel.

Stocks

Naturally, ESG stock investing remains the most widespread approach for ethical investors. This process has become easier than ever thanks to the popularization of ESG analytics companies, which investors can use as a resource to uncover viable assets.

Many of the best tech stocks, such as Nvidia and Adobe, have high ESG scores, which makes them popular with investors who employ this approach. However, it’s essential to remember that just because a company has an AAA or AA rating doesn’t mean that financial gain is guaranteed. Thus, investors must also evaluate the company technically and fundamentally to ensure it offers positive returns potential.

Carbon Credits

Many people now research how to invest in carbon credits as well as search for the best green investment funds, which have emerged as an ESG-friendly asset. For those unaware, carbon credits are a sort of ‘contract’ that allows the holder to emit one ton of carbon dioxide (or greenhouse gas equivalent) into the atmosphere.

These credits can be easily traded on the secondary market. For example, if a firm is trending to emit more CO2 than permitted, it can purchase carbon credits from a company that is trending to emit less. The ‘net emissions’ are the same, but both companies benefit.

Those looking to begin investing in ESG energy firms may wish to consider how these firms offset their CO2 footprint. If they regularly trade carbon credits, this is positive from an environmental perspective – leading to a higher ESG score. Some retail investors have also started searching for the best carbon credits ETFs as a way to passively gain exposure to carbon credits.

ESG Mutual Funds

As the name suggests, ESG investment funds are funds that only consider assets that have been thoroughly screened based on environmental, social, and governance criteria. These funds are suitable for ESG investors who don’t have the time (or knowledge) to manually create a portfolio and wish to invest passively.

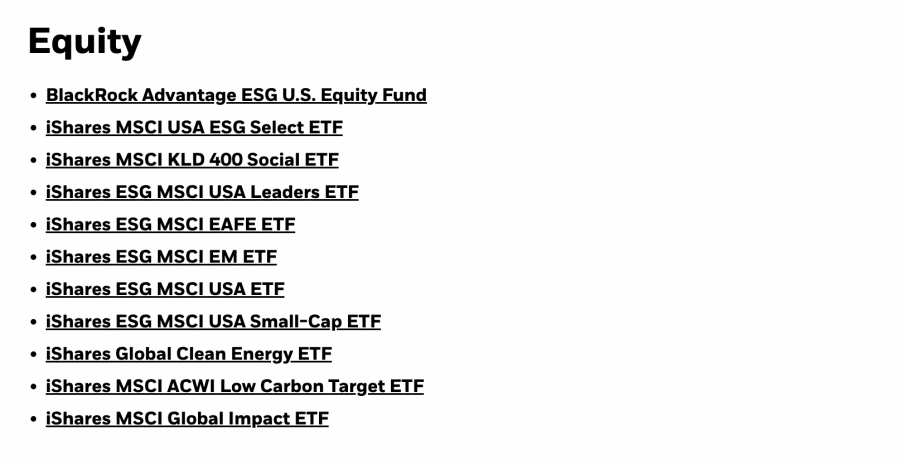

There is now an abundance of ESG mutual funds for investors to choose from, offered by leading entities like Vanguard and BlackRock. BlackRock ESG investing has become particularly popular thanks to its selection of ‘iShares’ funds.

ESG ETFs

Much like the Vanguard and BlackRock funds mentioned above, ESG ETFs are pooled investment vehicles that only consider assets with high environmental, social, and governance scores. However, these ETFs differ from mutual funds since they are publicly listed on major stock exchanges.

Due to this, investors interested in ETF trading can easily buy shares in these ETFs to gain exposure to the price fluctuations of the assets contained within. It’s worth noting that ESG ETFs often have a slightly higher expense ratio, which is justified due to the fund manager having to complete additional research to ensure each asset is ESG-friendly.

Pre-made Stock Portfolios

An alternative to ESG investment fund investing is pre-made portfolios. These portfolios tend to be offered by brokers and trading platforms as a way for beginner investors to gain exposure to a specific industry or asset class. However, some brokers also provide pre-made portfolios that focus on ESG-friendly assets.

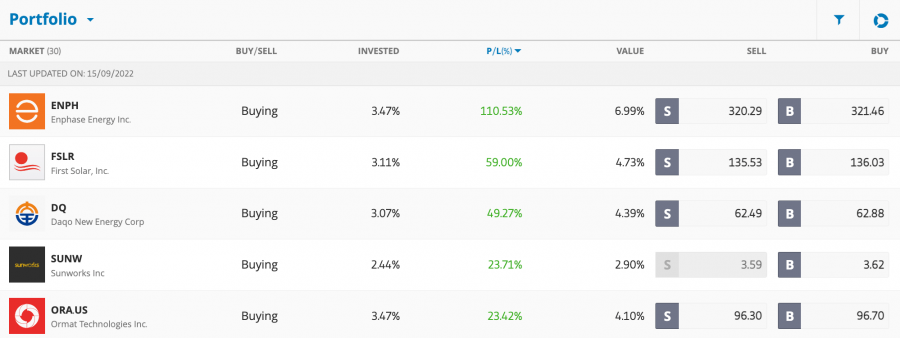

A prime example of this is the ‘Future of Power’ Smart Portfolio by eToro. This portfolio contains assets within the renewables sector – most of which strongly focus on aiding the environment. As a result, this portfolio may appeal to ethical investors wishing to gain exposure to sustainable investing funds.

Examples of ESG Investment Assets

There are now thousands of assets that ESG-focused investors can consider, which is why this strategy has become so popular in recent years. Although investors must do their due diligence and make their own decision, detailed below are some popular ESG investment assets that can be used as inspiration:

Nvidia (NVDA)

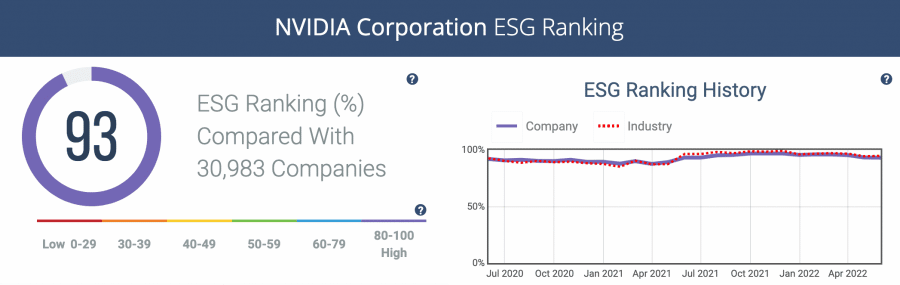

Nvidia has also garnered a reputation due to its high ESG score. According to CSRHub, Nvidia has a 93% ESG ranking compared with over 30,000 other companies. Naturally, this means the company is performing exceptionally well regarding its environmental, social, and governance impacts.

Since Nvidia is listed on the New York Stock Exchange (NYSE), investors can easily buy shares through most of the best trading platforms. Investors can also gain exposure to Nvidia’s price fluctuations through several ESG-focused funds and ETFs.

iShares MSCI USA ESG Select ETF (SUSA)

The iShares MSCI USA ESG Select ETF is an ESG investing ETF offered by BlackRock. This ETF seeks to track the results of a basket of US-based companies with positive environmental, social, and governance characteristics making it a popular option for those looking to engage with sustainable investing. Moreover, the ETF actively avoids companies with low ESG ratings or that have been involved in prominent controversies.

The iShares MSCI USA ESG Select ETF has over $3.3 billion in assets and invests in 181 different companies. Some of the ETF’s top holdings include Apple, Tesla, Home Depot, and PepsiCo. Along with its ESG-based principles, this ETF has also exhibited positive performance in recent years – returning an impressive 30.31% in 2021.

‘Future of Power’ Smart Portfolio

The ‘Future of Power’ Smart Portfolio is a pre-made portfolio offered by the heavily-regulated trading platform, eToro. This portfolio contains an array of stocks that operate within the scope of the clean energy sector, meaning most score highly when it comes to the ‘Environmental’ element of their ESG rating.

The minimum investment in this portfolio is just $500, making it more accessible than many mutual funds and ETFs. Assets are managed regularly, with popular holdings including Enphase Energy, First Solar, and Sunworks. Although the Future of Power portfolio can be volatile, investors were still able to generate returns of over 71% back in 2020.

78% of retail investor accounts lose money when trading CFDs with this provider.

CBL Nature-Based Global Emissions Offset Futures (N-GEO)

CBL Nature-Based Global Emissions Offset Futures are a type of futures contract that allows companies to offset their carbon footprint. However, these futures differ from other carbon offsets by focusing solely on high-quality nature-based offsets.

Many of the best futures trading platforms offer CBL Nature-Based Global Emissions Offset Futures to individuals, as they provide exposure to the price fluctuations inherent in the carbon offset market. Importantly, this market can be volatile and sometimes opaque – meaning these futures are better suited to experienced investors.

Best Buy (BBY)

Best Buy’s ESG report for 2022 noted several initiatives that have led to this high ESG score. These include extensive employee training, expanded benefits to employees’ families, and even drastically reduced water consumption. In addition, 45% of Best Buy’s Board of Directors is female, with the company also auditing all of their suppliers for ethical business practices before establishing a relationship.

Why do People Invest in ESG Companies and Funds?

According to Bloomberg, global ESG assets will exceed $53 trillion by 2025. But why are these assets so popular? To answer this question, detailed below are four reasons that ESG-friendly assets can benefit investors:

Potential for Financial Gain

Naturally, one of the main reasons people invest in ESG-focused assets is for financial gain. This is the case across all asset classes and forms the foundation of the financial markets.

However, the scope for financial gain is increased in many instances for ESG investors. Companies with a high ESG score are often more appealing for their longevity and positive impact. This can translate into more people buying their goods/services, leading to higher revenues – and better share price performance.

Exposure to High-Growth Sectors

Many ESG-focused companies operate in high-growth sectors, meaning investors that employ an ESG investing strategy can gain exposure by buying shares in these companies. A few examples of related high-growth industries include biotechnology, renewables, electric vehicles, and pharmaceuticals.

ESG investors who find the best cheap stocks operating in high-growth industries can put themselves in line to generate notable returns. A popular example of this is Linde, the global chemical giant. Linde’s shares are up over 100% since April 2020, when they were considered undervalued – all whilst the company has retained one of the highest ESG ratings in its industry.

Easily Accessible & Identifiable

Finally, more and more investors are now deciding to invest in ESG-focused assets due to how accessible and identifiable they are. As mentioned earlier, several sites provide well-researched ESG scores for publicly-traded companies, making it easy to see which ones are making the most positive impact.

Furthermore, even those that day trade stocks can now access ESG-friendly equities, which are often available as CFDs through leading brokers. This means that day traders can still employ a short-term trading strategy in a way that fits with their values and beliefs.

Helps Make a Positive Impact

ESG impact investing is an excellent way for investors to actively deploy their capital to help environmental, social, or governance-related causes. For those unaware, impact investing involves buying shares in companies that offer a good or service that directly benefits a particular group or aids the environment.

For example, ESG investors may buy shares in a company such as Archer-Daniels-Midland (ADM), which is actively helping to promote sustainable agriculture. By taking this approach, investors can rest assured that their capital is being used in the best possible way.

How to Find ESG Investment Assets

When researching how to invest in startups, investors must conduct their due diligence to ensure the company has a long-term future. ESG investing follows a similar approach, yet investors must also screen for suitable assets from an environmental, social, and governance perspective.

With that in mind, detailed below are three ways that investors can uncover ESG investment assets easily:

Use a Reputable Financial Analytics Site

ESG investment assets can be identified by using a reputable financial analytics site. Providers such as MSCI and Refinitiv offer a detailed analysis of thousands of publicly-traded companies, with most features available for free. However, investors who wish to dig a little deeper will often have to pay a fee to access the more advanced information.

Alternatively, many leading financial news sites also showcase ESG scores for most leading companies. For example, Yahoo Finance has a dedicated ‘Sustainability’ tab for each publicly-listed company that showcases its ESG rating and controversy level – both of which are regularly updated.

Keep Track of Current Affairs

By keeping tabs on the latest worldwide trends, investors can gain insight into pressing issues and the solutions on offer. In turn, this tends to highlight which companies are doing the most to provide these solutions – which is usually a signal of a high ESG score.

To illustrate, diversity has become a pressing issue in major companies, particularly at the executive level. However, DiversityInc found that Accenture is actively trying to solve this issue, prompting them to rank the company as number one worldwide regarding diversity and inclusion.

Use Twitter and Reddit

Finally, investments with a high ESG score can be found by using social media. The world is more interconnected than ever, meaning that when a company makes a decision or implements a policy deemed positive, it’s often reported in real-time on Twitter or Reddit.

In truth, many companies opt to announce ESG-friendly policy changes on these social media platforms, as they know it’ll generate the most publicity. Due to this, ESG investors looking for potential assets can scour Twitter and Reddit for prominent announcements, which can provide the basis for further research.

Brokers Offering ESG Investments

Due to this growth in popularity, many brokers and trading platforms worldwide have increased their offering of ESG-friendly investments. One of the most popular brokers to take this approach is eToro – the heavily-regulated trading platform that serves more than 28 million clients.

ESG investors will find it simple to find suitable assets with eToro, since the platform offers equities, currencies, commodities, indices, ETFs, and even cryptocurrencies. Since eToro operates primarily as a CFD broker, investors can benefit from the zero-commission fee structure. No transaction fees are charged since eToro includes its fee in the market spread.

Investors can fund their eToro account from as little as $10, with support for credit/debit card, bank transfer, PayPal, Skrill, and Neteller deposits. eToro supports USD as a base currency, meaning there are no deposit or currency conversion fees to contend with. Moreover, eToro’s sign-up process is streamlined, requiring no physical paperwork and taking less than ten minutes to complete.

eToro is also considered one of the best CFD brokers due to its trading tools, which include an array of technical indicators and order types. ESG-focused investors can also invest in eToro’s ‘Future of Power’ Smart Portfolio, which contains 30 sustainable equities. Finally, eToro even has an innovative ‘CopyTrader’ feature that allows users to copy the positions opened by other eToro traders – without any additional fees.

78% of retail investor accounts lose money when trading CFDs with this provider.

What is ESG Investing? – Conclusion

In summary, this ‘ESG investing 101’ guide has taken a comprehensive look at this popular strategy, covering what ESG investing is, how it works, and where investors can buy ESG-friendly assets today.

The popularity of ESG investing shows no signs of slowing, as investors have become more conscious of companies’ global impacts following the COVID-19 pandemic. With Bloomberg forecasting that ESG assets are likely to hit $53 trillion by 2025, there is expected to be an abundance of opportunities for morally-responsible investors in the years ahead.