ETFs (exchange-traded funds) enable investors to gain exposure to a broad range of stocks and other assets through a single investment.

The ETF will be managed on behalf of the investor and regularly rebalanced to ensure it continues to align with the objectives of the fund manager.

In this beginner’s guide on What is ETF Trading? – we explain everything there to know about this popular investment landscape.

What is ETF Trading? Overview of the Basics

ETFs are run by large investment funds – such as SPDR and Vanguard. Each ETF will look to track a specific market on behalf of investors that wish to gain exposure to a basket of assets. For example, some of the most popular ETFs in this market will look to track staple US-based index funds – such as the S&P 500 or Dow Jones.

Many ETFs will also track index funds from foreign stock exchanges, such as the FTSE 100 (UK) or the Hang Seng (Hong Kong). Other ETFs will look to track a broader range of stocks, such as those from the emerging markets or perhaps a collection of dividend-paying companies.

It is also possible to invest in ETFs that track other asset classes – such as gold, silver, and wheat. Either way, ETFs are managed on behalf of investors, which offers the opportunity to trade in a passive manner. Moreover, the ETFs will regularly rebalance the fund to ensure that it aligns with the objectives of the target market.

Most ETFs will be weighted too. For example, when investing in an S&P 500 ETF, more weight is given to companies with a larger market capitalization – such as Amazon, Microsoft, Tesla, and Apple. Another benefit of investing in ETFs is that investors will often have access to quarterly dividend payments.

This will be the case when investing in assets that attract regular income, such as dividend stocks or bonds. When it comes to fees, ETFs are often very competitive – especially when tracking major marketplaces like the S&P 500 or gold. ETF trading fees are calculated as an expense ratio, which is based on a percentage of the amount invested.

While the above explains the basics of What is ETF trading, in the sections below, we take a much deeper dive into how this investment class works.

How do ETFs Work? Detailed Explanation

Learning how ETF trading works is a lot easier when the investor has a grasp of the core principles, which we explain in the following sections.

Track a Specific Market

First and foremost, we should note that ETFs are different from mutual funds in how they approach their investment strategy. In the case of mutual funds, the objective is to outperform the broader market.

- For example, if the S&P 500 generates 10% in 2023, the mutual fund will aim to make a higher yield for its investors.

- In comparison, an ETF will look to mirror the market that is tracking.

- As such, it would look to make 10% annually if this is what the S&P 500 generates in the respective year.

In order to track a market, the ETF will personally purchase the respective assets. For instance, if the ETF is looking to track the Dow Jones, it will invest in all 30 stocks on behalf of its investors.

Note: Some ETFs are actively managed. This means that the ETF will attempt to outperform a specific market through active investment decisions.

ETF Weighting

The vast majority of ETFs will be weighted. This means that some assets represent a higher percentage of the ETF when compared to others.

A great example of a weighted ETF is the Vanguard S&P 500. As per the table below, although Vanguard will purchase stocks in all 500 companies, there is a sizable dominance by large-cap firms.

| Ticker | Holdings | CUSIP | SEDOL | % of fund | Shares | Market value |

| AAPL | Apple Inc. | 37833100 | 2046251 | 7.12 % | 343,149,759 | $55,765,267,335 |

| MSFT | Microsoft Corp. | 594918104 | 2588173 | 5.98 % | 166,912,332 | $46,858,968,086 |

| AMZN | Amazon.com Inc. | 23135106 | 2000019 | 3.36 % | 195,276,568 | $26,352,572,852 |

| TSLA | Tesla Inc. | 88160R101 | B616C79 | 2.13 % | 18,728,059 | $16,695,128,196 |

| GOOGL | Alphabet Inc. Class A | 02079K305 | BYVY8G0 | 1.99 % | 134,034,244 | $15,590,863,262 |

| GOOG | Alphabet Inc. Class C | 02079K107 | BYY88Y7 | 1.84 % | 123,301,056 | $14,381,835,172 |

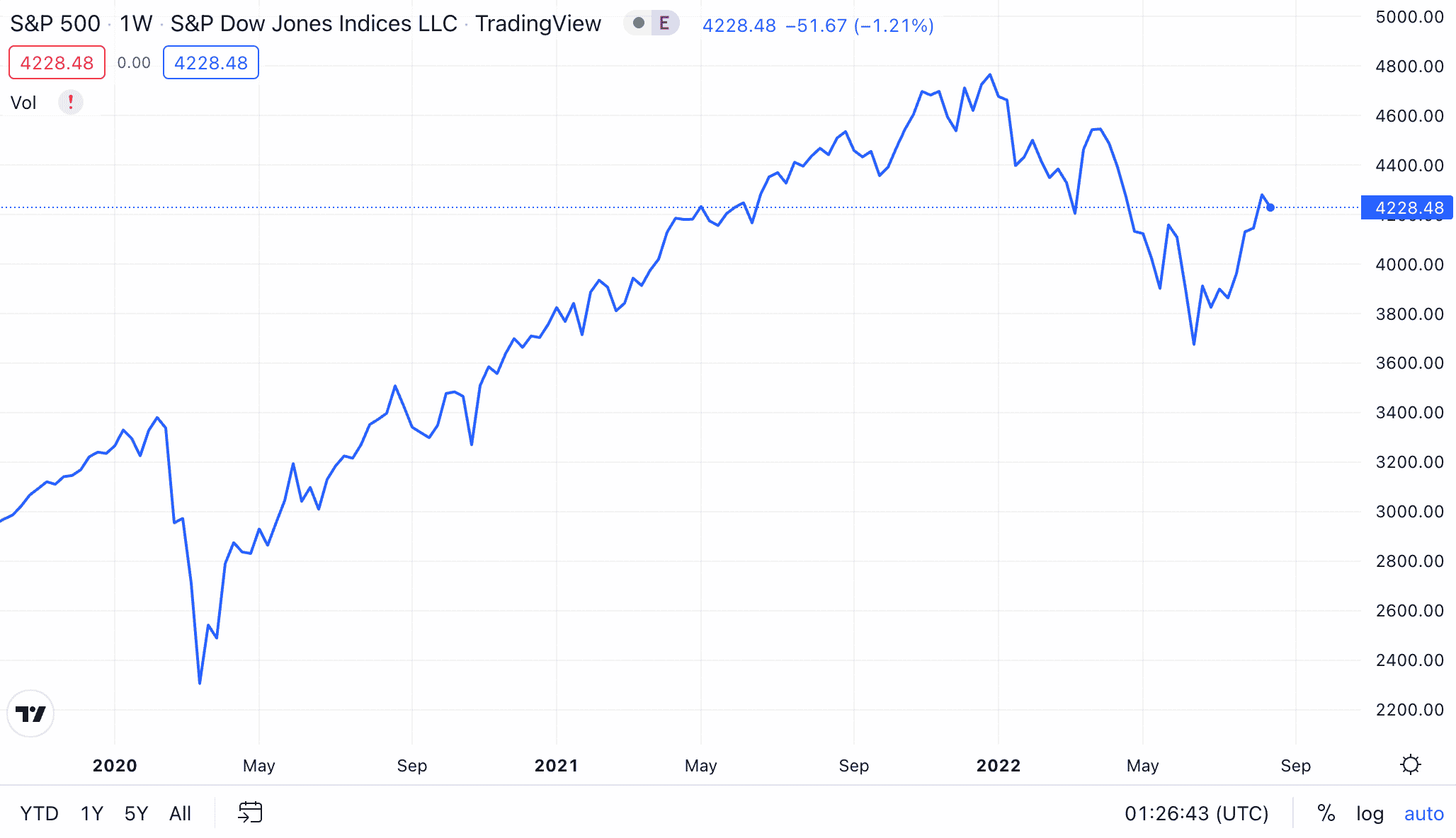

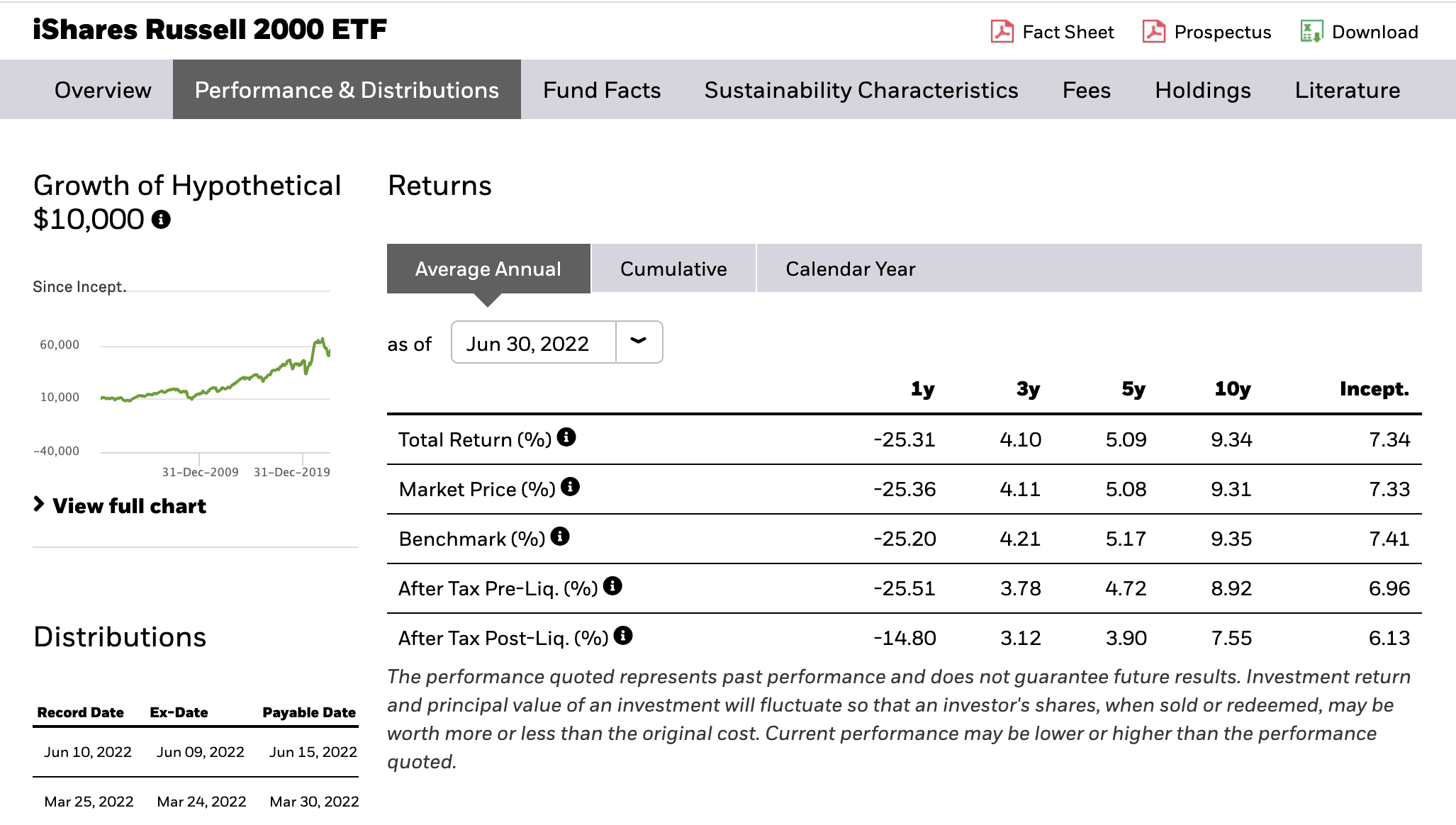

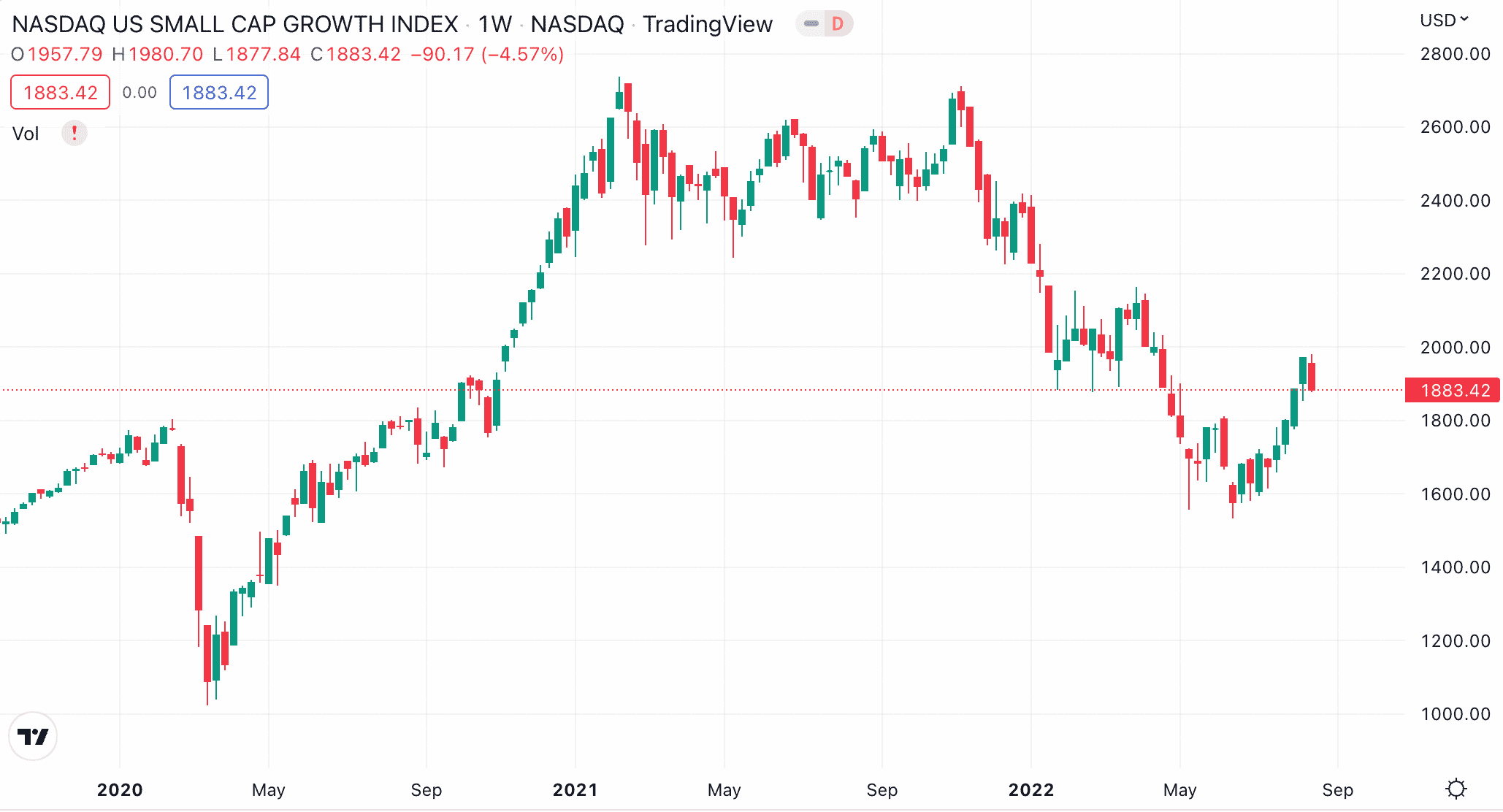

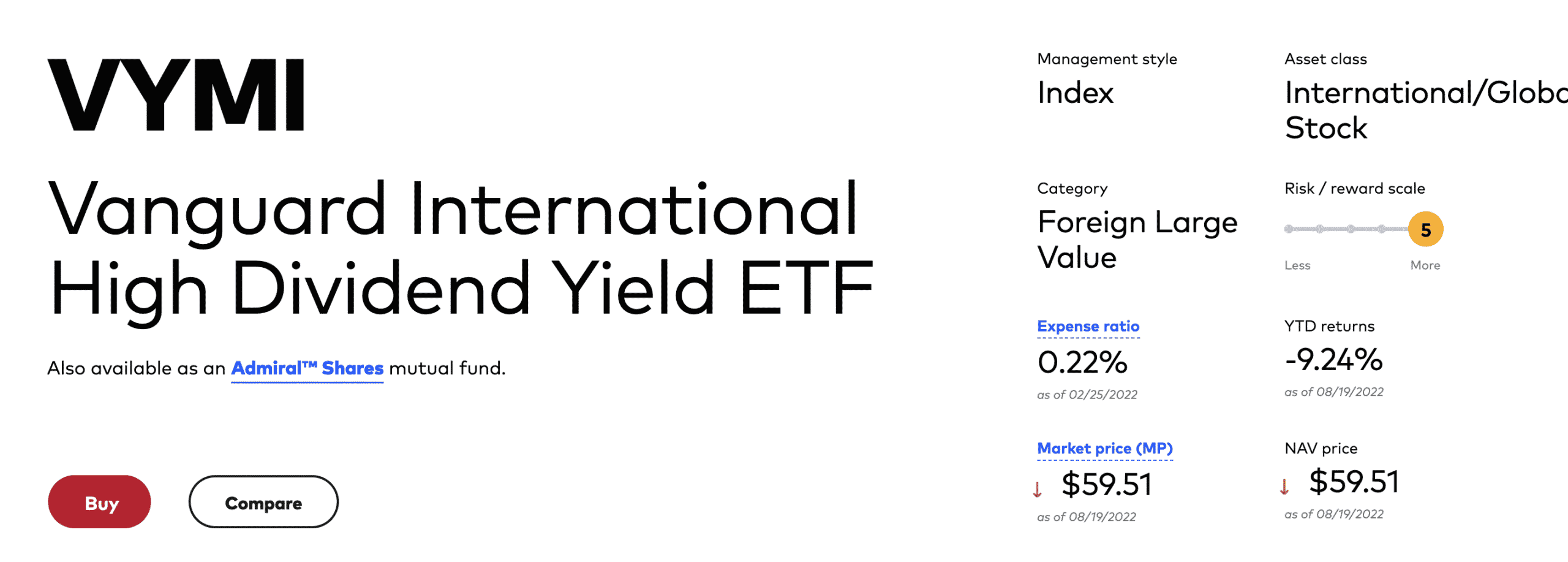

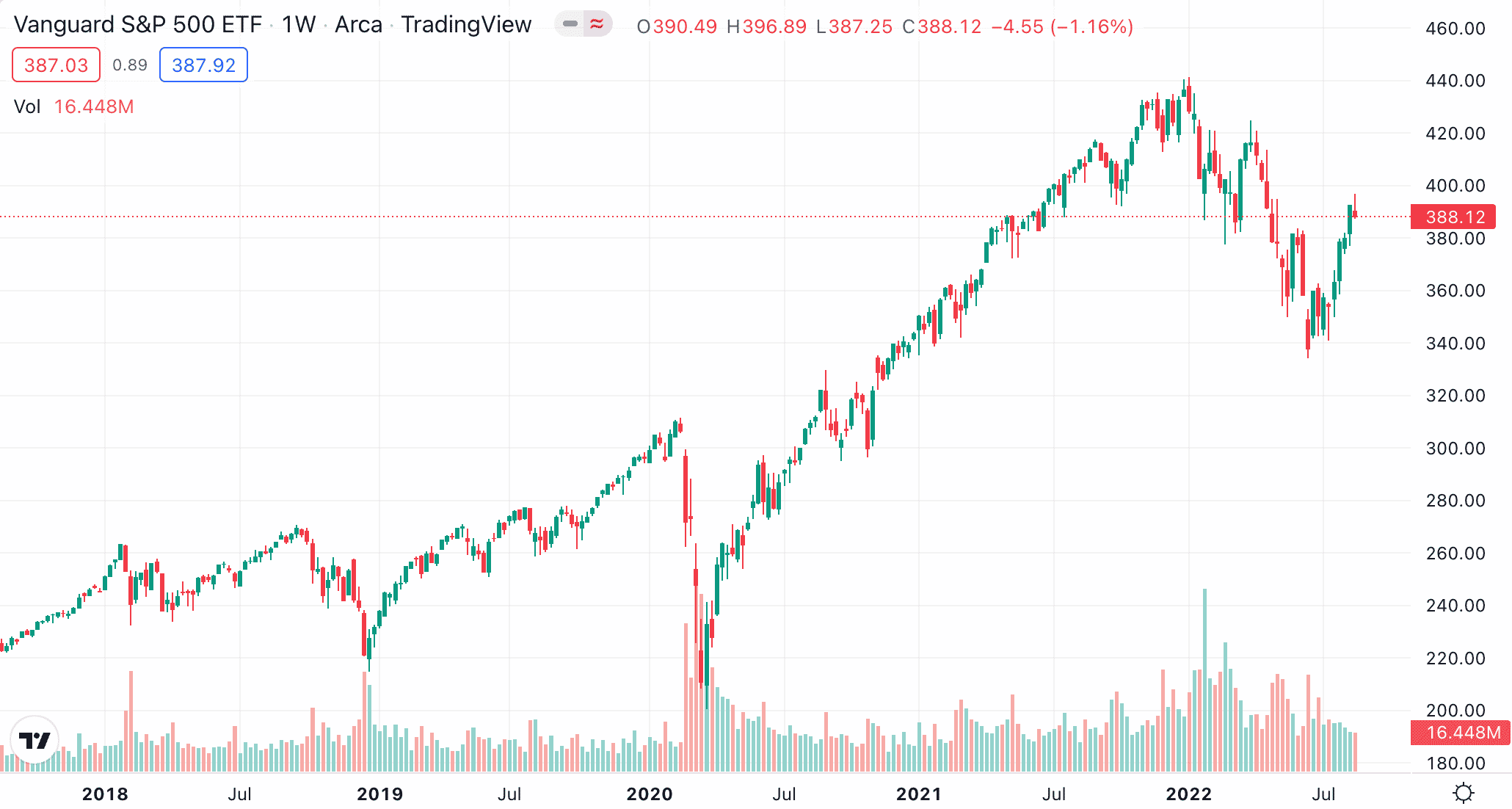

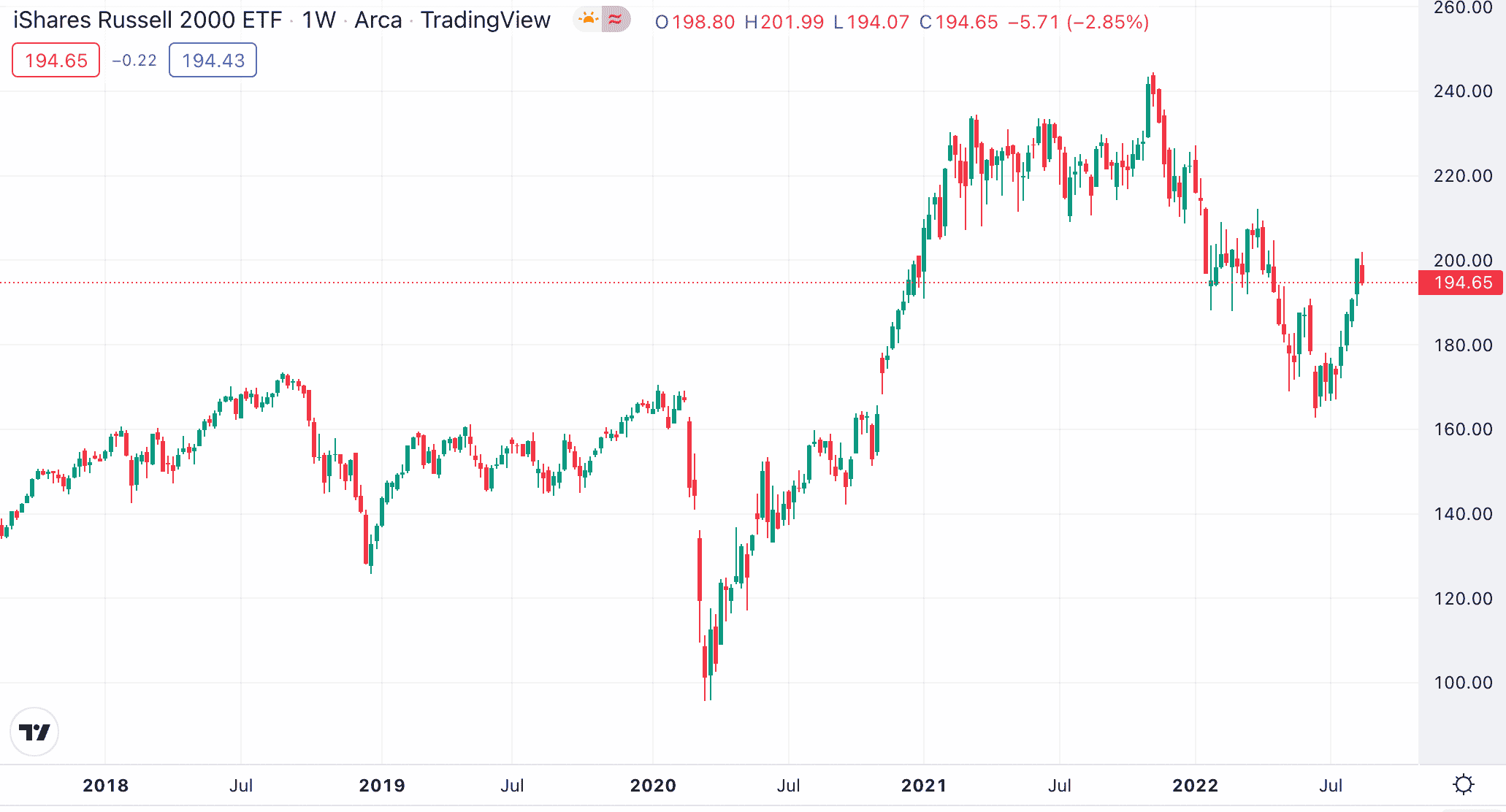

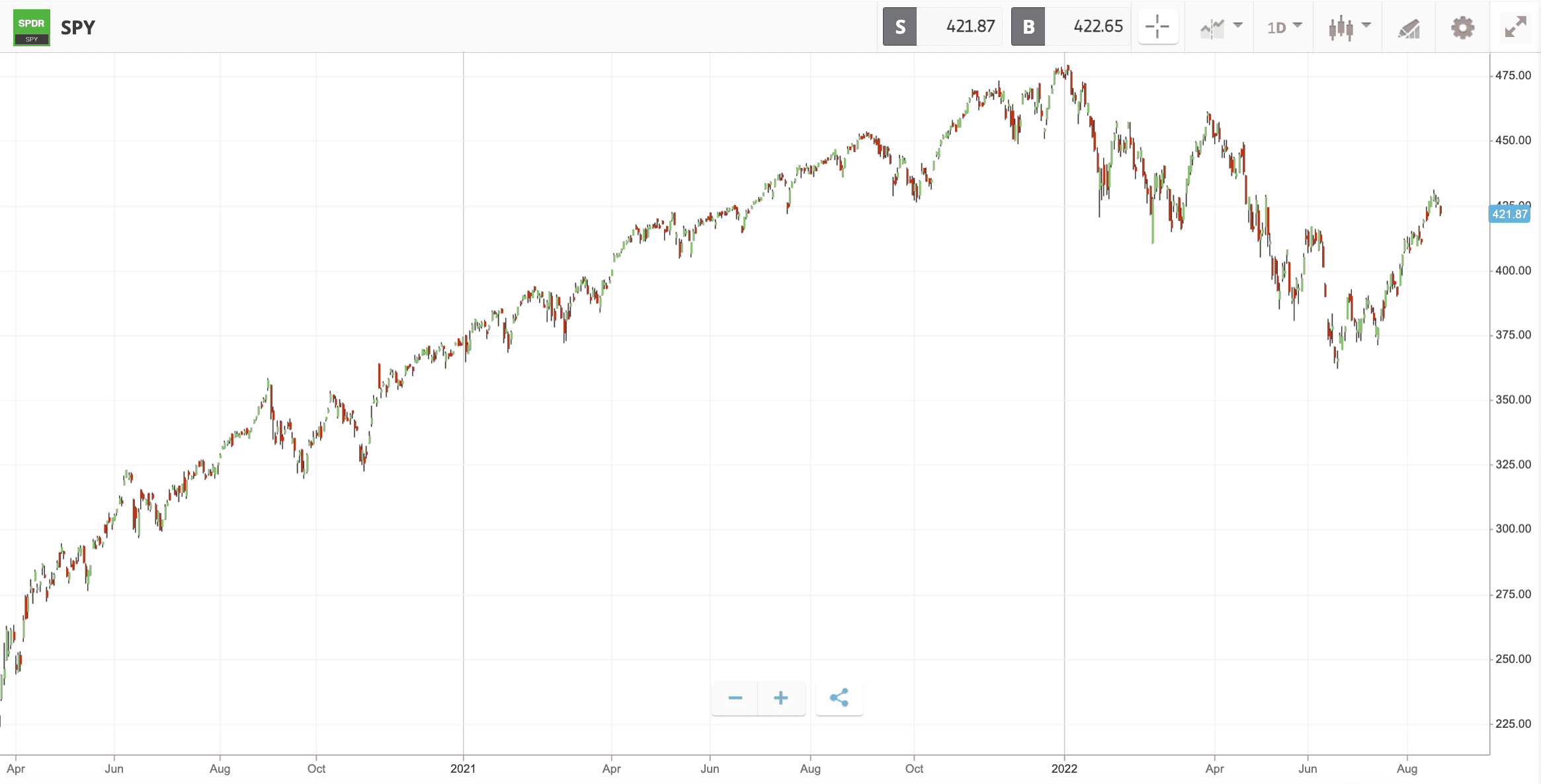

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider. For instance, Apple represents 7.12% of the fund, while in the case of Microsoft and Amazon, this stands at 5.98% and 3.36%, respectively. This means that more than 16% of the Vanguard S&P 500 ETF is represented by just three companies, out of 500. Nonetheless, this is how the S&P 500 index itself is weighted, as a greater percentage is given to companies based on market capitalization. In comparison, the Dow Jones has a weighting system that favors the stock price of the company. When investing in an ETF, the capital is essentially split between the assets held by the fund. In most cases, ETFs will reweight their portfolios every three months, in line with the respective market. For example, if Apple lost a significant amount of its market capitalization, the firm would likely have its weighting reduced in S&P 500 ETFs. Similarly, ETFs will often rebalance their portfolio. This means that certain companies will be removed and/or added from the ETF based on certain conditions. For example, in 2020, Dow Jones ETFs replaced long-standing constituent Exxon Mobile with Salesforce.com. When learning What is ETF Trading, investors should also have an understanding of how the value of the fund will rise and fall. First and foremost, ETFs trade in the same manner as stocks. This is because ETFs are listed on public exchanges like the NYSE. As such, this makes it a simple process to buy and sell ETFs, as trades can be executed whenever the respective exchange is open. In terms of how the value of an ETF is determined, this will depend on how the underlying assets contained within the fund are performing as a collective. This is overwise known as the NAV (Net Asset Value). For example: Leading on from the above example: In theory, this means that the share price of the ETF should also have risen by 80%. However, this isn’t always the case, as the ETF will need to take into account other factors – such as fees, as well as the fact that they often trade at a discount or premium. Nonetheless, large-cap ETFs run by the likes of iShares, Vanguard, and SPDR will often trade very closely in line with the respective NAV. In a nutshell, if the ETF holds assets that yield an income, investors will be entitled to their share of the proceeds – fewer fees. For example, if the investor decides to inject capital into the S&P 500, most ETFs will distribute dividends every three months. The amount distributed will depend on two factors: Seasoned investors will often reinvest the dividends back into the same ETF with the view of benefiting from compound interest. The process of buying and selling ETFs is much the same as investing in stocks. As we noted earlier, the value of the ETF will be represented by a stock that trades on an exchange. Whether the ETF rises or falls in value is depending on the underlying assets that it holds. Nonetheless, in order to invest in an ETF, this needs to go through a conventional online broker. The investor can buy or sell an ETF at any given time while the respective stock exchange is open. In the section of our guide on What is ETF Trading, we take a closer look at some of the main reasons why this investment class is popular. One of the main reasons that ETFs remain popular is that they offer a passive investment experience. All the investor needs to do is complete their investment with a broker that supports the respective ETF. After that, the broker will regularly rebalance and reweight the ETF on behalf of its investors. This means that the investor does not need to research the market regularly. With that said, investors should still consider whether the ETF remains in line with their long-term investment objectives. Another reason why ETFs are popular is that they enable investors to diversify via a single trade. Let’s take an ETF that tracks the Russell 2000 index as a prime example. This index fund tracks the value of 2,000 small-cap companies that are listed in the US and the highest weighted constitution represents just 0.41% of the market. In comparison, by opting for an ETF, the investor would be able to gain exposure to the Russell 2000 in a matter of seconds through a single investment – with no requirement to rebalance or reweight their portfolio. Another thing to note is that many online brokers in the ETF trading space support small, fractional investments. For example, popular stock broker eToro supports ETF investments from just $10. This would enable the investor to diversify across multiple ETFs to ensure that they are not overexposed to a small spectrum of markets. Throughout this guide so far, we have focused much of the discussion on conventional ETF markets that track major index funds like the S&P 500 and Dow Jones. However, it is important to note that ETFs offer access to a far broader range of markets – many of which are considered difficult to reach for the average, non-institutional investor. Examples of markets that ETFs offer access to include: Some investors will look to invest in a basket of equities from a specific stock category. This could, for example, include an ETF that exclusively tracks high-yield dividend stocks. In this example, the ETF would likely have a set of predefined objectives in place, such as only investing in companies that have paid an annualized dividend yield of 4% or above for at least five years. In other examples, the ETF might look to track growth stocks, or perhaps companies from a specific sector – such as oil and gas, utilities, or banking. Bonds are often difficult to access for the average trader. Therefore, one of the best ways to invest in bonds is via an ETF. There are hundreds of bond-specific ETFs listed on US exchanges, split across both corporate and government securities. Each bond ETF will have its own strategy, such as tracking bonds issued by the US government, or by blue-chip companies. In particular, ETFs offer retail clients the opportunity to purchase foreign government bonds indirectly. Ordinarily, bonds issued by foreign governments are only accessible by institutional investors. Either way, this type of ETF will be heavily focused on a fixed income. This will suit investors in the market for regular dividend payments. Note: Some ETFs will offer a blend of stocks and bonds. This will suit investors that wish to target both growth and income. Many inexperienced investors are often unaware that one of the best ways to gain exposure to commodities is via an ETF. After all, it would not be a viable task to attempt to invest in hard metals like gold or silver, or energies such as oil and gas, through a physical purchase. Instead, investors can gain exposure to their preferred commodities via a single ETF investment. For example, the SPDR Gold Shares ETF is one of the largest physically-backed gold funds globally. As the ETF is physically backed by gold, this means that investors can gain indirect exposure to the precious metal. Therefore, in theory, the market price of the ETF should closely match the spot value of gold. Moreover, investing in a commodity ETF offers a much more efficient route when it comes to cashing out. After all, the process of cashing out would simply require the investor to place a sell order at their chosen ETF broker. Another investment sector that is often difficult to reach for the average trader is the emerging markets. For example, being able to buy stocks from exchanges in India, Brazil, Thailand, or Indonesia. However, ETFs are operated by large-scale financial institutions that have access to pretty much any market globally. As such, some ETFs are exclusively focused on assets from high-growth markets across Asia, South America, and Africa. Crypto ETFs haven’t yet reached major US exchanges, but they have in other markets. This enables investors to buy Bitcoin and other digital assets through a traditional brokerage, as opposed to a crypto exchange. Some of the most liquid crypto ETFs as of writing include ARK Next Generation Internet. ETF providers are in the business of making money and, therefore, will charge investors an assortment of fees. This includes the fees associated with buying and selling the respective assets held by the ETF, as well as for processing account registrations, deposits, withdrawals, and other administrative tasks. The good news for investors is that all fees are combined to represent a single expense ratio. This is calculated as a percentage of the total amount invested into the ETF. Conventional ETFs tracking major index funds like the S&P 500 come with super-low expense ratios. With that being said, when investing in an ETF that tracks less conventional markets, such as stocks or bonds based in emerging countries, the expense ratio will be less competitive. Nonetheless, even the Emerging Markets Government Bond and International High Dividend Yield ETFs offered by Vanguard come with an expense ratio of just 0.20% and 0.22%, respectively. As a result, in the vast majority of cases, ETFs offered by leading providers typically come with low expense ratios – even when electing to gain exposure to non-conventional markets. Another important metric of ETF trading is that, in many cases, this marketplace is highly liquid. This is often the case even when indirectly investing in illiquid assets – such as real estate or precious metals. For example, let’s say that an investor decides to inject capital into an ETF that is physically backed by gold. In this scenario, the investor will have the opportunity to cash out their gold investment at any given time, as long as the respective exchange is open. In comparison, if the investor opted to buy physical gold bars, the process of cashing out would be a lot more cumbersome. Crucially, in a similar nature to stocks, ETFs are a highly liquid asset class that gives investors the option of exiting the respective market at the click of a button. Note: What time do ETFs start trading? This will depend on the stock exchange that the ETF is listed on. For example, if the ETF is listed on the NYSE, then trading will commence at 9:30 am and close for the day at 4:00 pm. Although ETFs are often sought after by passive investors, this asset class is also suitable for those looking to trade the markets actively. For example, on the one hand, ETFs that track major index funds like the Dow Jones are completely passive. This is because the ETF provider will simply buy the 30 stocks that represent the Dow Jones, and ensure that the portfolio is weighted to mirror the index itself. However, there are many ETFs that take an active approach to investing. This means that the ETF will look to outperform a specific market rather than simply tracking a relevant benchmark. This would perhaps include ETFs that hand-pick dividend or growth stocks, or bonds issued by select governments. In this section of our guide on What is ETF Trading, we will discuss some of the most popular funds in this space. One of the most popular ETFs globally for trading volume and general investor interest is the Vanguard S&P 500. As the name suggests, this tracks the S&P 500 – meaning that through a single investment, traders will indirectly own 500 large-cap stocks that trade on US-based exchanges. As we noted earlier, this ETF is weighted based on market capitalization, so a lot of exposure is given to heavyweight stocks such as Apple, Amazon, Microsoft, Google, and Tesla. This Vanguard ETF has tracked the S&P 500 performance almost like-for-like since its inception. For example, over the prior five years of trading, the S&P 500 index returned average annualized growth of 12.83%, while in the case of the ETF, gains have amounted to 12.78%. Since its inception in 2010, the Vanguard S&P 500 ETF has offered averaged annualized returns of 14.03%. When it comes to fees, the Vanguard S&P 500 ETF – which trades on the NYSE Arca, has an expense ratio of just 0.03%. As noted earlier, this amounts to a commission of just $3 for every $10,000 invested. In terms of dividends, this ETF makes a distribution every three months.

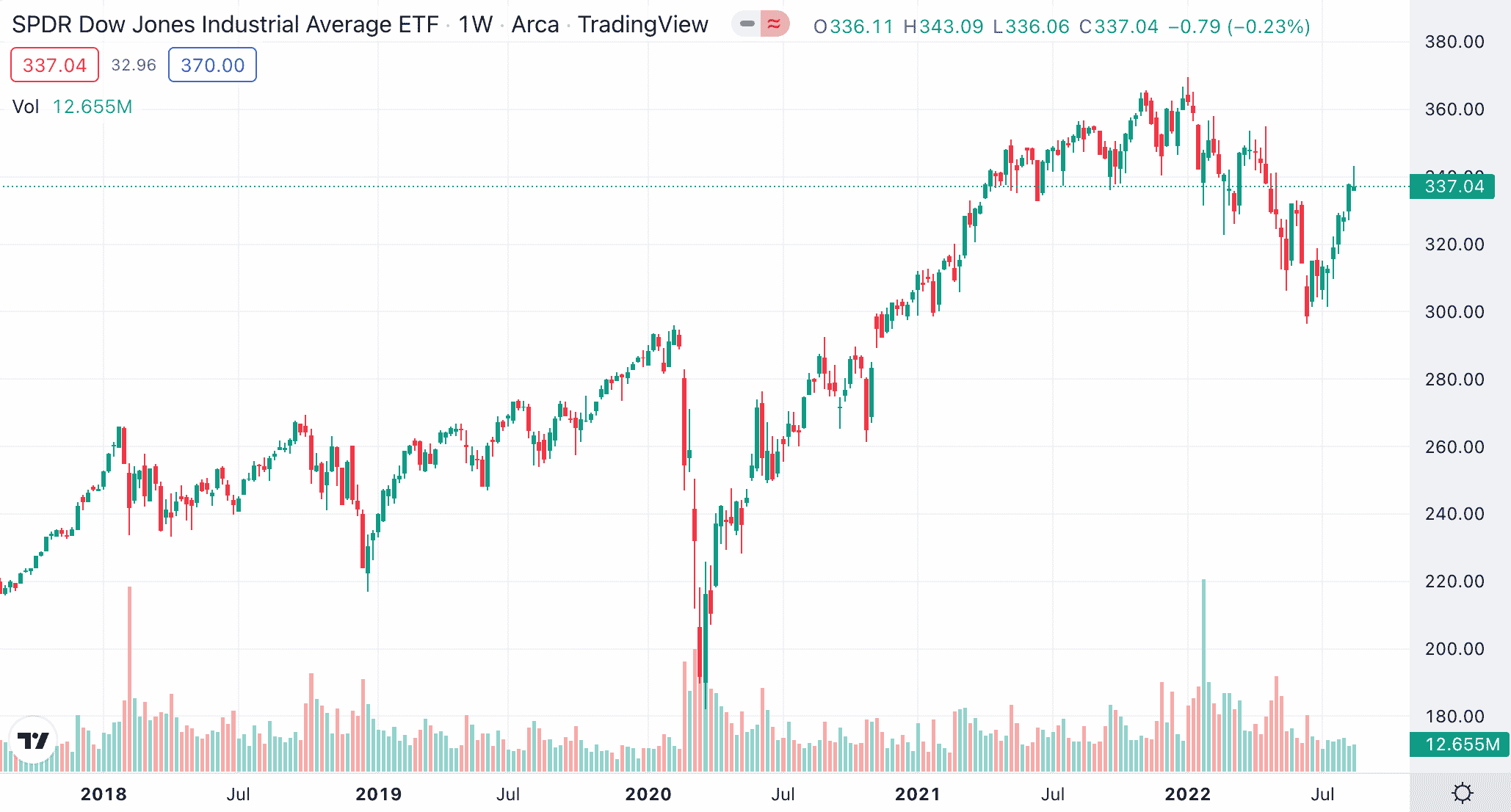

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider. This ETF tracks the performance of the Dow Jones Industrial Average. This is a major index fund that tracks 30 blue-chip companies that are listed in the US. This comprises a wide range of sectors to ensure that the Dow Jones represents the broader US economy. Unlike the vast majority of stock index funds, the Dow Jones gives preference to companies with a higher stock price, rather than the market capitalization. The most heavily weighted stocks on the SPDR Dow Jones ETF include UnitedHealth Group (10.56%), Goldman Sachs (6.87%), Home Depot (6.30%), Microsoft (5.62%), and McDonald’s (5.17%). All of the 30 companies within this SPDR ETF pay dividends, as the fund distributes payments every three months. When it comes to returns, this ETF has generated average annualized gains of 8.33% since its inception in 1998. The Dow Jones benchmark itself, over the same timeframe, has generated annual returns of 8.50%. Over a five-year period, this ETF has witnessed average annualized gains of 10.71%. In terms of fees, SPDR charges a gross expense ratio of 0.16%. This means that for every $10,000 invested in the ETF, a commission of just $16 is collected over the course of the year.

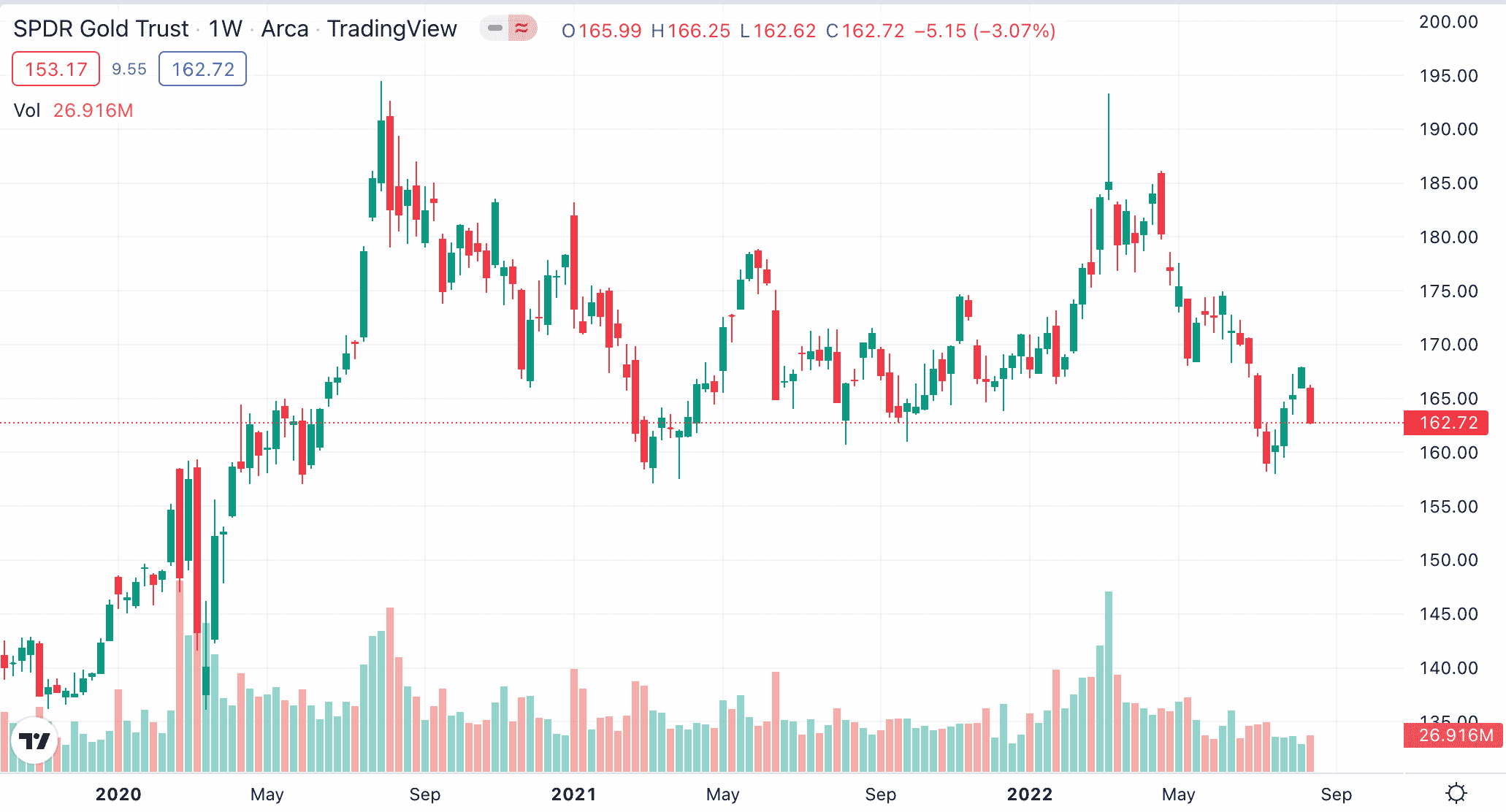

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider. Those looking to gain exposure to precious metals will often turn to the SPDR Gold Trust ETF. As we briefly covered earlier, the vast majority of this ETF’s NAV is backed by physical gold, with the balance held in cash. As of writing, the ETF is holding nearly 32 million ounces of physical gold, which translates into a NAV of over $55 billion. The SPDR Gold Trust is, therefore, one of the most effective ways of gaining exposure to the future value of gold without needing to worry about logistics, storage, insurance, or security. The SPDR Gold Trust ETF trades on the NYSE Arca, which makes it a highly liquid investment. The ETF provider uses HSBC as its custodian, and BNY Mellon Asset Servicing as its trustee. When it comes to fees, this ETF is slightly more expensive than the previously discussed funds, with an expense ratio of 0.40%. However, this is because of the cost involved in storing and insuring gold. When it comes to performance, the SPDR Gold Trust ETF has generated average annualized returns of 6.32% over the prior five years. In comparison, the global spot price of gold over the same period has offered average annualized returns of 6.84%.

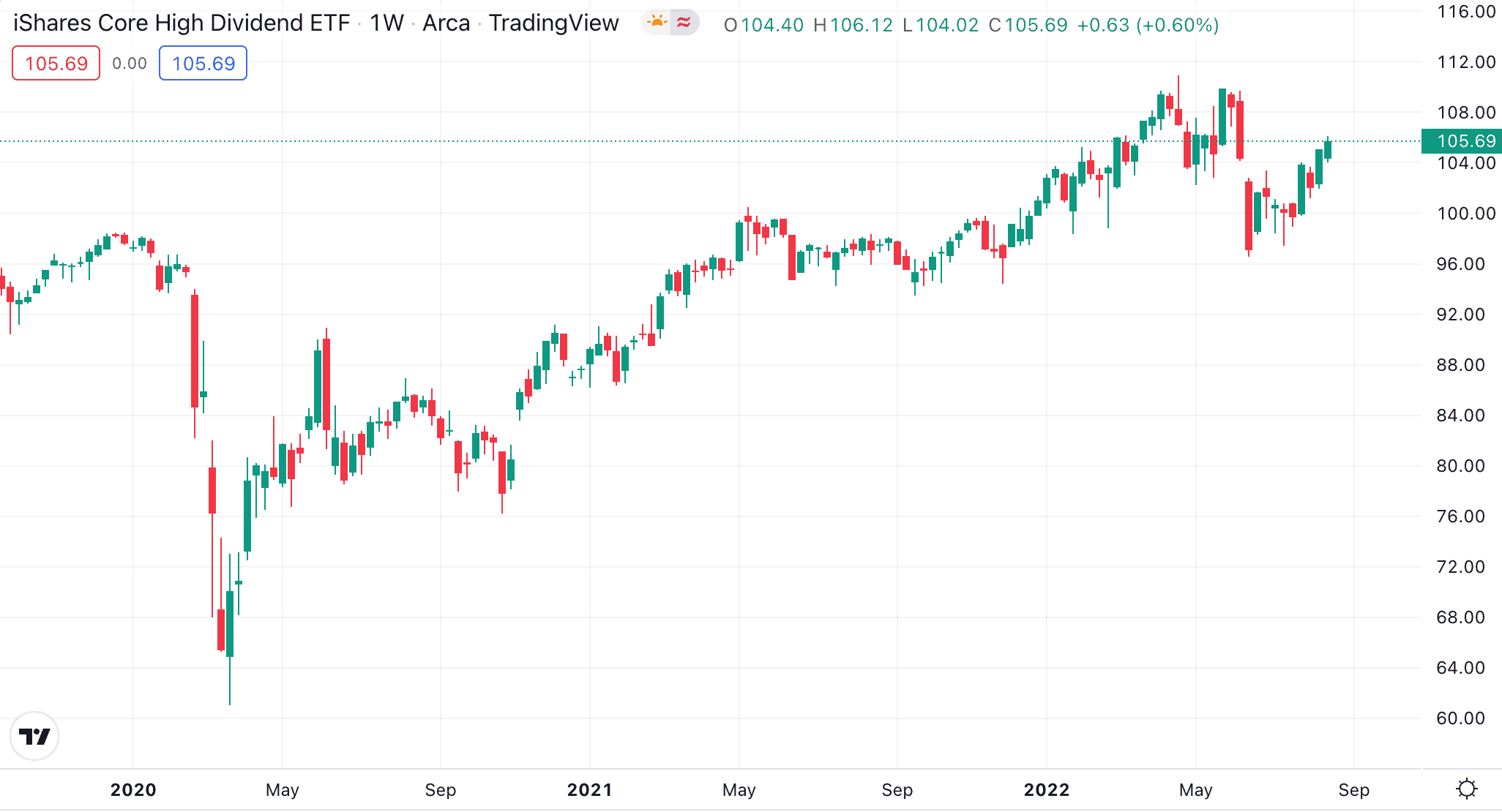

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider. One of the most popular funds for income seekers is the iShares Core High Dividend ETF. As the name suggests, the primary objective of this ETF is to invest in companies that offer an above-average dividend policy. Through a single investment, traders will gain exposure to 75 dividend-paying stocks that are listed in the US. iShares claims to only focus on established companies that have gone through a stringent screening process. Across the 75 companies that represent the ETF, Exxon Mobil (7.25%), Johnson & Johnson (6.15%), Chevron (5.16%), and Abbvie (5.13%) carry the largest weightings. Other notable companies held by the ETF include Verizon Communications (5.01%), Philip Morris (4.05%), and Merck & Co (3.88%). This is another ETF that is competitively priced, with iShares charging an expense ratio of just 0.08%. This amounts to just $8 for every $10,000 invested.

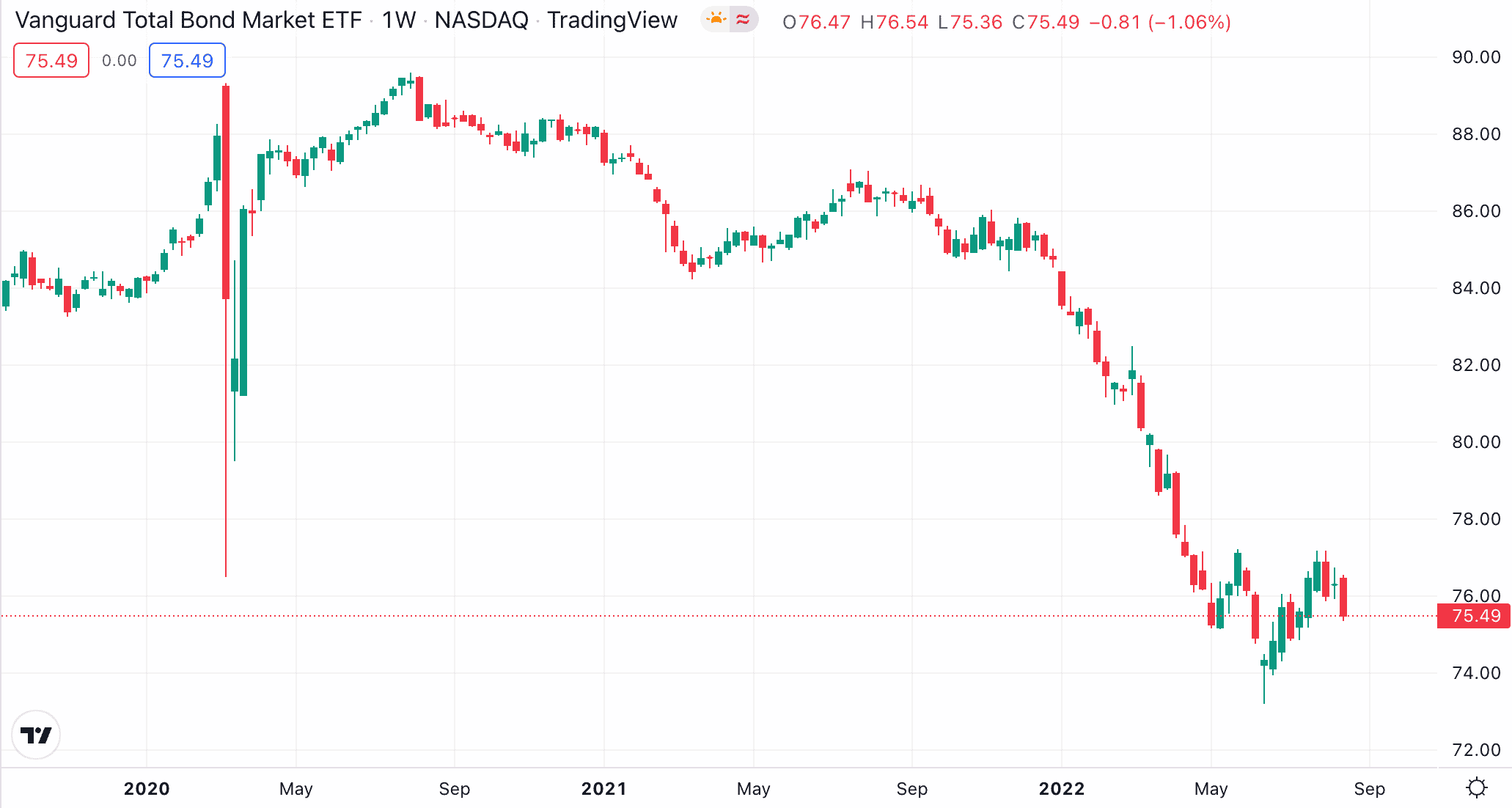

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider. A fund that remains popular with both risk-averse and dividend-seeking investors is the Vanguard Total Bond Market ETF. In total, this ETF offers indirect access to more than 10,000 individual bonds. This includes a broad blend of government and corporate bonds, with a variety of coupon rates and maturity dates. While 67% of the ETF is backed by US treasuries, 3.80% are AAA corporate bonds. 14% of the bonds held by the ETF are rated BBB, which offers more risk exposure. The Vanguard Total Bond Market ETF offers a dividend distribution every month, which is more frequent than the quarterly standard. When it comes to returns, this ETF has generated average annualized gains of 3.28% since its inception in 2007. Over a 10-year period, however, average annualized returns amount to just 1.59% – largely because of Federal interest rates remaining at record lows. With that said, Vanguard states that this ETF attracts a risk rating of just 2/5. This is supported by the fact that a majority of the bonds are issued by the US government. The expense ratio on this ETF amounts to just 0.03%.

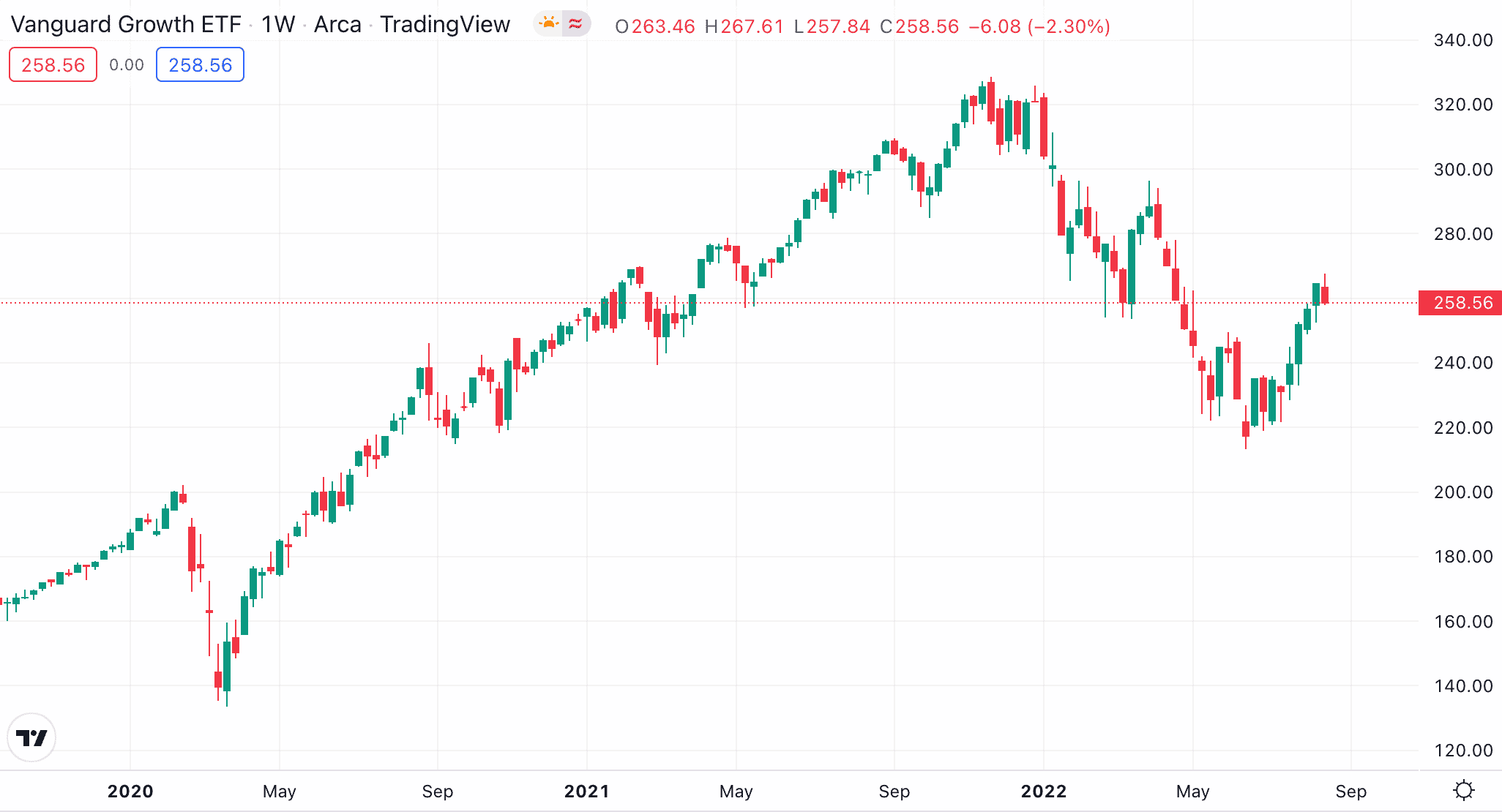

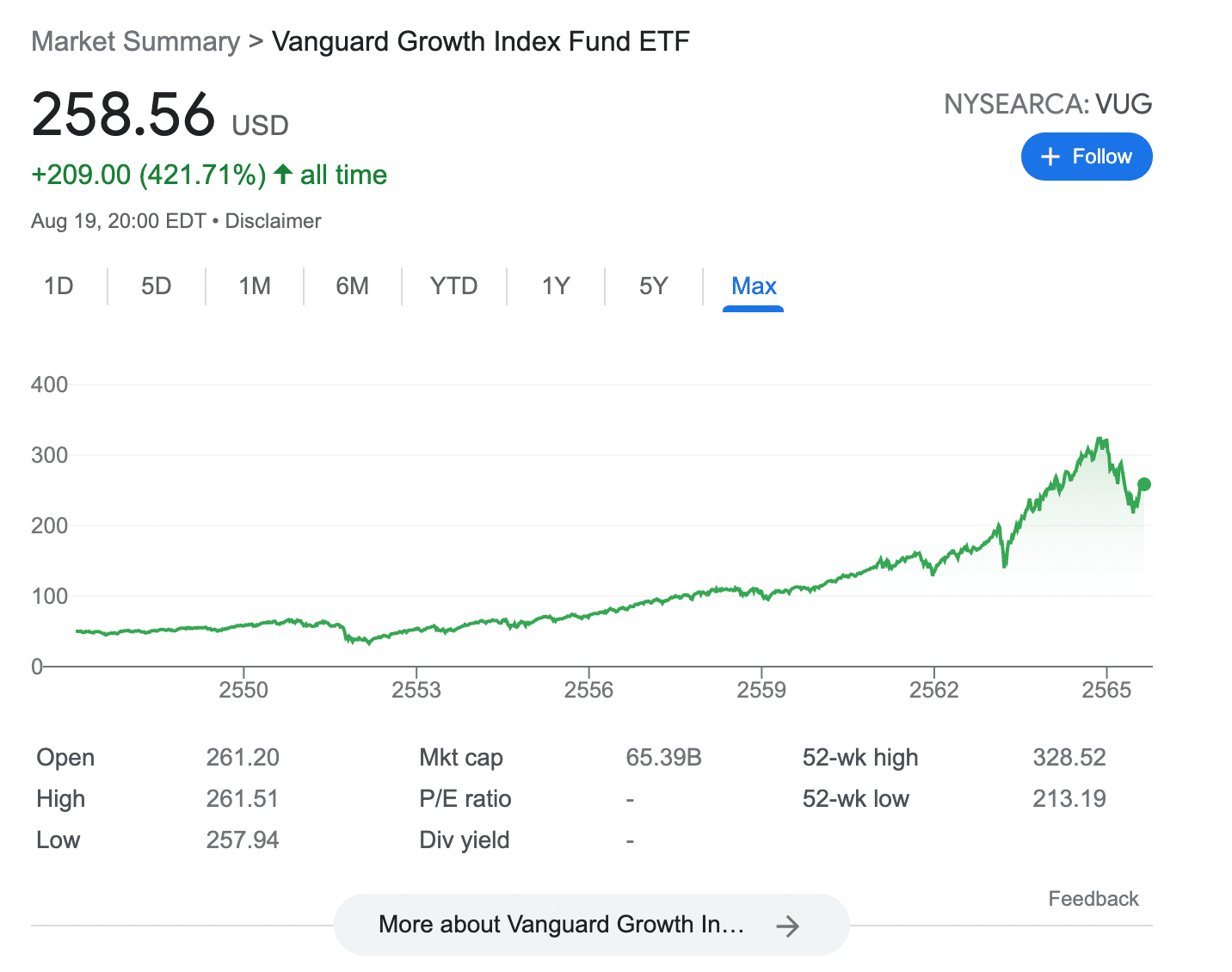

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider. Many investors in the US will look to focus on growth stocks for the higher risk-return spectrum on offer. One of the most effective and risk-averse ways to access this market is via an ETF, rather than attempting to select individual growth stocks with the highest potential. The Vanguard Growth ETF is a popular option here, which offers indirect access to over 260 growth stocks that trade on US exchanges. The average P/E and P/B ratio of the growth stocks held by the ETF amounts to 30.1x and 8x as of writing, with a median market capitalization of $309 billion. This indicates that the ETF is heavily weighted by large-cap companies. For example, while the ETF carries 260 growth stocks, 13.29% of its portfolio is weighted to Apple. Moreover, 11.17% and 6.21% are weighted to Microsoft and Amazon, respectively. Nonetheless, over a 10-year period, the Vanguard Growth ETF has generated average annualized gains of 15.15% – which outperforms the S&P 500 and Dow Jones considerably. On the flip side, over the prior year of trading, the ETF is down over 14%. The expense ratio on this ETF is competitive, with Vanguard charging just 0.04% annually. Note: All of the above ETFs are accessible on eToro from a minimum investment requirement of $10, on a commission-free basis.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider. Before learning how to start investing in ETFs, it is important to have a strategy in place – rather than injecting capital into the markets blindly. Some of the most popular ETF trading strategies are discussed in the sections below: Dollar-cost averaging offers a risk-averse approach to ETF investing. The main concept is that the investor will allocate a set amount of funds each month into their chosen ETFs. This is as opposed to investing a one-off lump sum. In doing so, there is less reliance on a single cost price when targeting long-term gains. For example, the investor might decide to allocate $500 into a series of ETFs at the end of each month. When the markets are bearish, this will enable the investor to buy into the ETF at a lower cost price. Many ETFs – especially those that track stocks or bonds, offer regular income in the form of dividend payments. This is often distributed to the investor on a quarterly basis, albeit, some ETFs pay dividends every month. Either way, a popular strategy undertaken by investors is to reinvest the dividends back into the respective ETF(s). This means that the investor will gradually increase their exposure to the financial markets over the course of time. Dividend reinvesting is synonymous with compounding interest. This is because the investor can earn capital growth and income on the additional ETF investments that were funded by the dividend payments. Oftentimes, by investing in just one ETF, it already offers diversification. After all, the Vanguard Total Bond Market ETF, for example, offers access to more than 10,000 individual bonds from several markets. However, investors might also consider diversifying further by gaining exposure to a broad range of ETFs. This might include ETFs that track growth stocks, dividend stocks, index funds, gold, silver, real estate, and bonds. Investors should also consider the risks associated with ETF trading, which we discuss below. The main risk to be aware of when investing in an ETF is the broader market. After all, the vast majority of ETFs are tasked with tracking a market, as opposed to outperforming it. Let’s take the SPDR Dow Jones Industrial Average as a prime example. When a wider bear market brings the Dow Jones index down with it, this will also be the case with any relevant ETFs. Unlike a mutual fund, the SPDR Dow Jones Industrial Average ETF would not look to outperform the bear market, as it is simply tasked with tracking it as closely as possible. Another risk to consider when learning how to trade ETFs is that this market is somewhat oversaturated. For example, an investor looking for an ETF that tracks growth stocks will ultimately have dozens of options to choose from. As each ETF will have its own objectives and predetermined rules, there can be a huge disparity in the performance of one growth fund when compared to the next. As such, knowing which ETF to choose for a specific goal can be challenging. The vast bulk of ETFs are considered intransigent, not least because they can only track a specific benchmark. For example, let’s say that a Dow Jones constituent continues to generate quarterly declines in revenue and operating income. Until the Down Jones index itself decides to remove the stock, all relevant ETFs will continue tracking it. In stark contrast, those investing in individual stocks on a DIY basis have the option of removing a poor-performing company from their portfolio at any given time. When trading ETFs, the investor will need to complete the process through a regulated stockbroker. The best stockbrokers in this industry offer low or zero commissions, small minimum deposit requirements, and access to plenty of ETFs. Those that are yet to choose the best broker for ETFs can scroll down to read our platform reviews. In the meantime, below we offer a simplified overview of how to get started with an ETF trade today via a regulated broker. All ETF brokers in this industry will require the investor to open an account. This is a standardized process that rarely differs between online brokers, and it requires the investor to enter some personal information surrounding their identity. This will include a full name, nationality, residential address, date of birth, social security number, and more. To activate the newly opened account, the investor will also need to go through a know-your-customer (KYC) process. Whether or not this is a simple process will ultimately depend on the broker. The reason for this is that some brokers can verify the identity of an investor near-instantly after a government-issued ID has been uploaded. Other brokers, unfortunately, are known to require many days before the account is verified. After the brokerage account has been verified, the investor can proceed to make a deposit. Once again, supported payment methods will vary from one broker to the next. Those in the US often only have access to ACH or domestic bank wires, albeit, the likes of eToro also support debit/credit cards and e-wallets. Be sure to meet the minimum deposit requirement stipulated by the broker as well as cover the intended ETF investment. Some online brokers will offer access to thousands of ETFs and mutual funds across both US and international markets. As such, the fastest way to find an ETF is to use the search function. Some brokers also offer a handy ETF screener. This will likely come with a range of filters that enable investors to find a suitable ETF that aligns with their financial objectives. After the investor has located their chosen ETF, the final step is to create an order with the broker. This will simply require the investor to specify their investment stake. Although ETFs trade as stocks on public exchanges, many online brokers support fractional investments. For example, the minimum ETF investment at eToro is $10 – regardless of its current stock price. After confirming the ETF investment, there is nothing more for the investor to do until they wish to cash out. In the meantime, the respective ETF provider will maintain, rebalance, and reweight the ETF on behalf of its investors. It is important to select a suitable broker when trading ETFs to ensure that: In the sections below, we discuss a selection of popular ETF brokers that consider the above criteria. eToro also offers ETFs that track dividend stocks, growth stocks, bonds, and emerging markets. Furthermore, investors will have access to commodity ETFs that focus on gold, silver, oil, and more. When it comes to account minimums, this typically stands at $50, albeit, investors from the US and the UK are only required to deposit $10. Irrespective of where the investor is from, ETFs at eToro can be purchased at a minimum of $10 per trade. This is the case regardless of the ETF price at the time of the order. Furthermore, and perhaps most importantly, eToro does not charge any commission on US or international ETF investments. By investing in an EFT that pays dividends, the eToro account will reflect this once the distribution is made. There are no ongoing maintenance fees charged by eToro when investing in ETFs. However, the expense ratio charged by the respective ETF provider will still apply. In addition to ETFs, eToro is also popular with those that wish to invest in stocks. The reason for this is that eToro offers access to more than 2,500 stocks from the US, Europe, Asia, and more – all of which can be bought and sold at 0% commission. Non-US traders will also have access to leveraged CFDs, which include stocks, ETFs, indices, and, forex. It is also possible to invest in cryptocurrency at eToro from a minimum of $10 per trade and at a fee of 1%. eToro also offers the ability to ‘copy’ other traders that use the platform. A trader can be copied based on their preferred asset class, risk rating, average trade duration, and more. There are also Smart Portfolios that operate in a similar nature to ETFs. The key difference is that each Smart Portfolio is hand-picked and managed by the eToro team. To trade ETFs at eToro, investors can open an account and make a deposit in less than five minutes. There are no fees charged or USD deposits and the most convenient payment options include debit and credit cards, Paypal, Neteller, and other e-wallets. Another thing to note is that eToro offers a free demo trading account. This enables all registered users to trade ETFs and other asset classes with paper money, and hence – there is no risk involved. The eToro platform can also be accessed via a trading app for iOS and Android. This offers the same tools and markets as found on the eToro website.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider. There is no minimum account balance requirement at Interactive Brokers. Moreover, US clients opening an IBKR lite account will be able to buy and sell domestic ETFs without paying any commission. This is also the case with US-listed stocks. Although Interactive Brokers also offers access to foreign-listed ETFs, this will attract additional fees. Interactive Brokers accepts deposits via ACH and bank wires. Although ETFs and index funds are two terms that are often used interchangeably, there is actually a difference in how each financial instrument operates. For instance, an index fund is tasked with tracking the performance of a specific market – like the S&P 500 or Dow Jones. However, the investment vehicle itself is an ETF. In other words, the Vanguard S&P 500 ETF is an investment vehicle that tracks the index fund of the same name. This guide has explored the ins and outs of how ETF trading works and which investor profiles might be interested in this asset class. As noted, ETFs enable investors to gain exposure to many assets and markets via a single trade. Furthermore, not only are ETFs an option for passive investors, but they often yield regular income via quarterly dividend payments. Investors should, however, think long and hard about which ETFs are right for their financial goals and risk tolerance.

Your capital is at risk. 79% of retail investor accounts lose money when trading CFDs with this provider.Allocation of Funds

Stock Price of an ETF

Dividends

Buying and Selling ETFs

A Closer Look at ETF Trading

Passive Investment

Diversification

Access to Non-Conventional Markets

Specific Stock Catagories

Bonds

Commodities

Emerging Markets

Crypto

Low Fees

Highly Liquid

Active and Passive Investors

Popular ETFs to Watch Right Now

Vanguard S&P 500

SPDR Dow Jones Industrial Average

SPDR Gold Trust

iShares Core High Dividend ETF

Vanguard Total Bond Market ETF

Vanguard Growth ETF

Popular Strategies for ETF Trading

Dollar-Cost Averaging

Dividend Reinvestments

Diversify

Risks of ETF Trading

Market Risk

Oversaturated Market

Intransigent

How to Start ETF Trading with a Regulated Broker

Step 1: Open a Brokerage Account

Step 2: Upload ID

Step 3: Deposit Money

Step 4: Search for ETF

Step 5: Trade ETF

Where to Start ETF Trading – Popular ETF Trading Brokers Reviewed

1. eToro

2. Interactive Brokers

Interactive Brokers is a popular US-based trading platform that offers thousands of markets. In addition to ETFs, this includes stocks, mutual funds, currencies, futures, options, bonds, and more. Those interested in futures trading could read our guide on the best futures trading platforms.

ETF Trading: ETF Trading vs Index Funds

Conclusion: What is ETF Trading?

FAQs

What does ETF mean and how do they work?

What are ETFs in trading?

What does ETF stand for in trading?

Where can I trade ETFs?

What ETFs does Warren Buffett recommend?

What are ETF trades?

What ETF tracks the NASDAQ?