Quant trading is a market strategy that entails using statistical and mathematical algorithms to spot short-term investment opportunities.

In this guide, we explore the question – what is quant trading?

Through simple and user-friendly explanations, read on to learn how quant trading works.

What is Quant Trading?

To answer the question – what is quant trading? – let’s start with the basics.

Quant trading refers to the utilization of techniques based on a specific type of analysis. Put simply, quantitative traders use mathematical calculations and data processing to find buying opportunities.

- Two of the most frequent data inputs utilized in these mathematical models are volume and price.

- Due to the fact that hedge funds and financial institutions typically utilize quantitative trading, the transaction sizes are often substantial.

- That is to say, quant trading entails the buying and selling of a large number of assets.

That said, retail investors who open much smaller positions are increasingly using quant trading strategies to identify market opportunities.

- For example, if an investor is interested in momentum trading, they may decide to create a quant algorithm that chooses assets based on an upward market trend.

- By using a few basic criteria, the system will automatically buy securities or other assets depending on the rising market trend.

Of course, these variables can change based on the trader’s objectives. Not only that, but experienced quant traders can create their own algorithms and manually execute buy and sell orders.

Your capital is at risk. 80.61% of retail investor accounts lose money when trading CFDs with this provider.

How does Quant Trading work?

In a nutshell, mathematics, the availability of extensive datasets, and modern science are all utilized by quantitative traders to help them make well-informed trading judgments.

- In order to apply a mathematical model of a trading strategy to historical market data, quantitative traders must design a computer program.

- A backtest and optimization of the model follow.

- The technique is then put into use in real-time markets with actual money if positive results are obtained.

An analogy works best to explain how quantitative trading models operate:

- Think about a prediction when the meteorologist says there is an 85% probability of a thunderstorm, however, the sun is shining.

- Whilst it seems unlikely to the untrained eye, the meteorologist gathers and analyzes climatic data from sensors placed around the region to reach the conclusion.

- Particular patterns in the data are revealed by computerized quantitative analysis.

- The meteorologist knows that these patterns are compared to similar ones found in past climate data via backtesting.

- As such, the meteorologist can confidently conclude that a thunderstorm will happen 85% of the time. Hence, the forecast.

To make judgments on potential equity opportunities, quantitative traders use the same kind of logic in the financial market. This is an important concept to understand when learning what is quant trading.

A Closer Look at Quant Trading

It goes without saying that the goal of trading is to determine the best chance of selling equities for more than they were purchased for. The volume of incoming data can overwhelm the decision-making process. Quantitative strategies allow the trader to monitor, evaluate, and make informed choices on stocks and other assets.

The trader employs programs to automate the analysis and monitoring of the markets and make trading choices. As a result, the application of quantitative trading techniques removes some of the difficulties faced by inexperienced traders. This process is generally automated, but can also require manual execution.

Quantitative strategies are suitable for both active and passive traders. One of the most common issues in trading is controlling emotion. Whether it’s greed, fear, or misguided hope, emotion can make traders suppress logical thought, which typically results in losses. Since computers and mathematics are emotionless, quantitative trading aims to solve this issue.

Backtesting includes using previous data to apply the strategy and gauge how well it would have fared in the market. As such, backtesting is carried out to validate. Via backtesting, quant traders can fine-tune and optimize the strategy because it can reveal underlying problems.

Popular Strategies for Quant Trading

Now that we’ve answered the question ‘how does quantitative trading work?’, we can talk about popular strategies.

The best quant trading strategies to consider as a beginner as discussed below:

Trends

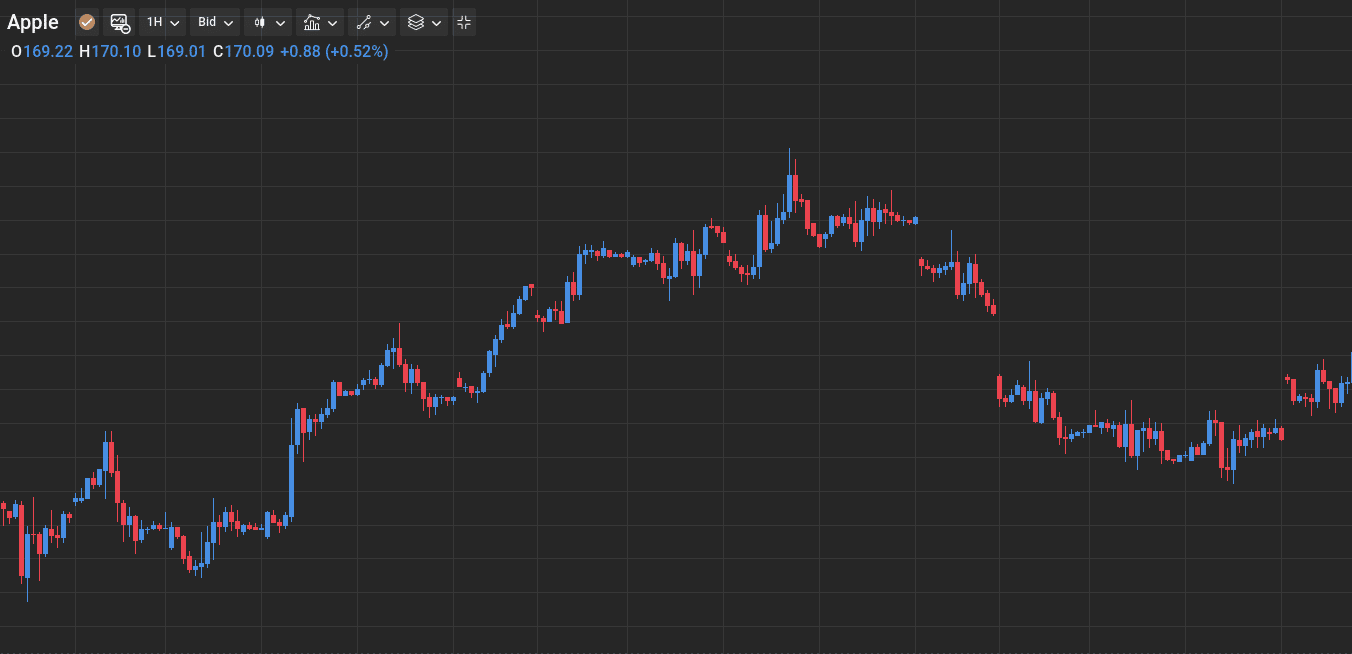

Some of the most popular quant trading strategies rely on moving average trends, price level changes, channel breakouts, and other relevant technical indicators.

Since these techniques don’t need making any predictions or price projections, they are the simplest to apply using quantitative trading.

Without delving into the complexities of predictive analysis, trading orders are automatically executed based on the occurrence of favorable patterns.

For quant trading firms, these are simple and basic to apply using algorithms. A well-liked trend-following tactic is to use the 50- and 200-day moving averages.

Long-Short Equity Strategy

Long-short stock strategies generate profits by taking advantage of predicted market movements that might go either up or down.

In this approach, equities that are seen to be comparatively underpriced are found, and long positions are taken in them. Meanwhile, short positions are taken in companies that are thought to be overvalued.

See further explanation below:

- Quant programs simultaneously open long and short positions to profit from inefficient pricing in connected assets.

- As such, long-short equity methods are market neutral.

- Let’s say quant trading firms think Pepsi is undervalued and Coca-Cola is overvalued.

- They would establish a short position on Coca-Cola and a long order on Pepsi at the same time.

- This strategy is also commonly referred to as ‘pairs trading’ by investors.

The idea may be used by investors to apply to a collection of connected securities. Furthermore, even if two stocks are active in separate industries, this does not rule out the possibility of correlation.

Statistical Arbitrage Trading

The price difference of equities also presents an opportunity for arbitrage trading. This happens when a dual-listed stock is purchased at a cheaper price in one market and simultaneously sold at a higher price in another one.

Given that there are occasionally price differences between stocks and futures instruments, the same procedure may be used for those investment vehicles as well.

Profitable possibilities are created when quantitative brokers’ algorithms are used to spot these price differences and effectively place multiple orders on behalf of the trader.

Execution System Via a Broker Instead

Investors might opt to create an MT4 (MetaTrader 4) trading account with an online broker.

This enables traders to buy and sell equities automatically via expert advisers (EVs). EV quant programs let investors create algorithms for any automated trading strategy.

Moreover, an MT4 account allows traders to employ a broad range of indicators to analyze the market, as the EA places orders on them. Another option is copying the buy and sell orders of a more experienced trader automatically.

This is possible via Copy Trading. This enables traders to mirror the buy and sell positions of an experienced investor without having to place any orders themselves.

We talk about alternatives to automated investment strategies later on in this guide on What is Quant Trading?

Risks of Quant Trading – Is Quant Trading Stressful?

Investors researching how to become a quant trader will also need to familiarize themselves with the risks involved. Every type of trade involves risk and while pattern recognition is a goal of quantitative analysts, the method is far from perfect.

There are significant data sets to sort through for the analysis process. Trading patterns can seem to imply certain outcomes may work, and then they don’t. As such, there are no guaranteed positive outcomes, as many investors will be aware.

For instance, directional risk, or delta, refers to the possibility of the market going in the opposite direction to the one the investor needs for it to go to profit.

As such, those asking ‘is quant trading profitable?’ will need to bear in mind that these algorithms and systems are only as good as the individual who developed them.

Moreover, because financial markets are continuously changing and unexpected events occur, a strategy that generates profits one day can create losses the next.

As such, the quantitative algorithms used will need to be adapted and backtested periodically for them to remain effective.

This method demands a high level of mathematical expertise, coding prowess, and market knowledge. This is where quant trading courses and quantitative brokers with algorithmic tools can be helpful for newbies.

Where to Start Quant Trading – Popular Quant Trading Brokers Reviewed

Prior to engaging in automated quant trading, investors will need to set up a brokerage account with a regulated platform.

It’s important to research the ins and outs of the platform prior to creating an account.

For instance, some of the metrics we look at include fees, the variety of assets that are available, algorithmic trading tools, and more.

1. Capital.com – Supports Quan Trading Tools via MT4

Capital.com is another regulated alternative to quantitative brokers. This intuitive trading platform is regulated by CySEC, FCA, ASIC, and the NBRB. This platform offers over 6,000 markets via CFDs. This includes stocks, cryptocurrencies, forex pairs, and commodities.

For any traders that are unfamiliar with CFDs, this is an instrument that tracks the price of an underlying asset. This enables traders to speculate on the rise or fall of any of the listed assets without owning them. As a result, Capital.com users can place a buy order on an asset they think is likely to rise in value, which is known as a long position.

CFDs at Capital.com also allow traders to short assets, which is achieved by placing a sell order. Notably, US investors will not be able to create an account at Capital.com. This is because the SEC has banned CFD trading in the US.

In terms of trading strategies involving algorithms, Capital.com is one of the best MT4 brokers. For those unaware, MT4 is a third-party platform that allows traders to access a range of products and tools in one place. We found this to include order management tools, live quotes, in-depth analytics, and indicators.

One of the best aspects of the MetaTrader platform is algorithmic trading. The platform includes the MQL4 Integrated Development Environment (IDE), which enables traders to deploy technical indicators and EAs. The object-oriented programming language MQL4 serves as the foundation for creating quant-like trading strategies.

The minimum deposit at Capital.com is £20, or the equivalent in any other accepted currency. At least, this is the case if making a deposit via debit/credit card or Neteller, Skrill, Trustly, Sofort, and other e-wallets. The minimum for a wire transfer deposit is $250 at Capital.com.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

2. eToro – Automated Copy Trading Tools

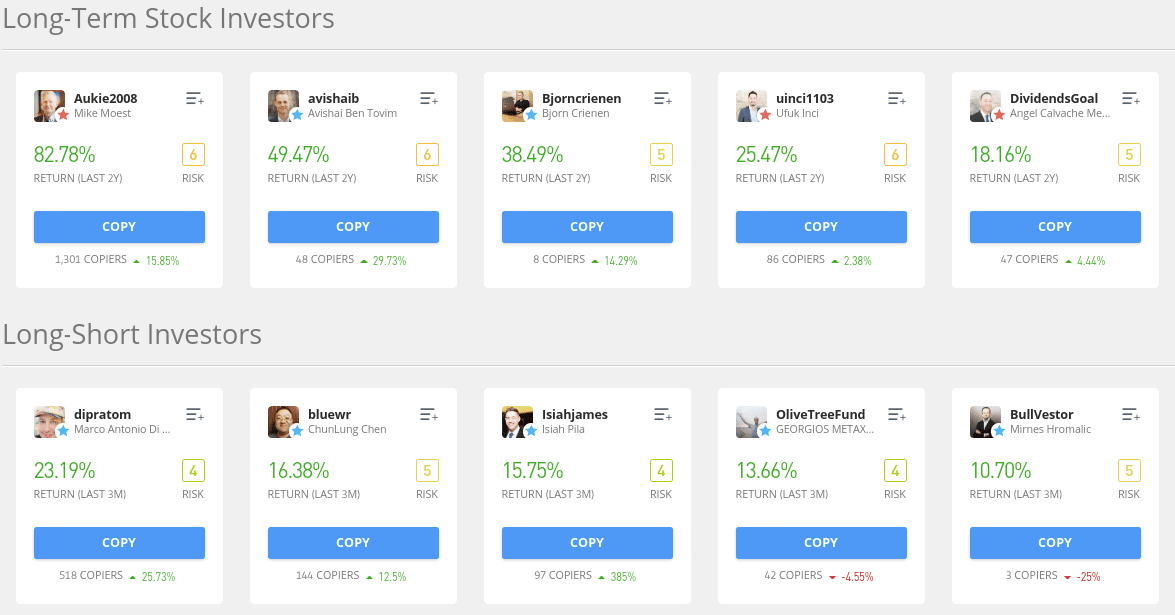

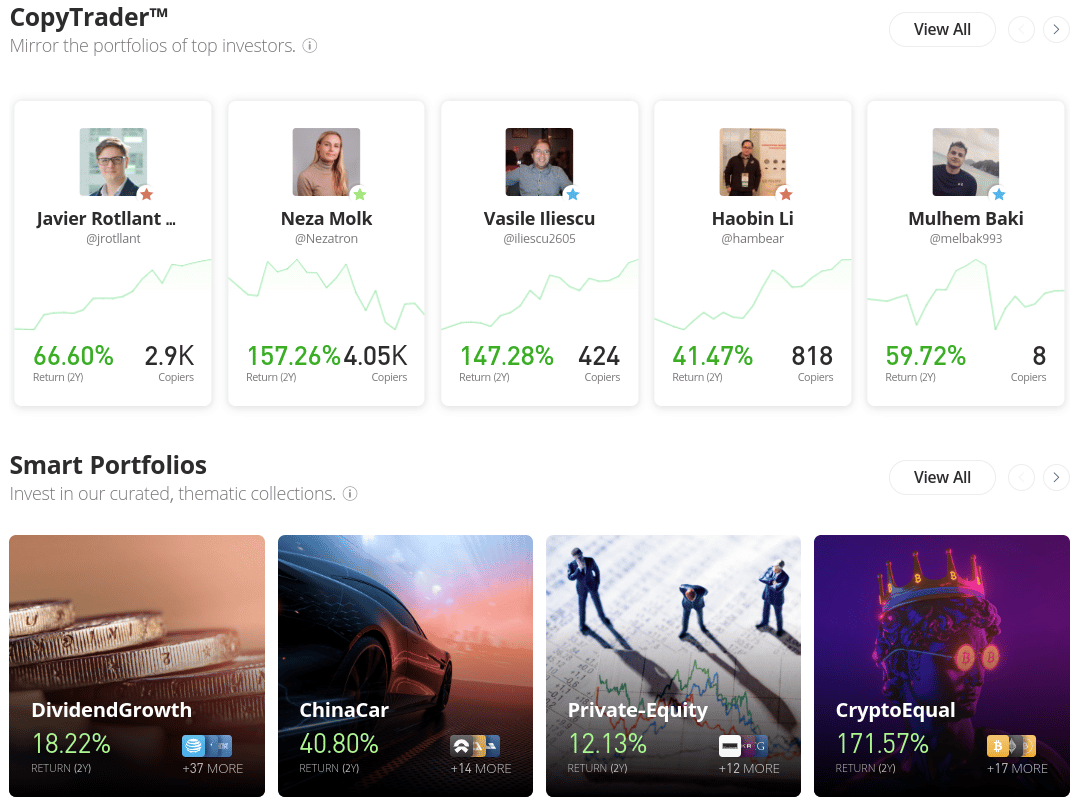

Passive investors might like eToro’s stand-out passive investment tool. This is because it’s also among the best copy trading platforms. By allocating $200 or more to Copy Trading, the investor will automatically mirror the same positions that have been executed by the chosen trader.

As we briefly discussed earlier, this allows investors to copy buy and sell orders without analyzing a range of complicated data or manually placing orders.

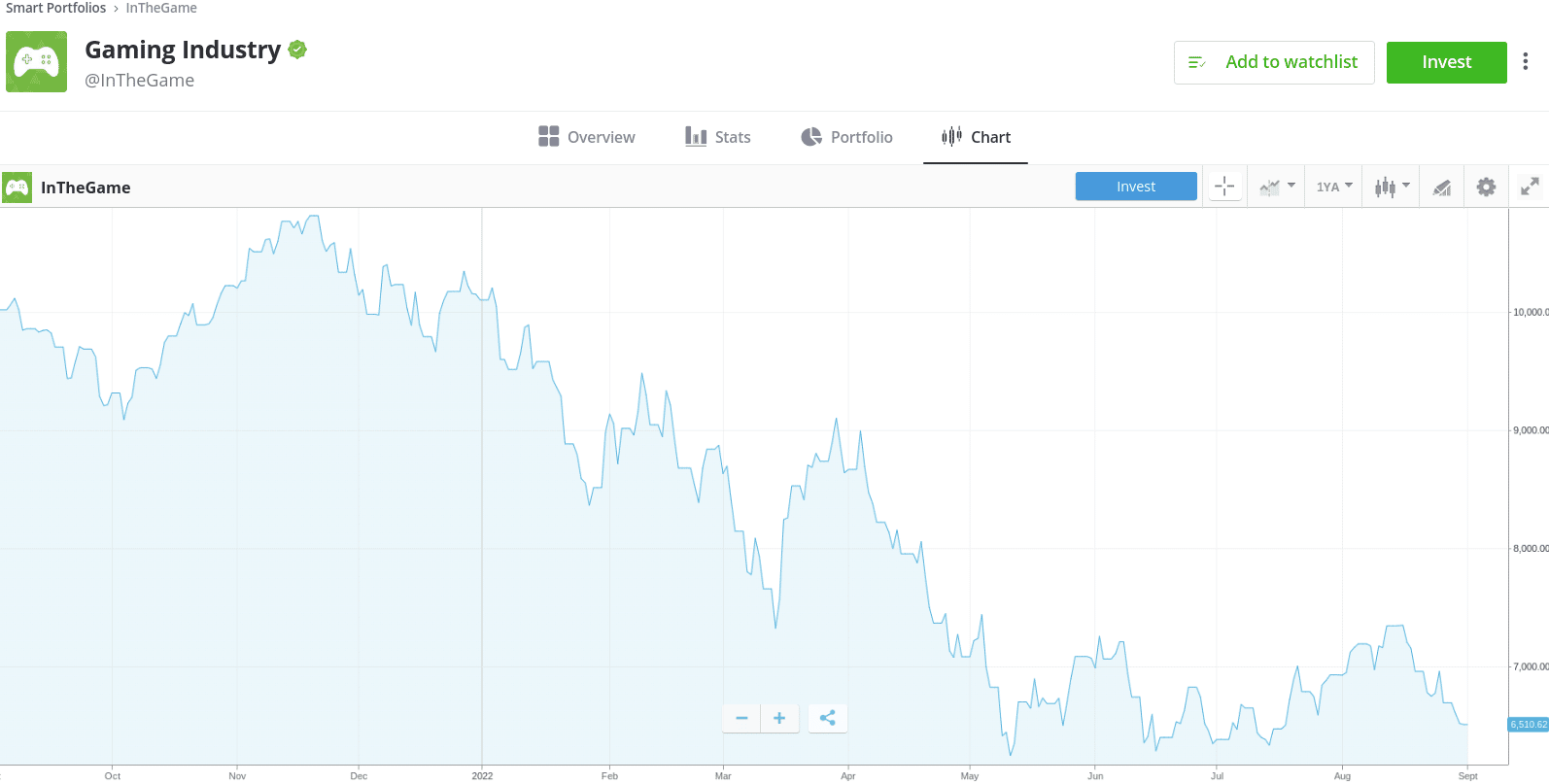

Copy Trading participants can be filtered down by the market they invest in, as well as their location, appetite for risk, and historical gains. eToro also offers a trading strategy that uses algorithms to create a curated portfolio of assets. This investment tool is called Smart Portfolio.

Assets that will make up the Smart Portfolio are chosen using an algorithm that determines the general sentiment of traders. According to eToro, Smart Portfolios are regularly rebalanced to ensure they continue to reflect investor opinion.

eToro employs cutting-edge natural language processing methods to quantify and assess market sentiment on all Smart Portfolios, then leverages this information for algorithmic trading. As such, investors can allocate $500 and will find an automated portfolio in their accounts.

This trading platform offers a range of assets, which includes thousands of stocks and a diverse selection of cryptocurrencies ETFs, and indices. Traders will also find a range of forex pairs and commodities. In terms of fees, those who invest in cryptocurrency will pay 1% on each buy and sell order. In contrast, stocks and ETFs are commission-free.

No additional fees apply to the Copy Trading or Smart Portfolio tools. US and UK investors can get started by funding their account with $10 or more, otherwise, the minimum stands at $50 for other nationalities.

Supported deposit methods include ACH, wire transfers, and credit/debit cards. Investors can also make a deposit using e-wallets such as Neteller or Skrill. eToro is also among the best paper trading platforms, as all investors have the option to utilize a virtual account with $100k in demo funds.

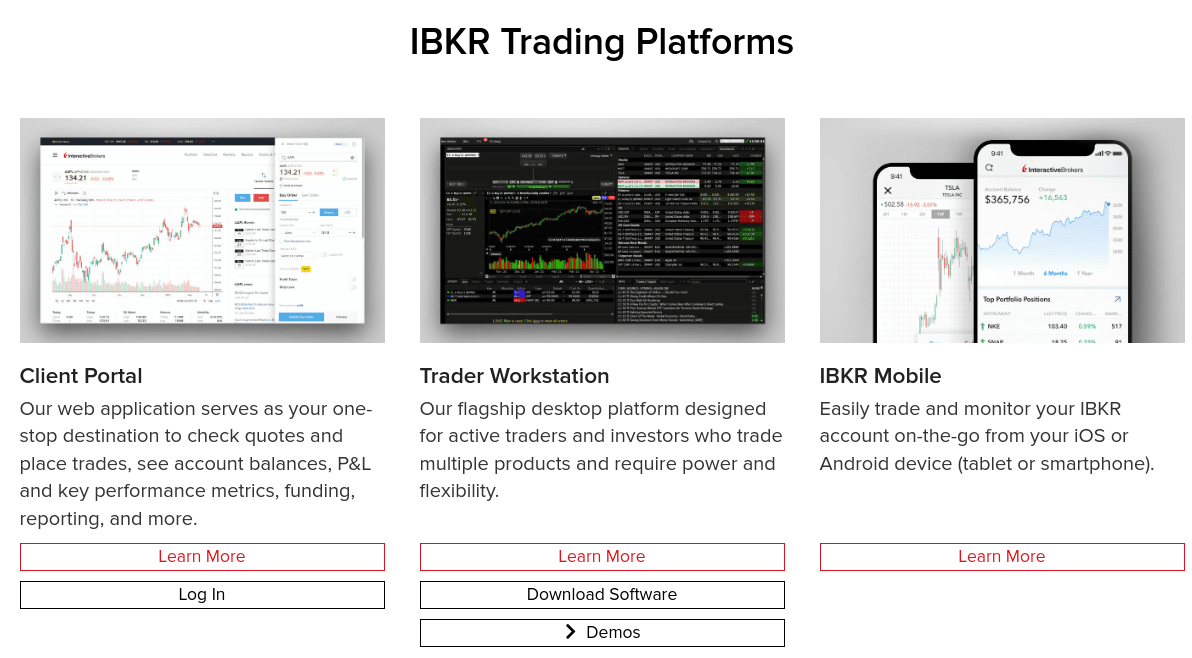

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider. Interactive Brokers offers a diverse selection of both domestic and international markets, including stocks, cryptocurrencies, bonds, ETFs, forex, funds, options, and gold trading – there are many algorithmic trading options at Interactive Brokers. Interactive Brokers has various platforms, such as IMPACT, Trader Workstation IBKR Mobile, APIs, and GlobalTrader. Traders who open large positions will have access to over 30 algorithms, including the Accumulate/Distribute system. This contains programmable logic to assist traders in filling bulk orders while reacting to market situations according to their own unique needs. There is no commission payable on US-listed stocks and ETFs at Interactive Brokers. The minimum deposit is $100, and accepted payment methods include ACH, mobile check deposit, and wire transfer. This guide has answered the question ‘what is a quant trader?’ in more ways than one. However, some investors may still wonder how it differs from traditional trading. Here’s a breakdown of how quant trading differs from traditional investment methods: Another key difference between the two is that traditional trading requires manual position opening and for the investor to time the market correctly. In contrast, quant trading usually entails creating an algorithm and then letting it place orders based on pre-determined parameters. Many investors opt for EAs for this purpose or Copy Trading. Did you know that investing in the best presale cryptos could help diversify your investment portfolio and get your foot in at ground level with some of the most promising new crypto projects on the market? Tamadoge (TAMA) is the Tamaverse’s gateway token, from which you can mint, breed, and battle your own Tamadoge pet in the metaverse. Tamadoge will allow users to breed, train, and battle their Tamadoge NFTs to top the leaderboard every month, allowing them to mint the doges they want. Over time, the Play-to-Earn opportunities will expand to include augmented reality experiences, allowing your NFT to interact with its Tamaverse friends. Tamadoge represents not only the future of the Doge ecosystem but also the future of Play-to-Earn.

Today, we’ve answered the question ‘what is quantitative trading?’. We’ve also talked about various quant trading strategies and how it compares with traditional methods. In quantitative trading, decisions are made using automated algorithms and mathematical functions. As such, quantitative trading is a common solution for removing the potential for irrational or emotionally charged trading decisions. But if you’re searching for an exciting new investment then Tamadoge is certainly a crypto project to keep an eye on. The TAMA coin will be listed on LBank and Uniswap, giving it far more public exposure. Higher prices are frequently associated with higher demand. Several cryptocurrencies rose in value following their initial coin offerings (ICOs). Time will tell whether Tamadoge will follow suit. Tamadoge - The Play to Earn Dogecoin3. Interactive Brokers – High-Level Quant Tools for Advanced Clients

Interactive Brokers is headquartered in Connecticut and accepts clients from the US and 200 other countries. The online brokerage is regulated by the SEC, CFTC, and FCA, in addition to being a member of SIPC, FINRA, and the NYSE.

Quant Trading vs Traditional Trading

Quant Trading vs Investing in Presale Cryptos

Conclusion

FAQs

What does a quant trader do?

What are quants in trading?

How much do quantitative traders make?

Is quantitative trading profitable?

What do you understand about quantitative trading?

How do I start learning quantitative trading?