What is value investing? With inflation and interest rates high, this is a key question to ask. Since the Pandemic, economic conditions are making growth stocks look too risky and value stocks more sensible. US investment giant JP Morgan reports that since November 2020 ‘the risk lies with Growth and the reward lies with Value.’

Below we define exactly what value investing is and show how it works in practice. We assess the risks and opportunities of value investing and compare it with growth investing. We review two brokers that offer value stocks at zero commission and, for balance, pinpoint a massive growth investment opportunity in the crypto world.

What is Value Investing?

Value investing definition: investing in the most undervalued stocks: companies whose share price is lower than one would expect given key metrics like their P/E ratio or Earnings Per Share (EPS).

- Value investing was pioneered by US economist Benjamin Graham. He outlined his ideas in the 1949 classic The Intelligent Investor.

- Graham mentored modern-day billionaire Warren Buffett of the hugely successful company Berkshire Hathaway.

- Buffett took the basic principle of value investing – to buy stocks trading at a discount – and added to it the notion of ideal value companies having a competitive advantage.

- Having researched the key question: what is value investing? investors may nowadays engage in value investing easily using popular investment apps and following some basic principles – as well as using free online resources to help pick stocks.

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

How Does Value Investing work?

Value investing is a stock-picking strategy. Generally it does not apply to other assets like commodities or bonds.

Budding value investors might follow four simple steps:

- Select a promising value company.

- Sign up with an online broker (examples are Capital.com and eToro).

- Deposit funds and purchase a share, or fraction of a share, in that value company.

- Hold that share until it has increased in value – and then sell it at a profit.

One way to understand the principle of value investing is to compare it with the opposite strategy, which is growth investing.

Let us apply a sample scenario to both strategies:

Suppose an investor was set on investing 1 dollar in stocks. Where does that dollar go?

What is a Value Investment?

If that dollar of investment goes to an established company with regular revenues whose stock price is currently cheap, then that would be considered a value investment.

- An example of a value investment right now would be US delivery giant FedEx (FDX).

Value stocks tend to be in the industrial, energy and consumer staples sectors.

- Value investors prioritise past performance and insist on low relative cost. Value investments tend to have low Price/Earnings Ratios compared to their peers.

What is a Growth Investment?

If that dollar of investment goes to a relatively young company with great revenue potential that is expensive, then that would be considered a growth investment.

- An example of a growth investment right now would be US Electronic Vehicles giant Tesla (TSLA). (Investors can buy Tesla stock with online brokers – examples of which are Capital.com and eToro reviewed below).

Growth stocks tend to be in the technology and consumer discretionary sectors.

- Growth investors prioritize future revenue performance and are happy to tolerate high share prices. Growth investments tend to have high Price/Earnings Ratios compared to their peers.

What is a Blend Investment?

Smart investors will immediately see that we could find a company that is both a value investment and a growth investment. In this case, influential investment analysts like Morningstar term the company a ‘blend investment’.

Examples of blend investments are US electronics giant Apple (APPL) and US retail giant Amazon (AMZN).

With well-established revenues, these companies can right now be considered as candidates for value stock investing. They are well-established companies with no significant debt issues, but their share prices have been hit hard by the Ukraine crisis as well as high inflation and interest rates.

They are also growth companies because they both have plenty of potential to grow their revenues in future and have relatively high P/E ratios.

(Investors can buy Apple stock and buy Amazon stock with online brokers – examples of which are Capital.com and eToro reviewed below).

So in answering the question what is value investing? we must be aware that there is no clear dividing line between value investments and growth investments. Rather, a spectrum exists.

Indeed, value investment guru Warren Buffett wrote in 1993 that, ‘the two approaches are joined at the hip: Growth is always a component in the calculation of value, constituting a variable whose importance can range from negligible to enormous and whose impact can be negative as well as positive.’

Let us clarify two more definitions before we look at value investing in more depth:

What is Deep Value Investing?

Deep value investing is when an investor invests in stocks which are at an incredibly low price. Often deep value investing takes the investor into waters where companies can be close to bankruptcy. This is certainly not risk-free investing.

What is a Value Investor?

A value investor is an investor who focuses on value companies. By contrast, a growth investor focuses on growth companies.

Smart investors would be looking to diversify their portfolio with different asset types as well as different stock strategies.

A Closer Look at Value Investing

So what type of investor is drawn to value investing?

Value investing was pioneered by US economist Benjamin Graham in the middle of last century. So investors may reasonably ask: does value investing still work? Is value investing dead?

The answer is no: value investing is not dead. In fact, investment analysts have established that, since 2020, value investing is taking back its crown as the premium investing strategy.

Since 2020, the MSCI World Value Index has outperformed the MSCI World Growth Index by 15% (source: JP Morgan/Bloomberg).

Research from investment bank giant JP Morgan shows that between 2007 and 2020, growth stocks did better than value stocks. With central banks pouring money into markets via quantitative easing (QE) and interest rates around zero, there was plenty of cheap money for growth companies to borrow. Optimistic evaluations were made based on future earnings.

This period of growth dominance peaked with mega-valuations of growth stocks. For example:

- Online comms provider Zoom Communications (ZM) was up 600% but has lost its gains since.

- Exercise bike maker Peloton stock (PTON) was up 900% but, again, has since lost its gains.

The Verdict on Value Investing from Investment Banks

High interest rates and inflation have put growth stocks on the back foot since the beginning of 2020. And value stocks are therefore back in vogue.

JP Morgan conclude that, ‘while Value has strongly outperformed Growth since November 2020, we believe this may just be the start of a Value comeback after 13 years of severe underperformance.’

Fellow investment giant Schroders confirms that the typical value investor is a patient investor. When it comes to value stocks, says Schroders, ‘their low price presents an attractive option for a patient, long-term investor with a stable liquidity profile who is prepared to sit through decade-long periods of underperformance.’

Best Assets for Value Investing

In figuring out where to begin investing, investors might well ask: what are the best assets for value investing? So, let us be clear: value investing applies only to the best cheap stocks. Value investing does not apply to any other asset class other than stocks, although some assets (like crypto, for example) may be classed as ‘growth’ assets.

Whatever investment strategy they follow with stocks, beginners would do well to focus on minimizing their risk.

Value ETFs

One way of spreading risk when it comes to buying stocks is to learn how to trade ETFs (Exchange-Traded Funds).

ETFs are funds which invest in a bunch of stocks at once. And investors can trade shares in ETFs with online brokers just like regular stocks.

Conveniently, some ETFs are labelled as ‘value ETFs’. This means they contain companies recognized to be value investments. Examples are:

- The Vanguard Mega Cap Value Index Fund ETF (MGV).

- Vanguard Russell 1000 Value Index Fund ETF (VONV).

Both these ETFs are available with Capital.com and other online brokers.

Best Strategies for Value Investing

Value investing is a strategy for picking stocks. It all boils down to picking the right stocks, buying them, holding them and then selling them at a profit.

Ultimately then, the tricky part of value investing is picking the right stocks.

Smart investors do their own research and cautiously take advantage of online resources that handle some of the legwork.

Value Investing Formula

The man known as the ‘Father of Value Investing’, Benjamin Graham split value stocks into 3 categories: defensive, enterprising and net-net. He provided formulae to determine which stocks were best.

These formulae are not impossible to apply for the beginner investor, but some arduous mathematics is required. Many beginner investors therefore choose to use a value investing stock screener instead.

Online value investing stock screeners automatically apply value formulae to global stocks – and show the investor which stocks come out on top. Some screeners are free, and some charge the investor.

Investors might also learn from other investors by using chat groups like value investing reddit or browsing broker eToro‘s CopyTrader function for value investing opportunities.

Look for Companies with Low P/E ratios

The Price/Earning Ratio is a key metric when it comes to how stock value is determined.

The P/E ratio shows how expensive a company is compared to how much money it is making. The higher the P/E ratio, the more expensive a company is.

- Companies with high P/E ratios tend to be growth companies. In this case, the metric shows that their share price is high compared to how much money they are making right now.

- Companies with low P/E ratios tend to be value companies. In this case, the metric shows that the share price is low compared to much money they are making right now – that is the definition of value.

The only way to determine whether a P/E ratio is low or high is to check a company’s P/E ratio against other companies in the sector.

- US value stock Target (TGT), for example, has a P/E ratio of 14 compared to its rivals Walmart (P/E ratio: 28) and CostCo (P/E ratio: 42).

Look for Companies with Good Dividend Records

Value stocks often number among the best dividend stocks.

Companies are under no obligation to pay dividends to shareholders. So, when they do, it is usually a sign of a well-established business with a claim to possibly being a value stock.

- For example, UK consumer durables giant Proctor & Gamble (PG) has increased its dividend payment for 65 consecutive years.

Heed the Advice of Value Investing Guru Warren Buffett

What’s value investing? Let’s ask an expert!

The ‘Oracle of Omaha’ Warren Buffett learned the craft of value investing under the wing of its pioneer Benjamin Graham. Stock in Buffett’s company, Berkshire Hathaway, is the most expensive in the world, with a single Class A share currently valued at over $412,000. This is a strong indicator that value investing works.

Two Buffett quotations stand out that answer the question: what is value investing?:

- ‘You should invest in a business that even a fool can run, because someday a fool will.’

- ‘Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good results.’

Investors with eToro can buy into the Berkshire Hathaway Smart Portfolio. This tracks the SEC filings of Buffett’s company and invests accordingly.

This Smart Portfolio invests in 33 companies. The top five are:

- Apple (APPL): 40.91%

- Bank of America (BAC): 10.52%

- Coca-Cola (KO): 8.41%

- Chevron (CVX): 7.82%

- American Express (AXP): 7.03%

Risks of Value Investing

Although considered to be the best recession-proof stocks, value companies are not risk-free. Stocks that are cheap at the price may face potentially catastrophic issues that the retail investor cannot spot. In this regard, Warren Buffett looks for companies that feature a ‘moat’ around their castle: ie. a competitive advantage to keep them safe.

Growth stocks are risky too: just because the market has high hopes for a growth company does not mean that the firm will achieve its revenue estimates in the future. This is particularly the cost in times of rising interest rates and inflation (like right now).

With both types of stock, there is also the counter-risk that money put into other types of asset would do better. But nobody has a crystal ball.

The most profitable cryptos represent the ultimate growth asset. Crypto is not a value asset, because most crypto are not linked to meaningful revenue generation – yet. But as growth assets, crypto are exceptional.

Below we outline a particularly exciting growth opportunity in the form of the cryptocurrency IMPT. In diversifying their portfolio, investors might thus want to balance their value investments with a small foray into high-risk/high-reward cryptocurrency.

Where to Start Value Investing – Most Popular Brokers Reviewed

When it comes to how to learn value investing, one way forward is for investors to do their own research and follow the price movement of stocks over the long-term. Then, an investor can use a free demo account from an online broker to get to grips with online investing without committing funds. Eventually, an investor can put down some real money, invest in stocks and start value investing for real.

Two popular online brokers that sell stocks include Capital.com and eToro.

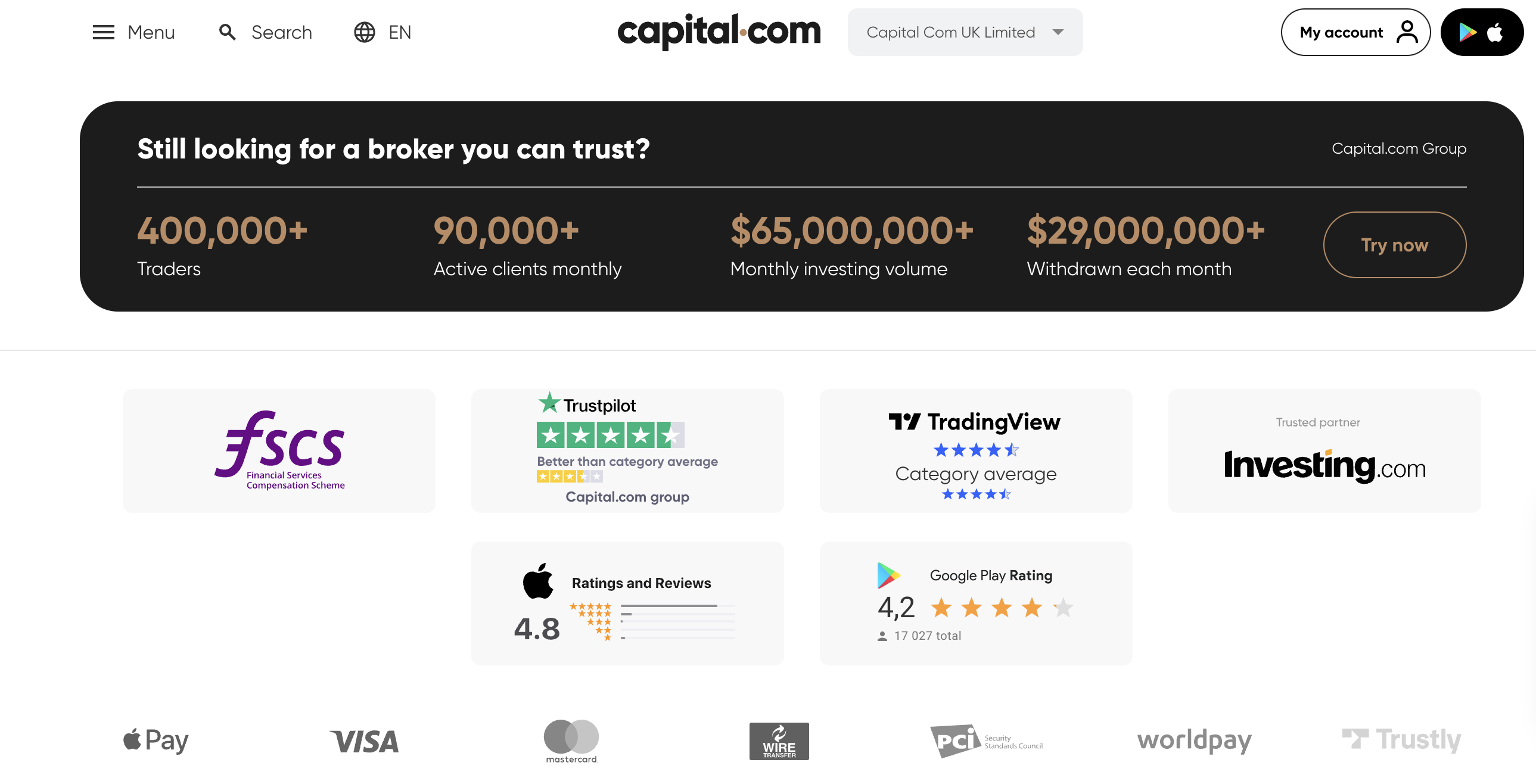

Capital.com – Popular CFD Broker Charging Zero Commission

Investors choosing to be investing in value stocks will be pleased to learn that this broker has a selection of 5,700 stocks to choose from. That means an investor will not be stuck for choice in balancing steady value acquisitions with growth stocks boasting promising futures; look no further than the most popular biotech stocks and tech stocks.

Capital.com is recognised as one of the most popular CFD brokers. Contracts-For-Difference give investors powerful options:

- With a CFD, we can ‘go short’ on a stock – which means betting that its price will fall, rather than rise. Going short is a great option to have in the toolbox, especially in bear markets.

- CFDs also permit investors to leverage their trade. This means ramping up the gearing on a trade so that gains (as well as losses unfortunately!) are higher. We do not recommend that beginners leverage trades.

Alongside shares and ETFs, this broker offers commodities, forex and indices. It is extensively regulated: by the FCA in the UK, ASIC in Australia and CySEC in Europe. Learn more in our full capital.com review.

What We Like

- Zero commission on trades

- Lots of market analysis and news articles

- Extensive regulation (FCA, ASIC and CySEC)

- Complimentary Account Manager assigned to new users

- Use CFDs to leverage trades and go short

| Approx Number of Stocks: | 5,700+ |

| Pricing System: | Spread fee plus CFD overnight fees |

| Deposit Fees | None |

| Payment methods: | Use wire transfer, Trustly, ApplePay, Worldpay or buy stocks with credit card |

| Inactivity Fee | None |

80.61% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider.

eToro - Popular Social Trading Platform Charging Zero Commission

Launched in 2007, eToro is a full-service broker that has served over 28m customers in its time. Like Capital.com, eToro is regulated by the FCA, ASIC and CySEC (as well as other bodies) and charges no commission on stock trades. Spread fees apply.

Investors looking to buy stocks on eToro have over 3,000 stocks to choose from. The choice spans 16 international exchanges and 17 sectors. Crypto, commodities, indices, forex and 264 ETFs are also available.

eToro has a reputation for being one of the most popular copy trading platforms.

- eToro's CopyTrader platform allows investors to copy the trading activity of more experienced traders. The service is free, automatic - and easy to bounce in and out of.

- Also specifically aimed at beginners is eToro's range of 70+ Smart Portfolios. These are strategic portfolios which investors can buy into. One of particular interest to us as we examine value investing is the Berkshire Hathaway Smart Portfolio. This invests in the same companies as legendary value investor Warren Buffett, who owns Berkshire Hathaway.

Top tip: on the hunt for value stocks? Start your search in the energy, consumable goods and manufacturing sectors. Simply navigate to the eToro 'stocks' page and cycle through your sector options as below:

Dig deeper into eToro with our full eToro review.

What We Like

- Zero commission on stock trades

- Plenty of beginner-friendly features

- Regulated by the FCA, ASIC, and CySEC

- Social Trading: CopyTrader and Smart Portfolios

- 3,000+ stocks available

| Approx Number of Stocks: | 3,000+ |

| Pricing System: | Spread fee (plus overnight fees if CFD trading) |

| Deposit Fees | None |

| Payment methods: | Wire transfer, credit card, payment wallets plus buy stocks with PayPal (Europe only) |

| Inactivity Fee | $10 after 12 months of inactivity |

Your capital is at risk. 78% of retail investor accounts lose money when trading CFDs with this provider.

Value Investing vs Crypto Investments

With the crypto sector boasting over 20,000 tokens to choose from, we might well ask: is value investing still relevant? The answer is yes, value investing is relevant - but it is worth considering matching value investing with growth investing.

And, with certain crypto, growth investing gets very exciting.

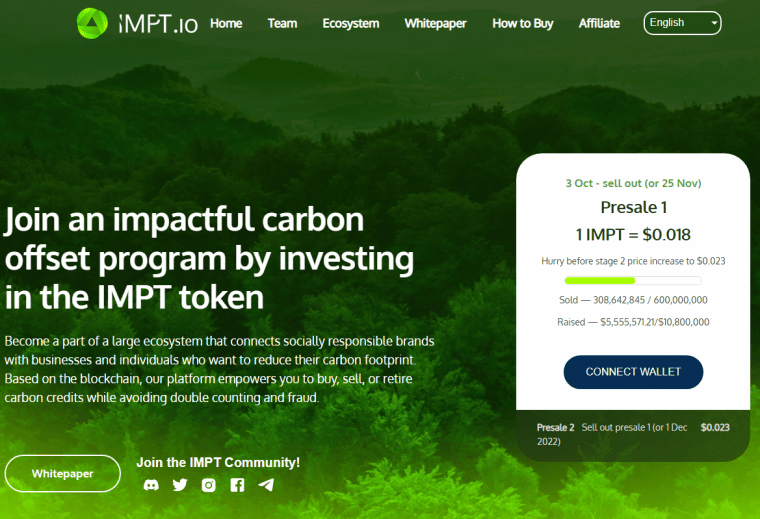

IMPT is a unique token that token holders can convert into carbon credits. Each IMPT token is backed by a Global Certification Protocol-compliant environmental project. After token holders convert their IMPT to offsets, they can either burn them to offset their own emissions or list them on carbon credit markets to sell them to eco-conscious companies. Investors who burn their IMPT earn a unique NFT that they can hold for long-term value.

IMPT is currently holding one of the best crypto presales of 2023. The project has already sold nearly $6 million worth of IMPT out of a Phase 1 goal of $10 million. Phase 1 continues to run until November 25 or whenever the $10 million goal is reached, so investors still have an opportunity to buy IMPT at the best possible price.

Figuring then on some long-term crypto investment? Investors can buy IMPT right now in just 4 easy steps:

- Get a MetaMask or Trust crypto wallet.

- Connect the wallet to the IMPT presale platform.

- Buy IMPT using Tether (USDT), Ethereum (ETH), or a credit card.

All IMPT purchased during the presale will be released to investors' wallets at the end of the presale.

| Min Investment | 10 IMPT ($0.18) |

| Max Investment | NA |

| Purchase Methods | USDT, ETH, Credit card |

| Blockchain | Ethereum (ERC-20 token) |

Conclusion

Above we have aimed to answer the question: what is value investing?

We have noted that value investing comes with the risk that a value company may not outperform a more expensive growth company. Then the investor is faced with a serious case of Fear Of Missing Out (FOMO).

A common way to tackle FOMO is to spread investments sensibly across both value and growth investments. Although we have noted that value investing applies only to stocks, we have further observed that cryptocurrency may be considered a growth asset in itself. And one cryptocurrency stands out in 2023: TAMA, arguably one of the best future cryptocurrencies available.

IMPT's growth potential is founded on its novel approach to carbon credits. Every IMPT token is backed by investment in an environmentally friendly project and can be converted into carbon offsets. IMPT is burned to utilize these offsets, decreasing the supply of the coin. So, there is a lot of growth potential crammed into one token!

The IMPT presale is happening now - check it out to invest in IMPT at the lowest possible prices!

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st