The global markets saw a major decline in 2022 – meaning that investors have the opportunity to buy assets at an attractive discount.

This is known as ‘buying the dip’ and crucially when focusing on high-grade assets, this can be a great long-term strategy to take advantage of.

In this guide, we take a comprehensive look at 10 core assets and markets to help answer the question – What to Invest in Right Now?

What to Invest in Right Now – Top 10 Assets

Looking for a quick overview of what to invest in right now? Check out the 10 assets listed below:

- High Potential Crypto Presales Like Fight Out – Overall Top Investment for 2023

- Stock Index Funds – Dollar-Cost Average Leading Index Funds Like the S&P 500

- Recession-Proof Stocks – Invest in Companies That Perform Well During a Recession

- Treasury Inflation-Protected Securities – Counter the Threat of Rising Inflation Through Specialist Bonds

- Precious Metals – Popular Asset Class to Hold During Economic Instability

- Tech Stocks – Load up on Leading Tech Stocks While Prices are Cheap

- Bond ETF – Hedge Against the Stock Market With a Diversified Portfolio of Bonds

- Bitcoin – Invest in the Future of Value While Crypto is Still Young

- Dividend Stocks – Focus on Stocks That Have a Proven Track Record in Paying Dividends Long-Term

- 401 (k) Plan – Get Started With a Long-Term Investment Plan That is Tax-Efficient

When assessing what to invest in right now, experienced traders will often build a diversified portfolio that tracks multiple assets and markets. In doing so, this reduces the risk of investing in a sub-par asset that subsequently impacts the overall value of the portfolio.

A Closer Look at the Top Assets to Invest in Now

In the following sections, we will explore 10 assets across multiple markets to ensure that all investor profiles are catered for. Each asset that we discuss will come with its own upside potential and of course – level of risk.

Read on as we uncover the best sectors to invest in right now.

1. High Potential Crypto Presales Like Fight Out – Overall Top Investment for 2023

Investing in the best crypto presales is somewhat similar to investing in a company before it goes public. This is because the project will offer its native crypto asset to early investors at a reduced entry price. The idea is that once the crypto asset is listed on an exchange, early investors will witness an attractive upside.

The actual investment process is somewhat simple, as it’s just a case of swapping a legacy crypto asset like Ethereum for the respective presale token. Moreover, considering the number of crypto presales entering the market right now, investors can easily diversify their investments to ensure that a risk-averse strategy is undertaken.

To briefly offer some insight into recently successful presales, let’s take the example of Tamadoge, which launched in September 2022. The first batch of TAMA tokens was made available to early presale investors at $0.01 each but by the time the presale finished, TAMA was selling for $0.03.

After the presale concluded – which raised $19 million – TAMA was then listed on the popular crypto exchange OKX and subsequently increased to an all-time high of $0.194, providing early presale investors with gains of almost 2,000%.

Prior to Tamadoge, the Lucky Block presale – which raised over $5 million in January 2022 – offered LBLOCK tokens to early investors at just $0.00015 and after listing on PancakeSwap surpassed a value of $0.009.

The earliest backers of LBLOCK, therefore, witnessed gains of over 6,000%. So that begs the question – what are the best crypto ICOs and presales to invest in right now?

In the following sections, we highlight two notable projects that are offering their native crypto asset via a presale campaign and look set for a huge 2023.

Fight Out (FGHT) – Revolutionary M2E Project developing Fitness App and Building Real-World Gyms

The highly ambitious project is developing a move-to-earn fitness app and will also build and develop real-world gyms kitted out with Web3 features in key locations around the world and is among the very best cryptos to invest in now.

While other M2E projects launched to great fanfare in 2022, they hype soon fell away as users complained about the need for expensive NFTs and a flawed rewards system.

Fight Out solves that issue by offering traditional app subscription and gym membership rather than the need to purchase NFTs.

Furthermore, rather than just tracking steps, Fight Out will use smart technology that tracks movement, key effort indicators, sleep and nutrition to build a digital fitness profile and provide a tailored workout regime – the program will be holistic and also has a focus on wellness and mental health as well as strength and cardio training.

Users earn REPS – the in-app currency – by working out at home or in a gym and build up their digital profile, which is customizable and represented by a soulbound avatar that cannot be sold or traded.

REPS, which have no value outside the app, are used to get discounts on subscriptions and memberships, book training sessions and purchase equipment, apparel and supplements. Users can also earn further REPS by pitting themselves against others in daily, weekly and monthly competitions.

The Fight Out team, which is doxxed and KYC verified, is already scouting locations for its first gym and has also signed on four world-class athletes to act as ambassadors – not just to market the project but to provide exclusive content such as masterclass training sessions and behind-the-scenes access.

The ambassadors are British boxing star Savannah Marshall, who is expected to face Claressa Shields in a rematch of the most-watched women’s boxing match ever this summer, UFC pair Amadanda Ribas (ranked No 9 in strawweight division) and Taila Santos (ranked No 2 flyweight and No 12 pound-for-pound) and Tremayne Dortch, who appeared on American Ninja Warrior and has built a huge social media following as a personal trainer.

FGHT tokens, which will underpin the project and fund gym and app development, are currently on sale for $0.0166 each, with stage 1 buyers also able to get up to 50% in bonuses.

By the time the presale ends, FGHT tokens will have increased in price by 100% to $0.0333, while the bonuses are only available during stage 1, which is already more than 50% sold out.

Read through the Fight Out whitepaper for more information and join the Telegram group for the latest news.

Dash 2 Trade (D2T) – Crypto Analytics Terminal With Professional-Grade Features

The crypto intelligence and analytics platform has already secured more than $13 million in investment and experts predict the D2T token will pump in price when it reaches exchanges.

It has only a limited supply of tokens, 1 billion, with D2T offering real utility as it offers access to all the tools, data and insights offered by the Dash 2 Trade protocol, which aims to help its users maximize their profit-making potential on crypto in 2023.

The terminal will host a varied suite of features and tools that enable traders and investors to consistently make smarter decisions – based on data, metrics and analytics

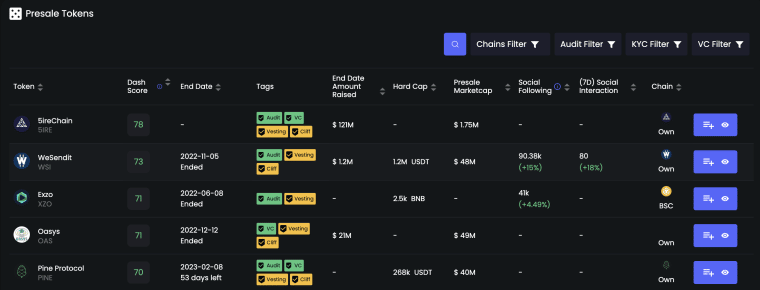

Available via a three-tiered monthly subscription, Dash 2 Trade offers trading signals, alerts on new token listings, professional-grade independent technical indicators and a bespoke scoring system to rate new projects.

Through manual and automated research, the presale system, the Dash Score, will provide subscribers with a fully-fledged analysis of upcoming ICOs alongside a rating on their upside potential out of 100.

Due diligence will be conducted on projects and information provided to users so they can invest in new projects with confidence and avoid flawed projects and outright scams – the Dash Score is now undergoing beta testing and will be live in the coming weeks.

On-chain metrics supplied by Dash 2 Trade are also of high value, as this highlights where the so-called smart money is going.

With sentiment and narrative just as important as underlying fundamentals, Dash 2 Trade explores the most popular cryptos that are trending on sites like Reddit at any given time, as well as analyzing on-chain data and watching whale wallet activity to spot, and take advantage of, developing trends.

Traders can take advantage of pro-level indicators such as moving averages and orderbook statistics, as well as use automated trading APIs and a backtester to test strategies in live market conditions without risking capital.

There are also social trading features such as trading competitions, members-only groups to discuss insights, copy trading features and a Learn to Earn academy where beginner traders can earn D2T for undergoing courses, as well as tapping into the wider community to expand their knowledge.

As mentioned above, Dash 2 Trade is now in the final days of its token presale, with D2T on sale for $0.0533 until January 5. Its IEO will then take place on January 11, with listings already confirmed on Uniswap, LBank, BitMart and Changelly Pro.

Dash 2 Trade has been developed by a group of experienced professional traders, who are doxxed and KYC-verified, who saw a huge gap in the crypto market for reliable trading and investment tools.

Read through Dash 2 Trade whitepaper for more info and join the Dash 2 Trade Telegram group for the latest updates.

2. Stock Index Funds – Dollar-Cost Average Leading Index Funds Like the S&P 500

When asking the question – what should I invest in right now? – it is of the utmost importance to diversify. This means that while crypto presales often offer unprecedented upside potential, investors should never put all of their eggs into one basket. As such, when assessing what to invest in right now, the stock market offers an element of diversification away from crypto assets.

On the one hand, some investors prefer to pick their own stocks – which we cover later. However, perhaps an even better way to approach the market is to invest in a stock index fund. This means investing in a basket of companies from a particular stock exchange or economy through a single trader.

For example, those wishing to invest in the broader US economy will typically opt for the S&P 500 – which has generated average annualized gains of 10% since it was launched in 1926. Not only does the S&P 500 track 500 large companies that are either listed on the Nasdaq or NYSE, but it is rebalanced every three months.

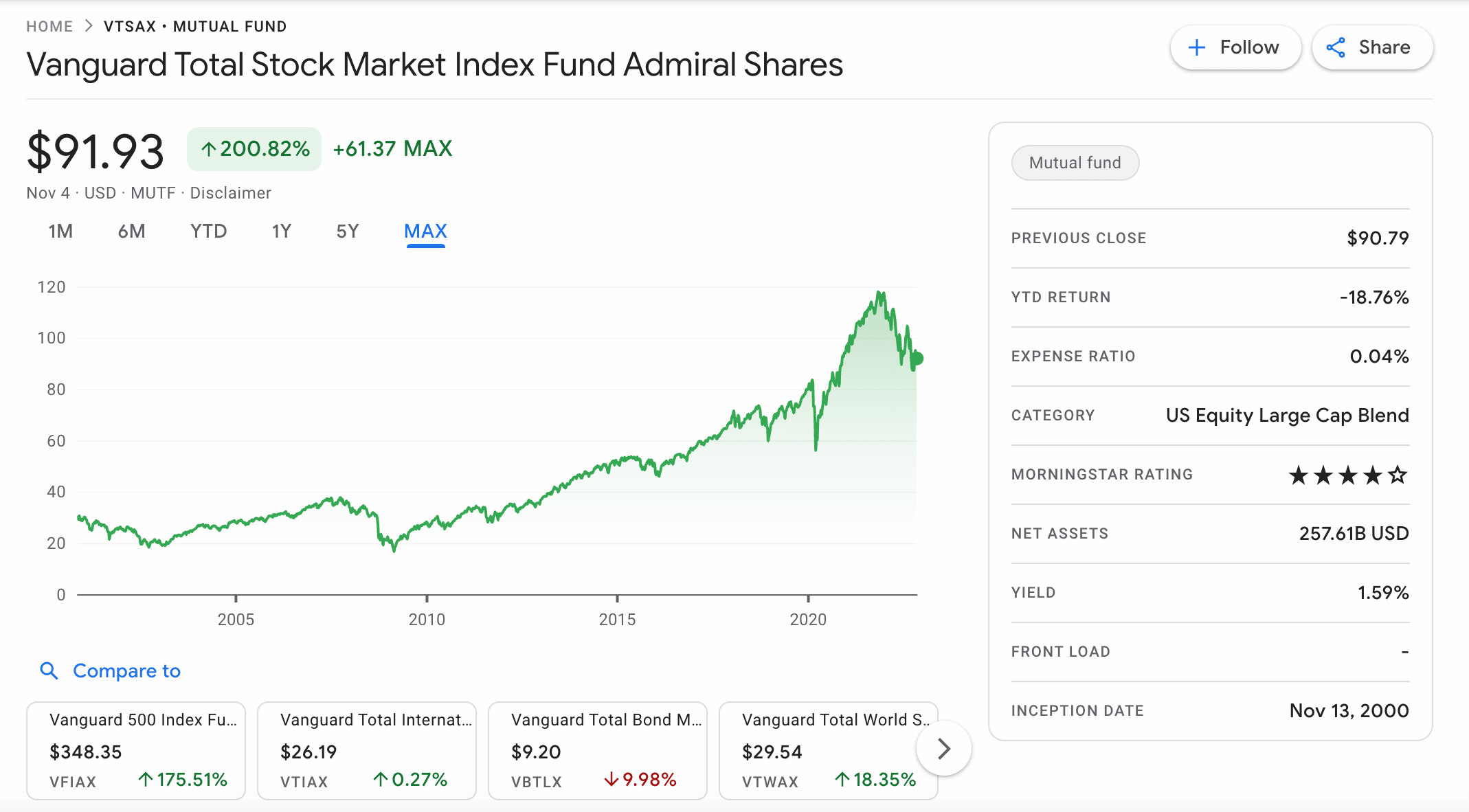

This ensures that the S&P 500 continues to mirror the wider US economy – at least in terms of stock valuations and price movements. Investors that wish to take portfolio diversification to the next level might even consider the Total Stock Market index fund offered by the likes of Vanguard and iShares.

This index fund tracks no less than 4,000 US stocks across large, mid, and small-cap companies. Other investors prefer the Dow Jones, which tracks 30 blue-chip stocks from a range of sectors. Irrespective of the chosen index fund, this investment product offers a diversified and passive way to approach the stock market – meaning it is ideal for beginners and time-starved investors.

3. Recession-Proof Stocks – Invest in Companies That Perform Well During a Recession

There are many strategies to consider when assessing what to invest in during a recession. With that being said, history suggests that certain companies typically perform well when then the broader economy is struggling. Equally, certain industries are best avoided during a recessionary period.

Crucially, consider that during a recession, discretionary spending takes a major hit. This refers to money that is spent on non-essential items, such as vacations, fashion, home improvements, and electronics. Non-discretionary spending, on the other hand, remains virtually untouched during a recession, as this refers to so-called mandatory expenses.

Think along the lines of groceries, utilities, and medicine. As a result, when assessing what stocks to invest in, many market commentators will suggest focusing on companies that operate in the aforementioned sectors. For example, Walmart stock is often favored by investors during a recession, considering that it sells groceries at competitive prices.

Dollar General is also considered a recession-proof stock too, considering that it operates nearly 17,000 discount stores throughout the US. In terms of utilities, consider exploring companies that have a solid grip on supplying households with water and electricity.

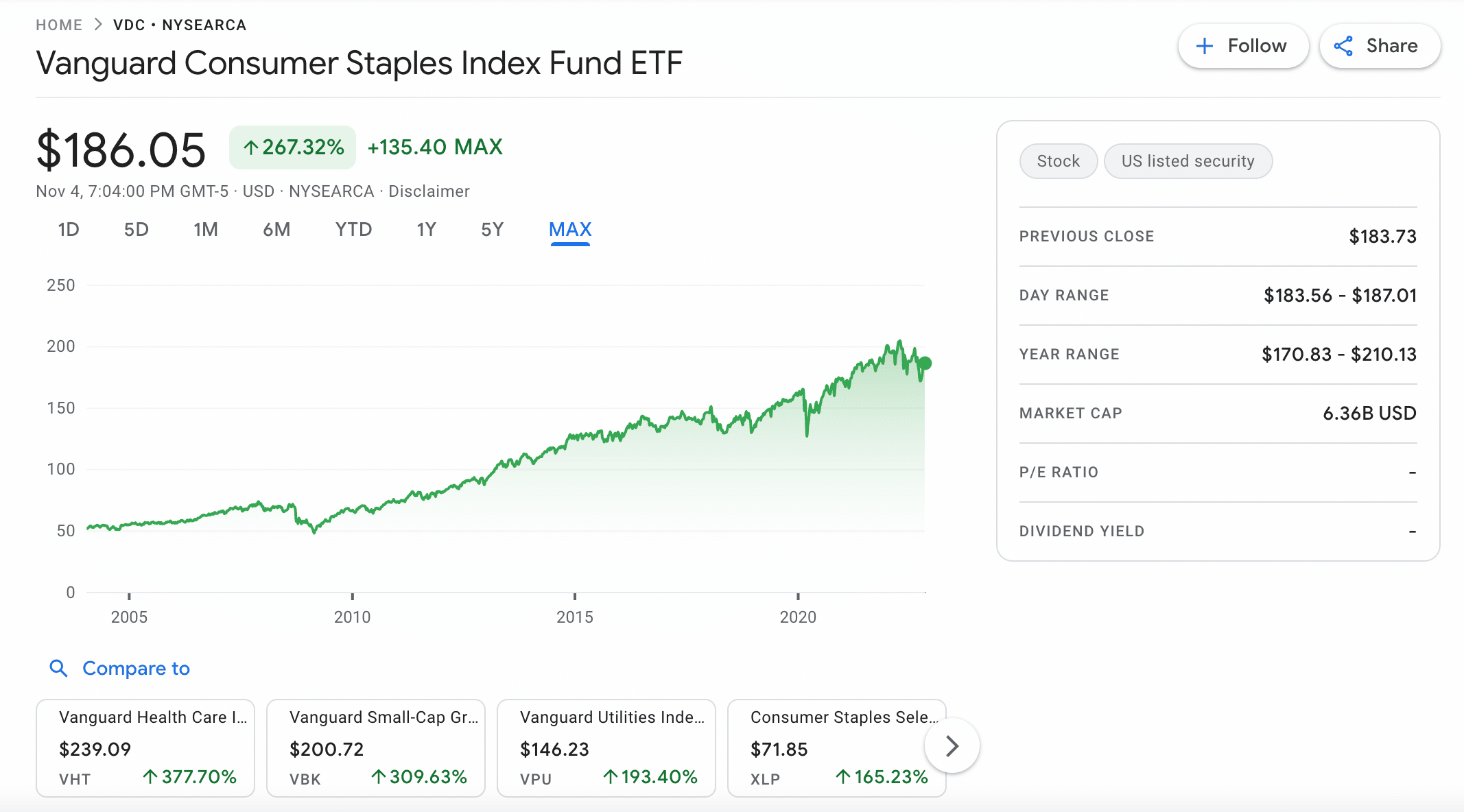

The likes of Johnson & Johnson and Procter & Gamble are popular too, as these companies sell products that are utilized by households around the world. Rather than attempting to hand-pick recession-proof stocks, it could be worth exploring suitable ETFs that offer instant diversification. The Vanguard Consumer Staples ETF, for example, invests in 100 staple companies.

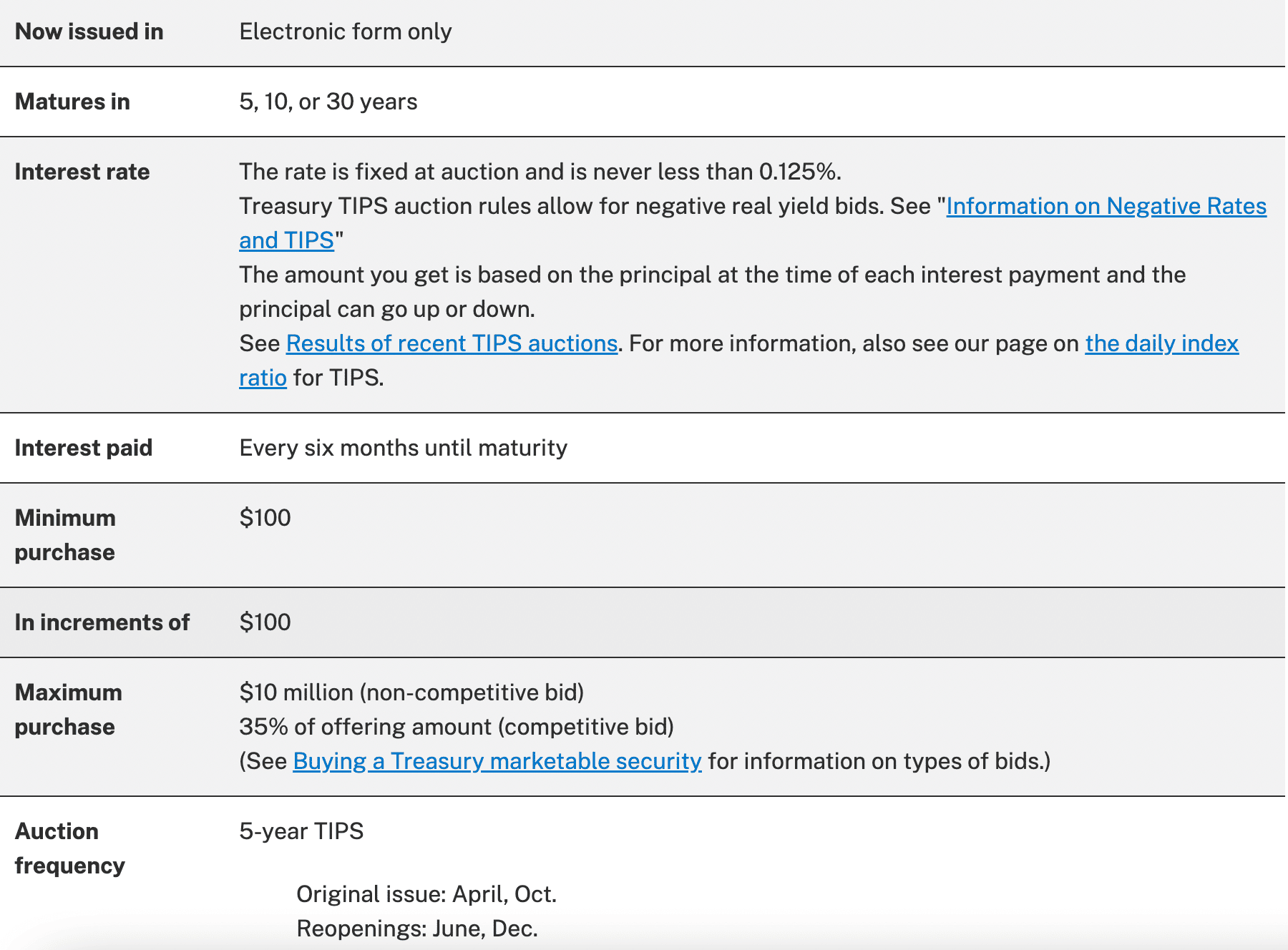

4. Treasury Inflation-Protected Securities – Counter the Threat of Rising Inflation Through Specialist Bonds

Inflation has been a major talking point globally over the prior year and this has resulted in a concerning decline in consumer purchasing power. As a result, many retail clients are exploring what to invest in during inflation periods. The key issue right now is that traditional asset classes – such as stock index funds, are witnessing bearish pricing action.

This makes the consequences of inflation even more alarming. With this in mind, one of the most common investment vehicles to help ride out high inflation levels is Treasury Inflation-Protected Securities – or simply TIPs. Put simply, TIPs are US government-issued bonds that are tasked with tracking the rise and fall of inflation rates.

In other words, when inflation rises, so does the yield on TIPs. While this won’t enable investors to generate growth, it will at the very least protect the value of wealth until inflation levels get back to target levels. Moreover, TIPs are backed by the US government, so there is little risk of the bonds resulting in a loss.

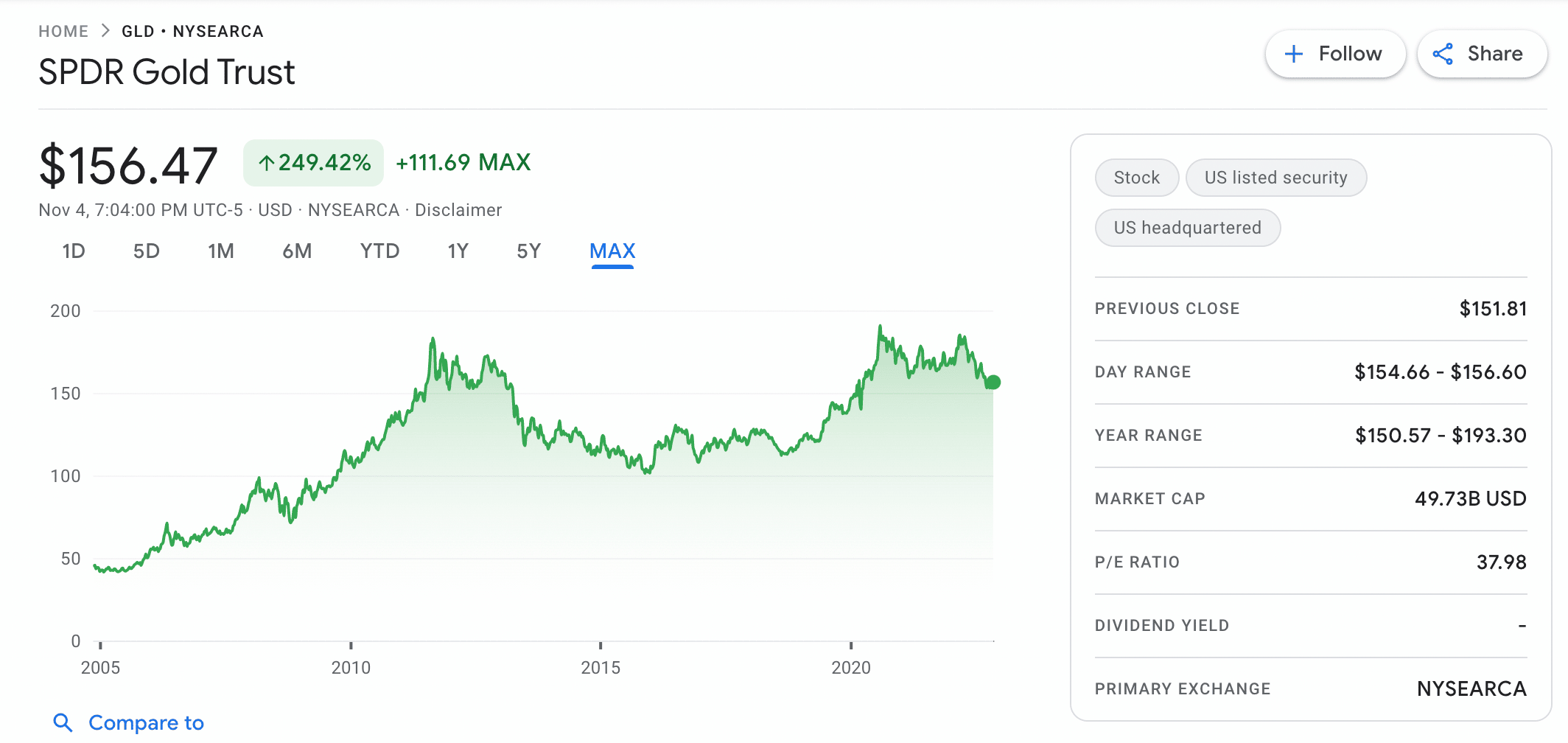

5. Precious Metals – Popular Asset Class to Hold During Economic Instability

Precious metals like gold and silver have been used as currency since the birth of time. Although precious metals are rarely used for medium of exchange purposes, they are often the go-to safe haven for storing value. This is especially the case when a recession is imminent and/or there is economic instability on the global stage.

In order to gain exposure to precious metals, there is no requirement to purchase physical bars of gold or silver. On the contrary, both of these asset classes can be accessed with ease via an ETF. The best ETFs to focus on should be those that are physically backed with precious metals – meaning that in theory, the investment should closely align with global prices.

Another reason why precious metal ETFs are the way to go is that they trade on stock exchanges. This means that investors can cash out at any given time – rather than needing to try and find somebody to buy physical coins or bars. Plus, precious metal ETFs rarely cost more than 0.5% annually in fund fees.

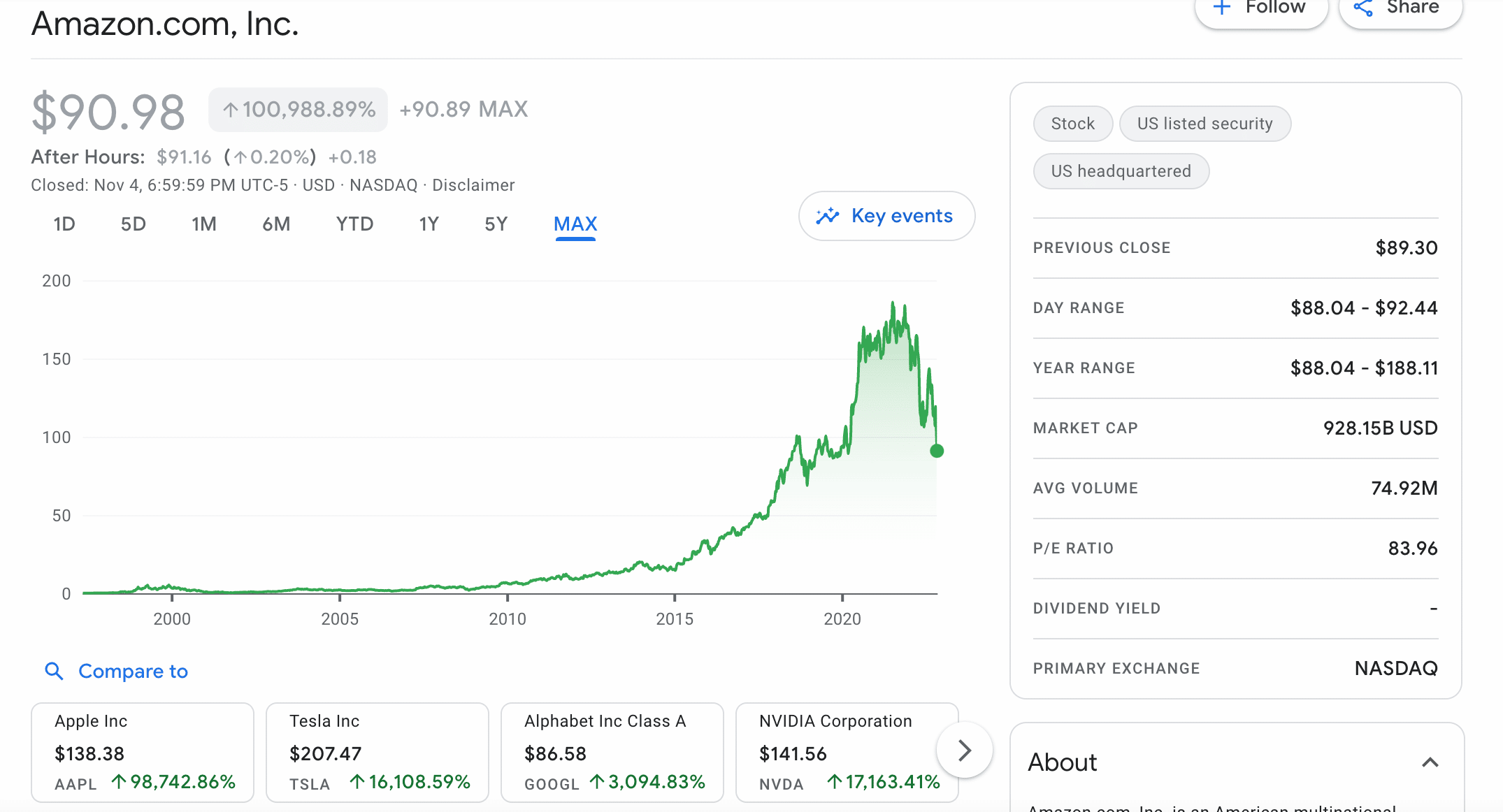

6. Tech Stocks – Load up on Leading Tech Stocks While Prices are Cheap

On the one hand, tech stocks are typically hit the hardest in the midst of a recession. This has already been the case for many stocks in this space throughout 2022 – with the markets seemingly favoring companies that operate in the consumer staples sector. With that said, long-term investors might find current pricing levels appealing.

For example, Amazon stock is down 47% over the prior 12 months, which means that the firm has since dropped by the trillion-dollar threshold. Similarly, Google’s parent company – Alphabet, is down 42% for the year. The downfall for Meta Platforms – the parent company of Facebook and Instagram, has been even more considerable – with the stock down over 70% for the year.

Crucially, this offers the opportunity to build a diversified portfolio of tech stocks at a heavily discounted entry price. This is in anticipation that when the next bull market arrives, the tech space will return to its former heights. There is, of course, no guarantee that this will be the case, so those considering tech stocks should ensure they also have exposure to other asset classes.

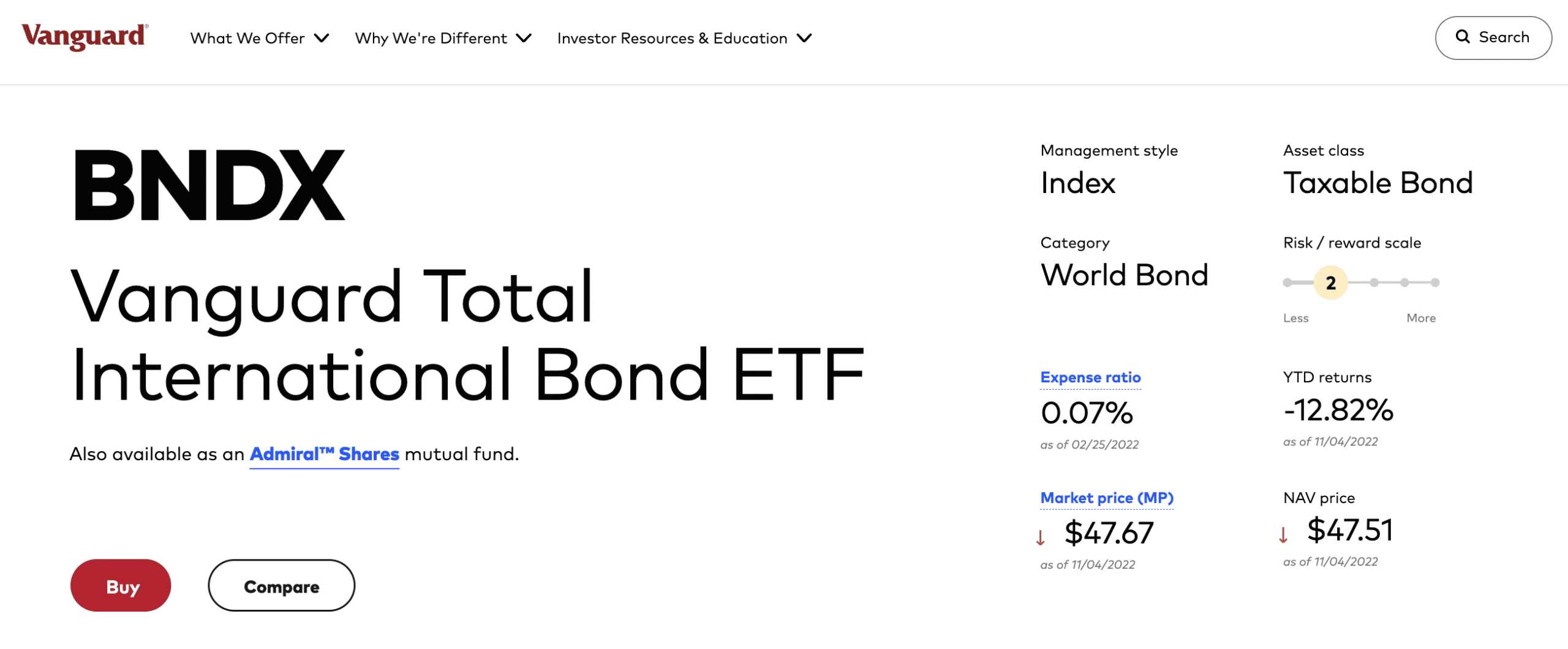

7. Bond ETF – Hedge Against the Stock Market With a Diversified Portfolio of Bonds

Another way to reduce exposure to the broader stock market is to invest in bonds. Once again, hand-picking individual bonds isn’t the best approach to take, considering that this requires investors to actively research the markets. Instead, it might be worth considering a bond ETF that offers access to a wide range of instruments.

The Vanguard Total International Bond ETF, for example, offers access to nearly 6,800 bonds from around the world. This passively managed ETF holds bonds from Japan, France, Germany, Italy, Canada, the UK, Spain, Australia, the US, and more.

Investors in this bond ETF will receive their share of any coupon payments on a monthly basis. Moreover, the Vanguard Total International Bond ETF charges an annual expense ratio of just 0.07%.

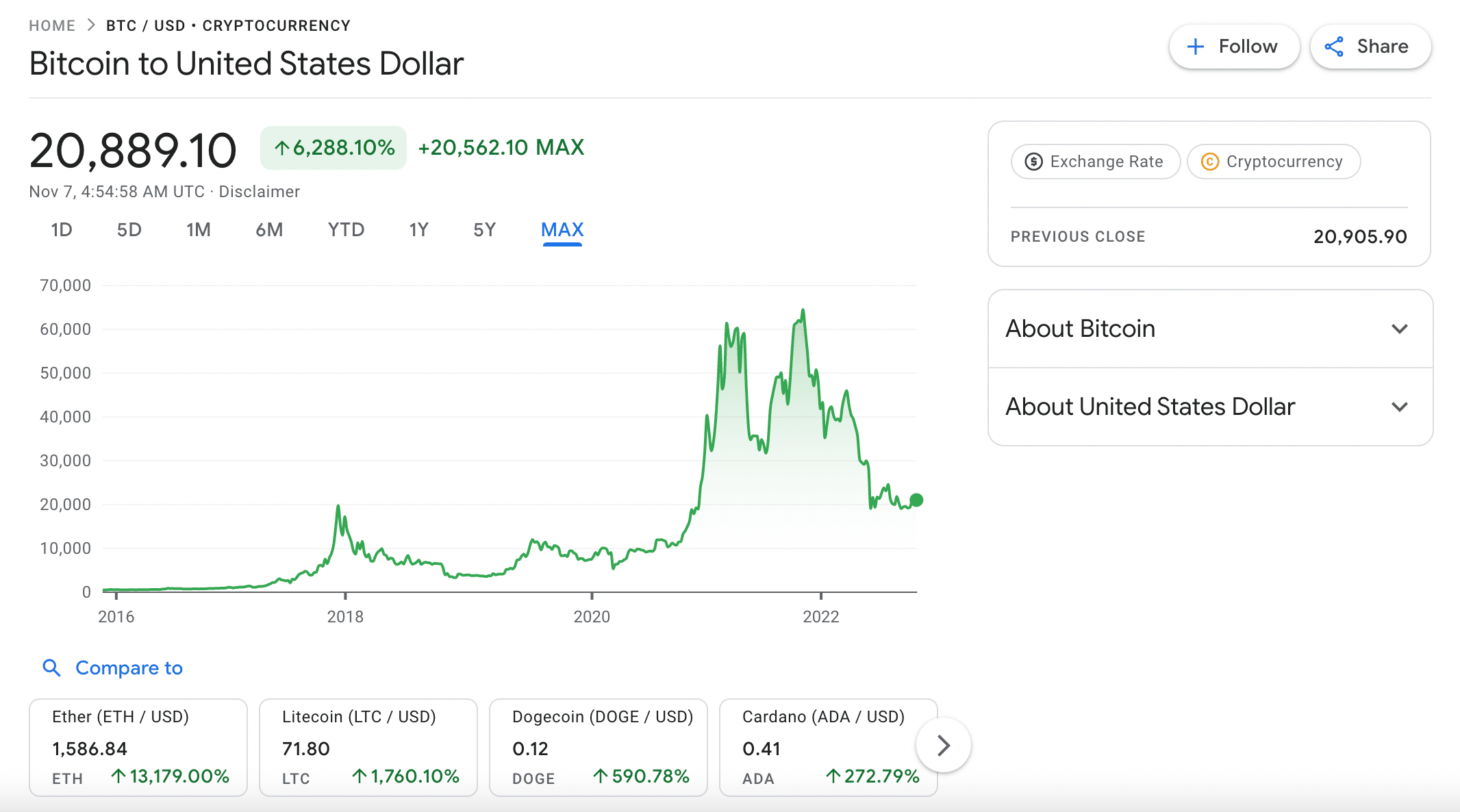

8. Bitcoin – Invest in the Future of Value While Crypto is Still Young

Although we previously discussed cryptocurrency, this was in relation to up-and-coming presale launches. As a result, when assessing high-growth assets to invest in, more established cryptocurrencies are perhaps worth considering too. After all, this industry is still in its infancy – at least when compared to the likes of stocks.

Wondering what is the best cryptocurrency to invest in? Many market commentators explain that beginners should elect to buy Bitcoin over other digital currencies. The reason for this is that Bitcoin is the original and most valuable cryptocurrency of choice. It is truly decentralized with no entity operating the Bitcoin network.

Moreover, there are hedge funds invested in Bitcoin and there is even a fully-fledged futures market that has been operational since 2017. Throughout the second half of 2022, Bitcoin has remained at the $20,000 level – give or take a few percentage points here or there. This represents a pricing point that is 70% below its former all-time higher.

This potentially represents a heavily discounted entry price – especially if Bitcoin goes on to generate new highs during the next much-anticipated bull run. Alternatively, for a more diversified approach to this industry, it could be worth considering crypto ETFs and index funds. It is possible to invest in Bitcoin and 70+other cryptocurrencies at eToro from just $10.

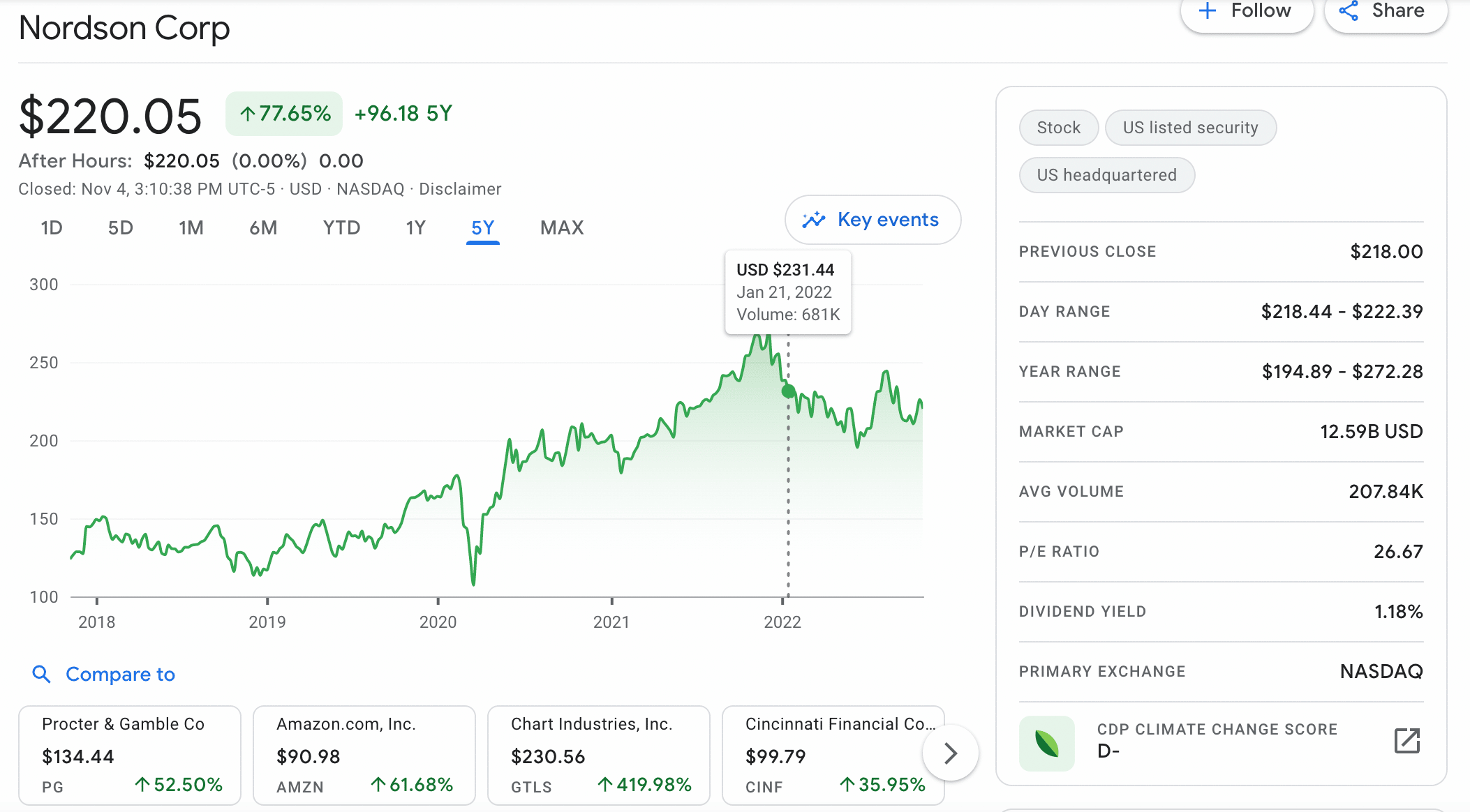

9. Dividend Stocks – Focus on Stocks That Have a Proven Track Record in Paying Dividends Long-Term

Dividend stocks are also highly sought-after during times of economic instability – especially in the lead-up to a recession. However, in this regard, it is best to focus on companies that have a long-standing and proven dividend policy in place, rather than on the highest yields available.

After all, companies offering unusually high yields will often not be able to sustain this during times of economic slowdowns. Instead, consider dividend aristocrats and kings – which refers to companies that have paid and increased the size of their payments for 25 and 50 consecutive years, respectively.

There are dozens of dividend stocks that fall under this umbrella and popular examples include Coca-Cola, Johnson & Johnson, Stanley Black & Decker, and Nordson. Still wondering what are good stocks to invest in now? Investors can also diversify by investing in an ETF that exclusively tracks dividend aristocrats. This will also turn the investment into a passive stream of income.

10. 401 (k) Plan – Get Started With a Long-Term Investment Plan That is Tax-Efficient

In addition to assessing what to invest in to make money, it is also important to evaluate tax obligations. And by setting up and maximizing a 401 (k) plan, this offers the most tax-efficient way to invest in the financial markets in the long run. 401 (k) plans are offered by many employers in the US and workers are encouraged to take part.

There are two 401 (k) plans to choose from – traditional and Roth. Traditional 401 (k) plans enable workers to invest a portion of their income without paying tax on the respective earnings. The tax is instead paid at the age of retirement when withdrawals from the 401 (k) are made. On the other hand, younger investors might prefer a Roth 401 (k).

This is because the tax is taken from the respective earnings straightaway – meaning that at the age of retirement, withdrawals can be made tax-free. The maximum amount that can be invested in a 401 (k) plan is $20,500 in 2022 and this will be increased to $22,500 in 2023.

Note: Don’t forget – some employers in the US match 401 (k) contributions up to a certain limit each year. This should be maximized, not least because the matching contribution is essentially free money that is being injected into the investment portfolio risk-free.

How to Pick What to Invest in Right Now for High Returns

In the sections above, we discussed a full range of assets – from crypto presales and tech stocks to precious metals and index funds. It is, however, important for investors to build their own portfolios based on their specific goals and tolerance for risk.

Below, we explain some of the key points to consider when assessing what to invest in right now.

Time Horizon

Before embarking on an investment journey, it is wise for beginners to consider the amount of time that they plan to spend in this market.

For example, some investors will be looking to build a long-term portfolio of assets with the view of securing a solid pot upon reaching the age of retirement. This is the preferred strategy to consider, as long-term investors can ride out short-term market cycles.

On the flip side, some investors will look to follow trends and subsequently generate short-term gains. While short-term traders do have the potential to outperform the market, this requires an active investment strategy with a strong focus on research and analysis.

Target Returns

Investors also need to assess their target returns when evaluating what to invest in right now.

- Investing in TIPs, for example, will do nothing more than track the current rate of inflation.

- While this can protect wealth during times of rising inflation, profit generation will not be possible.

- On the other hand, the likes of crypto presales and tech stocks perhaps offer the highest upside.

- Fight Out, for example, is offering access to its native FGHT token at a discounted price via its ongoing presale campaign and also offering up to 50% in bonuses for early buyers.

In a similar nature to stock IPOs, the value of D2T is expected to rise once the token is listed on a crypto exchange.

Risk Tolerance

Risk tolerance is another important consideration to make when assessing what to invest in right now.

For example, the likes of dividend aristocrats and kings are considered somewhat low-risk. This is because companies within this category have paid and increased the size of their dividends for at least 25 or 50 years, respectively.

Tech stocks, however, are considered super risky – especially in the midst of a recession. Crucially, companies like Amazon and Meta Platforms generally perform better when the global economy is strong.

Liquidity

Investors should also remember the important role that liquidity plays when it comes to selling an investment. Those that might require fast access to cash should only invest in highly liquid assets – such as stocks, crypto, and index funds.

On the other hand, those that are investing money that won’t be required in the short term might consider the likes of bonds and real estate – both of which can be time-consuming to sell during a broader recession.

Conclusion

In summary, knowing what to invest in right now is ultimately down to the individual profile of the investor. Beginners should consider their tolerance for risk and expected time in the market to build a portfolio that is right for their financial goals.

Both long-term and short-term investors might consider high-quality crypto presales for the upside on offer. Fight Out (FGHT) is perhaps the stand-out presale in this category, with the move-to-earn project already securing more than $2.5 million in funding and having ambitious plans to build a market-leading fitness app that rewards users, as well as real-world gyms that are integrated with Web3 technology.

FGHT tokens are currently on sale in the first round of the presale for just $0.0166 and will increase by 100% to $0.0333 by the time the presale ends.

FightOut - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $1M+ Raised

- Real-World Community, Gym Chain