With hundreds of thousands of users around the world and access to global markets, XTB has quickly risen up the ranks to become a leading broker. We’ve created this handy XTB review in order to make it easy for investors to decide whether the platform is right for them.

Throughout our XTB review, we’ll be taking an in-depth look at the ins and outs of the platform. A few areas we’ll be looking at include XTB fees, the XTB app, and the overall function of the platform. Let’s begin.

XTB Review: Pros & Cons

During out XTB review, we analyzed the broker and found the following pros and cons.

Pros Cons

78% of retail investor accounts lose money when trading CFDs with this provider.

Tradable assets

Having a good range of tradable assets is crucial for any large broker. XTB has over 2000 different assets available so there is always plenty of trading opportunities available.

Crypto

Cryptocurrency is the youngest and most exciting asset class presently available. It’s a rapidly emerging market with frequent developments and massive volatility; perfect for trading. Even the price of Bitcoin, the largest cryptocurrency, regularly falls and rises by double-digit percentages, making it an extremely exciting market.

The XTB crypto offerings are fairly plentiful. Investors can buy Bitcoin on XTB along with a myriad of other crypto-assets. While there are only 19 cryptocurrencies available for trade on XTB, it supports the most popular including, Bitcoin, Ethereum, Chainlink, and XRP.

XTB’s crypto offerings come in the form of contracts for difference (CFDs). This means that users are able to speculate on whether an asset will rise or fall in value without ever owning the underlying asset, which makes CFD trading on XTB perfect for short-term or day traders. As the broker uses CFDs for its crypto-assets, there’s no need to create an XTB wallet to hold crypto. Furthermore, crypto traders using XTB have access to leverage at a 1:5 ratio when buying Bitcoin on XTB.

Overall, it’s easy to long or short cryptocurrency on XTB. As the broker uses CFDs for its crypto-assets, frequent buying and selling is incredibly fast and unrestrictive. While crypto CFDs are available to the majority of XTB users, residents of the UK are not eligible for the feature.

Also see our full guide to trading cryptocurrency.

Stocks

The stock market is the original financial market. A stock represents fractional ownership of a company, for example, if a business was split into 10,000 shares and an investor purchased 1000, he would own 10% of the business. Every publicly-traded company has to be on a stock market of some description, meaning there are thousands of stocks available to investors.

On XTB alone, there are over 1,850 stock CFDs up for grabs.

The number of stocks and shares on XTB is vast. Because of this, there are plenty of opportunities available to traders and with the platform’s in-built stock screener and heatmap, finding opportunities has never been simpler.

As XTB is a regulated international broker, it supports lots of international stocks. It features some of the largest publicly traded companies from 16 different countries so both investors and traders have plenty of stocks to buy.

All in all, the stock offerings on XTB are excellent. There’s ample choice and most support 1:5 leverage meaning traders can have a position worth $500 for every $100 in their account.

Forex

The forex market is centered around trading various currency pairs (e.g. USD/JPY). As such, forex trading often involves taking advantage of slight dips or peaks in the market. Because of this, the best forex brokers will provide users with leverage so they don’t need large capital reserves to see meaningful profits.

It seems XTB understands and appreciates the need for leverage when trading forex as the broker offers a huge 1:500 leverage. This means that with a small $100 deposit, a person could have access to up to $50,000 in trading funds. It’s clear to see why XTB is a favorite among forex traders . It’s one of the highest leverage brokers out so it’s the perfect platform for taking advantage of small price movements.

XTB supports 48 currency pairs that are tradable 24/5, making it one of the best platforms for forex traders. For anyone that isn’t a fan of the comparatively large standard forex lot sizes, XTB also offers microlot trading. XTB trades can be big or small, so it’s perfect for investors of all kinds.

ETFs

Exchange-traded funds or ETFs, are a type of financial instrument. ETFs are generally designed to mirror the price of a certain index or sector. Because ETFs contain a large variety of companies they can be excellent for investors trying to de-risk or diversify. However, it’s important to note that ETFs do not provide ownership of the underlying assets, so if the fund managing an ETF goes under, client funds can be lost.

XTB supports 139 CFD-based ETFs and offers up to 1:10 leverage on positions. The ETFs are composed of assets in a range of sectors including bonds and innovation stocks. Each ETF is managed by an institution like iShares or Vanguard.

ETF trading on XTB is simple and powerful. As the broker offers 1:10 leverage it’s possible to amplify profits substantially but it’s worth noting that losses can also be magnified. We’ve got a great article for anyone wondering how to trade ETFs.

78% of retail investor accounts lose money when trading CFDs with this provider.

Indices

Indices are another type of financial asset that XTB users can trade with leverage. They are built to represent a specific index and therefore offer a clearer picture of the entire sector. An example of one of the most commonly traded indices is the US 100, which contains the top 100 US companies.

While indices tend to be relatively stable, XTB offers up to 1:200 leverage on index positions which can be used to significantly magnify returns.

As it currently stands, XTB offers 39 leading indices covering most major markets. With numbers like this and access to more than ample leverage, XTB is a great platform to buy and sell indices.

Commodities

A commodity is a basic good that is frequently used in commerce and can easily be interchanged with other goods of the same kind. A few of the most commonly traded commodities include oil, gold, and copper.

Investing in commodities can be a great way to reduce exposure to companies. Oftentimes, during periods of economic downturn, companies will fall in value whereas commodities will rise as people look for essential items that can be used as a hedge.

When writing our XTB review, the broker supported 39 different commodities and offers up to 1:500 leverage (although this figure varies greatly based on the commodity). Although commodities can be confusing at times, we’ve got a phenomenal article covering how to trade commodities that will simplify the entire process.

XTB Fees & Commissions

To make understanding XTB’s fee structure a little easier, we’ve broken them down into two categories; trading and non-trading fees.

XTB Trading Fees

XTB has some of the lowest fees in the industry. However, because the broker primarily uses a spread-based structure rather than charging a commission, the fees can be hard to understand. Below, we’ve included an easy-reference table with the fees linked to some of the most commonly traded instruments across each asset class.

| Cryptocurrency | Stocks | ETFs | Indices | Forex | Commodities | |

| Fee Type | Spread | Spread | Spread | Spread | Spread | Spread |

| Example | Bitcoin, $58.3 spread | Apple, $0.45 spread | iShares Core S&P 500, $1.22 spread | US 100, $1 spread | EUR/USD, $0.0001 spread | Oil, $0.03 spread |

XTB Non-Trading Fees

In addition to trading fees, most brokers will charge a few non-trading fees. These charges are mostly small and linked to the costs associated with managing client accounts. As some of XTB’s fees are linked to certain prerequisites, we’ve included a table detailing each below.

| Fee Type | Fee Amount |

| Inactivity Fee | $10 per month after 1 year inactivity |

| Deposit Fee | $0 (up to 2% on credit/debit card deposits) |

| Withdrawal Fee | $0 over $100, $20 for withdrawals under $50 |

78% of retail investor accounts lose money when trading CFDs with this provider.

XTB Platforms

Most brokers will offer support for a few different trading platforms. This gives users a bit of extra customizability, allowing people to trade how they want.

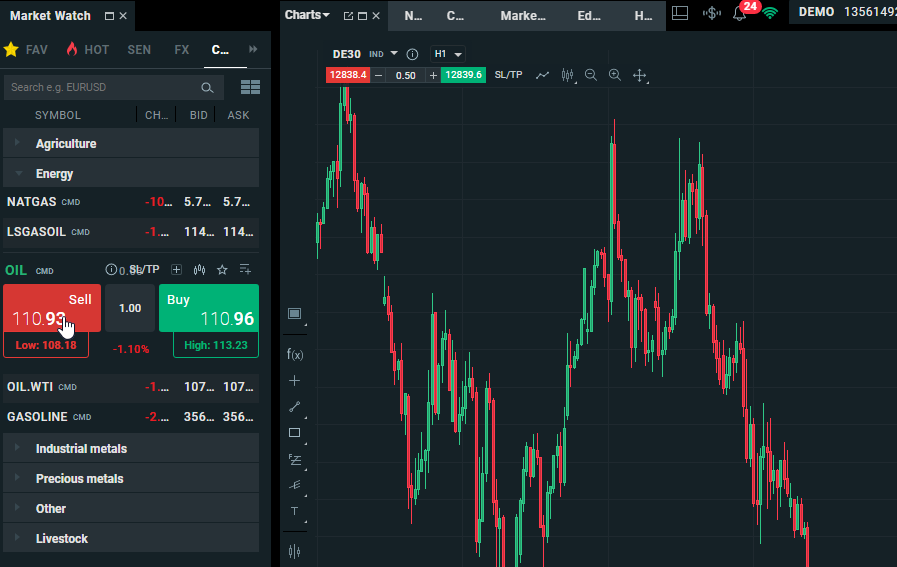

XTB’s propriety trading platform is called xStation 5. It’s well designed and extremely powerful. It supports over 2100 instruments and provides excellent order execution speeds. It follows the typical format with an order book and charts both available on the same page. For mobile traders, there is also an xStation mobile platform that offers most of the same great features as the desktop version.

Unfortunately for those that like to use MetaTrader, in November 2020 XTB suspended new clients from opening accounts and sub-accounts on the Mt4 platform. However, anyone with an account created prior to that period is still able to continue using MetaTrader as normal.

Is XTB User-Friendly?

Every broker has to focus on user experience. A smooth, easy-to-follow user experience can make the difference between a successful platform and one that struggles to gain traction.

XTB.com offers investors an excellent user experience which makes the broker a dream to use. As soon as anyone heads to the XTB homepage, they’re greeted with a sleek, mostly black and white color scheme that emphasizes key areas of the platform.

Important sections like XTB’s various financial instruments are labeled clearly and highlighted in green making it incredibly intuitive to navigate around the platform. Furthermore, XTB makes an effort to ensure key information is easily available and is not hidden behind needless menus.

All of these factors go together hand in hand to create an all-around excellent user experience. Even investors that have yet to use a broker before will find the platform easy to get used to. It’s one of the more well-designed brokers out there, which makes it a treat to use.

XTB Social Trading

Social trading, sometimes called mirror trading or copy trading, is a system that allows one user to automatically copy the trades of another user. Typically, traders’ profiles will feature some key statistics like YTD return and win/loss ratio to make it easier for users to mirror a trader that matches their goals. This type of trading can be great for new investors that are trying to practice different strategies. It enables beginners to earn a passive income through financial markets with relative ease.

Unfortunately, XTB copy trading is not currently supported. However, for users wondering how to copy trade on XTB, we’ve got a solution. eToro.com, another leading broker, has an extremely robust copy trading system that is great for beginners.

XTB Copy Portfolios

Copy portfolios are pre-made portfolios that allow investors to diversify their portfolios without hassle. They tend to be comprised of a series of companies from a specific index and are similar to exchange-traded funds (ETFs) but with a notable difference. Rather than investing in an all-encompassing fund that does not provide ownership of the underlying assets, copy portfolios are more akin to opening a range of positions. This means that unlike, ETFs, copy portfolios do provide ownership of the underlying assets. Sadly XTB does not currently offer any copy portfolio services. On the other hand, for investors looking to get a quick start, eToro does offer a range of copy portfolios covering a multitude of industries.

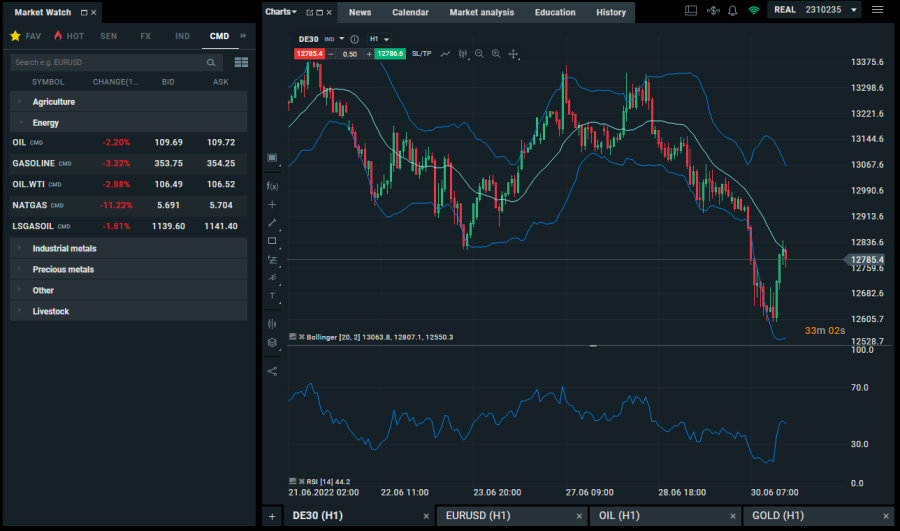

XTB Charting and Analysis

One of the core elements of any broker is its charting and analysis tools. These features are crucial to the success of any trader. Without a solid set of charting and analysis tools, it would be impossible to predict the market with any degree of accuracy, rendering technical strategies useless.

During our XTB review, we found the broker has an excellent suite of charting and analysis tools. Through the brokers xStation platform users are free to draw on charts using a range of tools, making it simple to plot patterns and identify trends. XTB performs equally as well when it comes to technical indicators. The platform supports 39 different indicators, including some of the most widely used indicators (RSI, MA, etc).

Outside of its analytical tools, XTB offers its users an extensive array of market research that when used in conjunction with the platform’s stock scanner and heatmap makes finding assets with potential incredibly simple.

XTB Account Types

While writing our XTB review we found out there are a few different account types available. While the majority of people will only have access to a standard account (which provides all XTB features), clients from outside of the EU can open a swap-free / Islamic account. These accounts are Riba-free and comply with Islamic law. Furthermore, XTB offers specialty corporate accounts but anyone wanting one must contact XTB directly.

XTB App Review

Gone are the days of trading from behind a desk in an office. In the modern world, an increasing number of people choose to invest on the go using a mobile phone. Therefore, it’s crucial that a broker offers a well-designed, speedy mobile app which has mostly the same features as the desktop platform. During this review of XTB’s mobile app, we analyzed a few key areas; whether it was beginner-friendly, how fast it is, the features offered, and the app’s design.

Login

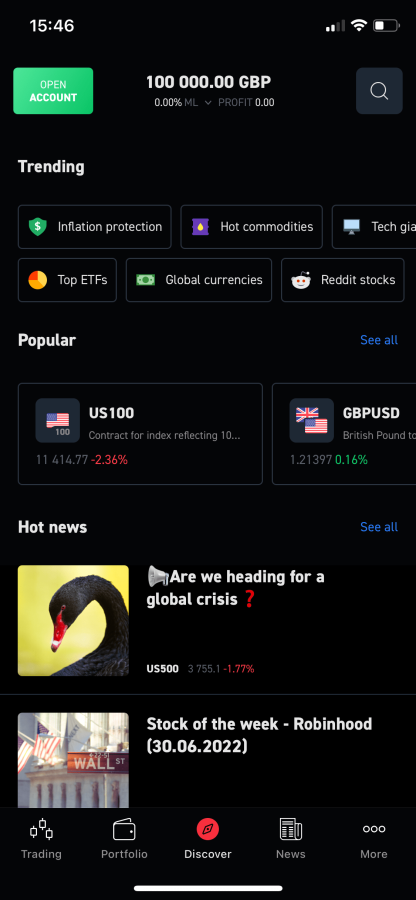

As soon as the XTB app is opened, it presents an XTB UK login page (the app auto-detects location so the XTB login will vary based on country of residence). The XTB app’s interface is easy on the eyes, it features both light and dark color schemes based on user preference. The initial screen following login consists of a few of the most popularly traded assets (GBP/USD, gold, etc). The primary navigation buttons are located toward the bottom of the app and are clearly labeled, making getting around the app very convenient.

Interface

The app is broken into 5 sections, Trading, Portfolio, Discover, News, and More. The ‘Trading’ section contains assets, charts, and allows the user to buy/sell. ‘Portfolio’ shows the user’s assets and open positions. ‘Discover’ provides trading ideas and shows some interesting trends. ‘News’ shows a selection of articles relating to financial topics. And lastly, ‘More’ shows things like account settings and deposit/withdrawals.

Features

In terms of speed, the XTB app is solid. It uses the same technology as the desktop platform to ensure trades are executed quickly and efficiently. It comes with mostly the same features as the desktop platform but there are a few limitations when it comes to technical indicators and order types. With that said, the XTB app does have full support for market, limit, stop, stop-loss, take-profit, and trailing stop orders.

Overview

All in all, the XTB app is extremely well designed and easy to use. It’s beginner-friendly and has a sleek, intuitive interface. Trading on XTB app is mostly the same as desktop, but as expected it can be harder to identify patterns correctly on the smaller screen.

78% of retail investor accounts lose money when trading CFDs with this provider.

XTB Payment Methods

Having a solid range of payment methods is almost as important as having low fees. While payment methods like bank transfers and credit/debit cards are common, the standard varies from country to country. Therefore, an international broker like XTB needs to support ample payment methods to ensure clients won’t run into any issues when depositing. Thankfully, XTB supports a huge variety of payment methods. Bank transfers, credit/debit cards, and a host of e-wallets are all supported. To check if a specific e-wallet is supported, view the below list.

- PayPal

- Paysafe

- Skrill

- Neteller

- Paydoo

- PayU

- SafetyPay

- ECOMMPAY

- BlueCash

- Blik

- Sofort

XTB Minimum Deposit

When it comes to depositing funds with a broker, the last thing any investor wants is to get through the process of creating and verifying an account just to find out that there’s an unreasonable minimum deposit. It can make or break a broker, particularly for investors that use strategies like dollar-cost averaging which requires frequent deposits.

There are a plethora of otherwise great brokers that have been ruined by charging egregious fees or requiring unaffordable minimum deposits. However, we’re happy to say that XTB is not one of them. The market-leading broker has the most affordable minimum deposit on the market; nothing.

It’s possible to deposit any amount of funds on XTB. This makes strategies involving frequent deposits viable and simple. Furthermore, XTB also has no depositing fees, making it an extremely cost-effective broker.

XTB Withdrawal Times

While it’s important to have fast and cheap deposits, the same is equally true for withdrawals. Having access to quick withdrawals is extremely important. Nobody knows when they may have to liquidate assets for an unexpected expense so it helps to know that a withdrawal will at least happen without hassle.

The XTB withdrawal fee is free, although the minimum varies between $50-$200 based on country of residence. The only withdrawal option is currently bank deposit, which while common, is a little restrictive. Thankfully, withdrawals are extremely fast on XTB. Most will be received within 1 business day, far better than the standard 2-5 business days.

XTB Bonuses & Promos

Everyone loves a good bonus. Some brokers will offer incentives to entice people to sign up for the platform but it tends to vary greatly from country to country. While XTB does not currently have a program to reward users for recommending the broker to friends and family, during our XTB review we found that there is a welcome bonus available to certain users.

Unfortunately, this welcome bonus is not available to UK or EU residents as it’s against regulations to offer cash-based incentives to these regions. However, for non-UK/EU & MENA residents, clients can snag an additional 50% on top of their initial deposit as long as they deposit more than $100 and trade at least 15% of the deposit amount within 60 days of opening an account. This bonus does not get applied automatically, so any interested investors will have to get in touch with the XTB sales team.

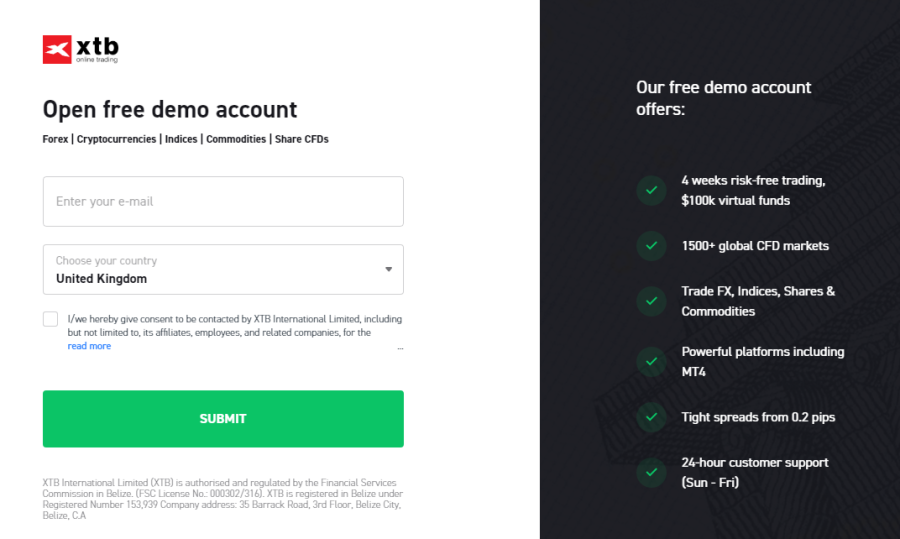

XTB Demo Account

Learning to trade as a beginner can be extremely stressful. Not only does one have to concern themselves with learning a new skill but they must also try to prevent the loss of funds.

However, using a demo account is a great way to practice trading without risking real funds, and luckily, XTB offers all users a practice account with 4 weeks ofrisk-free trading and $100,000 in virtual funds.

The XTB demo account is a comprehensive trading experience. It functions in the exact same way as the live platform, allowing users to trade a multitude of different financial instruments with real prices. Demo account users will also benefit from the same industry-leading support offered to XTB’s live account clients.

XTB Customer Support

Customer support is crucial to the smooth running of any broker. There will always be an important question that doesn’t have an easy answer, which is why having access to prompt assistance is so important.

Clearly, XTB understands this well. The broker has some of the fastest and most accessible customer support on the market.

Users have plenty of options at their disposal when it comes to reaching customer support. The broker supports email, live chat, and even 24/5 phone support, meaning that regardless of investor preference, there’s an easy option available.

After looking at other users XTB reviews, we’ve determined that the broker is, for the most part, responsive. However, live chat support will sometimes direct a user to an alternative contact method like email. While this can be a touch inconvenient, effective support is still rendered.

XTB Licensing & Security

Nobody wants to lose their investment portfolio due to a broker having lackluster security. Therefore, it’s crucial that any company dealing with client funds has the best possible security.

Budding investors will be happy to know that since its launch in 2002, XTB has never been hacked. This is a great sign for the company. 20 years without incident is a stellar track record so anybody that has invested with XTB can rest easy knowing their funds are secure. Furthermore, XTB is listed on the Warsaw stock exchange, meaning the company is subject to regular audits and increased scrutiny from regulators.

XTB uses a few interesting techniques to keep its users safe. Firstly, all client and corporate funds are stored in segregated accounts meaning that XTB should always have sufficient on-hand liquidity to support withdrawals. Considering how frequently some platforms lock withdrawals, we’d say this is a great sign.

When selecting a broker it’s always advisable to stick to regulated platforms. They provide customers with far more recourse in the event of something going awry. XTB is regulated by several leading entities. Residents of the UK are protected by the FCA, Cyprus & Hungary by CySEC, Spain by CNMV, other EU countries by KNF, UAE by the DFSA, and other countries by the IFSC. Overall, XTB is a very secure broker that is publicly traded and regulated by 6 entities.

XTB Accepted Countries

XTB is available in a wide range of countries across the globe. It operates in most large countries where trading is popular but there are a few notable expectations. There are a few geo-specific restrictions, for example, residents of the UK are not able to trade cryptocurrency on XTB. Furthermore, the broker does not currently accept clients from the United States, India, Australia, Belgium, as well as a few other countries mostly in the Asia or Africa regions.

How to Start Trading with XTB

Figuring out how to use a new broker can be a surprisingly difficult process. Each platform has different functions and follows different formats making it hard to switch between. However, we’ve included this handy guide that explains exactly how to start trading with XTB.

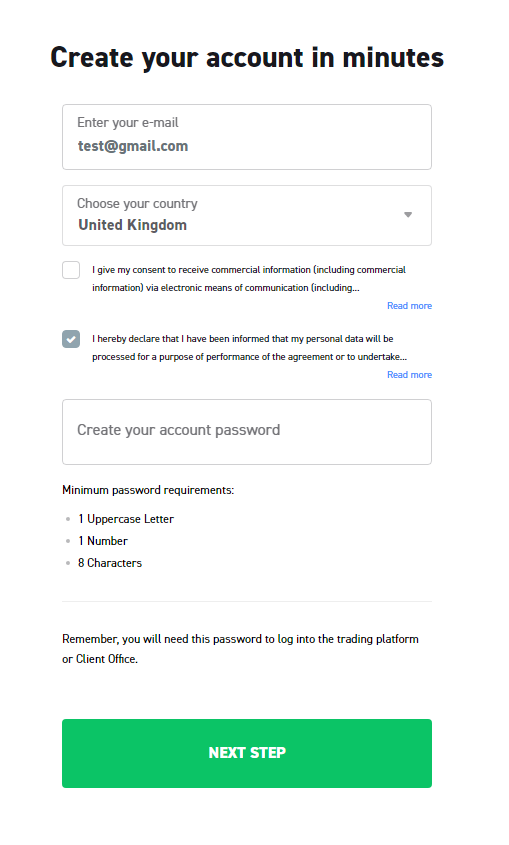

Step 1: Create an Account

To create an account with XTB simply head over to the XTB website and go through the registration process. It takes just a couple of minutes and requires only basic details like a name and email address.

78% of retail investor accounts lose money when trading CFDs with this provider.

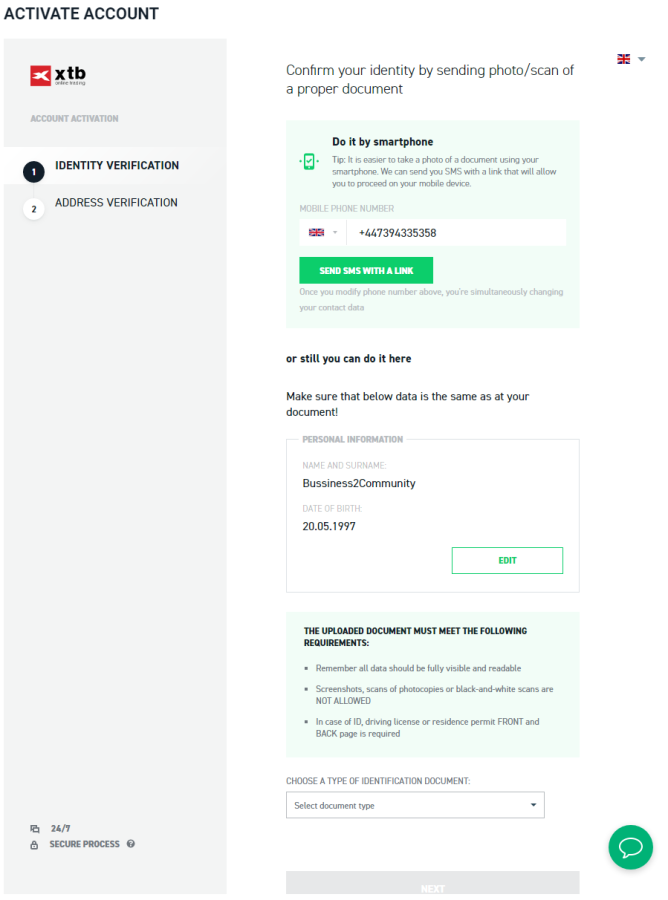

Step 2: Verify Account

Once the XTB account has been created, it needs to be verified. This is standard practice for any regulated broker. The only documents needed will be proof of identity (passport, driving license) and proof of address (bank statement, utility bill).

Step 3: Deposit Funds

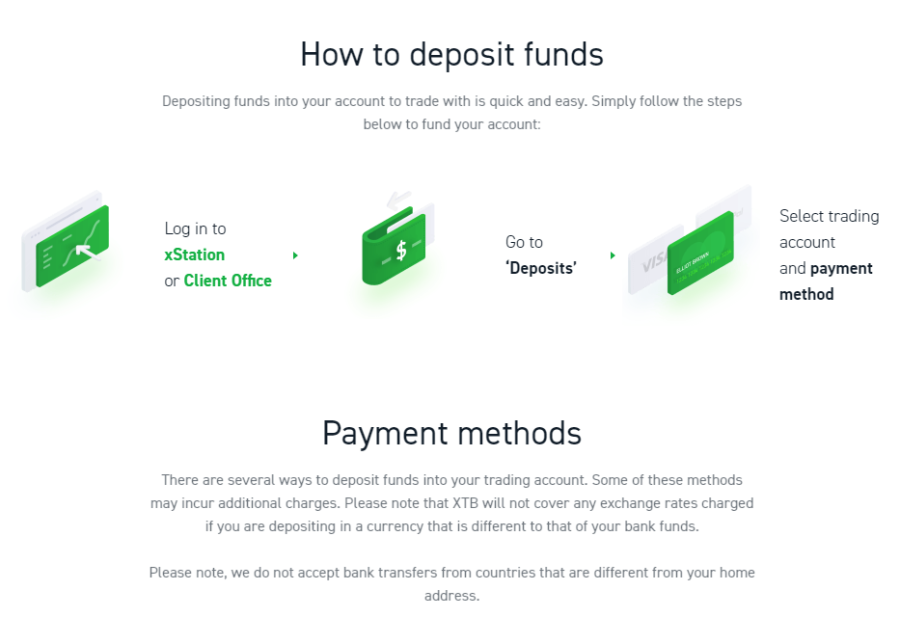

After the verification process is completed, it’s time to deposit. This can be done by heading to xStation or Client Office, navigating to ‘Deposits’, selecting a payment method, choosing how much to invest, and finally pushing deposit. XTB supports a wide range of payment methods including credit/debit cards, bank transfers, and e-wallets (PayPal, Skrill).

Step 4: Buy Assets

After the funds arrive in the account, it’s time to buy some assets. Simply head to xStation, type in the name of an asset, click on its name, choose a lot size, and press the green ‘Buy’ button. A position will be opened and viewable under the ‘Open Positions’ tab.

Step 5: Sell Assets

The process for selling an asset is very similar to buying one. Head to xStation, type in the name of an asset, click the relevant option, choose a lot size, and press ‘Sell’. Alternatively, to close an open position, navigate to the ‘Open Positions’, press the red ‘Close’ button, and select the relevant option (close profitable or close losing),

Conclusion

Throughout this XTB review, we’ve analyzed the ins and outs of the broker and discussed the areas it shines, as well as its shortcomings. Overall, XTB is an extremely well-rounded broker that has something for everybody. However, if it doesn’t quite pass the muster for some investors, we have another recommendation.

eToro is a another market-leading broker that offers thousands of tradable assets across every major market. It’s regulated, powerful, cheap, and perfect for traders and investors of all experience levels.

78% of retail investor accounts lose money when trading CFDs with this provider.