The decentralized finance (DeFi) industry offers a variety of ways that you can earn interest on your idle digital assets. At the forefront of this are yield farming and staking.

In this yield farming vs staking guide, we explain how each DeFi investment product works so that you can make an informed decision about which is right for you.

Yield Farming vs Staking – Key Differences

The main difference between staking and yield farming can be found in the table below:

- In most cases, you won’t need to agree to a minimum lock-up period when you engage with a yield farming pool. This means that you can withdraw your tokens at any time.

- Staking, however, often requires you to lock your tokens for a minimum period of time. With that said, some DeFi exchanges offer flexible staking terms.

- Staking typically comes with a fixed APY. This means that you always know exactly how much you will receive back once the staking term concludes. Yield farming, however, is a lot more volatile – so you never quite know what yield you will make.

- Yield farming will often generate a higher yield in comparison to staking. But, the risks with yield farming are typically higher too.

- Staking only requires you to deposit one token. Yield farming, on the other hand, allows you to earn interest on a trading pair. This means that you will need to deposit equal amounts of each token within the pair.

We cover the above differences in more detail throughout this guide.

What is Yield Farming?

DeFi yield farming is a service offered by decentralized exchanges (DEX). The main concept is that you will lend your digital tokens to a DEX so that it can offer buyers and sellers sufficient levels of liquidity on a specific trading pair.

- Pair / single token

- For instance, let’s suppose that the DEX offers the trading pair BNB/PXP.

- In order to swap BNB for PXP, or PXP for BNB, there needs to be an adequate amount of liquidity available to cover the exchange.

This is where yield farmers come in. To earn a yield on your tokens, you would be required to deposit the same amount in BNB and PXP. For instance, $1,000 worth of both BNB and PXP at current exchange rates.

For as long as your BNB and PXP tokens are contributing to the BNB/PXP liquidity pool on your chosen DEX, you will earn a percentage of trading fees. These are the fees that buyers and sellers pay to access the respective trading pair on a DEX.

As a result, yield farming offers a great way to offer passive income on your idle tokens. You will, however, need to have access to both tokens from a trading pair in order to provide liquidity.

What is Staking?

The main difference between staking and yield farming is that the latter requires two individual tokens to make a single trading pair – like BNB/PXP.

However, in the case of crypto staking, you are only required to lend one token to the respective exchange.

- Before we get to that, we should note that the staking in its original form involved locking your tokens in a Proof-of-Stake (PoS) blockchain like Cardano.

- This allows the blockchain to remain decentralized and thus – verify transactions in a secure and fast way.

- And in doing so, you will receive a passive income from the blockchain network for locking your PoS tokens.

The main disadvantage of traditional staking via a blockchain protocol is that yields are often super-low. Moreover, the process is only suitable for PoS coins.

This is why it is much better to use a DEX when engaging with staking tools. This will not only give you access to much higher yields but a wider pool of supported tokens outside of just PoS coins.

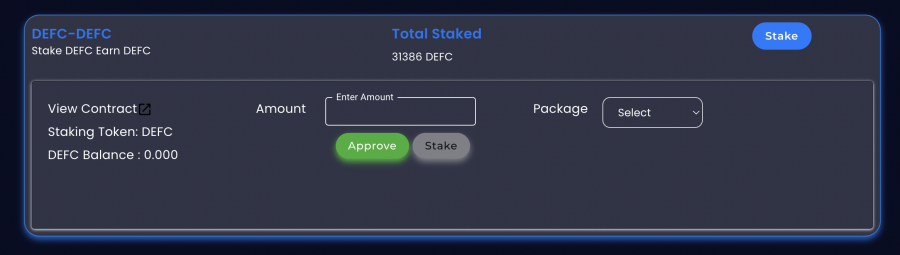

- In terms of the fundamentals, you will first need to decide which token you wish to stake and for how long.

- For instance, if you stake DeFi Coin on the DeFi Swap DEX, you will earn an APY of between 30% and 75% – depending on whether you opt for a 1, 3, 6, or 12-month term.

During your chosen lock-up period, you will not have access to your tokens. This means that under no circumstances can you cut the staking term short – even if you need instant access to funds.

On the contrary, you will need to wait for the term to pass before you get your tokens back – in addition to interest you have earned.

This is in stark contrast to yield farming, which typically comes in the form of flexible terms,

Main Advantages of Yield Farming

The main advantages of yield farming are as follows:

Flexible Terms

The yield farming vs staking debate will often boil down to flexibility. This is because, in the vast majority of cases, yield farming pools do not require you to agree to a minimum lock-up period.

This means that you can add or remove liquidity as and when you please. If you feel like you are overexposed to a specific pool, it’s just a case of making an instant withdrawal.

On the other hand, if you find that a particular yield farming pool is working well for you in terms of APYs, you might decide to deposit more tokens.

Huge Yields

Depending on your chosen trading pair, you might have access to significant yields that exceed anything that staking platforms can pay.

This will evidently depend on how liquid and volatile the pair is.

For example, if you are looking to provide liquidity for a new and relatively unknown crypto token, then there is every chance that the pool will yield triple-digit APYs.

Even highly liquid pairs can yield double-digit returns, which is why farming is so popular.

Main Advantages of Staking

The main advantages of staking are as follows:

Single Token Requirement

As noted above, when you engage with a yield farming tool, you will need to provide liquidity for a trading pair. Therefore, you need to have equal measures of both tokens.

In comparison, when you stake crypto, you only need to have a single token type. For example, if you like the sound of earning up to 75% on DeFi Coin staking, this is the only token that you need.

However, if you wish to provide liquidity for the DEFC/BNB pair, you will need access to both tokens – at equal value.

Attractive Yields

Although potentially not as lucrative as yield farming, staking still offers some highly attractive APYs.

In fact, other than the likes of Bitcoin and Ethereum, the vast bulk of crypto tokens can be staked at double-digit yields.

Fixed Yields

Another benefit that you might want to consider in this yield farming vs staking comparison is that the latter comes with fixed APYs.

This means that you know exactly how much you are going to make once the staking term has concluded.

You do, however, also need to remember that the monetary value of your investment will depend on the price action of the respective token that it is being staked.

Yield Farming vs Staking: Rates

When deciding on whether yield farming or staking is the best DeFi product for you, a major metric to consider is the size of the APY that you will be able to generate. After all, the main purpose of lending your crypto tokens out is to make money.

In a nutshell, there is no hard and fast rule as to how much you can make from both yield farming and staking, as there are plenty of variables at stake.

This includes:

Token Type

First and foremost, the type of crypto token that you are looking to farm or stake will have a major say in the yields on offer. For instance, if you were to stake a large-cap token like Ethereum, you should expect a lower APY.

This is because Ethereum is already an established crypto project and thus – it attracts higher interest from the broader markets. This would also be the case if you were to provide liquidity for a pair like ETH/USDT.

At the other end of the spectrum, staking an up-and-coming crypto token like DeFi Coin would attract a much higher yield. Similarly, if you were to farm a less liquid pair like DEFC/BNB, this would also generate a greater APY.

Lock Up Term

It goes without saying that APYs will generally increase when you agree to lock up your tokens for a longer period of time.

For instance, if you decide to stake your tokens on a flexible basis, then the APY on offer will be much lower than agreeing to lock the funds for 12 months.

With that being said, very rarely will you need to agree to a lock-up period when opting for a yield farming agreement.

Fixed vs Variable

Another thing to note about earning rates across both yield farming and staking is that the latter is typically fixed. This means that when you engage in a staking agreement, you will know exactly what APY you will make.

This will suit those of you that wish to limit the volatility risk as much as possible. Yield farming, however, provides no such safety net. On the contrary, there is no knowing what yield you will walk away with.

Sure, your chosen DeFi lending platform might give you an approximate APY – but this will be an estimate at best.

After all, farming yields will change throughout the day depending on a variety of metrics – such as volatility, arbitrage opportunities, and liquidity levels.

Yield Farming vs Staking: Risk

Another factor that you need to consider in the yield farming vs staking debate is that of risk. There are a variety of risks associated with both investment products, which we cover below:

Opportunity Risk

The first risk to consider is specifically linked to staking. Put simply, if you decide to lock your tokens up for a minimum number of days with the view of targeting higher yields, you won’t be able to touch the funds until the term concludes.

During this time, this means that you might miss out on other, more profitable investment opportunities. As we mentioned earlier, when your tokens are locked – they are held by a smart contract that cannot be amended.

This means that no matter how much you need access to the tokens, you will need to wait for the smart contract to release the funds when the respective date arrives.

Generally, you won’t have this risk when you engage in yield farming. This is because in most cases, you will always have the option of withdrawing your tokens from a yield farming liquidity pool as and when you like.

Impairment Risk

A risk specific to yield farming is that of impairment loss. This can be somewhat complex to understand at first glance.

Nonetheless, the main concept with impairment loss is that you could have made more money by simply leaving your tokens in a private wallet – as opposed to depositing them into a liquidity pool.

- For example, let’s say that you provide liquidity for the pair ADA/USDT.

- You decide to provide the equivalent of $500 in both ADA and USDT, so your total investment is $1,000.

- We’ll say that over the course of three months, you generate an APY of 40% by farming ADA/USDT.

- On a three-month term, this means that your tokens grew by 10%.

- However, if you could have made 20% during the same period by leaving your ADA and USDT in a private wallet, you have suffered from impairment loss.

After all, the process was somewhat counter-productive, as you would have generated a great APY had you avoided the yield farming pool.

Volatility Risk

Both staking and yield farming carry an inherent level of volatility risk. In its most basic form, this refers to the risk that the value of the tokens you have deposited into a liquidity or staking pool go down.

This means that when you eventually withdraw your crypto assets, your investment might still be worth less than what you started with – even though you have more tokens.

- For example, let’s suppose that you deposit 1 ETH into a 12-month staking agreement at an APY of 20%.

- When you make the deposit, ETH is trading at $4,000 per token.

- At the end of the 12-month staking period, you withdraw your original 1 ETH, plus 0.20 ETH in interest (20% of 1 ETH).

- This means that you now own 1.2 ETH. However, ETH is now trading at $2,000 per token – so your funds are worth $2,400 at current market prices.

- Because you originally invested the equivalent of $4,000 – you have made a loss of $1,600 – even though you now have 20% more in ETH tokens.

Perhaps volatility risk is more pressing in the case of staking, because with yield farming you can typically withdraw your tokens at any given time. While with staking, you won’t be able to make a withdrawal until the respective lock-up term concludes.

Platform Risk

You should also consider the risk of the platform you are using for staking or yield farming. After all, you will be going through a third-party platform. The only exception to this rule is if you decide to stake your tokens directly into the respective blockchain network.

Nonetheless, the specific risks associated with the platform will depend on whether it is centralized or decentralized.

If it is the former, then you need to trust that the centralized website will keep your tokens safe and subsequently pay you the yield that it promised.

In comparison, when staking or farming via a decentralized platform, you are depositing funds directly into a smart contract. This means that the platform will not directly have access to your tokens.

Smart Contract Risk

Leading on from the above section, smart contracts at decentralized platforms are not without their risks. This is because if the smart contract was not built correctly, it might be vulnerable to hackers.

This is why you still need to do your research when choosing a DeFi platform – irrespective of whether you prefer yield farming or staking.

Who is Yield Farming Best For?

Yield farming is perhaps best suited for experienced crypto investors that are happy to take on additional risk, with the view of targeting much higher returns.

As noted earlier, when you add tokens to a liquidity pool, you will typically be able to generate a higher APY in comparison to staking. But, you are also taking on the added risk of impairment loss.

On the other hand, yield farming is also suitable for those of you that want more flexibility when it comes to accessing your tokens.

This is because you typically have the option of withdrawing your crypto assets from a yield farming pool at any time – without restrictions.

Who is Staking Best For?

Staking will be best suited for those of you that want to know exactly how much you will make in return for locking away your tokens.

This is because, in the vast majority of cases, staking rates are fixed. As such, if you deposit 10,000 DEFC tokens into a staking pool for 12 months at an APY of 75%, you know that once the term concludes, you will receive 17,500 back.

With that being said, staking might not be suitable for you if there is a chance that you require instant access to your funds. This is because, once the tokens are locked into an agreement, you won’t be able to access them until the term concludes.

If this is the case, then perhaps it is worth searching for a flexible staking agreement. While this will yield lower APYs, you can at the very least be able to withdraw the tokens at any time.

Best Platform for Staking & Yield Farming

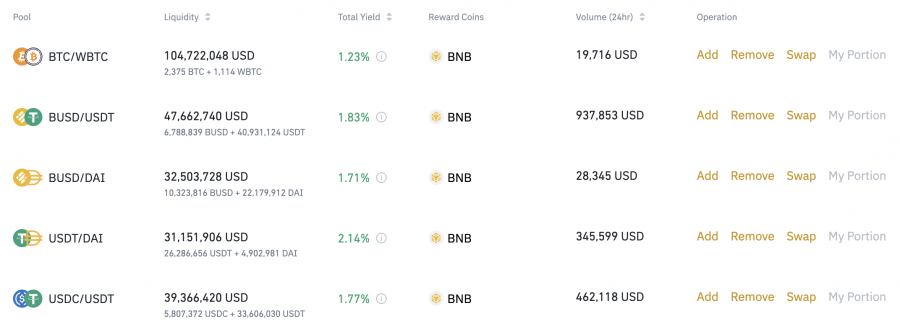

So now that you know the difference between staking and yield farming, you have likely decided on which DeFi product is best for you. If so, there the next step is to find a suitable platform that can facilitate your DeFi investments.

We found that the overall best platform for this purpose is DeFi Swap – which offers both staking and yield farming services in a decentralized and user-friendly manner.

Here’s why we like DeFi Swap:

DeFi Swap – Overall Best DeFi Platform for Staking and Yield Farming Services

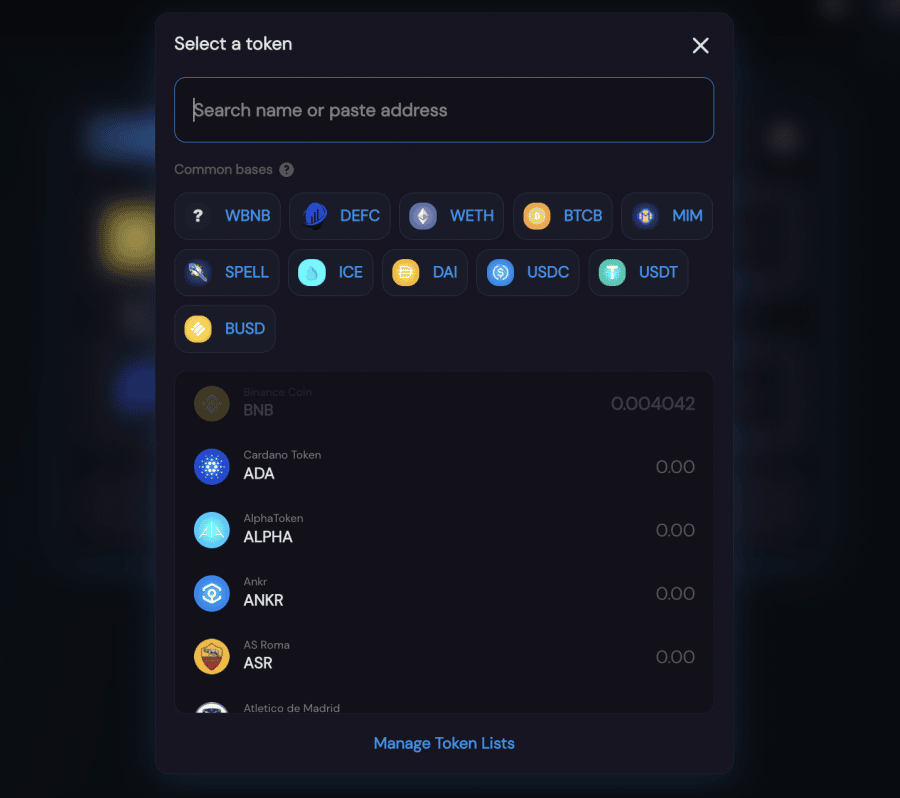

DeFi Swap is a newly launched decentralized exchange that offers a variety of services. This user-friendly platform can be accessed by investors of all skillsets due to its simple yet highly secure framework. In fact, you are not required to open an account to use DeFi Swap, nor do you need to provide any personal data.

Instead, you can start generating a yield on your idle crypto tokens straightaway by connecting your private wallet. In terms of its staking tools, you can choose from a wide range of tokens that operate on top of the Binance Smart Chain. We like that DeFi Swap gives you the option of four lock-up periods – 30, 90, 180, and 365 days.

This ensures that you choose a suitable term for your financial goals. In terms of yields, you can earn up to 75% by staking DeFi Coin for 12 months – which is the native crypto token of the DeFi Swap exchange. If you’re more interested in yield farming, DeFi Swap has you covered.

This will see you deposit a trading pair into a secure DeFi Swap liquidity pool. In doing so, you will receive a share of any trading fees that the pool collects from buyers and sellers. Yields will vary, and this will largely depend on what percentage share you have in the pool, as well as external factors such as the market value of each token that has been deposited.

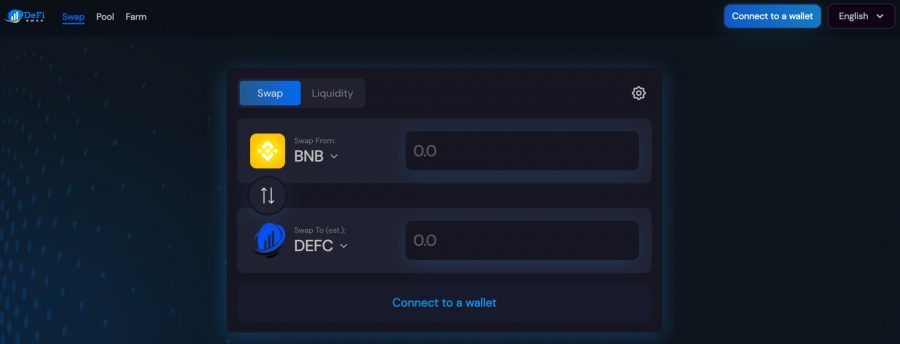

Either way, there are no lock-up periods when engaging with yield farming services on the DeFi Swap exchange. If there is a staking or yield farming pool that interests you but you don’t currently own the required tokens – you can use DeFi Swap to make an instant exchange in real-time.

For instance, if you currently hold BNB but you wish to stake DeFi Coin, you can make a conversion at the click of a button without needing to go through a centralized platform. Although as of writing DeFi Swap only hosts BSc tokens, cross-chain compatibility is being worked on right now. As such, this is something to expect shortly.

DeFi Swap is also working on building the best DeFi app for iOS and Android. This will offer the same services that you find on the main DeFi Swap desktop website. An NFT marketplace is also in the pipeline, as is a full suite of other DeFi investment features and tools.

Pros

Cons

Cryptoassets are a highly volatile unregulated investment product.

Conclusion

This guide has discussed the difference between staking and yield farming. Both DeFi investment products come with their own pros and cons, so consider what your financial goals and tolerance for risk look like.

If you’re ready to start earning a yield on your idle tokens right now, we found that DeFi Swap is the best platform for both staking and yield farming.

All you need to do is connect your wallet to the DeFi Swap exchange and you are good to start generating an attractive APY on your funds.

Cryptoassets are a highly volatile unregulated investment product.